Professional Documents

Culture Documents

Kiểm tra LMS - lần 2

Kiểm tra LMS - lần 2

Uploaded by

Kotoru HanoelCopyright:

Available Formats

You might also like

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- INS2098 Chapter 1 NoteDocument6 pagesINS2098 Chapter 1 NoteVũ Hồng NgânNo ratings yet

- Key Chapter 7 Ms - TrangDocument6 pagesKey Chapter 7 Ms - TrangHoàng Việt VũNo ratings yet

- Resource PlanningDocument15 pagesResource PlanningMAI NGUYỄN THÁI NHẬTNo ratings yet

- Cit ExcercisesDocument15 pagesCit Excercises20. Lê Phúc HoànNo ratings yet

- file ôn trắc nghiệm cuối kì 8 .vi.enDocument38 pagesfile ôn trắc nghiệm cuối kì 8 .vi.en2-Nguyễn Thị Lan Anh100% (2)

- Sumati Varma - Fundamentals of International Business (2018, Pearson India) - Libgen - Li (MConverter - Eu)Document617 pagesSumati Varma - Fundamentals of International Business (2018, Pearson India) - Libgen - Li (MConverter - Eu)YashaswiNo ratings yet

- Marketing MGT PDFDocument231 pagesMarketing MGT PDFgunjanNo ratings yet

- ProblemDocument1 pageProblemparesh agrawal100% (1)

- Stock SolutionDocument9 pagesStock Solution신동호No ratings yet

- Taxation Chapter 5 - 8Document117 pagesTaxation Chapter 5 - 8Hồng Hạnh NguyễnNo ratings yet

- CH 09Document43 pagesCH 09Nabae AsfarNo ratings yet

- Desarrollo de Caso DECIP Desarrollado - InglesDocument15 pagesDesarrollo de Caso DECIP Desarrollado - InglesLuis Alexander AvalosNo ratings yet

- Đề 1Document2 pagesĐề 1Anh TrầnNo ratings yet

- You Are Researching Time Manufacturing and Have Found The FollowingDocument1 pageYou Are Researching Time Manufacturing and Have Found The Followingtrilocksp SinghNo ratings yet

- (UEH) - 2020 - UEH 3 - DayDocument21 pages(UEH) - 2020 - UEH 3 - DayuknowgaryNo ratings yet

- Exercises 270919Document3 pagesExercises 270919Kim AnhNo ratings yet

- - Huỳnh Thị Thiên Nhi: Câu HỏiDocument9 pages- Huỳnh Thị Thiên Nhi: Câu HỏiBông GấuNo ratings yet

- Class 1Document4 pagesClass 1skjacobpoolNo ratings yet

- Chapter4 (Money and Banking)Document2 pagesChapter4 (Money and Banking)ibraheemNo ratings yet

- Rais12 SM CH07-23Document6 pagesRais12 SM CH07-23t0ckNo ratings yet

- End of Unit Test 7Document17 pagesEnd of Unit Test 7Stt 09 12E Vũ Nguyễn Năng KhánhNo ratings yet

- Answers To The Case QuestionsDocument3 pagesAnswers To The Case Questions彭子育No ratings yet

- CIT ExerciseDocument3 pagesCIT ExerciseThu Phương NguyễnNo ratings yet

- Planning AND Materiali TY: Subject: Basic Audit Lecturers: Nguyen Thi Mai HuongDocument53 pagesPlanning AND Materiali TY: Subject: Basic Audit Lecturers: Nguyen Thi Mai HuongMạnh hưng Lê100% (1)

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- Oscm Test BankDocument594 pagesOscm Test BankTrang VânNo ratings yet

- (123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thDocument6 pages(123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thHa Lien Vu KhanhNo ratings yet

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Document48 pagesÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNo ratings yet

- WRITING-Module 2 - K46 - UEHDocument3 pagesWRITING-Module 2 - K46 - UEHHảii YếnNo ratings yet

- FIN202 Midterm ExerciseDocument13 pagesFIN202 Midterm Exerciseyeeeeeqi100% (1)

- Đạo Đức Trắc NghiệmDocument20 pagesĐạo Đức Trắc NghiệmKhánh Linh LêNo ratings yet

- Thi Két Thúc HQC Phan B4C Ð41 HQC Chính QUY Kÿ 11 Näm HQC 2018 - 2019Document11 pagesThi Két Thúc HQC Phan B4C Ð41 HQC Chính QUY Kÿ 11 Näm HQC 2018 - 2019Sơn Thạch BùiNo ratings yet

- Bai Tap InsuranceDocument12 pagesBai Tap InsuranceVũ HoàngNo ratings yet

- HW Assignment For Week 8Document2 pagesHW Assignment For Week 8Lưu Gia BảoNo ratings yet

- Exercise 2Document8 pagesExercise 2Hồng Hạnh NguyễnNo ratings yet

- Chapter 5 Writing Emails 1 2212650022 Doan Phuong LinhDocument3 pagesChapter 5 Writing Emails 1 2212650022 Doan Phuong LinhMeap JudyNo ratings yet

