Professional Documents

Culture Documents

Example of Job Order Costing System

Example of Job Order Costing System

Uploaded by

HananOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example of Job Order Costing System

Example of Job Order Costing System

Uploaded by

HananCopyright:

Available Formats

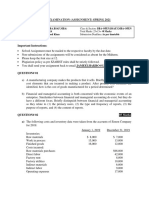

Worksheet for job order costing system

1. Consider a single month’s activity for Rand Company, a producer of gold and silver medallions. Rand Company has two jobs in

process during April, the first month of its fiscal year. Job A, a special minting of 1,000 gold medallions was started during

March, 2006. By the end of March, $30,000 in manufacturing costs had been recorded on Job A’s cost sheet. Job B, an order for

10,000 silver medallions the fall of the Berlin Wall, was started in April.

a. Rand Company had $ 7,000 in raw materials on hand. During the month the company purchased on account additional $

60,000 in raw materials.

b. $52,000 in raw materials was requisitioned from the storeroom for use in production. These raw materials included $28,000

of direct materials for Job A, $22,000 of direct materials for Job B, and $2,000 of indirect materials

c. $60,000 recorded for direct labor and $15,000 for indirect labor. $ 40,000 of direct labor cost was charged to Job A and the

remaining balance was charged to Job B.

d. the company incurred the following general factory costs during April

Utilities (heat, water and power) $21,000

Rent on factory equipment 16,000

Miscellaneous factory overhead 3,000

e. Rand Company recognized $13,000 accrued properly taxes and that $ 7,000 in prepaid insurance expired on factory

buildings and equipment.

f. the company recognized that $18,000 in depreciation on factory equipment during April

g. During April 10,000 machine hours worked on Job A and 5,000 machine hours were worked on job B assume the

predetermined overhead rate is $6 per machine hour.

h. incurred $ 30,000 in selling and administrative salary costs during April

i. depreciation on office equipment during April was $ 7,000

j. advertising cost was $ 42,000 and other selling and administrative expense was $ 8,000

k. Job A was completed during April and the beginning balance of finished goods in previous month was $ 10,000.

l. 750 of the 1,000 gold medallions in Job A were shipped to customers by the end of the month for the total sales revenue of

$225,000.

2. Hogle Company is a manufacturer that uses job order costing system. On January 1, 2004 at the beginning of its fiscal year, the

company’s inventory balances were as follows;

Raw materials $10,000

Work in process 5,000

Finished goods inventory 30,000

The company applies the overhead costs to jobs on the basis of machine hour worked. For the year 2004, the company estimated

that it would work 75,000 machine hours and incurs $450,000 in manufacturing overhead cost. The following transactions were

recorded for the year;

a. raw material were purchased on account $ 410,000

b. raw material were requisitioned for use in production, $380,000 ($360,000 direct materials and $20,000 indirect materials)

c. the following cost were incurred for the employee services; direct labor $ 75,000; indirect labor $110,000; sales commission, $

90,000 and administrative salaries $ 200,000

d. sales travel cost $ 17,000

e. utility costs in the factory were $43,000

f. advertising costs were $ 180,000

g. depreciation was recorded for the year; $ 350,000 ( 80% related to the factory operations and 20% relates to selling and

administrative activities)

h. insurance expired during the year $ 10,000 ( 70% relates to the factory operation and 30% relates to selling and administrative

activities)

i. Manufacturing overhead was applied to production. due to the expected demand for its products the company worked 80,000

machine hours during the year

j. Goods costing $870,000 to manufacture according to their job cost sheet were completed during the year.

k. Goods were sold on account to customers during the year for the total of $1,500,000. The goods cost of $870,000 to manufacture

according to their job cost sheet.

Required;

1. prepare the journal entries to record the preceding transactions

2. post the entries in (1) above to T- account

3. Is manufacturing overhead over applied or under applied for the year? Prepare a journal entry to close any balances in the

manufacturing overhead account.

