Professional Documents

Culture Documents

Business Trip-Reimbursement

Business Trip-Reimbursement

Uploaded by

abodee850Copyright:

Available Formats

You might also like

- Receipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiDocument1 pageReceipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiNasser AltuwaijriNo ratings yet

- Module 1 People and The Earths EcosystemDocument8 pagesModule 1 People and The Earths EcosystemRalph PanesNo ratings yet

- عبدالله فرحان وييب بيدزDocument1 pageعبدالله فرحان وييب بيدزelsherif749No ratings yet

- Order - SO393Document2 pagesOrder - SO393Sameer KhanNo ratings yet

- شركة جوتن السعودية المحدودة CD5024003037Document2 pagesشركة جوتن السعودية المحدودة CD5024003037alrashdydecorationNo ratings yet

- Invoice -شركة سلام البناء للمقاولاتDocument2 pagesInvoice -شركة سلام البناء للمقاولاتMuhammad Daniyal100% (1)

- Order - SO326Document1 pageOrder - SO326Sameer KhanNo ratings yet

- Invoice -مكتب الخليج للاستشارات الهندسيةDocument2 pagesInvoice -مكتب الخليج للاستشارات الهندسيةMuhammad DaniyalNo ratings yet

- Inv01 2022 09 0157Document1 pageInv01 2022 09 0157Ahmed GamalNo ratings yet

- انيسكو- ربط المضخةDocument1 pageانيسكو- ربط المضخةعبد الرحمن الشاعرNo ratings yet

- Invoice ViewDocument1 pageInvoice Viewfazil yoosufNo ratings yet

- VAT Invoice - 2024-01-31 - 00000007031318-2401-18359960Document2 pagesVAT Invoice - 2024-01-31 - 00000007031318-2401-18359960mhzp4ckj47No ratings yet

- Draft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceDocument1 pageDraft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceTilalNo ratings yet

- Flights:: اﻟ ر ﺣ ﻼ ت: Dear Passenger, Thanks for your paymentDocument1 pageFlights:: اﻟ ر ﺣ ﻼ ت: Dear Passenger, Thanks for your paymentzere.imanNo ratings yet

- Inv01 2022 06 0305Document1 pageInv01 2022 06 0305Ahmed Gamal100% (1)

- Quotation 206 1870Document1 pageQuotation 206 1870taybatalhejazjdNo ratings yet

- BillDocument3 pagesBillAbhay Dhakal100% (1)

- Report Lpco BNK Impr PermDocument1 pageReport Lpco BNK Impr PermNebiyat KitawNo ratings yet

- Inv 2023 0267Document1 pageInv 2023 0267infoNo ratings yet

- 02 Proforma InvoiceDocument13 pages02 Proforma InvoiceVinodNo ratings yet

- Tax Invoice: Customer Information Store InformationDocument2 pagesTax Invoice: Customer Information Store InformationMohamed Zedan100% (1)

- Lzurde InvoiceDocument1 pageLzurde Invoicediskhard91No ratings yet

- Fuse PDFDocument1 pageFuse PDFrohit tiwariNo ratings yet

- INV_2024_00122Document1 pageINV_2024_00122Amr NegedaNo ratings yet

- Vat InvoiceDocument2 pagesVat Invoiceإدريس البحريNo ratings yet

- SIMPLIFIED TAX INVOICE / ﺔﻄﺴﺒﻤﻟا ﺔﻴﺒﻳﺮﻀﻟا ةرﻮﺗﺎﻔﻟاDocument1 pageSIMPLIFIED TAX INVOICE / ﺔﻄﺴﺒﻤﻟا ﺔﻴﺒﻳﺮﻀﻟا ةرﻮﺗﺎﻔﻟاalganainy brothersNo ratings yet

- Tax Invoice: VAT Reg. NumberDocument1 pageTax Invoice: VAT Reg. NumberAhmed MousaNo ratings yet

