Professional Documents

Culture Documents

PYQs - Macroeconomics

PYQs - Macroeconomics

Uploaded by

TusharCopyright:

Available Formats

You might also like

- Alice MonologuesDocument4 pagesAlice MonologuesLa Spera Ottava67% (3)

- Ec2065 2013Document70 pagesEc2065 2013staticbitezNo ratings yet

- Resulting Trust Essay PlanDocument3 pagesResulting Trust Essay PlanSebastian Toh Ming WeiNo ratings yet

- SupervisionDocument45 pagesSupervisionsunielgowda100% (5)

- Eco SuggestionDocument1 pageEco SuggestionChodon BhikariNo ratings yet

- Money Banking and FinanceDocument6 pagesMoney Banking and FinanceAviral AkshatNo ratings yet

- PYQs - International - Economics - 2Document5 pagesPYQs - International - Economics - 2TusharNo ratings yet

- EconomicsDocument2 pagesEconomicsDivya SharmaNo ratings yet

- Microeconomics:: A 1 A 2 B 1 B 2 A 1 A 2 B 1 B 2Document12 pagesMicroeconomics:: A 1 A 2 B 1 B 2 A 1 A 2 B 1 B 225 sents zzNo ratings yet

- Paper 2 PYQDocument16 pagesPaper 2 PYQSaurabh PatelNo ratings yet

- Sem - V Eco & Maths SuggestionDocument21 pagesSem - V Eco & Maths SuggestionPritam Kumar PaulNo ratings yet

- Kartik MacroDocument1 pageKartik MacroSimran SabharwalNo ratings yet

- Advanced Macro EconomicsDocument6 pagesAdvanced Macro EconomicsIndraneel PsNo ratings yet

- BBC 2301 Money and Banking Year III Supplementary & SpecialDocument2 pagesBBC 2301 Money and Banking Year III Supplementary & SpecialitulejamesNo ratings yet

- Money Banking and FinanceDocument5 pagesMoney Banking and FinanceShilpita ChakravortyNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Economics)Document2 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Economics)Kareem Nawaz KhanNo ratings yet

- 4181 DatDocument2 pages4181 DatDhanush MenduNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Economics)Document3 pagesAllama Iqbal Open University, Islamabad: (Department of Economics)Imtiaz AhmadNo ratings yet

- PYQs - Growth - and - DevelopmentDocument5 pagesPYQs - Growth - and - DevelopmentTusharNo ratings yet

- Upsc - Mains Exam - 2019 Economics (Optional) Paper IDocument5 pagesUpsc - Mains Exam - 2019 Economics (Optional) Paper Iamol maliNo ratings yet

- Economics MacroDocument26 pagesEconomics MacroPreetika KaurNo ratings yet

- XII ECO Holiday HomeworkDocument2 pagesXII ECO Holiday HomeworkxagarxahNo ratings yet

- Tugas 04 - MakroDocument2 pagesTugas 04 - MakroMantraDebosaNo ratings yet

- Solve The Below Questions and Submit Prior Final Exam.: ECO 502: Individual Assignment#2 For AllDocument1 pageSolve The Below Questions and Submit Prior Final Exam.: ECO 502: Individual Assignment#2 For AllDiptoDCastleNo ratings yet

- Paper 1 - Topic WiseDocument16 pagesPaper 1 - Topic WiseSushant SulabhNo ratings yet

- H.S. 2nd Year 2-WPS OfficeDocument11 pagesH.S. 2nd Year 2-WPS OfficeRaju aliNo ratings yet

- Economics QP 2018, 219, 2022, 2023Document1 pageEconomics QP 2018, 219, 2022, 2023saikat.pal23-25No ratings yet

- Macro Ass No. 4.Document2 pagesMacro Ass No. 4.zayans84No ratings yet

- The Fed - Central Bank Digital Currency - A Literature ReviewDocument5 pagesThe Fed - Central Bank Digital Currency - A Literature ReviewJessyNo ratings yet

