Professional Documents

Culture Documents

Percentage Tax Items

Percentage Tax Items

Uploaded by

Kristine Campos0 ratings0% found this document useful (0 votes)

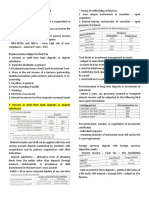

1 views3 pagesThis document outlines various percentage taxes applied to gross receipts or payments for different types of individuals and businesses in the Philippines. Taxes range from 0-30% and are applied to items like non-VAT registered persons, domestic carriers, international carriers, franchise grantees, radio/TV broadcasters, overseas communications, banks, insurance companies, property owners, and various entertainment industries.

Original Description:

BUSINESS TAXATION-PERCENTAGE TAX ITEMS- BSMA

Original Title

PERCENTAGE TAX ITEMS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines various percentage taxes applied to gross receipts or payments for different types of individuals and businesses in the Philippines. Taxes range from 0-30% and are applied to items like non-VAT registered persons, domestic carriers, international carriers, franchise grantees, radio/TV broadcasters, overseas communications, banks, insurance companies, property owners, and various entertainment industries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views3 pagesPercentage Tax Items

Percentage Tax Items

Uploaded by

Kristine CamposThis document outlines various percentage taxes applied to gross receipts or payments for different types of individuals and businesses in the Philippines. Taxes range from 0-30% and are applied to items like non-VAT registered persons, domestic carriers, international carriers, franchise grantees, radio/TV broadcasters, overseas communications, banks, insurance companies, property owners, and various entertainment industries.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

1.

Non-VAT registered persons under Gross sales or receipts 3%

Section 109 (BB)

2. Domestic carriers and keepers of garages Gross receipts 3%

3. International air/shipping carriers doing Gross receipts on transport of cargo 3%

business in the Philippines from the Philippines to a foreign

country

4. Franchise grantees: 2%

Gas and water utilities 3%

Gross receipts

Radio and television broadcasting companies

whose annual gross receipts of the preceding Gross receipts

year do not exceed Php10,000,000 and did not

opt to register as VAT taxpayer

5. Overseas dispatch, message or Amount paid for the service 10%

conversation originating from the

Philippines

6. Banks and non-bank financial Interest, commissions and discounts from lending

intermediaries performing quasi-banking activities as well as income from financial leasing,

functions on the basis of remaining maturities of

instruments from which receipts are derived:

• If maturity period is five years or 5%

less

• If maturity period is more than five 1%

years

Dividends and equity shares and net 0%

income of subsidiaries

Royalties, rentals of property, real or 7%

personal, profits from exchange and

all other items treated as gross income

under Sec. 32 of the Tax Code, as

amended

Net trading gains within the taxable 7%

year of foreign currency, debt

securities, derivatives and other

similar financial instruments

7. Other non-bank financial intermediaries Interest, commissions, discounts and 5%

all other items treated as gross income

under the Tax Code, as amended

Interest, commissions, discounts from lending

activities, as well as income from financial leasing

on the basis of remaining maturities of

instruments from which such receipts are

derived:

• If maturity period is five years or 5%

less

• If maturity period is more than five 1%

years

8. Life Insurance Total premiums collected 2%

Company/Agent/Corporation (except

purely cooperative companies or

associations)

9. Agents of foreign insurance companies (except reinsurance premium):

10. Insurance agents authorized under the Total premiums collected 4%

Insurance Code to procure policies of

insurance for companies not authorized

to transact business in the Philippines

11. Owners of property obtaining insurance Total premiums paid 5%

directly with foreign insurance companies

12. Proprietor, lessee or operator of the following:

13. Cockpits Gross receipts 18%

14. Cabarets, Night or Day Clubs, videoke Gross receipts 18%

bars, karaoke bars, karaoke televisions,

karaoke boxes and music lounges

15. Boxing exhibitions (except when the Gross receipts 10%

World or Oriental Championship is at

stake in any division, provided further

that at least one of the contenders for

World Championship is a citizen of the

Philippines and said exhibitions are

promoted by a citizen/s of the Philippines

or by a corporation/ association at least

60% of the capital of which is owned by

said citizen/s)

16. Professional basketball games (in lieu of Gross receipts 15%

all other percentage taxes of whatever

nature and description)

