Professional Documents

Culture Documents

Aali 070502 LG

Aali 070502 LG

Uploaded by

Cristiano DonzaghiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aali 070502 LG

Aali 070502 LG

Uploaded by

Cristiano DonzaghiCopyright:

Available Formats

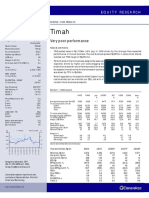

Result Commentary

Visit our website at www.trimegah.com 01 May 2007

Astra Agro Lestari

CPO Price Surge Salvaged Cost Increase

(AALI.JK/AALI IJ - Rp15,750) - HOLD

Result

z AALI's 3M07 revenue grew by 16.4% YoY to Rp1.0tr, on the back of a 37.5% price increase to Rp4,591/kg or

US$505/ton (net of tax). CPO sales volume declined by 13.8% YoY to 192,844tons, due to an 8.3% fall in

company's own FFB production to 808,475tons and a 23.4% drop in FFB purchases from third parties.

z Higher fertilizer and labor costs brought about a 22.4% YoY increase in total production cash cost to Rp2,675/

kg or US$294.0/ton. Given higher selling price increase versus cost, gross, operating, and net margins expanded

to 45.3%, 39.0%, and 26.5%, respectively.

z The company's bank loans increased by Rp60.9bn to Rp81.3bn, mostly used for its plantation expansion program

in East Kalimantan. AALI's current debt to equity ratio is 0.2x.

Comment

Equity Research

z AALI's 3M07 sales of Rp1.0tr is only 20.2% of our FY07 estimate, due to actual 3M07 CPO sales volume of only

19.4% of our FY07 forecast. CPO production volume is 20.2% of our FY07 estimate and 21.8% of the company's

guidance. We believe we have underestimated the impact of the El Nino weather phenomenon in 4Q06 to the

company estates' productivity. FFB production volume of 808,475tons is only 18.6% of our FY07 estimate.

Meanwhile, CPO selling price of US$505/ton is 2.0% higher than our forecast. Given currently strong CPO price

(YTD average of CPO Rotterdam CIF is US$629/ton), we believe AALI's selling price should rise. In 3M07 there

was still some carry over export contracts from last year; hence, a lower export price of US$450/ton versus

domestic US$522/ton in 3M07.

z Cost became apparent as a concern in 4Q06, as cash cost rose from US$244 in 9M06 to US$255/ton for FY06.

We previously expected that costs would alleviate in 1Q07, yet AALI's results signals otherwise. On a quarterly

INDONESIA

basis, cash cost rose slightly from US$290 in 4Q06 to US$294/ton in 1Q07. Labor cost increase is the primary

contributor to the increase, while fertilizer cost remains fairly stable according to the company. Despite higher

selling price, cost increases convey to a 3M07 net profit that is only 18.0% of our FY07 forecast.

z AALI is planning to enlarge its CPO planted area by 17,000ha. this year, which is 2,000ha higher than our current

estimate. The company is also in the process of developing a seed garden in Central Kalimantan. We have not

included the seed garden project in our valuation due to uncertainties surrounding such project and the ambiguous

associated timeline.

z We currently maintain our DCF-driven TP of Rp14,900 yet reduce our recommendation from BUY to HOLD

due to cost concerns and recent price appreciation. Additionally, current CPO futures contract in Rotterdam

of US$740/ton is 0.6% higher than its edible oil counterpart, soybean oil, which is traded in Chicago. In the past

two years, CPO traded at a daily average of a 26.1% discount to soybean.

Stock Data Financial Summary Y-o-Y and Q-o-Q Profitability Performance

Target Price: Rp14,900 (Rpbn) 3M06 3M07 Chg (%) 4Q06 1Q07 Chg (%)

P/E (x): 16.6

P/BV (x): 6.7 Sales 873 1,016 16.4 959 1,016 5.9

Div. Yield (%): 3.0 Gross Profit 345 460 33.3 342 460 34.5

Operating Profit 278 396 42.5 265 396 49.4

Net Profit 182 269 47.6 164 269 63.7

Gross Margin (%) 39.5 45.3 35.7 45.3

Sebastian Tobing Op. Margin (%) 31.9 39.0 27.6 39.0

Tel: (6221) 515 2727 Net Margin (%) 20.9 26.5 17.1 26.5

sebastian.tobing@trimegah.com Source : Company

Trimegah Research is also available electronically on : FirstCall.com, Multex and Securities.com

Result Commentary - Astra Agro Lestari

PT Trimegah Securities Tbk

19thFl, Artha Graha Building

Jl. Jend. Sudirman Kav. 52-53

Jakarta 12190, INDONESIA

Tel : (6221) 515 2727 Fax : (6221) 515 4580

DISCLAIMER

This report has been prepared by PT Trimegah Securities Tbk on behalf of itself and its affiliated companies and is provided for information purposes only.