- lý thuyết cuối kì MNCDocument6 pageslý thuyết cuối kì MNCPhan Minh KhuêNo ratings yet

- CH4+CH5 .FinincingDocument9 pagesCH4+CH5 .Finincingdareen alhadeed100% (1)

- Should You Hire A Full-Time Employee On A Permanent Contract?Document6 pagesShould You Hire A Full-Time Employee On A Permanent Contract?Эрисс ДаркNo ratings yet

- End of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83Document2 pagesEnd of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83opi ccxv100% (1)

- Case 1Document2 pagesCase 1Hà PhươngNo ratings yet

- GK Cmbctcqt2 Nhóm 8 Dhktkt16bDocument9 pagesGK Cmbctcqt2 Nhóm 8 Dhktkt16bPhan Thị Mỹ DuyênNo ratings yet

- Chapter 7 Risk and The Cost of Capital ReviewDocument6 pagesChapter 7 Risk and The Cost of Capital ReviewThuỷ TiênnNo ratings yet

- SBQuiz 3Document9 pagesSBQuiz 3Tran Pham Quoc ThuyNo ratings yet

- TEST 1 - MACRO - GPD - CPI - 50 CâuDocument10 pagesTEST 1 - MACRO - GPD - CPI - 50 CâuTrần Toàn100% (1)

- Exercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseDocument15 pagesExercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseVõ Kim loanNo ratings yet

- Exercise 6: Double Entry Bookkeeping (Level Advanced)Document2 pagesExercise 6: Double Entry Bookkeeping (Level Advanced)Lerry AnnNo ratings yet

- Accounting January 2016: Recording Adjusting and Closing Entries For A Service BusinessDocument55 pagesAccounting January 2016: Recording Adjusting and Closing Entries For A Service BusinessAlexia MercadoNo ratings yet

- Trắc nghiệm QLDMĐT 12.03.09Document41 pagesTrắc nghiệm QLDMĐT 12.03.09Hang Dinh Thi ThuNo ratings yet

- ch04 Homework SolutionDocument26 pagesch04 Homework SolutionPhúc NguyễnNo ratings yet

- Exercise 25Document3 pagesExercise 25Triet LeNo ratings yet

- On Tap Vi MoDocument14 pagesOn Tap Vi MoOanh Phan100% (1)

- New Microsoft Office Word DocumentDocument30 pagesNew Microsoft Office Word Documentawais_hussain7998No ratings yet

- Credit Risk Management of Commercial Banks in Vietnam: Facts and IssuesDocument15 pagesCredit Risk Management of Commercial Banks in Vietnam: Facts and IssuesKhánh LinhNo ratings yet

- Review FinDocument19 pagesReview FinHuệ LinhNo ratings yet

- Financial Statement Analysis of Vinamilk: Fabrikam ResidencesDocument21 pagesFinancial Statement Analysis of Vinamilk: Fabrikam ResidencesThanh TrầnNo ratings yet

- Bài tập tuần 4 - Case Study SOCADocument2 pagesBài tập tuần 4 - Case Study SOCAThảo HuỳnhNo ratings yet

- Logistics QTDocument11 pagesLogistics QTTrung Hồ Nguyễn ThànhNo ratings yet

- 717648292 Kiểm tra LMS lần 2Document17 pages717648292 Kiểm tra LMS lần 2Nhung Cáp PhươngNo ratings yet

- Bài Kiểm Tra LMS Lần 1 Xem Lại Bài LàmDocument14 pagesBài Kiểm Tra LMS Lần 1 Xem Lại Bài Làm12B-42- Nguyễn Mạnh TuấnNo ratings yet

- Exam 1Document7 pagesExam 1Trang LêNo ratings yet

- About Study - Performance Dataset & Group AssignmentDocument2 pagesAbout Study - Performance Dataset & Group AssignmentKotoru HanoelNo ratings yet

- Vegetable ? - 24Document27 pagesVegetable ? - 24Kotoru HanoelNo ratings yet

- Sakura 24Document15 pagesSakura 24Kotoru HanoelNo ratings yet

- Stripes 24Document4 pagesStripes 24Kotoru HanoelNo ratings yet

- Torte 24 EnglischDocument2 pagesTorte 24 EnglischKotoru HanoelNo ratings yet

- Bunny Toy Outfit - 24Document37 pagesBunny Toy Outfit - 24Kotoru Hanoel100% (1)

- T1 - IAS 12 - BT1 - KeyDocument3 pagesT1 - IAS 12 - BT1 - KeyKotoru HanoelNo ratings yet

- T1 - Key Theo Sach IAS 12 Gui SVDocument3 pagesT1 - Key Theo Sach IAS 12 Gui SVKotoru HanoelNo ratings yet

- Financial Pitch DeckDocument19 pagesFinancial Pitch DeckSebastian GuerraNo ratings yet

- Jio (Marketing Strategy Analysis)Document28 pagesJio (Marketing Strategy Analysis)Anwar BNo ratings yet

