Professional Documents

Culture Documents

Compensation

Compensation

Uploaded by

Regindin Laurice0 ratings0% found this document useful (0 votes)

5 views8 pagesfor activity

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfor activity

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views8 pagesCompensation

Compensation

Uploaded by

Regindin Lauricefor activity

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 8

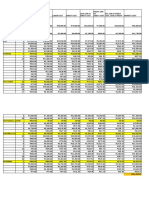

Staff March April May June July

Daily Salary ₱450.00 ₱450.00 ₱450.00 ₱450.00 ₱450.00

Number of Days Work 27 26 27 26 27

Total Monthly Salaries ₱12,150.00 ₱11,700.00 ₱12,150.00 ₱11,700.00 ₱12,150.00

Overtime Pay ₱421.88 ₱562.50 ₱281.25 ₱632.81 ₱351.56

Others ₱0.00 ₱0.00 ₱285.18 ₱0.00 ₱285.18

13 Month Pay ₱0.00 ₱0.00 ₱0.00 ₱0.00 ₱0.00

Total Gross Pay ₱12,571.88 ₱12,262.50 ₱12,716.43 ₱12,332.81 ₱12,786.74

Employee's Contribution ₱562.50 ₱540.00 ₱540.00 ₱540.00 ₱585.00

Employee's Compensation EC

Employee's Provident Fund Contribution

Total Employee SSS Contribution ₱562.50 ₱540.00 ₱540.00 ₱540.00 ₱585.00

Philhealth Premium ₱502.84 ₱490.48 ₱508.64 ₱493.28 ₱511.44

PAG-IBIG Premium ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00

Total Salaries Net of Allowable Deduction ₱10,984.66 ₱10,569.52 ₱11,001.36 ₱10,566.72 ₱10,953.56

Less: Applicable Withholding Tax

NET PAY ₱10,984.66 ₱10,569.52 ₱11,001.36 ₱10,566.72 ₱10,953.56

EMPLOYER SHARE

Employer's Contribution ₱1,140.00 ₱1,140.00 ₱1,140.00 ₱1,140.00 ₱1,140.00

Employer's Compensation EC ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00

Employer's Provident Fund Contribution

Total Employer SSS Contribution ₱1,150.00 ₱1,150.00 ₱1,150.00 ₱1,150.00 ₱1,150.00

Philhealth Premium ₱502.84 ₱490.48 ₱508.64 ₱493.28 ₱511.44

PAG-IBIG Premium ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00

Total Employer Share ₱1,752.84 ₱1,740.48 ₱1,758.64 ₱1,743.28 ₱1,761.44

Total Salaries Expense ₱12,571.88 ₱12,262.50 ₱12,716.43 ₱12,332.81 ₱12,786.74

August September October November December January February TOTAL

₱450.00 ₱450.00 ₱450.00 ₱450.00 ₱450.00 ₱450.00 ₱450.00 ₱5,400.00

27 26 27 26 27 27 25 ₱318.00

₱12,150.00 ₱11,700.00 ₱12,150.00 ₱11,700.00 ₱12,150.00 ₱12,150.00 ₱11,250.00 ₱143,100.00

₱421.88 ₱562.50 ₱492.19 ₱492.19 ₱281.25 ₱421.88 ₱562.50 ₱5,484.39

₱0.00 ₱0.00 ₱0.00 ₱475.31 ₱475.31 ₱0.00 ₱0.00 ₱1,520.98

₱0.00 ₱0.00 ₱0.00 ₱0.00 ₱6,075.00 ₱0.00 ₱0.00 ₱6,075.00

₱12,571.88 ₱12,262.50 ₱12,642.19 ₱12,667.50 ₱18,981.56 ₱12,571.88 ₱11,812.50 ₱156,180.37