Under no circumstances is it to be used or considered as an offer to sell, or a solicitation of any offer to buy. This report has been produced independently

and the forecasts, opinions and expectations contained herein are entirely those of Trimegah Securities.

While all reasonable care has been taken to ensure that information contained herein is not untrue or misleading at the time of publication, Trimegah

Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. This report is provided solely for the

information of clients of Trimegah Securities who are expected to make their own investment decisions without reliance on this report. Neither Trimegah

Securities nor any officer or employee of Trimegah Securities accept any liability whatsoever for any direct or consequential loss arising from any use of this

report or its contents. Trimegah Securities and/or persons connected with it may have acted upon or used the information herein contained, or the research

or analysis on which it is based, before publication. Trimegah Securities may in future participate in an offering of the company's equity securities.

2 PT Trimegah Securities Tbk - 01 May 2007

You might also like

- Analisis Laporan Keuangan PT Bukit AsamDocument10 pagesAnalisis Laporan Keuangan PT Bukit AsamALFIZAN AMINUDDINNo ratings yet

- Arch 7182 - Lecture WK 6 - Client Architect Agreements Part 3Document40 pagesArch 7182 - Lecture WK 6 - Client Architect Agreements Part 3Ben ShenNo ratings yet

- Cipla: Performance HighlightsDocument8 pagesCipla: Performance HighlightsKapil AthwaniNo ratings yet

- Exide Industries: Performance HighlightsDocument4 pagesExide Industries: Performance HighlightsMaulik ChhedaNo ratings yet

- Colgate-Palmolive: Performance HighlightsDocument4 pagesColgate-Palmolive: Performance HighlightsPrasad DesaiNo ratings yet

- 1Q18 Earnings Drop 49.9% Y/y On Lower Revenues, Below COL ForecastDocument6 pages1Q18 Earnings Drop 49.9% Y/y On Lower Revenues, Below COL ForecastMark Angelo BustosNo ratings yet

- Indopremier Company Update 1Q24 ASII 29 Apr 2024 Upgrade To BuyDocument6 pagesIndopremier Company Update 1Q24 ASII 29 Apr 2024 Upgrade To BuyfinancialshooterNo ratings yet

- IT Industry Q3FY09Document4 pagesIT Industry Q3FY09ca.deepaktiwariNo ratings yet

- Natco Pharma: Earnings Hit by Steep Price Erosion and Inventory Write-OffDocument8 pagesNatco Pharma: Earnings Hit by Steep Price Erosion and Inventory Write-OffN S100% (1)

- Natco Nirmal Bang PDFDocument8 pagesNatco Nirmal Bang PDFN SNo ratings yet

- Alembic Pharma LTD: Stock Price & Q4 Results of Alembic Pharma - HDFC SecuritiesDocument10 pagesAlembic Pharma LTD: Stock Price & Q4 Results of Alembic Pharma - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Astra Agro Lestari TBK: Soaring Financial Performance in 3Q20Document6 pagesAstra Agro Lestari TBK: Soaring Financial Performance in 3Q20Hamba AllahNo ratings yet

- 2011 Jan 31 - Cimb - SiaDocument11 pages2011 Jan 31 - Cimb - SiaKyithNo ratings yet

- MDA YE 2019 EN - Vfinal - RevisedDocument19 pagesMDA YE 2019 EN - Vfinal - Revisedredevils86No ratings yet

- PPB Group: 2019: Good Results Amid Challenging EnvironmentDocument4 pagesPPB Group: 2019: Good Results Amid Challenging EnvironmentZhi Ming CheahNo ratings yet

