Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsQuiz On Cash Ga Theories

Quiz On Cash Ga Theories

Uploaded by

garciarhodjeannemarthaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- ACCTG102 MidtermQ1 CashDocument13 pagesACCTG102 MidtermQ1 CashRose Marie93% (15)

- Collins-Donnelly, Kate (2014) Starving The Anxiety Gremlin For Children Aged 5-9 A CBT Workbook On Anxiety ManagementDocument193 pagesCollins-Donnelly, Kate (2014) Starving The Anxiety Gremlin For Children Aged 5-9 A CBT Workbook On Anxiety ManagementG100% (1)

- Cash and Cash EquivalentsDocument9 pagesCash and Cash EquivalentsPau Santos76% (29)

- Actg6146 ReviewerDocument21 pagesActg6146 ReviewerRegine Vega100% (1)

- FARAP-4501 (Cash and Cash Equivalents)Document10 pagesFARAP-4501 (Cash and Cash Equivalents)Marya NvlzNo ratings yet

- Adult Placement Test: Scegli L'alternativa Corretta Per Completare Gli SpaziDocument2 pagesAdult Placement Test: Scegli L'alternativa Corretta Per Completare Gli SpaziGanchimeg Shiirev100% (1)

- Cash and Cash Equi Theories and ProblemsDocument29 pagesCash and Cash Equi Theories and ProblemsIris Mnemosyne100% (5)

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaNo ratings yet

- DocxDocument48 pagesDocxLorraine Mae Robrido100% (1)

- PHD Progress Presentation TemplateDocument11 pagesPHD Progress Presentation TemplateAisha QamarNo ratings yet

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- Financial Accounting 1Document35 pagesFinancial Accounting 1Bunbun 221No ratings yet

- Cash and Cash Equivalents ExamDocument7 pagesCash and Cash Equivalents ExamRudydanvinz BernardoNo ratings yet

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDocument10 pagesP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- Theory of Accounts Cash and Cash EquivalentsDocument9 pagesTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- Q1 SMEsDocument6 pagesQ1 SMEsJennifer RasonabeNo ratings yet

- ProbsDocument27 pagesProbsDante Jr. Dela Cruz50% (2)

- Cash and Cash Equivalents TheoriesDocument5 pagesCash and Cash Equivalents Theoriesjane dillanNo ratings yet

- Handout - CashDocument17 pagesHandout - CashPenelope PalconNo ratings yet

- 11 ACCT 1AB CashDocument17 pages11 ACCT 1AB CashJustLike JeloNo ratings yet

- FAR-Cash & Cash Equivalents Theory-MCDocument5 pagesFAR-Cash & Cash Equivalents Theory-MCOlive Grace CaniedoNo ratings yet

- 2 - Cash and Cash EquivalentsDocument5 pages2 - Cash and Cash EquivalentsandreamrieNo ratings yet

- 01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Document4 pages01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Bea GarciaNo ratings yet

- Financial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyDocument8 pagesFinancial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyJamhel MarquezNo ratings yet

- Theories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesTheories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionRyan PatitoNo ratings yet

- Cash and Cash Equivalents, Bank Reconciliation, and Proof of CashDocument8 pagesCash and Cash Equivalents, Bank Reconciliation, and Proof of CashMichaelNo ratings yet

- Cash and Cash EqDocument18 pagesCash and Cash EqElaine YapNo ratings yet

- (Cash and Cash Equivalents Drills) Acc.106Document18 pages(Cash and Cash Equivalents Drills) Acc.106Boys ShipperNo ratings yet

- Acctg 100C 01Document6 pagesAcctg 100C 01Jose Magallanes100% (1)

- Problem Solving (With Answers)Document12 pagesProblem Solving (With Answers)sunflower100% (1)

- Theories Cash and Cash EquivalentsDocument9 pagesTheories Cash and Cash EquivalentsJavadd KilamNo ratings yet

- 03 - Cash & Cash Equivalents - TheoryDocument2 pages03 - Cash & Cash Equivalents - TheoryROMAR A. PIGANo ratings yet

- 1201 Cash QuestionsDocument12 pages1201 Cash QuestionsAngel Mae YapNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsDessa GarongNo ratings yet

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonNo ratings yet

- Intermediate Accounting TheoryDocument34 pagesIntermediate Accounting TheoryRizza Christine Thereza Usbal0% (1)

- DocxDocument10 pagesDocxYukiNo ratings yet

- C&CEDocument11 pagesC&CEAnne VinuyaNo ratings yet

- Ta-1004q1 Cash and Cash EquivalentsDocument3 pagesTa-1004q1 Cash and Cash Equivalentsleonardo alis100% (1)

