Professional Documents

Culture Documents

Financial Planning

Financial Planning

Uploaded by

iamyatinCopyright:

Available Formats

You might also like

- MilindMDeshpande Padma Award Docs1Document46 pagesMilindMDeshpande Padma Award Docs1Milind DeshpandeNo ratings yet

- Time Value of MoneyDocument20 pagesTime Value of MoneyJeetesh Kumar SinghNo ratings yet

- MF Chap 5 PDFDocument98 pagesMF Chap 5 PDFRebecca Fady El-hajjNo ratings yet

- Time Value2023Document68 pagesTime Value2023Geethika NayanaprabhaNo ratings yet

- Chap-2-Concepts of Value & Return Managerial FinanceDocument12 pagesChap-2-Concepts of Value & Return Managerial FinanceSoham Savjani100% (2)

- Chapter 5 Time Value of MoneyDocument25 pagesChapter 5 Time Value of MoneyAhmed FathelbabNo ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyMary Ann MarianoNo ratings yet

- 3b5a3lecture 3 Time Value of MoneyDocument34 pages3b5a3lecture 3 Time Value of MoneyApril MartinezNo ratings yet

- Topic 4 Valuation of Future Cashflows - Time Value For MoneyDocument39 pagesTopic 4 Valuation of Future Cashflows - Time Value For MoneyQianyiiNo ratings yet

- Charles T. Horngren, Srikant M. Datar, Madhav Rajan - Cost Accounting - A Managerial Emphasis, 14th Edition - Prentice Hall (2011)Document36 pagesCharles T. Horngren, Srikant M. Datar, Madhav Rajan - Cost Accounting - A Managerial Emphasis, 14th Edition - Prentice Hall (2011)Alvin AdrianNo ratings yet

- YhjhtyfyhfghfhfhfjhgDocument13 pagesYhjhtyfyhfghfhfhfjhgbabylovelylovelyNo ratings yet

- BF Lecture Notes Topic 2 Part 1-1Document33 pagesBF Lecture Notes Topic 2 Part 1-1yvonnepangestuNo ratings yet

- Lecture 4 Time Value of MoneyDocument16 pagesLecture 4 Time Value of MoneyA.D. Home TutorsNo ratings yet

- BWFF2033 - Topic 5 - Time Value of Money - Part 2Document30 pagesBWFF2033 - Topic 5 - Time Value of Money - Part 2ZiaNaPiramLiNo ratings yet

- FInMan Chapter 1Document4 pagesFInMan Chapter 1foracademicfiles.01No ratings yet

- Capital BudgetingDocument70 pagesCapital BudgetingAvirup ChakrabortyNo ratings yet

- Chapter 3 Time Value of MoneyDocument163 pagesChapter 3 Time Value of MoneyMoieenNo ratings yet

- Tvom 1Document82 pagesTvom 1Jennifer KhoNo ratings yet

- FM TheoryDocument55 pagesFM TheoryDAHIWALE SANJIVNo ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument151 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global EditionMustafa VaranNo ratings yet

- 05 Zutter Smart MFBrief 15e ch05Document140 pages05 Zutter Smart MFBrief 15e ch05zainal arifinNo ratings yet

- 2023 EBAD401 - Chapter 5 PPT LecturerDocument36 pages2023 EBAD401 - Chapter 5 PPT Lecturermaresa bruinersNo ratings yet

- Time Value of MoneyDocument27 pagesTime Value of Moneynayar alamNo ratings yet

- Lecture 4Document89 pagesLecture 4Lee Li HengNo ratings yet

- Basic of Corporate FinanceDocument44 pagesBasic of Corporate FinanceekanshjiNo ratings yet

- Time Value of MoneyDocument49 pagesTime Value of MoneyThenappan GanesenNo ratings yet

- Study Material For Corporate FinanceDocument62 pagesStudy Material For Corporate FinanceAnant JainNo ratings yet

- The Time Value of Money: Topic 3Document35 pagesThe Time Value of Money: Topic 3lazycat1703No ratings yet

- Lecture9-Time ValueDocument15 pagesLecture9-Time Valuefaizy24No ratings yet

- Topic 4 - TVMDocument30 pagesTopic 4 - TVMDeepika SinghNo ratings yet

- Time Value of Money NotesDocument95 pagesTime Value of Money NotesGabriel Trinidad SonielNo ratings yet

- Chapter 3 - FIN3004 - 2022Document109 pagesChapter 3 - FIN3004 - 2022Phương ThảoNo ratings yet

- CH 5 Time Value of Money Long VersionDocument147 pagesCH 5 Time Value of Money Long Versionalmandouh.mustafa.khaledNo ratings yet

- Guest Lecture Session 7Document23 pagesGuest Lecture Session 7Khushi HemnaniNo ratings yet

