Professional Documents

Culture Documents

CR Assignment Punishment For Whole Class

CR Assignment Punishment For Whole Class

Uploaded by

pamela17desai0 ratings0% found this document useful (0 votes)

2 views3 pagesOriginal Title

CR assignment punishment for whole class

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views3 pagesCR Assignment Punishment For Whole Class

CR Assignment Punishment For Whole Class

Uploaded by

pamela17desaiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

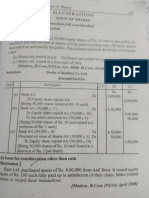

Illustration 22

The following is the Summary Balance Sheet of Vikrant Ltd:

Liabilities ₹ Assets ₹

Issued and Paid up Intangible Assets 50,000

Equity Share Capital 5,00,000 Fixed Assets 4,20,000

Statutory Reserve (to be mentioned 10,000 Current Assets 1,10,000

for 3 more years) Profit & Loss A/c 80,000

Debentures 1,00,000

Creditors

50,000_ 6,60,000

6,60,000

Virat Ltd agreed to absorb Vikrant Ltd on the following terms:

(1) Virat Ltd agreed to take over all the Assets and Liabilities.

(2) The Assets of Vikrant Ltd are to be considered to be worth ₹ 5,00,000.

(3) The purchase price is to be paid one-quarter in cash and the balance in shares,

which are issued at the market price.

(4) Liquidation expenses amounted to ₹300 agreed to be paid by Vikrant Ltd.

(5) Market value of share of ₹ 10 each of Virat Ltd is ₹12 per share.

(6) Debentures of Vikrant Ltd were paid.

(7) The amalgamation is in the nature of purchase

You are required to show :

a) Purchase Consideration

b) Ledger accounts in the books of Vikrant Ltd

c) Opening entries in the books of Virat Ltd

Solution:

Purchase Consideration (PC):

Particulars ₹ ₹

Market value of assets taken over --- --- --- --- --- 5,00,000

Less: Liabilities taken over

Creditors --- --- --- --- --- 50,000

Debentures --- --- --- --- --- 1,00,000 1,50,000

3,50,000

Purchase Consideration is to be Discharged

In cash 1/4 x ₹ 3,50,000 87,500

In shares 3/4 x ₹ 3,50,000 2,62,500

3,50,000

Working Notes:

No. of shares to be issued to the vendor co. has been calculated as under:

Amount to be paid in shares : 3/4 of ₹ 3,50,000 =2,62,500

Agreed Value of 1 share ₹ 12

No. of shares = 2,62,500 / 12 21,875 shares

In the books of Vikrant Ltd

Dr. Realisation Account Cr

Particulars ₹ Particulars ₹

To Intangible Assets 50,000 By Debentures 1,00,000

To Fixed Assets 4,20,000 By Creditors 50,000

To Current Assets 1,10,000 By Virat Ltd. (PC) 3,50,000

To Bank (Expenses) 300 By Equity 80,300

Shareholders (Loss on ________

__________ realisation) 5,80,300

5,80,300

Equity Shareholders Account

Particulars ₹ Particulars ₹

To Realisation A/c 80,300 By Equity Share Capital 5,00,000

By Statutory Reserve 10,000

To Profit & Loss A/c 80,000

To Bank 87,200

To Shares in Virat Ltd. 2,62,500

_______ 5,10,000

_

5,10,000

Virat Ltd Account

Particulars ₹ Particulars ₹

To Realisation A/c 3,50,000 By Bank A/c 87,500

By Shares in Virat Ltd. 2,62,500

3,50,000 3,50,000

Bank A/c

Particulars ₹ Particulars ₹

To Virat Ltd. 87,500 By Realisation A/c 300

87,200

87,500 By Equity Shareholders 87,500

Equity Shares in Virat Ltd.

Particulars ₹ Particulars ₹

To Virat Ltd. 2,62,500 By Equity Shareholders 2,62,500

2,62,500 2,62,500

In the books of Virat Ltd.

Journal

No. Particulars Dr. Cr.