- Quiz On Audit of CashDocument11 pagesQuiz On Audit of CashY JNo ratings yet

- BSA REVIEW Cash TheoriesDocument4 pagesBSA REVIEW Cash TheorieschristineNo ratings yet

- Simulates Midterm Exam. IntAcc1 PDFDocument11 pagesSimulates Midterm Exam. IntAcc1 PDFA NuelaNo ratings yet

- THEORIESOFACCOUNTSDocument3 pagesTHEORIESOFACCOUNTSMounicha AmbayecNo ratings yet

- Reviewer 1PB Toa 1920Document7 pagesReviewer 1PB Toa 1920Therese AcostaNo ratings yet

- F 51124304Document3 pagesF 51124304hanamay_07No ratings yet

- Test Bank Far 3 Cpar PDFDocument24 pagesTest Bank Far 3 Cpar PDFRommel Monfiel100% (1)

- ACEINT1 Intermediate Accounting 1 Midterm ExamDocument9 pagesACEINT1 Intermediate Accounting 1 Midterm ExamMarriel Fate CullanoNo ratings yet

- ACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Document10 pagesACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Marriel Fate Cullano0% (1)

- AllreviewerDocument127 pagesAllreviewerRoyu BreakerNo ratings yet

- 112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty CashDocument7 pages112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty CashKairo ZeviusNo ratings yet

- Cash and Cash EquivalentDocument4 pagesCash and Cash EquivalentTrinidad Sherwin ElmarNo ratings yet

- 4 Cash and Cash Equivalents. Bank Recon. Proof of Cash - ReceivablesDocument11 pages4 Cash and Cash Equivalents. Bank Recon. Proof of Cash - ReceivablesKent CondinoNo ratings yet

- 01 (PRELIMS) FAR 2 (Intacc 1 - 2)Document19 pages01 (PRELIMS) FAR 2 (Intacc 1 - 2)Francis AsisNo ratings yet

- TOA 01 CASH AND CASH EQUIVALENTS W SOL PDFDocument5 pagesTOA 01 CASH AND CASH EQUIVALENTS W SOL PDFJerelyn DaneNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- Inter Acctg Midterms 1Document4 pagesInter Acctg Midterms 1Jorie MeroyNo ratings yet

- IA1 - 1st Mock Quiz (With Suggested Answers)Document6 pagesIA1 - 1st Mock Quiz (With Suggested Answers)Rogienel ReyesNo ratings yet

- Cash and Cash Equivalent TheoryDocument1 pageCash and Cash Equivalent TheoryExcelsia Grace A. ParreñoNo ratings yet

- JPIA 1617 Prelim Reviewer BAC213 FINACC1Document13 pagesJPIA 1617 Prelim Reviewer BAC213 FINACC1Rafael Capunpon Vallejos100% (1)

- Cash Items ReviewerDocument49 pagesCash Items ReviewerlalalalaNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- IJAMR230608Document6 pagesIJAMR230608garciarhodjeannemarthaNo ratings yet

- JigsawDocument1 pageJigsawgarciarhodjeannemarthaNo ratings yet

- Module 1Document15 pagesModule 1garciarhodjeannemarthaNo ratings yet

- Airline Industry Developments - 1995 - 96 Audit Risk AlertsDocument23 pagesAirline Industry Developments - 1995 - 96 Audit Risk AlertsgarciarhodjeannemarthaNo ratings yet

- 2018 M1Document2 pages2018 M1garciarhodjeannemarthaNo ratings yet

- To The Life and Works of Carlos BulosanDocument4 pagesTo The Life and Works of Carlos BulosangarciarhodjeannemarthaNo ratings yet

- 2014 Annual Audit Plan AC20130785 Attach 1Document9 pages2014 Annual Audit Plan AC20130785 Attach 1garciarhodjeannemarthaNo ratings yet

- ReferencesDocument15 pagesReferencesgarciarhodjeannemarthaNo ratings yet

- PHI 17Q March 2023Document53 pagesPHI 17Q March 2023garciarhodjeannemarthaNo ratings yet

- Epson InkTankSystemPrinter L310 L360 (NoAddress) HighDocument4 pagesEpson InkTankSystemPrinter L310 L360 (NoAddress) HighgarciarhodjeannemarthaNo ratings yet

- Ijisrr 1286Document4 pagesIjisrr 1286garciarhodjeannemarthaNo ratings yet

- EJ1209947Document13 pagesEJ1209947garciarhodjeannemarthaNo ratings yet

- Lesson Exemplar School Grade Level Teacher Learning Area Practical Research 2 Teaching Date Quarter Teaching Time No. of DaysDocument9 pagesLesson Exemplar School Grade Level Teacher Learning Area Practical Research 2 Teaching Date Quarter Teaching Time No. of DaysJovie Bitas DaeloNo ratings yet

