Professional Documents

Culture Documents

Forex Channel Trading Strategy Explained With Examples

Forex Channel Trading Strategy Explained With Examples

Uploaded by

Ahmed Al-TememiCopyright:

Available Formats

You might also like

- T24 Core TablesDocument43 pagesT24 Core TablesJaya Narasimhan67% (3)

- ASHRAE-Psychrometric Chart PDFDocument2 pagesASHRAE-Psychrometric Chart PDFBrian MayNo ratings yet

- Chap07 Pbms MBF12eDocument22 pagesChap07 Pbms MBF12eBeatrice Ballabio100% (1)

- BW Uniformity Excel Link New2Document65 pagesBW Uniformity Excel Link New2Tharj ImamNo ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFNapoleon Low100% (2)

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDocument27 pagesForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- Peta Topografi Budidaya HortikulturaDocument1 pagePeta Topografi Budidaya Hortikulturadydrida mabesNo ratings yet

- A-FRAME CABIN HOUSE PLAN AND ELEVATION RevisedDocument1 pageA-FRAME CABIN HOUSE PLAN AND ELEVATION Revisedarchie bautistaNo ratings yet

- .W.T 017Document1 page.W.T 017Jay SenjaliaNo ratings yet

- X-Section MALETHA 3.400KMDocument8 pagesX-Section MALETHA 3.400KMhpsa9496No ratings yet

- Usdchf, H1Document1 pageUsdchf, H1Fir SueNo ratings yet

- Completion - MR Anil & Sunil - Sector 116-ModelDocument1 pageCompletion - MR Anil & Sunil - Sector 116-Modelujjwalhalder510No ratings yet

- Superior Railing DetailDocument1 pageSuperior Railing DetailRyan ChinNo ratings yet

- Replanteo-Cajay OkDocument1 pageReplanteo-Cajay OkLucio Torres PaucarNo ratings yet

- BASEDocument1 pageBASEJose Manuel Ortiz Arrieta LujanNo ratings yet

- Pak Oka ArayaDocument74 pagesPak Oka Arayaanwaribnu03No ratings yet

- Area 2102Document1 pageArea 2102aaromrgNo ratings yet

- Action Plan 1 (2 Mingguan) SmaDocument8 pagesAction Plan 1 (2 Mingguan) SmaHerdy Sanjaya SNo ratings yet

- CALICATAS HUASAMPATA-Layout1Document1 pageCALICATAS HUASAMPATA-Layout1Heiner SotoNo ratings yet

- Plano Formato A1Document1 pagePlano Formato A1David Condor RocaNo ratings yet

- Denah LT 1 PDFDocument1 pageDenah LT 1 PDFMaryam FauziahNo ratings yet

- Mollier r410 PDFDocument1 pageMollier r410 PDFbenja zeta peNo ratings yet

- Modelo de Calculo Del Programa PipeflowDocument8 pagesModelo de Calculo Del Programa PipeflowJoel Felipe Manrique RimachiNo ratings yet

- Sheet 1Document1 pageSheet 1Deepak BerwalNo ratings yet

- Daily Collection and Remittance Summary: 888 Good Fortune Gaming Ventures Corporation Province of AntiqueDocument30 pagesDaily Collection and Remittance Summary: 888 Good Fortune Gaming Ventures Corporation Province of AntiqueCrystal Jane LabaynoNo ratings yet

- Density Altitude ChartDocument1 pageDensity Altitude Chartkiran tasneemNo ratings yet

- Peta Topografi Kecamatan TominiDocument1 pagePeta Topografi Kecamatan TominiGilang RamadanNo ratings yet

- Denah LT Dasar: Sheet Number Approved by Name Signature / Date Notes / Revision Drawing Title Scale Project NameDocument6 pagesDenah LT Dasar: Sheet Number Approved by Name Signature / Date Notes / Revision Drawing Title Scale Project NameNathan JoeNo ratings yet