17. Jai-alai and race track Gross receipts 30%

18. Winnings on horse races · Winnings or 'dividends' 10%

· Winnings from double 4%

forecast/quinella and trifecta bets

· Prizes of owners of winning race 10%

horses

You might also like

- Project Management Achieving Competitive Advantage 5th Edition Pinto Test BankDocument35 pagesProject Management Achieving Competitive Advantage 5th Edition Pinto Test Bankashleygonzalezcqyxzgwdsa100% (14)

- RA Export 20230303-171712 (TEMPLATE-04 Haz) - ID230303164833 - Rev2023-03-03 - Cargo & Ballast Works - Ballast Water Treatment System FailureDocument3 pagesRA Export 20230303-171712 (TEMPLATE-04 Haz) - ID230303164833 - Rev2023-03-03 - Cargo & Ballast Works - Ballast Water Treatment System FailureHarman Sandhu100% (3)

- Kobelco Excavator Error CodesDocument7 pagesKobelco Excavator Error CodesMaryam86% (57)

- Percentage TaxDocument3 pagesPercentage TaxRainNo ratings yet

- Ch03 Percentage Tax Rates TableDocument2 pagesCh03 Percentage Tax Rates TableRenelyn FiloteoNo ratings yet

- CHAPTER 5 - Percentage TaxDocument2 pagesCHAPTER 5 - Percentage Taxnewlymade641No ratings yet

- Other Percentage Tax DraftDocument9 pagesOther Percentage Tax Draftbeadineros8No ratings yet

- Other Perceentage TaxesDocument9 pagesOther Perceentage TaxesBrian Martin AnupolNo ratings yet

- Other Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateDocument18 pagesOther Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateZaaavnn VannnnnNo ratings yet

- Quarterly Percentage Tax Rates TableDocument2 pagesQuarterly Percentage Tax Rates TableJoseph MangahasNo ratings yet

- Percentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedDocument4 pagesPercentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedAndrea TanNo ratings yet

- Quarterly Percentage Tax Rates Table: Taxable Base Tax RateDocument4 pagesQuarterly Percentage Tax Rates Table: Taxable Base Tax RateKathrine CruzNo ratings yet

- Taxation Reviewer - Percentage TaxDocument3 pagesTaxation Reviewer - Percentage TaxDaphne BarceNo ratings yet

- Tax Quiz BeeDocument10 pagesTax Quiz BeeMitchelle DumlaoNo ratings yet

- Tax Rates: Coverage Basis Tax RateDocument3 pagesTax Rates: Coverage Basis Tax RateDymphna Ann CalumpianoNo ratings yet

- Bullet Notes 9 - Other Percentage TaxDocument4 pagesBullet Notes 9 - Other Percentage TaxFlores Renato Jr. S.No ratings yet

- Other Percentage TaxDocument3 pagesOther Percentage Taxmira limNo ratings yet

- Excise Percentage TaxDocument9 pagesExcise Percentage TaxPines MacapagalNo ratings yet

- Other Percentage Taxes Transaction/Entity Tax Rate Tax BaseDocument4 pagesOther Percentage Taxes Transaction/Entity Tax Rate Tax BaseClarissa de VeraNo ratings yet

- Business TaxationDocument41 pagesBusiness TaxationKim AranasNo ratings yet

- Withholding Taxes 2023Document23 pagesWithholding Taxes 2023Antonette Frilles GibagaNo ratings yet

- Percentage TaxDocument28 pagesPercentage TaxkemboseNo ratings yet

- Infographics - TaxDocument12 pagesInfographics - TaxPablo InocencioNo ratings yet

- BIR Form 2551Q: Quarterly Percentage TaxDocument8 pagesBIR Form 2551Q: Quarterly Percentage TaxAngelyn SamandeNo ratings yet

- Other Percentage Tax SUMMARYDocument1 pageOther Percentage Tax SUMMARYMarionne GNo ratings yet

- Business and Transfer TaxationDocument5 pagesBusiness and Transfer TaxationElizabeth OlaNo ratings yet

- Withholding of Percentage TaxesDocument17 pagesWithholding of Percentage TaxesNilda Sahibul BaclayanNo ratings yet

- Module No 3 - INCOME TAXATION PART1ADocument6 pagesModule No 3 - INCOME TAXATION PART1APrinces S. RoqueNo ratings yet