- New English File - Elementary File 10 - Test 10Document5 pagesNew English File - Elementary File 10 - Test 10Sanja IlovaNo ratings yet

- Dracula and TBC CheatsheetDocument2 pagesDracula and TBC CheatsheetalicejessicapreesNo ratings yet

- Adv Unit8 RevisionDocument3 pagesAdv Unit8 RevisionDivi DaviNo ratings yet

- College of Engineering Course Syllabus Information Technology ProgramDocument5 pagesCollege of Engineering Course Syllabus Information Technology ProgramKhaled Al WahhabiNo ratings yet

- Monteverdi Clorinda e TancrediDocument19 pagesMonteverdi Clorinda e TancrediFelipeCussenNo ratings yet

- Brochure AurizonDocument5 pagesBrochure AurizonRachelNo ratings yet

- 1359 - 1368. TingkahanDocument5 pages1359 - 1368. TingkahanRizal Daujr Tingkahan IIINo ratings yet

- B Com English 2016Document12 pagesB Com English 2016PRIYANK PATEL67% (3)

- Roll Number Name Subject Marks Obtained Total Grade Result: 2967917 Bhagesh Ari MauryaDocument3 pagesRoll Number Name Subject Marks Obtained Total Grade Result: 2967917 Bhagesh Ari MauryaShiv PoojanNo ratings yet

- Kid Friendly 8th Grade California State StandardsDocument2 pagesKid Friendly 8th Grade California State StandardsEmily Q. LiuNo ratings yet

- Triveni Engineering Balance Sheet 2023Document429 pagesTriveni Engineering Balance Sheet 2023Puneet367No ratings yet

- Covid ReportDocument1 pageCovid ReportTV UNITNo ratings yet

- The Residences at Greenbelt Manila Tower 1-Bedroom For Sale 24DDocument2 pagesThe Residences at Greenbelt Manila Tower 1-Bedroom For Sale 24DJP ReyesNo ratings yet

- CH 6 Properties of Lasers in Introduction To OpticsDocument34 pagesCH 6 Properties of Lasers in Introduction To OpticsmoatazNo ratings yet

- The Eqv: Effective From May 2021 ProductionDocument40 pagesThe Eqv: Effective From May 2021 ProductionariNo ratings yet

- Intrusion Detection Systems & HoneypotsDocument33 pagesIntrusion Detection Systems & HoneypotsmanahujaNo ratings yet

- 4 - Quisombing V CA G.R. No. 93010 Aug 30 1990Document7 pages4 - Quisombing V CA G.R. No. 93010 Aug 30 1990Imma OlayanNo ratings yet

- A Review of Our Present Situation - Sirdar Kapur SinghDocument2 pagesA Review of Our Present Situation - Sirdar Kapur SinghSikhDigitalLibraryNo ratings yet

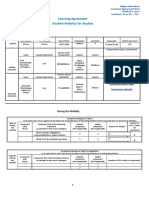

- Learning Agreement During The MobilityDocument3 pagesLearning Agreement During The MobilityVictoria GrosuNo ratings yet

- RHPA46 FreeDocument5 pagesRHPA46 Freeheyimdee5No ratings yet

- Sean Combs v. All Surface Entertainment, Inc., Cancellation No. 92051490 (T.T.A.B. 2012) (DIRTY MONEY)Document21 pagesSean Combs v. All Surface Entertainment, Inc., Cancellation No. 92051490 (T.T.A.B. 2012) (DIRTY MONEY)Charles E. ColmanNo ratings yet

- An Inside Look at USP71Document22 pagesAn Inside Look at USP71Dante IulliNo ratings yet

- Chapter 3: Operating-System StructuresDocument31 pagesChapter 3: Operating-System StructuresDiamond MindglanceNo ratings yet

- M-Sand in Tamil NaduDocument9 pagesM-Sand in Tamil Nadurameshkanu1No ratings yet

- Karsales (Harrow) LTD V Wallis (1956) EWCA Civ 4 (12 June 1956)Document7 pagesKarsales (Harrow) LTD V Wallis (1956) EWCA Civ 4 (12 June 1956)taonanyingNo ratings yet

- Ariston As 600 V DryerDocument40 pagesAriston As 600 V DryermmvdlpNo ratings yet

Quiz On Cash Ga Theories

Quiz On Cash Ga Theories

Uploaded by

garciarhodjeannemartha0 ratings0% found this document useful (0 votes)

4 views5 pagesOriginal Title

Quiz on Cash Ga Theories

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views5 pagesQuiz On Cash Ga Theories

