Professional Documents

Culture Documents

Tax Calculator AY 2024-25 - 092421

Tax Calculator AY 2024-25 - 092421

Uploaded by

Saurabh Saxena0 ratings0% found this document useful (0 votes)

14 views3 pagesThe document shows salary details for an individual named Rajeev Srivastava for the financial year 2023-24 including gross salary, deductions, taxable income and tax due calculations. It compares the tax calculations under the old tax regime where various deductions were available versus the new regime with no deductions but lower tax slabs. The total tax due for the individual is lower under the new tax regime at Rs. 1,92,601 compared to Rs. 2,47,201 under the old regime.

Original Description:

Tax Calculator AY 2024-25_092421

Original Title

Tax Calculator AY 2024-25_092421

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows salary details for an individual named Rajeev Srivastava for the financial year 2023-24 including gross salary, deductions, taxable income and tax due calculations. It compares the tax calculations under the old tax regime where various deductions were available versus the new regime with no deductions but lower tax slabs. The total tax due for the individual is lower under the new tax regime at Rs. 1,92,601 compared to Rs. 2,47,201 under the old regime.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views3 pagesTax Calculator AY 2024-25 - 092421

Tax Calculator AY 2024-25 - 092421

Uploaded by

Saurabh SaxenaThe document shows salary details for an individual named Rajeev Srivastava for the financial year 2023-24 including gross salary, deductions, taxable income and tax due calculations. It compares the tax calculations under the old tax regime where various deductions were available versus the new regime with no deductions but lower tax slabs. The total tax due for the individual is lower under the new tax regime at Rs. 1,92,601 compared to Rs. 2,47,201 under the old regime.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

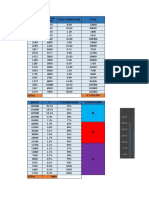

Old Regime New Regime

Gross Salary 16,67,310.00 16,67,310.00

House Rent Allowance u/s 80gg 0.00

Standard Deduction 50,000.00 50,000.00

Health Insurance Premium u/s 80D 0.00

Net Income 16,17,310.00 16,17,310.00

Total Saving u/s 80C 1,50,000.00

NPS u/s 80CCD(1B) 50,000.00

NPS u/s 80CCD(2) 0.00

CM Relief Fund u/s 80G 0.00

Home Loan Interest u/s 24b 0.00 0.00

Total Deduction 2,00,000.00 0.00

14,17,310.00 16,17,310.00

Taxable Income

14,17,310.00 16,17,310.00

Tax Due @ 5.00% 12,500.00 5.00% 15,000.00

Tax Due @ 20.00% 1,00,000.00 10.00% 30,000.00

Tax Due @ 30.00% 1,25,193.00 15.00% 45,000.00

20.00% 60,000.00

30.00% 35,193.00

Tax Due 2,37,693.00 1,85,193.00

Cess 4.00% 9,508.00 4.00% 7,408.00

Total Tax Due 2,47,201.00 1,92,601.00

Salary Detail for FY 2023-24

Name : Rajeev Srivastava PAN :

Month- Days in Total

DA % Basic DA HRA MA S/Pay ESA Gross EPF GSLI EC AC I.Tax Net Pay

year Month Ddt.