₱562.50 ₱562.50 ₱562.50 ₱562.50 ₱855.00 ₱562.50 ₱540.00 ₱6,975.00

₱562.50 ₱562.50 ₱562.50 ₱562.50 ₱855.00 ₱562.50 ₱540.00 ₱6,975.00

₱502.84 ₱502.84 ₱505.68 ₱506.68 ₱759.24 ₱502.84 ₱472.48 ₱6,259.28

₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱1,200.00

₱10,984.66 ₱10,534.66 ₱10,981.82 ₱10,530.82 ₱10,435.76 ₱10,984.66 ₱10,137.52 ₱128,665.72

₱10,984.66 ₱10,534.66 ₱10,981.82 ₱10,530.82 ₱10,435.76 ₱10,984.66 ₱10,137.52 ₱128,665.72

₱1,140.00 ₱1,140.00 ₱1,140.00 ₱1,140.00 ₱1,140.00 ₱1,140.00 ₱1,140.00 ₱13,680.00

₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱120.00

₱1,150.00 ₱1,150.00 ₱1,150.00 ₱1,150.00 ₱1,150.00 ₱1,150.00 ₱1,150.00 ₱13,800.00

₱502.84 ₱502.84 ₱505.68 ₱506.68 ₱759.24 ₱502.84 ₱472.48 ₱6,259.28

₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱1,200.00

₱1,752.84 ₱1,752.84 ₱1,755.68 ₱1,756.68 ₱2,009.24 ₱1,752.84 ₱1,722.48 ₱21,259.28

₱12,571.88 ₱12,262.50 ₱12,642.19 ₱12,667.50 ₱18,981.56 ₱12,571.88 ₱11,812.50 ₱156,180.37

Chief Cook March April May June July

Daily Salary ₱500.00 ₱500.00 ₱500.00 ₱500.00 ₱500.00

Number of Days Work 27 26 27 26 27

Total Monthly Salaries ₱13,500.00 ₱13,000.00 ₱13,500.00 ₱13,000.00 ₱13,500.00

Overtime Pay ₱625.00 ₱391.00 ₱468.75 ₱703.13 ₱390.63

Others ₱0.00 ₱316.88 ₱0.00 ₱0.00 ₱316.88

13 Month Pay ₱0.00 ₱0.00 ₱0.00 ₱0.00 ₱0.00

Total Gross Pay ₱14,125.00 ₱13,707.88 ₱13,968.75 ₱13,703.13 ₱14,207.51

Employee's Contribution ₱630.00 ₱607.50 ₱630.00 ₱607.50 ₱630.00

Employee's Compensation EC

Employee's Provident Fund Contribution

Total Employee SSS Contribution ₱630.00 ₱607.50 ₱630.00 ₱607.50 ₱630.00

Philhealth Premium ₱565.00 ₱548.28 ₱558.72 ₱548.12 ₱568.28

PAG-IBIG Premium ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00

Total Salaries Net of Allowable Deduction ₱12,205.00 ₱11,744.22 ₱12,211.28 ₱11,744.38 ₱12,201.72

Less: Applicable Withholding Tax

NET PAY ₱12,205.00 ₱11,744.22 ₱12,211.28 ₱11,744.38 ₱12,201.72

EMPLOYER SHARE

Employer's Contribution ₱1,330.00 ₱1,282.50 ₱1,330.00 ₱1,282.50 ₱1,330.00

Employer's Compensation EC ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00

Employer's Provident Fund Contribution

Total Employer SSS Contribution ₱1,340.00 ₱1,292.50 ₱1,340.00 ₱1,292.50 ₱1,340.00

Philhealth Premium ₱565.00 ₱548.28 ₱558.72 ₱548.12 ₱568.28

PAG-IBIG Premium ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00

Total Employer Share ₱2,005.00 ₱1,940.78 ₱1,998.72 ₱1,940.62 ₱2,008.28

Total Salaries Expense ₱14,125.00 ₱13,707.88 ₱13,968.75 ₱13,703.13 ₱14,207.51

August September October November December January February TOTAL

₱500.00 ₱500.00 ₱500.00 ₱500.00 ₱500.00 ₱500.00 ₱500.00 ₱6,000.00

27 26 27 26 27 27 25 ₱318.00

₱13,500.00 ₱13,000.00 ₱13,500.00 ₱13,000.00 ₱13,500.00 ₱13,500.00 ₱12,500.00 ₱159,000.00

