Professional Documents

Culture Documents

IT Assignment

IT Assignment

Uploaded by

Alena AlenaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT Assignment

IT Assignment

Uploaded by

Alena AlenaCopyright:

Available Formats

INCOME TAX

Assignment Questions

Last Date :- 19/1/2024

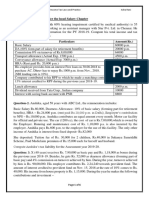

Problems on Computation of Gross Salary

1. Mr. X, physically handicapped person working in ABC Company Ltd. Bangalore has

furnished the following details of his income for the year 2022-23. Compute ihs income

from salary for the A. Y. 2023-24

a) Basic salary ₹40,000 p. m

b) Dearness allowance enters into retirement benefits ₹ 24,000

c) Fixed percentage of Commission on sale ₹ 1,500 per month.

d) Bonus ₹ 65,000

e) HRA ₹ 12,000 p.m. ( Rent Paid ₹ 10,600 p.m)

f) Transport allowance ₹ 4,000 p. m.

g) Reimbursement of Medical expenses ₹ 17,500 for treatment taken in private hospital.

h) Management contribution and own contribution to RPF is 15% of Salary

i) Interest credited to RPF is ₹ 11,000 at 11% p. a.

j) Professional tax paid by employees is ₹ 400 p. m

k) He is provided with more than 1.6 liter capacity car by the company for official use.

All the expenses including salary of the driver are met by the company.

l) Children education allowance ₹ 600 p.m per child for two children and children

hostel allowance₹ 1,000 p. m for two children.

2. From the following information calculate the income from salary of Mr. Anand for the A.

Y.2023-24

a) Basic salary ₹ 40,000 p.m

b) Dearness allowance 60% of basic forming part of salary.

c) Commission ₹ 18,000.

d) Bonus ₹ 60,000.

e) Employer and employees contribution to SPF is 15% of Salary.

f) Interest credited to SPF is ₹ 12,000 at 10% p.a.

g) CCA ₹ 500 p.m

h) Medical allowance ₹ 800 p.m.

i) He is provided with a rent free furnished house by the employer for which his

employer paid rent of ₹ 5,000 p.m. to the owner of the house. Cost of furniture is ₹

1,20,000.

j) He Is also provided with a car less than 1.6 litre capacity by the employer both for

personal and official use. All the expense of the car including salary of the driver are

paid by the employer.

k) Free telephone at his residence by the employer valued at ₹ 12,500.

l) Professional tax paid by him ₹ 450 p. m.

m) Gift voucher worth ₹ 12,500 were issued by the employer.

SUNILKUMAR C B. M.COM, B.ED., PGDBA., NET, K-SET, (MA) Page 1

3. Mrs. Hemamalini ( age 42 years) is working as a Director in Maruthi Suzuki Ltd.

Mumbai her salary income details are as follows:

a) Basic Salary ₹ 21,000 p. m.

b) Bonus – 2 months basic pay

c) Commission 3% on Sales. During the year she reached a sales target of ₹ 50,000

d) Dearness allowance forming part of Salary ₹ 7,000 p. m.

e) Medical allowance ₹ 1,400 p. m. ( Medical expenses were ₹ 20,000)

f) Entertainment Allowance ₹ 3,000 p. m

g) Children's hostel allowance for her two children @ ₹ 500 p. m. Per child ₹ 12,000

h) RPF company’s contribution ₹ 6,000 p. m.

i) RPF own contribution ₹ 5,000 p. m.

j) Interest accrued on 15th June 2018 RPF @ 11% ₹ 44,000

k) Diwali Gift ₹ 7,000

l) Holiday home facility at kulu ₹ 26,000

m) She has been provided with rent free furnished accommodation in Mumbai for which

company pays monthly rent of ₹ 10,000 and cost of furnished being ₹ 60,000

n) Honda city car above 1600cc has been provided along with driver for both private and

official use. Company owns the car and spent ₹ 55,000 on petrol and ₹ 36,000 on

driver salary.

o) Hemamalini paid Professional tax ₹ 2,400

p) She has been provided health club facility in a hotel by the employer, this facility is

available to all employees. Actual expenditure for providing this facility is ₹ 5000 p.

a.

q) Employer provider Watchmen facility, employer bears salary of ₹ 2000 per month

out of which ₹ 5000 per month is recovered.