- AIOU Assignment 402Document4 pagesAIOU Assignment 402ziabuttNo ratings yet

- CSS Economics Paper Questions For Goal 1 Paper 1: 2000-2019Document2 pagesCSS Economics Paper Questions For Goal 1 Paper 1: 2000-2019MaryamNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Economics) WarningDocument3 pagesAllama Iqbal Open University, Islamabad (Department of Economics) WarningIttrat NissarNo ratings yet

- Azərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiDocument5 pagesAzərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiNihad PashazadeNo ratings yet

- EKO2111: Macroeconomics II: Problem Set 4 Suggested SolutionsDocument3 pagesEKO2111: Macroeconomics II: Problem Set 4 Suggested SolutionsRizqy RamakrisnaNo ratings yet

- Tugas 05 - MakroDocument2 pagesTugas 05 - MakroMantraDebosaNo ratings yet

- BA5101 ECO - Model Exam - QPDocument3 pagesBA5101 ECO - Model Exam - QPAlbert MervinNo ratings yet

- 11.431J/15.426J Real Estate Finance & Investments, Fall 2006, Midterm Diagnostic ExamDocument3 pages11.431J/15.426J Real Estate Finance & Investments, Fall 2006, Midterm Diagnostic ExamClaudia Silvia AndreiNo ratings yet

- Christ University, Bangalore-560029 II BA End Semester Examination March 2011Document1 pageChrist University, Bangalore-560029 II BA End Semester Examination March 2011Sanjana PrabhuNo ratings yet

- EET 401 AssignmentDocument1 pageEET 401 Assignmentbeemuriithi24No ratings yet

- Test-001 (Paper-I) 11th Oct 2020Document4 pagesTest-001 (Paper-I) 11th Oct 2020Raghav KumarNo ratings yet

- Macroeconomics QuestionsDocument3 pagesMacroeconomics Questionsdongxuan0120No ratings yet

- International EconomicsDocument7 pagesInternational Economicsbekaruse00No ratings yet

- Tugas 03 - MakroDocument2 pagesTugas 03 - MakroMantraDebosaNo ratings yet

- SSRN Id3331135Document61 pagesSSRN Id3331135방병화No ratings yet

- MACROECONOMICSDocument1 pageMACROECONOMICSMahwash HassanNo ratings yet

- IOBM Question PaperDocument2 pagesIOBM Question PaperAtif AslamNo ratings yet

- Rajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100Document3 pagesRajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100SachinNo ratings yet

- IS LM Labor AssignmentDocument6 pagesIS LM Labor AssignmentNICHIKATAZI ENTERTAINMENTNo ratings yet

- 07 22 Optimal Quantity Bank Based Economy ECB PDFDocument76 pages07 22 Optimal Quantity Bank Based Economy ECB PDFaffafaNo ratings yet

- Macro Economics214 - Xid-3384632 - 1Document4 pagesMacro Economics214 - Xid-3384632 - 1Shubham ChitkaraNo ratings yet

- Macro Problem Set 5Document3 pagesMacro Problem Set 5ChangeBunnyNo ratings yet

- Macro 2020Document2 pagesMacro 2020naturechannel1234No ratings yet

- Macro With YearDocument5 pagesMacro With YearHasan Asif SouravNo ratings yet

- Work 1046Document48 pagesWork 1046BhanusreeNo ratings yet

- Macro Modified FRQs For 2020 Exam No GraphsDocument17 pagesMacro Modified FRQs For 2020 Exam No GraphsShirin JNo ratings yet

- Broadening Narrow Money Monetary Policy With A Central Bank Digital CurrencyDocument36 pagesBroadening Narrow Money Monetary Policy With A Central Bank Digital CurrencyBoz StyneNo ratings yet

- Online Special Examination September 2021: Economics Exam Ii 12 (Cambridge) .........Document6 pagesOnline Special Examination September 2021: Economics Exam Ii 12 (Cambridge) .........Chirath FernandoNo ratings yet

