Professional Documents

Culture Documents

Acs 300

Acs 300

Uploaded by

bchege55200Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acs 300

Acs 300

Uploaded by

bchege55200Copyright:

Available Formats

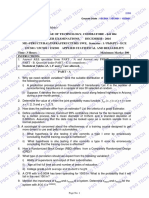

THE CATHOLIC UNIVERSITY OF EASTERN AFRICA

P.O. Box 62157

A. M. E. C. E. A 00200 Nairobi - KENYA

Telephone: 891601-6

Fax: 254-20-891084

MAIN EXAMINATION E-mail:academics@cuea.edu

AUGUST – DECEMBER 2018 TRIMESTER

FACULTY OF SCIENCE

DEPARTMENT OF MATHEMATICS AND ACTUARIAL SCIENCE

REGULAR PROGRAMME

ACS 300: ACTUARIAL MATHEMATICS I

Date: DECEMBER 2018 Duration: 2 Hours

INSTRUCTIONS: Answer Question ONE and any other TWO Questions

Q1. a) Differentiate between annuity-due and immediate annuity. 3marks

b) i) By definition or otherwise, differentiate prospective reserve from

retrospective reserve. (3 marks)

ii) State the condition under which the prospective reserve would be

equal to the retrospective reserve. (2 marks)

c) Using the AM92 mortality table, look up A65 and a65 at 4% p.a interest.

Hence verify that A65 =1-d a65 3marks

d) Calculate values for using AM92 mortality and 4% pa

interest (5mks) (5 marks)

e) Prove that the variance of is:

(6 marks)

f) Calculate the expected present value and variance of the present value

of an endowment assurance of 1 payable at the end of the year of death

for a life aged 40 exact, with a term of 15 years.

Cuea/ACD/EXM/AUGUST – DECEMBER 2018 / MATHEMATICS AND COMPUTER SCIENCE Page 1

ISO 9001:2008 Certified by the Kenya Bureau of Standards

Basis:

Mortality AM92 Select

Rate of interest 4% per annum

Expenses Nil (8 marks)

Q2. a) Briefly explain why we hold reserves in life insurance companies

(4 marks)

b) Evaluate the following functions, assuming the given basis:

i) a65:20 AM92 Ultimate mortality and interest at 4% pa

ii) A68:2 AM92 Ultimate mortality and interest at 6% pa (4 marks)

c) Let X be a random variable representing the present value of the benefits

of a whole life assurance, and Y be a random variable representing the

present value of the benefits of a temporary assurance with a term of n-

years. Both assurances have a sum assured of 1 payable at the end of the

year of death and were issued to the same life aged x.

i) Describe the benefits provided by the contract which has

a present value represented by the random variable X-Y

ii) Show that

Cov( X , Y ) 2 A1 Ax * A1

x:n x:n

And hence or otherwise that

Var ( X Y ) 2 Ax ( n| Ax )2 2 A1

x:n

Where the functions A are determined using an interest rate rate of I, and

the functions 2 A are determined using an interest rate of i 2 2i

(12marks)

Q3. a) In the context of net premiums for endowment assurance, explain the

following premium symbols

i)

ii)

iii) (3marks)

Cuea/ACD/EXM/AUGUST – DECEMBER 2018 / MATHEMATICS AND COMPUTER SCIENCE Page 2

ISO 9001:2008 Certified by the Kenya Bureau of Standards

b) A population with limiting age 100 has the following survival function:

Calculate the complete expectation of life at age 50 (5marks)

c) Derive a formula for the variance of the profit earned by an insurance

company offering an n-year endowment assurance policy to lives aged x.

Assume that premiums are payable annually in advance and death

benefits are payable at the end of the year of death. (8marks)

d) A life aged exactly 33 purchases a whole life assurance policy with a sum

assured of £40,00 payable at the end of the year of death. Premiums of

£520 are payable annually in advance. Calculate the variance of the

insurer’s profit on this contract, assuming AM92 Ultimate mortality and 4%

pa interest. (4marks)

Q4. a) Explain why premiums are normally paid in advance for an insurance

policy (2marks)

b) Prove that:

i) For temporary annuities:

1

ax:n ax:n (1 v n n px ) (4 marks)

2

c) A level annuity of 1 pa is to be paid continuously to a 40 year-old male. On

the basis of 4% pa interest and AM92 Ultimate mortality, calculate the

expected present value of this annuity. (2 marks)

d) A life aged exactly 50 buys a 15-year endowment assurance policy with a

sum assured of £50,000 payable on maturity or at the end of the year of

earlier death. Level premiums are payable monthly in advance. Calculate

the monthly premium assuming AM92 Ultimate mortality and 4% pa

interest. Ignore expenses. (6 marks)

e) Prove that

n| Ax Ax A1 v n n px Ax n (6 marks)

x:n

1 𝑖𝑣

Q5. a) Prove that ∫0 𝑣 𝑡 𝑑𝑡 = (3 marks)