Compute Taxable Salary for the Assessment year 2023-24.

4. Mrs. Smitha working as a sales executive in Maruti Limited. Kolkata and salary details

are as follows for the previous year 2022-23

a) Basic salary ₹ 21000 per month

b) Bonus equal to 2 months basic salary

c) Commission 3% on sales (During the year sales target of ₹ 5,00,000)

d) Dearness allowance ₹ 7,000 per month. (Eligible for retirement benefit)

e) Medical allowance ₹ 1,400 per month (Medical expenses ₹15,000 p. a.)

f) Children hostel allowance for two children at ₹ 500 per month per child.

g) Children education allowance for t her two children ₹400 per month for child.

h) RPF contribution by the company ₹ 6,000 per month.

i) RPF contribution by employees ₹ 5, 000 per month.

j) Interest credited on RPF 11% ₹ 44,000.

SUNILKUMAR C B. M.COM, B.ED., PGDBA., NET, K-SET, (MA) Page 2

k) She has been provided with company’s owned rent free furnished house in Mumbai

and cost of furniture provided ₹ 60,000.

l) Mrs. Smitha paid her professional tax ₹ 2,400 p.a.

m) The company during the year Requistioned her for a refresher course in Hongkong

and the cost of travel, stay expenses amounting to ₹ 56,500 were met by the company.

n) Medicalim insurance on life of Mrs. Smitha paid by the company ₹ 5,000

o) Payment of accidental insurance premium by the company ₹ 5,000.

Compute Taxable salary for the A. Y.2023-24

5. Mr. Yadav is an employee of State Bank of India Bangalore and he Submits the

following information relevant for the A. Y.2023-24. Compute his taxable income from

salary:

a) Basic Salary ₹ 8000 per month

b) Dearness allowance ₹ 1500 per month (does not form part of salary).

c) City compensatory allowance ₹ 300 p. m.

d) Bonus ₹ 10,000 per annum.

e) Conveyance allowance ₹ 2,000 p. m. ( 60% spent for office duties)

f) House Rent allowance ₹ 5,000 p. m. ( Rent paid by employee ₹ 7,000 p. m.)

g) Payment of LIC premium by SBI ₹ 4,000 p. a.

h) Service of Sweeper paid by SBI ₹ 200 per month.

i) Leave travel Concession ₹ 5,000 ( First time in current Block Period)

j) Reimbursement of Gas, electricity and water bill by the SBI ₹ 2,500 per annum.

k) RPF contribution by the bank and own contribution of employees 14% of Salary.

l) Interest credited to RPF at 14% ₹ 14,000.

m) Professional tax paid by Yadav ₹ 5,000.

n) Interest free loan for purchasing a house given on 01-10-18 ₹ 2,00,000 ( SBI lending

Rate is 10.1%)

6. Mr. Sudeep sales manager of ANZ Limited, Mumbai has furnished the following details

of his income for the year ended 31st March 2022. Compute his taxable income from

salary for the assessment year 2023-24

a) Basic salary ₹ 17500 per month

b) Dearness allowances ₹ 6,000 per month (forming part of salary)

c) Commission is 2% on sales. During the previous year sales target reached by him is ₹

4,00,000.

d) Bonus equal to 3 months basic salary.

e) Entertainment allowance 2,500 per month (amount spent 12,000).

f) Children hostel allowance for his 3 children ₹ 400 per month per child.

g) Reimbursement of medical bills ₹ 22,000 for the treatment taken in private Nursing

Home.

h) He is provided rent free furnished accommodation owned by the company. cost of

furniture ₹ 1,00,000. FRV of that accommodation is ₹ 7500 per month.