₱781.25 ₱625.00 ₱937.50 ₱625.00 ₱468.75 ₱625.00 ₱625.00 ₱7,266.01

₱0.00 ₱0.00 ₱0.00 ₱211.25 ₱0.00 ₱0.00 ₱422.50 ₱1,267.51

₱0.00 ₱0.00 ₱0.00 ₱0.00 ₱6,750.00 ₱0.00 ₱0.00 ₱6,750.00

₱14,281.25 ₱13,625.00 ₱14,437.50 ₱13,836.25 ₱20,718.75 ₱14,125.00 ₱13,547.50 ₱174,283.52

₱652.50 ₱607.50 ₱652.50 ₱630.00 ₱922.50 ₱630.00 ₱607.50 ₱7,807.50

₱652.50 ₱607.50 ₱652.50 ₱630.00 ₱922.50 ₱630.00 ₱607.50 ₱7,807.50

₱571.24 ₱545.00 ₱577.48 ₱553.44 ₱828.75 ₱565.00 ₱541.88 ₱6,971.19

₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱1,200.00

₱12,176.26 ₱11,747.50 ₱12,170.02 ₱11,716.56 ₱11,648.75 ₱12,205.00 ₱11,250.62 ₱143,021.31

₱12,176.26 ₱11,747.50 ₱12,170.02 ₱11,716.56 ₱11,648.75 ₱12,205.00 ₱11,250.62 ₱143,021.31

₱1,377.50 ₱1,282.50 ₱1,377.50 ₱1,330.00 ₱1,900.00 ₱1,330.00 ₱1,282.50 ₱16,435.00

₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱10.00 ₱120.00

₱1,387.50 ₱1,292.50 ₱1,387.50 ₱1,340.00 ₱1,910.00 ₱1,340.00 ₱1,292.50 ₱16,555.00

₱571.24 ₱545.00 ₱577.48 ₱553.44 ₱828.75 ₱565.00 ₱541.88 ₱6,971.19

₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱100.00 ₱1,200.00

₱2,058.74 ₱1,937.50 ₱2,064.98 ₱1,993.44 ₱2,838.75 ₱2,005.00 ₱1,934.38 ₱24,726.19

₱14,281.25 ₱13,625.00 ₱14,437.50 ₱13,836.25 ₱20,718.75 ₱14,125.00 ₱13,547.50 ₱174,283.52

You might also like

- Grind Export Files (C621957)Document34 pagesGrind Export Files (C621957)JovyNo ratings yet

- National Cranberry CooperativeDocument15 pagesNational Cranberry CooperativeSaswata Banerjee100% (4)

- OM WordDocument3 pagesOM WordpulakitNo ratings yet

- Labor Law Rev Midterms Sobrevinas ReviewerDocument33 pagesLabor Law Rev Midterms Sobrevinas ReviewerGerard TayaoNo ratings yet

- BatasDocument10 pagesBatasBrex Malaluan GaladoNo ratings yet

- TSC Financial PlanDocument61 pagesTSC Financial PlanJe BNo ratings yet

- VI. Financial Data: Monthly CostsDocument3 pagesVI. Financial Data: Monthly CostsJohn Paul AlegreNo ratings yet

- Salen, Carl Dhaniel 2A7 1Document4 pagesSalen, Carl Dhaniel 2A7 1Carl Dhaniel Garcia SalenNo ratings yet

- Café Relajante Financial Plan - SampleDocument13 pagesCafé Relajante Financial Plan - Samplexxpertiispaul69No ratings yet

