Professional Documents

Culture Documents

Accounting Method: Special Considerations in Reporting of Gross Income

Accounting Method: Special Considerations in Reporting of Gross Income

Uploaded by

migueltanfelix149Copyright:

Available Formats

You might also like

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Pre Trial Brief Petition For Declaration of Nullity of MarriageDocument5 pagesPre Trial Brief Petition For Declaration of Nullity of Marriageboniglai5100% (1)

- Project On The Constituent Elements of Crime in The Indian Penal CodeDocument18 pagesProject On The Constituent Elements of Crime in The Indian Penal CodeAsha Yadav100% (1)

- TAXNDocument22 pagesTAXNMonica MonicaNo ratings yet

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesNo ratings yet

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Chapter 9 SummaryDocument4 pagesChapter 9 SummaryFubuki JigokuNo ratings yet

- Business TaxationDocument7 pagesBusiness TaxationZehra LeeNo ratings yet

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDocument5 pagesExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayNo ratings yet

- Inclusion of Gross IncomeDocument24 pagesInclusion of Gross IncomeAce ReytaNo ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- Cpa Reviewer in TaxationDocument10 pagesCpa Reviewer in TaxationmaeNo ratings yet

- M4 P3 Inclusion Students Copy 1Document33 pagesM4 P3 Inclusion Students Copy 1Aaron BuendiaNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- Deductions From Gross Income PhilDocument7 pagesDeductions From Gross Income PhilchezrginNo ratings yet

- IndividualDocument14 pagesIndividualKenneth Bryan Tegerero TegioNo ratings yet

- Individual Income Taxation-ComputationDocument27 pagesIndividual Income Taxation-ComputationeuniNo ratings yet

- Northern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomeDocument16 pagesNorthern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomePauline EchanoNo ratings yet

- What Is Gross Income (Or Taxable Gross Income) ?Document24 pagesWhat Is Gross Income (Or Taxable Gross Income) ?Joe P PokaranNo ratings yet

- MSJG Income Tax Chapter 3 NotesDocument3 pagesMSJG Income Tax Chapter 3 NotesMar Sean Jan GabiosaNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- Part IV 2 Exclusion and Inclusion Regular Income TaxationDocument11 pagesPart IV 2 Exclusion and Inclusion Regular Income Taxationmary jhoyNo ratings yet

- Individuals Income TaxDocument25 pagesIndividuals Income TaxNestor III Dela CruzNo ratings yet

- Income TaxationDocument6 pagesIncome TaxationJahz Aira GamboaNo ratings yet

- New Income and Business TaxationDocument72 pagesNew Income and Business TaxationGSOCION LOUSELLE LALAINE D.100% (1)

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoNo ratings yet

- CHAPTER 13 - SummarizeDocument13 pagesCHAPTER 13 - SummarizejsgiganteNo ratings yet

- 03 - Income Taxation - Regular Income TaxationDocument6 pages03 - Income Taxation - Regular Income TaxationAbigail VergaraNo ratings yet

- Income Tax Notes LecturesDocument11 pagesIncome Tax Notes LecturesPam G.No ratings yet

- Accounting NotesDocument29 pagesAccounting NotesLia Nicole BungabongNo ratings yet

- Summary Notes On Tax Schemes Periods and Methods and ReportingDocument7 pagesSummary Notes On Tax Schemes Periods and Methods and ReportingSophia Dominique Uy AlzateNo ratings yet

- Module 7 Tax On IndividualsDocument25 pagesModule 7 Tax On IndividualsAbegail Jenn Elis MulderNo ratings yet

- Lesson 1Document10 pagesLesson 1laica cauilanNo ratings yet

- Module 9 Deductions From Gross IncomeDocument13 pagesModule 9 Deductions From Gross IncomeNineteen AùgùstNo ratings yet

- Handout 5-Concept of IncomeDocument7 pagesHandout 5-Concept of IncomeApolinar Alvarez Jr.No ratings yet

- Gi 4Document3 pagesGi 4migueltanfelix149No ratings yet

- Philippine Income Taxation - IncomeDocument48 pagesPhilippine Income Taxation - IncomeJenny Malabrigo, MBANo ratings yet