- Invoice 7615 11112Document1 pageInvoice 7615 11112Casil CiudadNo ratings yet

- Your Electronic Ticket ReceiptDocument3 pagesYour Electronic Ticket ReceiptinfoNo ratings yet

- SABB Platinum Visa Credit Card StatementDocument2 pagesSABB Platinum Visa Credit Card StatementMujahed AhmedNo ratings yet

- Food TechnologyDocument2 pagesFood TechnologyamazingworldfactrNo ratings yet

- Invoice From BB 1374498841Document2 pagesInvoice From BB 1374498841amazingworldfactrNo ratings yet

- Nour Energy - Branch of Nour Communications Co.Document1 pageNour Energy - Branch of Nour Communications Co.Abdullah BishawiNo ratings yet

- KWS 2024 04 0082Document1 pageKWS 2024 04 0082Sher DilNo ratings yet

- Quotation: Customer Code: 81063 Information VAT Number - 300055945410003Document1 pageQuotation: Customer Code: 81063 Information VAT Number - 300055945410003Marcial Jr. MilitanteNo ratings yet

- لقطة شاشة ٢٠٢٤-٠٣-٠٢ في ٣.٤٤.٣٩ مDocument1 pageلقطة شاشة ٢٠٢٤-٠٣-٠٢ في ٣.٤٤.٣٩ مAmjad EuthmanNo ratings yet

- Aziz Saleh Bin Ahmed Al Atia Alghamdi Policy Details عزيز صالح بن احمد ال عطیه الغامديDocument1 pageAziz Saleh Bin Ahmed Al Atia Alghamdi Policy Details عزيز صالح بن احمد ال عطیه الغامديBapak Abdul Aziz SalehNo ratings yet

- Py Cobil 5Document8 pagesPy Cobil 5Riyaad MandisaNo ratings yet

- Mar 2021 009093639349Document3 pagesMar 2021 009093639349shakil ahmadNo ratings yet

- Amd Masar Invoice CompDocument1 pageAmd Masar Invoice CompyasirNo ratings yet

- Web 910903295Document3 pagesWeb 910903295nouredeensalehNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: InvoicehusseinNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: InvoicehusseinNo ratings yet

- Invoice 00023Document1 pageInvoice 00023ahlamNo ratings yet

- Ets QTN 2022 01460Document1 pageEts QTN 2022 01460SUNIL TPNo ratings yet

- COPY TAX INVOICE : JISH ContributionDocument7 pagesCOPY TAX INVOICE : JISH Contributionfx64s8hnxpNo ratings yet

- Lazurde Invoice - NN166Document1 pageLazurde Invoice - NN166diskhard91No ratings yet

- Vf Worldwide Holdings Ltd د ي ﺗ ﻲ إ ل ھ ﻮ ﻟ ﺪ ﯾﻨ ﻐ ﺰ و ر ﻟ ﺪ و اﯾ ﺪ إ ف ﻓ ﻲDocument1 pageVf Worldwide Holdings Ltd د ي ﺗ ﻲ إ ل ھ ﻮ ﻟ ﺪ ﯾﻨ ﻐ ﺰ و ر ﻟ ﺪ و اﯾ ﺪ إ ف ﻓ ﻲmohamed salahNo ratings yet

- ATS Invoice Print Selected Inv 150721Document1 pageATS Invoice Print Selected Inv 150721rehmanimtNo ratings yet

- - OIEP0173273100000007756p~: كﺮﺘﺸﻤﻟا تﺎﻧﺎﻴﺑ Customer DetailsDocument1 page- OIEP0173273100000007756p~: كﺮﺘﺸﻤﻟا تﺎﻧﺎﻴﺑ Customer Detailsمحمود المغيري محمود المغيريNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: Invoicehamedesam45No ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: Invoicehamedesam45No ratings yet

- Declaration 3740546881271Document5 pagesDeclaration 3740546881271OnPoint Business ConsultancyNo ratings yet

- Your Electronic Ticket ReceiptDocument3 pagesYour Electronic Ticket ReceiptMotaz AbdallahNo ratings yet

