Professional Documents

Culture Documents

Chapter 1 - Analyze Transaction

Chapter 1 - Analyze Transaction

Uploaded by

Lê Nguyễn Anh ThưCopyright:

Available Formats

You might also like

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Nguyen Hong Chau - Hwchapter1,2 - PA1Document6 pagesNguyen Hong Chau - Hwchapter1,2 - PA1Châu NguyễnNo ratings yet

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- Assignment 123Document2 pagesAssignment 123shivrajsidhu20No ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocument4 pagesQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNo ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Opening Balance On 31, July: Assets LiabilitiesDocument3 pagesOpening Balance On 31, July: Assets LiabilitiesArnab Abhijit BhattacharyaNo ratings yet

- AccountingDocument7 pagesAccountingMohammad Bin ShafiqNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- CH.2 HWDocument11 pagesCH.2 HWSally PhungNo ratings yet

- Studies in Accounting 3Document19 pagesStudies in Accounting 3amirrashad141No ratings yet

- Patricia Petsch - Maria HernandezDocument10 pagesPatricia Petsch - Maria Hernandez075765ppNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Accounting Cycle1Document4 pagesAccounting Cycle1Ahmer NaeemNo ratings yet

- Tugas05 AKM1M 21013010130 Shavira Aisyah MaharaniDocument7 pagesTugas05 AKM1M 21013010130 Shavira Aisyah MaharanicaNo ratings yet

- Problem 1-3 Module 1Document7 pagesProblem 1-3 Module 1Tiffany GunawanNo ratings yet

- Pa 1Document4 pagesPa 1Aditya DzikirNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Mokoagouw, Angie Lisy (Advance Problem Chapter 1)Document14 pagesMokoagouw, Angie Lisy (Advance Problem Chapter 1)AngieNo ratings yet

- 2008-03-07 181349 Linda 4Document2 pages2008-03-07 181349 Linda 4gianghoanganh79No ratings yet

- Principles of Accounting Needles 12th Edition Solutions ManualDocument25 pagesPrinciples of Accounting Needles 12th Edition Solutions ManualnganphudrwlNo ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Tugas 1 Akuntansi PengantarDocument6 pagesTugas 1 Akuntansi PengantarblademasterNo ratings yet

- Acc Chapter 2Document4 pagesAcc Chapter 2WissalNo ratings yet

- AkunDocument9 pagesAkunmorinNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- WB Statement of Cash FlowsDocument10 pagesWB Statement of Cash FlowseynullabeyliseymurNo ratings yet

- AFM AssignmentDocument7 pagesAFM AssignmentMudit BhargavaNo ratings yet

- Chapter 5 SpreadsheetDocument7 pagesChapter 5 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Accounting Cycle 2Document6 pagesAccounting Cycle 2Ahmer NaeemNo ratings yet

- Financial Statement Construction ExercisesDocument14 pagesFinancial Statement Construction ExercisesScribdTranslationsNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Pelenio - Abm 12-ADocument2 pagesPelenio - Abm 12-AAAAAANo ratings yet

- Akl Ii TM 11Document4 pagesAkl Ii TM 11Amalia FillahNo ratings yet

- Solution 2Document3 pagesSolution 2AbhishekKumarNo ratings yet

- Soal Latihan Chapter 01Document3 pagesSoal Latihan Chapter 01Indrian Sibi todingNo ratings yet

- Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageOperating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Session 1 SolutionDocument17 pagesSession 1 SolutionAbhishek KamdarNo ratings yet

- Clairemont Co Ejercio de Practica MartesDocument2 pagesClairemont Co Ejercio de Practica Martescarlos huertasNo ratings yet

- Assignment 17Document8 pagesAssignment 17Nicolas ErnestoNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Uswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Document4 pagesUswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Kiki amaliaNo ratings yet

- TIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yDocument9 pagesTIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yEstefanía ZavalaNo ratings yet

- Chintia Novrianti 3c Lat 12 RevDocument6 pagesChintia Novrianti 3c Lat 12 RevShintia NovriantiNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set ADocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set AleshamunsayNo ratings yet

- Bài 2Document5 pagesBài 2Huyền ĐoànNo ratings yet

- Balance Sheet As of October 2018: Jl. Gunung Lingai Blok AADocument1 pageBalance Sheet As of October 2018: Jl. Gunung Lingai Blok AARiski Nack OutsiderNo ratings yet

- Pengantar Akuntansi (Tugas Kelompok)Document2 pagesPengantar Akuntansi (Tugas Kelompok)pekka19981No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Assignment Financial Statement AnalysisDocument7 pagesAssignment Financial Statement AnalysisNeel ManushNo ratings yet