- Chapter 7: Introduction To Regular Income TaxDocument5 pagesChapter 7: Introduction To Regular Income TaxArna Kaira Kjell DiestraNo ratings yet

- Income Tax IndividualDocument22 pagesIncome Tax IndividualJohn Oicemen RocaNo ratings yet

- Allowable DeductionDocument33 pagesAllowable DeductionJobell CaballeroNo ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- Regular Income Tax: Inclusion in Gross IncomeDocument9 pagesRegular Income Tax: Inclusion in Gross IncomeE.D.JNo ratings yet

- Nature and Concept: OF IncomeDocument193 pagesNature and Concept: OF IncomeFranchise AlienNo ratings yet

- Taxation - Allowable Business DeductionsDocument51 pagesTaxation - Allowable Business DeductionsHannah OrosNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- Axsdaqgasdgasdg 123123 Aeasdfw SadgDocument6 pagesAxsdaqgasdgasdg 123123 Aeasdfw SadgMark LimNo ratings yet

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Tax Midterm ReviewerDocument8 pagesTax Midterm ReviewerkarenongsucoNo ratings yet

- Bsa2 - TaxDocument40 pagesBsa2 - TaxLyca Nichol IbanNo ratings yet

- Income Taxation SchemesDocument7 pagesIncome Taxation SchemesLeonard CañamoNo ratings yet

- Lesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingDocument28 pagesLesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingCJ GranadaNo ratings yet

- Income Tax (1) - FinalDocument50 pagesIncome Tax (1) - FinalMay Encarnina P. Gaoiran100% (5)

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Income TaxDocument38 pagesIncome TaxNaiza Mae R. BinayaoNo ratings yet

- IT Module No. 7: Introduction To Regular Income TaxDocument13 pagesIT Module No. 7: Introduction To Regular Income TaxjakeNo ratings yet

- Worksheet 5 q2 TaxationDocument15 pagesWorksheet 5 q2 TaxationAllan TaripeNo ratings yet

- Lesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Document25 pagesLesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Alkhair SangcopanNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Sattelite Directory PDFDocument6 pagesSattelite Directory PDFbaba aliNo ratings yet

- Pronunciation Activity (Unit 10, Page 85) Vowel SoundsDocument1 pagePronunciation Activity (Unit 10, Page 85) Vowel SoundsJennifer Rojas Bravo0% (1)

- General HOA Property Managment LetterDocument1 pageGeneral HOA Property Managment LetterAldenilo VieiraNo ratings yet

- Final Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DDocument4 pagesFinal Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DHanna Ruth FloreceNo ratings yet

- Republic of The Philippines: Bacolod City Police Office Police Station 7Document14 pagesRepublic of The Philippines: Bacolod City Police Office Police Station 7Jo LazanasNo ratings yet

- 10.15 Pipeline ListDocument31 pages10.15 Pipeline ListDangolNo ratings yet

- Midterm Exam in Lea-3 Set BDocument4 pagesMidterm Exam in Lea-3 Set BEuve Jane Lawis-FloresNo ratings yet

- 4 Local Government in TexasDocument63 pages4 Local Government in TexasNida MahmoodNo ratings yet

- Acknowledgment of The Easement: Case: Bogo-Medellin Milling Co V CaDocument20 pagesAcknowledgment of The Easement: Case: Bogo-Medellin Milling Co V CaizaNo ratings yet

- HR Recruiter Data FileDocument16 pagesHR Recruiter Data FileSingh SahabNo ratings yet

- Network Outsourcing July 2011Document18 pagesNetwork Outsourcing July 2011Shankar VenugopalNo ratings yet

- Document Designer in Oracle CPQ Data SheetDocument3 pagesDocument Designer in Oracle CPQ Data SheetJojoNo ratings yet

- Assessment of Accounting Practices of SariDocument6 pagesAssessment of Accounting Practices of SariAngel Cris BulanonNo ratings yet