- 1 s2.0 S0040162522002414 MainDocument39 pages1 s2.0 S0040162522002414 MainKeamogetse MotlogeloaNo ratings yet

- Macro Chap 12 Exercise Macsg12-Aggregate-Demand-In-The-Money-Goods-And-Current-Markets PDFDocument30 pagesMacro Chap 12 Exercise Macsg12-Aggregate-Demand-In-The-Money-Goods-And-Current-Markets PDFAA BB MMNo ratings yet

- Tutorial 8 AkDocument4 pagesTutorial 8 AkJonathan JoesNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- PA German I ADocument27 pagesPA German I ASam OwensNo ratings yet

- Ancient History 12 - Daily Notes - (Sankalp (UPSC 2024) )Document16 pagesAncient History 12 - Daily Notes - (Sankalp (UPSC 2024) )nigamkumar2tbNo ratings yet

- TED Taiye SelasiDocument4 pagesTED Taiye SelasiMinh ThuNo ratings yet

- 2 Schools of ThoughtsDocument4 pages2 Schools of ThoughtsbotiodNo ratings yet

- Break Even Analysis New PrintDocument22 pagesBreak Even Analysis New Printحسين النعيميNo ratings yet

- P6 Social Studies End of Term I Joint ExaminationsDocument13 pagesP6 Social Studies End of Term I Joint Examinationsemmanuelobiro51No ratings yet

- Topic: Student Politics in PakistanDocument7 pagesTopic: Student Politics in PakistanIrfan FarooqNo ratings yet

- Indifference Curve AnalysisDocument91 pagesIndifference Curve AnalysisShweta SinghNo ratings yet

- Tenses For Talking About The NewsDocument5 pagesTenses For Talking About The NewsThunder BurgerNo ratings yet

- Profiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003Document115 pagesProfiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003National Education Policy CenterNo ratings yet

- John Lee - China's Rise and The Road To War - WSJDocument4 pagesJohn Lee - China's Rise and The Road To War - WSJ33ds100No ratings yet

- The Special Activities DivisionDocument4 pagesThe Special Activities DivisionSpencer PearsonNo ratings yet

- The Blood PDFDocument4 pagesThe Blood PDFAdeNo ratings yet

- Psychiatric Nursing NotesDocument13 pagesPsychiatric Nursing NotesCarlo VigoNo ratings yet

- ProjectDocument3 pagesProjectKimzee kingNo ratings yet

- 中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-LibraryDocument490 pages中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-Libraryxxx caoNo ratings yet

- The Enneagram GuideDocument26 pagesThe Enneagram GuideMoon5627No ratings yet

- ExampleDocument3 pagesExampleAhad nasserNo ratings yet

- Babu Jagjeevana Ram Uttarandhra Sujala SravanthiDocument5 pagesBabu Jagjeevana Ram Uttarandhra Sujala SravanthiYuvaraju CherukuriNo ratings yet

- Asphyxial DeathDocument17 pagesAsphyxial DeathSisca ChearzNo ratings yet

- Tata Aig Mediprime Insurance BrochureDocument2 pagesTata Aig Mediprime Insurance Brochurerehmy082No ratings yet

- Outstanding-Performance-in-SOCIAL SCIENCE-1Document16 pagesOutstanding-Performance-in-SOCIAL SCIENCE-1Tyron Rex SolanoNo ratings yet

- Rehabilitation Finance V AltoDocument4 pagesRehabilitation Finance V AltoChristian AnresNo ratings yet

- Tugas AK Hal 337Document45 pagesTugas AK Hal 337Selvy ApriliantyNo ratings yet

- Iqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and ConstructionDocument31 pagesIqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and Constructionjacksonbello34No ratings yet

- The Insiders Game How Elites Make War and Peace Elizabeth N Saunders Full ChapterDocument67 pagesThe Insiders Game How Elites Make War and Peace Elizabeth N Saunders Full Chapterjoann.lamb584100% (16)

PYQs - Macroeconomics

PYQs - Macroeconomics

Uploaded by

TusharOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PYQs - Macroeconomics

PYQs - Macroeconomics

Uploaded by

TusharCopyright:

Available Formats

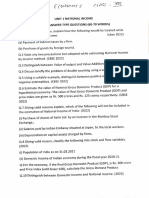

ECONOMICS (Optional) K-1 HANDOUT by Mr.