- VRL L L (VRL) : Ogistics TDDocument6 pagesVRL L L (VRL) : Ogistics TDjagadish madiwalarNo ratings yet

- Panca Mitra Multiperdana: Tailwinds AheadDocument6 pagesPanca Mitra Multiperdana: Tailwinds AheadSatria BimaNo ratings yet

- Kim Eng SekuritasDocument9 pagesKim Eng SekuritasefendidutaNo ratings yet

- Flash Note: ThailandDocument8 pagesFlash Note: ThailandAshokNo ratings yet

- Company Update - EXCL 20181102 3Q18 Results Data Volume Support EXCL RevenueDocument8 pagesCompany Update - EXCL 20181102 3Q18 Results Data Volume Support EXCL RevenueMighfari ArlianzaNo ratings yet

- Parag Milk Foods LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel BrokingDocument8 pagesParag Milk Foods LTD - Company Profile, Performance Update, Balance Sheet & Key Ratios - Angel Brokingmoisha sharmaNo ratings yet

- Bajaj Finance Sell: Result UpdateDocument5 pagesBajaj Finance Sell: Result UpdateJeedula ManasaNo ratings yet

- Dishman PharmaDocument8 pagesDishman Pharmaapi-234474152No ratings yet

- Concor - Q1FY20 - Result Update PDFDocument6 pagesConcor - Q1FY20 - Result Update PDFBethany CaseyNo ratings yet

- Motilal Oswal Sees 20% UPSIDE in Piramal Pharma Healthy RecoveryDocument8 pagesMotilal Oswal Sees 20% UPSIDE in Piramal Pharma Healthy RecoveryMohammed Israr ShaikhNo ratings yet

- SMBR PDFDocument5 pagesSMBR PDFAulia Hamdani FeizalNo ratings yet

- JS-Fertilizer 22FEB23Document3 pagesJS-Fertilizer 22FEB23FakharNo ratings yet

- Asii 190423-PDDocument6 pagesAsii 190423-PDFediantoNo ratings yet

- Mitra Adiperkasa: Indonesia Company GuideDocument14 pagesMitra Adiperkasa: Indonesia Company GuideAshokNo ratings yet

- Delta Corp: CMP: INR 166 TP: INR 304 (+83%) The Ship's SteadyDocument6 pagesDelta Corp: CMP: INR 166 TP: INR 304 (+83%) The Ship's SteadyJatin SoniNo ratings yet

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattNo ratings yet

- PRJ 5 2 24 PLDocument7 pagesPRJ 5 2 24 PLcaezarcodmNo ratings yet

- PTPP Uob 15 Mar 2022Document5 pagesPTPP Uob 15 Mar 2022Githa Adhi Pramana I GDNo ratings yet

- Breadtalk Group LTD: Singapore Company GuideDocument14 pagesBreadtalk Group LTD: Singapore Company GuideCleoNo ratings yet

- Report On Bodhi Tree MultimediaDocument5 pagesReport On Bodhi Tree MultimediabhoomikaNo ratings yet

- PP London Sumatra Indonesia: Equity ResearchDocument6 pagesPP London Sumatra Indonesia: Equity Researchkrisyanto krisyantoNo ratings yet

- Cipla Report - Doc Gourav Cygnus RecoveredDocument32 pagesCipla Report - Doc Gourav Cygnus RecoveredRohit BhansaliNo ratings yet

- SMGR Ugrade - 4M17 Sales FinalDocument4 pagesSMGR Ugrade - 4M17 Sales FinalInna Rahmania d'RstNo ratings yet

- Vinati Organics: AccumulateDocument7 pagesVinati Organics: AccumulateBhaveek OstwalNo ratings yet

- Ashok Leyland: Performance HighlightsDocument9 pagesAshok Leyland: Performance HighlightsSandeep ManglikNo ratings yet

- HappyDocument13 pagesHappykhushal jainNo ratings yet

- Indopremier Company Update SIDO 5 Mar 2024 Reiterate Buy HigherDocument7 pagesIndopremier Company Update SIDO 5 Mar 2024 Reiterate Buy Higherprima.brpNo ratings yet

- Indofood Sukses Makmur: Equity ResearchDocument4 pagesIndofood Sukses Makmur: Equity ResearchAbimanyu LearingNo ratings yet