- Payrollactivity 1Document6 pagesPayrollactivity 1Chrizel NiloNo ratings yet

- Puto Balanghoy FeasibilityDocument10 pagesPuto Balanghoy FeasibilityBarangay PulanglupaNo ratings yet

- Personal Budget TrackerDocument46 pagesPersonal Budget TrackerKit ChampNo ratings yet

- D' Mallows Income Statement For The Year Ended 2018-2022 Schedule 2018 2019Document23 pagesD' Mallows Income Statement For The Year Ended 2018-2022 Schedule 2018 2019April Loureen Dale TalhaNo ratings yet

- SalariesDocument8 pagesSalariespau mejaresNo ratings yet

- BOQ FormatExcelDocument2 pagesBOQ FormatExcelHomeSolutions Iloilo100% (2)

- Financial Analysis Model: Income StatementDocument7 pagesFinancial Analysis Model: Income StatementalyNo ratings yet

- Financial Analysis Model: Income StatementDocument7 pagesFinancial Analysis Model: Income StatementalyNo ratings yet

- Financial AspectDocument56 pagesFinancial AspectAngela LaurillaNo ratings yet

- Worksheet 8 Amortization ScheduleDocument2 pagesWorksheet 8 Amortization ScheduleAdrian DominoNo ratings yet

- Buying Transaction Cost: Companies Lot Size Amount Per Stock Starting Value Blue Chip StocksDocument3 pagesBuying Transaction Cost: Companies Lot Size Amount Per Stock Starting Value Blue Chip StocksIsseah Gaño OcampoNo ratings yet

- Savory Bistro Cheesilog Financial StatementDocument18 pagesSavory Bistro Cheesilog Financial Statementmauijoycarreon06006No ratings yet

- Malunggay Seafood Empanada Income StatementDocument1 pageMalunggay Seafood Empanada Income StatementMel Jilsen CernaNo ratings yet

- Amortization Dream CarDocument6 pagesAmortization Dream CarMiguel SpecsNo ratings yet

- Revenues: TotalDocument6 pagesRevenues: TotalDani CawaiNo ratings yet

- Tax ComputationDocument4 pagesTax Computationrfso16No ratings yet

- Lamiong LumpiaDocument74 pagesLamiong LumpiaJoan AvanzadoNo ratings yet

- Micro Finance - DRI FileDocument4 pagesMicro Finance - DRI FileDonald IbonaNo ratings yet

- Financial PlanDocument1 pageFinancial PlanAngel CuerdoNo ratings yet

- Cebu-Pacific FSDocument14 pagesCebu-Pacific FSFranck Jeremy MoogNo ratings yet

- Caed103 PrefexamDocument17 pagesCaed103 PrefexamShaneen AdorableNo ratings yet

- Eib Finances - Sheet1Document1 pageEib Finances - Sheet1api-359849819No ratings yet

- Financial AspectDocument16 pagesFinancial AspectJezeree DichosoNo ratings yet

- Profit Loss Statement - TemplateDocument3 pagesProfit Loss Statement - TemplateJohn Rey Bantay RodriguezNo ratings yet

- EPF Calculator by AssetYogiDocument27 pagesEPF Calculator by AssetYogisaseshNo ratings yet

- FINAL FEASIBDocument177 pagesFINAL FEASIBApril Loureen Dale TalhaNo ratings yet

- LOAN AMORTIZATION SCHEDULE 36 MonthsDocument1 pageLOAN AMORTIZATION SCHEDULE 36 MonthsDanielleMLNo ratings yet

- General Mathematics Performance Task # 2: LEADER: Jercy Constantino MembersDocument4 pagesGeneral Mathematics Performance Task # 2: LEADER: Jercy Constantino MembersIvan CanosaNo ratings yet

- Financial AnalysisDocument5 pagesFinancial Analysiscecille ramirezNo ratings yet

- Brew&BitesDocument13 pagesBrew&BitesMark Anthony Cosico DelgadoNo ratings yet

- Retirement CalculatorDocument13 pagesRetirement CalculatorYash SandhuNo ratings yet

