Professional Documents

Culture Documents

ChallanForm

ChallanForm

Uploaded by

Suhail880380 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

24020700479059_ChallanForm

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views2 pagesChallanForm

ChallanForm

Uploaded by

Suhail88038Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

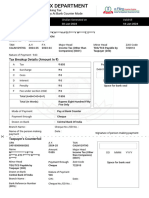

INCOME TAX DEPARTMENT

Challan Form For Making Tax

Payment Through Pay At Bank Counter Mode

CRN Challan Generated on Valid till

24020700479059 07-Feb-2024 22-Feb-2024

ITNS No. : 281

Name : J*K S***E C**********E B**K L*****D

e-mail ID : ta*********@gmail.com

Mobile No. : 99XXXXXX71

TAN A.Y. F.Y. Major Head Minor Head ZAO Code

AMRJ12692B 2024-25 2023-24 Income Tax (Other than TDS/TCS Payable by 722044

Companies) (0021) Taxpayer (200)

Nature of Payment : 94A

Tax Breakup Details (Amount In ₹)

A Tax ₹ 13,942 For Use In Receiving Bank

B Surcharge ₹0 Debit to A/c / Cheque credited on

C Cess ₹0

D Interest ₹0 DD MMM YYYY

E Penalty ₹0 Space for bank seal

F Fee under section 234E ₹0

Total (A+B+C+D+E+F) ₹ 13,942

Total (In Words) Rupees Thirteen Thousand

Nine Hundred And Forty

Two Only

Mode of Payment : Pay at Bank Counter

Payment through : Cheque

Drawn on Bank : Jammu And Kashmir Bank Limited

Branch Name : Cheque No./DD No. :

Name of the person making Date :

Signature of person making payment

payment :

Taxpayer’s Counterfoil

CRN A.Y. TAN

24020700479059 2024-25 AMRJ12692B

Name Amount Major Head

J*K S***E C**********E B**K ₹ 13,942 Income Tax (Other DD MMM YYYY

L*****D than Companies)

(0021)

Minor Head Payment through ZAO Code Space for bank seal

TDS/TCS Payable by Cheque 722044

Taxpayer (200)

Drawn on Bank Nature of Payment

Jammu And Kashmir Bank 94A

Limited

Branch Name : CIN : Date :

Bank Reference Number Cheque No./DD No. :

(BRN) :

You might also like

- Kitkat Nestle Palm Oil Crisis ManagementDocument16 pagesKitkat Nestle Palm Oil Crisis ManagementVăn NhânnNo ratings yet

- Porter's Five Forces Analysis Is A Framework For The IndustryDocument4 pagesPorter's Five Forces Analysis Is A Framework For The Industrylove_bkbNo ratings yet

- Lgu SWM Scmar 2017 LatestDocument19 pagesLgu SWM Scmar 2017 LatestSean Allen Pagkalinawan100% (1)

- IDC: Predictive Analytics and ROIDocument10 pagesIDC: Predictive Analytics and ROIAmrit SharmaNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- Tds Pakka TalabDocument2 pagesTds Pakka Talabdpmuftp2012No ratings yet

- Tds Vinoba NagarDocument2 pagesTds Vinoba Nagardpmuftp2012No ratings yet

- Tds Challan Radha NagarDocument2 pagesTds Challan Radha Nagardpmuftp2012No ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- 24062700105033_ChallanFormDocument1 page24062700105033_ChallanFormasinghas72No ratings yet

- ChallanFormDocument1 pageChallanFormArun JadhavNo ratings yet

- ChallanFormDocument1 pageChallanFormbghosh00112233No ratings yet

- ChallanFormDocument1 pageChallanFormrmzmuhammedNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- ChallanFormDocument1 pageChallanFormvinodvadageri367No ratings yet

- ChallanFormDocument2 pagesChallanFormConsumer Cooperative Medicine JPCNo ratings yet