- Module in Financial Management - 05Document8 pagesModule in Financial Management - 05Angelo DomingoNo ratings yet

- Module 2 Time Value of MoneyDocument42 pagesModule 2 Time Value of Moneyrishabsingh2322No ratings yet

- Module 2 Time Value of MoneyDocument42 pagesModule 2 Time Value of MoneyNani MadhavNo ratings yet

- Fin254 Ch05 NNH TVM UpdatedDocument80 pagesFin254 Ch05 NNH TVM Updatedamir khanNo ratings yet

- Chapter 2 Time Value of Money Edited (Student)Document20 pagesChapter 2 Time Value of Money Edited (Student)Nguyễn Thái Minh ThưNo ratings yet

- Time Value of Money: All Rights ReservedDocument79 pagesTime Value of Money: All Rights ReservedBilal SahuNo ratings yet

- A212 - Topic 3 - FV PV - Part I (Narration)Document31 pagesA212 - Topic 3 - FV PV - Part I (Narration)Teo ShengNo ratings yet

- LECTURE 3 - EET - Time Value of Money 2Document24 pagesLECTURE 3 - EET - Time Value of Money 2Adhyaksa Meiputra HermawanNo ratings yet

- Topic 03 - ZUTTER - Smart - 15e - ch05 TVOM (Part 1) Rv1.2Document70 pagesTopic 03 - ZUTTER - Smart - 15e - ch05 TVOM (Part 1) Rv1.2Omar SanadNo ratings yet

- SessionDocument111 pagesSessionvidyadhar16No ratings yet

- (Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamDocument51 pages(Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamMuhammad Ramiz AminNo ratings yet

- Materi TVM 1 Dan TVM 2 PDFDocument73 pagesMateri TVM 1 Dan TVM 2 PDFamirah muthiaNo ratings yet

- Finance and Management Accounting 2 Week 2Document29 pagesFinance and Management Accounting 2 Week 2565961628No ratings yet

- MK Day 4 - 2020Document21 pagesMK Day 4 - 2020Rizal Nuhensyah PratamaNo ratings yet

- Chapter 3 - FIN3004 - 2024Document99 pagesChapter 3 - FIN3004 - 2024luuthuydiem63No ratings yet

- Foundations of Finance: Tenth Edition, Global EditionDocument57 pagesFoundations of Finance: Tenth Edition, Global EditionSemih AYBASTINo ratings yet

- The Time Value of MoneyDocument43 pagesThe Time Value of MoneykamleshNo ratings yet

- Financial Note P3Document22 pagesFinancial Note P3Firas AkmarNo ratings yet

- Chapter 6 - Time Value of MoneyDocument7 pagesChapter 6 - Time Value of MoneyJean EliaNo ratings yet

- CHP 5Document72 pagesCHP 5Khaled A. M. El-sherifNo ratings yet

- FM Unit 4 Lecture Notes - Time Value of MoneyDocument4 pagesFM Unit 4 Lecture Notes - Time Value of MoneyDebbie DebzNo ratings yet

- Mata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Document52 pagesMata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Faishal Alghi FariNo ratings yet

- Quant Methods L1 (SS 1-2) AOF PDFDocument116 pagesQuant Methods L1 (SS 1-2) AOF PDFErwin NavarreteNo ratings yet

- Assignment No - 01 (Financial Management (FIN 501)Document9 pagesAssignment No - 01 (Financial Management (FIN 501)aajakirNo ratings yet

- Time Value of Money (TVM)Document58 pagesTime Value of Money (TVM)Nistha BishtNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Chapter 4 Financial PlanningDocument8 pagesChapter 4 Financial PlanningHannah Pauleen G. LabasaNo ratings yet

- Collateralized Mortgage Obligations (CMO)Document3 pagesCollateralized Mortgage Obligations (CMO)maria_tigasNo ratings yet

- VenkysDocument4 pagesVenkysgopi11789No ratings yet

- Chapter 2 Financail Manegement Chapter II - FSA From Instructor 2024 3rd YearDocument37 pagesChapter 2 Financail Manegement Chapter II - FSA From Instructor 2024 3rd YearTarekegn DemiseNo ratings yet

- HUDCO Tax Free Bonds - Shelf ProspectusDocument282 pagesHUDCO Tax Free Bonds - Shelf ProspectusSachin ShirwalkarNo ratings yet

- 3510 NotesDocument2 pages3510 NotesRengNo ratings yet

- Savings and InvestmentDocument49 pagesSavings and InvestmentAbhinav DubeyNo ratings yet

- Beyond NPV & IRR: Touching On Intangibles: Economic Evaluation of Upstream TechnologyDocument23 pagesBeyond NPV & IRR: Touching On Intangibles: Economic Evaluation of Upstream TechnologyBiswarup BandyopadhyayNo ratings yet