1. Business Purchase A/c Dr. 3,50,000

3,50,000

To Liquidators of Vikrant Ltd. A/c

[Being P. C. agreed with Vendor Co.]

______________________________________

2 Fixed Assets A/c Dr. 4,20,000

Dr. 1,10,000

Current Assets A/c

50,000

To Trade Creditors A/c

1,00,000

To Debentures in Vikrant A/c

30,000

To Capital Reserve A/c

3,50,000

To Business Purchase A / c

[Being Assets & Liabilities taken over]

3. Liquidators of Vikrant Ltd. A/c Dr. 3,50,000

To Equity Share Capital A/c 2,18,750

To Securities Premium A/c 43,750

To Bank A/c 87,500

[Being purchase consideration paid]

4 Amalgamation Adjustment Reserve To Dr. 10,000

10,000

Statutory Reserve [Being Statutory Reserve

carried forward]

5. Debentures in Vikrant A/c To Bank A/c Dr. 1,00,000

1,00,000

[Being payment to Debenture holders of vendor

Co. being Debenture not taken over]

You might also like

- SSSForm Affidavit Separation From EmploymentDocument1 pageSSSForm Affidavit Separation From Employmentfpmaypa67% (6)

- The First Lutheran Church Endowment Fund By-LawsDocument7 pagesThe First Lutheran Church Endowment Fund By-LawspostscriptNo ratings yet

- (Tax) CPAR Preweek2Document7 pages(Tax) CPAR Preweek2Nor-janisah PundaodayaNo ratings yet

- CR Assignment Roll No. 118 New Sum 22Document4 pagesCR Assignment Roll No. 118 New Sum 22pamela17desaiNo ratings yet

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Ts Grewal Class 12 Accountancy Chapter 7 PDFDocument11 pagesTs Grewal Class 12 Accountancy Chapter 7 PDFmonikaNo ratings yet

- Internal ReconsrtuctionDocument33 pagesInternal ReconsrtuctionRenuNo ratings yet

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Document11 pagesMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasNo ratings yet

- By: Vinit Mishra Sir: Ca IntermediateDocument128 pagesBy: Vinit Mishra Sir: Ca IntermediategimNo ratings yet

- Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice QuestionsDocument26 pagesChapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice Questionsnikhil diwan75% (4)

- 2accountancy-Ms (4) - 230329 - 173510Document11 pages2accountancy-Ms (4) - 230329 - 173510jiya.mehra.2306No ratings yet

- CA Bcom PH 3rd Sem 2016Document7 pagesCA Bcom PH 3rd Sem 2016Gursirat KaurNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- Internal Reconstruction P-1 Liabilities Rs Assets RsDocument8 pagesInternal Reconstruction P-1 Liabilities Rs Assets RsPaulomi LahaNo ratings yet

- 637617311650478425SM Session12Document4 pages637617311650478425SM Session12kreshmith2No ratings yet

- 637617311031534884SM Session11Document3 pages637617311031534884SM Session11kreshmith2No ratings yet

- Accounting Redemption of Debentures 1642416359Document19 pagesAccounting Redemption of Debentures 1642416359Shashank SikarwarNo ratings yet

- Bv2018 Revised Conceptual FrameworkDocument18 pagesBv2018 Revised Conceptual FrameworkTeneswari RadhaNo ratings yet

- Cbse Question Bank Admission of PartnersDocument6 pagesCbse Question Bank Admission of Partnersvsy9926No ratings yet

- CA Inter Accounts A MTP 1 Nov 2022Document13 pagesCA Inter Accounts A MTP 1 Nov 2022smartshivenduNo ratings yet

- Accountancy: Pre-Board Examinations 2078Document3 pagesAccountancy: Pre-Board Examinations 2078Herman PecassaNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- REVISION TEST Admission of A PartnerDocument2 pagesREVISION TEST Admission of A PartnerOshvi Shrivastava100% (1)

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Corporate AccountingDocument25 pagesCorporate Accountingrakshithaparimala100No ratings yet