𝛿

Hence or otherwise, By considering a term assurance policy as a series of

one-year deferred term assurance policies, show that:

Cuea/ACD/EXM/AUGUST – DECEMBER 2018 / MATHEMATICS AND COMPUTER SCIENCE Page 3

ISO 9001:2008 Certified by the Kenya Bureau of Standards

(6 marks)

b) Calculate the annual premium for a term assurance with a term of 10

years to a male aged 30, with a sum assured of £500,000, assuming

AM92 Ultimate mortality and interest of 4% pa. Assume that the death

benefit is paid at the end of the year of death. (7marks)

c) John aged exactly 35, buys a term assurance policy that pays a benefit of

£100,000 at the end of the year of his death if he dies before age 65. What

is the expected accumulated value of this benefit at time 10?

Basis: AM92 Ultimate, 6% pa Interest (5marks)

*END*

Cuea/ACD/EXM/AUGUST – DECEMBER 2018 / MATHEMATICS AND COMPUTER SCIENCE Page 4

ISO 9001:2008 Certified by the Kenya Bureau of Standards

You might also like

- ct62010 2013Document165 pagesct62010 2013Amit Poddar100% (2)

- The Catholic University of Eastern Africa A. M. E. C. E. A: Acs 301: Actuarial Mathematics IiDocument4 pagesThe Catholic University of Eastern Africa A. M. E. C. E. A: Acs 301: Actuarial Mathematics IiKimondo KingNo ratings yet

- Advanced Risk Mathematics Exam 21 - 22Document6 pagesAdvanced Risk Mathematics Exam 21 - 22Martin KasukuNo ratings yet

- FandI CT5 200704 ExamDocument6 pagesFandI CT5 200704 ExamEuston ChinharaNo ratings yet

- Ilovepdf Merged 4Document223 pagesIlovepdf Merged 4Dani ShaNo ratings yet

- Fandi Ct5 200804 Exam FinalDocument7 pagesFandi Ct5 200804 Exam FinalEuston ChinharaNo ratings yet

- Examination: Subject CT5 - Contingencies Core TechnicalDocument6 pagesExamination: Subject CT5 - Contingencies Core TechnicalMadonnaNo ratings yet

- CT6 QP 0506Document5 pagesCT6 QP 0506Nilotpal ChattorajNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument6 pagesInstitute of Actuaries of India: ExaminationsVasudev PurNo ratings yet

- Examination: Subject CT5 Contingencies Core TechnicalDocument7 pagesExamination: Subject CT5 Contingencies Core TechnicalMadonnaNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument5 pagesInstitute of Actuaries of India: ExaminationsNitai Chandra GangulyNo ratings yet

- Mathematics-Ii: Instructions To CandidatesDocument3 pagesMathematics-Ii: Instructions To CandidateskanwardeeprahiNo ratings yet

- Math20962 Contingencies 1Document6 pagesMath20962 Contingencies 1will bNo ratings yet

- Fandi Ct5 200909 Exam FinalDocument6 pagesFandi Ct5 200909 Exam FinalEuston ChinharaNo ratings yet

- CT6 QP 0416Document6 pagesCT6 QP 0416Shubham JainNo ratings yet

- CS2 Mock 1 Paper ADocument14 pagesCS2 Mock 1 Paper AvidhiNo ratings yet

- Examination: Subject CT5 Contingencies Core TechnicalDocument7 pagesExamination: Subject CT5 Contingencies Core TechnicalMadonnaNo ratings yet

- Cs2a April23 Exam Clean-ProofDocument7 pagesCs2a April23 Exam Clean-ProofsizanesdNo ratings yet

- 104 April 2001 QuestionDocument7 pages104 April 2001 QuestionKanika KanodiaNo ratings yet

- FandI CT6 200804 Exam FINALDocument6 pagesFandI CT6 200804 Exam FINALUrvi purohitNo ratings yet

- Fandi Ct6 201009 Exam FinalDocument6 pagesFandi Ct6 201009 Exam FinalKeithNo ratings yet

- FE-Unit 1, 2 QuestionsDocument4 pagesFE-Unit 1, 2 Questionsarya.enactusdcacNo ratings yet