SHYAM SUNDAR

1. Explain the major differences between the Classical and Keynesian Economics. (10

Marks, 2023)

2. “Under Rational Expectation Hypothesis, systematic monetary policy is ineffective.”

Explain the above statement using a suitable model. (20 Marks, 2023)

3. In the IS-LM framework, the effectiveness of monetary and fiscal policies depend on

the interest elasticity of investment. Explain. (15 Marks, 2023)

4. How important is speculative demand for money in achieving unemployment

equilibrium in the Keynesian model? Discuss. (!5 marks, 2023)

5. Discuss Friedman’s restatement of Quantity Theory of Money. Under what

conditions, it reduces to Classical QTM? Explain. (15 marks, 2023)

6. Discuss the concept of ‘liquidity trap’ in the liquidity preference model of interest. (10

marks, 2022)

7. In demand for money, what are the major differences between ‘transaction approach’

and ‘cash balance approach’? (10 marks, 2022)

8. IS curve is the locus of equilibrium points in the commodity market. What do the

points above and below the IS curve signify? (15 marks, 2022)

9. Compare the deposit multiplier with the money multiplier. Is there any impact on the

money multiplier arising out of massive use of credit and debit cards? Justify your

answer. (15 marks, 2022)

10. What will be the shape of the aggregate supply curve in the Classical and Keynesian

models? Give detailed explanation. (15 marks, 2022)

11. Explain the quantitative methods of credit control adopted by the central bank. (10

marks, 2022)

12. Examine the relationship between business cycle and changes in autonomous

expenditure. (10 marks, 2021)

13. Does government borrowing always crowd out the private investment? Illustrate. (10

marks, 2021)

VAJIRAM & RAVI 1

14. The slope of IS schedule will be steeper if government reduces the rate of

proportional tax but will not change at allif government reduces the level of a lump-

sum tax. True or False? Explain.

15. State the difference in underlying expectations lead to differences in Keynesian and

Classical AS curve. (15 marks, 2021)

16. Apply the theory of liquidity preference to explain why an increase in money supply

lowers the interest rate. What does this explanation assume about the price level? (15

marks, 2021)

17. If the government raises taxes on labour income and interest income, explain how

potential GDP and economic growth are affected. (15 marks, 2021)

18. Explain how the weaknesses of Keynesian speculative demand for money have been

identified in Regressive Expectations model. (20 marks, 2021)

19. Derive short-run AS curve following Lucas, when expectations are not realised,

assuming that labour market clears. What will be its shape when expectations are

fulfilled? (10+5 marks, 2021)

20. Describe high powered theory of money supply in brief. State the assumptions made

in its construction. (8+7 marks, 2021)

21. Explain how equilibrium rate of interest and income are determined with the

interaction of both product and money markets (10 marks, 2020)

22. Distinguish between post-Keynesian approaches to horizontalist and structuralist

theory of endogenous money supply. (10 marks, 2020)

23. What do you mean by Tobin’s q theory of investment. How would you modify the

standard IS-LM functions in the presence of Tobin’s q? (15 marks, 2020)

VAJIRAM & RAVI 2

You might also like

- Alice MonologuesDocument4 pagesAlice MonologuesLa Spera Ottava67% (3)

- Ec2065 2013Document70 pagesEc2065 2013staticbitezNo ratings yet

- Resulting Trust Essay PlanDocument3 pagesResulting Trust Essay PlanSebastian Toh Ming WeiNo ratings yet

