Professional Documents

Culture Documents

G - Casa Si Banca - Cash and Bank

G - Casa Si Banca - Cash and Bank

Uploaded by

ovidiu.tisloveanuCopyright:

Available Formats

You might also like

- Internal Audit Checklist of Real EstateDocument41 pagesInternal Audit Checklist of Real Estatemaahi782% (45)

- Accounts Dept Audit ChecklistDocument3 pagesAccounts Dept Audit Checklistandruta1978100% (4)

- Internal Audit Department Hotel Audit ProgramDocument17 pagesInternal Audit Department Hotel Audit ProgramIdo DodyNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Statutory Audit ProgramDocument6 pagesStatutory Audit Programsahil19feb100% (6)

- Cash - TeachersDocument12 pagesCash - TeachersJustin ManaogNo ratings yet

- Bank Branch Audit ManualDocument55 pagesBank Branch Audit ManualNeeraj Goyal100% (1)

- P - VENITURI SI CHELT FIN - Financial Inc&expDocument1 pageP - VENITURI SI CHELT FIN - Financial Inc&expovidiu.tisloveanuNo ratings yet

- K - DATORII PE TL - Non-Current LiabilitiesDocument1 pageK - DATORII PE TL - Non-Current Liabilitiesovidiu.tisloveanuNo ratings yet

- Rekonsiliasi Bank 1718764831Document11 pagesRekonsiliasi Bank 1718764831dqk2tqvpnhNo ratings yet

- 03 - CCA Report - Quarterly - OldDocument3 pages03 - CCA Report - Quarterly - Oldpave.scgroupNo ratings yet

- 01 - Audit of Cash - PrE 325Document32 pages01 - Audit of Cash - PrE 325Eloiza Madonza ComilangNo ratings yet

- Accounting: 1. Rreconciling The Bank StatementDocument5 pagesAccounting: 1. Rreconciling The Bank StatementtetshevaNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- F - Creante Clienti - ReceivablesDocument2 pagesF - Creante Clienti - Receivablesovidiu.tisloveanuNo ratings yet

- Audit ProgramDocument9 pagesAudit ProgramChris Ian TagsipNo ratings yet

- Booking of Expenses To Correct Account HeadDocument2 pagesBooking of Expenses To Correct Account HeadVinay SinghNo ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationMai SaberolaNo ratings yet

- Hotel Audit ProgramDocument17 pagesHotel Audit ProgramOlugbenga Adedapo100% (2)

- L FURNIZORI SuppliersDocument2 pagesL FURNIZORI Suppliersovidiu.tisloveanuNo ratings yet

- Bookkeeping To Trial Balance 9Document17 pagesBookkeeping To Trial Balance 9elelwaniNo ratings yet

- Preparation of Bank Reconciliation Statement With Amended Cash BookDocument20 pagesPreparation of Bank Reconciliation Statement With Amended Cash BookNayanNo ratings yet

- Audit ChecklistDocument46 pagesAudit ChecklistCA Gourav Jashnani67% (3)

- Core Text Module 2 Session 3Document5 pagesCore Text Module 2 Session 3apple_doctoleroNo ratings yet

- Audit ProceduresDocument5 pagesAudit ProceduresAna RetNo ratings yet

- Accounting Worksheet: What Is A Worksheet?Document7 pagesAccounting Worksheet: What Is A Worksheet?ScribdTranslationsNo ratings yet

- Lesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsDocument7 pagesLesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsJulliene Sanchez DamianNo ratings yet

- Audit Manual For CoopsDocument35 pagesAudit Manual For CoopsowieNo ratings yet

- Explain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageDocument5 pagesExplain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageBeyonce SmithNo ratings yet

- Project On Finalization of Partnership FirmDocument38 pagesProject On Finalization of Partnership Firmvenkynaidu67% (3)

- Journal Accounts To Trial BalanceDocument47 pagesJournal Accounts To Trial Balancebhaskyban100% (1)

- Activities of Branches and Other Units of The BankDocument32 pagesActivities of Branches and Other Units of The BankMegbaru MisikirNo ratings yet

- QuesDocument4 pagesQuesSreejith NairNo ratings yet

- Auditing and Accounting Auditing Cash & Bank Balances: ObjectiveDocument3 pagesAuditing and Accounting Auditing Cash & Bank Balances: ObjectiveMohit SainiNo ratings yet

- Special Journals and Internal ControlDocument16 pagesSpecial Journals and Internal ControlFarah PatelNo ratings yet

