Professional Documents

Culture Documents

Mitteilungszentrale - Mitteilungen.steuerauszug 2023 CSS Borislav Vulic

Mitteilungszentrale - Mitteilungen.steuerauszug 2023 CSS Borislav Vulic

Uploaded by

Borislav VulicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mitteilungszentrale - Mitteilungen.steuerauszug 2023 CSS Borislav Vulic

Mitteilungszentrale - Mitteilungen.steuerauszug 2023 CSS Borislav Vulic

Uploaded by

Borislav VulicCopyright:

Available Formats

CSS Your direct contact

Agentur Brig Customer Service Center

Furkastrasse 34 Phone 0844 277 277

3900 Brig Monday to Friday, 8 - 18h

Mr

Borislav Vulic

c/o Bomini GmbH

Gliserallee 1

3902 Glis

Brig, 13.01.2024

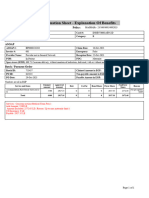

Overview of premiums and costs for the 2023 tax year

Insured person: Vulic, Borislav (Client number: 779-01-516)

Date of birth: 04.07.1989

Invoices processed from/to: 01.01.2023 – 31.12.2023

Overview of premiums Amount in CHF

Basic insurance (KVG) 4'230.00

Total invoiced premiums 4'230.00

Overview of benefits

Total invoice amount 573.05

Insured costs (incl. deductible and retention fee) -573.05

Non-insured costs 0.00

Your co-payment

Deductible 300.00

Retention fee 27.35

Non-insured costs 0.00

Total invoiced costs 327.35

Any non-insured costs relating to illness, accident, dental treatment and disability should be deducted from your taxable

income in accordance with the thresholds set by your canton of residence. Please see the following pages for details of your

invoices. You may also deduct your deductible and retention fee from your taxable income.

If you have any questions or concerns, please get in touch – we will be happy to help.

Legal entity for the basic insurance (KVG): CSS Kranken-Versicherung AG

Legal entity for supplementary insurance (VVG): CSS Versicherung AG

373266997 / 3 / 0180247 /XmdKwMNsRFm9U3jKyV3Yaw-001/avis/01/d0329/3.43.1//en/ 0180247 / 0147601 / 0458064 /%%PRDEV%% Page 1 / 1

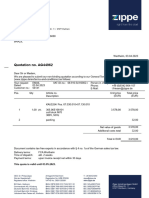

Detailed statement of health costs 2023 for the tax return

Insured person: Vulic, Borislav (Client number: 779-01-516)

Date of birth: 04.07.1989

Invoices processed from/to: 01.01.2023 – 31.12.2023

Insurer’s Non-insured

Date Invoicing party Amount portion costs Your share

17.02.2023 Familienpraxis König AG, Brig 260.95 260.95

31.03.2023 Apotheke Dr. Guntern AG, Brig 23.55 23.55

31.03.2023 Apotheke Dr. Guntern AG, Brig 48.00 29.25 18.75

12.05.2023 City-Apotheke, Brig 6.25 5.60 0.65

26.05.2023 HVS-SZO Spital Visp, Visp 234.30 210.85 23.45

Total 573.05 245.70 0.00 327.35

Legal entity for the basic insurance (KVG): CSS Kranken-Versicherung AG

Legal entity for supplementary insurance (VVG): CSS Versicherung AG

373266997 / 3 / 0180247 /XmdKwMNsRFm9U3jKyV3Yaw-001/avis/01/d0329/3.43.1/60/en/ 0180247 / 0147601 / 0458065 /%%PRDEV%% Page 1 / 1

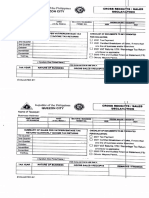

Client information

Notes, guidance, explanations and

information on the overview of

premiums and costs for the tax year.

The most important points in brief Frequently asked questions – helpful

answers

Enclosed please find a statement for your tax return. Depending on

the canton where you live, illness and accident costs, as well as the Why doesn’t the tax statement list all the benefits from the past

premiums you have paid, may be deducted from tax. Please contact year?

your local tax office for more information. • The tax statement covers the benefits settled by us between

1 January and 31 December, regardless of the date of treatment.

Once you have requested the statement, it will be sent to you each If we have not settled all of your bills by 31 December, the re-

year by the end of February. This is done automatically, and you will mainder will appear on the tax statement for the following year.

not have to order the statement again in the future.

Why are the deductible and retention fee higher than they appear

on my policy?

• The date of treatment is used as the basis for calculating the

deductible and retention fee.

