Professional Documents

Culture Documents

Unit 2 w1

Unit 2 w1

Uploaded by

dharshana.segaranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 2 w1

Unit 2 w1

Uploaded by

dharshana.segaranCopyright:

Available Formats

UNIT 2

Corporate Valuation

1. The following financial information is available for company D, an unlisted

pharmaceutical company, which is being valued

EBITDA: 400 million

Book value of assets: 1,000 million

Sales: 2,500 million

Based on the evaluation of number of listed pharmaceutical companies A, B and C have been

found to be comparable to company D. The financial information for these companies is

given below:

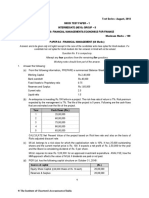

A B C

Sales 1600 2000 3200

EBITDA 280 360 480

Book Value of assets 800 1000 1400

Enterprise value (EV) 2000 3500 4200

Calculate the enterprise value of D using average value estimates.

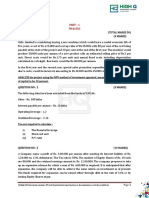

2. Following is the balance sheet of hypothetical company limited as on March 31, current

year:

(Rs in lakhs)

Liabilities Amount Assets Amount

Share Capital 40 Fixed Assets 150 120

40,000 11% preference shares Less: Depreciation 30

of Rs.100 each, fully paid up.

Current Assets

1,20,000 equity shares of 120 Stocks 100

Rs.100 each, fully paid up. Debtors 50

Cash & Bank 10

Profit & Loss Account 23

Preliminary Expenses 02

10% debentures 20

Trade Creditors 71

Provision for Income Tax 08

282 282

Additional Information:

i) A firm of professional valuers has provided the following market estimates of its various

assets: Fixed assets Rs.130 lakhs, stocks Rs102 lakhs, debtors Rs.45 lakhs. All other assets

are to be taken at their balance sheet values.

ii) The company is yet to declare and pay dividend on preference shares

iii) The valuers also estimate the current sale proceeds of the firm’s assets, in the event of its

liquidation: fixed assets Rs.105 lakhs, stock 90 lakhs, debtors Rs.40 lakhs. Besides, the firm

is to incur Rs.15 lakhs as liquidation costs.

You are required to compute the net asset value per share as per book value, market value and

liquidation value.

3. In the current year, a firm has reported a profit of Rs.65 lakhs, after paying taxes @ 35%.

On close examination, the analyst ascertains that the current year’s income includes: i)

extraordinary income of Rs.10 lakhs and ii) extraordinary losses of Rs.3 lakhs. Apart from

existing operations, which are normal in nature and are likely to continue in the future, the

company expects to launch a new product in the coming year.

Revenue and cost estimates in respect of the new product are as follows:

(Rs in lakhs)

Sales 60

Material Cost 15

Labour Cost (additional) 10

Allocated fixed cost. 5

Additional fixed cost 8

a) From the given information, compute the value of the business, given that capitalisation

rate applicable to such business in the market is 15 percent.

b) Determine the market price per share assuming

i. The company has 1,00,000 11% preference shares of Rs.100 each fully paid-up

ii. The company has 4,00,000 equity shares of Rs.100 each, fully paid-up

iii. P/E ratio 8 times

4. Suppose the firm has employed a total capital of Rs.1,000 lakhs (provided equally by 10

percent debt and 5 lakh equity shares of Rs.100 each), its cost of equity is 14% and it is

subject to corporate tax rate of 40 percent. The projected free cashflows to all investors of the

firm for 5 years are given below:

Year end Rs (in lakhs)

1 300

2 200

3 500

4 150

5 600

Compute a) valuation of firm b) valuation of equity shares. Assume 10 percent debt is

repayable at year 5 and interest is paid at each year end.

5. The following particulars are available in respect of a corporate:

1. Capital employed is Rs.500 million.

2. Operating profits after taxes for last three years are Rs.80 million, Rs.100 million,

Rs.90 million; current year operating profit after taxes is Rs.105 million.

3. Riskless rate of return is 10 percent.

4. Risk premium relevant to the business of corporate firm is 5 percent.

You are required to compute the value of goodwill, based on the present value of

super profits method. Super profits are to be computed on the basis of the average

profits of 4 years. It is expected that the firm is likely to earn super profits for the next

five years only.

6. The following particulars are available in respect of a corporate:

Future Maintainable Profit: Rs. 33.5 crores

Normal rate of return: 12% pa

Capital employed as on 31 March 20XX: Rs. 250 crores

Determine the value of goodwill assuming the firm will earn super profit for the next 5 years.

Also calculate the value of goodwill using capitalisation method.