- July - Dec 2019 Cash DisbursDocument1 pageJuly - Dec 2019 Cash DisbursDanica FajardoNo ratings yet

- Midterm ExamDocument19 pagesMidterm Examkate trishaNo ratings yet

- Money Target 1000 Rs.Document1 pageMoney Target 1000 Rs.highlightsesports64No ratings yet

- Pricing Year 1 Jessepresso Cup O'Josh Patpuccino Jericreamy: CoffeeDocument78 pagesPricing Year 1 Jessepresso Cup O'Josh Patpuccino Jericreamy: CoffeeChristian Job ReniedoNo ratings yet

- August Cash Remittance Form Iggys TalipapaDocument69 pagesAugust Cash Remittance Form Iggys Talipapafinance.tangingyamanfoundationNo ratings yet

- BALANCED!!!Document72 pagesBALANCED!!!XhaNo ratings yet

- FINANCESDocument7 pagesFINANCESchennelryNo ratings yet

- Reserve Requirement SheetDocument2 pagesReserve Requirement SheetMJ NuarinNo ratings yet

- Total Quantity Payment Discount (5%) Total Payment Minimum Maximum AverageDocument4 pagesTotal Quantity Payment Discount (5%) Total Payment Minimum Maximum AverageMary Joy EspinaNo ratings yet

- Genmath RamosfrfanceDocument3 pagesGenmath RamosfrfanceFrance RamosNo ratings yet

- Book 1Document2 pagesBook 1Vinz Villahermosa BorbonNo ratings yet

- Financial Statements KesiahDocument42 pagesFinancial Statements KesiahAries Gonzales CaraganNo ratings yet

- Financial Position 1 3Document14 pagesFinancial Position 1 3micahcoleen.cagampanNo ratings yet

- CEA Data CollectionDocument8 pagesCEA Data CollectionJohn Cesar PaunatNo ratings yet

- College of Health and Human Sciences2tuition Tables Fy2324.1Document2 pagesCollege of Health and Human Sciences2tuition Tables Fy2324.1Mampouya BabinNo ratings yet

- Loan Amortization - EONDocument2 pagesLoan Amortization - EONDanielleMLNo ratings yet

- Malunggay Seafood Empanada Balance SheetDocument1 pageMalunggay Seafood Empanada Balance SheetMel Jilsen CernaNo ratings yet

- Income: Yearly Household BudgetDocument5 pagesIncome: Yearly Household BudgetAnonymous POS4z6aPvNo ratings yet

- Scuba Budget - Sheet1 1Document1 pageScuba Budget - Sheet1 1api-464386047No ratings yet

- Mendoza French Aira C. FinmarDocument2 pagesMendoza French Aira C. FinmarTrayle HeartNo ratings yet

- A. Total Project Cost Computation of Total Project CostDocument52 pagesA. Total Project Cost Computation of Total Project CostAyreesh Mey SpntNo ratings yet

- Income Statment XXXXXXXXXDocument1 pageIncome Statment XXXXXXXXXkgodbo00No ratings yet

- Collection Summary 2018-2021Document121 pagesCollection Summary 2018-2021Chuck FernandezNo ratings yet

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019From EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019No ratings yet

- POSTERDocument1 pagePOSTERRegindin LauriceNo ratings yet

- Target Market 1Document10 pagesTarget Market 1Regindin LauriceNo ratings yet

- MnemonicDocument6 pagesMnemonicRegindin LauriceNo ratings yet

- Course Subject ExpectationsDocument1 pageCourse Subject ExpectationsRegindin LauriceNo ratings yet

- Jurisdiction of ArbitratorDocument17 pagesJurisdiction of ArbitratorRegindin LauriceNo ratings yet

- Ang Inang KalikasanDocument1 pageAng Inang KalikasanRegindin LauriceNo ratings yet

