Professional Documents

Culture Documents

Ch2 Assignment

Ch2 Assignment

Uploaded by

Rachit JainCopyright:

Available Formats

You might also like

- Ey Certificate in Financial Modelling and ValuationDocument8 pagesEy Certificate in Financial Modelling and ValuationThanh Nguyen100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- IRS-Service Look Up MBS by Cusip October 2007Document163 pagesIRS-Service Look Up MBS by Cusip October 2007tsherwood100% (1)

- Chapter 16Document25 pagesChapter 16Christian Blanza Lleva100% (2)

- Goodwill PDFDocument5 pagesGoodwill PDFBHUMIKA JAINNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- REVISION 2022 Part A - CH. 3Document2 pagesREVISION 2022 Part A - CH. 3ADAM ABDUL RAZACKNo ratings yet

- Goodwill 2024 PDF SPCCDocument44 pagesGoodwill 2024 PDF SPCCdestroyever0No ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- Change in Profit Sharing Ratio Among The Existing PartnersDocument15 pagesChange in Profit Sharing Ratio Among The Existing Partnersvajoj90546No ratings yet

- T1 GoodwillDocument1 pageT1 GoodwillSanchita KhattarNo ratings yet

- Grade-12 HHWDocument12 pagesGrade-12 HHWjanduharjinder65No ratings yet

- Girl's High School and College, Prayagraj 2020-2021Document2 pagesGirl's High School and College, Prayagraj 2020-2021Shinchan ShuklaNo ratings yet

- Valuation of GoodwillDocument4 pagesValuation of GoodwillPANKAJ's ACCOUNTANCY PATHSHALANo ratings yet

- GoodwillDocument19 pagesGoodwillmenekyakiaNo ratings yet

- Ch2 Nature and Valuation of GoodwillDocument4 pagesCh2 Nature and Valuation of GoodwillAmna SarfrazNo ratings yet

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Most Imp Questions Fundamentals To Admission - 240319 - 232457Document5 pagesMost Imp Questions Fundamentals To Admission - 240319 - 232457Qwe assdNo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- 12 Acc 1 ModelDocument11 pages12 Acc 1 ModeljessNo ratings yet

- Examin8 - Online TestDocument1 pageExamin8 - Online Test95mgbkxbn9No ratings yet

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocument3 pagesGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- QP Class Xii AccountancyDocument8 pagesQP Class Xii AccountancyRKS TECHNo ratings yet

- GR-12-ACCOUNTANCY-SA-2024Document19 pagesGR-12-ACCOUNTANCY-SA-2024bhumika motiyaniNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Goodwill Nature and ValuationDocument86 pagesGoodwill Nature and Valuationthakurdivyanka2007No ratings yet

- Rapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Document5 pagesRapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Swami NarangNo ratings yet

- Test Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Accounts and Business Studies Question BankDocument5 pagesAccounts and Business Studies Question BankAkshat TiwariNo ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- 1st b.com testDocument27 pages1st b.com testupparanarasimhulu4No ratings yet

- TS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)Document20 pagesTS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)Krishna singhNo ratings yet

- Goodwill 1Document3 pagesGoodwill 1D. Naarayan NandanNo ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- Worksheet-6 - Valuation of GoodwillDocument5 pagesWorksheet-6 - Valuation of GoodwillAryan JainNo ratings yet

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Class XII Accounts Set 4Document7 pagesClass XII Accounts Set 4HTML Learning HubNo ratings yet

- Fa May June - 2019Document5 pagesFa May June - 2019xodic49847No ratings yet

- Additional Questions 3Document4 pagesAdditional Questions 3Shyam SoniNo ratings yet

- Class XII Accountancy Unit Test 1 15.05.2021Document3 pagesClass XII Accountancy Unit Test 1 15.05.2021Mohm. Armaan MalikNo ratings yet

- Account MOCK Test - 2Document6 pagesAccount MOCK Test - 2CA ASPIRANTNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalNo ratings yet

