Professional Documents

Culture Documents

Statement 601533 74663593 08 Mar 2024-Desbloqueado

Statement 601533 74663593 08 Mar 2024-Desbloqueado

Uploaded by

8zpsyy86trOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement 601533 74663593 08 Mar 2024-Desbloqueado

Statement 601533 74663593 08 Mar 2024-Desbloqueado

Uploaded by

8zpsyy86trCopyright:

Available Formats

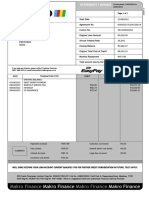

Account Name Account No Sort Code Page No

MR GOIANO LO 74553593 61-15-33 1 of 2

Select Account

Summary

MR GOIANO DE LONDRES Statement Date 08 MAR 2024

352 A-C

Period Covered 10 FEB 2024 to 08 MAR 2024

352 C HARROW RD

LONDON Previous Balance £568.61

W9 2HT Paid In £1,521.46

Withdrawn £898.66

New Balance £191.02

BIC NWBKGB2L

IBAN GB91NWBK60153374634594

Welcome to your NatWest Statement

Why file and store your statements when we can do it for you? Manage your statements online at www.natwest.com

If you have changed your address, telephone number, email address or occupation, please let us know.

Date Description Paid In(£) Withdrawn(£) Balance(£)

10 FEB 2024 BROUGHT FORWARD 568.61

13 FEB Card Transaction 6374 12FEB24 WWW.LEXHAMI

NSURANCE.CO 01379646549 GB 50.66 517.95

15 FEB Automated Credit A RODRIGUEZ PAYMENT FP 15/02/24 1758

300000001297401560 1,460.00 1,977.95

19 FEB OnLine Transaction A RIBEIRO PAYMENT VIA MOBILE -

PYMT FP 19/02/24 10 46120443027589000N 20.00 1,957.95

26 FEB OnLine Transaction A Rodriguez Payment VIA MOBILE -

PYMT FP 25/02/24 10 13132421735788000N 28.00 1,929.95

29 FEB OnLine Transaction A RIBEIRO PAYMENT VIA MOBILE -

PYMT FP 29/02/24 10 51153241133871000N 800.00 1,129.95

01 MAR Automated Credit A RODRIGUEZ PAYMENT FP 01/03/24 1811

400000001308474286 27.34 1,157.29

Automated Credit A RODRIGUEZ PAYMENT FP 01/03/24 1759

100000001300377319 34.12 1,191.41

Interest (variable) you currently pay us on overdrawn balances

When you stay within your arranged overdraft limit

Amount Account overdrawn by:

Over £0 33.75% NAR 39.49% EAR

When you go over your arranged overdraft limit

Rate that applies on the amount:

Up to your arranged limit 33.75% NAR 39.49% EAR

Above your arranged limit 33.75% NAR 39.49% EAR

When you do not have an arranged overdraft limit

Applicable rate on full amount 33.75% NAR 39.49% EAR

Interest (variable) we currently pay you on your credit balance

We do not pay credit interest on this account.

Overdraft Arrangements

For charging periods starting on or after 18th October 2023, we reduced unpaid transaction fees from £2.15 to £1.55 for personal accounts. For more

information please go to natwest.com/current-accounts/rates-and-charges.html.

Any overdraft related charges will be notified to you in your 'Pre Advice of Interest and Charges'. For personal accounts, we will not charge you more

than £19.40 in a monthly charging period for an unarranged overdraft or any unpaid transactions. For charging periods starting on or after 18th

October 2023, this will be reduced to £18.80 in a monthly charging period.

NAR - the Nominal Annual Rate is the annual rate of interest you'll pay on your overdraft. It doesn't take into account that you'll pay interest on any

interest that has been added to your overdraft balance in the previous month.

EAR - the Effective Annual Rate is the real cost of an overdraft shown as a yearly rate, which takes into account how often we charge interest to the

account, if this applies.

AER - the Annual Equivalent Rate is used for accounts where you earn interest, if this applies. It shows what the gross interest rate would be if we paid it

to the account every year and you then received interest as part of the account balance.

National Westminster Bank Plc. Registered in England & Wales No.929027.

Registered Office: 250 Bishopsgate, London, EC2M 4AA.

Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

RETSTMT - V110 05/01/24

Account Name Account No Sort Code Page No

MR GOIANO RIBEIRO 44663593 61-15-33 2 of 2

Take control of your finances Switching to paperless statements

Stay on top of your finances with our digital banking services. By switching to paperless statements if applicable, you could cut down on

To apply, visit the clutter and reduce paper waste.

www.natwest.com/mobile For more information, visit

or to register for Online Banking, visit www.natwest.com/paperless

www.natwest.com/online You can change your paperless preferences in Online Banking,

App is available to personal and business customers aged 11+ using by selecting the Paperless Settings option

compatible iOS and Android devices and a UK or international mobile in

specific countries

Need help with your finances

Whether you want to set up a savings goal to fund your dreams or make a financial plan for the future, we're here to help with our free financial health

check.