SUNILKUMAR C B. M.COM, B.ED., PGDBA., NET, K-SET, (MA) Page 3

i) Free telephone at his residence ₹ 3,500.

j) Medical insurance of Mr. Sudeep paid by company ₹ 4000 per annum.

k) Employment tax paid by the company ₹ 1,000 per annum.

l) LIC insurance premium paid by the company ₹ 1,500 per annum on behalf of Mr.

Sudeep.

7. The following particular related to the income of Mr. Pavan For the previous year 2022-

23

He Is employed in a cotton textile mill at Bangalore on monthly salary of ₹ 25,000. He is

also entitled to a Commission at 1% of sales affected by him. The sales affected by him

during the previous year amounted to ₹ 40,00,000 . He received the following allowances

and perquisites during previous year.

a) Dearness pay at ₹ 6,000 per month.

b) Bonus at two months basic salary.

c) Entertainment allowance @ ₹ 2,000 per month.

d) House Rent allowance ₹ 5,000 per month.

e) Income tax of Mr. Pavan paid by employer ₹ 10,000.

f) Free telephone installed at his residence ₹ 6,000.

g) He and his employer contribution 15% of his salary to his RPF and interest credited

to this fund at 10% amounted to ₹ 30,000 during the year.

h) He spent ₹ 6,000 per month as rent of the house occupied by him in Bangalore.

Compute his taxable income under the head salaries for the A.Y 2023-24

8. Mr. Kiran is working in a private company in Bangalore. From the following details of

his salary compute the income from salary for the A.Y. 2023-24

a) Net Basic Salary ₹ 74,000. After deduction of tax at Source of ₹ 8,000 in the year.

b) DA ₹ 800 per month equal to 3 months basic salary.

c) House Rent allowances ₹ 800 per month but he is paying rent of ₹ 1,200 per month

for his residence in Bangalore.

d) His son is studying in a residential school in Mysore and Company paying education

allowance if ₹ 4,000 and hostel allowance ₹ 4,000 yearly.

e) He is contributing to RPF at 15% of Salary and the company contributing an equal

amount.

f) Interest earned on RPF ₹ 4,200 at 14% p. a.

g) Conveyance allowance ₹ 8,500 of which he spent ₹ 5,500 for official purpose.

h) He is the member of lions Club an annual membership fees ₹ 2,000 paid by company.

i) Kiran has a telephone in his residence for personal and official use and it’s bill ₹

5,000 paid by the company

j) He paid ₹ 510 professional tax

SUNILKUMAR C B. M.COM, B.ED., PGDBA., NET, K-SET, (MA) Page 4

k) Cash incentives received ₹ 5,000.

SUNILKUMAR C B. M.COM, B.ED., PGDBA., NET, K-SET, (MA) Page 5

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- ICAP Income Tax Numericals Regards Awais Ali PDFDocument52 pagesICAP Income Tax Numericals Regards Awais Ali PDFInam Ul Haq Minhas0% (2)

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- MCQ - Income Under The Head Salary by CA Kishan KumarDocument16 pagesMCQ - Income Under The Head Salary by CA Kishan KumarGoutam ChakrabortyNo ratings yet

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- Sem - IV Master Problem On SalaryDocument1 pageSem - IV Master Problem On SalaryHemant shawNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- Workhseet-4Document3 pagesWorkhseet-4ManidevNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- +++C$C, CCC$ CDocument7 pages+++C$C, CCC$ CKomal Damani ParekhNo ratings yet

- PFTP - Unit II - Income From Salary - Short SumsDocument3 pagesPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974No ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Problems On Income From Other SourcesDocument3 pagesProblems On Income From Other Sourcesgoli pandeyNo ratings yet

- Updated Tax AssignmentDocument3 pagesUpdated Tax AssignmentFarhan CheemaNo ratings yet

- Q.P. Voc-I Direct TaxDocument4 pagesQ.P. Voc-I Direct TaxNitin DhawleNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Illustration On Special AllowanceDocument3 pagesIllustration On Special AllowanceNitin RajNo ratings yet