- 1.2.1 Financial Performance RatiosDocument135 pages1.2.1 Financial Performance RatiosGary ANo ratings yet

- Portfolio RevisionDocument24 pagesPortfolio RevisionRitesh SolankiNo ratings yet

- Project ReportDocument65 pagesProject Reportyhulhil100% (1)

- Chapter 4Document65 pagesChapter 4임재영No ratings yet

- MKT CH 1Document18 pagesMKT CH 1ermias alemeNo ratings yet

- ICT Seek - and - Destroy - Profile - Playbit - EduDocument6 pagesICT Seek - and - Destroy - Profile - Playbit - EdubacreatheNo ratings yet

- Shaurya Resume RevisedDocument2 pagesShaurya Resume RevisedMs. Jaya Asrani (SU Executive Assistant)No ratings yet

- Yale Lecture NotesDocument52 pagesYale Lecture NotesK NorthNo ratings yet

- FM Cia 1.1 - 2123531Document15 pagesFM Cia 1.1 - 2123531Rohit GoyalNo ratings yet

- ASAL Business WB Chapter 3 AnswersDocument3 pagesASAL Business WB Chapter 3 AnswersFenil ShahNo ratings yet

- GST 221 Entrepreneurial Studies 1 - 2014-1Document6 pagesGST 221 Entrepreneurial Studies 1 - 2014-1CHI KITCHENNo ratings yet

- Golden Notes - Mercantile Law - RemovedDocument154 pagesGolden Notes - Mercantile Law - RemovedJazer DairoNo ratings yet

- Chapter 1 Nature, Purpose and Scope of Financial ManagementDocument15 pagesChapter 1 Nature, Purpose and Scope of Financial ManagementPatricia Bianca ArceoNo ratings yet

- Project On MCLDocument60 pagesProject On MCLaeroplane WingsNo ratings yet

- Evl SyedaNoorFatima IMC PG DistinctionDocument21 pagesEvl SyedaNoorFatima IMC PG DistinctionSheraz AhmadNo ratings yet

- Internship Report Index BBADocument9 pagesInternship Report Index BBACrazy SoulNo ratings yet

- Daftar Pembimbing Tugas Akhir 2022-2023Document7 pagesDaftar Pembimbing Tugas Akhir 2022-2023Riski RahmadNo ratings yet

- ZZZZZZDocument12 pagesZZZZZZCruz80% (5)

- NDFC 34Document3 pagesNDFC 34Rafi AzamNo ratings yet

- Exercise InterestDocument1 pageExercise InterestimlanglavangNo ratings yet

- Retained Earnings Short TestDocument2 pagesRetained Earnings Short TestAngelica CastilloNo ratings yet

- Other Percentage Taxes PDFDocument16 pagesOther Percentage Taxes PDFJociel De GuzmanNo ratings yet

- International Economics 14Th Edition Robert Carbaugh Test Bank Full Chapter PDFDocument41 pagesInternational Economics 14Th Edition Robert Carbaugh Test Bank Full Chapter PDFcemeteryliana.9afku100% (11)

- Chapter Four Financial Market in The Financial SystemsDocument136 pagesChapter Four Financial Market in The Financial SystemsNatnael Asfaw100% (1)

- Unlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFDocument17 pagesUnlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFAbhishekNo ratings yet

- Lec 8 Corporate Parenting and Good GovernanceDocument59 pagesLec 8 Corporate Parenting and Good Governancegina renathaNo ratings yet

Kiểm tra LMS - lần 2

Kiểm tra LMS - lần 2

Uploaded by

Kotoru HanoelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kiểm tra LMS - lần 2

Kiểm tra LMS - lần 2

Uploaded by

Kotoru HanoelCopyright:

Available Formats

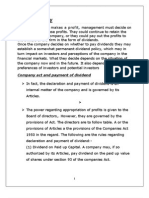

31191027209 - Lê Thị Khánh Linh

Nhà của tôi Các khoá học của tôi Khoa Tài chính Nguyễn Ngọc Định TCDN-KI1-K45CQ 5/11 - LMS lần 2 Bài kiểm

tra LMS - Lần 2

Bắt đầu vào lúc Thứ bảy, 14 Tháng mười một 2020, 10:50 AM

Trạng thái Đã xong

Kết thúc lúc Thứ bảy, 14 Tháng mười một 2020, 10:56 AM

Thời gian thực hiện 5 phút 24 giây

Điểm 20,00/20,00

Điểm 10,00 trên 10,00 (100%)

Câu Hỏi 1 Đúng Đạt điểm 1,00 trên 1,00

Sewer's Paradise is an all equity firm that has 5,000 shares of stock outstanding at a market price of $15 a

share. The firm's management has decided to issue $30,000 worth of debt and use the funds to repurchase

shares of the outstanding stock. The interest rate on the debt will be 10 percent. What are the earnings per

share at the break-even level of earnings before interest and taxes? Ignore taxes.