Quiz On Cash Ga Theories

Uploaded by

garciarhodjeannemarthaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

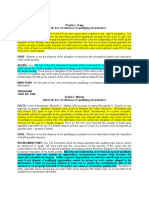

UNIVERSITY OF EASTERN PANGASINAN

BINALONAN, PANGASINAN

GOVERNMENT ACCOUNTING

THEORIES

QUIZ NO. 1

1. Which of the following should not be considered “cash”?

a. Change fund

b. Certified check

c. Personal check

d. Postdated check

2. All of the following may be included in “cash”, except

a. Currency

b. Money market instrument

c. Checking account balance

d. Saving account balance

3. Deposit held as compensating balance

a. Usually do not earn interest

b. If legally restricted and held against short-term credit may be included as cash

c. If legally restricted and held against long-term credit may be included among current assets

d. None of these

4. What is the treatment of customers’ postdated checks?

a. Account receivable

b. Prepaid expenses

c. Cash

d. Account payable

5. Which of the following is not considered as a cash equivalent?

a. A these-year treasury note maturing on May 30 of the current year purchased by the entity

on April 15 of the current year

b. A three-year treasury note maturing on May 30 of the current year purchased by the entity

on January 15 of the current year

c. A 90-day T-bill

d. A 60-day money market placement

6. At the end of the current year, an entity had various checks and papers in the safe. Which of the

following should not be included in “cash” in the current year-end statement of financial position?

a. US $20,000 cash

b. Past due promissory note issued in favor of the entity by the President

c. Another entity’s P150,000 check payable to the entity dated December 15 of the current year

d. The entity’s undelivered check payable to a supplier dated December 31 of the current year

7. Which of the following should be excluded from cash and cash equivalents?

a. The minimum cash balance in the current account which is maintained to avoid service

charge

b. A check issued by the entity on December 27 of the current year but dated January 15 of

next year

c. Time deposit which matures in one year

d. A customer’s check denominated in a foreign currency

8. Which of the following statement is incorrect?

a. The accounting function should be separated from the custodianship of asset

b. Certain clerical personnel should be rotated among various jobs

c. The responsibility for receiving merchandise and paying for it should usually be given to

one person

PREPARED BY: LEONIDES L. GAVINA

d. An entity’s personnel should be given well-defined responsibilities

9. At the end of the current year, an entity had cash accounts at three different banks. One account

is segregated solely for payment into a bond sinking fund. A second account, used for branch

operations, is overdrawn. The third account, used for regular corporate operations, has a positive

balance. How should these accounts be reported?

a. The segregated account should be reported as a noncurrent asset, the regular account

should be reported as a current asset, and the overdraft should be reported as a current

liability

b. The segregated and regular accounts should be reported as current assets, and the overdraft

should be reported as a current liability

c. The segregated account should be reported as a noncurrent asset, and the regular account

should be reported as a current asset net of the overdraft

d. The segregated and regular accounts should be reported as current assets net of the

overdraft

10. Under which classification is cash restricted for plant expansion reported?

a. Current assets

b. Noncurrent asset

c. Current liabilities

d. Equity

11. Petty cash fund is

a. Separately classified as current asset

b. Money kept on hand for making minor disbursements of coin and currency rather than by

writing checks

c. Set aside for the payment of payroll

d. Restricted cash

12. The internal control feature specific to petty cash is

a. Separation of duties

b. Assignment of responsibility

c. Proper authorization

d. Imprest system

13. What is the major purpose of an imprest petty cash fund?

a. To effectively plan cash inflows and outflows

b. To ease the payment of cash to vendors

c. To determine the honesty of the petty cashier

d. To effectively control cash disbursements

14. The petty cash fund account under the imprest fund system is debited

a. Only when the fund is created

b. When the fund is created and everytime it is replenished

c. When the fund is created and when the size of the fund is increased

d. When the fund is created and when the fund is descreased

15. In reimbursing the petty cash fund, which of the following is true?

a. Cash in debited

b. Petty cash is debited

c. Petty cash is credited

d. Expense account are debited

16. Which of the following statement in relation to petty cash is incorrect?

a. The imprest petty cash system in effect adheres to the rule of disbursement by check

b. Entries are made to the petty cash account only to increase or decrease the size of the

fund or to adjust the balance if not replenished at year-end

c. The petty cash account is debited when the fund is replenished

d. The petty cash fund is reported as part of current asset.

17. When a petty cash fund is used, which of the following statement is true?

a. The balance of the petty cash fund should be reported in the statement of financial

position as a long-term investment

PREPARED BY: LEONIDES L. GAVINA

b. The petty cashier’s summary of petty cash payments serves as a journal entry that is

posted to the appropriate general ledger account

c. The reimbursement of the petty cash fund should be credited to the cash account

d. Entries that include a credit to the cash account should be recorded at the time

payments from the petty cash fund are made

18. A Cash Over and Short account

a. Is not generally accepted

b. Is debited when the petty cash fund proves out over

c. Is debited when the petty cash fund proves out short

d. Is a account to cash

19. Which of the following statement in relation tom petty cash fund is false?

a. Each disbursement from petty cash should be supported by a petty cash voucher

b. The creation of a petty cash fund requires a journal entry to reflect the transfer of fund

out of the general cash account.

c. At any time, the sum of the cash in the petty cash fund and the total of petty cash

vouchers should equal the amount for which the imprest petty cash fund was

established.

d. With the establishment of an imprest petty cash fund, one person is given the authority

and responsibility for issuing checks to cover minor disbursements.