- Accounts XiiDocument12 pagesAccounts XiiTanya JainNo ratings yet

- FR 2 QDocument14 pagesFR 2 QG INo ratings yet

- 1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Document6 pages1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Indra Kumar TiwariNo ratings yet

- Tutorial Pre & Post (Changes During The Year)Document5 pagesTutorial Pre & Post (Changes During The Year)Ellie QarinaNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- Financial Accounting NotesDocument25 pagesFinancial Accounting NotesNamish GuptaNo ratings yet

- MTP-5 QuestionDocument6 pagesMTP-5 Questionvirat rajputNo ratings yet

- Notes_Death of a Partner_c6a0578f-8281-4ed3-a44c-e2beeaaa6daaDocument12 pagesNotes_Death of a Partner_c6a0578f-8281-4ed3-a44c-e2beeaaa6daamda94355No ratings yet

- 12 Accounts 2020 21 Practice Paper 3Document9 pages12 Accounts 2020 21 Practice Paper 3Vijey RamalingamNo ratings yet

- SUMMER HOLILDAYS HomeworkDocument33 pagesSUMMER HOLILDAYS HomeworkLorem LoremNo ratings yet

- 1) AccountsDocument21 pages1) AccountsKrushna MateNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- English Arihant Cuet Modified PDFDocument113 pagesEnglish Arihant Cuet Modified PDFRachit JainNo ratings yet

- A 1112Document6 pagesA 1112Rachit JainNo ratings yet

- Themes of VistasDocument8 pagesThemes of VistasRachit JainNo ratings yet

- Competency Based Questions (ECO) - 11-02-2024Document2 pagesCompetency Based Questions (ECO) - 11-02-2024Rachit JainNo ratings yet

- Competency Based Question (BST) 11-02-2024Document2 pagesCompetency Based Question (BST) 11-02-2024Rachit JainNo ratings yet

- Capital Budgeting Answer KeyDocument31 pagesCapital Budgeting Answer KeyEsel DimapilisNo ratings yet

- Aahan Foods Group9Document11 pagesAahan Foods Group9TryNo ratings yet

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- When Value Failed - But Quantum Succeeded - The Honest Truth by Ajit Dayal PDFDocument7 pagesWhen Value Failed - But Quantum Succeeded - The Honest Truth by Ajit Dayal PDFdeepakc598No ratings yet

- CCI - Technical AnalysisDocument20 pagesCCI - Technical AnalysisqzcNo ratings yet

- Ikb Marketing Brochure PDF 000038548747Document74 pagesIkb Marketing Brochure PDF 000038548747hblodget6728No ratings yet

- Cash and Marketable SecuritiesDocument19 pagesCash and Marketable SecuritiesShiekyn Shafie100% (1)

- Sixth Departmental QuizDocument8 pagesSixth Departmental QuizMica R.No ratings yet

- Reading Stock Market PDFDocument3 pagesReading Stock Market PDFfiorella lillian tito cerronNo ratings yet

- Full Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full ChapterDocument36 pagesFull Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full Chapterpledgerzea.rus7as100% (26)

- 2) Short Notes: A) Forms of DividendDocument2 pages2) Short Notes: A) Forms of DividendTarunvir KukrejaNo ratings yet

- FM Theory Questions VtuDocument4 pagesFM Theory Questions VtuGururaj AvNo ratings yet

- Seventeenth Edition, Global Edition: Strategy, Balanced Scorecard, and Strategic Profitability AnalysisDocument41 pagesSeventeenth Edition, Global Edition: Strategy, Balanced Scorecard, and Strategic Profitability AnalysisAlanood WaelNo ratings yet

- 3-3-1-1 - 3-3-1-2 Lesson - FINMADocument8 pages3-3-1-1 - 3-3-1-2 Lesson - FINMAPgumballNo ratings yet

- ECO558Document26 pagesECO558Nur Adriana binti Abdul AzizNo ratings yet

- July2023 Acc117 Acc106 Test 2 QDocument5 pagesJuly2023 Acc117 Acc106 Test 2 QAmirul AmirNo ratings yet