As it is our settlement date that is relevant where the tax state-

ment is concerned, it is possible that it may also contain benefits

and their co-payments from previous years.

This may then result in the deductible and retention fee being

higher than they are listed on the policy.

• The deductible stated on the tax statement may consist of those

from both basic and supplementary insurance.

The statement contains a bill which has since been corrected.

Will I receive a new cost overview?

• A correction will not generate a new tax statement. As the cor-

rection was made the subsequent year, it will not appear until that

year’s statement.

Why can’t I see my family members’ tax statements in myCSS?

• You will only be able to view the tax statement for the person in

question if you are designated as the recipient of their correspon-

dence. If you would like to change this, please let us know, and

we will be pleased to do so. GRA-921e-04.22-occ

373266997 / 3 / 0180247 /XmdKwMNsRFm9U3jKyV3Yaw-001/avis/01/d0329/3.43.1/60/en/ 0180247 / 0147601 / 0458066 /%%PRDEV%%

You might also like

- Premium ReceiptDocument1 pagePremium Receiptkarthink123100% (1)

- CertificateDocument2 pagesCertificateMahmut SoyerNo ratings yet

- PremiumRept MDS - RameshDocument2 pagesPremiumRept MDS - Rameshnavengg521No ratings yet

- Premium ReceiptDocument1 pagePremium ReceiptPraba KaranNo ratings yet

- Accounts For Clubs and SocietiesDocument4 pagesAccounts For Clubs and SocietiesSimba Muhonde100% (2)

- Insurance Premium Payment Certification: E-Policy ServiceDocument2 pagesInsurance Premium Payment Certification: E-Policy ServiceMuntana TewpaingamNo ratings yet

- Transfer Quote 4 PDFDocument11 pagesTransfer Quote 4 PDFjarraspeedyNo ratings yet

- Pinkerton (A) - ExhibitsDocument7 pagesPinkerton (A) - ExhibitsFarrah ZhaoNo ratings yet

- Deed of Conditional Sale. SampleDocument2 pagesDeed of Conditional Sale. SampleWilson Manalang100% (1)

- Policy Borislav Vulic 20230301 10014241154Document5 pagesPolicy Borislav Vulic 20230301 10014241154Borislav VulicNo ratings yet

- 2024-01-21 Application Borislav VulicDocument6 pages2024-01-21 Application Borislav VulicBorislav VulicNo ratings yet

- OfferDocument4 pagesOfferBijoy babuNo ratings yet

- BCPRDFRZ C0000000 00 PN050763 915 220901CP 001Document8 pagesBCPRDFRZ C0000000 00 PN050763 915 220901CP 001GoldenJubliee 01No ratings yet

- NewPolicyDocuments 3Document8 pagesNewPolicyDocuments 3Luke RowlandNo ratings yet

- Premium Statements Borislav Vulic 2024-01!13!002112141504Document1 pagePremium Statements Borislav Vulic 2024-01!13!002112141504Borislav VulicNo ratings yet

- Mr. F.M. Apostol Str. Izvor 10 900206 MANGALIA Roemenie: Subject: Health Insurance TerminationDocument2 pagesMr. F.M. Apostol Str. Izvor 10 900206 MANGALIA Roemenie: Subject: Health Insurance TerminationFlorentin Cristian ApostolNo ratings yet

- Condiciones Particulares Ivan Bautista Bernal (2620) inDocument10 pagesCondiciones Particulares Ivan Bautista Bernal (2620) in68y2wczjc5No ratings yet

- HDFCGA0312202100003212Document8 pagesHDFCGA0312202100003212Dhanush Shiva Dollaiah0% (1)

- Muntiariani NTUC Income-InsuranceDocument2 pagesMuntiariani NTUC Income-InsuranceSyscom PrintingNo ratings yet

- Budget Insurance POLICY NUMBER 778754485Document13 pagesBudget Insurance POLICY NUMBER 778754485suzan moeketsiNo ratings yet

- Parents Insurance PremiumDocument1 pageParents Insurance Premiumprajeesh.vijayanNo ratings yet

- Myvhi Policy Document 11281889Document2 pagesMyvhi Policy Document 11281889Snjezana BosnjakNo ratings yet

- NewPolicyDocuments 2Document8 pagesNewPolicyDocuments 2S BarkerNo ratings yet

- Date: 05 Mar 2022 To,: (Please Quote This Reference Number in All Future Correspondence)Document2 pagesDate: 05 Mar 2022 To,: (Please Quote This Reference Number in All Future Correspondence)Sohan DasNo ratings yet

