Professional Documents

Culture Documents

Microsoft 365 Co-Pilot: Powered by AI

Microsoft 365 Co-Pilot: Powered by AI

Uploaded by

stanleymudzamiri80 ratings0% found this document useful (0 votes)

1 views1 pageOriginal Title

Document (22)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageMicrosoft 365 Co-Pilot: Powered by AI

Microsoft 365 Co-Pilot: Powered by AI

Uploaded by

stanleymudzamiri8Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Powered by AI

Microsoft 365 Co-pilot

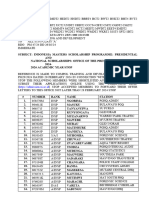

Certainly! Here are five purposes of control accounts:

1. Summarization: They summarize the details of individual transactions

of a similar nature into one account, making it easier to manage and

review financial information.

2. Error Detection: Control accounts facilitate the identification and

correction of errors by providing a means to reconcile the total of the

control account with the total of the individual entries in the subsidiary

ledgers.

3. Efficiency: They improve the efficiency of the accounting process by

keeping the general ledger uncluttered with detailed entries, which are

instead recorded in the subsidiary ledgers.

4. Internal Control: Control accounts serve as an internal check

mechanism to ensure that transactions are recorded accurately in both

the control and subsidiary accounts, thereby preventing fraud and

misrepresentation.

5. Financial Reporting: They assist in the financial reporting process by

providing a clear and concise summary of the company's financial

transactions, which is essential for the preparation of accurate financial

statements1234.

Control accounts are a key component in the double-entry bookkeeping

system and are used to maintain the integrity of the financial records. They are

particularly useful for accounts with a large number of transactions, such as

accounts receivable and accounts payable. By ensuring that the balance of the

control account matches the total of the subsidiary accounts, businesses can

have confidence in the accuracy of their financial reports.

Source(s)

1. Control Account - What Is It, Types, Example, Purpose, Uses

2. What is the purpose of control accounts? | AccountingCoach

3. What is Control Account? Benefits of using a Control Account

4. Control Account: Understanding its Role in Financial Management

You might also like

- Ilovepdf MergedDocument19 pagesIlovepdf Mergedhd9116636005No ratings yet

- Fap I PPT 2014 Ch-4Document21 pagesFap I PPT 2014 Ch-4mickamhaaNo ratings yet

- Chapter 4 Accoumting SystemsDocument4 pagesChapter 4 Accoumting SystemsDawit TesfayeNo ratings yet

- Unit 1 - Management AccountingDocument16 pagesUnit 1 - Management Accountingdilipkumar.1267No ratings yet

- Control AccountDocument4 pagesControl Accountnayyaung linpromaxNo ratings yet

- Module 004 Week002-Finacct3 Review of The Accounting ProcessDocument6 pagesModule 004 Week002-Finacct3 Review of The Accounting Processman ibeNo ratings yet

- TOPIK 3-Accounting System and ControlDocument24 pagesTOPIK 3-Accounting System and Controlfalina88No ratings yet

- Ch04 Accounting Systems: Chapter Four Accounting Systems 5.1. Manual and Computerized Accounting SystetemsDocument4 pagesCh04 Accounting Systems: Chapter Four Accounting Systems 5.1. Manual and Computerized Accounting SystetemsKanbiro Orkaido100% (2)

- MGMT ACC (UNIT - 1) Bhagiya MamDocument10 pagesMGMT ACC (UNIT - 1) Bhagiya MamDineshNo ratings yet

- Financial Accounting - IntroDocument16 pagesFinancial Accounting - Introaiswarya sNo ratings yet

- Accounting Chapter Four SummarizeDocument7 pagesAccounting Chapter Four SummarizeMesay TilahunNo ratings yet

- Introduction To Management Accounting: Learning ObjectivesDocument7 pagesIntroduction To Management Accounting: Learning ObjectivesMumbaiNo ratings yet