Select one:

a. $1.88

b. $1.50

c. $1.67

d. $1.46

e. $1.94

Câu trả lời của bạn đúng

The correct answer is: $1.50

Câu Hỏi 2 Đúng Đạt điểm 1,00 trên 1,00

Which of the following should be included in the analysis of a new product?

I. money already spent for research and development of the new product

II. reduction in sales for a current product once the new product is introduced

III. increase in accounts receivable needed to finance sales of the new product

IV. market value of a machine owned by the firm which will be used to produce the new product

Select one:

a. II, III, and IV only

b. I, II, III, and IV

c. I and III only

d. I, II, and III only

e. II and IV only

Câu trả lời của bạn đúng

The correct answer is: II, III, and IV only

Câu Hỏi 3 Đúng Đạt điểm 1,00 trên 1,00

Naylor's is an all equity firm with 60,000 shares of stock outstanding at a market price of $50 a share. The

company has earnings before interest and taxes of $87,000. Naylor's has decided to issue $750,000 of debt

at 7.5 percent. The debt will be used to repurchase shares of the outstanding stock. Currently, you own 500

shares of Naylor's stock. How many shares of Naylor's stock will you continue to own if you unlever this

position? Assume you can loan out funds at 7.5 percent interest. Ignore taxes.

Select one:

a. 500 shares

b. 425 shares

c. 300 shares

d. 350 shares

e. 375 shares

Câu trả lời của bạn đúng

The correct answer is: 375 shares

Câu Hỏi 4 Đúng Đạt điểm 1,00 trên 1,00

Bruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce

currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Bruce will borrow

$61,000 and use the proceeds to repurchase shares. What will the WACC be after recapitalization?

Select one:

a. 16.30 percent

b. 18.86 percent

c. 18.29 percent

d. 17.15 percent

e. 16.87 percent

Câu trả lời của bạn đúng

The correct answer is: 17.15 percent

Câu Hỏi 5 Đúng Đạt điểm 1,00 trên 1,00

You have computed the break-even point between a levered and an unlevered capital structure. Assume

there are no taxes. At the break-even level, the:

Select one:

a. advantages of leverage exceed the disadvantages of leverage.

b. earnings per share for the levered option are exactly double those of the unlevered option.

c. firm is just earning enough to pay for the cost of the debt.

d. firm's earnings before interest and taxes are equal to zero.

e. firm has a debt-equity ratio of .50.

Câu trả lời của bạn đúng

The correct answer is: firm is just earning enough to pay for the cost of the debt.

Câu Hỏi 6 Đúng Đạt điểm 1,00 trên 1,00

Down Bedding has an unlevered cost of capital of 13 percent, a cost of debt of 7.8 percent, and a tax rate of

32 percent. What is the target debt-equity ratio if the targeted cost of equity is 15.51 percent?

Select one:

a. .84

b. .71

c. .68

d. .76

e. .63

Câu trả lời của bạn đúng

The correct answer is: .71

Câu Hỏi 7 Đúng Đạt điểm 1,00 trên 1,00

Georga's Restaurants has 4,500 bonds outstanding with a face value of $1,000 each and a coupon rate of

8.25 percent. The interest is paid semi-annually. What is the amount of the annual interest tax shield if the

tax rate is 37 percent?

Select one:

a. $137,362.50

b. $162,411.90

c. $187,750.00

d. $233,887.50

e. $210,420.00

Câu trả lời của bạn đúng

The correct answer is: $137,362.50

Câu Hỏi 8 Đúng Đạt điểm 1,00 trên 1,00

Which one of the following will increase net working capital? Assume the current ratio is greater than 1.0.

Select one:

a. selling inventory at cost

b. selling inventory at a profit on credit

c. paying off a long-term debt

d. paying a supplier for a previous purchase

e. purchasing inventory on credit

Câu trả lời của bạn đúng

The correct answer is: selling inventory at a profit on credit

Câu Hỏi 9 Đúng Đạt điểm 1,00 trên 1,00

Which of the following will increase the operating cycle?

I. increasing the inventory turnover rate

II. increasing the payables period

III. decreasing the receivable turnover rate

IV. decreasing the inventory level

Select one:

a. II and III only

b. I and IV only

c. I only

d. II and IV only

e. III only

Câu trả lời của bạn đúng

The correct answer is: III only

Câu Hỏi 10 Đúng Đạt điểm 1,00 trên 1,00

Which one of the following is indicative of a short-term restrictive financial policy?

Select one:

a. purchasing inventory on an as-needed basis

b. keeping inventory levels high

c. granting credit to all customers

d. investing heavily in marketable securities

e. maintaining a large accounts receivable balance

Câu trả lời của bạn đúng

The correct answer is: purchasing inventory on an as-needed basis

Câu Hỏi 11 Đúng Đạt điểm 1,00 trên 1,00

The Lumber Mart recently replaced its management team. As a result, the firm is implementing a restrictive

short-term policy in place of the flexible policy under which the firm had been operating. Which of the

following should the employees expect as a result of this policy change?