- G99ZP5S9MLTQDocument1 pageG99ZP5S9MLTQGenius icloudNo ratings yet

- Alinma ReportDocument1 pageAlinma Reportgmmm0020No ratings yet

- Report Lpco BNK Impr PermDocument6 pagesReport Lpco BNK Impr Permtasheabdi6100% (2)

- 2Document1 page2adullah aminNo ratings yet

- Report Imp Rels PermDocument1 pageReport Imp Rels PermMusté AbdiNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: Invoicehamedesam45No ratings yet

- A G Gardiner EssaysDocument50 pagesA G Gardiner Essaysngisjqaeg100% (2)

- 13L00501A - 7P-A: General NotesDocument7 pages13L00501A - 7P-A: General NotesCLS AKNo ratings yet

- TensesDocument1 pageTensesharis ilyasNo ratings yet

- Rela Tori OhhDocument1,830 pagesRela Tori OhhLeandro MedeirosNo ratings yet

- Disinfection Cabinet and Insect KillersDocument4 pagesDisinfection Cabinet and Insect Killerssathya moorthy KamakottiNo ratings yet

- 21st Century WeaponsDocument6 pages21st Century WeaponsSaqibMahmoodNo ratings yet

- Free Bitcoin MethodDocument7 pagesFree Bitcoin MethodOkoye VictorNo ratings yet

- CHUYÊN ĐỀ CHỈ SỰ NHƯỢNG BỘDocument5 pagesCHUYÊN ĐỀ CHỈ SỰ NHƯỢNG BỘĐinh DuyênNo ratings yet

- ConcordDocument2 pagesConcordLiwang Ulama UtamaNo ratings yet

- Runner of Francis Turbine:) Cot Cot (Document5 pagesRunner of Francis Turbine:) Cot Cot (Arun Kumar SinghNo ratings yet

- Current Trends of Farm Power Sources inDocument6 pagesCurrent Trends of Farm Power Sources inNakul DevaiahNo ratings yet

- LG W1943C Chass LM92C PDFDocument23 pagesLG W1943C Chass LM92C PDFDaniel Paguay100% (1)

- Hand Book of Transport Mode Lling - : Kenneth J. ButtonDocument8 pagesHand Book of Transport Mode Lling - : Kenneth J. ButtonSamuel ValentineNo ratings yet

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document2 pagesElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Prashant PatilNo ratings yet

- Achieving Success Through Effective Business CommunicationDocument36 pagesAchieving Success Through Effective Business Communicationfaizankhan23No ratings yet

- Views, Synonyms, and SequencesDocument46 pagesViews, Synonyms, and Sequencesprad15No ratings yet

- Good, Bad and Ugly Process Burner FlamesDocument3 pagesGood, Bad and Ugly Process Burner Flamesratninp9368No ratings yet

- Calcium HypochloriteDocument260 pagesCalcium HypochloriteWidya Pradipta100% (1)

- Advancement ProposalDocument2 pagesAdvancement ProposalJEFFERSON GOMEZNo ratings yet

- Lapczyk PDFDocument22 pagesLapczyk PDFFredy PicaulyNo ratings yet

- Brainy kl7 Unit Test 7 CDocument5 pagesBrainy kl7 Unit Test 7 CMateusz NochNo ratings yet

- JD - Part Time Online ESL Teacher - Daylight PDFDocument2 pagesJD - Part Time Online ESL Teacher - Daylight PDFCIO White PapersNo ratings yet

- Ibot vs. TaycoDocument2 pagesIbot vs. TaycoMishal Oisin100% (1)

- Bricked N910FDocument2 pagesBricked N910FPhan Mem Tien ÍchNo ratings yet

- Cincinnati Retirement System Update: March 28, 2022Document24 pagesCincinnati Retirement System Update: March 28, 2022WVXU NewsNo ratings yet

- Common Service Data Model (CSDM) 3.0 White PaperDocument31 pagesCommon Service Data Model (CSDM) 3.0 White PaperЕвгения МазинаNo ratings yet