- Accounting Cycle: Transaction Analysis Journalizing Posting Unadjusted Trial BalanceDocument28 pagesAccounting Cycle: Transaction Analysis Journalizing Posting Unadjusted Trial BalanceLOURIE JANE GULLEMNo ratings yet

- Completing The Accounting CycleDocument3 pagesCompleting The Accounting CycleHeeseung LeeNo ratings yet

- About The AuthorDocument11 pagesAbout The AuthorYassi CurtisNo ratings yet

- Accounts PDFDocument46 pagesAccounts PDFArushi Singh100% (1)

- 04 Accounting For Service BusinessDocument37 pages04 Accounting For Service Businesscarlo bundalian100% (1)

- UCSB Campus Information & Procedure Manual Reviewing & Reconciling TheDocument6 pagesUCSB Campus Information & Procedure Manual Reviewing & Reconciling Themansoor2685No ratings yet

- VJ Mini ProjectDocument10 pagesVJ Mini ProjectRAKESH VARMA100% (1)

- Statutory Audit ProgramDocument7 pagesStatutory Audit ProgramSuman Pyatha0% (1)

- Internal Audit AccountsDocument9 pagesInternal Audit AccountsKanaka Raja CNo ratings yet

- VJ Mini ProjectDocument20 pagesVJ Mini ProjectRAKESH VARMANo ratings yet

- Revenue AuditDocument4 pagesRevenue AuditSaurabh SanandNo ratings yet

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- Bank Reconciliation StatementDocument6 pagesBank Reconciliation StatementamnatariqshahNo ratings yet

- Bank Reconciliation (Theories and Concept) : Bank Reconciliation, According To Williams, Haka, Et - Al. (2008)Document3 pagesBank Reconciliation (Theories and Concept) : Bank Reconciliation, According To Williams, Haka, Et - Al. (2008)Princess MagpatocNo ratings yet

- Intermediate Accounting I - Notes (9.13.2022)Document18 pagesIntermediate Accounting I - Notes (9.13.2022)Mainit, Shiela Mae, S.No ratings yet

- Abm 1 Midterm Marlowne Brialle T. GalaponDocument9 pagesAbm 1 Midterm Marlowne Brialle T. GalaponCharles Elquime GalaponNo ratings yet

- Accounting For Service Business Lecture 04Document4 pagesAccounting For Service Business Lecture 04Wrhed ValentinNo ratings yet

- Explain Bank Reconciliation Statement. Why Is It PreparedDocument6 pagesExplain Bank Reconciliation Statement. Why Is It Preparedjoker.dutta100% (1)

- Acc201 Su2Document5 pagesAcc201 Su2Gwyneth LimNo ratings yet

- W-AP - Administration and Selling ExpensesDocument15 pagesW-AP - Administration and Selling ExpensesPopeye AlexNo ratings yet

- Project ReportDocument75 pagesProject ReportPankaj ThakurNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Inventories Questions Edpalina-IsidroDocument2 pagesInventories Questions Edpalina-IsidroAndrea Florence Guy VidalNo ratings yet

- EXEMPTIONDocument15 pagesEXEMPTIONAndrey PavlovskiyNo ratings yet

- CH 3Document40 pagesCH 3nigoxiy168No ratings yet

- INB302 Individual Assignment ID 1722075Document3 pagesINB302 Individual Assignment ID 1722075Jagannath SahaNo ratings yet

- Types of Businesses Chart WorksheetDocument1 pageTypes of Businesses Chart WorksheetYousif Jamal Al Naqbi 12BENo ratings yet

- Chance of A Lifetime (A Case Study) : Assignment No. 2 (FPM)Document4 pagesChance of A Lifetime (A Case Study) : Assignment No. 2 (FPM)Hamza KhalidNo ratings yet

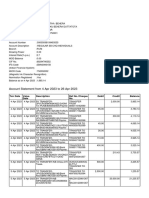

- Account Statement From 4 Apr 2023 To 26 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 4 Apr 2023 To 26 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceBIKRAM KUMAR BEHERANo ratings yet

- 55 Chapter 7 PracticeDocument1 page55 Chapter 7 Practicegio gioNo ratings yet

- History of The European UnionDocument21 pagesHistory of The European UnionSheejaVargheseNo ratings yet

- 4 AET2011 Conf VMin Nigerian Construction IndustryDocument8 pages4 AET2011 Conf VMin Nigerian Construction IndustryTolu BoltonNo ratings yet