I. reduction in sales due to stock outs

II. greater inventory selection

III. decreased sales due to the new accounts receivable credit policy

IV. decreased investment in marketable securities

Select one:

a. I and II only

b. I, II, and IV only

c. I, III, and IV only

d. I, II, III, and IV

e. II and IV only

Câu trả lời của bạn đúng

The correct answer is: I, III, and IV only

Câu Hỏi 12 Đúng Đạt điểm 1,00 trên 1,00

North Side Wholesalers has sales of $948,000. The cost of goods sold is equal to 72 percent of sales. The

firm has an average inventory of $23,000. How many days on average does it take the firm to sell its

inventory?

Select one:

a. 16.48 days

b. 29.68 days

c. 26.35 days

d. 12.30 days

e. 11.24 days

Câu trả lời của bạn đúng

The correct answer is: 12.30 days

Câu Hỏi 13 Đúng Đạt điểm 1,00 trên 1,00

Gateway Communications is considering a project with an initial fixed asset cost of $2.46 million which will

be depreciated straight-line to a zero book value over the 10-year life of the project. At the end of the

project the equipment will be sold for an estimated $300,000. The project will not directly produce any sales

but will reduce operating costs by $725,000 a year. The tax rate is 35 percent. The project will require

$45,000 of inventory which will be recouped when the project ends. Should this project be implemented if

the firm requires a 14 percent rate of return? Why or why not?

Select one:

a. Yes; The NPV is $387,516.67

b. Yes; The NPV is $251,860.34

c. No; The NPV is -$172,937.49.

d. No; The NPV is -$87,820.48.

e. Yes; The NPV is $466,940.57

Câu trả lời của bạn đúng

The correct answer is: Yes; The NPV is $466,940.57

Câu Hỏi 14 Đúng Đạt điểm 1,00 trên 1,00

As of the beginning of the quarter, Swenson's, Inc. had a cash balance of $460. During the quarter, the

company collected $520 from customers and paid suppliers $360. The company also paid an interest

payment of $20 and a tax payment of $110. In addition, the company repaid $140 on its long-term debt.

What is Callahan's cash balance at the end of the quarter?

Select one:

a. $490

b. $430

c. $350

d. $320

e. -$110

Câu trả lời của bạn đúng

The correct answer is: $350

Câu Hỏi 15 Đúng Đạt điểm 1,00 trên 1,00

Danielle's is a furniture store that is considering adding appliances to its offerings. Which of the following

should be considered incremental cash flows of this project?

I. utilizing the credit offered by a supplier to purchase the appliance inventory

II. benefiting from increased furniture sales to appliance customers

III. borrowing money from a bank to fund the appliance project

IV. purchasing parts for inventory to handle any appliance repairs that might be necessary

Select one:

a. I, II, and IV only

b. II, III, and IV only

c. III and IV only

d. I and II only

e. I, II, III, and IV

Câu trả lời của bạn đúng

The correct answer is: I, II, and IV only

Câu Hỏi 16 Đúng Đạt điểm 1,00 trên 1,00

All of the following are related to a proposed project. Which of these should be included in the cash flow at

time zero?

I. purchase of $1,400 of parts inventory needed to support the project

II. loan of $125,000 used to finance the project

III. depreciation tax shield of $1,100

IV. $6,500 of equipment needed to commence the project

Select one:

a. I, II, III, and IV

b. II and IV only

c. I and IV only

d. I and II only

e. I, II, and IV only

Câu trả lời của bạn đúng

The correct answer is: I and IV only

Câu Hỏi 17 Đúng Đạt điểm 1,00 trên 1,00

Kelly's Corner Bakery purchased a lot in Oil City 6 years ago at a cost of $280,000. Today, that lot has a

market value of $340,000. At the time of the purchase, the company spent $15,000 to level the lot and

another $20,000 to install storm drains. The company now wants to build a new facility on that site. The

building cost is estimated at $1.47 million. What amount should be used as the initial cash flow for this

project?

Select one:

a. -$1,825,000

b. -$1,845,000

c. -$1,860,000

d. -$1,470,000

e. -$1,810,000

Câu trả lời của bạn đúng

The correct answer is: -$1,810,000

Câu Hỏi 18 Đúng Đạt điểm 1,00 trên 1,00

Jefferson & Sons is evaluating a project that will increase annual sales by $138,000 and annual costs by

$94,000. The project will initially require $110,000 in fixed assets that will be depreciated straight-line to a

zero book value over the 4-year life of the project. The applicable tax rate is 32 percent. What is the

operating cash flow for this project?

Select one:

a. $46,480

b. $11,220

c. $38,720

d. $29,920

e. $46,620

Câu trả lời của bạn đúng

The correct answer is: $38,720

Câu Hỏi 19 Đúng Đạt điểm 1,00 trên 1,00

Bruno's Lunch Counter is expanding and expects operating cash flows of $26,000 a year for 4 years as a

result. This expansion requires $39,000 in new fixed assets. These assets will be worthless at the end of the

project. In addition, the project requires $3,000 of net working capital throughout the life of the project.