- Insecticides India LTD: Stock Price & Q4 Results of Insecticides India Limited - HDFC SecuritiesDocument9 pagesInsecticides India LTD: Stock Price & Q4 Results of Insecticides India Limited - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Blue Star: Performance HighlightsDocument8 pagesBlue Star: Performance HighlightskasimimudassarNo ratings yet

- Greaves +angel+ +04+01+10Document6 pagesGreaves +angel+ +04+01+10samaussieNo ratings yet

- 1Q17 Income Better Than Expected, FV Estimate Raised: Share DataDocument6 pages1Q17 Income Better Than Expected, FV Estimate Raised: Share DataJajahinaNo ratings yet

- ABG+Shipyard 11-6-08 PLDocument3 pagesABG+Shipyard 11-6-08 PLapi-3862995No ratings yet

- Piramal Enterprises LTD: Business Structure and Its GovernanceDocument8 pagesPiramal Enterprises LTD: Business Structure and Its GovernanceAnuragNo ratings yet

- Moil 20nov19 Kotak PCG 00153Document7 pagesMoil 20nov19 Kotak PCG 00153darshanmadeNo ratings yet

- Press Release March 2019Document5 pagesPress Release March 2019Mallika TandonNo ratings yet

- StarCement Q3FY24ResultReview8Feb24 ResearchDocument9 pagesStarCement Q3FY24ResultReview8Feb24 Researchvarunkul2337No ratings yet

- FOCUS - Indofood Sukses Makmur: Saved by The GreenDocument10 pagesFOCUS - Indofood Sukses Makmur: Saved by The GreenriskaNo ratings yet

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocument8 pagesRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNo ratings yet

- Tata Steel: Performance HighlightsDocument6 pagesTata Steel: Performance Highlightsmd.iet87No ratings yet

- Angel Broking - BHELDocument5 pagesAngel Broking - BHELFirdaus JahanNo ratings yet

- Sanofi IndiaDocument9 pagesSanofi IndiaAshish RathoreNo ratings yet

- Press Release 2018 May PDFDocument4 pagesPress Release 2018 May PDFJairaj JadhavNo ratings yet

- Press Release 2018 MayDocument4 pagesPress Release 2018 MayJairaj JadhavNo ratings yet

- 7jul11 - Tiger AirwaysDocument3 pages7jul11 - Tiger AirwaysmelyeapNo ratings yet

- Aali 0803Document1 pageAali 0803Cristiano DonzaghiNo ratings yet

- Aali 0802Document1 pageAali 0802Cristiano DonzaghiNo ratings yet

- RegionalFundFlow - NomuraDocument28 pagesRegionalFundFlow - NomuraCristiano DonzaghiNo ratings yet

- Pgas 070529Document3 pagesPgas 070529Cristiano DonzaghiNo ratings yet

- Antm 080218 OdDocument3 pagesAntm 080218 OdCristiano DonzaghiNo ratings yet

- Tins 080429 OdDocument3 pagesTins 080429 OdCristiano DonzaghiNo ratings yet

- Timah 070123 15000Document1 pageTimah 070123 15000Cristiano DonzaghiNo ratings yet

- Tins 060831Document2 pagesTins 060831Cristiano DonzaghiNo ratings yet

- ISAT 060106 Network Expansion ContinuesDocument2 pagesISAT 060106 Network Expansion ContinuesCristiano DonzaghiNo ratings yet

- ANTM 060106 Higher Volume Mitigates Rising CostsDocument2 pagesANTM 060106 Higher Volume Mitigates Rising CostsCristiano DonzaghiNo ratings yet

- Mod 4 Environmental Laws and Policies in The PhilDocument20 pagesMod 4 Environmental Laws and Policies in The PhilMary Grace Buenaventura67% (3)

- Checked-Chapter-Ii-Rrl 2Document13 pagesChecked-Chapter-Ii-Rrl 2ROSARIO CHARLENE IRISH P.100% (1)

- Juvenile JusticeDocument110 pagesJuvenile JusticeArpit Maggo100% (1)

- Jarugulu Mohan Rao DLDocument1 pageJarugulu Mohan Rao DLsaiengineeringworks9666No ratings yet