- SupervisionDocument45 pagesSupervisionsunielgowda100% (5)

- Eco SuggestionDocument1 pageEco SuggestionChodon BhikariNo ratings yet

- Money Banking and FinanceDocument6 pagesMoney Banking and FinanceAviral AkshatNo ratings yet

- PYQs - International - Economics - 2Document5 pagesPYQs - International - Economics - 2TusharNo ratings yet

- EconomicsDocument2 pagesEconomicsDivya SharmaNo ratings yet

- Microeconomics:: A 1 A 2 B 1 B 2 A 1 A 2 B 1 B 2Document12 pagesMicroeconomics:: A 1 A 2 B 1 B 2 A 1 A 2 B 1 B 225 sents zzNo ratings yet

- Paper 2 PYQDocument16 pagesPaper 2 PYQSaurabh PatelNo ratings yet

- Sem - V Eco & Maths SuggestionDocument21 pagesSem - V Eco & Maths SuggestionPritam Kumar PaulNo ratings yet

- Kartik MacroDocument1 pageKartik MacroSimran SabharwalNo ratings yet

- Advanced Macro EconomicsDocument6 pagesAdvanced Macro EconomicsIndraneel PsNo ratings yet

- BBC 2301 Money and Banking Year III Supplementary & SpecialDocument2 pagesBBC 2301 Money and Banking Year III Supplementary & SpecialitulejamesNo ratings yet

- Money Banking and FinanceDocument5 pagesMoney Banking and FinanceShilpita ChakravortyNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Economics)Document2 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Economics)Kareem Nawaz KhanNo ratings yet

- 4181 DatDocument2 pages4181 DatDhanush MenduNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Economics)Document3 pagesAllama Iqbal Open University, Islamabad: (Department of Economics)Imtiaz AhmadNo ratings yet

- PYQs - Growth - and - DevelopmentDocument5 pagesPYQs - Growth - and - DevelopmentTusharNo ratings yet

- Upsc - Mains Exam - 2019 Economics (Optional) Paper IDocument5 pagesUpsc - Mains Exam - 2019 Economics (Optional) Paper Iamol maliNo ratings yet

- Economics MacroDocument26 pagesEconomics MacroPreetika KaurNo ratings yet

- XII ECO Holiday HomeworkDocument2 pagesXII ECO Holiday HomeworkxagarxahNo ratings yet

- Tugas 04 - MakroDocument2 pagesTugas 04 - MakroMantraDebosaNo ratings yet

- Solve The Below Questions and Submit Prior Final Exam.: ECO 502: Individual Assignment#2 For AllDocument1 pageSolve The Below Questions and Submit Prior Final Exam.: ECO 502: Individual Assignment#2 For AllDiptoDCastleNo ratings yet

- Paper 1 - Topic WiseDocument16 pagesPaper 1 - Topic WiseSushant SulabhNo ratings yet

- H.S. 2nd Year 2-WPS OfficeDocument11 pagesH.S. 2nd Year 2-WPS OfficeRaju aliNo ratings yet

- Economics QP 2018, 219, 2022, 2023Document1 pageEconomics QP 2018, 219, 2022, 2023saikat.pal23-25No ratings yet

- Macro Ass No. 4.Document2 pagesMacro Ass No. 4.zayans84No ratings yet

- The Fed - Central Bank Digital Currency - A Literature ReviewDocument5 pagesThe Fed - Central Bank Digital Currency - A Literature ReviewJessyNo ratings yet

- AIOU Assignment 402Document4 pagesAIOU Assignment 402ziabuttNo ratings yet

- CSS Economics Paper Questions For Goal 1 Paper 1: 2000-2019Document2 pagesCSS Economics Paper Questions For Goal 1 Paper 1: 2000-2019MaryamNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Economics) WarningDocument3 pagesAllama Iqbal Open University, Islamabad (Department of Economics) WarningIttrat NissarNo ratings yet

- Azərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiDocument5 pagesAzərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiNihad PashazadeNo ratings yet

- EKO2111: Macroeconomics II: Problem Set 4 Suggested SolutionsDocument3 pagesEKO2111: Macroeconomics II: Problem Set 4 Suggested SolutionsRizqy RamakrisnaNo ratings yet

- Tugas 05 - MakroDocument2 pagesTugas 05 - MakroMantraDebosaNo ratings yet

- BA5101 ECO - Model Exam - QPDocument3 pagesBA5101 ECO - Model Exam - QPAlbert MervinNo ratings yet

- 11.431J/15.426J Real Estate Finance & Investments, Fall 2006, Midterm Diagnostic ExamDocument3 pages11.431J/15.426J Real Estate Finance & Investments, Fall 2006, Midterm Diagnostic ExamClaudia Silvia AndreiNo ratings yet

- Christ University, Bangalore-560029 II BA End Semester Examination March 2011Document1 pageChrist University, Bangalore-560029 II BA End Semester Examination March 2011Sanjana PrabhuNo ratings yet

- EET 401 AssignmentDocument1 pageEET 401 Assignmentbeemuriithi24No ratings yet

- Test-001 (Paper-I) 11th Oct 2020Document4 pagesTest-001 (Paper-I) 11th Oct 2020Raghav KumarNo ratings yet

- Macroeconomics QuestionsDocument3 pagesMacroeconomics Questionsdongxuan0120No ratings yet

- International EconomicsDocument7 pagesInternational Economicsbekaruse00No ratings yet

- Tugas 03 - MakroDocument2 pagesTugas 03 - MakroMantraDebosaNo ratings yet

- SSRN Id3331135Document61 pagesSSRN Id3331135방병화No ratings yet

- MACROECONOMICSDocument1 pageMACROECONOMICSMahwash HassanNo ratings yet

- IOBM Question PaperDocument2 pagesIOBM Question PaperAtif AslamNo ratings yet

- Rajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100Document3 pagesRajeshwar Higher Secondary School, Mhow FIRST PRE-BOARD 2011-2012 Subject:-Economics Class:-Xii TIME:-3 HRS. M.M. 100SachinNo ratings yet

- IS LM Labor AssignmentDocument6 pagesIS LM Labor AssignmentNICHIKATAZI ENTERTAINMENTNo ratings yet

- 07 22 Optimal Quantity Bank Based Economy ECB PDFDocument76 pages07 22 Optimal Quantity Bank Based Economy ECB PDFaffafaNo ratings yet

- Macro Economics214 - Xid-3384632 - 1Document4 pagesMacro Economics214 - Xid-3384632 - 1Shubham ChitkaraNo ratings yet

- Macro Problem Set 5Document3 pagesMacro Problem Set 5ChangeBunnyNo ratings yet

- Macro 2020Document2 pagesMacro 2020naturechannel1234No ratings yet

- Macro With YearDocument5 pagesMacro With YearHasan Asif SouravNo ratings yet

- Work 1046Document48 pagesWork 1046BhanusreeNo ratings yet

- Macro Modified FRQs For 2020 Exam No GraphsDocument17 pagesMacro Modified FRQs For 2020 Exam No GraphsShirin JNo ratings yet

- Broadening Narrow Money Monetary Policy With A Central Bank Digital CurrencyDocument36 pagesBroadening Narrow Money Monetary Policy With A Central Bank Digital CurrencyBoz StyneNo ratings yet

- Online Special Examination September 2021: Economics Exam Ii 12 (Cambridge) .........Document6 pagesOnline Special Examination September 2021: Economics Exam Ii 12 (Cambridge) .........Chirath FernandoNo ratings yet

- 1 s2.0 S0040162522002414 MainDocument39 pages1 s2.0 S0040162522002414 MainKeamogetse MotlogeloaNo ratings yet