- E-Internship Report 1Document13 pagesE-Internship Report 1Avani TomarNo ratings yet

- Real Estate (Knowledge) : Workshop 1 Guide Taking InstructionsDocument8 pagesReal Estate (Knowledge) : Workshop 1 Guide Taking InstructionsKimberly TanNo ratings yet

- Cibc 080222Document484 pagesCibc 080222nvnkmrnNo ratings yet

- BarangayDocument9 pagesBarangayJoebert SencioNo ratings yet

- 301 Public ExpenditureDocument72 pages301 Public ExpenditureZannath HabibNo ratings yet

- Business CombiDocument14 pagesBusiness CombiJohn Cesar PaunatNo ratings yet

- Inter. Acc. (Assigment) - 1Document3 pagesInter. Acc. (Assigment) - 1hudeyfaadam97No ratings yet

- Time Value of MoneyDocument17 pagesTime Value of Moneyabdiel100% (3)

- Wpi, Cpi and Inflation: Presented By-Ishita Navneet Ekta C. Sanghvi Anish Kumar Goel Bagish JhaDocument36 pagesWpi, Cpi and Inflation: Presented By-Ishita Navneet Ekta C. Sanghvi Anish Kumar Goel Bagish Jhaaditya_85No ratings yet

- Trade of Canada, 1933: Condensed Preliminary ReportDocument174 pagesTrade of Canada, 1933: Condensed Preliminary ReportBennett ChiuNo ratings yet

- SS Practice Question 1 RPGT & RPC Oct 2022Document3 pagesSS Practice Question 1 RPGT & RPC Oct 2022FeahRafeah KikiNo ratings yet

- Spiceland GE2 SM Ch7.1Document98 pagesSpiceland GE2 SM Ch7.1夜晨曦No ratings yet

- Payback BC MethodDocument1 pagePayback BC MethodJam LarsonNo ratings yet

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiNo ratings yet

- Mankiw Chapter 12 Mundell Fleming Model Is LM and ErDocument40 pagesMankiw Chapter 12 Mundell Fleming Model Is LM and Erbasirunjie86No ratings yet

- Strategic Plan 2022-26Document68 pagesStrategic Plan 2022-26jeremytoh89No ratings yet

- 4) Lawful Money SecretsDocument88 pages4) Lawful Money SecretsOneNationNo ratings yet

- 09-02-2021-CA ListDocument13 pages09-02-2021-CA ListNeeraj AroraNo ratings yet

- Chapter 1, Business MathDocument12 pagesChapter 1, Business MathSopheap CheaNo ratings yet

- A.S. GlittreDocument5 pagesA.S. GlittredeepakNo ratings yet

G - Casa Si Banca - Cash and Bank

G - Casa Si Banca - Cash and Bank

Uploaded by

ovidiu.tisloveanuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

G - Casa Si Banca - Cash and Bank

G - Casa Si Banca - Cash and Bank

Uploaded by

ovidiu.tisloveanuCopyright:

Available Formats

G – CASA SI BANCA / Cash and bank

Done/ No/

paper ref.

Not appl.

Working

Task description

1. Risk/control issues

Enquire those in charge about the controls which function in this area. Enquire about the application of the following

controls. Document the information obtained from the interviews in a working paper. Where applicable test the

application and functioning of controls (document the results of tests in the working paper). Draw a conclusion

regarding the control over this area and the level of reliance to be placed on controls (high, medium, low).

Is there a limit established for cash transactions (value of any one transaction, value of total transactions during one

day)?

Is there a limit established for maximum amount to be available in cash in the cashier?

Are overdraft facilities authorized and correctly operated within the limits defined by management?

Are fund transfers and automated methods of effecting banking transactions valid and authorized?

Are all bank accounts only established for a defined and authorized purpose?

Are all the prevailing banking terms and conditions optimized in terms of account type, transaction levels, interest

payable on balances, levels of charges?

Are there written procedures governing the set up and use of banking facilities established and implemented?

Are bank accounts (bank statements) regularly reconciled with accounting records?

Are excess balances promptly identified and authorized for transfer?

Are inter-account movements optimized to the benefit of the organization or to avoid shortfalls?

Does the company ensure that unauthorized overdrafts are avoided?

What prevents the processing of a transaction that would place an in account in overdraft?

Are overdraft limits established and if so, what prevents the limit being exceeded?