You might also like

- Volkswagen Group: Adapting in The Age of AIDocument3 pagesVolkswagen Group: Adapting in The Age of AIBIBARI BORONo ratings yet

- Ais Problem 2.2Document21 pagesAis Problem 2.2Md Rifat Motaleb100% (1)

- How To Open A Coffee Shop: The Definitive GuideDocument20 pagesHow To Open A Coffee Shop: The Definitive GuideYuswa Yuswandhi67% (3)

- M3 - Valuation Question SetDocument13 pagesM3 - Valuation Question SetHetviNo ratings yet

- Financial Management PROBLEMS FROM UNIT - 2Document14 pagesFinancial Management PROBLEMS FROM UNIT - 2jeganrajrajNo ratings yet

- Attempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDocument23 pagesAttempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDiabolic Colt100% (1)

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- A Study of Shell Oil and Its Stakeholders in NigeriaDocument21 pagesA Study of Shell Oil and Its Stakeholders in NigeriaOloye Elayela100% (1)

- Leverages ProblemsDocument4 pagesLeverages Problemsk,hbibk,n50% (2)

- Problems On Leverage AnalysisDocument4 pagesProblems On Leverage AnalysisMandar SangleNo ratings yet

- Capital Structure and Leverages-ProblemsDocument7 pagesCapital Structure and Leverages-ProblemsUday GowdaNo ratings yet

- Unit 2 LeveragesDocument4 pagesUnit 2 Leveragesbhargavayg1915No ratings yet

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankDocument9 pagesDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniNo ratings yet

- FM II Case Study For ValuationsDocument2 pagesFM II Case Study For Valuationssiddhant kohliNo ratings yet

- M and A ExercisesDocument4 pagesM and A ExercisesSweet tripathiNo ratings yet

- Strategic Corporate FinanceDocument3 pagesStrategic Corporate FinanceNawaz GodilNo ratings yet

- FM Assignment MMS 21-23Document4 pagesFM Assignment MMS 21-23Mandar SangleNo ratings yet

- Work Book M5 AFMDocument5 pagesWork Book M5 AFMNaimeesha MattaparthiNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Commando Test On FM (COC, CSP, DP) : Ranker's ClassesDocument3 pagesCommando Test On FM (COC, CSP, DP) : Ranker's ClassesmuskanNo ratings yet

- Asset Base Approach ProblemsDocument5 pagesAsset Base Approach Problemspratik waliwandekarNo ratings yet

- Work Sheet 3 & 4 Business FinanceDocument3 pagesWork Sheet 3 & 4 Business FinancePrateek YadavNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalkimjethaNo ratings yet

- Coc Ques pt1Document4 pagesCoc Ques pt1dhall.tushar2004No ratings yet

- Leverage: Prepared By:-Priyanka GohilDocument23 pagesLeverage: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- WACC puOgaACHywDocument3 pagesWACC puOgaACHywAravNo ratings yet

- Assignment 2 - Numerical QuestionsDocument6 pagesAssignment 2 - Numerical QuestionsGazala KhanNo ratings yet

- New ProjectDocument10 pagesNew Projectvishal soniNo ratings yet

- CVMA ResvisionDocument3 pagesCVMA ResvisionApurva RamtekeNo ratings yet

- Module 6 Leverage QuestionsDocument3 pagesModule 6 Leverage QuestionsJayashree ChakrapaniNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan S100% (1)

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument34 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephNo ratings yet

- MACR Unit-III-Problems & SolutionsDocument58 pagesMACR Unit-III-Problems & SolutionsPrasannakumar S100% (2)

- Finance ManagementDocument18 pagesFinance Managementsainath mistryNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument3 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekNo ratings yet

- Financial Analysis - RATIOSDocument55 pagesFinancial Analysis - RATIOSRoy YadavNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet

- IAS 36 CFAP UpdatedDocument17 pagesIAS 36 CFAP UpdatedUmmar FarooqNo ratings yet

- Ca Inter 4-12-2019 PDFDocument172 pagesCa Inter 4-12-2019 PDFstillness speaksNo ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- The Following Financial Data Have Been Furnished by A Ltd. and B LTDDocument10 pagesThe Following Financial Data Have Been Furnished by A Ltd. and B LTDNaveen SatiNo ratings yet

- 3A. Capital Structure Leverages Numerical MarkedDocument3 pages3A. Capital Structure Leverages Numerical MarkedSundeep MogantiNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- Financial Goal PlanningDocument10 pagesFinancial Goal Planningsharvari kadamNo ratings yet

- Ratio Analysis Liquidity Ratios Solvency RatiosDocument55 pagesRatio Analysis Liquidity Ratios Solvency Ratiossarika gurjarNo ratings yet

- Buy Back of Shares: Class WorkDocument8 pagesBuy Back of Shares: Class WorkVirendra Jat shortsNo ratings yet