20. Which of the following statements in relation to the cash short or over count is true?

a. It would be impossible to have cash shortage or overage if employees were paid in cash

rather than by check.

b. The entry to account for daily cash sales for which a small amount of cash shortage

existed would include a debit to cash short or over account.

c. If the cash short or over account has a debit balance at the end of the period it must be

debited to an expense account.

d. A credit balance in a cash short or over account should be considered a liability because

the short changed costumer will demand return of this amount.

21. A bank reconciliation is

a. A formal financial statement that lists all of the bank account balances of an entity.

b. A merger of two banks that previously were competitors.

c. A statement sent by the bank to depositor on a monthly basis.

d. A schedule that accounts for the differences between an entity’s cash balance as

shown in the bank statement and the cash balance shown in the general ledger.

22. Which of the following items must be added to the cash balance per ledger in preparing a bank

reconciliation which ends with adjusted cash balance?

a. Note receivable collected by bank in favor of the depositor and credited to the

account of the depositor

b. NSF customer check

c. Service charge

d. Erroneous bank debit

23. In preparing a bank reconciliation, interest paid by the bank on the account is

a. Added to the bank balance

b. Subtracted from the bank balance

c. Added to the book balance

d. Subtracted from the book balance

24. In preparing a monthly bank reconciliation, which of the following would be added to the

balance per bank statement to arrive at the correct cash balance?

a. Outstanding checks

b. Bank service charge

c. Deposit in transit

d. A customer’s note collected by the bank on behalf of the depositor

25. Which of the following must be deducted from the bank statement balance in preparing a bank

reconciliation which ends with adjusted cash balance?

a. Deposit in transit

PREPARED BY: LEONIDES L. GAVINA

b. Outstanding check

c. Reduction of loan charged to the account of the depositor

d. Certified check

26. If the balance shown on entity’s bank statement is less than the correct cash balance and

neither the entity nor the bank has made any errors, there must be

a. Deposit credited by the bank but not yet recorded by the entity

b. Outstanding checks

c. Deposits in transit

d. Bank charges not yet recorded by the entity

27. If the cash balance shown on entity’s accounting records is less than the correct cash balance

and neither the entity nor the bank has made any errors, there must be

a. Deposit credited by the bank but not yet recorded by the entity

b. Deposits in transit

c. Outstanding checks

d. Bank charges not yet recorded by the entity

28. Which of the following would not require an adjusting entry on the depositor’s books?

a. NSF check from customer

b. Check in payment of account payable as recorded by the depositor is overstated

c. Deposit of another entity is credited by the bank to the account of the depositor

d. Bank service charge

29. Bank reconciliation are normally prepared on a monthly basis to identify adjustments needed in

the depositor’s records and identify bank errors. Adjustments on the part of the depositor should

be recorded for

a. Bank errors, outstanding checks and deposit in transit

b. All items except bank errors, outstanding checks and deposit in transit

c. Book errors, bank errors, deposit in transit and outstanding checks

d. Outstanding checks and deposits in transit

30. Bank statement provide information about all of the following, except

a. Checks cleared during the period

b. NSF checks

c. Bank charges for the period

d. Errors made by the depositor

31. Which of the following statement is false?

a. A certified checks is a liability of the bank certifying it.

b. A certified checks will be accepted by many persons who would not otherwise accept a

personal checks

c. A certified checks is one drawn by a bank upon itself

d. A certified checks should not be included in the outstanding checks

32. A proof of cash

a. Is a physical count of currencies on hand at the end of reporting period

b. Is a formal statement showing the total cash receipts during the year

c. Is a four-column bank reconciliation showing reconciliation of cash balances per book

and per bank at the beginning and end of the current month and reconciliation of cash

receipts and cash disbursements of the bank and the depositor during the current month

d. Is a summary of cash receipts and cash payments

33. A proof of cash would be useful for

a. Discovering cash receipts that have been recorded in the journal

b. Discovering time lag in making deposit

c. Discovering cash receipts that have been recorded but have not been deposited

d. Discovering an inadequate separation of incompatible

34. Which of the following is not a characteristic of system of cash control

a. Use of a voucher system

b. Combined responsibility for handling and recording cash

c. Daily deposit of all cash received

PREPARED BY: LEONIDES L. GAVINA

d. Internal audits at irregular intervals

35. Which of the following statement in relation to bank reconciliation is true

a. Bank service charge will cause the cash balance per ledger to be higher than that