- Macro Chap 12 Exercise Macsg12-Aggregate-Demand-In-The-Money-Goods-And-Current-Markets PDFDocument30 pagesMacro Chap 12 Exercise Macsg12-Aggregate-Demand-In-The-Money-Goods-And-Current-Markets PDFAA BB MMNo ratings yet

- Tutorial 8 AkDocument4 pagesTutorial 8 AkJonathan JoesNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- PA German I ADocument27 pagesPA German I ASam OwensNo ratings yet

- Ancient History 12 - Daily Notes - (Sankalp (UPSC 2024) )Document16 pagesAncient History 12 - Daily Notes - (Sankalp (UPSC 2024) )nigamkumar2tbNo ratings yet

- TED Taiye SelasiDocument4 pagesTED Taiye SelasiMinh ThuNo ratings yet

- 2 Schools of ThoughtsDocument4 pages2 Schools of ThoughtsbotiodNo ratings yet

- Break Even Analysis New PrintDocument22 pagesBreak Even Analysis New Printحسين النعيميNo ratings yet

- P6 Social Studies End of Term I Joint ExaminationsDocument13 pagesP6 Social Studies End of Term I Joint Examinationsemmanuelobiro51No ratings yet

- Topic: Student Politics in PakistanDocument7 pagesTopic: Student Politics in PakistanIrfan FarooqNo ratings yet

- Indifference Curve AnalysisDocument91 pagesIndifference Curve AnalysisShweta SinghNo ratings yet

- Tenses For Talking About The NewsDocument5 pagesTenses For Talking About The NewsThunder BurgerNo ratings yet

- Profiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003Document115 pagesProfiles of For-Profit Education Management Companies: Fifth Annual Report 2002-2003National Education Policy CenterNo ratings yet

- John Lee - China's Rise and The Road To War - WSJDocument4 pagesJohn Lee - China's Rise and The Road To War - WSJ33ds100No ratings yet

- The Special Activities DivisionDocument4 pagesThe Special Activities DivisionSpencer PearsonNo ratings yet

- The Blood PDFDocument4 pagesThe Blood PDFAdeNo ratings yet

- Psychiatric Nursing NotesDocument13 pagesPsychiatric Nursing NotesCarlo VigoNo ratings yet

- ProjectDocument3 pagesProjectKimzee kingNo ratings yet

- 中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-LibraryDocument490 pages中文打字机一个世纪的汉字突围史 美墨磊宁Thomas S Mullaney Z-Libraryxxx caoNo ratings yet

- The Enneagram GuideDocument26 pagesThe Enneagram GuideMoon5627No ratings yet

- ExampleDocument3 pagesExampleAhad nasserNo ratings yet

- Babu Jagjeevana Ram Uttarandhra Sujala SravanthiDocument5 pagesBabu Jagjeevana Ram Uttarandhra Sujala SravanthiYuvaraju CherukuriNo ratings yet

- Asphyxial DeathDocument17 pagesAsphyxial DeathSisca ChearzNo ratings yet

- Tata Aig Mediprime Insurance BrochureDocument2 pagesTata Aig Mediprime Insurance Brochurerehmy082No ratings yet

- Outstanding-Performance-in-SOCIAL SCIENCE-1Document16 pagesOutstanding-Performance-in-SOCIAL SCIENCE-1Tyron Rex SolanoNo ratings yet

- Rehabilitation Finance V AltoDocument4 pagesRehabilitation Finance V AltoChristian AnresNo ratings yet

- Tugas AK Hal 337Document45 pagesTugas AK Hal 337Selvy ApriliantyNo ratings yet

- Iqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and ConstructionDocument31 pagesIqwq-Ft-Rspds-00-120103 - 1 Preservation During Shipping and Constructionjacksonbello34No ratings yet

- The Insiders Game How Elites Make War and Peace Elizabeth N Saunders Full ChapterDocument67 pagesThe Insiders Game How Elites Make War and Peace Elizabeth N Saunders Full Chapterjoann.lamb584100% (16)