- Gilbarco LegacyDocument14 pagesGilbarco LegacyRick AlingalanNo ratings yet

- Sbpa - Rnav Dakat 1b Rwy 29 - Star - 20230810Document1 pageSbpa - Rnav Dakat 1b Rwy 29 - Star - 20230810CMDT MatheusNo ratings yet

- Sbgo - Rnav Ednar 1a - Sirem 1a Rwy 14 - Star - 20230420Document1 pageSbgo - Rnav Ednar 1a - Sirem 1a Rwy 14 - Star - 20230420Pedro AlbaniNo ratings yet

- AX SeriesDocument2 pagesAX SeriesVitor AquinoNo ratings yet

- 0506 (CCHICA) 33KV: 2Lprch 2LprchDocument1 page0506 (CCHICA) 33KV: 2Lprch 2LprchJIMENEZPSNo ratings yet

- Steel Shop Drawing-ModelDocument1 pageSteel Shop Drawing-ModelAli MoazNo ratings yet

- DX30Z Elec PDFDocument1 pageDX30Z Elec PDFPilaquinga DiegoNo ratings yet

- Price ActionDocument1 pagePrice Actionaka akaNo ratings yet

- Acad-11!24!2022 - Lev. Llano Marin-HojaDocument1 pageAcad-11!24!2022 - Lev. Llano Marin-HojaERCARVAJALNo ratings yet

- 4-Midterm Exam-Task No.3 (Floor Plan & Elevation)Document1 page4-Midterm Exam-Task No.3 (Floor Plan & Elevation)MavNo ratings yet

- Bifasica Barra1Document1 pageBifasica Barra1Deyvis CadillopNo ratings yet

- SUMMARY NDT - CHECK MeiDocument9 pagesSUMMARY NDT - CHECK Meianton timurNo ratings yet

- Peta Lahan Kawasan AmbunganDocument1 pagePeta Lahan Kawasan AmbunganAhyar GunawanNo ratings yet

- Sbja - FLN 1a 1b Rwy 05 23 - Sid - 20211104Document1 pageSbja - FLN 1a 1b Rwy 05 23 - Sid - 20211104Fábio KastelamaryNo ratings yet

- Provision of Ramp With Shed (See Blow-Up Detail)Document1 pageProvision of Ramp With Shed (See Blow-Up Detail)Adrian PachecoNo ratings yet

- Ashrae Psychrometric+ChartDocument2 pagesAshrae Psychrometric+ChartASHNA K NAVADNo ratings yet

- Ashrae ChartDocument2 pagesAshrae ChartCarlo Ray SelabaoNo ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFZaid Tariq AlabiryNo ratings yet

- Psychrometric Chart Ashrae PDFDocument2 pagesPsychrometric Chart Ashrae PDFambuenaflorNo ratings yet

- ASHRAEPSYCHROMETRICa206119 PDFDocument2 pagesASHRAEPSYCHROMETRICa206119 PDFAlexandre Jusis BlancoNo ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFEdmar AbuboNo ratings yet

- ASHRAE Chart PDFDocument2 pagesASHRAE Chart PDFalialavi2No ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFLemuel GerardsNo ratings yet

- ASHRAE Chart PDFDocument2 pagesASHRAE Chart PDFpatricio-1703No ratings yet

- Ashrae-Psychart Eng N SI PDFDocument2 pagesAshrae-Psychart Eng N SI PDFJonaz CruzNo ratings yet

- ASHRAE Chart PDFDocument2 pagesASHRAE Chart PDFvitaliskcNo ratings yet

- ASHRAE Psychrometric ChartDocument2 pagesASHRAE Psychrometric ChartNaqqash SajidNo ratings yet

- ASHRAE Chart2 PDFDocument2 pagesASHRAE Chart2 PDFalialavi2No ratings yet

- Psychrometric Chart PDFDocument2 pagesPsychrometric Chart PDFvitaliskcNo ratings yet