What controls are in place over the storage and usage of blank company cheques, and are all company cheques

accounted for?

2. Agree list of cash and bank accounts to the trial balance (A)

Obtain a list with all cash and bank accounts balances, check the mathematical accuracy of the total and trace the

total against cash and bank as per trial balance. Ensure there is no difference between breakdown and cash and

bank account balance as per trial balance.

3. Test cash and bank accounts (A, E, CO)

Trace all the items from the list obtained above against supporting documents (cash register, bank statements).

Investigate all the differences, if any.

4. Confirm bank accounts and special arrangements (C, A, E, RO)

Send request of confirmation of bank balances to respective banks, obtain confirmation letter from them and trace

the amount as per confirmation against amount as per bank balances breakdown. Investigate differences, if any and

determine whether any adjustments are necessary. Assess impact of special arrangements or restrictions identified

and determine whether disclosure is appropriate.

5. Test valuation of foreign currency balances (V, A)

Obtain a list with all cash and bank accounts balances per currency and amount. Value the cash and bank accounts

balances denominated in foreign currencies using exchange rates at the audit date and trace the total against cash

and bank as per trial balance.

6. Test cut-off of cash transactions (CO, A)

Examine transactions in the cash register for a period before and after the balance sheet date and check that they

are recorded in the correct period.

7. Test cut-off of interest income (CO, A)

Check the interest income for all bank accounts balances as per bank statements and make sure that all interest income

is correctly identified and recorded in profit and loss account for the period they are related to. Make sure that interest

income for all bank accounts are reasonably calculated by the bank. Re-perform the calculation of interest income using

the average bank balances and the interest rate granted by the bank for current accounts held at that every bank.

8. Consider financial position of depositories (V, PD)

Obtain a list with all bank balances by bank name, amount and currency. Check that cash is held in banks with low

risk of liquidity. Determine whether any special inquiries should be made regarding the financial conditions of

depositories where cash is held.

You might also like

- Internal Audit Checklist of Real EstateDocument41 pagesInternal Audit Checklist of Real Estatemaahi782% (45)

- Accounts Dept Audit ChecklistDocument3 pagesAccounts Dept Audit Checklistandruta1978100% (4)

- Internal Audit Department Hotel Audit ProgramDocument17 pagesInternal Audit Department Hotel Audit ProgramIdo DodyNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Statutory Audit ProgramDocument6 pagesStatutory Audit Programsahil19feb100% (6)

- Cash - TeachersDocument12 pagesCash - TeachersJustin ManaogNo ratings yet

- Bank Branch Audit ManualDocument55 pagesBank Branch Audit ManualNeeraj Goyal100% (1)

- P - VENITURI SI CHELT FIN - Financial Inc&expDocument1 pageP - VENITURI SI CHELT FIN - Financial Inc&expovidiu.tisloveanuNo ratings yet

- K - DATORII PE TL - Non-Current LiabilitiesDocument1 pageK - DATORII PE TL - Non-Current Liabilitiesovidiu.tisloveanuNo ratings yet

- Rekonsiliasi Bank 1718764831Document11 pagesRekonsiliasi Bank 1718764831dqk2tqvpnhNo ratings yet

- 03 - CCA Report - Quarterly - OldDocument3 pages03 - CCA Report - Quarterly - Oldpave.scgroupNo ratings yet

- 01 - Audit of Cash - PrE 325Document32 pages01 - Audit of Cash - PrE 325Eloiza Madonza ComilangNo ratings yet

- Accounting: 1. Rreconciling The Bank StatementDocument5 pagesAccounting: 1. Rreconciling The Bank StatementtetshevaNo ratings yet

- 1 The Accounting Equation Accounting Cycle Steps 1 4Document6 pages1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNo ratings yet

- F - Creante Clienti - ReceivablesDocument2 pagesF - Creante Clienti - Receivablesovidiu.tisloveanuNo ratings yet

- Audit ProgramDocument9 pagesAudit ProgramChris Ian TagsipNo ratings yet

- Booking of Expenses To Correct Account HeadDocument2 pagesBooking of Expenses To Correct Account HeadVinay SinghNo ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationMai SaberolaNo ratings yet

- Hotel Audit ProgramDocument17 pagesHotel Audit ProgramOlugbenga Adedapo100% (2)

- L FURNIZORI SuppliersDocument2 pagesL FURNIZORI Suppliersovidiu.tisloveanuNo ratings yet