- BahuraDocument1 pageBahuraRegindin LauriceNo ratings yet

- Ang LupaDocument1 pageAng LupaRegindin LauriceNo ratings yet

- Ang KaragatanDocument1 pageAng KaragatanRegindin LauriceNo ratings yet

- Ang KagubatanDocument1 pageAng KagubatanRegindin LauriceNo ratings yet

- Ilaw at Buklod NG Manggagawa (IBM) v. NLRCDocument2 pagesIlaw at Buklod NG Manggagawa (IBM) v. NLRCdasfghkjlNo ratings yet

- Leave TMS PolicyDocument5 pagesLeave TMS PolicyPwc ApparelsNo ratings yet

- CA State Employment Harassment ComplaintDocument29 pagesCA State Employment Harassment ComplaintJason IngberNo ratings yet

- Term Paper Report On Christian Account On Dignity of LabourDocument39 pagesTerm Paper Report On Christian Account On Dignity of LabourMiriam B BennieNo ratings yet

- Labour LawsDocument45 pagesLabour LawsShivam MaheshwariNo ratings yet

- Facilities Management v. Dela Osa G.R. No. L-38649Document2 pagesFacilities Management v. Dela Osa G.R. No. L-38649Nica PaladNo ratings yet

- Soriano Vs Secretary of FinanceDocument6 pagesSoriano Vs Secretary of FinancePio MathayNo ratings yet

- Chart of Costing: Future CERAMIC CompanyDocument46 pagesChart of Costing: Future CERAMIC CompanyCeramiatNo ratings yet

- Cases Part 3Document10 pagesCases Part 3Ayban NabatarNo ratings yet

- SERVICE CONTRACT Activ Moving Rewards Union Manpower Services Unskilled WorkerDocument7 pagesSERVICE CONTRACT Activ Moving Rewards Union Manpower Services Unskilled WorkerStefan VrabieNo ratings yet

- Sample Contractual LettersDocument17 pagesSample Contractual LettersJOHN ERICNo ratings yet

- Naeci PDFDocument136 pagesNaeci PDFrobertoNo ratings yet

- Cases Labor LawDocument44 pagesCases Labor LaworlandoNo ratings yet

- Tamil Nadu Shops Permitted To Remain Open 365 Days A Year For Three YearsDocument2 pagesTamil Nadu Shops Permitted To Remain Open 365 Days A Year For Three YearsVignesh Faque JockeeyNo ratings yet

- Manual of Operations M-01: National Confederation of CooperativesDocument21 pagesManual of Operations M-01: National Confederation of Cooperativespapotchi patototNo ratings yet

- LabStand Bar Q - A (2014-2016) (LSG1718)Document10 pagesLabStand Bar Q - A (2014-2016) (LSG1718)Charish KuranNo ratings yet

- PRESIDENTIAL DECREE No.851Document11 pagesPRESIDENTIAL DECREE No.851Krishna PalomaresNo ratings yet

- Legal Aspects of HRDocument10 pagesLegal Aspects of HRRachel CoutinhoNo ratings yet

- Shops and Establishment ActDocument27 pagesShops and Establishment ActSuresh Murugan100% (1)

- Lect 1 Mines Act 1923Document44 pagesLect 1 Mines Act 1923Wajid HussainNo ratings yet

- Activity in PayrollDocument9 pagesActivity in PayrollFionalisa celindroNo ratings yet

- MA 1 Mock Exam QuestionDocument4 pagesMA 1 Mock Exam QuestionAbdul Gaffar100% (1)

- Accounting For LabourDocument10 pagesAccounting For LabourTaleem Tableeg100% (1)

- Ramos Vs CIRDocument5 pagesRamos Vs CIRKrisha BodiosNo ratings yet

- POEA SEC SeafarersDocument39 pagesPOEA SEC SeafarersAdrian de La CuestaNo ratings yet

- Traders Royal Bank Vs NLRC - LaborDocument8 pagesTraders Royal Bank Vs NLRC - LaborArt CrestFall ManlongatNo ratings yet