Professional Documents

Culture Documents

Taxation-II (Honors) 2022-23

Taxation-II (Honors) 2022-23

Uploaded by

futureisgreat0592Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation-II (Honors) 2022-23

Taxation-II (Honors) 2022-23

Uploaded by

futureisgreat0592Copyright:

Available Formats

HSth Sm.)-Tavation-11-HCC-5.

2CHCBCS| 2)

Group B

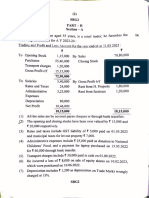

4. The following particulars are furnished by Mrs. S. Raut for the previous year 2021-22

Income from Salary 9,40,000

Income from let out House Property 3,20,000

Income from Business 5,80,000

Income from other sources 60,000

She is entitled to a deduction u/s 80C for 7 1,50,000, u/s 80G 7 30,000 and u/s 80D? 20,000

Tax Deducted at Source is 7 1,80,000.

Compute the advance tax payable by Mrs. Raut with the due dates of payment of instalment assuming

she is i) 45 years old (i) 65 years old. 8-2

Or,

(a) Tax payable by Tuhinfor the assessment year 2022-23 is computed at 7 1,08,600. From the following

details, compute interest payable u/s 234A and 234B, ifany, by Tuhin for the A.Y. 2022-23

- Tax paid on 31/01/2022

42,000

- Tax paid on 31/07/2022

16,600

TDS 50,000

Due date of filing return 31/07/2022

Date of filing return 04/11/2022

(b) State how much fees an assessee has to pay us 234F of the Income Tax Act.

Group-C

5. The particulars of income of Mrs. Madhumita Chakraborty, aged 58 years, for the tinaneial year

2021-22 are under:

a) Net salary 7 7,22,000 after deduction oftax at source 8,000.

(b) Income from business owned by her R 3,00,000 and allowable expenses 1,80,000.

(c) Long-term capital gain on sale of building? 1,80,000 and short-term capital gain on sale of

gold 30,000.

(d) Dividend from TATA Motors 18,000

(e) Interest on fixed deposit with SBI 7 8,400

(f)Interest on Govt. Securities 7 24,000

(g) Winning from lottery (net) 68,800 (TDS @31.2%)

(h) She deposited in PPF 80,000 during the year

G) Premium paid on life Insurance on her own Iife taken on 15.07.18 36,000 (poliey value 3,00,000)

g) Donation to National Defence Fund ? 30,000

k) Paid 25,000 to Rama Krishna Mission

d) Paid premium on Mediclaim Insurance Policy on own health by cheque ? 24,000.

Compute her total income and tax liability for the assessment year 2022-23. She does not exereise optio

ws 115BAC.

(3) W5th Sm.)-Taxation-L-HCC-S.2CHCBCS

Or.

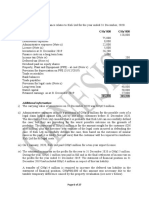

SiSwas & Associates, a fim of Chartered Accountants consisting of two partners, Mr. Biswas and

Mr. Saha. sharing profits cqually. furnishes the following profit and loss account for the year ending

31st March, 2022.

Particulars Amount Particulars Amount

)

Establishment and Audit fees 7,00,000

other expenses 8,60,000| Consultancy charges 9.60,000

Depreciation on

Motor car 40,000 Interest on Bank F.D. 40.000

Books 10,000 Long-term capital gain

Donation to a registered on sale of land 1.50,000

political party 20,000

Interest on capital @15% p.a.

Biswas 50,000

Saha 25,000

Remuneration to partners 5,00,000

Net profit 3,45,000

18,50,000 18.50.000

Other information

) Depreciation as per IT rules 1,90,000

(1) Long-term capital gain computed as per provision of the IT Act.

ii) Out establishment and other expenses of 6.000 is disallowed

Compute total income and tax liability of the fim for the assessment year 2022-23 assuming that the tirm

satisfied all the conditions of section 184 and 40(b). 12-3

Indirect Tax

(Marks 40)

Group - D

6. (a) Give two examples of indirect taxes in India.

(b) Mention any three important features of GST in India.

Or

State which type/types of GST would be leviable under each of the follow ing cases:

i) A of Ladakh (Union Territory) supplied goods to B of Ladakh.