- Faculty - Applied Sciences - 2022 - Session 2 - Degree - Asc550-1Document5 pagesFaculty - Applied Sciences - 2022 - Session 2 - Degree - Asc550-1Atifah RozlanNo ratings yet

- Tutorial 7Document2 pagesTutorial 7Robert OoNo ratings yet

- FandI CT3 200709 Exam FINALDocument8 pagesFandI CT3 200709 Exam FINALTuff BubaNo ratings yet

- Specimen Paper CS1Document7 pagesSpecimen Paper CS1sunitaNo ratings yet

- Maths 2019Document12 pagesMaths 2019owenhealy2205No ratings yet

- IandF CT6 201809 ExamPaperDocument6 pagesIandF CT6 201809 ExamPaperPetya ValchevaNo ratings yet

- CS2A_121_EXAMDocument8 pagesCS2A_121_EXAMtanishajainNo ratings yet

- University of Dar Es Salaam College of Natural and Applied SciencesDocument9 pagesUniversity of Dar Es Salaam College of Natural and Applied SciencesMARYLUCY ASSENGANo ratings yet

- IandF CT8 201109 Exam FINADocument7 pagesIandF CT8 201109 Exam FINAmuskan jainNo ratings yet

- ct52010 2014Document202 pagesct52010 2014Corry CarltonNo ratings yet

- Examination: Subject CT5 - Contingencies Core TechnicalDocument7 pagesExamination: Subject CT5 - Contingencies Core TechnicalMadonnaNo ratings yet

- Section Check in Statistics Continuous Random Variables BDocument12 pagesSection Check in Statistics Continuous Random Variables BMERRY CHRISMAYANTINo ratings yet

- Correlation RegressionDocument7 pagesCorrelation RegressionNikhil TandukarNo ratings yet

- IandF CT6 201709 ExamDocument7 pagesIandF CT6 201709 ExamUrvi purohitNo ratings yet

- MathsDocument4 pagesMathsfawad aslam100% (1)

- Actuarial Society of India Examinations: 5 November 2004 Subject 105 - Actuarial Mathematics IDocument5 pagesActuarial Society of India Examinations: 5 November 2004 Subject 105 - Actuarial Mathematics IharmanpreetsinghNo ratings yet

- CT 111Document6 pagesCT 111Urvi purohitNo ratings yet

- FandI CT6 200909 Exam FINALDocument7 pagesFandI CT6 200909 Exam FINALUrvi purohitNo ratings yet

- CM2 Mock 6 Paper ADocument6 pagesCM2 Mock 6 Paper AVishva ThombareNo ratings yet

- CT3 QP 0509Document6 pagesCT3 QP 0509Nitai Chandra GangulyNo ratings yet

- Sta 2100 Probability-And-Statistics I April 2012Document4 pagesSta 2100 Probability-And-Statistics I April 2012Onduso Sammy MagaraNo ratings yet

- 2018 SA Aug-18Document18 pages2018 SA Aug-18vishwas kumarNo ratings yet

- Statistical Method For Economics QUESTION BANK 2010-11: Bliss PointDocument16 pagesStatistical Method For Economics QUESTION BANK 2010-11: Bliss Pointsiva prakashNo ratings yet

- Acteduk Ct6 Hand Qho v04Document58 pagesActeduk Ct6 Hand Qho v04ankitag612No ratings yet

- Fazaia Degree College Arf KamraDocument3 pagesFazaia Degree College Arf KamraMuhammad AwaisNo ratings yet

- FandI CT5 200809 Exam FINALDocument7 pagesFandI CT5 200809 Exam FINALEuston ChinharaNo ratings yet

- January Exam 2014: All CandidatesDocument3 pagesJanuary Exam 2014: All Candidatesmember787No ratings yet

- Cm1a 121 ExamDocument7 pagesCm1a 121 ExamShuvrajyoti BhattacharjeeNo ratings yet

- Questionpaper UnitS1 (6683) January2003Document5 pagesQuestionpaper UnitS1 (6683) January2003DodoNo ratings yet

- 15CN01 2Document4 pages15CN01 2saranNo ratings yet

- CS1B April22 EXAM Clean ProofDocument5 pagesCS1B April22 EXAM Clean ProofSeshankrishnaNo ratings yet

- Principls of Microeconomic nJ3qscm4JjDocument3 pagesPrincipls of Microeconomic nJ3qscm4JjMuhammad Ibrahim KhanNo ratings yet

- KMK 2023Document5 pagesKMK 2023Ainnur NatasyaNo ratings yet

- Page 1/2Document4 pagesPage 1/2Moussa Al HassanNo ratings yet

- Math - T (5) QDocument24 pagesMath - T (5) Q水墨墨No ratings yet

- Complete PastpaperDocument82 pagesComplete Pastpapersecret studentNo ratings yet