- Yield Curves RiskWorXDocument7 pagesYield Curves RiskWorXraghu_prabhuNo ratings yet

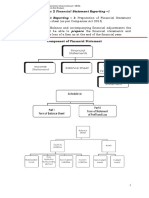

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- Introduction To Fintech: Igor PesinDocument56 pagesIntroduction To Fintech: Igor PesinLittle NerdNo ratings yet

- Cushman Marketbeat Industrial (2014 q2)Document1 pageCushman Marketbeat Industrial (2014 q2)vdmaraNo ratings yet

- American Income PortfolioDocument9 pagesAmerican Income PortfoliobsfordlNo ratings yet

- Josephchung Resume PNC CssDocument2 pagesJosephchung Resume PNC Cssapi-325505813No ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- 9-1b PT Pohan, PT Sohan, PT TohanDocument23 pages9-1b PT Pohan, PT Sohan, PT TohanToys AdventureNo ratings yet

- Stock ReturnDocument7 pagesStock ReturnHans Surya Candra DiwiryaNo ratings yet

- How Market Ecology Explains Market Malfunction: Maarten P. Scholl, Anisoara Calinescu, and J. Doyne FarmerDocument9 pagesHow Market Ecology Explains Market Malfunction: Maarten P. Scholl, Anisoara Calinescu, and J. Doyne FarmerJames MitchellNo ratings yet

- DERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYDocument21 pagesDERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYsunthatburns00No ratings yet

- 3ma M3 AssignDocument12 pages3ma M3 Assignzyx xyzNo ratings yet

- Investment Principles of Media Management and Their Significance InvestmentDocument29 pagesInvestment Principles of Media Management and Their Significance InvestmentPRANJAL CHAKRABORTYNo ratings yet

- BNP emDocument20 pagesBNP emchaotic_pandemoniumNo ratings yet

- Unit 5Document22 pagesUnit 5Dr Suman RamapatiNo ratings yet

- Optcl (Working Capital Management)Document74 pagesOptcl (Working Capital Management)Chinmay Chintan BarikNo ratings yet

- Coal India LimitedDocument35 pagesCoal India LimitedBobby ChristiantoNo ratings yet

- Module 6 FINP1 Financial ManagementDocument28 pagesModule 6 FINP1 Financial ManagementChristine Jane LumocsoNo ratings yet

- Chapter 11 - Test BankDocument86 pagesChapter 11 - Test Bankمحمد عقابنةNo ratings yet

- Busia Investment ForumDocument3 pagesBusia Investment ForuminyasiNo ratings yet

- The Blacker The Berry, The Sweeter The Juice: Management Guidance 270Document3 pagesThe Blacker The Berry, The Sweeter The Juice: Management Guidance 270maxmueller15No ratings yet

Financial Planning

Financial Planning

Uploaded by

iamyatinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Planning

Financial Planning

Uploaded by

iamyatinCopyright:

Available Formats

E IFS An IIM-CA-IIT

Alumni Venture

EXCEL BASED FINANCIAL

PLANNING

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

Time Value of Money

1. Future value (FV) of a single cash flow

2. Present value (PV) of a single cash flow

3. FV of annuity

4. PV of annuity

5. Calculating payments

6. Calculating rate

7. Retirement planning

8. Constant perpetuity

9. Growing perpetuity

10.Growing annuity

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

Time Value of Money

As individuals we often take decisions to save money

for a future need or borrow money for current

consumption. To take these decisions we need to

calculate the amount of money we need to invest, if

we are saving or the cost of borrowing, if we are

applying for a loan.

To carry out the above tasks we need to understand

the time value of money.

Why do we believe that Money has time Value?

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

1. Future value (FV) of a single cash flow

YEAR 2014 2020

Money deposited in bank/

Nifty ETFin2014 will be of

what value in 2020

`

Note: No recurring payments

are made

Definitions:

PRESENT VALUE (PV)= A single amount invested at time=0

FUTURE VALUE (FV)=Value of money deposited at some time in future

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

1. Future value (FV) of a single cash flow

– Application

Example 1: If you deposit Rs. 100 for 10 years at an interest of 8%

per year compounded annually. How much money will you have at

the end of 10 years?

Excel solution: =FV(rate,nper,pmt,pv,type)

RATE: Rate of interest PMT: To Remember: PMT =

per period Installment amount

An equal amount of money

NPER: number of periods. invested at equal intervals

To Remember: Number of

times you will receive PV: A single amount invested at

interest time=0

TYPE: Required only when

PMT is made

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

1. Future value (FV) of a single cash flow

– Application

Example 1: You win a lottery of Rs. 100 and invest it in a 10 year fixed deposit

scheme with ICICI bank at an interest of 8% per year compounded annually.