4. prepare the schedule of cost goods manufactured and cost of goods for the year 2004

5. prepare an income statement for the year 2004

You might also like

- Test Answers For Accounts Payable 2015 - ElanceDocument14 pagesTest Answers For Accounts Payable 2015 - ElancesnezalatasNo ratings yet

- Ross12e Chapter03 TB AnswerkeyDocument44 pagesRoss12e Chapter03 TB AnswerkeyÂn TrầnNo ratings yet

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocument34 pagesZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNo ratings yet

- Preliminary Exam in Cost Accounting and ControlDocument5 pagesPreliminary Exam in Cost Accounting and ControlMohammadNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Cost Accounting Cycle ProblemsDocument3 pagesCost Accounting Cycle ProblemsAnonymous sn5Tcc100% (1)

- Job Order Costing Difficult RoundDocument8 pagesJob Order Costing Difficult RoundsarahbeeNo ratings yet

- Assignment 2 Job Order CostingDocument9 pagesAssignment 2 Job Order CostingGerson GloreNo ratings yet

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Cost Accounting Worksheet Chap 3Document5 pagesCost Accounting Worksheet Chap 3Muhammad UsmanNo ratings yet

- CA Group Task Job Costing 26032021 080344pm 15112021 065026pmDocument2 pagesCA Group Task Job Costing 26032021 080344pm 15112021 065026pmMeraj AliNo ratings yet

- Practice Problem Job CostingDocument4 pagesPractice Problem Job CostingDonna Zandueta-TumalaNo ratings yet

- 2020 Practice MCQsDocument28 pages2020 Practice MCQsĐàm Quang Thanh TúNo ratings yet

- Exam # 2 Chapter 15, 16, 17 ReviewDocument2 pagesExam # 2 Chapter 15, 16, 17 ReviewAnnNo ratings yet

- Chapter 2 - Asgmt-1Document2 pagesChapter 2 - Asgmt-1MarkJoven BergantinNo ratings yet

- Job Costing and Overhead ER PDFDocument16 pagesJob Costing and Overhead ER PDFShaira VillaflorNo ratings yet

- Job Order in Class Practice QuestionsDocument5 pagesJob Order in Class Practice QuestionsBisma ShahabNo ratings yet

- Exercise 1 - Cost Accumulation Procedure DeterminationDocument8 pagesExercise 1 - Cost Accumulation Procedure DeterminationstillwinmsNo ratings yet

- End of Chapter 2 ExerciesDocument11 pagesEnd of Chapter 2 ExerciesMaricar PinedaNo ratings yet

- CACCDocument3 pagesCACCMarielle JalandoniNo ratings yet

- Required:: Predetermined MOH Rate Estimated MOH $340,000 $2/DL$ Estimated Base $170,000Document1 pageRequired:: Predetermined MOH Rate Estimated MOH $340,000 $2/DL$ Estimated Base $170,000Sri MasjuwitaNo ratings yet

- FAR Exams2Document4 pagesFAR Exams2Francine PimentelNo ratings yet

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- Chapter 02 and 04 Extra ProblemsDocument4 pagesChapter 02 and 04 Extra ProblemsElvan Mae Rita ReyesNo ratings yet

- Assig 2Document4 pagesAssig 2Sýëd FűrrűķhNo ratings yet

- Worksheet1-Basics & COGSDocument5 pagesWorksheet1-Basics & COGSmohsinmustafa.2001No ratings yet

- DocxDocument19 pagesDocxcherry blossomNo ratings yet

- ExerciseDocument1 pageExerciseDedi JuventiniNo ratings yet

- Midterm Version 1Document57 pagesMidterm Version 1faensaNo ratings yet

- Qualifying Exam Reviewer 2017 - CostDocument12 pagesQualifying Exam Reviewer 2017 - CostAdrian Francis100% (1)

- Cost Exercise On Job OrderDocument3 pagesCost Exercise On Job Orderkennaa701No ratings yet

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- PSMI Corp. Is A Manufacturer That Used Job-Order Costing. On October 1Document2 pagesPSMI Corp. Is A Manufacturer That Used Job-Order Costing. On October 1elviarmadaniNo ratings yet

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDocument4 pagesProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresNo ratings yet

- ACCG 2000 Week 3 Homework Questions PDFDocument3 pagesACCG 2000 Week 3 Homework Questions PDF张嘉雯No ratings yet