To find out more visit:

www.natwest.com/financial-health-check.html

Statement Abbreviations

N-S TRN FEE = Non Sterling Transaction Fee

VRATE = Variable Payment Scheme Exchange Rate

OD = Overdrawn

How to contact us

Message Us via the mobile app

Ask Cora, our digital assistant at: www.natwest.com

24hr Lost/Stolen Cards: 0370 600 0459

Telephone Banking 8am-8pm: 03457 888 444

To register for Telephone Banking: 03458 351 251

24hr Business Telephone Banking: 03457 114 477

To use Relay UK add 18001 in front of the numbers above.

Branch Address: Notting Hill Gate Branch, PO Box 1936, 46 Notting Hill Gate, London, W11 3HZ.

Important information about compensation arrangements

Your deposit is eligible for protection under the Financial Services Compensation Scheme (FSCS).

Your eligible deposits with Natwest are protected by the Financial Services Compensation Scheme. This means that all deposits with one or more of

National Westminster Bank Plc, NatWest Premier, Ulster Bank and Mettle are covered under the same FSCS limit. An FSCS Information Sheet and list of

exclusions will be provided to you on an annual basis. For further information about the compensation provided by the FSCS, refer to the website:

www.FSCS.org.uk

Dispute Resolution

If you have a problem with your agreement, please try to resolve it with us in the first instance. If you are not happy with the way in which we handled

your complaint or the result, you may be able to complain to the Financial Ombudsman Service. If you do not take up your problem with us first you will

not be entitled to complain to the Ombudsman. We can provide details of how to contact the Ombudsman.

If you need to contact us about a complaint, you can:

● Message Us via the mobile app

● Visit www.natwest.com/complaints

● Telephone 03457 888 444 (to use Relay UK add 18001 in front of the number)

For a Braille, large print or audio versions of your statement

call 03457 888 444 or contact your local branch

(to use Relay UK add 18001 in front of the number).

You might also like

- Statement 02-AUG-19 AC 40963607 PDFDocument4 pagesStatement 02-AUG-19 AC 40963607 PDFDanielNo ratings yet

- Statement 30-DEC-22 AC 50882755 01045142 PDFDocument5 pagesStatement 30-DEC-22 AC 50882755 01045142 PDFferuzbekNo ratings yet

- Statement 21-NOV-22 AC 03013375 23042820Document3 pagesStatement 21-NOV-22 AC 03013375 23042820Vitor BinghamNo ratings yet

- 2023 08 31 - Statement 1Document2 pages2023 08 31 - Statement 1ranielysilvaukNo ratings yet

- Gold Business Account 82Document1 pageGold Business Account 82nicole.philippsNo ratings yet

- MR Robert Kardel BankDocument2 pagesMR Robert Kardel BanklucadiegomoNo ratings yet

- Barclays Original STDocument6 pagesBarclays Original STEsidor Palushi100% (1)

- Statement 05-APR-23 AC 20312789 07043628 PDFDocument4 pagesStatement 05-APR-23 AC 20312789 07043628 PDFBakhter Jabarkhil0% (1)

- Statement 21-APR-23 AC 73219674 23081839Document3 pagesStatement 21-APR-23 AC 73219674 23081839g6psbtnb87No ratings yet

- Statement 02 Dec 22 AC 40963607 PDFDocument3 pagesStatement 02 Dec 22 AC 40963607 PDFJarrod GlandtNo ratings yet

- Lloyds Bank StatementDocument2 pagesLloyds Bank StatementGavin DuhraNo ratings yet

- SOAP PLANT Project Report CompleteDocument8 pagesSOAP PLANT Project Report CompleteER. INDERAMAR SINGH52% (25)

- Preview 4Document2 pagesPreview 4LoredanaNo ratings yet

- Statement 04-JAN-23 AC 33118487 06042607Document3 pagesStatement 04-JAN-23 AC 33118487 06042607moNo ratings yet

- Statement 31-JUL-20 AC 33211541Document6 pagesStatement 31-JUL-20 AC 33211541meu pau67% (3)

- 7) The SWOT Analysis of ITC Limited Is As Follows:: StrengthsDocument2 pages7) The SWOT Analysis of ITC Limited Is As Follows:: Strengthsshalabh100% (2)

- StarlingCertifiedStatement 01-02-2024!12!02 2024Document1 pageStarlingCertifiedStatement 01-02-2024!12!02 2024assia.aaitNo ratings yet

- Statement 05-JAN-23 AC 90917699 07110015Document3 pagesStatement 05-JAN-23 AC 90917699 07110015pfjhnkgnbvNo ratings yet