Gi) C of Andaman supplied goods to D of Chandigah

Cii) E of Delhi supplied goods to F of Delhi. +1+2

Please Turu Over

You might also like

- Written Quiz SITHCCC006Document15 pagesWritten Quiz SITHCCC006ajay67% (3)

- GST PRACTICE SET - 6th EDITION - SET JDocument6 pagesGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINo ratings yet

- 2010 A Level H2 P3 Suggested AnswersDocument10 pages2010 A Level H2 P3 Suggested AnswersMichelle LimNo ratings yet

- GKJ Taxation Final (Sums)Document7 pagesGKJ Taxation Final (Sums)ankandas3498No ratings yet

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- New SyllabusDocument16 pagesNew Syllabusmyash6136No ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Paper 16Document5 pagesPaper 16VijayaNo ratings yet

- Document From Rajan®Document5 pagesDocument From Rajan®Anit LuckyNo ratings yet

- Direct Tax Laws Detail Test 1 May 2024 Test Paper 1702105507Document9 pagesDirect Tax Laws Detail Test 1 May 2024 Test Paper 1702105507shauryagupta20013007No ratings yet

- 23 Tax JuneDocument16 pages23 Tax JunemistryankusNo ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersDocument9 pagesTAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersMohammad FaridNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- CA INT Super 30 Q DT PDFDocument64 pagesCA INT Super 30 Q DT PDFKomal BasantaniNo ratings yet

- DT - Test 2 - D23 - NSDocument3 pagesDT - Test 2 - D23 - NSMadhav TailorNo ratings yet

- Test 3 Tax SolutionsDocument17 pagesTest 3 Tax SolutionsManjulaNo ratings yet

- DeductionsDocument13 pagesDeductionsShivaram ShivaramNo ratings yet

- tax qpDocument6 pagestax qpAashish kumarNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Paper7 Syl22 Dec23 Set1Document6 pagesPaper7 Syl22 Dec23 Set1rishabhrai676No ratings yet

- Nov DecIII V Sem 2020Document8 pagesNov DecIII V Sem 2020dweeps75No ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Aditya Sharma - II Mid Term PaperDocument4 pagesAditya Sharma - II Mid Term PaperAditya SharmaNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- FAR MA-2023 QuestionDocument4 pagesFAR MA-2023 QuestionMd HasanNo ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument17 pages(In Lakhs) : © The Institute of Chartered Accountants of Indiaarihant bokdiaNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Final New Indirect Tax Laws Test 3 Detailed May Solution 1617180255Document17 pagesFinal New Indirect Tax Laws Test 3 Detailed May Solution 1617180255CAtestseriesNo ratings yet

- Final DT 30 QPDocument6 pagesFinal DT 30 QPshivam chaturvediNo ratings yet

- Module 3 Dec 20Document132 pagesModule 3 Dec 20Dinesh GadkariNo ratings yet

- Paper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Document6 pagesPaper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Bhupen SharmaNo ratings yet

- Income Tax IISep Oct 2022Document15 pagesIncome Tax IISep Oct 2022supritha724No ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - ND-2022 - QuestionsajedulNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Sem - 4 - Jadavpur University Questions PaperDocument13 pagesSem - 4 - Jadavpur University Questions Papernishashams94No ratings yet

- Taxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347Document11 pagesTaxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347ashishchafle007No ratings yet

- INCOME TAX Examiner Favorite Question Session 3 Without AnswerDocument11 pagesINCOME TAX Examiner Favorite Question Session 3 Without Answersiddhant.gupta.delhiNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- 5 6215195415390715991Document16 pages5 6215195415390715991RITIK AGARWALNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- TDS & TCSDocument11 pagesTDS & TCSKartikNo ratings yet

- Paper7 Set1 SolutionDocument17 pagesPaper7 Set1 Solutionwhitedevil69696No ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- Cma Inter DT Idt Jun 24Document11 pagesCma Inter DT Idt Jun 24Pritam patelNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- Mohit Agarwal QP Tax LawsDocument17 pagesMohit Agarwal QP Tax LawsManisha DasNo ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- Paper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Jun 2020 - Set 1Document5 pagesPaper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Jun 2020 - Set 1GODWIN VIJUNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- 5 - Principles of Taxation07092021Document10 pages5 - Principles of Taxation07092021Jahirul IslamNo ratings yet

- 2facc of Corporate Entities AssignmentDocument4 pages2facc of Corporate Entities AssignmentSia VermaNo ratings yet

- Test Paper-2 Master Question PGBPDocument3 pagesTest Paper-2 Master Question PGBPyeidaindschemeNo ratings yet