- Answers To NavneetDocument12 pagesAnswers To NavneetPawan TalrejaNo ratings yet

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993No ratings yet

- RTP Dec 18 AnsDocument36 pagesRTP Dec 18 AnsbinuNo ratings yet

- Semester II (Ugcf) 2412091201 ADocument9 pagesSemester II (Ugcf) 2412091201 Aindukush8No ratings yet

- Retirement of Partners Cbse Question BankDocument6 pagesRetirement of Partners Cbse Question Bankabhayku1689No ratings yet

- 12 Accounts CBSE Sample Papers 2019 Marking SchemeDocument16 pages12 Accounts CBSE Sample Papers 2019 Marking SchemeSalokya KhandelwalNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Abc Unit 3 PDFDocument7 pagesAbc Unit 3 PDFLuckygirl JyothiNo ratings yet

- Chapter 1 - Buyback Additional QuestionsDocument9 pagesChapter 1 - Buyback Additional QuestionsMohammad ArifNo ratings yet

- 9 Bonus & Right IssueDocument9 pages9 Bonus & Right Issueanilrj14pc8635jprNo ratings yet

- Mgt402 Assigenment Result Fall2009Document5 pagesMgt402 Assigenment Result Fall2009maqsoom471No ratings yet

- QUESTION PAPER 36195 (Solution)Document17 pagesQUESTION PAPER 36195 (Solution)Faizu KhamNo ratings yet

- M&a Basic Internal Reconstruction QDocument7 pagesM&a Basic Internal Reconstruction Qayushi aggarwalNo ratings yet

- AnswersDocument5 pagesAnswersPawan TalrejaNo ratings yet

- Absorption Questions 1Document4 pagesAbsorption Questions 1naazhim nasarNo ratings yet

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Accounting-Bonus Issue and Right-Issue-1653399117076303Document17 pagesAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamNo ratings yet

- Rohit TestDocument9 pagesRohit TestRohitNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- Advanced Corporate Accounting Jan - 2024 SupplementaryDocument2 pagesAdvanced Corporate Accounting Jan - 2024 SupplementarysaradhachinnaboyinaNo ratings yet

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Financial Accounting - B, Com Sem I NEP 2022 PDFDocument6 pagesFinancial Accounting - B, Com Sem I NEP 2022 PDF『SHREYAS NAIDU』No ratings yet

- Accountancy 12 SapnleDocument21 pagesAccountancy 12 Sapnlemohit pandeyNo ratings yet

- AmalgamationDocument20 pagesAmalgamationVasu JainNo ratings yet

- Accounts Solution Mock 2 12-11Document21 pagesAccounts Solution Mock 2 12-11Foundation Group tuitionNo ratings yet

- Partnership PQ SolDocument18 pagesPartnership PQ SolvedthkNo ratings yet

- 3internal Reconstruction 230725 165705Document6 pages3internal Reconstruction 230725 165705Ruchita JanakiramNo ratings yet

- Account Must Do List!! Nov - 2022 - 220911 - 200510Document259 pagesAccount Must Do List!! Nov - 2022 - 220911 - 200510KartikNo ratings yet

- COM203 AmalgamationDocument10 pagesCOM203 AmalgamationLogeshNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- MAA Assignment RKDocument9 pagesMAA Assignment RKKrishna RayasamNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- 2020-BPS - Pre - Board II-Accountancy Answer KeyDocument16 pages2020-BPS - Pre - Board II-Accountancy Answer KeyJoshi DrcpNo ratings yet

- HW 16433Document2 pagesHW 16433Abdullah Khan100% (1)

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Manager Real Estate ROW in Chicago IL Resume Andrew ViolaDocument3 pagesManager Real Estate ROW in Chicago IL Resume Andrew ViolaAndrewViolaNo ratings yet

- 08 Philip Morris Inc. vs. CADocument2 pages08 Philip Morris Inc. vs. CARaya Alvarez TestonNo ratings yet

- Veterinary Medicine 08-2016 Room AssignmentDocument7 pagesVeterinary Medicine 08-2016 Room AssignmentPRC BaguioNo ratings yet