How much money will you have at the end of 10 years?

Excel solution = FV(rate,nper,pmt,pv,type)

Compounded annually means interest is paid once in a year, therefore one

period is 1 year

Rate (Rate of return per period) = 8%

Number of periods = 10

PMT = 0 (as no recurring payment)

PV = -100 (since it is cash outflow)

TYPE= not required (as Type is required only when payment is made)

Solution:

=FV(8%,10,0,-100)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

1. Future value (FV) of a single cash flow

– Application

Example 2: You win a lottery of `100 and invest it in 10 year fixed deposit

scheme with ICICI bank at an interest of 8% per year compounded semi-

annually. How much money will you have at the end of 10 years?

Excel solution = FV(rate,nper,pmt,pv,type)

Compounded semiannually means interest is paid twice in a year, therefore one

period is 6 months

Rate (Rate of return per period) = 8% / 2 = 4%

Number of periods = 10*2 = 20

PMT = 0 (as no recurring payment)

PV = -100 (since it is cash outflow)

TYPE= not required (as Type is required only when payment is made)

Solution:

=FV(4%,20,0,-100)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

1. Future value (FV) of a single cash flow

– Application

Example 3: You win a lottery of `100 and invest it in 10 year fixed deposit

scheme with ICICI bank at an interest of 8% per year compounded quarterly.

How much money will you have at the end of 10 years?

Excel solution = FV(rate,nper,pmt,pv,type)

Solution:

=FV(2%,40,0,-100)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

1. Future value (FV) of a single cash flow

– Application

Example 4: My son is 1 year old today, I plan to get him enrolled in a B-School

after 25 years. Cost of MBA today is 15 lacs. What will be cost of MBA after 25

years?

Excel solution = FV(rate,nper,pmt,pv,type)

Assuming Inflation = 6%

Solution:

=FV(6%,25,0,-15)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

Frequency of Compounding

Effect of Compounding on FV of Rs.1

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

2. Present value (PV) of a single cash flow

YEAR 2014 2020

How much money should you

deposit/invest today (one time) to

accumulate a certain amount at

some point in the future

`

Note: No recurring payments

are made

Definitions:

PRESENT VALUE (PV)= A single amount invested at time=0 (today)

FUTURE VALUE (FV)=Value of money deposited at some time in future

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

2. Present value (PV) of a single cash flow

– Application

Example 1: My son is 1 year old today, I plan to get him enrolled in a B-School

after 25 years. Cost of MBA today is 15 lacs. We have already calculated the FV

of 15 lacs is 64.38 lacs. What is the amount of money I need to deposit/Invest

today (1 time payment) to accumulate the required amount after 25 years?

a) In bank

b) In Nifty ETF

c) In Junior Nifty ETF

Excel solution = PV(rate,nper,pmt,FV,type)

Assuming Bank rate = 8% p.a.

Nifty ETF return = 15% p.a.

Junior Nifty ETF = 17% p.a.

Solution: a)

=PV(8%,25,0,6438000)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity

Definitions:

Annuity: Series of equal amount of payments at equal intervals of time

ANNUITY

ANNUITY ORDINARY

DUE ANNUITY

BEGINING ENDING

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity

ANNUITY Definitions:

Series of equal amount of payments at equal intervals of time. But the

DUE

first payment is made at the beginning of the first period

Note: 1st payment

made at the beginning

of 1st period

TIME 1st 2nd 3rd 4th 5th

Period B Period B Period B Period B Period B

If these are annual payments, this will be called as a 5 year annuity due (since there are 5 payments)

If these are monthly payments, this will be called as a 5 month annuity due

And so on..

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity

ORDINARY Definitions:

Series of equal amount of payments at equal intervals of time.

ANNUITY

But the first payment is made at the end of the first period

Note: Payment is The first payment is made after 1 period from today

made at the end (Planning starts today, but first payment is made later)

of 1st period which can be an year, month , day. etc

TIME 1st 2nd 3rd 4th 5th

Period E Period E Period E Period E Period E

If these are annual payments, this will be called as a 5 year ordinary annuity

If these are monthly payments, this will be called as a 5 month ordinary annuity

And so on..e end

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity – Ordinary annuity

What is the amount that I would have at the end of the 5th Period (Year, Month, etc) if I

invest / deposit a fixed amount of money at the end of every year for five consecutive

years?

5th

TIME 1st 2nd 3rd 4th 5th Period E

Period E Period E Period E Period E Period E

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity –Annuity due

What is the amount that I would have at the end of the 5th Period (Year, Month, etc) (to

make ordinary and annuity due comparable on the same future date), if I invest / deposit a

fixed amount of money at the beginning of every year for five consecutive years?