- ChallanFormDocument1 pageChallanFormiemjalaalNo ratings yet

- ChallanFormDocument1 pageChallanFormkuldip SinghNo ratings yet

- ChallanFormDocument1 pageChallanFormspmusrinivasaraoNo ratings yet

- ChallanFormDocument1 pageChallanForm15Suman SahaNo ratings yet

- ChallanFormDocument1 pageChallanFormVipin MishraNo ratings yet

- ChallanFormDocument1 pageChallanFormVipin MishraNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- ChallanFormDocument2 pagesChallanFormtheniqcabcalltaxiNo ratings yet

- ChallanFormDocument1 pageChallanFormACAS LLPNo ratings yet

- ChallanFormDocument1 pageChallanFormnews24into7into365No ratings yet

- ChallanFormDocument1 pageChallanFormGaurav SardanaNo ratings yet

- ChallanFormDocument1 pageChallanFormhp agencyNo ratings yet

- ChallanFormDocument1 pageChallanFormsyedaafreen.inNo ratings yet

- TAX ChallanFormDocument1 pageTAX ChallanFormzaiddparkar1No ratings yet

- ChallanFormDocument1 pageChallanFormSHIVAPPA HEBBALNo ratings yet

- ChallanFormDocument1 pageChallanFormmanjuskkNo ratings yet

- ChallanFormDocument1 pageChallanFormSudhanshu MishraNo ratings yet

- ChallanFormDocument1 pageChallanFormomNo ratings yet

- Income Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)Document1 pageIncome Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)DilleshNo ratings yet

- ChallanFormDocument1 pageChallanFormAman GargNo ratings yet

- Opus 94c Mar 12.5.24 24Document1 pageOpus 94c Mar 12.5.24 24vlogwithfun06No ratings yet

- Piduguralla Municipality: ReceiptDocument1 pagePiduguralla Municipality: ReceiptSHAIK AJEESNo ratings yet

- Property Tax Receipt - 2022Document1 pageProperty Tax Receipt - 2022Bablu DexterNo ratings yet

- ReportDocument1 pageReportmedengcollegesNo ratings yet

- 24042400104981IBKL ChallanReceiptDocument1 page24042400104981IBKL ChallanReceiptaccounthoNo ratings yet

- Guntur Municipal Corporation: ReceiptDocument1 pageGuntur Municipal Corporation: ReceiptSqaure PodNo ratings yet

- 23120500288895UTIB ChallanReceiptDocument1 page23120500288895UTIB ChallanReceiptbinitashah11573No ratings yet

- CBDTSMChallanForm02 09 2022Document1 pageCBDTSMChallanForm02 09 2022asok maitiNo ratings yet

- Medipath TDS 1st Oct 22Document1 pageMedipath TDS 1st Oct 22asok maitiNo ratings yet

- Rajesh TambeDocument1 pageRajesh TambemodakmmNo ratings yet

- 24030400014921RBIS ChallanReceiptDocument1 page24030400014921RBIS ChallanReceiptaccounthoNo ratings yet

- RoyalDocument2 pagesRoyallc2023asnNo ratings yet

- CBDT Challan - Ay 2017-18Document1 pageCBDT Challan - Ay 2017-18SATEESH SIRAPURAPUNo ratings yet

- TCS ChallanReceipt Oct-23Document1 pageTCS ChallanReceipt Oct-23ss_mirganjNo ratings yet

- View Tax Payment Details: Reference Number: 29973456Document2 pagesView Tax Payment Details: Reference Number: 29973456arjuntyagi22No ratings yet

- 23120500253875UTIB ChallanReceiptDocument1 page23120500253875UTIB ChallanReceiptbinitashah11573No ratings yet

- Tds ChallanDocument2 pagesTds Challannilesh vithalaniNo ratings yet

- Challan 1Document2 pagesChallan 1lc2023asnNo ratings yet

- ChallanDocument2 pagesChallanSanidev MishraNo ratings yet

- Screenshot 2023-12-07 at 5.27.16 PMDocument1 pageScreenshot 2023-12-07 at 5.27.16 PMdrsadhu2001No ratings yet

- BWSPR2200Q 23122900076834ICIC DTAX 29122023 TaxPayerDocument1 pageBWSPR2200Q 23122900076834ICIC DTAX 29122023 TaxPayerbuyindianlocalsNo ratings yet