- TAX 401 Percentage Tax Part 1Document7 pagesTAX 401 Percentage Tax Part 1Juan Miguel UngsodNo ratings yet

- Notes Other Tax PercentageDocument7 pagesNotes Other Tax PercentageJohn RellonNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJeffrey BionaNo ratings yet

- Tax RateDocument8 pagesTax RateJames Domini Lopez LabianoNo ratings yet

- Tax RateDocument8 pagesTax RateJames Domini Lopez LabianoNo ratings yet

- Business Tax SummaryDocument10 pagesBusiness Tax SummaryJohn Raymond MarzanNo ratings yet

- Passive Income Tax RateDocument4 pagesPassive Income Tax RateGileah ZuasolaNo ratings yet

- Other Percentage Taxes: Prof. Jeanefer Reyes CPA, MPADocument29 pagesOther Percentage Taxes: Prof. Jeanefer Reyes CPA, MPAmark anthony espirituNo ratings yet

- Income Tax Chart - Individual TaxpayersDocument2 pagesIncome Tax Chart - Individual TaxpayersAlthia Joy AlisingNo ratings yet

- Tax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument4 pagesTax Rate A. For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of Professioniona4andalNo ratings yet

- Percentage TaxesDocument8 pagesPercentage TaxesTokha YatsurugiNo ratings yet

- OPT, Excise, DST, Tax RemediesDocument11 pagesOPT, Excise, DST, Tax RemediesLou Brad Nazareno IgnacioNo ratings yet

- Income Tax For CorporationsDocument2 pagesIncome Tax For CorporationskjabbugaoNo ratings yet

- Module 3 Percentage TaxDocument10 pagesModule 3 Percentage TaxDay DreamNo ratings yet

- Percentage TAX: Prepared By: Mrs. Nelia I. Tomas, Cpa, LPTDocument37 pagesPercentage TAX: Prepared By: Mrs. Nelia I. Tomas, Cpa, LPTTokis SabaNo ratings yet

- Percentage Tax and VATDocument15 pagesPercentage Tax and VATanyonghasayu30No ratings yet

- (Bustax) ReviewerDocument4 pages(Bustax) Reviewerphia triesNo ratings yet

- TAXATION 2 Chapter 8 Percentage Tax PDFDocument4 pagesTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoNo ratings yet

- 10 Income Tax Rates 12Document12 pages10 Income Tax Rates 12jomarvaldezconabacaniNo ratings yet

- HumRes TaxDocument3 pagesHumRes TaxJob Noel BernardoNo ratings yet

- What Is Percentage TaxDocument4 pagesWhat Is Percentage Taxmy miNo ratings yet

- Reported By: Group 3 - Boja, Edlyn M. Guevarra, Noemi G. Paule, Charlene P. BSA IV-CoronationDocument41 pagesReported By: Group 3 - Boja, Edlyn M. Guevarra, Noemi G. Paule, Charlene P. BSA IV-CoronationElla MalitNo ratings yet

- Bsa1202 Ss2324e Individuals 08a AddendumDocument2 pagesBsa1202 Ss2324e Individuals 08a Addendumninarissi.05No ratings yet

- Tax NotesDocument6 pagesTax NotesDeloria DelsaNo ratings yet

- Notes in Percentage TaxDocument8 pagesNotes in Percentage TaxESTRADA, Angelica T.No ratings yet

- TAX-401: Percentage TAX (P 1) : - T R S ADocument6 pagesTAX-401: Percentage TAX (P 1) : - T R S AEira ShaneNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJohn Felix Morelos DoldolNo ratings yet

- Opt HandoutDocument4 pagesOpt HandoutjulsNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Tax 05 Percentage Tax LectureDocument12 pagesTax 05 Percentage Tax LectureAllan Jay CabreraNo ratings yet

- Final Income TaxationDocument4 pagesFinal Income TaxationJean Diane Jovelo100% (1)

- Chapter 5: Final Income Taxation Final Withholding SystemDocument4 pagesChapter 5: Final Income Taxation Final Withholding SystemHanz RecitasNo ratings yet

- Chap 11 - Percentage Taxes ValenciaDocument23 pagesChap 11 - Percentage Taxes ValenciaDanzen Bueno Imus0% (1)

- Learning Mod 4 CfasDocument17 pagesLearning Mod 4 CfasKristine CamposNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesKristine CamposNo ratings yet