- United States v. Dominic Mariani, 851 F.2d 595, 2d Cir. (1988)Document10 pagesUnited States v. Dominic Mariani, 851 F.2d 595, 2d Cir. (1988)Scribd Government DocsNo ratings yet

- Nigerian EIA ActDocument31 pagesNigerian EIA ActOribuyaku DamiNo ratings yet

- Parametric Design For Manufacturing: Something That Moves Something, Created by Ohad Meyuhas, ArchitectDocument23 pagesParametric Design For Manufacturing: Something That Moves Something, Created by Ohad Meyuhas, ArchitectkfioreNo ratings yet

- Revision Worksheet On SolutionsDocument2 pagesRevision Worksheet On SolutionsAdrielle KovoorNo ratings yet

- NCA March 2023 Requirements - Exigences Pour Les Examens Du CNE en MarsDocument4 pagesNCA March 2023 Requirements - Exigences Pour Les Examens Du CNE en MarsJ SNo ratings yet

- Fourth Judges CaseDocument4 pagesFourth Judges CaseAkanksha PurohitNo ratings yet

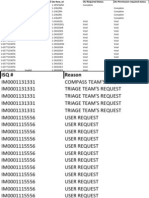

- Datafix JanDocument61 pagesDatafix JanSantanu AecNo ratings yet

- Ferguson v. City of Charleston, 4th Cir. (2002)Document43 pagesFerguson v. City of Charleston, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- 2018 Omnibus Summary Rules For Cancellation Cases ofDocument25 pages2018 Omnibus Summary Rules For Cancellation Cases ofjerick mel unipa100% (1)

- Quick Reference Guide Pharmacists Dispensing Purchasing Controlled SubstancesDocument2 pagesQuick Reference Guide Pharmacists Dispensing Purchasing Controlled Substancesritchelle abigail mataNo ratings yet

- People v. Madarang, G.R. No. 132319, 12 May 2000Document4 pagesPeople v. Madarang, G.R. No. 132319, 12 May 2000Anna BarbadilloNo ratings yet

- Englishtratop Etrips Ewipo Wto Colloquium 2017 e PDFDocument148 pagesEnglishtratop Etrips Ewipo Wto Colloquium 2017 e PDFAdrei GoergyNo ratings yet

- ISO 4833 2 2013 Amd 1 2022Document7 pagesISO 4833 2 2013 Amd 1 2022VickyNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentswathiNo ratings yet

- OpTransactionHistoryTpr17 09 2019 PDFDocument2 pagesOpTransactionHistoryTpr17 09 2019 PDFSonu DangiNo ratings yet

Accounting Method: Special Considerations in Reporting of Gross Income

Accounting Method: Special Considerations in Reporting of Gross Income

Uploaded by

migueltanfelix149Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Method: Special Considerations in Reporting of Gross Income

Accounting Method: Special Considerations in Reporting of Gross Income

Uploaded by

migueltanfelix149Copyright:

Available Formats

SPECIAL CONSIDERATIONS IN REPORTING OF GROSS INCOME

1. Accounting method

o Cash basis taxpayer – collection as gross income

o Accrual basis taxpayer – revenue either collected or uncollected as gross income

2. Situs Rule

o Taxpayer taxable only on Philippine Income – only items of gross income subject to

regular tax from source w/in the PH are included in gross income

o Taxpayer taxable on global income – items of gross income subject to regular tax from

sources w/in and w/out the PH are included in gross income

3. Effects of Value Added on Reportable Income

o VAT taxpayers – if their sales or receipts exceeds 3M in the last consecutive 12 – month

period (12%)

o Non-VAT taxpayers –if their sales or receipts is below VAT threshold or designated by

law

Example: VAT taxpayers

A VAT-registered taxpayer charge 97,500 to a client for rental

The VAT taxpayer shall split the billing as follows:

Rent Income (97,500/112%) 87,054

Plus: Output VAT (97,500 x 12/112 10,446

Invoice Price 97,500

- Only rental income subject to income tax

- Output VAT must be recorded as liability

Example: Non-VAT taxpayers

A VAT-registered taxpayer charge 97,500 to a client for rental

- Non-VAT taxpayers are not subject to VAT

- The entire charge is gross income subject to income tax

4. Creditable Withholding tax

o Deducted by income payors against the gross income of taxpayer are not exclusions in

gross income

o Deductible against annual income tax due

5. Power of the CIR to redistribute income and deductions

o Authorization to distribute or allocate gross income or deductions in business to prevent

tax evasion and clear reflection of income of business.