Mar-23 30 38% 85548 32508 7316 194 0 435 126001 12500 150 1141 0

15000 28791 97210

Apr-23 30 38% 88400 33592 7560 200 0 450 130202 12500 150 1141 1356

15000 30147 100055

May-23 31 38% 88400 33592 7560 200 0 450 130202 12500 150 1141 1356

15000 30147 100055

Jun-23 30 42% 88400 37128 7560 200 0 450 133738 13000 150 1141 1356

15000 30647 103091

Jul-23 31 42% 88400 37128 7560 200 0 450 133738 13000 150 1141 1356

15000 30647 103091

Aug-23 31 42% 88400 37128 7560 200 0 450 133738 13000 150 1141 1356

15000 30647 103091

Sep-23 30 42% 88400 37128 7560 200 0 450 133738 13000 150 1141 1356

15000 30647 103091

Oct-23 31 42% 88400 37128 7560 200 0 450 133738 13000 150 1141 0

15000 29291 104447

Nov-23 30 46% 91100 41906 7560 200 0 450 141216 13500 150 1141 0

15000 29791 111425

Dec-23 31 46% 91100 41906 7560 200 0 450 141216 13500 150 1141 0

15000 29791 111425

Jan-24 31 46% 91100 41906 7560 200 0 450 141216 13500 150 1141 0

15000 29791 111425

Feb-24 28 46% 91100 41906 7560 200 0 450 141216 13500 150 1141 0

15000 29791 111425

DA Arrear (38% to 42%) 17566 11966 5600 17566 0

DA Arrear (34% to 38%) 14573 9973 4600 14573 0

Increment Arrear 15212 1521 0 1521 13691

Total 1068748 452956 90476 2394 0 5385 1667310 179960 1800 13692 8136 190200 393788 1273522

Gross Salary (Rs.) = 16,67,310.00

Standard Deduction (Rs.) = 50,000.00

Net Income (Rs.) = 16,17,310.00

Deduction Tax Calculation

CM Relief Fund u/s 80G (Rs.) = 0.00 Taxable Income (Rs.) = 16,17,310.00

Home Loan Interest u/s 24b (Rs.) = 0.00 Tax Due @%5 (Rs.) = 15,000.00

Total Deduction (Rs.) = 0.00 Tax Due @%10 (Rs.) = 30,000.00

Tax Due @%15 (Rs.) = 45,000.00

Tax Due @%20 (Rs.) = 60,000.00

Tax Due @%30 (Rs.) = 35,193.00

Rebate Under 87(A) (Rs.) = 0.00

Due Tax (Rs.) = 1,85,193.00

cess (@4%) (Rs.) = 7,408.00

Total Tax Due (Rs.) = 1,92,601.00

You might also like

- Frank Spence ValuationDocument2 pagesFrank Spence ValuationShivam AryaNo ratings yet

- DIY MAP Your Soul Plan Chart: T/DR Markus Van Der WesthuizenDocument14 pagesDIY MAP Your Soul Plan Chart: T/DR Markus Van Der WesthuizenValentin Mihai100% (4)

- 1 - Investment Banking and BrokerageDocument152 pages1 - Investment Banking and BrokerageLordie BlueNo ratings yet

- Solution Capital Budgeting AssignmentDocument8 pagesSolution Capital Budgeting AssignmentAryamanNo ratings yet

- LBP Form No. 4Document8 pagesLBP Form No. 4Shie La Ma RieNo ratings yet

- Santiago Calle LawsuitDocument7 pagesSantiago Calle LawsuitNeil StreetNo ratings yet

- Bachelor Degree TimetableDocument20 pagesBachelor Degree Timetablebite meNo ratings yet

- Basic % DA Ihra Rent R Ohra Cperks Dperks Eperks PRPDocument21 pagesBasic % DA Ihra Rent R Ohra Cperks Dperks Eperks PRPSooperAktifNo ratings yet

- Tahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanDocument9 pagesTahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanElis Lisa Pantolosang RegelNo ratings yet

- Aa (GPF) 21-22 - 03-06-2022Document87 pagesAa (GPF) 21-22 - 03-06-2022Konne Sai KrishnaNo ratings yet

- Costo Unitario (U$) Total Referencia Del Artículo Consumo AnualDocument2 pagesCosto Unitario (U$) Total Referencia Del Artículo Consumo AnualEDGAR MICHEL PARRA SAN MARTINNo ratings yet

- Book 1Document8 pagesBook 1namikazejnrNo ratings yet

- Compration 12-13, 13-14 & 14-15Document4 pagesCompration 12-13, 13-14 & 14-15Rajeshbabhu RajeshbabhuNo ratings yet

- Hiter MariooDocument9 pagesHiter Marioorakha hibatillah azmanNo ratings yet

- Calculo de Noches de HospedajeDocument2 pagesCalculo de Noches de HospedajemarciaNo ratings yet