- Inter Test Paper 4 - SalaryDocument3 pagesInter Test Paper 4 - SalarySrushti Agarwal100% (1)

- Assignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsDocument2 pagesAssignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsWaasfaNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Tax Management ModelDocument17 pagesTax Management ModelZacharia VincentNo ratings yet

- 1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDDocument3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST NDadhishree bhattacharyaNo ratings yet

- 4 SalariesDocument6 pages4 SalariesSrinishaNo ratings yet

- Assignment No.01 - Salary IncomeDocument1 pageAssignment No.01 - Salary Incomeabdul.fattaahbakhsh29No ratings yet

- Employt Revision Qns. 2023Document8 pagesEmployt Revision Qns. 2023Mbeiza MariamNo ratings yet

- Class Quiz 1 SalaryDocument4 pagesClass Quiz 1 SalaryParnika SinghalNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- M4 Tax Planning Practice QuestionsDocument32 pagesM4 Tax Planning Practice Questionsapi-3814557No ratings yet

- Employment Income Udom PDFDocument13 pagesEmployment Income Udom PDFMaster KihimbwaNo ratings yet

- Employment Income UdomDocument13 pagesEmployment Income UdomMaster KihimbwaNo ratings yet

- Employment IncomeDocument14 pagesEmployment IncomeMussaNo ratings yet

- NullDocument5 pagesNullAshar HammadNo ratings yet

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- Taxation of Individuals QuestionsDocument2 pagesTaxation of Individuals QuestionsPerpetua KamauNo ratings yet

- Tax Mid Term Draft: 15 MarksDocument4 pagesTax Mid Term Draft: 15 MarksWaasfa100% (1)

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- Income From Other Sources - Theory & Question BankDocument7 pagesIncome From Other Sources - Theory & Question Bankvishakma0No ratings yet

- Income Under The Head Salaries Assignment EscholarsDocument38 pagesIncome Under The Head Salaries Assignment EscholarspuchipatnaikNo ratings yet

- Income Tax Question BankDocument26 pagesIncome Tax Question Bankmounap04No ratings yet

- CFP Sample Paper Tax PlanningDocument4 pagesCFP Sample Paper Tax PlanningamishasoniNo ratings yet

- QP 2 PDFDocument7 pagesQP 2 PDFShankar ReddyNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- Quiz 4Document1 pageQuiz 4Khalid IMRANNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Nov DecIII V Sem 2020Document8 pagesNov DecIII V Sem 2020dweeps75No ratings yet

- New Employment Inc QnsDocument13 pagesNew Employment Inc QnsLoveness JoseehNo ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- M.K. Gupta Ca Education Income Tax: Multiple Choice QuestionsDocument2 pagesM.K. Gupta Ca Education Income Tax: Multiple Choice QuestionsdeepakadhanaNo ratings yet

- Dac 212:principles of Taxation Revision Questions Topics 1-4Document6 pagesDac 212:principles of Taxation Revision Questions Topics 1-4Nickson AkolaNo ratings yet

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100Document8 pagesTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100TejTejuNo ratings yet

- Test Paper 1 SalaryDocument4 pagesTest Paper 1 SalaryjesurajajosephNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Toward a National Eco-compensation Regulation in the People's Republic of ChinaFrom EverandToward a National Eco-compensation Regulation in the People's Republic of ChinaNo ratings yet

- Corporate Accounting I - Unit 1 EditedDocument39 pagesCorporate Accounting I - Unit 1 EditedAngelin TherusNo ratings yet

- Last Study Topics: - Present Value (PV) - Net Present Value (NPV) - NPV Rule - Rate of Return RuleDocument102 pagesLast Study Topics: - Present Value (PV) - Net Present Value (NPV) - NPV Rule - Rate of Return RuleTalib DoaNo ratings yet

- Cash Flow AnalysisDocument15 pagesCash Flow AnalysisElvie Abulencia-BagsicNo ratings yet

- 1999 Reputacion, Litigio PDFDocument29 pages1999 Reputacion, Litigio PDFSergio OrdóñezNo ratings yet