The Arm’s Length Principle

Uncontrolled pricing method determined by free market forces is preferred

Failure to comply may expose the taxpayer to a transfer pricing adjustment (BIR re-computes)

It shall be applied to

1. Cross-border transactions between associated enterprises

2. Domestic transaction between associated enterprises

EXCLUSION FROM GROSS INCOME

Income which not be subject to income tax

Not included in gross income subject to regular tax, capital gains tax or final tax

Items that are NOT included in Gross Income and EXEMPT from taxation

a. Proceeds of life insurance policy

b. Amount received by the insured as a return of premium

c. Gift, bequest, devise or descent

d. Compensation for injuries

e. Income exempt under treaty

f. Retirement benefits, pensions, gratuities, etc.

g. Miscellaneous items

You might also like

- Regular Income Tax - Itemized DeductionsDocument12 pagesRegular Income Tax - Itemized DeductionsJaneNo ratings yet

- Pre Trial Brief Petition For Declaration of Nullity of MarriageDocument5 pagesPre Trial Brief Petition For Declaration of Nullity of Marriageboniglai5100% (1)

- Project On The Constituent Elements of Crime in The Indian Penal CodeDocument18 pagesProject On The Constituent Elements of Crime in The Indian Penal CodeAsha Yadav100% (1)

- TAXNDocument22 pagesTAXNMonica MonicaNo ratings yet

- Chapter 9 Regular Income Tax - Inclusion From Gross IncomeDocument5 pagesChapter 9 Regular Income Tax - Inclusion From Gross IncomeJason MablesNo ratings yet

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Chapter 9 SummaryDocument4 pagesChapter 9 SummaryFubuki JigokuNo ratings yet

- Business TaxationDocument7 pagesBusiness TaxationZehra LeeNo ratings yet

- Exempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawDocument5 pagesExempt: BMBE, Enterrises Enjoying Tax Holiday Incentives Under CREATE LawPaula Mae DacanayNo ratings yet

- Inclusion of Gross IncomeDocument24 pagesInclusion of Gross IncomeAce ReytaNo ratings yet

- Inctax Lecture Notes Froup 2 and 6Document27 pagesInctax Lecture Notes Froup 2 and 6KrizahMarieCaballeroNo ratings yet

- Cpa Reviewer in TaxationDocument10 pagesCpa Reviewer in TaxationmaeNo ratings yet

- M4 P3 Inclusion Students Copy 1Document33 pagesM4 P3 Inclusion Students Copy 1Aaron BuendiaNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- Deductions From Gross Income PhilDocument7 pagesDeductions From Gross Income PhilchezrginNo ratings yet

- IndividualDocument14 pagesIndividualKenneth Bryan Tegerero TegioNo ratings yet

- Individual Income Taxation-ComputationDocument27 pagesIndividual Income Taxation-ComputationeuniNo ratings yet

- Northern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomeDocument16 pagesNorthern Cpa Review: Taxation Regular Income Taxation: Deductions From Gross IncomePauline EchanoNo ratings yet

- What Is Gross Income (Or Taxable Gross Income) ?Document24 pagesWhat Is Gross Income (Or Taxable Gross Income) ?Joe P PokaranNo ratings yet

- MSJG Income Tax Chapter 3 NotesDocument3 pagesMSJG Income Tax Chapter 3 NotesMar Sean Jan GabiosaNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- Part IV 2 Exclusion and Inclusion Regular Income TaxationDocument11 pagesPart IV 2 Exclusion and Inclusion Regular Income Taxationmary jhoyNo ratings yet

- Individuals Income TaxDocument25 pagesIndividuals Income TaxNestor III Dela CruzNo ratings yet