- Ra 7686 (DTS)Document9 pagesRa 7686 (DTS)Bfc CollegesNo ratings yet

- Summer - Internship - Report - Project - Apprais - NaveenDocument89 pagesSummer - Internship - Report - Project - Apprais - NaveenNaveen GuptaNo ratings yet

- Project On A Study of Increasing Trend of Gold Loan by Manthan JoganiDocument139 pagesProject On A Study of Increasing Trend of Gold Loan by Manthan JoganiSonalNo ratings yet

- Hire Purchase Notes 10 YrDocument80 pagesHire Purchase Notes 10 YrLalitKukreja100% (2)

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Captal Market - Investments BankingDocument8 pagesCaptal Market - Investments BankingSameer OmlesNo ratings yet

- Economics ProjectDocument27 pagesEconomics ProjectKashish AgrawalNo ratings yet

- Exercises IAS 32 and IAS 39Document3 pagesExercises IAS 32 and IAS 39Gustavo Almeida100% (1)

- International Financial SystemDocument21 pagesInternational Financial SystemZawad TahmeedNo ratings yet

- Law 106 Corporation LawDocument9 pagesLaw 106 Corporation LawMitchi BarrancoNo ratings yet

- Senior Operations Onboarding Analyst in King of Prussia PA Resume Stephen FeldmanDocument2 pagesSenior Operations Onboarding Analyst in King of Prussia PA Resume Stephen FeldmanStephenFeldmanNo ratings yet

- IPM BBA Assignment 2Document1 pageIPM BBA Assignment 2maher213No ratings yet

- G. Modes of Extinguishment - NotesDocument12 pagesG. Modes of Extinguishment - NotesMarife Tubilag ManejaNo ratings yet

- Chick ThesisDocument47 pagesChick ThesisAyoniseh CarolNo ratings yet

- Matthew Brown Unit 4: Pre-Production PortfolioDocument12 pagesMatthew Brown Unit 4: Pre-Production PortfolioMatthew BrownNo ratings yet

- Sales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayDocument2 pagesSales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayThomas HollidayNo ratings yet

- Organisational Behavior On SBM BANKDocument101 pagesOrganisational Behavior On SBM BANKkeshav_26No ratings yet

- Business PlanDocument13 pagesBusiness PlanKeziah LaysonNo ratings yet

- Ethical Dilemmas in Product DevelopmentDocument44 pagesEthical Dilemmas in Product Developmentfrndjohn88% (8)

- Donation ReceiptDocument1 pageDonation ReceiptFARMAN SHAIKH SAHABNo ratings yet

- Impact of GST On Stock MarketDocument14 pagesImpact of GST On Stock MarketSiddhartha0% (1)

- ACCTG 7 - Advanced Accounting 1 Corporate Liquidation Quiz Problem 1Document9 pagesACCTG 7 - Advanced Accounting 1 Corporate Liquidation Quiz Problem 1Fery AnnNo ratings yet

- Auditing Problem Test Bank 1Document14 pagesAuditing Problem Test Bank 1EARL JOHN Rosales100% (5)

- DS82 CompleteDocument6 pagesDS82 CompleteBambang WijanarkoNo ratings yet

- Spouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsDocument11 pagesSpouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsRobyn JonesNo ratings yet

- Cost AccountingDocument18 pagesCost AccountingXyza Faye Regalado0% (1)

- Garments & Tailoring Business: Submitted byDocument6 pagesGarments & Tailoring Business: Submitted bykartik DebnathNo ratings yet

- Critical Reasoning SampleDocument2 pagesCritical Reasoning SampleNissho KanonNo ratings yet

Chapter 1 - Analyze Transaction

Chapter 1 - Analyze Transaction

Uploaded by

Lê Nguyễn Anh ThưOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 - Analyze Transaction

Chapter 1 - Analyze Transaction

Uploaded by

Lê Nguyễn Anh ThưCopyright:

Available Formats

Thursday, September 7, 2023 8:38 AM

Sole proprietorship Partnership Corporation

Number of owners 1 >=2 >=2

Legal Status No No Yes

Corporation tax No No Yes

Personal tax Yes Yes Yes

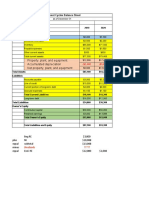

Transaction 1:

Cash Supplies Equipment Account Payable Equity Revenues Expenses

Taylors invests $30,000 cash set up a business

Equity --> Owner's capital: increase

Assets --> Cash: increase +$30,000 + $30,000

Transaction 2: - $2,500 +$2,500

Purchase supplies $2,500 by cash. - $26,000 +$26,000

Assets --> (Cash : Decrease & Supplies: Increase

Transaction 3: + 7,100 + $7,100

Purchase equipment for cash $26,000 + $4,200 +$4,200

Assets --> (Cash: Decrease $ Equipment: Increase)

- $1,700 + 1,700

Transaction 4:

Purchase supplies on account $ 7,100 $4,000 $9,600 $26,000 $7,100 $30,000 $4,200 $1,700

Asset --> Supplies: Increase Total Assets: $39,600 = Liabilities: $7,100 + Equity: $32,500

Liabilities --> Account Payable: Increase

Transaction 5: INCOME STATEMENT

Provides consulting service for cash $4,200

Revenues: $4,200

Asset --> Cash: Increase

Equity --> Revenues: Increase Expenses: $1,700

Transaction 6: - - Rent $1,000

Payment of expense in cash (include $1,000 rent & $700 salary) - Salary $700

Asset --> Cash: Decrease Net Profit $2,500

Equity --> Expenses (Rent & Salary): Increase

Statement of changes in Equity

- Owner's capital: $ 30,000

- Less Owner withdrawal: $0

- Add Revenues: $ 4,200

- Less Expenses: $1,700

Equity: $32,500

Balance sheet

- Cash: $ 4,000

- Supplies: $9,600

- Equipment: $ 26,000

- Total Asset: $39,600

- Account Payable: $7,100

Total Liabilities: $7,100

Owner's Capital $30,000

Net Profit $2,500

Total Equity $32,500

Total Liabilities And Equity $39,600

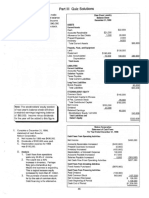

STATEMENT OF CASH FLOWS

Direct Indirect

Quick Notes Page 1

You might also like

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Nguyen Hong Chau - Hwchapter1,2 - PA1Document6 pagesNguyen Hong Chau - Hwchapter1,2 - PA1Châu NguyễnNo ratings yet

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- Assignment 123Document2 pagesAssignment 123shivrajsidhu20No ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocument4 pagesQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNo ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Opening Balance On 31, July: Assets LiabilitiesDocument3 pagesOpening Balance On 31, July: Assets LiabilitiesArnab Abhijit BhattacharyaNo ratings yet

- AccountingDocument7 pagesAccountingMohammad Bin ShafiqNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- CH.2 HWDocument11 pagesCH.2 HWSally PhungNo ratings yet

- Studies in Accounting 3Document19 pagesStudies in Accounting 3amirrashad141No ratings yet

- Patricia Petsch - Maria HernandezDocument10 pagesPatricia Petsch - Maria Hernandez075765ppNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Accounting Cycle1Document4 pagesAccounting Cycle1Ahmer NaeemNo ratings yet

- Tugas05 AKM1M 21013010130 Shavira Aisyah MaharaniDocument7 pagesTugas05 AKM1M 21013010130 Shavira Aisyah MaharanicaNo ratings yet

- Problem 1-3 Module 1Document7 pagesProblem 1-3 Module 1Tiffany GunawanNo ratings yet

- Pa 1Document4 pagesPa 1Aditya DzikirNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Mokoagouw, Angie Lisy (Advance Problem Chapter 1)Document14 pagesMokoagouw, Angie Lisy (Advance Problem Chapter 1)AngieNo ratings yet

- 2008-03-07 181349 Linda 4Document2 pages2008-03-07 181349 Linda 4gianghoanganh79No ratings yet

- Principles of Accounting Needles 12th Edition Solutions ManualDocument25 pagesPrinciples of Accounting Needles 12th Edition Solutions ManualnganphudrwlNo ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Tugas 1 Akuntansi PengantarDocument6 pagesTugas 1 Akuntansi PengantarblademasterNo ratings yet

- Acc Chapter 2Document4 pagesAcc Chapter 2WissalNo ratings yet

- AkunDocument9 pagesAkunmorinNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- WB Statement of Cash FlowsDocument10 pagesWB Statement of Cash FlowseynullabeyliseymurNo ratings yet

- AFM AssignmentDocument7 pagesAFM AssignmentMudit BhargavaNo ratings yet

- Chapter 5 SpreadsheetDocument7 pagesChapter 5 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Accounting Cycle 2Document6 pagesAccounting Cycle 2Ahmer NaeemNo ratings yet

- Financial Statement Construction ExercisesDocument14 pagesFinancial Statement Construction ExercisesScribdTranslationsNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Pelenio - Abm 12-ADocument2 pagesPelenio - Abm 12-AAAAAANo ratings yet

- Akl Ii TM 11Document4 pagesAkl Ii TM 11Amalia FillahNo ratings yet

- Solution 2Document3 pagesSolution 2AbhishekKumarNo ratings yet

- Soal Latihan Chapter 01Document3 pagesSoal Latihan Chapter 01Indrian Sibi todingNo ratings yet

- Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageOperating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Session 1 SolutionDocument17 pagesSession 1 SolutionAbhishek KamdarNo ratings yet