- Jeffrey Epstein39s Little Black Book UnredactedDocument95 pagesJeffrey Epstein39s Little Black Book Unredactedrevor100% (3)

- 0RBIAR0B4E1ADocument321 pages0RBIAR0B4E1AAnkur VermaNo ratings yet

- Specification - MechanicalDocument5 pagesSpecification - MechanicalEDEN FALCONINo ratings yet

Business Trip-Reimbursement

Business Trip-Reimbursement

Uploaded by

abodee850Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Trip-Reimbursement

Business Trip-Reimbursement

Uploaded by

abodee850Copyright:

Available Formats

Business Trip Reimbursement

ID No. 20506 Name: Abdulelah Algamri Department: Engineering

a Business Travel General Purchases

Per Diem PO Required (Attached)

Against Actual Invoice Petty Expenses (No PO Required)

Destination Al-Jubail

Purpose LECO inspection and sample preparation Others

Specify

Approved Travel Date(s) Actual Travel Date(s) Difference

Start Date 4-Mar-24 Start Date 4-Mar-24

End Date 7-Mar-24 End Date 7-Mar-24

No. of Days 3 No. of Days 3 0 Day(s)

Justification for Changes in Travel Dates:

Total Cash Advance (SR) - -

Less: Actual Expenses (Use Separate Sheet if Necsessary)

Ref. Inv. ITEM Curr. Amount Qty Unit Rate Total (SR) VAT (15%) Total (SR)

(F Currency) (VAT Excl.) (VAT Incl.)

Refer to the Attached below Hotel Bill SAR 127.66 3 127.66 392.55 57.45 450.00

Refer to the Attached below Food Bills SAR 15.00 1 15.00 15.00 2.25 17.25

Refer to the Attached below Food Bills SAR 18.26 1 18.26 18.26 2.74 21.00

Total Expenses (SR) 488.25

Net Due From/(To) Employee (488.25)

Remarks:

EMPLOYEE DEPT. HEAD HR DEPT FINANCE DEPT FINAL APPROVAL

Distribution: Original - Accounts Department, Copy - Employee Form FI 002

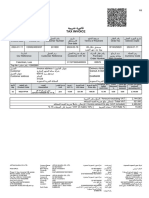

ﺍﻟﻔﺮﺣﺎﻥ ﻟﻸﺟﻨﺤﻪ ﺍﻟﻔﻨﺪﻗﻴﺔ )ﺍﻟﺠﺒﻴﻞ -ﺍﻟﺒﻠﺪ( ﺍﻟﻔﺮﺣﺎﻥ ﻟﻸﺟﻨﺤﻪ ﺍﻟﻔﻨﺪﻗﻴﺔ )ﺍﻟﺠﺒﻴﻞ -ﺍﻟﺒﻠﺪ(

Al Jubail ﺍﻟﺠﺒﻴﻞ

Al-Waha ﺍﻟﻮﺍﺣﺔ

CR No. 2055133989 ﺍﻟﺴﺠﻞ ﺍﻟﺘﺠﺎﺭﻱ VAT No. 300888594100003 ﺍﻟﺮﻗﻢ ﺍﻟﻀﺮﯾﺒﻲ

Simplified Tax Invoice ﻓﺎﺗﻮﺭﺓ ﺿﺮﻳﺒﻴﺔ ﻣﺒﺴﻄﺔ

Invoice No 30433 ﺭﻗﻢ ﺍﻟﻔﺎﺗﻮﺭﺓ

Invoice date )07/03/2024 (26/08/1445 ﺗﺎﺭﻳﺦ ﺍﻟﻔﺎﺗﻮﺭﺓ

Created on م 07/03/2024 07:13:09 ﺃﻧﺸﺄﺕ ﻓﻲ

Res. No 00869 ﺭﻗﻢ ﺍﻟﺤﺠﺰ

Res.Period 04/03/2024 - 07/03/2024 ﻓﺘﺮﺓ ﺍﻟﺤﺠﺰ

Unit No. 707ﻏﺮﻓﺔ ﻭﺣﻤﺎﻡ 2ﺳﺮﻳﺮ ﺭﻗﻢ ﺍﻟﻮﺣﺪﺓ

Unit Type ﻏﺮﻓﺔ ﻣﻔﺮﺩﺓ ﻧﻮﻉ ﺍﻟﻮﺣﺪﺓ

Buyer SPACE SPACE SPACE SPACE ﺍﻟﻤﺸﺘﺮﻱ

District --- ﺍﻟﺤﻲ Guest Name ﻋﺒﺪ ﺍﻻﻟﻪ ﺍﻟﻌﻤﺮﻱ ﺍﺳﻢ ﺍﻟﻌﻤﻴﻞ

Street --- ﺷﺎﺭﻉ Mobile No 00966532867764 ﺭﻗﻢ ﺍﻟﺠﻮﺍﻝ

Postal Code --- ﺍﻟﺮﻣﺰ ﺍﻟﺒﺮﻳﺪﻱ Corporate --- ﺍﻟﺸﺮﻛﺔ

Build / (Add) No. )--- / (--- ﺍﻟﻤﺒﻨﻰ ) /ﺍﻹﺿﺎﻓﻲ( Country --- ﺍﻟﺪﻭﻟﺔ

VAT No. --- ﺍﻟﺮﻗﻢ ﺍﻟﻀﺮﻳﺒﻲ City --- ﺍﻟﻤﺪﻳﻨﺔ

Additional Seller's information ﻣﻌﻠﻮﻣﺎﺕ ﺍﻟﺒﺎﺋﻊ ﺍﻹﺿﺎﻓﻴﺔ

Building No. --- ﺭﻗﻢ ﺍﻟﻤﺒﻨﻰ Country ﺍﻟﻤﻤﻠﻜﺔ ﺍﻟﻌﺮﺑﻴﺔ ﺍﻟﺴﻌﻮﺩﻳﺔ ﺍﻟﺪﻭﻟﺔ

Additional No. --- ﺍﻟﺮﻗﻢ ﺍﻹﺿﺎﻓﻲ City ﺍﻟﺠﺒﻴﻞ ﺍﻟﻤﺪﻳﻨﺔ

Street ﻋﺒﺪﺍﻟﻌﺰﻳﺰ King Abdulaziz Road ﺷﺎﺭﻉ District ﺍﻟﻮﺍﺣﺔ ﺍﻟﺤﻲ

ﺍﻹﺟﻤﺎﻟﻲ ﺍﻟﻜﻠﻲ ﻣﺒﻠﻎ ﺍﻟﻀﺮﻳﺒﺔ ﻧﺴﺒﺔ ﺍﻟﻀﺮﻳﺒﺔ ﺍﻹﺟﻤﺎﻟﻲ ﺍﻟﺨﺼﻢ ﺍﻹﺟﻤﺎﻟﻲ ﺍﻟﻔﺮﻋﻲ ﺍﻟﺴﻌﺮ ﺍﻟﻜﻤﻴﺔ ﺍﻟﻮﺻﻒ

Grand Total Tax Amount Tax Rate Total Discount Sub Total Price QTY Description

ﺗﻜﻠﻔﺔ ﺍﻻﻳﺠﺎﺭ Rental Amount /

440.43 57.45 15.00 382.98 0.00 382.98 127.66 3

04/03/2024-06/03/2024

Lodging tax - Rental )(2.5 %

9.57 0.00 0.00 9.57 0.00 9.57 3.19 3

ﺭﺳﻮﻡ ﺍﺷﻐﺎﻝ ﻣﺮﺍﻓﻖ ﺍﻻﻳﻮﺍﺀ -ﺍﻳﺠﺎﺭ

Totals SPACE ﺍﻟﻤﺒﺎﻟﻎ ﺍﻹﺟﻤﺎﻟﻴﺔ

Total not subject to VAT 9.57 SAR ﺍﻟﻤﺒﺎﻟﻎ ﺍﻟﻐﻴﺮ ﺧﺎﺿﻌﺔ ﻟﻠﻀﺮﻳﺒﺔ

Total subject to VAT 382.98 SAR ﺍﻟﻤﺒﺎﻟﻎ ﺍﻟﺨﺎﺿﻌﺔ ﻟﻠﻀﺮﻳﺒﺔ

)VAT (15% 57.45 SAR ﺿﺮﻳﺒﺔ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﻀﺎﻓﺔ )(15%

)Grand Total (Including VAT 450.00 SAR ﺍﻹﺟﻤﺎﻟﻲ ﺍﻟﻜﻠﻲ )ﺷﺎﻣﻞ ﺿﺮﻳﺒﺔ ﺍﻟﻘﻴﻤﺔ ﺍﻟﻤﻀﺎﻓﺔ(

Notes ﻣﻼﺣﻈﺎﺕ

ﻓﺎﺗﻮﺭﺓ ﻋﻠﻰ ﺍﻟﻌﻘﺪ ﺭﻗﻢ ). (869

ﻫﺎﺗﻒ 0133638288: ﺍﻟﺮﻣﺰ ﺍﻟﺒﺮﻳﺪﻱ 39953: ﺍﻟﺒﺮﻳﺪ ﺍﻻﻟﻜﺘﺮﻭﻧﻲ alfarhan_hotel@yahoo.com: Page 1 of 1

You might also like

- Receipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiDocument1 pageReceipt - ASC Apt 52 - Mr. Abdulllah Al TuwairijiNasser AltuwaijriNo ratings yet

- Module 1 People and The Earths EcosystemDocument8 pagesModule 1 People and The Earths EcosystemRalph PanesNo ratings yet

- عبدالله فرحان وييب بيدزDocument1 pageعبدالله فرحان وييب بيدزelsherif749No ratings yet

- Order - SO393Document2 pagesOrder - SO393Sameer KhanNo ratings yet

- شركة جوتن السعودية المحدودة CD5024003037Document2 pagesشركة جوتن السعودية المحدودة CD5024003037alrashdydecorationNo ratings yet

- Invoice -شركة سلام البناء للمقاولاتDocument2 pagesInvoice -شركة سلام البناء للمقاولاتMuhammad Daniyal100% (1)

- Order - SO326Document1 pageOrder - SO326Sameer KhanNo ratings yet

- Invoice -مكتب الخليج للاستشارات الهندسيةDocument2 pagesInvoice -مكتب الخليج للاستشارات الهندسيةMuhammad DaniyalNo ratings yet

- Inv01 2022 09 0157Document1 pageInv01 2022 09 0157Ahmed GamalNo ratings yet

- انيسكو- ربط المضخةDocument1 pageانيسكو- ربط المضخةعبد الرحمن الشاعرNo ratings yet

- Invoice ViewDocument1 pageInvoice Viewfazil yoosufNo ratings yet

- VAT Invoice - 2024-01-31 - 00000007031318-2401-18359960Document2 pagesVAT Invoice - 2024-01-31 - 00000007031318-2401-18359960mhzp4ckj47No ratings yet

- Draft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceDocument1 pageDraft: ﺔﻴﺒﻳﺮﺿ ةرﻮﺗﺎﻓ Tax InvoiceTilalNo ratings yet

- Flights:: اﻟ ر ﺣ ﻼ ت: Dear Passenger, Thanks for your paymentDocument1 pageFlights:: اﻟ ر ﺣ ﻼ ت: Dear Passenger, Thanks for your paymentzere.imanNo ratings yet

- Inv01 2022 06 0305Document1 pageInv01 2022 06 0305Ahmed Gamal100% (1)

- Quotation 206 1870Document1 pageQuotation 206 1870taybatalhejazjdNo ratings yet

- BillDocument3 pagesBillAbhay Dhakal100% (1)

- Report Lpco BNK Impr PermDocument1 pageReport Lpco BNK Impr PermNebiyat KitawNo ratings yet