- Income TaxationDocument6 pagesIncome TaxationJahz Aira GamboaNo ratings yet

- New Income and Business TaxationDocument72 pagesNew Income and Business TaxationGSOCION LOUSELLE LALAINE D.100% (1)

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoNo ratings yet

- CHAPTER 13 - SummarizeDocument13 pagesCHAPTER 13 - SummarizejsgiganteNo ratings yet

- 03 - Income Taxation - Regular Income TaxationDocument6 pages03 - Income Taxation - Regular Income TaxationAbigail VergaraNo ratings yet

- Income Tax Notes LecturesDocument11 pagesIncome Tax Notes LecturesPam G.No ratings yet

- Accounting NotesDocument29 pagesAccounting NotesLia Nicole BungabongNo ratings yet

- Summary Notes On Tax Schemes Periods and Methods and ReportingDocument7 pagesSummary Notes On Tax Schemes Periods and Methods and ReportingSophia Dominique Uy AlzateNo ratings yet

- Module 7 Tax On IndividualsDocument25 pagesModule 7 Tax On IndividualsAbegail Jenn Elis MulderNo ratings yet

- Lesson 1Document10 pagesLesson 1laica cauilanNo ratings yet

- Module 9 Deductions From Gross IncomeDocument13 pagesModule 9 Deductions From Gross IncomeNineteen AùgùstNo ratings yet

- Handout 5-Concept of IncomeDocument7 pagesHandout 5-Concept of IncomeApolinar Alvarez Jr.No ratings yet

- Gi 4Document3 pagesGi 4migueltanfelix149No ratings yet

- Philippine Income Taxation - IncomeDocument48 pagesPhilippine Income Taxation - IncomeJenny Malabrigo, MBANo ratings yet

- Chapter 7: Introduction To Regular Income TaxDocument5 pagesChapter 7: Introduction To Regular Income TaxArna Kaira Kjell DiestraNo ratings yet

- Income Tax IndividualDocument22 pagesIncome Tax IndividualJohn Oicemen RocaNo ratings yet

- Allowable DeductionDocument33 pagesAllowable DeductionJobell CaballeroNo ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- Regular Income Tax: Inclusion in Gross IncomeDocument9 pagesRegular Income Tax: Inclusion in Gross IncomeE.D.JNo ratings yet

- Nature and Concept: OF IncomeDocument193 pagesNature and Concept: OF IncomeFranchise AlienNo ratings yet

- Taxation - Allowable Business DeductionsDocument51 pagesTaxation - Allowable Business DeductionsHannah OrosNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- Axsdaqgasdgasdg 123123 Aeasdfw SadgDocument6 pagesAxsdaqgasdgasdg 123123 Aeasdfw SadgMark LimNo ratings yet

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Tax Midterm ReviewerDocument8 pagesTax Midterm ReviewerkarenongsucoNo ratings yet

- Bsa2 - TaxDocument40 pagesBsa2 - TaxLyca Nichol IbanNo ratings yet

- Income Taxation SchemesDocument7 pagesIncome Taxation SchemesLeonard CañamoNo ratings yet

- Lesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingDocument28 pagesLesson 2: Income Tax Schemes, Accounting Periods, Methods and ReportingCJ GranadaNo ratings yet

- Income Tax (1) - FinalDocument50 pagesIncome Tax (1) - FinalMay Encarnina P. Gaoiran100% (5)

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Income TaxDocument38 pagesIncome TaxNaiza Mae R. BinayaoNo ratings yet

- IT Module No. 7: Introduction To Regular Income TaxDocument13 pagesIT Module No. 7: Introduction To Regular Income TaxjakeNo ratings yet

- Worksheet 5 q2 TaxationDocument15 pagesWorksheet 5 q2 TaxationAllan TaripeNo ratings yet

- Lesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Document25 pagesLesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Alkhair SangcopanNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet

- Sattelite Directory PDFDocument6 pagesSattelite Directory PDFbaba aliNo ratings yet

- Pronunciation Activity (Unit 10, Page 85) Vowel SoundsDocument1 pagePronunciation Activity (Unit 10, Page 85) Vowel SoundsJennifer Rojas Bravo0% (1)