5th

TIME 1st 2nd 3rd 4th 5th Period E

Period B Period B Period B Period B Period B

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity – Ordinary annuity

Example 1: If I deposit Rs.5,000 every year in bank for 5 consecutive years,

beginning one year from now, calculate the amount of money I would have

at the end of 5th year

a) Assuming bank rate = 8% per annum

Excel solution = FV(rate,nper,pmt,PV,type)

Solution:

=FV(8%,5,5000,0,0)

Type: Type is “0” for ordinary annuity and “1” for annuity due

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity – Ordinary annuity

Example 2: If I deposit Rs.5,000 every month in bank for 5 years, beginning

one month from now, calculate the amount of money I would have at the

end of 5th year

a) Assuming bank rate = 8% per annum

Excel solution = FV(rate,nper,pmt,PV,type)

Solution:

=FV(8%/12,5*12,5000,0,0)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity – Ordinary annuity

Example 3: If a 20 year plans to invest Rs.1,00,000 at the end of every

year(first payment to be made 1 year from today) till he is 60 (last payment

at 60). What is the amount money he/she would have accumulated when he

turns 60?

a) Deposited in PPF at the rate of 8.5% p.a

b) Invested in Nifty (assume a return of 15% p.a)

Solution

a) =FV(8.5%,40,100000,0,0)

b) = FV(15%,40,100000,0,0)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

3. FV of annuity – Ordinary annuity

Example 4: If a 20 year old plans to invest 10,000 per month (first payment

to be made 1 month from today) till he turns 60 (last payment at 60). What

is the amount of money he/she would have accumulated when he turns 60?

a) Deposited in PPF at the rate of 8.5% p.a

b) Invested in Nifty (assume a return of 15% p.a)

Solution:

a) =FV(8.5%/12,40*12,10000,0,0)

b) =FV(15%/12,40*12,10000,0,0)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

4. PV of annuity – Ordinary annuity

`

1st 2nd 3rd 4th 5th

Period E Period E Period E Period E Period E

Withdrawals

TIME 1st

Period B

What is the amount of money

to be deposited/invested

today so that one can withdraw

a certain amount every period?

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

4. PV of annuity – Ordinary annuity

Example 1: Assuming I am 60 (just retired) today and my monthly expenses

can be met with Rs.1,00,000. From the end of this month I would require

Rs.1,00,000 every month till I am 90 years old. What is the amount of

money I need to deposit in the bank today that allows me to withdraw

1,00,000 every month till I turn 90? (Assume the bank balance when I turn

90 will be 0)

Solution:

a) =PV(8%/12,30*12,-100000,0,0)

Calculating Insurance cover

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

4. PV of annuity – Ordinary annuity

Example 2: A family’s monthly expenses are Rs 50,000. The only earning

member of the family wants to take an life insurance that pays his family Rs

50,000 every month for 10 years in case of earning member’s death. What

is the life insurance cover required to meet this requirement? Consider this

as an ordinary annuity

Solution:

a) =PV(8%/12,10*12,-50000,0,0)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

5. Calculating payments

Example 1: My son is 1 year old today, I plan to get him enrolled in a B-

School after 25 years. Cost of MBA today is 15 lacs. What is the amount of

money I need to deposit/Invest every month (end) for 25 years to

accumulate the required amount?

a) Deposit in bank

b) Invest in niftybees

=PMT(rate,nper,PV,FV,type)

Solution:

a) =PMT(8%/12,25*12,0,6438000,0)

b) =PMT(15%/12,25*12,0,6438000,0)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

6. Calculating Rate

Example 1: Sensex in 1980 was trading at 100. if you invest an amount in

1980 and hold that investment till today (for 34 years) when sensex is

25000. What is CAGR (the rate of return every year)

Solution:

=rate(34,0,-100,25000)

Example 2: Sensex in 2003 was trading at 4000 at today in 2014 it is trading

at 25,000. Calculate CAGR

Solution:

=rate(11,0,-4000,25000)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

6. Calculating Rate

Example 3: I have started investing with Rs 10,000 and wish to accumulate

Rs 1 cr in next 20 years. What is the required Compounded annual growth

rate (CAGR) – the required rate of return every year ?

Solution:

=rate(20,0,-10000,10000000,0,30%)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

7. Retirement planning

Example 1: I am a 20 year old, my monthly expenses are Rs.1,00,000 per

month. I will retire at the age of 60. Life expectancy is 90 years. What is the

amount of money that I need to deposit/invest every month in bank/nifty

ETF (starting one month from now, till the age of 60) to accumulate the

required retirement corpus that would be sufficient to meet my needs for the

age of 60 to 90

Assumption: the retirement corpus would be kept in the bank

Solution: The solution is divided into three parts:

a) Calculating my monthly expenses from 60 – 90

=FV(6%,40,0,100000)

b) Calculating the PV of an ordinary annuity, from 60 – 90

=PV(8%/12,30*12,1028000,0,0)

c) Calculating payments to be made in the bank to accumulate

Rs.14,00,00,000 by 60

=PMT(8%/12,40*12,0,140000000,0)

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

7. Retirement planning

c) Calculating payments:

ii. In the nifty ETF to accumulate Rs.14,00,00,000 by 60

=PMT(15%/12,40*12,0,140000000,0)

How to reduce these monthly payments further?