- Clairemont Co Ejercio de Practica MartesDocument2 pagesClairemont Co Ejercio de Practica Martescarlos huertasNo ratings yet

- Assignment 17Document8 pagesAssignment 17Nicolas ErnestoNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- Uswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Document4 pagesUswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Kiki amaliaNo ratings yet

- TIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yDocument9 pagesTIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yEstefanía ZavalaNo ratings yet

- Chintia Novrianti 3c Lat 12 RevDocument6 pagesChintia Novrianti 3c Lat 12 RevShintia NovriantiNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set ADocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set AleshamunsayNo ratings yet

- Bài 2Document5 pagesBài 2Huyền ĐoànNo ratings yet

- Balance Sheet As of October 2018: Jl. Gunung Lingai Blok AADocument1 pageBalance Sheet As of October 2018: Jl. Gunung Lingai Blok AARiski Nack OutsiderNo ratings yet

- Pengantar Akuntansi (Tugas Kelompok)Document2 pagesPengantar Akuntansi (Tugas Kelompok)pekka19981No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Assignment Financial Statement AnalysisDocument7 pagesAssignment Financial Statement AnalysisNeel ManushNo ratings yet

- Ra 7686 (DTS)Document9 pagesRa 7686 (DTS)Bfc CollegesNo ratings yet

- Summer - Internship - Report - Project - Apprais - NaveenDocument89 pagesSummer - Internship - Report - Project - Apprais - NaveenNaveen GuptaNo ratings yet

- Project On A Study of Increasing Trend of Gold Loan by Manthan JoganiDocument139 pagesProject On A Study of Increasing Trend of Gold Loan by Manthan JoganiSonalNo ratings yet

- Hire Purchase Notes 10 YrDocument80 pagesHire Purchase Notes 10 YrLalitKukreja100% (2)

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Captal Market - Investments BankingDocument8 pagesCaptal Market - Investments BankingSameer OmlesNo ratings yet

- Economics ProjectDocument27 pagesEconomics ProjectKashish AgrawalNo ratings yet

- Exercises IAS 32 and IAS 39Document3 pagesExercises IAS 32 and IAS 39Gustavo Almeida100% (1)

- International Financial SystemDocument21 pagesInternational Financial SystemZawad TahmeedNo ratings yet

- Law 106 Corporation LawDocument9 pagesLaw 106 Corporation LawMitchi BarrancoNo ratings yet

- Senior Operations Onboarding Analyst in King of Prussia PA Resume Stephen FeldmanDocument2 pagesSenior Operations Onboarding Analyst in King of Prussia PA Resume Stephen FeldmanStephenFeldmanNo ratings yet

- IPM BBA Assignment 2Document1 pageIPM BBA Assignment 2maher213No ratings yet

- G. Modes of Extinguishment - NotesDocument12 pagesG. Modes of Extinguishment - NotesMarife Tubilag ManejaNo ratings yet

- Chick ThesisDocument47 pagesChick ThesisAyoniseh CarolNo ratings yet

- Matthew Brown Unit 4: Pre-Production PortfolioDocument12 pagesMatthew Brown Unit 4: Pre-Production PortfolioMatthew BrownNo ratings yet

- Sales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayDocument2 pagesSales Representative Pharmaceutical Biotechnology in Knoxville TN Resume Thomas HollidayThomas HollidayNo ratings yet

- Organisational Behavior On SBM BANKDocument101 pagesOrganisational Behavior On SBM BANKkeshav_26No ratings yet

- Business PlanDocument13 pagesBusiness PlanKeziah LaysonNo ratings yet

- Ethical Dilemmas in Product DevelopmentDocument44 pagesEthical Dilemmas in Product Developmentfrndjohn88% (8)

- Donation ReceiptDocument1 pageDonation ReceiptFARMAN SHAIKH SAHABNo ratings yet

- Impact of GST On Stock MarketDocument14 pagesImpact of GST On Stock MarketSiddhartha0% (1)

- ACCTG 7 - Advanced Accounting 1 Corporate Liquidation Quiz Problem 1Document9 pagesACCTG 7 - Advanced Accounting 1 Corporate Liquidation Quiz Problem 1Fery AnnNo ratings yet

- Auditing Problem Test Bank 1Document14 pagesAuditing Problem Test Bank 1EARL JOHN Rosales100% (5)

- DS82 CompleteDocument6 pagesDS82 CompleteBambang WijanarkoNo ratings yet

- Spouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsDocument11 pagesSpouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsRobyn JonesNo ratings yet

- Cost AccountingDocument18 pagesCost AccountingXyza Faye Regalado0% (1)

- Garments & Tailoring Business: Submitted byDocument6 pagesGarments & Tailoring Business: Submitted bykartik DebnathNo ratings yet

- Critical Reasoning SampleDocument2 pagesCritical Reasoning SampleNissho KanonNo ratings yet