What is the net present value of this expansion project at a required rate of return of 16 percent?

Select one:

a. $18,477.29

b. $29,416.08

c. $28,288.70

d. $32,409.57

e. $21,033.33

Câu trả lời của bạn đúng

The correct answer is: $32,409.57

Câu Hỏi 20 Đúng Đạt điểm 1,00 trên 1,00

Homemade leverage is:

Select one:

a. the borrowing or lending of money by individual shareholders as a means of adjusting their level of

financial leverage.

b. the incurrence of debt by a corporation in order to pay dividends to shareholders.

c. best defined as an increase in a firm's debt-equity ratio.

d. the exclusive use of debt to fund a corporate expansion project.

e. the term used to describe the capital structure of a levered firm.

Câu trả lời của bạn đúng

The correct answer is: the borrowing or lending of money by individual shareholders as a means of adjusting their

level of financial leverage.

◄ Chương 26 - Tài trợ và kế hoạch tài chính ngắn hạn

Chuyển tới...

Chương 28 - Quản trị tín dụng thương mại và hàng tồn kho ►

Bạn đang đăng nhập với tên 31191027209 - Lê Thị Khánh Linh (Thoát)

You might also like

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- INS2098 Chapter 1 NoteDocument6 pagesINS2098 Chapter 1 NoteVũ Hồng NgânNo ratings yet

- Key Chapter 7 Ms - TrangDocument6 pagesKey Chapter 7 Ms - TrangHoàng Việt VũNo ratings yet

- Resource PlanningDocument15 pagesResource PlanningMAI NGUYỄN THÁI NHẬTNo ratings yet

- Cit ExcercisesDocument15 pagesCit Excercises20. Lê Phúc HoànNo ratings yet

- file ôn trắc nghiệm cuối kì 8 .vi.enDocument38 pagesfile ôn trắc nghiệm cuối kì 8 .vi.en2-Nguyễn Thị Lan Anh100% (2)

- Sumati Varma - Fundamentals of International Business (2018, Pearson India) - Libgen - Li (MConverter - Eu)Document617 pagesSumati Varma - Fundamentals of International Business (2018, Pearson India) - Libgen - Li (MConverter - Eu)YashaswiNo ratings yet

- Marketing MGT PDFDocument231 pagesMarketing MGT PDFgunjanNo ratings yet

- ProblemDocument1 pageProblemparesh agrawal100% (1)

- Stock SolutionDocument9 pagesStock Solution신동호No ratings yet

- Taxation Chapter 5 - 8Document117 pagesTaxation Chapter 5 - 8Hồng Hạnh NguyễnNo ratings yet

- CH 09Document43 pagesCH 09Nabae AsfarNo ratings yet

- Desarrollo de Caso DECIP Desarrollado - InglesDocument15 pagesDesarrollo de Caso DECIP Desarrollado - InglesLuis Alexander AvalosNo ratings yet

- Đề 1Document2 pagesĐề 1Anh TrầnNo ratings yet

- You Are Researching Time Manufacturing and Have Found The FollowingDocument1 pageYou Are Researching Time Manufacturing and Have Found The Followingtrilocksp SinghNo ratings yet

- (UEH) - 2020 - UEH 3 - DayDocument21 pages(UEH) - 2020 - UEH 3 - DayuknowgaryNo ratings yet

- Exercises 270919Document3 pagesExercises 270919Kim AnhNo ratings yet

- - Huỳnh Thị Thiên Nhi: Câu HỏiDocument9 pages- Huỳnh Thị Thiên Nhi: Câu HỏiBông GấuNo ratings yet

- Class 1Document4 pagesClass 1skjacobpoolNo ratings yet

- Chapter4 (Money and Banking)Document2 pagesChapter4 (Money and Banking)ibraheemNo ratings yet

- Rais12 SM CH07-23Document6 pagesRais12 SM CH07-23t0ckNo ratings yet

- End of Unit Test 7Document17 pagesEnd of Unit Test 7Stt 09 12E Vũ Nguyễn Năng KhánhNo ratings yet

- Answers To The Case QuestionsDocument3 pagesAnswers To The Case Questions彭子育No ratings yet

- CIT ExerciseDocument3 pagesCIT ExerciseThu Phương NguyễnNo ratings yet

- Planning AND Materiali TY: Subject: Basic Audit Lecturers: Nguyen Thi Mai HuongDocument53 pagesPlanning AND Materiali TY: Subject: Basic Audit Lecturers: Nguyen Thi Mai HuongMạnh hưng Lê100% (1)

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- Oscm Test BankDocument594 pagesOscm Test BankTrang VânNo ratings yet

- (123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thDocument6 pages(123doc) - Testbank-Chap18-Corporate-Finance-By-Ross-10thHa Lien Vu KhanhNo ratings yet

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Document48 pagesÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNo ratings yet