- ASHRAE-Chart No1 PDFDocument2 pagesASHRAE-Chart No1 PDFaukanaiiNo ratings yet

- Ashrae ChartDocument2 pagesAshrae Chartimo konsensyaNo ratings yet

- Sample CarwashDocument1 pageSample CarwashSabrex MacadatoNo ratings yet

- Sheet 2Document1 pageSheet 2walltowall designNo ratings yet

- Ars - L1 & l2 Pak Maruap Silaban Rev.2-Rev BaruDocument1 pageArs - L1 & l2 Pak Maruap Silaban Rev.2-Rev BaruMochamad Ridwan AfandiNo ratings yet

- Support and Resistance in Trading - Definition & ExamplesDocument24 pagesSupport and Resistance in Trading - Definition & ExamplesAhmed Al-TememiNo ratings yet

- ZPAR Real Estate Marketing Plan 6723ecDocument17 pagesZPAR Real Estate Marketing Plan 6723ecAhmed Al-TememiNo ratings yet

- Bioaqua Order List 2021 - 01Document156 pagesBioaqua Order List 2021 - 01Ahmed Al-TememiNo ratings yet

- Oman Demographics Profile 2019Document1 pageOman Demographics Profile 2019Ahmed Al-TememiNo ratings yet

- Projected Gains and Losses ReportDocument3 pagesProjected Gains and Losses ReportShakhir MohunNo ratings yet

- Trendfans and Trendline BreaksDocument43 pagesTrendfans and Trendline BreaksPanayiotis PeppasNo ratings yet

- Mesopotamia: The History of ForexDocument8 pagesMesopotamia: The History of ForexRamiza BanuNo ratings yet

- Challan Receipt PDFDocument1 pageChallan Receipt PDFMONISH NAYAR0% (1)

- 15 Uploader FINAL - CDLDocument45 pages15 Uploader FINAL - CDLMuhammad AliNo ratings yet

- 7B. General Terms & Conditions of Contract For SupplyDocument17 pages7B. General Terms & Conditions of Contract For SupplyTHANGARAJA CNo ratings yet

- Structure of Indian Financial SystemDocument24 pagesStructure of Indian Financial SystemRaj SodhaNo ratings yet

- Rothschild Bank AG Zurich Annual Report 20112012Document60 pagesRothschild Bank AG Zurich Annual Report 20112012blyzerNo ratings yet

- Introduction of Financial MarketDocument11 pagesIntroduction of Financial Marketatul AgalaweNo ratings yet

- $EGG JustaneggDocument1 page$EGG Justaneggandmad0424No ratings yet

- "Trade Finance": A Summer Training Project Report OnDocument5 pages"Trade Finance": A Summer Training Project Report OnSudarshan RaviNo ratings yet

- IIBF Banking and FinanceDocument16 pagesIIBF Banking and FinanceLakshay Singh0% (1)

- Theories of Exchange Rate DeterminationDocument6 pagesTheories of Exchange Rate DeterminationOmisha SinghNo ratings yet

- Dean of School of Business LecturerDocument7 pagesDean of School of Business LecturerThạchThảooNo ratings yet

- Report On MIS of SCBDocument47 pagesReport On MIS of SCBReezwan Ahmed100% (1)

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- Fstraders Introduction To Our Trading Strategy Credits To B.MDocument22 pagesFstraders Introduction To Our Trading Strategy Credits To B.MCapRa XuboNo ratings yet

- Time Deposit RatesDocument4 pagesTime Deposit RatesJanina Rhea Lazo-CruzNo ratings yet

- Malawi Investment PortfolioDocument66 pagesMalawi Investment PortfoliovijaybalareddyNo ratings yet

- XII Eco Macro CH - 5 MoneyDocument3 pagesXII Eco Macro CH - 5 MoneysunshineNo ratings yet

- 1KGFDXP - Edwin TorresDocument4 pages1KGFDXP - Edwin TorresEdgar OrdoñezNo ratings yet

- Notes and Points On IMFDocument135 pagesNotes and Points On IMFUnni AmpadiNo ratings yet

- Bfs - Unit II Short NotesDocument12 pagesBfs - Unit II Short NotesvelmuruganbNo ratings yet