reported by the bank, all other things being equal

b. Credit memos will cause the cash balance per ledger to be higher than that reported by

the bank, all other things being equal

c. Outstanding checks will cause the cash balance per ledger to be higher than that

reported by the bank, all other things being equal

d. The cash amount reported in the statement of financial position must be the balance

reported in the bank statement

*****************************END OF QUIZ****************************

PREPARED BY: LEONIDES L. GAVINA

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- ACCTG102 MidtermQ1 CashDocument13 pagesACCTG102 MidtermQ1 CashRose Marie93% (15)

- Collins-Donnelly, Kate (2014) Starving The Anxiety Gremlin For Children Aged 5-9 A CBT Workbook On Anxiety ManagementDocument193 pagesCollins-Donnelly, Kate (2014) Starving The Anxiety Gremlin For Children Aged 5-9 A CBT Workbook On Anxiety ManagementG100% (1)

- Cash and Cash EquivalentsDocument9 pagesCash and Cash EquivalentsPau Santos76% (29)

- Actg6146 ReviewerDocument21 pagesActg6146 ReviewerRegine Vega100% (1)

- FARAP-4501 (Cash and Cash Equivalents)Document10 pagesFARAP-4501 (Cash and Cash Equivalents)Marya NvlzNo ratings yet

- Adult Placement Test: Scegli L'alternativa Corretta Per Completare Gli SpaziDocument2 pagesAdult Placement Test: Scegli L'alternativa Corretta Per Completare Gli SpaziGanchimeg Shiirev100% (1)

- Cash and Cash Equi Theories and ProblemsDocument29 pagesCash and Cash Equi Theories and ProblemsIris Mnemosyne100% (5)

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaNo ratings yet

- DocxDocument48 pagesDocxLorraine Mae Robrido100% (1)

- PHD Progress Presentation TemplateDocument11 pagesPHD Progress Presentation TemplateAisha QamarNo ratings yet

- SolutionsDocument25 pagesSolutionsDante Jr. Dela Cruz100% (1)

- Financial Accounting 1Document35 pagesFinancial Accounting 1Bunbun 221No ratings yet

- Cash and Cash Equivalents ExamDocument7 pagesCash and Cash Equivalents ExamRudydanvinz BernardoNo ratings yet

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDocument10 pagesP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- Theory of Accounts Cash and Cash EquivalentsDocument9 pagesTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- Q1 SMEsDocument6 pagesQ1 SMEsJennifer RasonabeNo ratings yet

- ProbsDocument27 pagesProbsDante Jr. Dela Cruz50% (2)

- Cash and Cash Equivalents TheoriesDocument5 pagesCash and Cash Equivalents Theoriesjane dillanNo ratings yet

- Handout - CashDocument17 pagesHandout - CashPenelope PalconNo ratings yet

- 11 ACCT 1AB CashDocument17 pages11 ACCT 1AB CashJustLike JeloNo ratings yet

- FAR-Cash & Cash Equivalents Theory-MCDocument5 pagesFAR-Cash & Cash Equivalents Theory-MCOlive Grace CaniedoNo ratings yet

- 2 - Cash and Cash EquivalentsDocument5 pages2 - Cash and Cash EquivalentsandreamrieNo ratings yet

- 01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Document4 pages01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Bea GarciaNo ratings yet

- Financial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyDocument8 pagesFinancial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyJamhel MarquezNo ratings yet

- Theories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument15 pagesTheories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionRyan PatitoNo ratings yet

- Cash and Cash Equivalents, Bank Reconciliation, and Proof of CashDocument8 pagesCash and Cash Equivalents, Bank Reconciliation, and Proof of CashMichaelNo ratings yet

- Cash and Cash EqDocument18 pagesCash and Cash EqElaine YapNo ratings yet

- (Cash and Cash Equivalents Drills) Acc.106Document18 pages(Cash and Cash Equivalents Drills) Acc.106Boys ShipperNo ratings yet

- Acctg 100C 01Document6 pagesAcctg 100C 01Jose Magallanes100% (1)

- Problem Solving (With Answers)Document12 pagesProblem Solving (With Answers)sunflower100% (1)

- Theories Cash and Cash EquivalentsDocument9 pagesTheories Cash and Cash EquivalentsJavadd KilamNo ratings yet

- 03 - Cash & Cash Equivalents - TheoryDocument2 pages03 - Cash & Cash Equivalents - TheoryROMAR A. PIGANo ratings yet