- Liderança Com PropósitosDocument6 pagesLiderança Com PropósitosAmandaNo ratings yet

- UnlockedDocument4 pagesUnlockedmistiriouzNo ratings yet

- Classic 11 March 2023 To 12 April 2023: Your AccountDocument6 pagesClassic 11 March 2023 To 12 April 2023: Your Accountrig ers100% (1)

- PreviewDocument3 pagesPreviewjohncerioniNo ratings yet

- Statement 601616 95209670 22 Dec 2023Document4 pagesStatement 601616 95209670 22 Dec 2023seiyabaaNo ratings yet

- PreviewDocument5 pagesPreviewRialdu DuarteNo ratings yet

- FCD Westpac Business Bank Savings StatementDocument3 pagesFCD Westpac Business Bank Savings StatementMadison MooreNo ratings yet

- Kevin O DonnellDocument4 pagesKevin O DonnellITNo ratings yet

- PreviewhelloDocument15 pagesPreviewhelloshehztarNo ratings yet

- Dent Eimear LindaDocument4 pagesDent Eimear LindaITNo ratings yet

- Easter ChickDocument3 pagesEaster Chickmarythorne17No ratings yet

- Bank StatementsDocument6 pagesBank Statementsrj4btyqmzbNo ratings yet

- PreviewDocument5 pagesPreviewolamide.odukunleNo ratings yet

- STATEMENT1Document1 pageSTATEMENT19nynqfjbjpNo ratings yet

- FileopenDocument2 pagesFileopenagentiwe787No ratings yet

- Miss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260Document1 pageMiss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260nonkumbuloshabaneNo ratings yet

- Chabal Laura ClaireDocument4 pagesChabal Laura ClaireITNo ratings yet

- Sumbani Trust Club STAND 1629/61 6586 Tinkler ST Soshanguve-A Pretoria 0002Document1 pageSumbani Trust Club STAND 1629/61 6586 Tinkler ST Soshanguve-A Pretoria 0002Trust SumbaniNo ratings yet

- 653MakroProductFinanceLoansEmailPostSmart E-Statement Apr2023 542Document1 page653MakroProductFinanceLoansEmailPostSmart E-Statement Apr2023 542judithkhosaNo ratings yet

- Aspire Credit Card StatementDocument2 pagesAspire Credit Card StatementSangam sahuNo ratings yet

- UK SantanderDocument3 pagesUK SantandermaxilybovNo ratings yet

- Statement 01 JUN 22 AC 43362329 03042300Document4 pagesStatement 01 JUN 22 AC 43362329 03042300Tammnar AkterNo ratings yet

- Preview HALIFAXDocument4 pagesPreview HALIFAX13KARATNo ratings yet

- 11 Sep 2021 FNBDocument1 page11 Sep 2021 FNBDon MadzivaNo ratings yet

- Reward Current Account 31 March 2022 To 30 April 2022: Your Account Arranged Overdraft Limit 1,000Document4 pagesReward Current Account 31 March 2022 To 30 April 2022: Your Account Arranged Overdraft Limit 1,000ITNo ratings yet

- Preview PDFDocument5 pagesPreview PDFTym SoerNo ratings yet

- Statament Kim 2Document5 pagesStatament Kim 2raheemtimo1No ratings yet

- PreviewDocument9 pagesPreviewjames.gardner1310No ratings yet

- January Postpay BillDocument4 pagesJanuary Postpay BillestrobetceoNo ratings yet

- Feb 23 To Jan 24Document40 pagesFeb 23 To Jan 24Next Media UKNo ratings yet

- Statement 02-DEC-22 AC 53796868 04053258Document13 pagesStatement 02-DEC-22 AC 53796868 04053258André SilvaNo ratings yet

- Statement 05-MAY-23 AC 13285189 07052004Document4 pagesStatement 05-MAY-23 AC 13285189 07052004Sonu sojanNo ratings yet

- NEW Higginbotham-Jonespreview +++ - HALIFAXDocument4 pagesNEW Higginbotham-Jonespreview +++ - HALIFAX13KARATNo ratings yet

- Fairmoney Statement 20231201 20231202 17014921791037748Document2 pagesFairmoney Statement 20231201 20231202 17014921791037748rehobothpublications123No ratings yet

- Statement 21-JUN-21 ADocument13 pagesStatement 21-JUN-21 AJasmina Cakaj100% (1)

- PDF Document 444D 82E5 B0 0Document6 pagesPDF Document 444D 82E5 B0 0Ionutpopescu1997No ratings yet