- Premium Statements Borislav Vulic 2023-05!13!001813127090Document1 pagePremium Statements Borislav Vulic 2023-05!13!001813127090Borislav VulicNo ratings yet

- 2023 Itr SushmithakuppusamiDocument18 pages2023 Itr SushmithakuppusamidennisNo ratings yet

- Ulip StatementDocument2 pagesUlip StatementShashwat DuggalNo ratings yet

- Supreme Transliner, Inc. vs. BPI Family Savings Bank, Inc. 644 SCRA 59, February 25, 2011Document6 pagesSupreme Transliner, Inc. vs. BPI Family Savings Bank, Inc. 644 SCRA 59, February 25, 2011Francise Mae Montilla MordenoNo ratings yet

- Congratulations! You Are Eligible To Receive A Bonus of 9,488.43 On Your Max Life Life Gain Premier For Paying All Your Premiums RegularlyDocument2 pagesCongratulations! You Are Eligible To Receive A Bonus of 9,488.43 On Your Max Life Life Gain Premier For Paying All Your Premiums RegularlyBhavik ThakerNo ratings yet

- Notice of Amended Assessment - Year Ended 30 June 2023Document4 pagesNotice of Amended Assessment - Year Ended 30 June 2023carmenzhou2001No ratings yet

- Leaflet Contributions 2024Document2 pagesLeaflet Contributions 2024tomislavdrvar798No ratings yet

- BP0000130263 1Document1 pageBP0000130263 1abanoub.ebrahiem253No ratings yet

- BP0000130263-1 1699190395990Document1 pageBP0000130263-1 1699190395990abanoub.ebrahiem253No ratings yet

- Ergun 20 Feb 24Document10 pagesErgun 20 Feb 24GuilhermeNo ratings yet

- Reliance Covid-19 Indemnity Policy-Certificate of InsuranceDocument5 pagesReliance Covid-19 Indemnity Policy-Certificate of InsurancePavan Kalyan UngaralaNo ratings yet

- Policy Account Statement 007562606 151317Document3 pagesPolicy Account Statement 007562606 151317Sandeep JoshiNo ratings yet

- Ulipstatement 2Document2 pagesUlipstatement 2Shashwat DuggalNo ratings yet

- Medical Insurance Mother - Cleaned.cleanedDocument1 pageMedical Insurance Mother - Cleaned.cleanedAdil KhanNo ratings yet

- TIA/AMI/V35Document6 pagesTIA/AMI/V35Chris MaynardNo ratings yet

- Document - 2023-08-02T140218.691Document2 pagesDocument - 2023-08-02T140218.691Tissie MkumbadzalaNo ratings yet

- Student Finance Account - LetterDocument2 pagesStudent Finance Account - Letterarthurh75005No ratings yet

- PremiumRept FamilyDocument2 pagesPremiumRept Familynavengg521No ratings yet

- Parents Mediclaim - 2023Document1 pageParents Mediclaim - 2023rohit.kedareNo ratings yet

- Kotak PolicyDocument2 pagesKotak Policybhavesh patilNo ratings yet

- Screenshot 2024-04-16 at 15.34.10Document3 pagesScreenshot 2024-04-16 at 15.34.10libbychizNo ratings yet

- A SabpcschDocument2 pagesA Sabpcschnatalieklemparova462No ratings yet

- Policy DocumentDocument36 pagesPolicy DocumentAsenNo ratings yet

- Your Semester Contribution: Seite 1Document5 pagesYour Semester Contribution: Seite 1IslamElGalyNo ratings yet

- MCLMDocument13 pagesMCLMcibil scoreNo ratings yet

- Medical Insurance Policy ParentsDocument1 pageMedical Insurance Policy Parentssivavm4No ratings yet

- Invoice Gh00094427Document1 pageInvoice Gh00094427Ahmed GomaaNo ratings yet

- WC Policy SingrauliDocument3 pagesWC Policy Singrauliskaurravneet1No ratings yet

- Ghi 71 23 0453652 000 - 20230516Document6 pagesGhi 71 23 0453652 000 - 20230516raju singhNo ratings yet

- Power Bill 7.27Document2 pagesPower Bill 7.27Jessica SantiagoNo ratings yet

- Date: 07 Jul 2021 To,: (Please Quote This Reference Number in All Future Correspondence)Document2 pagesDate: 07 Jul 2021 To,: (Please Quote This Reference Number in All Future Correspondence)Manish SharmaNo ratings yet

- AG44962Document2 pagesAG44962Ramon LeoneNo ratings yet

- Half Yearly Unit Statement: PSRV2810021041104Document3 pagesHalf Yearly Unit Statement: PSRV2810021041104GURUMOORTHY PNo ratings yet

