Professional Documents

Culture Documents

Quiz 2

Quiz 2

Uploaded by

chipcanes320 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageQuiz 2

Quiz 2

Uploaded by

chipcanes32Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Quiz 2: Cost-Benefit Analysis

1. What is the primary purpose of conducting a cost-benefit analysis? a) To determine the

total cost of a project b) To compare the monetary benefits and costs of a project c) To

estimate the time required to complete a project d) To evaluate the environmental impact

of a project

2. How is net present value (NPV) calculated? a) Subtracting the initial investment cost

from the total revenue b) Subtracting the total cost from the total benefit c) Discounting

the future cash flows and subtracting the initial investment d) Discounting the future cash

flows and adding the initial investment

3. Define opportunity cost. a) The explicit monetary cost of an activity b) The value of the

next best alternative forgone c) The total cost of producing one additional unit of output

d) The revenue earned from selling additional units of output

4. What does a positive net present value (NPV) indicate? a) The project is economically

feasible b) The project is economically unfeasible c) The project is expected to generate

losses d) The project is expected to break even

5. In a cost-benefit analysis, how are non-monetary factors typically evaluated? a) They are

converted into monetary units using market prices b) They are ignored because they

cannot be quantified c) They are evaluated qualitatively using subjective judgments d)

They are considered separately from monetary factors

6. How does the discount rate affect the present value of future cash flows? a) A higher

discount rate increases present value b) A higher discount rate decreases present value c)

A lower discount rate increases present value d) A lower discount rate decreases present

value

7. What is the formula for calculating the benefit-cost ratio? a) Total benefits / Total costs

b) Total costs / Total benefits c) Net benefits / Net costs d) Net costs / Net benefits

8. What is the purpose of sensitivity analysis in cost-benefit analysis? a) To identify the

most profitable alternative b) To assess the impact of uncertainty on project outcomes c)

To estimate the opportunity cost of the project d) To calculate the breakeven point of the

project

9. Describe a situation where sunk costs should be ignored in decision-making. a) When

sunk costs are recoverable b) When sunk costs are relevant to future decisions c) When

sunk costs are non-recoverable and irrelevant to future decisions d) When sunk costs

represent a significant portion of the total project cost

10. How does the length of the project affect the discount rate used in a cost-benefit analysis?

a) Longer projects require a higher discount rate b) Longer projects require a lower

discount rate c) The length of the project has no effect on the discount rate d) Longer

projects require a variable discount rate that changes over time

You might also like

- Columbia Class Notes - Mauboussin (2000)Document60 pagesColumbia Class Notes - Mauboussin (2000)Michael James Cestas100% (2)

- Shanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015Document8 pagesShanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015SharmaNo ratings yet

- Sample QuestionsDocument19 pagesSample QuestionsManu MonNo ratings yet

- MCQ of Corporate Finance PDFDocument11 pagesMCQ of Corporate Finance PDFsinghsanjNo ratings yet

- Chap 07 Cost-ManagementDocument12 pagesChap 07 Cost-ManagementRobincrusoeNo ratings yet

- Engineering Economics McqsDocument26 pagesEngineering Economics McqsMr. CoolNo ratings yet

- Ross12e Chapter05 TBDocument19 pagesRoss12e Chapter05 TBHải YếnNo ratings yet

- C NDocument14 pagesC NSomerProjNo ratings yet

- C) Allow For Normal SpoilageDocument6 pagesC) Allow For Normal SpoilageGleichel MaeraNo ratings yet

- Finance NotesDocument11 pagesFinance NotesHariharan SelvarajuNo ratings yet

- Q&A - Entry Test For Cost ManagementDocument3 pagesQ&A - Entry Test For Cost Managementapi-3738465No ratings yet

- TAKE HOME EXAM Engineering EconomicsDocument12 pagesTAKE HOME EXAM Engineering EconomicsStephanie Jean Magbanua CortezNo ratings yet

- ProjectDocument27 pagesProjectdharanmurali3881No ratings yet

- Cost ManagementDocument4 pagesCost ManagementGhosh DipankarNo ratings yet

- Cost Management ExamDocument20 pagesCost Management ExamSuleiman Baruni100% (3)

- Amity Assign On Project ManagementDocument7 pagesAmity Assign On Project ManagementAliya ShahNo ratings yet

- 100 Sample Questions of MCQ Project ManagementDocument10 pages100 Sample Questions of MCQ Project ManagementmaheshNo ratings yet

- Shanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015Document8 pagesShanti Business School: PGDM Trimester-Iii End Term Examination JULY - 2015SharmaNo ratings yet

- Question Bank M.Com - IT.IIDocument8 pagesQuestion Bank M.Com - IT.IIAnkita BhaduleNo ratings yet