- Montecarlo SimulationDocument27 pagesMontecarlo Simulationsobhinmylesamy4No ratings yet

- Assets 1631000 10563150 18008100Document4 pagesAssets 1631000 10563150 18008100CA RAKESHNo ratings yet

- JooooDocument3 pagesJooooJosé LuisNo ratings yet

- Soal No 30Document3 pagesSoal No 30Andhika GilangNo ratings yet

- Conciliacion 1101.1201Document177 pagesConciliacion 1101.1201manuelNo ratings yet

- Production Decisions at Harding Silicon Enterprises Inc Answer.Document4 pagesProduction Decisions at Harding Silicon Enterprises Inc Answer.chunghsin0305No ratings yet

- Investment AppraisalDocument18 pagesInvestment AppraisalKwasi MmehNo ratings yet

- Employee Retention Scheme Policy - MEPUGC07Document2 pagesEmployee Retention Scheme Policy - MEPUGC07Arif Ameenuddin NNo ratings yet

- April 2023 To March 2023Document47 pagesApril 2023 To March 2023shivam.kr20081995No ratings yet

- 4 April A - 2018Document18 pages4 April A - 2018Xen Operation DPHNo ratings yet

- Ejercicio Del Equipo4Document5 pagesEjercicio Del Equipo4Zero &No ratings yet

- Expenditure FormatDocument2 pagesExpenditure FormatBilal ShahNo ratings yet

- Tax&InflasiDocument8 pagesTax&Inflasiiqbal febriansyahNo ratings yet

- MSC Finance Capital BudgetingDocument4 pagesMSC Finance Capital Budgetingshahsamkit08No ratings yet

- (J) (I) (I) (I) (J) (I) (J) (I) (I) (J) (J)Document6 pages(J) (I) (I) (I) (J) (I) (J) (I) (I) (J) (J)LandyPratonoNo ratings yet

- Global - 2012Document27 pagesGlobal - 2012Sridhar GandikotaNo ratings yet

- عرض سعر 3Document1 pageعرض سعر 3omar99366No ratings yet

- Statistics Report: Output Filename: Fe Dec 13, 2018Document3 pagesStatistics Report: Output Filename: Fe Dec 13, 2018nurafniNo ratings yet

- Vapor Pressure Variation With Temperature (Antoine Eq.) : Comp. Name Water Antonie Constants 18.30 3816.44 - 46.13Document44 pagesVapor Pressure Variation With Temperature (Antoine Eq.) : Comp. Name Water Antonie Constants 18.30 3816.44 - 46.13Arun Lakshmn0% (1)

- Alphathum Payment Detail File No. Unit No. Name SGST As Per 4QT Basic Amt As Per 4qt Service Tax As Per 4Qt CessDocument30 pagesAlphathum Payment Detail File No. Unit No. Name SGST As Per 4QT Basic Amt As Per 4qt Service Tax As Per 4Qt CessChinu BhallaNo ratings yet

- Saham 1Document14 pagesSaham 1Yudistira WaskitoNo ratings yet

- PO For TCSDocument6 pagesPO For TCSSathish GunaNo ratings yet

- Annual Rate 13% Quarterly Rate 0.0325Document4 pagesAnnual Rate 13% Quarterly Rate 0.0325Maithri Vidana KariyakaranageNo ratings yet

- Session 2Document5 pagesSession 2Sayan GangulyNo ratings yet

- Aug'22Document1 pageAug'22akashenterprise.infoNo ratings yet

- Calculo Pro LaboreDocument9 pagesCalculo Pro LaboreM2S SistemasNo ratings yet

- Controle Equipamentos WMS - Geral TIDocument399 pagesControle Equipamentos WMS - Geral TILeonardo LimaNo ratings yet

- ICO of An AssetDocument24 pagesICO of An Assetconsultnadeem70No ratings yet

- Budget Analysis: by Department Period: Desember 2019 002-Asia Sumedang/FDocument10 pagesBudget Analysis: by Department Period: Desember 2019 002-Asia Sumedang/Flank4 pissNo ratings yet