- Complete Aptitude Test 2-Solution SetDocument41 pagesComplete Aptitude Test 2-Solution SetPutinNo ratings yet

- 2013 Defeasance AnalysisDocument1 page2013 Defeasance AnalysisPennLiveNo ratings yet

- Mock Exam Part 1Document28 pagesMock Exam Part 1LJ SegoviaNo ratings yet

- Ligutan v. Court of Appeals, G.R. No. 138677, February 12, 2002, 376 SCRA 560.Document10 pagesLigutan v. Court of Appeals, G.R. No. 138677, February 12, 2002, 376 SCRA 560.Jade Clemente0% (1)

- Dissertation 2Document64 pagesDissertation 2Nikos Karakaisis0% (1)

- Excel ActivitiesDocument4 pagesExcel ActivitiesSon Bhoy MachadoNo ratings yet

- Literature Review of Monetary Policy in IndiaDocument5 pagesLiterature Review of Monetary Policy in Indiaea0bvc3s100% (1)

- Modes of Issue of Securities Under Company's LawDocument21 pagesModes of Issue of Securities Under Company's LawShubham KalitaNo ratings yet

- Category A & B & C (Accounting)Document330 pagesCategory A & B & C (Accounting)AdityaNo ratings yet

- Excel Loan CalculatorDocument11 pagesExcel Loan CalculatorramcharanNo ratings yet

- Sadaf Alam and Mishal Nadeem 2015 Capital MarketDocument13 pagesSadaf Alam and Mishal Nadeem 2015 Capital MarketBabar NawazNo ratings yet

- Coventure Management, LLC: Form Adv Part 2ADocument18 pagesCoventure Management, LLC: Form Adv Part 2Ahult.elliot90No ratings yet

- Residual Method: A Development AppraisalDocument10 pagesResidual Method: A Development AppraisalYeowkoon ChinNo ratings yet

- Arizona Promissory Note: Pursuant To Arizona Statute 44-1201Document3 pagesArizona Promissory Note: Pursuant To Arizona Statute 44-1201PawPaul MccoyNo ratings yet

- Ocean Thermal Energy Corp V C Robert Coe III Et Al Cacdce-19-05299 0194.0Document8 pagesOcean Thermal Energy Corp V C Robert Coe III Et Al Cacdce-19-05299 0194.0mkuriloNo ratings yet

- Chapter 7Document89 pagesChapter 7Jihad H. SalehNo ratings yet

- Engineering Economy: Kiv Ryan A. Albino, Ece, EctDocument51 pagesEngineering Economy: Kiv Ryan A. Albino, Ece, EctRoss Sonny Cruz100% (2)

- Accounting Standard SummaryDocument17 pagesAccounting Standard Summarymegha.mm56No ratings yet

- Midterm Quiz 2 Partnership Dissolution Without Answer KeyDocument4 pagesMidterm Quiz 2 Partnership Dissolution Without Answer Keyaleksiyaah lexleyNo ratings yet

- Credit Risk I - Individual Loan RiskDocument39 pagesCredit Risk I - Individual Loan RiskBudi RahmanNo ratings yet

- 13 - Bond InvestmentDocument3 pages13 - Bond InvestmentralphalonzoNo ratings yet

- Brea ch05 BMM 7e SGDocument91 pagesBrea ch05 BMM 7e SGAshish BhallaNo ratings yet

- Chapter 8 (MC Medium) FlashcardsDocument12 pagesChapter 8 (MC Medium) FlashcardsMaryane AngelaNo ratings yet

- Dissertation On Credit ManagementDocument6 pagesDissertation On Credit ManagementPaperWritingServicesBestUK100% (1)

- LP Theory ClassNOTESDocument9 pagesLP Theory ClassNOTESNur Anna Batrisya Binti AzlanNo ratings yet

- Internship Report of Nepal Bank LimitedDocument30 pagesInternship Report of Nepal Bank LimitedSantos BhattaraiNo ratings yet