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

8. Constant perpetuity

Example 1: You decide to give Rs.10,00,000 every year, starting one year

from now till eternity. What is the amount of money you should deposit in the

bank to meet this requirement. Assuming bank rate = 8%

Solution:

PV of a constant Perpetuity = PMT/r ; 1000000/0.08 = 12500000

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

9. Growing perpetuity

Example 1: You decide to give Rs.10,00,000 every year, starting one year

from now till eternity. You want this annual payment to grow every year by

6% (that takes care of inflation). What is the amount of money you should

deposit in the bank to meet this requirement. Assuming bank rate = 8%

Solution:

PV of a constant Perpetuity = PMT/(r-g) ; 1000000/(0.08-0.06) = 50000000

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

10. Growing annuity

Example 1: Assuming I am 60 (just retired) today and my monthly expenses

can be met with Rs.1,00,000. From the end of this month I would require

Rs.1,00,000 every month till I am 90 years old. This monthly requirement

will go on increasing every month by 0.5%. What is the amount of money I

need to deposit in the bank today that allows me to withdraw Rs.1,00,000,

in the first month, with a 0.5% increase in these withdrawals every

subsequent month till I turn 90? (Assume the bank balance when I turn 90

will be 0)

Solution:

a) =PV((8%-6%)/12,30*12,-100000,0,0)

Calculating Insurance cover

+91-9560777373

www.eifs.in E IFS An IIM-CA-IIT

Alumni Venture

You might also like

- MilindMDeshpande Padma Award Docs1Document46 pagesMilindMDeshpande Padma Award Docs1Milind DeshpandeNo ratings yet

- Time Value of MoneyDocument20 pagesTime Value of MoneyJeetesh Kumar SinghNo ratings yet

- MF Chap 5 PDFDocument98 pagesMF Chap 5 PDFRebecca Fady El-hajjNo ratings yet

- Time Value2023Document68 pagesTime Value2023Geethika NayanaprabhaNo ratings yet

- Chap-2-Concepts of Value & Return Managerial FinanceDocument12 pagesChap-2-Concepts of Value & Return Managerial FinanceSoham Savjani100% (2)

- Chapter 5 Time Value of MoneyDocument25 pagesChapter 5 Time Value of MoneyAhmed FathelbabNo ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyMary Ann MarianoNo ratings yet

- 3b5a3lecture 3 Time Value of MoneyDocument34 pages3b5a3lecture 3 Time Value of MoneyApril MartinezNo ratings yet

- Topic 4 Valuation of Future Cashflows - Time Value For MoneyDocument39 pagesTopic 4 Valuation of Future Cashflows - Time Value For MoneyQianyiiNo ratings yet

- Charles T. Horngren, Srikant M. Datar, Madhav Rajan - Cost Accounting - A Managerial Emphasis, 14th Edition - Prentice Hall (2011)Document36 pagesCharles T. Horngren, Srikant M. Datar, Madhav Rajan - Cost Accounting - A Managerial Emphasis, 14th Edition - Prentice Hall (2011)Alvin AdrianNo ratings yet

- YhjhtyfyhfghfhfhfjhgDocument13 pagesYhjhtyfyhfghfhfhfjhgbabylovelylovelyNo ratings yet

- BF Lecture Notes Topic 2 Part 1-1Document33 pagesBF Lecture Notes Topic 2 Part 1-1yvonnepangestuNo ratings yet

- Lecture 4 Time Value of MoneyDocument16 pagesLecture 4 Time Value of MoneyA.D. Home TutorsNo ratings yet

- BWFF2033 - Topic 5 - Time Value of Money - Part 2Document30 pagesBWFF2033 - Topic 5 - Time Value of Money - Part 2ZiaNaPiramLiNo ratings yet

- FInMan Chapter 1Document4 pagesFInMan Chapter 1foracademicfiles.01No ratings yet

- Capital BudgetingDocument70 pagesCapital BudgetingAvirup ChakrabortyNo ratings yet

- Chapter 3 Time Value of MoneyDocument163 pagesChapter 3 Time Value of MoneyMoieenNo ratings yet

- Tvom 1Document82 pagesTvom 1Jennifer KhoNo ratings yet

- FM TheoryDocument55 pagesFM TheoryDAHIWALE SANJIVNo ratings yet

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument151 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global EditionMustafa VaranNo ratings yet