- L24 - Control AccountsDocument12 pagesL24 - Control AccountsJosephNo ratings yet

- 4622 - Control Account PDFDocument2 pages4622 - Control Account PDFrooneybell10No ratings yet

- Preparing Financial StatementDocument33 pagesPreparing Financial StatementkacaribuantonNo ratings yet

- Week 6 Journal: SAP ERP AND Accounting ProcessDocument2 pagesWeek 6 Journal: SAP ERP AND Accounting ProcessKouser SultanaNo ratings yet

- T4 Control AccountsDocument20 pagesT4 Control AccountsHD DNo ratings yet

- Management AccountingDocument108 pagesManagement AccountingBATUL ABBAS DEVASWALANo ratings yet

- Management AccountingDocument14 pagesManagement AccountingBristi SonowalNo ratings yet

- AIS PaperDocument8 pagesAIS PaperTarra AuliaNo ratings yet

- Full Management Accounting 6th SemDocument188 pagesFull Management Accounting 6th SemSpandana Madhan SmrbNo ratings yet

- Finance Acc 2mark & 5mark ImportantDocument6 pagesFinance Acc 2mark & 5mark ImportantMADHANNo ratings yet

- Managerial AccountingDocument19 pagesManagerial AccountingRichy Rahul AdithyaNo ratings yet

- Manonmaniam Sundaranar University: For More Information Visit: HTTP://WWW - Msuniv.ac - inDocument204 pagesManonmaniam Sundaranar University: For More Information Visit: HTTP://WWW - Msuniv.ac - inDhirendra Singh patwalNo ratings yet

- Chapter 1 A Model For Processing AIS (New)Document6 pagesChapter 1 A Model For Processing AIS (New)Muhammad IrshadNo ratings yet

- Study Note 1 Fundamental of AccountingDocument54 pagesStudy Note 1 Fundamental of Accountingnaga naveenNo ratings yet

- Finance Study Unit 1Document9 pagesFinance Study Unit 1aman pandeyNo ratings yet

- FA I Chapter 4 Accounting SystemsDocument21 pagesFA I Chapter 4 Accounting SystemsDzokeo KayuNo ratings yet

- Module 5 PDFDocument47 pagesModule 5 PDFJerin MathewNo ratings yet

- Unit 1.introduction To Cost AccountingDocument2 pagesUnit 1.introduction To Cost AccountingClark Jamiel Luangco MartijaNo ratings yet

- Management Accounting Unit 1Document6 pagesManagement Accounting Unit 1Jay MehtaNo ratings yet

- Managemet AccountingDocument163 pagesManagemet AccountingGunjeet Singh SachdevaNo ratings yet

- Notes On Introduction To AccountingDocument6 pagesNotes On Introduction To AccountingVRINDA TOSHNIWAL DPSN-STDNo ratings yet

- Bba 304 PDFDocument522 pagesBba 304 PDFsureshbaddha86% (7)

- FAR Summary NotesDocument53 pagesFAR Summary NotesVeronica BañaresNo ratings yet

- FI - Module: General Ledger AccountingDocument3 pagesFI - Module: General Ledger AccountingdarshitNo ratings yet

- Accounting I UnitDocument28 pagesAccounting I UnitBalasaranyasiddhuNo ratings yet

- CHAPTER ONE-cost accounting-IIDocument5 pagesCHAPTER ONE-cost accounting-IIdejen mengstieNo ratings yet

- Actg 5 PDFDocument30 pagesActg 5 PDFHo Ming LamNo ratings yet

- CH 1 CostDocument6 pagesCH 1 Costdanielnebeyat7No ratings yet

- Chapter-1 Introduction To AccountingDocument6 pagesChapter-1 Introduction To Accountingagarwalpawan1No ratings yet

- 1 Chapter OneDocument36 pages1 Chapter OneMegbaru TesfawNo ratings yet

- Financial Accounting and Cost AccountingDocument6 pagesFinancial Accounting and Cost AccountingdranilshindeNo ratings yet