- Self InsuranceDocument2 pagesSelf Insurancerajat.singhNo ratings yet

- 55DE80008891Document2 pages55DE80008891D KNo ratings yet

- INV1891216412Document6 pagesINV1891216412ahmedNo ratings yet

- Accrued CommissionDocument248 pagesAccrued CommissionShîmèlîs MèñğîstûNo ratings yet

- Policy Number: - Premium Paid Certificate For FY: #Total Amount Paid During The Financial YearDocument1 pagePolicy Number: - Premium Paid Certificate For FY: #Total Amount Paid During The Financial YearGeogy GeorgeNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Faq enDocument2 pagesFaq enBorislav VulicNo ratings yet

- Bacthera-ACR-Layout - Level 1 - Rev1 21-08-06Document1 pageBacthera-ACR-Layout - Level 1 - Rev1 21-08-06Borislav VulicNo ratings yet

- Policy Borislav Vulic 20230301 10014241154Document5 pagesPolicy Borislav Vulic 20230301 10014241154Borislav VulicNo ratings yet

- Datasheet COW LOTO Nov 2022Document2 pagesDatasheet COW LOTO Nov 2022Borislav VulicNo ratings yet

- Dvprogram State Gov Application AspxDocument1 pageDvprogram State Gov Application AspxBorislav VulicNo ratings yet

- 67081.d Original de 21202Document4 pages67081.d Original de 21202Borislav VulicNo ratings yet

- MHW Pid-740-Vu221-Mec-001Document1 pageMHW Pid-740-Vu221-Mec-001Borislav VulicNo ratings yet

- Premium Statements Borislav Vulic 2023-05!13!001813127090Document1 pagePremium Statements Borislav Vulic 2023-05!13!001813127090Borislav VulicNo ratings yet

- TransactionDocument1 pageTransactionBorislav VulicNo ratings yet

- (00 41 01) - Steuerbescheinigung - Deklaration - 21916278 - 319137 - 25Document3 pages(00 41 01) - Steuerbescheinigung - Deklaration - 21916278 - 319137 - 25Borislav VulicNo ratings yet

- Power Cable FundamentalsDocument1 pagePower Cable FundamentalsBorislav VulicNo ratings yet

- Policy or Procedure For Rules & Regulation Register For ISO 1Document2 pagesPolicy or Procedure For Rules & Regulation Register For ISO 1Borislav VulicNo ratings yet

- Suspended Personnel Platform Check ListDocument1 pageSuspended Personnel Platform Check ListBorislav VulicNo ratings yet

- ChemicalsafetyDocument12 pagesChemicalsafetyBorislav VulicNo ratings yet

- JobDocument42 pagesJobBorislav VulicNo ratings yet

- Streetsweeper Main TCH KLSTDocument1 pageStreetsweeper Main TCH KLSTBorislav VulicNo ratings yet

- Kundan KumarDocument2 pagesKundan KumarBorislav VulicNo ratings yet

- Fieldwork Leader's Health and Safety Checklist: Fieldwork Course Dates Name of Fieldwork Leader Signature DateDocument5 pagesFieldwork Leader's Health and Safety Checklist: Fieldwork Course Dates Name of Fieldwork Leader Signature DateBorislav VulicNo ratings yet

- Auto Updated HSSE DASH BOARDDocument132 pagesAuto Updated HSSE DASH BOARDBorislav VulicNo ratings yet

- Job Hazard Analysis Elevator Mechanic and Lead 7 2017Document6 pagesJob Hazard Analysis Elevator Mechanic and Lead 7 2017Borislav VulicNo ratings yet

- Questions - AnswersDocument19 pagesQuestions - AnswersBorislav VulicNo ratings yet

- 01 July 2022 Gulf Job Vacancies NewspaperDocument113 pages01 July 2022 Gulf Job Vacancies NewspaperBorislav VulicNo ratings yet

- Job Safety Analysis FormDocument1 pageJob Safety Analysis FormBorislav VulicNo ratings yet

- Chemical Safety Sheets ChemicalDocument1,064 pagesChemical Safety Sheets ChemicalBorislav VulicNo ratings yet

- Chemicals Hazard - Basics AwarnessDocument53 pagesChemicals Hazard - Basics AwarnessBorislav VulicNo ratings yet

- 4 Post Lift MaintenanceDocument4 pages4 Post Lift MaintenanceBorislav VulicNo ratings yet

- Harness Inspection Checklist: CommentsDocument1 pageHarness Inspection Checklist: CommentsBorislav VulicNo ratings yet