- Kushan Kushano-Sasanian and Kidarite Coi PDFDocument16 pagesKushan Kushano-Sasanian and Kidarite Coi PDFTommasoNo ratings yet

- CoinChangelly - Coinmarketcap Converter - Crypto Calculator - Bitcoin PriceDocument6 pagesCoinChangelly - Coinmarketcap Converter - Crypto Calculator - Bitcoin PriceCoin ChangellyNo ratings yet

- Yun Kwan Byung Vs PAGCOR December 11, 2009Document7 pagesYun Kwan Byung Vs PAGCOR December 11, 2009Darlene GanubNo ratings yet

- Economic AbbreviationsDocument6 pagesEconomic AbbreviationsqasmsNo ratings yet

Forex Channel Trading Strategy Explained With Examples

Forex Channel Trading Strategy Explained With Examples

Uploaded by

Ahmed Al-TememiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forex Channel Trading Strategy Explained With Examples

Forex Channel Trading Strategy Explained With Examples

Uploaded by

Ahmed Al-TememiCopyright:

Available Formats

Forex Channel Trading Strategy

Explained With Examples

By Tim Morris - November 5, 2017

Forex Channel Trading Strategy

Price charts often look like a chaotic mess. A code that takes

forever to decipher. And this is often true, especially for new

traders with untrained eyes. However, for traders who have had

enough chart time, forex charts at times reveal an orderly

pattern amidst the chaos.

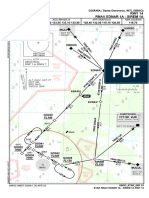

Take this chart for example.

:

Newbies, often see this chart and wouldn’t have an idea what to

do with it. Some would have an idea that this is a bullish

trending chart, but still wouldn’t have a clue on how to trade it.

But a few who have observed charts for quite some time would

see a major support and resistance forming a channel.

Moreover, they would see resistances where price broke-out to

:

resume the uptrend.

To them, the chart has become an orderly and predictable

market, which increases their confidence in trading their setups,

and increasing their chances of having a profitable trade.

Trading channels is not as complicated as it sounds. It all starts

with identifying major supports and resistances. However,

instead of horizontal supports and resistances, what commonly

takes place are diagonal supports and resistances. To qualify as

a support or resistance, price must respect the identified

support or resistance twice, and confirmed by a third swing high

or swing low.

The resulting support and resistance should be parallel to each

other to be considered as a channel, with the resistance as the

upper bounds of the channel and the support as the lower

bounds of the channel.

Once the channel is identified, it would be easy to notice how

price bounces up and down the price chart traveling from the

:

support to the resistance, then back to the support, repeatedly.

This becomes an orderly chart, which is somehow easier to

predict.

How to Effectively Trade Channels

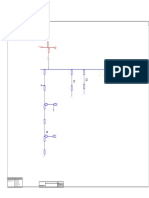

Within the channel, price would have minor diagonal supports

and resistances, often forming minor patterns or even minor

channels, which become more visible on the lower timeframes.

~ H1 0.88400

0.88377

0.88405 0.83379 EURGBP.m,

0.89190

0.89305

-

0.89075

Flag Expanding

|

or Bull Flag Channel Descending 0.88730

0.88615

0.88379

or Bull Flag Wedge

0.88270

- 0.87925

0.87810

1 0.87700

Oct 08:00

27 28 28

2 Sep2

29 Sep 29

3 Sep 3 2017

Sep 4 SepOct

4 5

Oct 08:00

Oct

5 Oct

20:00 08:00

Oct 20:00

Oct 08:00 20:00Oct 08:00 20:00 08:00 20:00 20:00 0.87585

Patterns are well and good, they could serve as an additional

confluence or rationale for taking the trade. However, their use

ends there, an additional confidence booster for the trading

setup. What is important is the support or resistance where the

trade should breakout from.

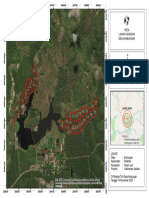

To identify which direction the trade should take, we should first

identify if the channel is bullish or bearish. In this case, the

chart is a bullish trending channel. Since, this is a bullish

trending channel, what we will be looking for are bounces off the

channel’s support, and breakouts from the minor resistances.