- Bookkeeping To Trial Balance 9Document17 pagesBookkeeping To Trial Balance 9elelwaniNo ratings yet

- Preparation of Bank Reconciliation Statement With Amended Cash BookDocument20 pagesPreparation of Bank Reconciliation Statement With Amended Cash BookNayanNo ratings yet

- Audit ChecklistDocument46 pagesAudit ChecklistCA Gourav Jashnani67% (3)

- Core Text Module 2 Session 3Document5 pagesCore Text Module 2 Session 3apple_doctoleroNo ratings yet

- Audit ProceduresDocument5 pagesAudit ProceduresAna RetNo ratings yet

- Accounting Worksheet: What Is A Worksheet?Document7 pagesAccounting Worksheet: What Is A Worksheet?ScribdTranslationsNo ratings yet

- Lesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsDocument7 pagesLesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsJulliene Sanchez DamianNo ratings yet

- Audit Manual For CoopsDocument35 pagesAudit Manual For CoopsowieNo ratings yet

- Explain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageDocument5 pagesExplain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageBeyonce SmithNo ratings yet

- Project On Finalization of Partnership FirmDocument38 pagesProject On Finalization of Partnership Firmvenkynaidu67% (3)

- Journal Accounts To Trial BalanceDocument47 pagesJournal Accounts To Trial Balancebhaskyban100% (1)

- Activities of Branches and Other Units of The BankDocument32 pagesActivities of Branches and Other Units of The BankMegbaru MisikirNo ratings yet

- QuesDocument4 pagesQuesSreejith NairNo ratings yet

- Auditing and Accounting Auditing Cash & Bank Balances: ObjectiveDocument3 pagesAuditing and Accounting Auditing Cash & Bank Balances: ObjectiveMohit SainiNo ratings yet

- Special Journals and Internal ControlDocument16 pagesSpecial Journals and Internal ControlFarah PatelNo ratings yet

- Accounting Cycle: Transaction Analysis Journalizing Posting Unadjusted Trial BalanceDocument28 pagesAccounting Cycle: Transaction Analysis Journalizing Posting Unadjusted Trial BalanceLOURIE JANE GULLEMNo ratings yet

- Completing The Accounting CycleDocument3 pagesCompleting The Accounting CycleHeeseung LeeNo ratings yet

- About The AuthorDocument11 pagesAbout The AuthorYassi CurtisNo ratings yet

- Accounts PDFDocument46 pagesAccounts PDFArushi Singh100% (1)

- 04 Accounting For Service BusinessDocument37 pages04 Accounting For Service Businesscarlo bundalian100% (1)

- UCSB Campus Information & Procedure Manual Reviewing & Reconciling TheDocument6 pagesUCSB Campus Information & Procedure Manual Reviewing & Reconciling Themansoor2685No ratings yet

- VJ Mini ProjectDocument10 pagesVJ Mini ProjectRAKESH VARMA100% (1)

- Statutory Audit ProgramDocument7 pagesStatutory Audit ProgramSuman Pyatha0% (1)

- Internal Audit AccountsDocument9 pagesInternal Audit AccountsKanaka Raja CNo ratings yet

- VJ Mini ProjectDocument20 pagesVJ Mini ProjectRAKESH VARMANo ratings yet

- Revenue AuditDocument4 pagesRevenue AuditSaurabh SanandNo ratings yet

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- Bank Reconciliation StatementDocument6 pagesBank Reconciliation StatementamnatariqshahNo ratings yet

- Bank Reconciliation (Theories and Concept) : Bank Reconciliation, According To Williams, Haka, Et - Al. (2008)Document3 pagesBank Reconciliation (Theories and Concept) : Bank Reconciliation, According To Williams, Haka, Et - Al. (2008)Princess MagpatocNo ratings yet

- Intermediate Accounting I - Notes (9.13.2022)Document18 pagesIntermediate Accounting I - Notes (9.13.2022)Mainit, Shiela Mae, S.No ratings yet

- Abm 1 Midterm Marlowne Brialle T. GalaponDocument9 pagesAbm 1 Midterm Marlowne Brialle T. GalaponCharles Elquime GalaponNo ratings yet

- Accounting For Service Business Lecture 04Document4 pagesAccounting For Service Business Lecture 04Wrhed ValentinNo ratings yet

- Explain Bank Reconciliation Statement. Why Is It PreparedDocument6 pagesExplain Bank Reconciliation Statement. Why Is It Preparedjoker.dutta100% (1)