- Exam 1 OnlineDocument2 pagesExam 1 OnlineGreg N Michelle SuddethNo ratings yet

- Cost Accounting Midterm Exam 2018.editedDocument3 pagesCost Accounting Midterm Exam 2018.editedMarites ArcenaNo ratings yet

- Revision Excercises Midterm Cost Accounting CA232Document6 pagesRevision Excercises Midterm Cost Accounting CA232Chacha gmidNo ratings yet

- ACT 202 AssignmentDocument3 pagesACT 202 AssignmentFahim AnjumNo ratings yet

- BSA QualifyingReviewer-6 PDFDocument12 pagesBSA QualifyingReviewer-6 PDFQueen ElleNo ratings yet

- Managerial Acc AssignmentDocument3 pagesManagerial Acc AssignmentDũng PhanNo ratings yet

- Basic Mas ConceptsDocument7 pagesBasic Mas Conceptsjulia4razoNo ratings yet

- Class Handout - Job Costing Session - 2and3-2Document4 pagesClass Handout - Job Costing Session - 2and3-2Ritwik MahajanNo ratings yet

- Assignment of Management Accounting TechniquesDocument6 pagesAssignment of Management Accounting TechniquesSaniaNo ratings yet

- Cost AccountingDocument59 pagesCost AccountingMuhammad UsmanNo ratings yet

- Job Order CostingDocument9 pagesJob Order CostingApple BaldemoroNo ratings yet

- Chapter 01 - Managerial Accounting and Cost ConceptsDocument14 pagesChapter 01 - Managerial Accounting and Cost ConceptsHardly Dare GonzalesNo ratings yet

- Day 06Document8 pagesDay 06Cy PenalosaNo ratings yet

- Cost AcctgDocument6 pagesCost AcctgMarynelle Labrador SevillaNo ratings yet

- CIMA - Question Bank (Relevant For F2)Document12 pagesCIMA - Question Bank (Relevant For F2)bebebam100% (1)

- Chapter 9 Review QuestionsDocument8 pagesChapter 9 Review QuestionsKanika DahiyaNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- Job Order QuestionsDocument6 pagesJob Order Questionsإبراهيم الشيخيNo ratings yet

- Acc101 Probset1 v2Document5 pagesAcc101 Probset1 v2BamPanggatNo ratings yet

- 1 Manufacturing ExercisesDocument3 pages1 Manufacturing ExercisesRead this SecretNo ratings yet

- Cost Accounting Mastery - 2Document2 pagesCost Accounting Mastery - 2Mark Revarez0% (1)

- 2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Document3 pages2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Darius Delacruz50% (2)

- Montaño - Computation of CostsDocument3 pagesMontaño - Computation of CostsJuan Miguel DosonoNo ratings yet

- Set eDocument4 pagesSet eKurt HendiveNo ratings yet

- AnswerDocument1 pageAnswerHananNo ratings yet

- Course TitleDocument8 pagesCourse TitleHananNo ratings yet

- Essay FinalDocument6 pagesEssay FinalHananNo ratings yet

- Emergency Travel Health Insurance Directive No. SIB282004Document4 pagesEmergency Travel Health Insurance Directive No. SIB282004HananNo ratings yet

- Example 1 - RM2Document21 pagesExample 1 - RM2HananNo ratings yet

- Act CH MisDocument56 pagesAct CH MisHananNo ratings yet

- Chapter TwoDocument16 pagesChapter TwoHananNo ratings yet

- FM AssignmentDocument2 pagesFM AssignmentHananNo ratings yet

- Chapter 3 FMDocument79 pagesChapter 3 FMHananNo ratings yet

- Chapter 4 Risk and ReturnDocument28 pagesChapter 4 Risk and ReturnHananNo ratings yet

- Chapter 1Document7 pagesChapter 1HananNo ratings yet

- Effect of Credit Risk, Liquidity Risk, and Market Risk Banking To Profitability Bank (Study On Devised Banks in Indonesia Stock Exchange)Document8 pagesEffect of Credit Risk, Liquidity Risk, and Market Risk Banking To Profitability Bank (Study On Devised Banks in Indonesia Stock Exchange)miko sondangNo ratings yet