:

We could therefore, forego the other markings on the chart and

consider only the channel, and the minor resistances for the

trade setup.

~ H1 1 0.88400

0.88405

0.88362

0.83370 EURGBP.m,

0.89400

0.89275

- 0.89155

0.88910

•

0.88545

0.88370

•

0.88180

-

0.87935

- 0.87810

0.87570

0.87445

Oct 04:00

27 28 28

2 29

Sep2 Sep 29

3 Sep Sep

3 2017 4 SepOct

4 5

Oct Oct

516:00

04:00 Oct 04:00

16:00

Oct Oct 04:00

16:00 Oct 16:00

04:00 16:00

04:00 16:00

The Trade Setup: Entry, Stop Loss and

Take ProAt

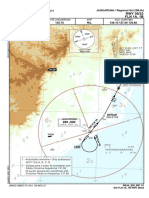

Since this is an uptrend, what we will be analyzing is a buy

setup.

Entry: To enter a trade, a breakout from the minor resistance

should occur. A retest would also be a helpful confirmation of the

trade as this increases the probability of a real breakout. Entries

could either be a buy stop order on top of the high of the

breakout candle, or a market buy order on the retest.

Stop Loss: The stop loss should be placed on the minor swing

low, which is often below the channel’s support.

Take Profit: The take profit should be set at the corresponding

upper end of the channel perpendicular to the entry candle. This

:

is because it would be hard to predict where price will stop since

we

Get are

FREE using a diagonal

$50 Trading resistance

Bonus + Deposit asToa$5000!

Bonus Up basis for our target.

Also, there are times when price would just be near the

channel’s resistance, but wouldn’t touch it.

~ H1 - 0.88400

0.88405

0.88362 0.83399 EURGBP.m,

- 0.89155

0.88915

Take Profit

-

0.88675

0.88555

. - 0884

35 Entry

0.88315 0.88399

0.88195

-

StopLoss 0.88075

0.87955

•

0.87835

0.87715

0.87595

- 05:00

5 Oct

27 28 2

28 Sep229 Sep 29 Sep Sep

2017 4 SepOct

4 Oct 17:00

05:00

5 Oct 05:00

17:00

Oct Oct 05:00

17:00 11:00 Oct 17:00 17:00

05:00 17:00 0.87475

Conclusion

Trading channels is a basic skill thatNow

Trade many professional traders

use. This might be due to how the setups become orderly,

despite the chaos of the market, which increases confidence in

the trading setups.

Trade Now

The confluence of a bullish channel, a breakout from a minor

support, and often a bullish continuation chart pattern,

increases the probability of a successful trade. Other indicators

could also support as confluence for a channel trading setup.

However, there are times when a trade setup is formed from a

contraction, instead of a retracement. Expanding flags and

rectangles are often found during contractions, while bull flags,

pennants, and wedges are often found on retracements. I prefer

:

trading retracements as it is easier to predict and since

breakouts are clearer.

Channel trading is not perfect. There are still some failed trades

when using channel trading. However, when combined with

other strategies and confluences, setups become high

probability setups.

Tim Morris

https://www.forexmt4indicators.com/

Tim Morris is a work from home dad, home-based forex trader, writer and

blogger by passion. He likes to research and share the latest forex trading

strategies and forex indicators on ForexMT4Indicators.com. His passion is

to let everyone to be able to learn and download different types of forex

trading strategies and mt4/mt5 indicators at ForexMT4Indicators.com

:

You might also like

- T24 Core TablesDocument43 pagesT24 Core TablesJaya Narasimhan67% (3)

- ASHRAE-Psychrometric Chart PDFDocument2 pagesASHRAE-Psychrometric Chart PDFBrian MayNo ratings yet

- Chap07 Pbms MBF12eDocument22 pagesChap07 Pbms MBF12eBeatrice Ballabio100% (1)

- BW Uniformity Excel Link New2Document65 pagesBW Uniformity Excel Link New2Tharj ImamNo ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFNapoleon Low100% (2)