- Lm-Intermediate Accounting Module 2Document19 pagesLm-Intermediate Accounting Module 2Kristine CamposNo ratings yet

- The Global EconomyDocument8 pagesThe Global EconomyKristine CamposNo ratings yet

- Potret, Esensi, Target Dan Hakikat Spiritual Quotient Dan ImplikasinyaDocument13 pagesPotret, Esensi, Target Dan Hakikat Spiritual Quotient Dan ImplikasinyaALFI ROSYIDA100% (1)

- NYXBrand BookDocument34 pagesNYXBrand BookCristian Fernandez100% (1)

- Datasheet KA7500BDocument8 pagesDatasheet KA7500BFady HachemNo ratings yet

- B00H83LE66 SoftArchive - Net WomenDocument102 pagesB00H83LE66 SoftArchive - Net WomensuzukishareNo ratings yet

- Android Operating SystemDocument6 pagesAndroid Operating SystemDayanara CuevasNo ratings yet

- DWIN LCD Display With ApplicationDocument23 pagesDWIN LCD Display With ApplicationcihanNo ratings yet

- Premature Fatigue Failure of A Spring Due To Quench CracksDocument8 pagesPremature Fatigue Failure of A Spring Due To Quench CracksCamilo Rojas GómezNo ratings yet

- Manual de Utilizare Sursa de Alimentare 27.6 V5 A Pulsar EN54-5A17 230 VAC50 HZ Montaj Aparent LEDDocument40 pagesManual de Utilizare Sursa de Alimentare 27.6 V5 A Pulsar EN54-5A17 230 VAC50 HZ Montaj Aparent LEDGabriel SerbanNo ratings yet

- Compact Phase Shifter For 4G Base Station AntennaDocument2 pagesCompact Phase Shifter For 4G Base Station AntennaDo SonNo ratings yet

- Manorgbev Fellinger Nico C. Case Study Chapter 9 B 122Document10 pagesManorgbev Fellinger Nico C. Case Study Chapter 9 B 122Anne NuludNo ratings yet

- Learning Styles and Learning PreferencesDocument32 pagesLearning Styles and Learning Preferencespatterson nji mbakwaNo ratings yet

- Integer Programming Part 2Document41 pagesInteger Programming Part 2missMITNo ratings yet

- 9m-Ypg SN 41356 Finding Workpack 2018 16 Mar 2018Document3 pages9m-Ypg SN 41356 Finding Workpack 2018 16 Mar 2018mycopteraviationNo ratings yet

- Abhishek AnandDocument1 pageAbhishek AnandPritanshi AnandNo ratings yet

- Veterinary Course WorkDocument5 pagesVeterinary Course Workbcnwhkha100% (2)

- Caterpillar Engine Service Manual CT S Eng33068zDocument10 pagesCaterpillar Engine Service Manual CT S Eng33068zEliseeNo ratings yet

- The Warren Buffet Portfolio - SUMMARY NOTESDocument33 pagesThe Warren Buffet Portfolio - SUMMARY NOTESMMMMM99999100% (1)

- T-88 Structural Aircraft Adhesive: Technical Data SheetDocument2 pagesT-88 Structural Aircraft Adhesive: Technical Data Sheetanon_271015207No ratings yet

- Proof of The Orthogonality RelationsDocument3 pagesProof of The Orthogonality RelationsDeepikaNo ratings yet

- Tushar MalhotraDocument54 pagesTushar MalhotraAkash BhadalaNo ratings yet

- E School Management SystemDocument36 pagesE School Management SystemShivangi Priya VlogsNo ratings yet

- A Summer Training ReportDocument123 pagesA Summer Training ReportJeet SahuNo ratings yet

- Info Pompe Pistonase PDFDocument44 pagesInfo Pompe Pistonase PDFMarin GarazNo ratings yet

- Medieval PhilosophyDocument52 pagesMedieval PhilosophyMelkamNo ratings yet

- 2019 Colloquium Draft March 12Document33 pages2019 Colloquium Draft March 12Jessica BrummelNo ratings yet

- Milkfish Cage Culture Flyer PDFDocument2 pagesMilkfish Cage Culture Flyer PDFPrincess FontillasNo ratings yet

- Samsung CLX-2160 (Service Manual)Document158 pagesSamsung CLX-2160 (Service Manual)info3551No ratings yet