- Chapter 6Document15 pagesChapter 6RebelliousRascalNo ratings yet

- All Abou EngulfDocument36 pagesAll Abou EngulfAlberto BonuccelliNo ratings yet

- Benefits and Limitations of Inflation Indexed Treasury BondsDocument16 pagesBenefits and Limitations of Inflation Indexed Treasury BondsBindia AhujaNo ratings yet

- FN107-1342 - Footnotes Levin-Coburn Report.Document1,037 pagesFN107-1342 - Footnotes Levin-Coburn Report.Rick ThomaNo ratings yet

- Impact of Festival Affecting Stock Market Indices in BRICS RewrittenDocument9 pagesImpact of Festival Affecting Stock Market Indices in BRICS RewrittensushmasreedaranNo ratings yet

- Alex Sharpe CaseDocument17 pagesAlex Sharpe Casemusunna galibNo ratings yet

- Res551 Lecture Notes Part BDocument106 pagesRes551 Lecture Notes Part BMUHAMMAD DANIEL BIN MOHD SALIMNo ratings yet

- Derivative MarketDocument6 pagesDerivative MarketRandy ManzanoNo ratings yet

- ISDA Equities Derivatives 2011 DefinitionsDocument333 pagesISDA Equities Derivatives 2011 Definitionsdafoozz100% (2)

- 4 Question - FinanceDocument22 pages4 Question - FinanceMuhammad IrfanNo ratings yet

- FinQuiz - CFA Level 3, June, 2017 - Study PlanDocument3 pagesFinQuiz - CFA Level 3, June, 2017 - Study PlanTaha OwaisNo ratings yet

Ch2 Assignment

Ch2 Assignment

Uploaded by

Rachit JainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch2 Assignment

Ch2 Assignment

Uploaded by

Rachit JainCopyright:

Available Formats

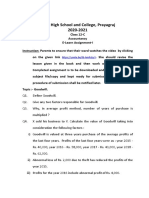

DELHI PUBLIC SCHOOL JALANDHAR

SUBJECT :ACCOUNTANCY CLASS :XII B

DATE:25-4-2023 ASSIGNMENT 2

TOPIC: GOODWILL- NATURE AND VALUATION

(AVERAGE PROFIT METHOD)

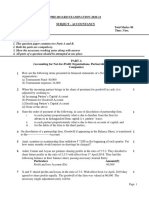

1.Goodwill is to be valued at three years purchase of four years average profit. Profits for last four years ending

on 31st March of the firm were:

2015 ₹ 12,000; 2016 ₹ 18,000; 2017 ₹ 16,000; 2018 ₹ 14,000.

Calculate amount of Goodwill.

2.Calculate the value of firm’s goodwill on the basis of one and half years purchase of the average profit of the

last three years. The profit for first year was ₹ 1,00,000, profit for the second year was twice the profit of the

first year and for the third year profit was one and half times of the profit of the second year.

3.A and B are partners sharing profits in the ratio of 3 : 2. They decided to admit C as a partner from

1st April, 2018 on the following terms:

(i) C will be given 2/5th share of the profit.

(ii) Goodwill of the firm be valued at two years purchase of three years normal average profit of the firm.

profits of the previous three years ended 31st March, were:

2018 – Profit ₹ 30,000 ( after debiting loss of stock by fire ₹ 40,000).

2017 – Loss ₹ 80,000 (includes voluntary retirement compensation paid ₹ 1,10,000).

2016 – Profit ₹ 1,10,000 (including a gain (profit) of ₹ 30,000 on the sale of fixed assets).

you are required to value the goodwill

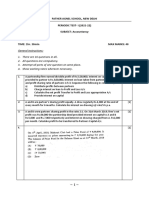

4.X and Y are partners sharing profits and losses in the ratio of 3 : 2. They admit Z into partnership for 1/4th

share in goodwill. Z brings in his share of goodwill in cash. Goodwill for this purpose is to be calculated at two

years purchase of the average normal profit of past three years. Profits of the last three years ended 31st March,

were:

2016 – Profit ₹ 50,000 (including profit on sale of assets ₹5,000).