- Acfrogcpj8f4rb4ruc4ixv3sboxmthrv Scinfrpri Zxkyunmqbvh2ttyciftmytrhiv T7ggynydva5f Ukzezyeph Xobjj2sw4mc0aaya5jkcepw1611chmnkiienbmhk9n 5aghyohatdhdDocument4 pagesAcfrogcpj8f4rb4ruc4ixv3sboxmthrv Scinfrpri Zxkyunmqbvh2ttyciftmytrhiv T7ggynydva5f Ukzezyeph Xobjj2sw4mc0aaya5jkcepw1611chmnkiienbmhk9n 5aghyohatdhddae ChoNo ratings yet

- Statement of Account: BranchDocument2 pagesStatement of Account: BranchKelum KonaraNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document5 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)Sam PannuNo ratings yet

- UK Nationwide Word PDFDocument5 pagesUK Nationwide Word PDFmaxilybovNo ratings yet

- Account Statement - 2022 12 01 - 2023 03 31 - en GB - f1832dDocument11 pagesAccount Statement - 2022 12 01 - 2023 03 31 - en GB - f1832dmtogooNo ratings yet

- Gold Account 06 December 2021 To 06 June 2022Document1 pageGold Account 06 December 2021 To 06 June 2022mohamed elmakhzniNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Slides Topic 12 BhoDocument51 pagesSlides Topic 12 BhoFranchesca CalmaNo ratings yet

- Ca Pranav Darvekar: Career ConspectusDocument4 pagesCa Pranav Darvekar: Career Conspectuspranavdarvekar100% (2)

- Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Solutions ManualDocument45 pagesPearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Solutions Manualsmiletadynamia7iu4100% (24)

- Chapter 32Document22 pagesChapter 32Clifford BacsarzaNo ratings yet

- Value Investing in ThailandDocument14 pagesValue Investing in ThailandOhm BussarakulNo ratings yet

- 2SOGS RM Lecture 3 - Time Value of MoneyDocument36 pages2SOGS RM Lecture 3 - Time Value of MoneyRight Karl-Maccoy HattohNo ratings yet

- A Market Feasibility Study On Opening of New Branches of Investment and Finance CompanyDocument65 pagesA Market Feasibility Study On Opening of New Branches of Investment and Finance CompanyDr Waseem CNo ratings yet

- MHB Audited Financial Statements 31dec2019Document66 pagesMHB Audited Financial Statements 31dec2019Izzaty RidzuanNo ratings yet

- Cases in Guaranty and SuretyshipDocument51 pagesCases in Guaranty and SuretyshipErxha Lado0% (1)

- Housing and Human SettlementDocument23 pagesHousing and Human SettlementYuuki Rito100% (2)

- Basel IVDocument6 pagesBasel IVMuhammad Talha FayyazNo ratings yet

- Task 3 - Investment AppraisalDocument12 pagesTask 3 - Investment AppraisalYashmi BhanderiNo ratings yet

- Z13 Re - NPD Po: Page 1 / 1Document1 pageZ13 Re - NPD Po: Page 1 / 1sprabhaNo ratings yet

- Islamic Trade Finance Group-7 FinalDocument11 pagesIslamic Trade Finance Group-7 FinalKaushik HazarikaNo ratings yet

- Texas Treasury - ABA Routing Numbers and SWIFT Address GuideDocument1 pageTexas Treasury - ABA Routing Numbers and SWIFT Address GuideTina Wan QenobiNo ratings yet

- Article Rev Cost AccountingDocument3 pagesArticle Rev Cost AccountingFikir GebregziabherNo ratings yet

- FAOP61629Document3 pagesFAOP61629nikhil.21072No ratings yet

- M Com Syllabus May 2019 PDFDocument170 pagesM Com Syllabus May 2019 PDFMidhun MoncyNo ratings yet

- 004 EH 403 WWW v2Document6 pages004 EH 403 WWW v2Chezka Bianca TorresNo ratings yet

- Acroynms Capital MarketsDocument37 pagesAcroynms Capital MarketsAnuj Sharma100% (1)

- What Does REHABILITATION MeanDocument23 pagesWhat Does REHABILITATION MeanMaLizaCainapNo ratings yet

- Financial Accounting - Chapter 3Document50 pagesFinancial Accounting - Chapter 3Hamza PagaNo ratings yet

- The Crucial Role of Managerial Accounting in A Dynamic Business EnvironmentDocument32 pagesThe Crucial Role of Managerial Accounting in A Dynamic Business EnvironmentSpencer GelinNo ratings yet

- Birla-Corporation-Limited 204 QuarterUpdateDocument8 pagesBirla-Corporation-Limited 204 QuarterUpdatearif420_999No ratings yet

- Cash Planning ExerciseDocument2 pagesCash Planning ExerciseRaniel PamatmatNo ratings yet

- Conduit Foreign IncomeDocument36 pagesConduit Foreign IncomeRizki Adhi PratamaNo ratings yet

- Latihan 1Document2 pagesLatihan 1Dommy RampiselaNo ratings yet

- CH 02Document55 pagesCH 02indah lestariNo ratings yet