- Inv 2023 0267Document1 pageInv 2023 0267infoNo ratings yet

- 02 Proforma InvoiceDocument13 pages02 Proforma InvoiceVinodNo ratings yet

- Tax Invoice: Customer Information Store InformationDocument2 pagesTax Invoice: Customer Information Store InformationMohamed Zedan100% (1)

- Lzurde InvoiceDocument1 pageLzurde Invoicediskhard91No ratings yet

- Fuse PDFDocument1 pageFuse PDFrohit tiwariNo ratings yet

- INV_2024_00122Document1 pageINV_2024_00122Amr NegedaNo ratings yet

- Vat InvoiceDocument2 pagesVat Invoiceإدريس البحريNo ratings yet

- SIMPLIFIED TAX INVOICE / ﺔﻄﺴﺒﻤﻟا ﺔﻴﺒﻳﺮﻀﻟا ةرﻮﺗﺎﻔﻟاDocument1 pageSIMPLIFIED TAX INVOICE / ﺔﻄﺴﺒﻤﻟا ﺔﻴﺒﻳﺮﻀﻟا ةرﻮﺗﺎﻔﻟاalganainy brothersNo ratings yet

- Tax Invoice: VAT Reg. NumberDocument1 pageTax Invoice: VAT Reg. NumberAhmed MousaNo ratings yet

- Invoice 7615 11112Document1 pageInvoice 7615 11112Casil CiudadNo ratings yet

- Your Electronic Ticket ReceiptDocument3 pagesYour Electronic Ticket ReceiptinfoNo ratings yet

- SABB Platinum Visa Credit Card StatementDocument2 pagesSABB Platinum Visa Credit Card StatementMujahed AhmedNo ratings yet

- Food TechnologyDocument2 pagesFood TechnologyamazingworldfactrNo ratings yet

- Invoice From BB 1374498841Document2 pagesInvoice From BB 1374498841amazingworldfactrNo ratings yet

- Nour Energy - Branch of Nour Communications Co.Document1 pageNour Energy - Branch of Nour Communications Co.Abdullah BishawiNo ratings yet

- KWS 2024 04 0082Document1 pageKWS 2024 04 0082Sher DilNo ratings yet

- Quotation: Customer Code: 81063 Information VAT Number - 300055945410003Document1 pageQuotation: Customer Code: 81063 Information VAT Number - 300055945410003Marcial Jr. MilitanteNo ratings yet

- لقطة شاشة ٢٠٢٤-٠٣-٠٢ في ٣.٤٤.٣٩ مDocument1 pageلقطة شاشة ٢٠٢٤-٠٣-٠٢ في ٣.٤٤.٣٩ مAmjad EuthmanNo ratings yet

- Aziz Saleh Bin Ahmed Al Atia Alghamdi Policy Details عزيز صالح بن احمد ال عطیه الغامديDocument1 pageAziz Saleh Bin Ahmed Al Atia Alghamdi Policy Details عزيز صالح بن احمد ال عطیه الغامديBapak Abdul Aziz SalehNo ratings yet

- Py Cobil 5Document8 pagesPy Cobil 5Riyaad MandisaNo ratings yet

- Mar 2021 009093639349Document3 pagesMar 2021 009093639349shakil ahmadNo ratings yet

- Amd Masar Invoice CompDocument1 pageAmd Masar Invoice CompyasirNo ratings yet

- Web 910903295Document3 pagesWeb 910903295nouredeensalehNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: InvoicehusseinNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: InvoicehusseinNo ratings yet

- Invoice 00023Document1 pageInvoice 00023ahlamNo ratings yet

- Ets QTN 2022 01460Document1 pageEts QTN 2022 01460SUNIL TPNo ratings yet

- COPY TAX INVOICE : JISH ContributionDocument7 pagesCOPY TAX INVOICE : JISH Contributionfx64s8hnxpNo ratings yet

- Lazurde Invoice - NN166Document1 pageLazurde Invoice - NN166diskhard91No ratings yet