2017 – Loss ₹ 20,000 (includes loss by fire ₹ 30,000).

2018 – Profit ₹ 70,000 (including insurance claim received ₹ 18,000 and interest on investments

and Dividend received ₹ 8,000).

Calculate value of goodwill.

5.Sumit purchased Amit’s business on 1st April, 2018. Goodwill was decided to be valued at two years’

purchase of average normal profit of last four years. The profits for the past four years were:

Books of Account revealed that:

(i) Abnormal loss of ₹ 20,000 was debited to Profit and Loss Account for the year ended 31st March,

2015.

1

(ii) A fixed asset was sold in the year ended 31st March, 2016 and gain (profit) of ₹ 25,000 was

credited to Profit and Loss Account.

(iii) In the year ended 31st March, 2017 assets of the firm were not insured due to oversight.

Insurance premium not paid was ₹ 15,000.

Calculate the value of goodwill.

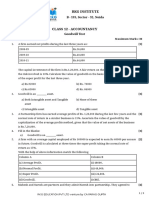

6.X and Y are partners in a firm. They admit Z into partnership for equal share. It was agreed that goodwill will

be valued at three years purchase of average profit of last five years. Profits for the last five years were:

Books of Account of the firm revealed that:

(i) The firm had gain (profit) of ₹ 50,000 from sale of machinery sold in the year ended 31st March,

2015. The gain (profit) was credited in Profit and Loss Account.

(ii) There was an abnormal loss of ₹ 20,000 incurred in the year ended 31st March, 2016 because of

a machine becoming obsolete in accident.

(iii) Overhauling cost of second hand machinery purchased on 1st July, 2016 amounting to ₹ 1,00,000 was

debited to Repairs Account. Depreciation is charged @ 20% p.a. on Written Down Value Method.

Calculate the value of goodwill.

(Date of submission-27 April,2023)

You might also like

- Ey Certificate in Financial Modelling and ValuationDocument8 pagesEy Certificate in Financial Modelling and ValuationThanh Nguyen100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- IRS-Service Look Up MBS by Cusip October 2007Document163 pagesIRS-Service Look Up MBS by Cusip October 2007tsherwood100% (1)

- Chapter 16Document25 pagesChapter 16Christian Blanza Lleva100% (2)

- Goodwill PDFDocument5 pagesGoodwill PDFBHUMIKA JAINNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- Good Will Tuition QuestionsDocument3 pagesGood Will Tuition QuestionsKunika DubeyNo ratings yet

- REVISION 2022 Part A - CH. 3Document2 pagesREVISION 2022 Part A - CH. 3ADAM ABDUL RAZACKNo ratings yet

- Goodwill 2024 PDF SPCCDocument44 pagesGoodwill 2024 PDF SPCCdestroyever0No ratings yet

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- Change in Profit Sharing Ratio Among The Existing PartnersDocument15 pagesChange in Profit Sharing Ratio Among The Existing Partnersvajoj90546No ratings yet

- T1 GoodwillDocument1 pageT1 GoodwillSanchita KhattarNo ratings yet

- Grade-12 HHWDocument12 pagesGrade-12 HHWjanduharjinder65No ratings yet

- Girl's High School and College, Prayagraj 2020-2021Document2 pagesGirl's High School and College, Prayagraj 2020-2021Shinchan ShuklaNo ratings yet

- Valuation of GoodwillDocument4 pagesValuation of GoodwillPANKAJ's ACCOUNTANCY PATHSHALANo ratings yet

- GoodwillDocument19 pagesGoodwillmenekyakiaNo ratings yet

- Ch2 Nature and Valuation of GoodwillDocument4 pagesCh2 Nature and Valuation of GoodwillAmna SarfrazNo ratings yet

- Valuation of Goodwill Class NotesDocument4 pagesValuation of Goodwill Class NotesRajesh NangaliaNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Most Imp Questions Fundamentals To Admission - 240319 - 232457Document5 pagesMost Imp Questions Fundamentals To Admission - 240319 - 232457Qwe assdNo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- RKG Imp Q (CH 1 & 2) DoneDocument3 pagesRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25No ratings yet