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDocument27 pagesForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- Peta Topografi Budidaya HortikulturaDocument1 pagePeta Topografi Budidaya Hortikulturadydrida mabesNo ratings yet

- A-FRAME CABIN HOUSE PLAN AND ELEVATION RevisedDocument1 pageA-FRAME CABIN HOUSE PLAN AND ELEVATION Revisedarchie bautistaNo ratings yet

- .W.T 017Document1 page.W.T 017Jay SenjaliaNo ratings yet

- X-Section MALETHA 3.400KMDocument8 pagesX-Section MALETHA 3.400KMhpsa9496No ratings yet

- Usdchf, H1Document1 pageUsdchf, H1Fir SueNo ratings yet

- Completion - MR Anil & Sunil - Sector 116-ModelDocument1 pageCompletion - MR Anil & Sunil - Sector 116-Modelujjwalhalder510No ratings yet

- Superior Railing DetailDocument1 pageSuperior Railing DetailRyan ChinNo ratings yet

- Replanteo-Cajay OkDocument1 pageReplanteo-Cajay OkLucio Torres PaucarNo ratings yet

- BASEDocument1 pageBASEJose Manuel Ortiz Arrieta LujanNo ratings yet

- Pak Oka ArayaDocument74 pagesPak Oka Arayaanwaribnu03No ratings yet

- Area 2102Document1 pageArea 2102aaromrgNo ratings yet

- Action Plan 1 (2 Mingguan) SmaDocument8 pagesAction Plan 1 (2 Mingguan) SmaHerdy Sanjaya SNo ratings yet

- CALICATAS HUASAMPATA-Layout1Document1 pageCALICATAS HUASAMPATA-Layout1Heiner SotoNo ratings yet

- Plano Formato A1Document1 pagePlano Formato A1David Condor RocaNo ratings yet

- Denah LT 1 PDFDocument1 pageDenah LT 1 PDFMaryam FauziahNo ratings yet

- Mollier r410 PDFDocument1 pageMollier r410 PDFbenja zeta peNo ratings yet

- Modelo de Calculo Del Programa PipeflowDocument8 pagesModelo de Calculo Del Programa PipeflowJoel Felipe Manrique RimachiNo ratings yet

- Sheet 1Document1 pageSheet 1Deepak BerwalNo ratings yet

- Daily Collection and Remittance Summary: 888 Good Fortune Gaming Ventures Corporation Province of AntiqueDocument30 pagesDaily Collection and Remittance Summary: 888 Good Fortune Gaming Ventures Corporation Province of AntiqueCrystal Jane LabaynoNo ratings yet

- Density Altitude ChartDocument1 pageDensity Altitude Chartkiran tasneemNo ratings yet

- Peta Topografi Kecamatan TominiDocument1 pagePeta Topografi Kecamatan TominiGilang RamadanNo ratings yet

- Denah LT Dasar: Sheet Number Approved by Name Signature / Date Notes / Revision Drawing Title Scale Project NameDocument6 pagesDenah LT Dasar: Sheet Number Approved by Name Signature / Date Notes / Revision Drawing Title Scale Project NameNathan JoeNo ratings yet

- Gilbarco LegacyDocument14 pagesGilbarco LegacyRick AlingalanNo ratings yet

- Sbpa - Rnav Dakat 1b Rwy 29 - Star - 20230810Document1 pageSbpa - Rnav Dakat 1b Rwy 29 - Star - 20230810CMDT MatheusNo ratings yet

- Sbgo - Rnav Ednar 1a - Sirem 1a Rwy 14 - Star - 20230420Document1 pageSbgo - Rnav Ednar 1a - Sirem 1a Rwy 14 - Star - 20230420Pedro AlbaniNo ratings yet

- AX SeriesDocument2 pagesAX SeriesVitor AquinoNo ratings yet

- 0506 (CCHICA) 33KV: 2Lprch 2LprchDocument1 page0506 (CCHICA) 33KV: 2Lprch 2LprchJIMENEZPSNo ratings yet