- MCQ OF CHAPTER 12 A & B - Payment of TaxDocument11 pagesMCQ OF CHAPTER 12 A & B - Payment of TaxAman AgarwalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Space Closing Mechanics - DIFFERENT LOOPSDocument147 pagesSpace Closing Mechanics - DIFFERENT LOOPSdrarjunvedvyas100% (18)

- 016 Alhambra Cigar and Cigarette Manufacturing, Co. v. CollectorDocument1 page016 Alhambra Cigar and Cigarette Manufacturing, Co. v. CollectorDexter GasconNo ratings yet

- Rock Mechanics Fundamentals: Foot) - What Is Its Specific Gravity?Document18 pagesRock Mechanics Fundamentals: Foot) - What Is Its Specific Gravity?Ghulam Mohyuddin SohailNo ratings yet

- Olive Booklet PDFDocument83 pagesOlive Booklet PDFkareem3456No ratings yet

- Team 3 Group InsuranceDocument42 pagesTeam 3 Group InsuranceAnonymous Ua8mvPkNo ratings yet

- Transducer Engineering 2 Marks With AnswersDocument13 pagesTransducer Engineering 2 Marks With AnswersSridharan DNo ratings yet

- Liquid FormsDocument29 pagesLiquid Formsaman jainNo ratings yet

- Coring & Coring Analysis 2Document21 pagesCoring & Coring Analysis 2Reband Azad100% (1)

- CASE STUDY CAKE BATIK Proximate AnalysisDocument25 pagesCASE STUDY CAKE BATIK Proximate AnalysisNur Azhani100% (1)

- Agri Network of Interventions Card (ANI-Kard)Document14 pagesAgri Network of Interventions Card (ANI-Kard)Joyap MogsNo ratings yet

- P-Channel 30-V (D-S) MOSFET: Features Product SummaryDocument9 pagesP-Channel 30-V (D-S) MOSFET: Features Product SummarySantiago Luis GomezNo ratings yet

- Drexel SL 30-40-50 AC MM F-626-0419Document140 pagesDrexel SL 30-40-50 AC MM F-626-0419Abel GonzalezNo ratings yet

- Food Technology Question PaperDocument4 pagesFood Technology Question PaperKaunteya PatilNo ratings yet

- Elems 05Document101 pagesElems 05Reynald de VeraNo ratings yet

- SFDA Requirement For DEXADocument9 pagesSFDA Requirement For DEXAEhsan alwafaaNo ratings yet

- MSDS - Pidicryl 120V - 2021-EuDocument17 pagesMSDS - Pidicryl 120V - 2021-Euhai nguyenNo ratings yet

- Best, 2019 - Selection and Management of Commonly Used Enteral Feeding TubesDocument5 pagesBest, 2019 - Selection and Management of Commonly Used Enteral Feeding TubesThuane SalesNo ratings yet

- FamiliesDocument26 pagesFamiliesChaoukiNo ratings yet

- Work at Heights Risk Assessment and PermitDocument4 pagesWork at Heights Risk Assessment and PermitNikola StojanovNo ratings yet

- N45-N67 Opm PDFDocument45 pagesN45-N67 Opm PDFAndres Sorin100% (4)

- LN37B530P7F Chassis-N64C-Service-Manual PDFDocument131 pagesLN37B530P7F Chassis-N64C-Service-Manual PDFlaratoralNo ratings yet

- LyricsDocument6 pagesLyricsViernes, John Henilon C. - BSED FilipinoNo ratings yet

- Code On Wages 2019 - NotesDocument3 pagesCode On Wages 2019 - NotesAnand ReddyNo ratings yet

- From The Book "Key To Health"Document3 pagesFrom The Book "Key To Health"Raksha SharmaNo ratings yet

- Nepro Plastics Pvc4Document12 pagesNepro Plastics Pvc4chaouch.najehNo ratings yet

- Attachment 15 The Silent Genocide of The Boer Nation in South Africa IndexDocument3 pagesAttachment 15 The Silent Genocide of The Boer Nation in South Africa Indexapi-232649836No ratings yet

- Vegetarian Moussaka Recipe With Mushroom SauceDocument1 pageVegetarian Moussaka Recipe With Mushroom SauceMarija JesicNo ratings yet

- 2 Definition and Applications: Estimation of Physiological RequirementsDocument7 pages2 Definition and Applications: Estimation of Physiological RequirementsRj SantiagoNo ratings yet