- Introduction To AccountingDocument16 pagesIntroduction To AccountingPiyushNo ratings yet

- Functions of Management AccountingDocument8 pagesFunctions of Management AccountingAbhishek Kumar100% (1)

- FAA - Unit 1 - 2021Document11 pagesFAA - Unit 1 - 2021Pranjal ChopraNo ratings yet

- CHAPTER 7 Lecture Notes Accounting Information SystemsDocument4 pagesCHAPTER 7 Lecture Notes Accounting Information SystemsJaredNo ratings yet

- Chapter 1Document50 pagesChapter 1sujal sikariyaNo ratings yet

- Unit 1Document72 pagesUnit 1Sumit SoniNo ratings yet

- M02 - AIS - Effective AIS PDFDocument4 pagesM02 - AIS - Effective AIS PDFwingsenigma 00No ratings yet

- Basic AccountingDocument85 pagesBasic AccountingVrinda BNo ratings yet

- Introduction To Accounting Topic: Introduction To AccountingDocument2 pagesIntroduction To Accounting Topic: Introduction To AccountingDURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- Accounting System1Document13 pagesAccounting System1Nwogboji EmmanuelNo ratings yet

- Management's Responsibilities in An AuditDocument12 pagesManagement's Responsibilities in An AuditAnaghaPuranik0% (1)

- Management Accounting (MA)Document114 pagesManagement Accounting (MA)Shivangi Patel100% (1)

- 61a6cbec682c8 - Book Keeping and AccountingDocument16 pages61a6cbec682c8 - Book Keeping and AccountingAnuska ThapaNo ratings yet

- Aacounting For Manager AssignmentDocument19 pagesAacounting For Manager Assignmentsheetalsagar07741No ratings yet

- Branches of AccountingDocument3 pagesBranches of AccountingMohitNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Copilot: Powered by AIDocument2 pagesCopilot: Powered by AIstanleymudzamiri8No ratings yet

- Sports Psychology Presentation by B. MashavaDocument25 pagesSports Psychology Presentation by B. Mashavastanleymudzamiri8No ratings yet

- Copilot: Powered by AIDocument2 pagesCopilot: Powered by AIstanleymudzamiri8No ratings yet

- Analyzing and Evaluation Electoral ProcessesDocument18 pagesAnalyzing and Evaluation Electoral Processesstanleymudzamiri8No ratings yet

- Copilot: Powered by AIDocument1 pageCopilot: Powered by AIstanleymudzamiri8No ratings yet

- What Is Inductive Reasoning? Definitions, Types and ExamplesDocument11 pagesWhat Is Inductive Reasoning? Definitions, Types and Examplesstanleymudzamiri8No ratings yet

- Human Trafficking An IntroductionDocument5 pagesHuman Trafficking An Introductionstanleymudzamiri8No ratings yet

- Radio Indonesia Masters Scholarship ProgrammeDocument3 pagesRadio Indonesia Masters Scholarship Programmestanleymudzamiri8No ratings yet

- Is It Justifiable Vicarious LiabilityDocument141 pagesIs It Justifiable Vicarious Liabilitystanleymudzamiri8No ratings yet

- Employee Rights and Employee RightsDocument1 pageEmployee Rights and Employee Rightsstanleymudzamiri8No ratings yet

- Origins of The StateDocument2 pagesOrigins of The Statestanleymudzamiri8No ratings yet

- ConservatismDocument11 pagesConservatismstanleymudzamiri8No ratings yet

- Types of ReadingDocument2 pagesTypes of Readingstanleymudzamiri8No ratings yet

- IMRa DDocument2 pagesIMRa Dstanleymudzamiri8No ratings yet

- AuthoritarianDocument11 pagesAuthoritarianstanleymudzamiri8No ratings yet

- Paragraph IngDocument1 pageParagraph Ingstanleymudzamiri8No ratings yet