- Stock Average CalculatorDocument5 pagesStock Average CalculatorSuprabhat SealNo ratings yet

- HSN Mar 2023Document2 pagesHSN Mar 2023Arul KumarNo ratings yet

- LN (T) LN (-LN (R (T) ) ) : Chart TitleDocument8 pagesLN (T) LN (-LN (R (T) ) ) : Chart TitleCriserioNo ratings yet

- Tugas 2Document9 pagesTugas 2Adi PrasetyoNo ratings yet

- Havells India Limited: Standard Electricals LTDDocument4 pagesHavells India Limited: Standard Electricals LTDbhadreshjoshiNo ratings yet

- Incentive Atharv-Dec'23Document1 pageIncentive Atharv-Dec'23Pankaj KhandelwalNo ratings yet

- PDF Zona FrancaDocument5 pagesPDF Zona FrancaKIMBERLY PATRICIA MARENCO LUNANo ratings yet

- Reciprocal ModelDocument7 pagesReciprocal ModelPalak SharmaNo ratings yet

- Latest Quarterly/Halfyearly As On (Months) : %OI %OI %OI (OI)Document6 pagesLatest Quarterly/Halfyearly As On (Months) : %OI %OI %OI (OI)amruta_2612No ratings yet

- Export Pairty SheetDocument4 pagesExport Pairty SheetBrijesh PanchalNo ratings yet

- AutoloanDocument1 pageAutoloanWesley Raphael Melo FlavianoNo ratings yet

- Gain & Loss EQUITY Report As On 28.02.2023 FNR352P102Document3 pagesGain & Loss EQUITY Report As On 28.02.2023 FNR352P102PALLAVI SHARMANo ratings yet

- Latest Quarterly/Halfyearly As On (Months)Document3 pagesLatest Quarterly/Halfyearly As On (Months)mansi07No ratings yet

- 12 MesesDocument2 pages12 MesesFermando LugoNo ratings yet

- Libro2Document6 pagesLibro2bhjjbkjjbjkjNo ratings yet

- PRC Calculation 2021 NewDocument3 pagesPRC Calculation 2021 NewPraneeth SarkarNo ratings yet

- PRC Calculation 2021 NewDocument3 pagesPRC Calculation 2021 NewPraneeth SarkarNo ratings yet

- Data Set On SaratogaHousesDocument150 pagesData Set On SaratogaHousesjoluksNo ratings yet

- PF Esi Calculation Sheet ExampleDocument3 pagesPF Esi Calculation Sheet ExampleRajinder KumarNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Euclid Geometry CheatsheetDocument2 pagesEuclid Geometry CheatsheetSaurabh SaxenaNo ratings yet

- CBSE Class 9 Mathematics WorksheetDocument2 pagesCBSE Class 9 Mathematics WorksheetSaurabh SaxenaNo ratings yet

- Class 7 Computer Science CHAPTER 3 (Computer Viruses)Document2 pagesClass 7 Computer Science CHAPTER 3 (Computer Viruses)Saurabh SaxenaNo ratings yet

- Class 7 Extra Computer Science CHAPTER 3 (Computer Viruses)Document3 pagesClass 7 Extra Computer Science CHAPTER 3 (Computer Viruses)Saurabh SaxenaNo ratings yet

- IngredientsDocument5 pagesIngredientsSaurabh SaxenaNo ratings yet

- Abbreviations ComputerDocument8 pagesAbbreviations ComputerSaurabh SaxenaNo ratings yet

- Ga Tender PurposeDocument2 pagesGa Tender PurposeSaurabh SaxenaNo ratings yet

- 7 Cbse1Document4 pages7 Cbse1Saurabh SaxenaNo ratings yet

- 8 Cbse2Document4 pages8 Cbse2Saurabh SaxenaNo ratings yet

- CBSE Class 7 English - AdjectiveDocument1 pageCBSE Class 7 English - AdjectiveSaurabh SaxenaNo ratings yet