- Investigation Data Form: To Be Accomplished by The OfficeDocument1 pageInvestigation Data Form: To Be Accomplished by The OfficeMabini Municipal Police StationNo ratings yet

- Dwnload Full Science of Psychology An Appreciative View 4th Edition King Solutions Manual PDFDocument27 pagesDwnload Full Science of Psychology An Appreciative View 4th Edition King Solutions Manual PDFziarotzabihif100% (16)

- Cheque Petition IN MVOP 281 of 2009 (P-4)Document3 pagesCheque Petition IN MVOP 281 of 2009 (P-4)rkjayakumar7639No ratings yet

- EBOOK Etextbook PDF For Auditing A Risk Based Approach 11Th Edition by Karla M Johnstone Download Full Chapter PDF Docx KindleDocument61 pagesEBOOK Etextbook PDF For Auditing A Risk Based Approach 11Th Edition by Karla M Johnstone Download Full Chapter PDF Docx Kindlecharles.martinez668100% (45)

- English For Academic & Professional Purposes: Quarter 3 Week 6Document10 pagesEnglish For Academic & Professional Purposes: Quarter 3 Week 6Blank O FeorNo ratings yet

- The Fischer Controversy, The War Origins Debate and France: A Non HistoryDocument17 pagesThe Fischer Controversy, The War Origins Debate and France: A Non HistoryTrinh Hoang PhiNo ratings yet

- Kaufmann, Eric - Liberal Fundamentalism: A Sociology of WokenessDocument21 pagesKaufmann, Eric - Liberal Fundamentalism: A Sociology of WokenessYork LuethjeNo ratings yet

- Guidelines For BasketballDocument1 pageGuidelines For BasketballShela Lapeña EscalonaNo ratings yet

- Statement of Funds & Securities For The Period From Feb 7 2022 To Feb 12 2022Document4 pagesStatement of Funds & Securities For The Period From Feb 7 2022 To Feb 12 2022dinesh guptaNo ratings yet

- Announcement The Result of KNB Selection Batch 3 Year 2023 TteDocument10 pagesAnnouncement The Result of KNB Selection Batch 3 Year 2023 TteMuzzammilAlMackyNo ratings yet

- VTR 441Document2 pagesVTR 441richardbiggNo ratings yet

- Consumer Awareness: Social Science Project Class 10thDocument22 pagesConsumer Awareness: Social Science Project Class 10thJigna Patel100% (2)

- FBI v. Fazaga (Amicus Brief)Document36 pagesFBI v. Fazaga (Amicus Brief)The Brennan Center for JusticeNo ratings yet

- The Wars of Louis XIV, 1667 - 1714 by John A. LynnDocument436 pagesThe Wars of Louis XIV, 1667 - 1714 by John A. LynnNorman Villagomez GlzNo ratings yet

- Additional Provisions Not Affecting NegotiabilityDocument23 pagesAdditional Provisions Not Affecting NegotiabilityLoNo ratings yet

- Unlawful Detainer PDFDocument3 pagesUnlawful Detainer PDFJNo ratings yet

- Notes in Criminal Law Book II Notes in Criminal Law Book IIDocument49 pagesNotes in Criminal Law Book II Notes in Criminal Law Book IIPrime DacanayNo ratings yet

- Distribution - Excel & Access PackagesDocument2 pagesDistribution - Excel & Access Packagesumer plays gameNo ratings yet

- Contract of ServiceDocument3 pagesContract of ServiceRandy LemewNo ratings yet

- Amway Plan Vs OthersDocument12 pagesAmway Plan Vs OtherschandanNo ratings yet

- Lesson II: Social Relationships in Middle and Late AdolescenceDocument23 pagesLesson II: Social Relationships in Middle and Late AdolescenceHazel Roxas DraguinNo ratings yet

- Stokes CDocument196 pagesStokes ChoneromarNo ratings yet

- Bacaan Sholat Fardhu 2 KABIRAUDocument2 pagesBacaan Sholat Fardhu 2 KABIRAUPuji LestariNo ratings yet

- Constitutionality of Media TrialsDocument23 pagesConstitutionality of Media TrialsBhashkar MehtaNo ratings yet

- Canon 17 - Santos v. ArrojadoDocument3 pagesCanon 17 - Santos v. ArrojadoAra GrospeNo ratings yet