- It 000153644004 2023 00Document1 pageIt 000153644004 2023 00sibghatullahmiranibNo ratings yet

- 24030701379609SBIN ChallanReceiptDocument1 page24030701379609SBIN ChallanReceiptFiroz AliNo ratings yet

- Rail Transloading GuideDocument17 pagesRail Transloading Guideanon_727911667No ratings yet

- The Stock Market For DummiesDocument2 pagesThe Stock Market For DummiesjikolpNo ratings yet

- Simple and Compound Interest: Winmeen VAO Mission 100Document13 pagesSimple and Compound Interest: Winmeen VAO Mission 100KruthickNo ratings yet

- Finance For International BusinessDocument19 pagesFinance For International BusinessHuy NgoNo ratings yet

- 2006 ANZSIC CODE (Versi Lengkap)Document513 pages2006 ANZSIC CODE (Versi Lengkap)Andi SitumorangNo ratings yet

- Nifty Futures Lot Sizes Information - Dec 2013Document8 pagesNifty Futures Lot Sizes Information - Dec 2013justtrade013926No ratings yet

- Ra 1425 Jose RizalDocument26 pagesRa 1425 Jose RizalJoven GabinoNo ratings yet

- Ura Internship Shortlist For JuneDocument14 pagesUra Internship Shortlist For JuneThe Independent Magazine100% (2)

- Mark D. Lebow and Catherine Lebow v. Commissioner of Internal Revenue, 104 F.3d 355, 2d Cir. (1996)Document4 pagesMark D. Lebow and Catherine Lebow v. Commissioner of Internal Revenue, 104 F.3d 355, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- Chemical Resistance Table Iso TR 10358Document54 pagesChemical Resistance Table Iso TR 10358marijaaaaaaaaaaNo ratings yet

- Role of NGOs in The Promotion of EducationDocument5 pagesRole of NGOs in The Promotion of EducationnrsiddiquipkNo ratings yet

- Country Currency CodesDocument5 pagesCountry Currency CodesMidhun KrishnaNo ratings yet

- Market EconomyDocument84 pagesMarket EconomyRazvan OracelNo ratings yet

- Solnik & McLeavey - Global Investment 6th EdDocument5 pagesSolnik & McLeavey - Global Investment 6th Edhotmail13No ratings yet

- Case Study: Tourism and Biodiversity (Ecotourism - A Sustainable Development Tool, A Case For Belize)Document34 pagesCase Study: Tourism and Biodiversity (Ecotourism - A Sustainable Development Tool, A Case For Belize)Aarthi PadmanabhanNo ratings yet

- Part I: Executive Summary - Brief Description of The BusinessDocument9 pagesPart I: Executive Summary - Brief Description of The BusinessJani MarajanNo ratings yet

- Globalization BbaDocument9 pagesGlobalization BbaDisha JainNo ratings yet

- New Welcome To IBPS - (CWE - Clerks-IV) - Application Form Print NewwDocument5 pagesNew Welcome To IBPS - (CWE - Clerks-IV) - Application Form Print NewwYepuru ChaithanyaNo ratings yet

- Philips Lighting GuideDocument19 pagesPhilips Lighting GuideCecila Torrez BenitezNo ratings yet

- Thayer, Cambodia Issues & ChallengesDocument47 pagesThayer, Cambodia Issues & ChallengesCarlyle Alan ThayerNo ratings yet

- Times of The Great Depression: of Mice and MenDocument8 pagesTimes of The Great Depression: of Mice and Menapi-315553414No ratings yet

- RtgsDocument7 pagesRtgsDixita ParmarNo ratings yet

- CNPC SubsidiariesDocument4 pagesCNPC SubsidiariesMike WrightNo ratings yet

- CV CompressedDocument2 pagesCV Compressed3J Solutions BDNo ratings yet

- Abu Dhabi Delhi On Apr 28th 2023Document2 pagesAbu Dhabi Delhi On Apr 28th 2023Abdul Rahman ShaikhNo ratings yet

- Creative EuropeDocument4 pagesCreative EuropeZahara ApNo ratings yet