- WRITING-Module 2 - K46 - UEHDocument3 pagesWRITING-Module 2 - K46 - UEHHảii YếnNo ratings yet

- FIN202 Midterm ExerciseDocument13 pagesFIN202 Midterm Exerciseyeeeeeqi100% (1)

- Đạo Đức Trắc NghiệmDocument20 pagesĐạo Đức Trắc NghiệmKhánh Linh LêNo ratings yet

- Thi Két Thúc HQC Phan B4C Ð41 HQC Chính QUY Kÿ 11 Näm HQC 2018 - 2019Document11 pagesThi Két Thúc HQC Phan B4C Ð41 HQC Chính QUY Kÿ 11 Näm HQC 2018 - 2019Sơn Thạch BùiNo ratings yet

- Bai Tap InsuranceDocument12 pagesBai Tap InsuranceVũ HoàngNo ratings yet

- HW Assignment For Week 8Document2 pagesHW Assignment For Week 8Lưu Gia BảoNo ratings yet

- Exercise 2Document8 pagesExercise 2Hồng Hạnh NguyễnNo ratings yet

- Chapter 5 Writing Emails 1 2212650022 Doan Phuong LinhDocument3 pagesChapter 5 Writing Emails 1 2212650022 Doan Phuong LinhMeap JudyNo ratings yet

- lý thuyết cuối kì MNCDocument6 pageslý thuyết cuối kì MNCPhan Minh KhuêNo ratings yet

- CH4+CH5 .FinincingDocument9 pagesCH4+CH5 .Finincingdareen alhadeed100% (1)

- Should You Hire A Full-Time Employee On A Permanent Contract?Document6 pagesShould You Hire A Full-Time Employee On A Permanent Contract?Эрисс ДаркNo ratings yet

- End of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83Document2 pagesEnd of Chapter Exercises: Solutions: Answer: (I) Expected Opportunity Cost of $86 (Ii) Expected Opportunity Cost of $83opi ccxv100% (1)

- Case 1Document2 pagesCase 1Hà PhươngNo ratings yet

- GK Cmbctcqt2 Nhóm 8 Dhktkt16bDocument9 pagesGK Cmbctcqt2 Nhóm 8 Dhktkt16bPhan Thị Mỹ DuyênNo ratings yet

- Chapter 7 Risk and The Cost of Capital ReviewDocument6 pagesChapter 7 Risk and The Cost of Capital ReviewThuỷ TiênnNo ratings yet

- SBQuiz 3Document9 pagesSBQuiz 3Tran Pham Quoc ThuyNo ratings yet

- TEST 1 - MACRO - GPD - CPI - 50 CâuDocument10 pagesTEST 1 - MACRO - GPD - CPI - 50 CâuTrần Toàn100% (1)

- Exercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseDocument15 pagesExercise Exercise 3.1 Component Accounting - Engine: Costs of PurchaseVõ Kim loanNo ratings yet

- Exercise 6: Double Entry Bookkeeping (Level Advanced)Document2 pagesExercise 6: Double Entry Bookkeeping (Level Advanced)Lerry AnnNo ratings yet

- Accounting January 2016: Recording Adjusting and Closing Entries For A Service BusinessDocument55 pagesAccounting January 2016: Recording Adjusting and Closing Entries For A Service BusinessAlexia MercadoNo ratings yet

- Trắc nghiệm QLDMĐT 12.03.09Document41 pagesTrắc nghiệm QLDMĐT 12.03.09Hang Dinh Thi ThuNo ratings yet

- ch04 Homework SolutionDocument26 pagesch04 Homework SolutionPhúc NguyễnNo ratings yet

- Exercise 25Document3 pagesExercise 25Triet LeNo ratings yet

- On Tap Vi MoDocument14 pagesOn Tap Vi MoOanh Phan100% (1)

- New Microsoft Office Word DocumentDocument30 pagesNew Microsoft Office Word Documentawais_hussain7998No ratings yet

- Credit Risk Management of Commercial Banks in Vietnam: Facts and IssuesDocument15 pagesCredit Risk Management of Commercial Banks in Vietnam: Facts and IssuesKhánh LinhNo ratings yet

- Review FinDocument19 pagesReview FinHuệ LinhNo ratings yet

- Financial Statement Analysis of Vinamilk: Fabrikam ResidencesDocument21 pagesFinancial Statement Analysis of Vinamilk: Fabrikam ResidencesThanh TrầnNo ratings yet

- Bài tập tuần 4 - Case Study SOCADocument2 pagesBài tập tuần 4 - Case Study SOCAThảo HuỳnhNo ratings yet

- Logistics QTDocument11 pagesLogistics QTTrung Hồ Nguyễn ThànhNo ratings yet

- 717648292 Kiểm tra LMS lần 2Document17 pages717648292 Kiểm tra LMS lần 2Nhung Cáp PhươngNo ratings yet

- Bài Kiểm Tra LMS Lần 1 Xem Lại Bài LàmDocument14 pagesBài Kiểm Tra LMS Lần 1 Xem Lại Bài Làm12B-42- Nguyễn Mạnh TuấnNo ratings yet