- CSE - 3rd ECONOMICS - FOR - ENGINEERSDocument8 pagesCSE - 3rd ECONOMICS - FOR - ENGINEERSsamir pramanikNo ratings yet

- QuizletDocument27 pagesQuizletMeilysaNo ratings yet

- Chapter 1 Practice QuestionsDocument13 pagesChapter 1 Practice QuestionshahaheheNo ratings yet

- Pmbok Quiz 5 - Cost 2019Document6 pagesPmbok Quiz 5 - Cost 2019CarlosNo ratings yet

- University of Calicut School of Distance Education Bba Semester ViDocument11 pagesUniversity of Calicut School of Distance Education Bba Semester ViHanan HanNo ratings yet

- Quiz Bing M1-10Document32 pagesQuiz Bing M1-10Zidan SubhiNo ratings yet

- MCQ of Corporate Valuation Mergers AcquisitionsDocument19 pagesMCQ of Corporate Valuation Mergers AcquisitionsNuman AliNo ratings yet

- Cost Management - QuestionsDocument4 pagesCost Management - QuestionsLawzy Elsadig Seddig100% (1)

- PMP® - PMBOK® Guide - Sixth Edition - Classroom Test PaperDocument42 pagesPMP® - PMBOK® Guide - Sixth Edition - Classroom Test PaperJithuRaj100% (1)

- Diagnostic Test: How Much Do You Know of NPV and IRR? (Module 3) How Much Do You Know of NPV and IRR?Document3 pagesDiagnostic Test: How Much Do You Know of NPV and IRR? (Module 3) How Much Do You Know of NPV and IRR?John Carlo SantiagoNo ratings yet

- MAS - Capital BudgetingDocument15 pagesMAS - Capital Budgetingkevinlim186100% (7)

- Project ManagementDocument7 pagesProject ManagementEYOB AHMEDNo ratings yet

- MCQs On Project Management PDFDocument14 pagesMCQs On Project Management PDFsonali bhosaleNo ratings yet

- PMP - Classroom Testpaper With Answers PDFDocument56 pagesPMP - Classroom Testpaper With Answers PDFjahabarsathick100% (1)

- FM MBA Final print outDocument3 pagesFM MBA Final print outIfa FayisaNo ratings yet

- Ch. 11 Test BankDocument28 pagesCh. 11 Test BankMohamed Fathi Ali100% (1)

- Corporate Finance MCQDocument35 pagesCorporate Finance MCQRohan RoyNo ratings yet

- Mas Q4 Feb 2019 KeyDocument5 pagesMas Q4 Feb 2019 KeyyejiNo ratings yet

- Practice Questions: Project Cost Management 107Document14 pagesPractice Questions: Project Cost Management 107obee1234No ratings yet

- 50 MCQs SAMPLE For Project ManagementDocument12 pages50 MCQs SAMPLE For Project ManagementFaizan AslamNo ratings yet

- Mid Term ExamDocument11 pagesMid Term ExamMohammed IbrahimNo ratings yet

- Answers - Mid Term Exam Advanced Project Management Arab AcademyDocument14 pagesAnswers - Mid Term Exam Advanced Project Management Arab AcademyMohammed IbrahimNo ratings yet

- Roject OST Anagement: Mauro Sotille - Respostas CustosDocument4 pagesRoject OST Anagement: Mauro Sotille - Respostas CustospnorbertoNo ratings yet

- Examen Financial Management Octubre 2022Document3 pagesExamen Financial Management Octubre 2022monrasenNo ratings yet

- 18 Cost ManagementDocument4 pages18 Cost ManagementVanita GanthadeNo ratings yet

- 2 Introductory Certificate - The APM Project Fundamentals Qualification. Exam PaperDocument11 pages2 Introductory Certificate - The APM Project Fundamentals Qualification. Exam PaperKunal GuptaNo ratings yet

- Quantitative Techniques - Theories Part 2Document2 pagesQuantitative Techniques - Theories Part 2Ems TeopeNo ratings yet

- 206 PMP Pmbok-5 Practice Test Q & ADocument39 pages206 PMP Pmbok-5 Practice Test Q & AaafaqkyoNo ratings yet

- IT4204 - IT Project Management: University of Colombo, Sri LankaDocument7 pagesIT4204 - IT Project Management: University of Colombo, Sri LankaWipuli Lochana DisanayakeNo ratings yet

- Sample Paper For Preparing MCQs Project ManagementDocument13 pagesSample Paper For Preparing MCQs Project ManagementIqtadar AliNo ratings yet

- PQ 1Document6 pagesPQ 1Somnath KhandagaleNo ratings yet

- Project Management-1006Document18 pagesProject Management-1006api-3776226No ratings yet

- Financial ManagementDocument20 pagesFinancial ManagementMilind DesaiNo ratings yet