- General HOA Property Managment LetterDocument1 pageGeneral HOA Property Managment LetterAldenilo VieiraNo ratings yet

- Final Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DDocument4 pagesFinal Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DHanna Ruth FloreceNo ratings yet

- Republic of The Philippines: Bacolod City Police Office Police Station 7Document14 pagesRepublic of The Philippines: Bacolod City Police Office Police Station 7Jo LazanasNo ratings yet

- 10.15 Pipeline ListDocument31 pages10.15 Pipeline ListDangolNo ratings yet

- Midterm Exam in Lea-3 Set BDocument4 pagesMidterm Exam in Lea-3 Set BEuve Jane Lawis-FloresNo ratings yet

- 4 Local Government in TexasDocument63 pages4 Local Government in TexasNida MahmoodNo ratings yet

- Acknowledgment of The Easement: Case: Bogo-Medellin Milling Co V CaDocument20 pagesAcknowledgment of The Easement: Case: Bogo-Medellin Milling Co V CaizaNo ratings yet

- HR Recruiter Data FileDocument16 pagesHR Recruiter Data FileSingh SahabNo ratings yet

- Network Outsourcing July 2011Document18 pagesNetwork Outsourcing July 2011Shankar VenugopalNo ratings yet

- Document Designer in Oracle CPQ Data SheetDocument3 pagesDocument Designer in Oracle CPQ Data SheetJojoNo ratings yet

- Assessment of Accounting Practices of SariDocument6 pagesAssessment of Accounting Practices of SariAngel Cris BulanonNo ratings yet

- United States v. Dominic Mariani, 851 F.2d 595, 2d Cir. (1988)Document10 pagesUnited States v. Dominic Mariani, 851 F.2d 595, 2d Cir. (1988)Scribd Government DocsNo ratings yet

- Nigerian EIA ActDocument31 pagesNigerian EIA ActOribuyaku DamiNo ratings yet

- Parametric Design For Manufacturing: Something That Moves Something, Created by Ohad Meyuhas, ArchitectDocument23 pagesParametric Design For Manufacturing: Something That Moves Something, Created by Ohad Meyuhas, ArchitectkfioreNo ratings yet

- Revision Worksheet On SolutionsDocument2 pagesRevision Worksheet On SolutionsAdrielle KovoorNo ratings yet

- NCA March 2023 Requirements - Exigences Pour Les Examens Du CNE en MarsDocument4 pagesNCA March 2023 Requirements - Exigences Pour Les Examens Du CNE en MarsJ SNo ratings yet

- Fourth Judges CaseDocument4 pagesFourth Judges CaseAkanksha PurohitNo ratings yet

- Datafix JanDocument61 pagesDatafix JanSantanu AecNo ratings yet

- Ferguson v. City of Charleston, 4th Cir. (2002)Document43 pagesFerguson v. City of Charleston, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- 2018 Omnibus Summary Rules For Cancellation Cases ofDocument25 pages2018 Omnibus Summary Rules For Cancellation Cases ofjerick mel unipa100% (1)

- Quick Reference Guide Pharmacists Dispensing Purchasing Controlled SubstancesDocument2 pagesQuick Reference Guide Pharmacists Dispensing Purchasing Controlled Substancesritchelle abigail mataNo ratings yet

- People v. Madarang, G.R. No. 132319, 12 May 2000Document4 pagesPeople v. Madarang, G.R. No. 132319, 12 May 2000Anna BarbadilloNo ratings yet

- Englishtratop Etrips Ewipo Wto Colloquium 2017 e PDFDocument148 pagesEnglishtratop Etrips Ewipo Wto Colloquium 2017 e PDFAdrei GoergyNo ratings yet

- ISO 4833 2 2013 Amd 1 2022Document7 pagesISO 4833 2 2013 Amd 1 2022VickyNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentswathiNo ratings yet

- OpTransactionHistoryTpr17 09 2019 PDFDocument2 pagesOpTransactionHistoryTpr17 09 2019 PDFSonu DangiNo ratings yet