- Acc201 Su2Document5 pagesAcc201 Su2Gwyneth LimNo ratings yet

- W-AP - Administration and Selling ExpensesDocument15 pagesW-AP - Administration and Selling ExpensesPopeye AlexNo ratings yet

- Project ReportDocument75 pagesProject ReportPankaj ThakurNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Inventories Questions Edpalina-IsidroDocument2 pagesInventories Questions Edpalina-IsidroAndrea Florence Guy VidalNo ratings yet

- EXEMPTIONDocument15 pagesEXEMPTIONAndrey PavlovskiyNo ratings yet

- CH 3Document40 pagesCH 3nigoxiy168No ratings yet

- INB302 Individual Assignment ID 1722075Document3 pagesINB302 Individual Assignment ID 1722075Jagannath SahaNo ratings yet

- Types of Businesses Chart WorksheetDocument1 pageTypes of Businesses Chart WorksheetYousif Jamal Al Naqbi 12BENo ratings yet

- Chance of A Lifetime (A Case Study) : Assignment No. 2 (FPM)Document4 pagesChance of A Lifetime (A Case Study) : Assignment No. 2 (FPM)Hamza KhalidNo ratings yet

- Account Statement From 4 Apr 2023 To 26 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 4 Apr 2023 To 26 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceBIKRAM KUMAR BEHERANo ratings yet

- 55 Chapter 7 PracticeDocument1 page55 Chapter 7 Practicegio gioNo ratings yet

- History of The European UnionDocument21 pagesHistory of The European UnionSheejaVargheseNo ratings yet

- 4 AET2011 Conf VMin Nigerian Construction IndustryDocument8 pages4 AET2011 Conf VMin Nigerian Construction IndustryTolu BoltonNo ratings yet

- E-Internship Report 1Document13 pagesE-Internship Report 1Avani TomarNo ratings yet

- Real Estate (Knowledge) : Workshop 1 Guide Taking InstructionsDocument8 pagesReal Estate (Knowledge) : Workshop 1 Guide Taking InstructionsKimberly TanNo ratings yet

- Cibc 080222Document484 pagesCibc 080222nvnkmrnNo ratings yet

- BarangayDocument9 pagesBarangayJoebert SencioNo ratings yet

- 301 Public ExpenditureDocument72 pages301 Public ExpenditureZannath HabibNo ratings yet

- Business CombiDocument14 pagesBusiness CombiJohn Cesar PaunatNo ratings yet

- Inter. Acc. (Assigment) - 1Document3 pagesInter. Acc. (Assigment) - 1hudeyfaadam97No ratings yet

- Time Value of MoneyDocument17 pagesTime Value of Moneyabdiel100% (3)

- Wpi, Cpi and Inflation: Presented By-Ishita Navneet Ekta C. Sanghvi Anish Kumar Goel Bagish JhaDocument36 pagesWpi, Cpi and Inflation: Presented By-Ishita Navneet Ekta C. Sanghvi Anish Kumar Goel Bagish Jhaaditya_85No ratings yet

- Trade of Canada, 1933: Condensed Preliminary ReportDocument174 pagesTrade of Canada, 1933: Condensed Preliminary ReportBennett ChiuNo ratings yet

- SS Practice Question 1 RPGT & RPC Oct 2022Document3 pagesSS Practice Question 1 RPGT & RPC Oct 2022FeahRafeah KikiNo ratings yet

- Spiceland GE2 SM Ch7.1Document98 pagesSpiceland GE2 SM Ch7.1夜晨曦No ratings yet

- Payback BC MethodDocument1 pagePayback BC MethodJam LarsonNo ratings yet

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiNo ratings yet

- Mankiw Chapter 12 Mundell Fleming Model Is LM and ErDocument40 pagesMankiw Chapter 12 Mundell Fleming Model Is LM and Erbasirunjie86No ratings yet

- Strategic Plan 2022-26Document68 pagesStrategic Plan 2022-26jeremytoh89No ratings yet

- 4) Lawful Money SecretsDocument88 pages4) Lawful Money SecretsOneNationNo ratings yet

- 09-02-2021-CA ListDocument13 pages09-02-2021-CA ListNeeraj AroraNo ratings yet

- Chapter 1, Business MathDocument12 pagesChapter 1, Business MathSopheap CheaNo ratings yet

- A.S. GlittreDocument5 pagesA.S. GlittredeepakNo ratings yet