- Ross12e Chapter23 TBDocument8 pagesRoss12e Chapter23 TBhi babyNo ratings yet

- PMP QuestionsDocument55 pagesPMP QuestionsBharath Raj83% (6)

- Quiz 1Document2 pagesQuiz 1Malik Ali SabihNo ratings yet

- Mock Test 2 - 2016.05.06Document11 pagesMock Test 2 - 2016.05.06vtaneski1975No ratings yet

- Exam Cost, QualityDocument5 pagesExam Cost, QualityMarianne kamelNo ratings yet

- Diagnostic Capital BudgetingDocument2 pagesDiagnostic Capital BudgetingJohn Carlo SantiagoNo ratings yet

- 05-Project Cost ManagementDocument27 pages05-Project Cost Managementmohamed gakoshNo ratings yet

- Valuation of Bonds and Shares: Problem 1Document15 pagesValuation of Bonds and Shares: Problem 1anubha srivastavaNo ratings yet

- Choosing Innovation ProjectDocument25 pagesChoosing Innovation ProjectChrisha Jane LanutanNo ratings yet

- Chapter 2 TVMDocument45 pagesChapter 2 TVMGupta AashiyaNo ratings yet

- Poultry Farming - 4 LITEDocument18 pagesPoultry Farming - 4 LITEAnonymous tW1zTL2ltNo ratings yet

- FNCE101 wk02Document43 pagesFNCE101 wk02Ian ChengNo ratings yet

- Finance Bis Mcqs & Tf5Document1 pageFinance Bis Mcqs & Tf5Souliman MuhammadNo ratings yet

- Titan BiotechDocument37 pagesTitan BiotechshridharNo ratings yet

- Financial Statement Analysis NotesDocument25 pagesFinancial Statement Analysis NotesparinNo ratings yet

- National Roads Authority: Project Appraisal GuidelinesDocument38 pagesNational Roads Authority: Project Appraisal GuidelinesPratish BalaNo ratings yet

- fm2 3Document20 pagesfm2 3Rahul SrivastavaNo ratings yet

- 8960 Equity Research Methodology 112603Document2 pages8960 Equity Research Methodology 112603Ashish NirajNo ratings yet

- Introduction To Corporate Finance 5th Edition Frino Test BankDocument17 pagesIntroduction To Corporate Finance 5th Edition Frino Test Bankbradleygillespieditcebswrf100% (20)

- Pre - Post Money Valuation Template - UploadDocument7 pagesPre - Post Money Valuation Template - UploadKrishna SharmaNo ratings yet

- DFR Venmyn RandDocument43 pagesDFR Venmyn RandSreedharBj0% (1)

- Nike Cost of Capital CaseDocument18 pagesNike Cost of Capital CasePatricia VidalNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Easy R2R Process Interview QuestionsDocument8 pagesEasy R2R Process Interview Questionschandrakant mehtreNo ratings yet

- Valuation of Your Early Drug Candidate: by Linda Pullan, PH.DDocument15 pagesValuation of Your Early Drug Candidate: by Linda Pullan, PH.DYinsheng XuNo ratings yet

- Corporate Finance - Exercises Session 1Document18 pagesCorporate Finance - Exercises Session 1LouisRemNo ratings yet

- Damodaran DCFDocument15 pagesDamodaran DCFpraveen_356100% (2)

- CFA L1 Quartic Quants Time Value of Money NotesDocument14 pagesCFA L1 Quartic Quants Time Value of Money NotesNishant SenapatiNo ratings yet

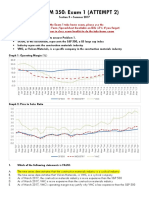

- BUS ADM 350: Exam 1 (ATTEMPT 2)Document6 pagesBUS ADM 350: Exam 1 (ATTEMPT 2)Maddah HussainNo ratings yet

- F1-Hybrid Vehicle Case StudyDocument2 pagesF1-Hybrid Vehicle Case StudyHongjung ChaNo ratings yet

- Private Equity Valuation - BrochureDocument5 pagesPrivate Equity Valuation - BrochureJustine9910% (1)

- Valuation & Macroeco Finance Session - 131016Document59 pagesValuation & Macroeco Finance Session - 131016Vivek AnandanNo ratings yet

- Extra Reading For Further Comprehension: Net Present Value (NPV)Document27 pagesExtra Reading For Further Comprehension: Net Present Value (NPV)widedbenmoussaNo ratings yet

- NOTES On Finma Mod 3 Stocks and Their ValuationDocument4 pagesNOTES On Finma Mod 3 Stocks and Their ValuationLeyanna Pauleen VillanuevaNo ratings yet

- Capital Investment Appraisal For EnglandDocument80 pagesCapital Investment Appraisal For EnglandgishaqueNo ratings yet