- Memorandum of AssociationDocument3 pagesMemorandum of AssociationUtkarsh KhandelwalNo ratings yet

- Labsii 215 2011 Labsii Hojjettoota MootummaaDocument62 pagesLabsii 215 2011 Labsii Hojjettoota MootummaaAbuki84% (32)

- Central Administrative Tribunal Judgement On Modified Parity For Pre-2006 PensionersDocument19 pagesCentral Administrative Tribunal Judgement On Modified Parity For Pre-2006 Pensionersgssekhon9406No ratings yet

- Investigative Report PPT FinalDocument24 pagesInvestigative Report PPT FinalDivya Chetan GohelNo ratings yet

- 2020 KUSA Product Catalog - FinalDocument7 pages2020 KUSA Product Catalog - FinalTapes AndreiNo ratings yet

- C04A Tender Clarification - Expansion Reinforcing BandDocument2 pagesC04A Tender Clarification - Expansion Reinforcing BandGabriel LimNo ratings yet

- Abraham LincolnDocument3 pagesAbraham LincolnGerome VNo ratings yet

- LARA Suspension document-WEEMSDocument6 pagesLARA Suspension document-WEEMSMadeline CiakNo ratings yet

- Attachments - Rainbow RowellDocument29 pagesAttachments - Rainbow RowellAlvin Yerc0% (1)

- PWC Parts & Accessories CatalogDocument250 pagesPWC Parts & Accessories CatalogFernando CentenoNo ratings yet

- SFP SampleDocument6 pagesSFP SampleHazel Joy DemaganteNo ratings yet

- United States vs. Del Rosario, 2 Phil., 127, April 15, 1903Document2 pagesUnited States vs. Del Rosario, 2 Phil., 127, April 15, 1903Campbell HezekiahNo ratings yet

- Application, Recognition, or Consideration of Jewish Law by Courts in United States, 81 A.L.R.6tDocument65 pagesApplication, Recognition, or Consideration of Jewish Law by Courts in United States, 81 A.L.R.6tאליעזר קופערNo ratings yet

- Heirs of Ypon VS RicaforteDocument2 pagesHeirs of Ypon VS RicafortemgeeNo ratings yet

- Bulfinch's Mythology: The Age of Chivalry or Legends of King ArthurDocument191 pagesBulfinch's Mythology: The Age of Chivalry or Legends of King ArthurMaus MerryjestNo ratings yet

- CC Debugger Quick Start Guide ( - Texas Instruments, IncorporatedDocument3 pagesCC Debugger Quick Start Guide ( - Texas Instruments, IncorporatedRaul RiveroNo ratings yet

- Technical Specification Continuous OVD Any Pattern KLX ("Foil")Document5 pagesTechnical Specification Continuous OVD Any Pattern KLX ("Foil")Nhũ Ép Kim KurzNo ratings yet

- Surfrider Foundation's Comments On The Proposed Settlement Agreement On Plant Size and Level of OperationDocument22 pagesSurfrider Foundation's Comments On The Proposed Settlement Agreement On Plant Size and Level of OperationL. A. PatersonNo ratings yet

- Delaware Corporate Bylaws TemplateDocument7 pagesDelaware Corporate Bylaws TemplateEmiliano De MartinoNo ratings yet

- Renter'S Handbook: Renting in SeattleDocument31 pagesRenter'S Handbook: Renting in Seattlechef ouiNo ratings yet

- De Leon VSDocument2 pagesDe Leon VSLilla Dan ContrerasNo ratings yet

- Construction Contracts: Procurement Methods in BotswanaDocument12 pagesConstruction Contracts: Procurement Methods in BotswanaPhoebe Joice SecuyaNo ratings yet

- Consumer Protection CouncilDocument2 pagesConsumer Protection Councilsadia hashamNo ratings yet

- Questions To Be Asked in Taking The AffidavitDocument2 pagesQuestions To Be Asked in Taking The AffidavitJero TakeshiNo ratings yet