- 12 Acc 1 ModelDocument11 pages12 Acc 1 ModeljessNo ratings yet

- Examin8 - Online TestDocument1 pageExamin8 - Online Test95mgbkxbn9No ratings yet

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocument3 pagesGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- QP Class Xii AccountancyDocument8 pagesQP Class Xii AccountancyRKS TECHNo ratings yet

- GR-12-ACCOUNTANCY-SA-2024Document19 pagesGR-12-ACCOUNTANCY-SA-2024bhumika motiyaniNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Goodwill Nature and ValuationDocument86 pagesGoodwill Nature and Valuationthakurdivyanka2007No ratings yet

- Rapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Document5 pagesRapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Swami NarangNo ratings yet

- Test Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Accounts and Business Studies Question BankDocument5 pagesAccounts and Business Studies Question BankAkshat TiwariNo ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- 1st b.com testDocument27 pages1st b.com testupparanarasimhulu4No ratings yet

- TS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)Document20 pagesTS Grewal Solution Class 12 Chapter 2 Goodwill Nature and Valuation (2018 2019)Krishna singhNo ratings yet

- Goodwill 1Document3 pagesGoodwill 1D. Naarayan NandanNo ratings yet

- Change in Psr-12th Commerce-AccountancyDocument5 pagesChange in Psr-12th Commerce-Accountancysinghharshu3222No ratings yet

- Worksheet-6 - Valuation of GoodwillDocument5 pagesWorksheet-6 - Valuation of GoodwillAryan JainNo ratings yet

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Class XII Accounts Set 4Document7 pagesClass XII Accounts Set 4HTML Learning HubNo ratings yet

- Fa May June - 2019Document5 pagesFa May June - 2019xodic49847No ratings yet

- Additional Questions 3Document4 pagesAdditional Questions 3Shyam SoniNo ratings yet

- Class XII Accountancy Unit Test 1 15.05.2021Document3 pagesClass XII Accountancy Unit Test 1 15.05.2021Mohm. Armaan MalikNo ratings yet

- Account MOCK Test - 2Document6 pagesAccount MOCK Test - 2CA ASPIRANTNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalNo ratings yet

- Accounts XiiDocument12 pagesAccounts XiiTanya JainNo ratings yet

- FR 2 QDocument14 pagesFR 2 QG INo ratings yet

- 1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Document6 pages1,60,000. C Is Admitted and New Profit Sharing Ratio Is Agreed at 6: 9Indra Kumar TiwariNo ratings yet

- Tutorial Pre & Post (Changes During The Year)Document5 pagesTutorial Pre & Post (Changes During The Year)Ellie QarinaNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- Financial Accounting NotesDocument25 pagesFinancial Accounting NotesNamish GuptaNo ratings yet

- MTP-5 QuestionDocument6 pagesMTP-5 Questionvirat rajputNo ratings yet

- Notes_Death of a Partner_c6a0578f-8281-4ed3-a44c-e2beeaaa6daaDocument12 pagesNotes_Death of a Partner_c6a0578f-8281-4ed3-a44c-e2beeaaa6daamda94355No ratings yet

- 12 Accounts 2020 21 Practice Paper 3Document9 pages12 Accounts 2020 21 Practice Paper 3Vijey RamalingamNo ratings yet

- SUMMER HOLILDAYS HomeworkDocument33 pagesSUMMER HOLILDAYS HomeworkLorem LoremNo ratings yet

- 1) AccountsDocument21 pages1) AccountsKrushna MateNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- English Arihant Cuet Modified PDFDocument113 pagesEnglish Arihant Cuet Modified PDFRachit JainNo ratings yet

- A 1112Document6 pagesA 1112Rachit JainNo ratings yet

- Themes of VistasDocument8 pagesThemes of VistasRachit JainNo ratings yet

- Competency Based Questions (ECO) - 11-02-2024Document2 pagesCompetency Based Questions (ECO) - 11-02-2024Rachit JainNo ratings yet