- All Questions Are Compulsory, Closed BookDocument2 pagesAll Questions Are Compulsory, Closed BookMAYANK JAINNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Question Paper Problems 2008-2012Document9 pagesQuestion Paper Problems 2008-2012sujith1978No ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- FM MTP Question Paper Nov 19Document6 pagesFM MTP Question Paper Nov 19sriramakrishnajayamNo ratings yet

- UntitledDocument18 pagesUntitledAlok TiwariNo ratings yet

- Part 1 - FM & ECO - 27145216 PDFDocument3 pagesPart 1 - FM & ECO - 27145216 PDFMaharajan GomuNo ratings yet

- NumericalsDocument10 pagesNumericalsswapnil tiwariNo ratings yet

- Buyback Share &own DebentureDocument8 pagesBuyback Share &own DebentureGhanshyam LakhaniNo ratings yet

- Cost of DebtDocument2 pagesCost of Debtbekalgagan29No ratings yet

- Assignment - Leverage - ADocument1 pageAssignment - Leverage - AJijenthiran DuraisamiNo ratings yet

- Valuation of SharesDocument52 pagesValuation of Sharesarupghosh8090No ratings yet

- Dividends Exercises Chapter 9 For AssignmentDocument2 pagesDividends Exercises Chapter 9 For AssignmentNiziU MaraNo ratings yet

- CV - Roveena ThakurDocument2 pagesCV - Roveena ThakurKushagra PandeNo ratings yet

- Rural Litigation and Ent. Vs UPDocument8 pagesRural Litigation and Ent. Vs UPPulkitAgrawalNo ratings yet

- Laporan Keuangan ANJT 2021Document89 pagesLaporan Keuangan ANJT 2021Yaugo Bagus WicaksonoNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFYuvraj Gogoi100% (1)

- Automation Level Migration Engineering ManualDocument86 pagesAutomation Level Migration Engineering ManualDogan KarabulutNo ratings yet

- LBC Courier Terms and ConditionsDocument3 pagesLBC Courier Terms and ConditionsTomas Diane LizardoNo ratings yet

- Chapter 4Document34 pagesChapter 4Hameed GulNo ratings yet

- Unit 16 New Economic: PolicyDocument12 pagesUnit 16 New Economic: PolicyBA20-042 DambaruNo ratings yet

- God's Grace Forex BookDocument11 pagesGod's Grace Forex BookMatimu Nene ChabalalaNo ratings yet

- What Is Iso CertificationDocument4 pagesWhat Is Iso CertificationShailesh GuptaNo ratings yet

- Enderes vs. Lee TSNDocument3 pagesEnderes vs. Lee TSNLowell MadrilenoNo ratings yet

- Latihan Soal AkuntansiDocument5 pagesLatihan Soal Akuntansiabe cedeNo ratings yet

- Vidadi ƏlizadəDocument9 pagesVidadi ƏlizadəChingiz QarayevNo ratings yet

- Journal Paper 2299 Speedmart Case StudyDocument7 pagesJournal Paper 2299 Speedmart Case StudyNoriani ZakariaNo ratings yet

- Melaleuca Compensation PlanDocument7 pagesMelaleuca Compensation PlanTanka Prasad BhattaraiNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 3Document5 pagesBUS 5111 - Financial Management - Written Assignment Unit 3LaVida LocaNo ratings yet

- Quarter 3: Caregiving: Teacher: Jolina Mae C. Anit, LPTDocument15 pagesQuarter 3: Caregiving: Teacher: Jolina Mae C. Anit, LPTJolina AnitNo ratings yet

- Internship Under CA Final ReportDocument22 pagesInternship Under CA Final ReportChahatNo ratings yet

- Ceo at 22 Book v1.0Document177 pagesCeo at 22 Book v1.0eruditebookkeepingNo ratings yet

- Yamane v. B.A. Lepanto CondominiumDocument6 pagesYamane v. B.A. Lepanto CondominiumSuzyNo ratings yet

- Bacullo - THC 109Document1 pageBacullo - THC 109Ranze Angelique Concepcion BaculloNo ratings yet

- OUMH2203 English For Workplace Comm - Emay23 (CS)Document211 pagesOUMH2203 English For Workplace Comm - Emay23 (CS)suriaNo ratings yet

- Beard Group Corporate Restructuring Review For November 2011Document32 pagesBeard Group Corporate Restructuring Review For November 2011bankrupt0No ratings yet

- C1 - Internal UseDocument9 pagesC1 - Internal UseFidiyanti FebrinaNo ratings yet

- Udyam Registration Certificate 1 PAGEDocument1 pageUdyam Registration Certificate 1 PAGERahulPandeyNo ratings yet

- BA Training BRD RajDocument28 pagesBA Training BRD RajSathish CNo ratings yet