- 05 Zutter Smart MFBrief 15e ch05Document140 pages05 Zutter Smart MFBrief 15e ch05zainal arifinNo ratings yet

- 2023 EBAD401 - Chapter 5 PPT LecturerDocument36 pages2023 EBAD401 - Chapter 5 PPT Lecturermaresa bruinersNo ratings yet

- Time Value of MoneyDocument27 pagesTime Value of Moneynayar alamNo ratings yet

- Lecture 4Document89 pagesLecture 4Lee Li HengNo ratings yet

- Basic of Corporate FinanceDocument44 pagesBasic of Corporate FinanceekanshjiNo ratings yet

- Time Value of MoneyDocument49 pagesTime Value of MoneyThenappan GanesenNo ratings yet

- Study Material For Corporate FinanceDocument62 pagesStudy Material For Corporate FinanceAnant JainNo ratings yet

- The Time Value of Money: Topic 3Document35 pagesThe Time Value of Money: Topic 3lazycat1703No ratings yet

- Lecture9-Time ValueDocument15 pagesLecture9-Time Valuefaizy24No ratings yet

- Topic 4 - TVMDocument30 pagesTopic 4 - TVMDeepika SinghNo ratings yet

- Time Value of Money NotesDocument95 pagesTime Value of Money NotesGabriel Trinidad SonielNo ratings yet

- Chapter 3 - FIN3004 - 2022Document109 pagesChapter 3 - FIN3004 - 2022Phương ThảoNo ratings yet

- CH 5 Time Value of Money Long VersionDocument147 pagesCH 5 Time Value of Money Long Versionalmandouh.mustafa.khaledNo ratings yet

- Guest Lecture Session 7Document23 pagesGuest Lecture Session 7Khushi HemnaniNo ratings yet

- Module in Financial Management - 05Document8 pagesModule in Financial Management - 05Angelo DomingoNo ratings yet

- Module 2 Time Value of MoneyDocument42 pagesModule 2 Time Value of Moneyrishabsingh2322No ratings yet

- Module 2 Time Value of MoneyDocument42 pagesModule 2 Time Value of MoneyNani MadhavNo ratings yet

- Fin254 Ch05 NNH TVM UpdatedDocument80 pagesFin254 Ch05 NNH TVM Updatedamir khanNo ratings yet

- Chapter 2 Time Value of Money Edited (Student)Document20 pagesChapter 2 Time Value of Money Edited (Student)Nguyễn Thái Minh ThưNo ratings yet

- Time Value of Money: All Rights ReservedDocument79 pagesTime Value of Money: All Rights ReservedBilal SahuNo ratings yet

- A212 - Topic 3 - FV PV - Part I (Narration)Document31 pagesA212 - Topic 3 - FV PV - Part I (Narration)Teo ShengNo ratings yet

- LECTURE 3 - EET - Time Value of Money 2Document24 pagesLECTURE 3 - EET - Time Value of Money 2Adhyaksa Meiputra HermawanNo ratings yet

- Topic 03 - ZUTTER - Smart - 15e - ch05 TVOM (Part 1) Rv1.2Document70 pagesTopic 03 - ZUTTER - Smart - 15e - ch05 TVOM (Part 1) Rv1.2Omar SanadNo ratings yet

- SessionDocument111 pagesSessionvidyadhar16No ratings yet

- (Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamDocument51 pages(Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamMuhammad Ramiz AminNo ratings yet

- Materi TVM 1 Dan TVM 2 PDFDocument73 pagesMateri TVM 1 Dan TVM 2 PDFamirah muthiaNo ratings yet

- Finance and Management Accounting 2 Week 2Document29 pagesFinance and Management Accounting 2 Week 2565961628No ratings yet

- MK Day 4 - 2020Document21 pagesMK Day 4 - 2020Rizal Nuhensyah PratamaNo ratings yet

- Chapter 3 - FIN3004 - 2024Document99 pagesChapter 3 - FIN3004 - 2024luuthuydiem63No ratings yet

- Foundations of Finance: Tenth Edition, Global EditionDocument57 pagesFoundations of Finance: Tenth Edition, Global EditionSemih AYBASTINo ratings yet

- The Time Value of MoneyDocument43 pagesThe Time Value of MoneykamleshNo ratings yet

- Financial Note P3Document22 pagesFinancial Note P3Firas AkmarNo ratings yet

- Chapter 6 - Time Value of MoneyDocument7 pagesChapter 6 - Time Value of MoneyJean EliaNo ratings yet

- CHP 5Document72 pagesCHP 5Khaled A. M. El-sherifNo ratings yet

- FM Unit 4 Lecture Notes - Time Value of MoneyDocument4 pagesFM Unit 4 Lecture Notes - Time Value of MoneyDebbie DebzNo ratings yet