- Steel Shop Drawing-ModelDocument1 pageSteel Shop Drawing-ModelAli MoazNo ratings yet

- DX30Z Elec PDFDocument1 pageDX30Z Elec PDFPilaquinga DiegoNo ratings yet

- Price ActionDocument1 pagePrice Actionaka akaNo ratings yet

- Acad-11!24!2022 - Lev. Llano Marin-HojaDocument1 pageAcad-11!24!2022 - Lev. Llano Marin-HojaERCARVAJALNo ratings yet

- 4-Midterm Exam-Task No.3 (Floor Plan & Elevation)Document1 page4-Midterm Exam-Task No.3 (Floor Plan & Elevation)MavNo ratings yet

- Bifasica Barra1Document1 pageBifasica Barra1Deyvis CadillopNo ratings yet

- SUMMARY NDT - CHECK MeiDocument9 pagesSUMMARY NDT - CHECK Meianton timurNo ratings yet

- Peta Lahan Kawasan AmbunganDocument1 pagePeta Lahan Kawasan AmbunganAhyar GunawanNo ratings yet

- Sbja - FLN 1a 1b Rwy 05 23 - Sid - 20211104Document1 pageSbja - FLN 1a 1b Rwy 05 23 - Sid - 20211104Fábio KastelamaryNo ratings yet

- Provision of Ramp With Shed (See Blow-Up Detail)Document1 pageProvision of Ramp With Shed (See Blow-Up Detail)Adrian PachecoNo ratings yet

- Ashrae Psychrometric+ChartDocument2 pagesAshrae Psychrometric+ChartASHNA K NAVADNo ratings yet

- Ashrae ChartDocument2 pagesAshrae ChartCarlo Ray SelabaoNo ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFZaid Tariq AlabiryNo ratings yet

- Psychrometric Chart Ashrae PDFDocument2 pagesPsychrometric Chart Ashrae PDFambuenaflorNo ratings yet

- ASHRAEPSYCHROMETRICa206119 PDFDocument2 pagesASHRAEPSYCHROMETRICa206119 PDFAlexandre Jusis BlancoNo ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFEdmar AbuboNo ratings yet

- ASHRAE Chart PDFDocument2 pagesASHRAE Chart PDFalialavi2No ratings yet

- Ashrae Chart PDFDocument2 pagesAshrae Chart PDFLemuel GerardsNo ratings yet

- ASHRAE Chart PDFDocument2 pagesASHRAE Chart PDFpatricio-1703No ratings yet

- Ashrae-Psychart Eng N SI PDFDocument2 pagesAshrae-Psychart Eng N SI PDFJonaz CruzNo ratings yet

- ASHRAE Chart PDFDocument2 pagesASHRAE Chart PDFvitaliskcNo ratings yet

- ASHRAE Psychrometric ChartDocument2 pagesASHRAE Psychrometric ChartNaqqash SajidNo ratings yet

- ASHRAE Chart2 PDFDocument2 pagesASHRAE Chart2 PDFalialavi2No ratings yet

- Psychrometric Chart PDFDocument2 pagesPsychrometric Chart PDFvitaliskcNo ratings yet

- ASHRAE-Chart No1 PDFDocument2 pagesASHRAE-Chart No1 PDFaukanaiiNo ratings yet

- Ashrae ChartDocument2 pagesAshrae Chartimo konsensyaNo ratings yet

- Sample CarwashDocument1 pageSample CarwashSabrex MacadatoNo ratings yet

- Sheet 2Document1 pageSheet 2walltowall designNo ratings yet

- Ars - L1 & l2 Pak Maruap Silaban Rev.2-Rev BaruDocument1 pageArs - L1 & l2 Pak Maruap Silaban Rev.2-Rev BaruMochamad Ridwan AfandiNo ratings yet

- Support and Resistance in Trading - Definition & ExamplesDocument24 pagesSupport and Resistance in Trading - Definition & ExamplesAhmed Al-TememiNo ratings yet