- Competency Based Question (BST) 11-02-2024Document2 pagesCompetency Based Question (BST) 11-02-2024Rachit JainNo ratings yet

- Capital Budgeting Answer KeyDocument31 pagesCapital Budgeting Answer KeyEsel DimapilisNo ratings yet

- Aahan Foods Group9Document11 pagesAahan Foods Group9TryNo ratings yet

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- When Value Failed - But Quantum Succeeded - The Honest Truth by Ajit Dayal PDFDocument7 pagesWhen Value Failed - But Quantum Succeeded - The Honest Truth by Ajit Dayal PDFdeepakc598No ratings yet

- CCI - Technical AnalysisDocument20 pagesCCI - Technical AnalysisqzcNo ratings yet

- Ikb Marketing Brochure PDF 000038548747Document74 pagesIkb Marketing Brochure PDF 000038548747hblodget6728No ratings yet

- Cash and Marketable SecuritiesDocument19 pagesCash and Marketable SecuritiesShiekyn Shafie100% (1)

- Sixth Departmental QuizDocument8 pagesSixth Departmental QuizMica R.No ratings yet

- Reading Stock Market PDFDocument3 pagesReading Stock Market PDFfiorella lillian tito cerronNo ratings yet

- Full Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full ChapterDocument36 pagesFull Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full Chapterpledgerzea.rus7as100% (26)

- 2) Short Notes: A) Forms of DividendDocument2 pages2) Short Notes: A) Forms of DividendTarunvir KukrejaNo ratings yet

- FM Theory Questions VtuDocument4 pagesFM Theory Questions VtuGururaj AvNo ratings yet

- Seventeenth Edition, Global Edition: Strategy, Balanced Scorecard, and Strategic Profitability AnalysisDocument41 pagesSeventeenth Edition, Global Edition: Strategy, Balanced Scorecard, and Strategic Profitability AnalysisAlanood WaelNo ratings yet

- 3-3-1-1 - 3-3-1-2 Lesson - FINMADocument8 pages3-3-1-1 - 3-3-1-2 Lesson - FINMAPgumballNo ratings yet

- ECO558Document26 pagesECO558Nur Adriana binti Abdul AzizNo ratings yet

- July2023 Acc117 Acc106 Test 2 QDocument5 pagesJuly2023 Acc117 Acc106 Test 2 QAmirul AmirNo ratings yet

- Chapter 6Document15 pagesChapter 6RebelliousRascalNo ratings yet

- All Abou EngulfDocument36 pagesAll Abou EngulfAlberto BonuccelliNo ratings yet

- Benefits and Limitations of Inflation Indexed Treasury BondsDocument16 pagesBenefits and Limitations of Inflation Indexed Treasury BondsBindia AhujaNo ratings yet

- FN107-1342 - Footnotes Levin-Coburn Report.Document1,037 pagesFN107-1342 - Footnotes Levin-Coburn Report.Rick ThomaNo ratings yet

- Impact of Festival Affecting Stock Market Indices in BRICS RewrittenDocument9 pagesImpact of Festival Affecting Stock Market Indices in BRICS RewrittensushmasreedaranNo ratings yet

- Alex Sharpe CaseDocument17 pagesAlex Sharpe Casemusunna galibNo ratings yet

- Res551 Lecture Notes Part BDocument106 pagesRes551 Lecture Notes Part BMUHAMMAD DANIEL BIN MOHD SALIMNo ratings yet

- Derivative MarketDocument6 pagesDerivative MarketRandy ManzanoNo ratings yet

- ISDA Equities Derivatives 2011 DefinitionsDocument333 pagesISDA Equities Derivatives 2011 Definitionsdafoozz100% (2)

- 4 Question - FinanceDocument22 pages4 Question - FinanceMuhammad IrfanNo ratings yet

- FinQuiz - CFA Level 3, June, 2017 - Study PlanDocument3 pagesFinQuiz - CFA Level 3, June, 2017 - Study PlanTaha OwaisNo ratings yet