- 1201 Cash QuestionsDocument12 pages1201 Cash QuestionsAngel Mae YapNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsDessa GarongNo ratings yet

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonNo ratings yet

- Intermediate Accounting TheoryDocument34 pagesIntermediate Accounting TheoryRizza Christine Thereza Usbal0% (1)

- DocxDocument10 pagesDocxYukiNo ratings yet

- C&CEDocument11 pagesC&CEAnne VinuyaNo ratings yet

- Ta-1004q1 Cash and Cash EquivalentsDocument3 pagesTa-1004q1 Cash and Cash Equivalentsleonardo alis100% (1)

- Quiz On Audit of CashDocument11 pagesQuiz On Audit of CashY JNo ratings yet

- BSA REVIEW Cash TheoriesDocument4 pagesBSA REVIEW Cash TheorieschristineNo ratings yet

- Simulates Midterm Exam. IntAcc1 PDFDocument11 pagesSimulates Midterm Exam. IntAcc1 PDFA NuelaNo ratings yet

- THEORIESOFACCOUNTSDocument3 pagesTHEORIESOFACCOUNTSMounicha AmbayecNo ratings yet

- Reviewer 1PB Toa 1920Document7 pagesReviewer 1PB Toa 1920Therese AcostaNo ratings yet

- F 51124304Document3 pagesF 51124304hanamay_07No ratings yet

- Test Bank Far 3 Cpar PDFDocument24 pagesTest Bank Far 3 Cpar PDFRommel Monfiel100% (1)

- ACEINT1 Intermediate Accounting 1 Midterm ExamDocument9 pagesACEINT1 Intermediate Accounting 1 Midterm ExamMarriel Fate CullanoNo ratings yet

- ACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Document10 pagesACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Marriel Fate Cullano0% (1)

- AllreviewerDocument127 pagesAllreviewerRoyu BreakerNo ratings yet

- 112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty CashDocument7 pages112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty CashKairo ZeviusNo ratings yet

- Cash and Cash EquivalentDocument4 pagesCash and Cash EquivalentTrinidad Sherwin ElmarNo ratings yet

- 4 Cash and Cash Equivalents. Bank Recon. Proof of Cash - ReceivablesDocument11 pages4 Cash and Cash Equivalents. Bank Recon. Proof of Cash - ReceivablesKent CondinoNo ratings yet

- 01 (PRELIMS) FAR 2 (Intacc 1 - 2)Document19 pages01 (PRELIMS) FAR 2 (Intacc 1 - 2)Francis AsisNo ratings yet

- TOA 01 CASH AND CASH EQUIVALENTS W SOL PDFDocument5 pagesTOA 01 CASH AND CASH EQUIVALENTS W SOL PDFJerelyn DaneNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- Inter Acctg Midterms 1Document4 pagesInter Acctg Midterms 1Jorie MeroyNo ratings yet

- IA1 - 1st Mock Quiz (With Suggested Answers)Document6 pagesIA1 - 1st Mock Quiz (With Suggested Answers)Rogienel ReyesNo ratings yet

- Cash and Cash Equivalent TheoryDocument1 pageCash and Cash Equivalent TheoryExcelsia Grace A. ParreñoNo ratings yet

- JPIA 1617 Prelim Reviewer BAC213 FINACC1Document13 pagesJPIA 1617 Prelim Reviewer BAC213 FINACC1Rafael Capunpon Vallejos100% (1)

- Cash Items ReviewerDocument49 pagesCash Items ReviewerlalalalaNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- IJAMR230608Document6 pagesIJAMR230608garciarhodjeannemarthaNo ratings yet

- JigsawDocument1 pageJigsawgarciarhodjeannemarthaNo ratings yet

- Module 1Document15 pagesModule 1garciarhodjeannemarthaNo ratings yet

- Airline Industry Developments - 1995 - 96 Audit Risk AlertsDocument23 pagesAirline Industry Developments - 1995 - 96 Audit Risk AlertsgarciarhodjeannemarthaNo ratings yet

- 2018 M1Document2 pages2018 M1garciarhodjeannemarthaNo ratings yet

- To The Life and Works of Carlos BulosanDocument4 pagesTo The Life and Works of Carlos BulosangarciarhodjeannemarthaNo ratings yet

- 2014 Annual Audit Plan AC20130785 Attach 1Document9 pages2014 Annual Audit Plan AC20130785 Attach 1garciarhodjeannemarthaNo ratings yet

- ReferencesDocument15 pagesReferencesgarciarhodjeannemarthaNo ratings yet

- PHI 17Q March 2023Document53 pagesPHI 17Q March 2023garciarhodjeannemarthaNo ratings yet

- Epson InkTankSystemPrinter L310 L360 (NoAddress) HighDocument4 pagesEpson InkTankSystemPrinter L310 L360 (NoAddress) HighgarciarhodjeannemarthaNo ratings yet