- Exam 1Document7 pagesExam 1Trang LêNo ratings yet

- About Study - Performance Dataset & Group AssignmentDocument2 pagesAbout Study - Performance Dataset & Group AssignmentKotoru HanoelNo ratings yet

- Vegetable ? - 24Document27 pagesVegetable ? - 24Kotoru HanoelNo ratings yet

- Sakura 24Document15 pagesSakura 24Kotoru HanoelNo ratings yet

- Stripes 24Document4 pagesStripes 24Kotoru HanoelNo ratings yet

- Torte 24 EnglischDocument2 pagesTorte 24 EnglischKotoru HanoelNo ratings yet

- Bunny Toy Outfit - 24Document37 pagesBunny Toy Outfit - 24Kotoru Hanoel100% (1)

- T1 - IAS 12 - BT1 - KeyDocument3 pagesT1 - IAS 12 - BT1 - KeyKotoru HanoelNo ratings yet

- T1 - Key Theo Sach IAS 12 Gui SVDocument3 pagesT1 - Key Theo Sach IAS 12 Gui SVKotoru HanoelNo ratings yet

- Financial Pitch DeckDocument19 pagesFinancial Pitch DeckSebastian GuerraNo ratings yet

- Jio (Marketing Strategy Analysis)Document28 pagesJio (Marketing Strategy Analysis)Anwar BNo ratings yet

- 1.2.1 Financial Performance RatiosDocument135 pages1.2.1 Financial Performance RatiosGary ANo ratings yet

- Portfolio RevisionDocument24 pagesPortfolio RevisionRitesh SolankiNo ratings yet

- Project ReportDocument65 pagesProject Reportyhulhil100% (1)

- Chapter 4Document65 pagesChapter 4임재영No ratings yet

- MKT CH 1Document18 pagesMKT CH 1ermias alemeNo ratings yet

- ICT Seek - and - Destroy - Profile - Playbit - EduDocument6 pagesICT Seek - and - Destroy - Profile - Playbit - EdubacreatheNo ratings yet

- Shaurya Resume RevisedDocument2 pagesShaurya Resume RevisedMs. Jaya Asrani (SU Executive Assistant)No ratings yet

- Yale Lecture NotesDocument52 pagesYale Lecture NotesK NorthNo ratings yet

- FM Cia 1.1 - 2123531Document15 pagesFM Cia 1.1 - 2123531Rohit GoyalNo ratings yet

- ASAL Business WB Chapter 3 AnswersDocument3 pagesASAL Business WB Chapter 3 AnswersFenil ShahNo ratings yet

- GST 221 Entrepreneurial Studies 1 - 2014-1Document6 pagesGST 221 Entrepreneurial Studies 1 - 2014-1CHI KITCHENNo ratings yet

- Golden Notes - Mercantile Law - RemovedDocument154 pagesGolden Notes - Mercantile Law - RemovedJazer DairoNo ratings yet

- Chapter 1 Nature, Purpose and Scope of Financial ManagementDocument15 pagesChapter 1 Nature, Purpose and Scope of Financial ManagementPatricia Bianca ArceoNo ratings yet

- Project On MCLDocument60 pagesProject On MCLaeroplane WingsNo ratings yet

- Evl SyedaNoorFatima IMC PG DistinctionDocument21 pagesEvl SyedaNoorFatima IMC PG DistinctionSheraz AhmadNo ratings yet

- Internship Report Index BBADocument9 pagesInternship Report Index BBACrazy SoulNo ratings yet

- Daftar Pembimbing Tugas Akhir 2022-2023Document7 pagesDaftar Pembimbing Tugas Akhir 2022-2023Riski RahmadNo ratings yet

- ZZZZZZDocument12 pagesZZZZZZCruz80% (5)

- NDFC 34Document3 pagesNDFC 34Rafi AzamNo ratings yet

- Exercise InterestDocument1 pageExercise InterestimlanglavangNo ratings yet

- Retained Earnings Short TestDocument2 pagesRetained Earnings Short TestAngelica CastilloNo ratings yet

- Other Percentage Taxes PDFDocument16 pagesOther Percentage Taxes PDFJociel De GuzmanNo ratings yet

- International Economics 14Th Edition Robert Carbaugh Test Bank Full Chapter PDFDocument41 pagesInternational Economics 14Th Edition Robert Carbaugh Test Bank Full Chapter PDFcemeteryliana.9afku100% (11)

- Chapter Four Financial Market in The Financial SystemsDocument136 pagesChapter Four Financial Market in The Financial SystemsNatnael Asfaw100% (1)

- Unlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFDocument17 pagesUnlock-NISM XV - RESEARCH ANALYST EXAM - PRACTICE TEST 3 PDFAbhishekNo ratings yet

- Lec 8 Corporate Parenting and Good GovernanceDocument59 pagesLec 8 Corporate Parenting and Good Governancegina renathaNo ratings yet