- 2010 Excel Functions Macros and Data Commands Manual As of March 2010Document108 pages2010 Excel Functions Macros and Data Commands Manual As of March 2010Liliana Hurtado100% (5)

- CH 9 Joint-Process CostingDocument13 pagesCH 9 Joint-Process CostingSaleh MohammadNo ratings yet

- Purchase Order FreshDocument1 pagePurchase Order FreshBIJAYALAXMI PANIGRAHINo ratings yet

- Dearness Allowance: by Alpi Sharma Kavya Krishnan KDocument15 pagesDearness Allowance: by Alpi Sharma Kavya Krishnan KKavya KrishnanNo ratings yet

- Pension Papers ProformaDocument12 pagesPension Papers Proformasajidnazir56No ratings yet

- 5 Money and BanksDocument12 pages5 Money and BanksVeronika AlieksieienkoNo ratings yet

- CHAPTER 12 Stock ValuationDocument36 pagesCHAPTER 12 Stock ValuationVivi CheyNo ratings yet

- K V Aromatics Private Limited-Oct 2019 ICRADocument7 pagesK V Aromatics Private Limited-Oct 2019 ICRAPuneet367No ratings yet

- Corpo Assignment 9 CasesDocument9 pagesCorpo Assignment 9 CasesJM GuevarraNo ratings yet

- Risk, Cost of Capital, and ValuationDocument34 pagesRisk, Cost of Capital, and ValuationNguyễn Cẩm HươngNo ratings yet

- Chapter 13.Document6 pagesChapter 13.perdana findaNo ratings yet

- Exercise 2.3Document2 pagesExercise 2.3lheamaecayabyab4No ratings yet

- A4 Letterhead - Sq.enDocument22 pagesA4 Letterhead - Sq.enGeri HoxhaNo ratings yet

- Question Paper 2008 Delhi Set-1 CBSE Class-12 Business StudiesDocument4 pagesQuestion Paper 2008 Delhi Set-1 CBSE Class-12 Business StudiesAshish GangwalNo ratings yet

- CARE SheTrades Impact Fund Summary PDFDocument3 pagesCARE SheTrades Impact Fund Summary PDFRuby MethaNo ratings yet

- Richard Fuld Punched in Face in Lehman Brothers GymDocument21 pagesRichard Fuld Punched in Face in Lehman Brothers GymAkash saxenaNo ratings yet

- 1 Dio, RC, Tax Due. WorldDocument14 pages1 Dio, RC, Tax Due. WorldAngelou J. Delos ReyesNo ratings yet

- IAS 32 39 IFRS 7 9 Long Term LiabilitiesDocument48 pagesIAS 32 39 IFRS 7 9 Long Term LiabilitiesSamer BrownNo ratings yet

- V Semester Bba Management Accounting-Ratio Analysis: Questions & Answers ContinuedDocument6 pagesV Semester Bba Management Accounting-Ratio Analysis: Questions & Answers ContinuedFalak Falak fatimaNo ratings yet

- Matt V HSBC Exhibit - HDocument64 pagesMatt V HSBC Exhibit - Hchunga85No ratings yet

- MATHS Quantitative AptitudeDocument5 pagesMATHS Quantitative AptitudeKumar shantanu Basak0% (1)

- CE AFWeek Two LectureDocument58 pagesCE AFWeek Two LectureKhosi GrootboomNo ratings yet

- EDHEC Comments On The Amaranth Case: Early Lessons From The DebacleDocument23 pagesEDHEC Comments On The Amaranth Case: Early Lessons From The DebaclePablo TrianaNo ratings yet

- Paper20A Set1Document10 pagesPaper20A Set1Ramanpreet KaurNo ratings yet

- Business ValuationsDocument14 pagesBusiness ValuationsInnocent MapaNo ratings yet

- Lecture 1 - 2Document70 pagesLecture 1 - 2premsuwaatiiNo ratings yet

- Invoice 24-01-23Document1 pageInvoice 24-01-23Mohan DoifodeNo ratings yet