- Ijisrr 1286Document4 pagesIjisrr 1286garciarhodjeannemarthaNo ratings yet

- EJ1209947Document13 pagesEJ1209947garciarhodjeannemarthaNo ratings yet

- Lesson Exemplar School Grade Level Teacher Learning Area Practical Research 2 Teaching Date Quarter Teaching Time No. of DaysDocument9 pagesLesson Exemplar School Grade Level Teacher Learning Area Practical Research 2 Teaching Date Quarter Teaching Time No. of DaysJovie Bitas DaeloNo ratings yet

- New English File - Elementary File 10 - Test 10Document5 pagesNew English File - Elementary File 10 - Test 10Sanja IlovaNo ratings yet

- Dracula and TBC CheatsheetDocument2 pagesDracula and TBC CheatsheetalicejessicapreesNo ratings yet

- Adv Unit8 RevisionDocument3 pagesAdv Unit8 RevisionDivi DaviNo ratings yet

- College of Engineering Course Syllabus Information Technology ProgramDocument5 pagesCollege of Engineering Course Syllabus Information Technology ProgramKhaled Al WahhabiNo ratings yet

- Monteverdi Clorinda e TancrediDocument19 pagesMonteverdi Clorinda e TancrediFelipeCussenNo ratings yet

- Brochure AurizonDocument5 pagesBrochure AurizonRachelNo ratings yet

- 1359 - 1368. TingkahanDocument5 pages1359 - 1368. TingkahanRizal Daujr Tingkahan IIINo ratings yet

- B Com English 2016Document12 pagesB Com English 2016PRIYANK PATEL67% (3)

- Roll Number Name Subject Marks Obtained Total Grade Result: 2967917 Bhagesh Ari MauryaDocument3 pagesRoll Number Name Subject Marks Obtained Total Grade Result: 2967917 Bhagesh Ari MauryaShiv PoojanNo ratings yet

- Kid Friendly 8th Grade California State StandardsDocument2 pagesKid Friendly 8th Grade California State StandardsEmily Q. LiuNo ratings yet

- Triveni Engineering Balance Sheet 2023Document429 pagesTriveni Engineering Balance Sheet 2023Puneet367No ratings yet

- Covid ReportDocument1 pageCovid ReportTV UNITNo ratings yet

- The Residences at Greenbelt Manila Tower 1-Bedroom For Sale 24DDocument2 pagesThe Residences at Greenbelt Manila Tower 1-Bedroom For Sale 24DJP ReyesNo ratings yet

- CH 6 Properties of Lasers in Introduction To OpticsDocument34 pagesCH 6 Properties of Lasers in Introduction To OpticsmoatazNo ratings yet

- The Eqv: Effective From May 2021 ProductionDocument40 pagesThe Eqv: Effective From May 2021 ProductionariNo ratings yet

- Intrusion Detection Systems & HoneypotsDocument33 pagesIntrusion Detection Systems & HoneypotsmanahujaNo ratings yet

- 4 - Quisombing V CA G.R. No. 93010 Aug 30 1990Document7 pages4 - Quisombing V CA G.R. No. 93010 Aug 30 1990Imma OlayanNo ratings yet

- A Review of Our Present Situation - Sirdar Kapur SinghDocument2 pagesA Review of Our Present Situation - Sirdar Kapur SinghSikhDigitalLibraryNo ratings yet

- Learning Agreement During The MobilityDocument3 pagesLearning Agreement During The MobilityVictoria GrosuNo ratings yet

- RHPA46 FreeDocument5 pagesRHPA46 Freeheyimdee5No ratings yet

- Sean Combs v. All Surface Entertainment, Inc., Cancellation No. 92051490 (T.T.A.B. 2012) (DIRTY MONEY)Document21 pagesSean Combs v. All Surface Entertainment, Inc., Cancellation No. 92051490 (T.T.A.B. 2012) (DIRTY MONEY)Charles E. ColmanNo ratings yet

- An Inside Look at USP71Document22 pagesAn Inside Look at USP71Dante IulliNo ratings yet

- Chapter 3: Operating-System StructuresDocument31 pagesChapter 3: Operating-System StructuresDiamond MindglanceNo ratings yet

- M-Sand in Tamil NaduDocument9 pagesM-Sand in Tamil Nadurameshkanu1No ratings yet

- Karsales (Harrow) LTD V Wallis (1956) EWCA Civ 4 (12 June 1956)Document7 pagesKarsales (Harrow) LTD V Wallis (1956) EWCA Civ 4 (12 June 1956)taonanyingNo ratings yet

- Ariston As 600 V DryerDocument40 pagesAriston As 600 V DryermmvdlpNo ratings yet