- ZPAR Real Estate Marketing Plan 6723ecDocument17 pagesZPAR Real Estate Marketing Plan 6723ecAhmed Al-TememiNo ratings yet

- Bioaqua Order List 2021 - 01Document156 pagesBioaqua Order List 2021 - 01Ahmed Al-TememiNo ratings yet

- Oman Demographics Profile 2019Document1 pageOman Demographics Profile 2019Ahmed Al-TememiNo ratings yet

- Projected Gains and Losses ReportDocument3 pagesProjected Gains and Losses ReportShakhir MohunNo ratings yet

- Trendfans and Trendline BreaksDocument43 pagesTrendfans and Trendline BreaksPanayiotis PeppasNo ratings yet

- Mesopotamia: The History of ForexDocument8 pagesMesopotamia: The History of ForexRamiza BanuNo ratings yet

- Challan Receipt PDFDocument1 pageChallan Receipt PDFMONISH NAYAR0% (1)

- 15 Uploader FINAL - CDLDocument45 pages15 Uploader FINAL - CDLMuhammad AliNo ratings yet

- 7B. General Terms & Conditions of Contract For SupplyDocument17 pages7B. General Terms & Conditions of Contract For SupplyTHANGARAJA CNo ratings yet

- Structure of Indian Financial SystemDocument24 pagesStructure of Indian Financial SystemRaj SodhaNo ratings yet

- Rothschild Bank AG Zurich Annual Report 20112012Document60 pagesRothschild Bank AG Zurich Annual Report 20112012blyzerNo ratings yet

- Introduction of Financial MarketDocument11 pagesIntroduction of Financial Marketatul AgalaweNo ratings yet

- $EGG JustaneggDocument1 page$EGG Justaneggandmad0424No ratings yet

- "Trade Finance": A Summer Training Project Report OnDocument5 pages"Trade Finance": A Summer Training Project Report OnSudarshan RaviNo ratings yet

- IIBF Banking and FinanceDocument16 pagesIIBF Banking and FinanceLakshay Singh0% (1)

- Theories of Exchange Rate DeterminationDocument6 pagesTheories of Exchange Rate DeterminationOmisha SinghNo ratings yet

- Dean of School of Business LecturerDocument7 pagesDean of School of Business LecturerThạchThảooNo ratings yet

- Report On MIS of SCBDocument47 pagesReport On MIS of SCBReezwan Ahmed100% (1)

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- Fstraders Introduction To Our Trading Strategy Credits To B.MDocument22 pagesFstraders Introduction To Our Trading Strategy Credits To B.MCapRa XuboNo ratings yet

- Time Deposit RatesDocument4 pagesTime Deposit RatesJanina Rhea Lazo-CruzNo ratings yet

- Malawi Investment PortfolioDocument66 pagesMalawi Investment PortfoliovijaybalareddyNo ratings yet

- XII Eco Macro CH - 5 MoneyDocument3 pagesXII Eco Macro CH - 5 MoneysunshineNo ratings yet

- 1KGFDXP - Edwin TorresDocument4 pages1KGFDXP - Edwin TorresEdgar OrdoñezNo ratings yet

- Notes and Points On IMFDocument135 pagesNotes and Points On IMFUnni AmpadiNo ratings yet

- Bfs - Unit II Short NotesDocument12 pagesBfs - Unit II Short NotesvelmuruganbNo ratings yet

- Kushan Kushano-Sasanian and Kidarite Coi PDFDocument16 pagesKushan Kushano-Sasanian and Kidarite Coi PDFTommasoNo ratings yet

- CoinChangelly - Coinmarketcap Converter - Crypto Calculator - Bitcoin PriceDocument6 pagesCoinChangelly - Coinmarketcap Converter - Crypto Calculator - Bitcoin PriceCoin ChangellyNo ratings yet

- Yun Kwan Byung Vs PAGCOR December 11, 2009Document7 pagesYun Kwan Byung Vs PAGCOR December 11, 2009Darlene GanubNo ratings yet

- Economic AbbreviationsDocument6 pagesEconomic AbbreviationsqasmsNo ratings yet