- Photonics, Volume 2: Nanophotonic Structures and MaterialsFrom EverandPhotonics, Volume 2: Nanophotonic Structures and MaterialsNo ratings yet

- Standard and Super-Resolution Bioimaging Data Analysis: A PrimerFrom EverandStandard and Super-Resolution Bioimaging Data Analysis: A PrimerNo ratings yet

- Dispute FormDocument1 pageDispute Formuzair muhdNo ratings yet

- Form Exchange Regulation: ForeignDocument1 pageForm Exchange Regulation: Foreignsammam mahdi samiNo ratings yet

- Acct Statement XX0947 20102022Document62 pagesAcct Statement XX0947 2010202227 Vishal HadiyaNo ratings yet

- Banks and The Importance of Banking Importance of Bank HistoryDocument33 pagesBanks and The Importance of Banking Importance of Bank HistoryMohammad Farhan shaikh50% (4)

- Reviewer Revaluation and ImpairmentDocument3 pagesReviewer Revaluation and ImpairmentMei Leen DanielesNo ratings yet

- Project On Home LoanDocument64 pagesProject On Home LoanAjay Singhal100% (6)

- Commission StructureDocument11 pagesCommission Structuredreamz unfulfilledNo ratings yet

- Quiz 10Document1 pageQuiz 10Lalaine BeatrizNo ratings yet

- Universidad Iberoamericana - Unibe-: Disbursement RecordDocument2 pagesUniversidad Iberoamericana - Unibe-: Disbursement Recordodontologia unibeNo ratings yet

- Financing of International TradeDocument12 pagesFinancing of International TradeREHANRAJNo ratings yet

- LC Letter of CreditDocument13 pagesLC Letter of CreditSudershan ThaibaNo ratings yet

- CA School Accounting ManualDocument606 pagesCA School Accounting ManualJeehye Shin100% (1)

- Chapter 1: The Principles of Lending and Lending BasicsDocument5 pagesChapter 1: The Principles of Lending and Lending Basicshesham zakiNo ratings yet

- 914010001051417 (3)Document3 pages914010001051417 (3)ShawnDhineshNo ratings yet

- Bonus Loan FormDocument2 pagesBonus Loan FormPATCOMC CooperativeNo ratings yet

- QS To Broker MH - PT. GADING LAUTAN PERKASA (6 KAPAL)Document4 pagesQS To Broker MH - PT. GADING LAUTAN PERKASA (6 KAPAL)AKHMAD SHOQI ALBINo ratings yet

- Income Statement FormatDocument2 pagesIncome Statement FormatShruti MohanNo ratings yet

- Act 110 Activity 8Document8 pagesAct 110 Activity 8Norkan DimalawangNo ratings yet

- Reo Cpa Review Management Services Pre-Week - May 2023 BatchDocument23 pagesReo Cpa Review Management Services Pre-Week - May 2023 BatchAliah Punguinagina MagintaoNo ratings yet

- Inv 2272 10272020Document1 pageInv 2272 10272020Ab Mejía VargasNo ratings yet

- Topic 1 - Conceptual Framework-Revised 2023Document48 pagesTopic 1 - Conceptual Framework-Revised 2023ANH VÕ QUỲNHNo ratings yet

- HolaKola HW Model ProvideDocument4 pagesHolaKola HW Model ProvideslmedcalfeNo ratings yet

- MGMT 4104 Unit 1Document30 pagesMGMT 4104 Unit 1Muskan KumariNo ratings yet

- OPS Vs NPSDocument18 pagesOPS Vs NPSKeshav SaraswatNo ratings yet

- Fox Valley College Disbursement DatesDocument1 pageFox Valley College Disbursement Datespaulsniff6No ratings yet

- Mergers in Indian Banking Final ProjectDocument80 pagesMergers in Indian Banking Final Projectketan karmoreNo ratings yet

- Zemen Bank Annual Report 2010Document21 pagesZemen Bank Annual Report 2010leunamaa100% (1)

- Alphabet Inc. Class ADocument118 pagesAlphabet Inc. Class AJose AntonioNo ratings yet

- Assignment - MBF 307 - Finacle Trade FinanceDocument2 pagesAssignment - MBF 307 - Finacle Trade Financeranvir kumarNo ratings yet

- Jawaban Soal Latihan LKK1-BondsDocument21 pagesJawaban Soal Latihan LKK1-Bondszahra calista armansyahNo ratings yet