- 001 HSE Induction (Rev.02-Final)Document26 pages001 HSE Induction (Rev.02-Final)Borislav VulicNo ratings yet

- Chemical StorageDocument38 pagesChemical StorageBorislav VulicNo ratings yet

- Chemical Handling 1Document25 pagesChemical Handling 1Borislav VulicNo ratings yet

- 06 Financial Aspect FinalDocument19 pages06 Financial Aspect FinalRou JayNo ratings yet

- Rollins Corporation Is Estimating Its Wacc 2Document2 pagesRollins Corporation Is Estimating Its Wacc 2DoreenNo ratings yet

- Po000078223 PDFDocument2 pagesPo000078223 PDFSunil PatelNo ratings yet

- Business Partnership, Taxable Associations, Joint Venture, Joint Accounts or Co-OwnershipsDocument2 pagesBusiness Partnership, Taxable Associations, Joint Venture, Joint Accounts or Co-OwnershipsdailydoseoflawNo ratings yet

- Iesco Online Billl PDFDocument2 pagesIesco Online Billl PDFAsad AliNo ratings yet

- CH 14 Control Accounts Part 1Document8 pagesCH 14 Control Accounts Part 1BuntheaNo ratings yet

- DTTL Tax Global Transfer Pricing Guide 2014Document221 pagesDTTL Tax Global Transfer Pricing Guide 2014NTA0117No ratings yet

- 2022 GrossReceipts - SalesDeclarationFormDocument1 page2022 GrossReceipts - SalesDeclarationFormMark Anthony AlvarioNo ratings yet

- Financial Statements: Historical Results 2012 2013 2014Document2 pagesFinancial Statements: Historical Results 2012 2013 2014yugyeom rojasNo ratings yet

- Sample QuestionsDocument2 pagesSample QuestionsAsaduzzaman LimonNo ratings yet

- WCM Sum IcaiDocument32 pagesWCM Sum IcaiKumardeep SinghaNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013Eliza BethNo ratings yet

- Finac Chap 12 HWDocument2 pagesFinac Chap 12 HWGloria BeltranNo ratings yet

- (See Rule 11, 11E) Electronic Return Under The Maharashtra State Tax On Professions, Trades, Callings and Employments Act, 1975Document3 pages(See Rule 11, 11E) Electronic Return Under The Maharashtra State Tax On Professions, Trades, Callings and Employments Act, 1975Gabbar SinghNo ratings yet

- Uqld2915518153052999 Payment SummaryDocument1 pageUqld2915518153052999 Payment SummarylavidisNo ratings yet

- October 2020 Between Mr.B.JANARTHANAN S/O BALAKRISHNA NAIDU No.23/3 Varatharaj NagarDocument2 pagesOctober 2020 Between Mr.B.JANARTHANAN S/O BALAKRISHNA NAIDU No.23/3 Varatharaj NagarthanuNo ratings yet

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelNo ratings yet

- C14 CHP 12 2 Homework Sol S CorpsDocument6 pagesC14 CHP 12 2 Homework Sol S CorpsRimpy SondhNo ratings yet

- 3 Month Deferment Tax Instalment CP204Document1 page3 Month Deferment Tax Instalment CP204Alaya VirjaNo ratings yet

- Mr. Vitlesh PanditaDocument5 pagesMr. Vitlesh PanditaVitlesh PanditaNo ratings yet

- Name: - Date: - Level 12-Fundamentals of Accounting 2 Worksheet No. 7 I. Trial Balance and Financial Statement Preparation (50 Points)Document9 pagesName: - Date: - Level 12-Fundamentals of Accounting 2 Worksheet No. 7 I. Trial Balance and Financial Statement Preparation (50 Points)Kim FloresNo ratings yet

- Atria Convergence Technologies Limited, Due Date: 10/ /2020Document3 pagesAtria Convergence Technologies Limited, Due Date: 10/ /2020Siva Sagar JaggaNo ratings yet

- Agatha Is Planning To Start A New Business Venture and PDFDocument1 pageAgatha Is Planning To Start A New Business Venture and PDFDoreenNo ratings yet

- QuestionsDocument5 pagesQuestionsTris EatonNo ratings yet

- Chapter 16Document22 pagesChapter 16KENTANG GORENGNo ratings yet

- Theories of TaxationDocument4 pagesTheories of TaxationHyacinth Eiram AmahanCarumba LagahidNo ratings yet

- 4 5B Taxation of Individuals Graduated RatesDocument9 pages4 5B Taxation of Individuals Graduated RatesArgie DeguzmanNo ratings yet