- Mata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Document52 pagesMata Kuliah: Manajemen Keuangan 1 Kode Mata Kuliah/Sks: Mn5003 / 3 Sks Kurikulum: 2012 Versi: 0.1Faishal Alghi FariNo ratings yet

- Quant Methods L1 (SS 1-2) AOF PDFDocument116 pagesQuant Methods L1 (SS 1-2) AOF PDFErwin NavarreteNo ratings yet

- Assignment No - 01 (Financial Management (FIN 501)Document9 pagesAssignment No - 01 (Financial Management (FIN 501)aajakirNo ratings yet

- Time Value of Money (TVM)Document58 pagesTime Value of Money (TVM)Nistha BishtNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Chapter 4 Financial PlanningDocument8 pagesChapter 4 Financial PlanningHannah Pauleen G. LabasaNo ratings yet

- Collateralized Mortgage Obligations (CMO)Document3 pagesCollateralized Mortgage Obligations (CMO)maria_tigasNo ratings yet

- VenkysDocument4 pagesVenkysgopi11789No ratings yet

- Chapter 2 Financail Manegement Chapter II - FSA From Instructor 2024 3rd YearDocument37 pagesChapter 2 Financail Manegement Chapter II - FSA From Instructor 2024 3rd YearTarekegn DemiseNo ratings yet

- HUDCO Tax Free Bonds - Shelf ProspectusDocument282 pagesHUDCO Tax Free Bonds - Shelf ProspectusSachin ShirwalkarNo ratings yet

- 3510 NotesDocument2 pages3510 NotesRengNo ratings yet

- Savings and InvestmentDocument49 pagesSavings and InvestmentAbhinav DubeyNo ratings yet

- Beyond NPV & IRR: Touching On Intangibles: Economic Evaluation of Upstream TechnologyDocument23 pagesBeyond NPV & IRR: Touching On Intangibles: Economic Evaluation of Upstream TechnologyBiswarup BandyopadhyayNo ratings yet

- Yield Curves RiskWorXDocument7 pagesYield Curves RiskWorXraghu_prabhuNo ratings yet

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- Introduction To Fintech: Igor PesinDocument56 pagesIntroduction To Fintech: Igor PesinLittle NerdNo ratings yet

- Cushman Marketbeat Industrial (2014 q2)Document1 pageCushman Marketbeat Industrial (2014 q2)vdmaraNo ratings yet

- American Income PortfolioDocument9 pagesAmerican Income PortfoliobsfordlNo ratings yet

- Josephchung Resume PNC CssDocument2 pagesJosephchung Resume PNC Cssapi-325505813No ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- 9-1b PT Pohan, PT Sohan, PT TohanDocument23 pages9-1b PT Pohan, PT Sohan, PT TohanToys AdventureNo ratings yet

- Stock ReturnDocument7 pagesStock ReturnHans Surya Candra DiwiryaNo ratings yet

- How Market Ecology Explains Market Malfunction: Maarten P. Scholl, Anisoara Calinescu, and J. Doyne FarmerDocument9 pagesHow Market Ecology Explains Market Malfunction: Maarten P. Scholl, Anisoara Calinescu, and J. Doyne FarmerJames MitchellNo ratings yet

- DERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYDocument21 pagesDERIVATIVES HEDGE ILLUSTRATIONS Edited AMBOYsunthatburns00No ratings yet

- 3ma M3 AssignDocument12 pages3ma M3 Assignzyx xyzNo ratings yet

- Investment Principles of Media Management and Their Significance InvestmentDocument29 pagesInvestment Principles of Media Management and Their Significance InvestmentPRANJAL CHAKRABORTYNo ratings yet

- BNP emDocument20 pagesBNP emchaotic_pandemoniumNo ratings yet

- Unit 5Document22 pagesUnit 5Dr Suman RamapatiNo ratings yet

- Optcl (Working Capital Management)Document74 pagesOptcl (Working Capital Management)Chinmay Chintan BarikNo ratings yet

- Coal India LimitedDocument35 pagesCoal India LimitedBobby ChristiantoNo ratings yet

- Module 6 FINP1 Financial ManagementDocument28 pagesModule 6 FINP1 Financial ManagementChristine Jane LumocsoNo ratings yet

- Chapter 11 - Test BankDocument86 pagesChapter 11 - Test Bankمحمد عقابنةNo ratings yet

- Busia Investment ForumDocument3 pagesBusia Investment ForuminyasiNo ratings yet

- The Blacker The Berry, The Sweeter The Juice: Management Guidance 270Document3 pagesThe Blacker The Berry, The Sweeter The Juice: Management Guidance 270maxmueller15No ratings yet