- Medanta Hospital, Lucknow Opd Schedule: To Book An Appointment, Call +91 522 4505050Document3 pagesMedanta Hospital, Lucknow Opd Schedule: To Book An Appointment, Call +91 522 4505050Saurabh SaxenaNo ratings yet

- Uttar Pradesh Minimum Wages Effective 1st October 2017Document1 pageUttar Pradesh Minimum Wages Effective 1st October 2017Saurabh SaxenaNo ratings yet

- Business Continuity Planning ChecklistDocument2 pagesBusiness Continuity Planning ChecklistShawn AmeliNo ratings yet

- Age DiscriminationDocument2 pagesAge DiscriminationMona Karllaine CortezNo ratings yet

- Powerful Phrases For Customer ServiceDocument16 pagesPowerful Phrases For Customer ServiceArturo GallardoNo ratings yet

- ReadingDocument17 pagesReadingTâm NguyễnNo ratings yet

- Tesla Manufacturing Plant in Canada AnnouncementDocument1 pageTesla Manufacturing Plant in Canada AnnouncementMaria MeranoNo ratings yet

- At Professional Responsibilities and Other Topics With AnswersDocument27 pagesAt Professional Responsibilities and Other Topics With AnswersShielle AzonNo ratings yet

- Root Cause Valid For Reason CodeDocument2 pagesRoot Cause Valid For Reason CodenagasapNo ratings yet

- Del Rosario V ShellDocument2 pagesDel Rosario V Shellaratanjalaine0% (1)

- TheSun 2009-04-10 Page04 Independents Can Keep Seats CourtDocument1 pageTheSun 2009-04-10 Page04 Independents Can Keep Seats CourtImpulsive collectorNo ratings yet

- Shaikh Zain Ul Aqtab SiddiqDocument4 pagesShaikh Zain Ul Aqtab SiddiqMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaNo ratings yet

- (Limpin, Shakti Dev) Mil Q4W1Document3 pages(Limpin, Shakti Dev) Mil Q4W1Shakti Dev LimpinNo ratings yet

- Board ResolutionDocument6 pagesBoard ResolutionAntonio GanubNo ratings yet

- 13 Okol vs. Slimmer's World InternationalDocument2 pages13 Okol vs. Slimmer's World Internationaljed_sindaNo ratings yet

- kazan-helicopters (Russian Helicopters) 소개 2016Document33 pageskazan-helicopters (Russian Helicopters) 소개 2016Lee JihoonNo ratings yet

- MRP PDFDocument45 pagesMRP PDFSamNo ratings yet

- Banners of The Insurgent Army of N. Makhno 1918-1921Document10 pagesBanners of The Insurgent Army of N. Makhno 1918-1921Malcolm ArchibaldNo ratings yet

- CORPORATION Sec 1 17Document39 pagesCORPORATION Sec 1 17BroskipogiNo ratings yet

- Interface Technology 2009 PDFDocument352 pagesInterface Technology 2009 PDFrakacyuNo ratings yet

- Nurses Bill of RightsDocument1 pageNurses Bill of RightsFlauros Ryu Jabien100% (1)

- Arup Mauritius BrochureDocument8 pagesArup Mauritius BrochureKhalil HosaneeNo ratings yet

- Wilcom EmroiWilcom Embroidery Software Learning Tutorial in HindiDocument10 pagesWilcom EmroiWilcom Embroidery Software Learning Tutorial in HindiGuillermo RosasNo ratings yet

- A La CarteDocument3 pagesA La CarteJyot SoodNo ratings yet

- Argala: Illustration: Define Primary Argala and Virodha Argala On Lagna For A Standard BirthDocument4 pagesArgala: Illustration: Define Primary Argala and Virodha Argala On Lagna For A Standard Birthsurinder sangarNo ratings yet

- Theory and Models of Consumer BehaviorDocument28 pagesTheory and Models of Consumer BehaviorNK ShresthaNo ratings yet