- Vf Worldwide Holdings Ltd د ي ﺗ ﻲ إ ل ھ ﻮ ﻟ ﺪ ﯾﻨ ﻐ ﺰ و ر ﻟ ﺪ و اﯾ ﺪ إ ف ﻓ ﻲDocument1 pageVf Worldwide Holdings Ltd د ي ﺗ ﻲ إ ل ھ ﻮ ﻟ ﺪ ﯾﻨ ﻐ ﺰ و ر ﻟ ﺪ و اﯾ ﺪ إ ف ﻓ ﻲmohamed salahNo ratings yet

- ATS Invoice Print Selected Inv 150721Document1 pageATS Invoice Print Selected Inv 150721rehmanimtNo ratings yet

- - OIEP0173273100000007756p~: كﺮﺘﺸﻤﻟا تﺎﻧﺎﻴﺑ Customer DetailsDocument1 page- OIEP0173273100000007756p~: كﺮﺘﺸﻤﻟا تﺎﻧﺎﻴﺑ Customer Detailsمحمود المغيري محمود المغيريNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: Invoicehamedesam45No ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: Invoicehamedesam45No ratings yet

- Declaration 3740546881271Document5 pagesDeclaration 3740546881271OnPoint Business ConsultancyNo ratings yet

- Your Electronic Ticket ReceiptDocument3 pagesYour Electronic Ticket ReceiptMotaz AbdallahNo ratings yet

- G99ZP5S9MLTQDocument1 pageG99ZP5S9MLTQGenius icloudNo ratings yet

- Alinma ReportDocument1 pageAlinma Reportgmmm0020No ratings yet

- Report Lpco BNK Impr PermDocument6 pagesReport Lpco BNK Impr Permtasheabdi6100% (2)

- 2Document1 page2adullah aminNo ratings yet

- Report Imp Rels PermDocument1 pageReport Imp Rels PermMusté AbdiNo ratings yet

- Va Lid: InvoiceDocument1 pageVa Lid: Invoicehamedesam45No ratings yet

- A G Gardiner EssaysDocument50 pagesA G Gardiner Essaysngisjqaeg100% (2)

- 13L00501A - 7P-A: General NotesDocument7 pages13L00501A - 7P-A: General NotesCLS AKNo ratings yet

- TensesDocument1 pageTensesharis ilyasNo ratings yet

- Rela Tori OhhDocument1,830 pagesRela Tori OhhLeandro MedeirosNo ratings yet

- Disinfection Cabinet and Insect KillersDocument4 pagesDisinfection Cabinet and Insect Killerssathya moorthy KamakottiNo ratings yet

- 21st Century WeaponsDocument6 pages21st Century WeaponsSaqibMahmoodNo ratings yet

- Free Bitcoin MethodDocument7 pagesFree Bitcoin MethodOkoye VictorNo ratings yet

- CHUYÊN ĐỀ CHỈ SỰ NHƯỢNG BỘDocument5 pagesCHUYÊN ĐỀ CHỈ SỰ NHƯỢNG BỘĐinh DuyênNo ratings yet

- ConcordDocument2 pagesConcordLiwang Ulama UtamaNo ratings yet

- Runner of Francis Turbine:) Cot Cot (Document5 pagesRunner of Francis Turbine:) Cot Cot (Arun Kumar SinghNo ratings yet

- Current Trends of Farm Power Sources inDocument6 pagesCurrent Trends of Farm Power Sources inNakul DevaiahNo ratings yet

- LG W1943C Chass LM92C PDFDocument23 pagesLG W1943C Chass LM92C PDFDaniel Paguay100% (1)

- Hand Book of Transport Mode Lling - : Kenneth J. ButtonDocument8 pagesHand Book of Transport Mode Lling - : Kenneth J. ButtonSamuel ValentineNo ratings yet

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document2 pagesElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Prashant PatilNo ratings yet

- Achieving Success Through Effective Business CommunicationDocument36 pagesAchieving Success Through Effective Business Communicationfaizankhan23No ratings yet

- Views, Synonyms, and SequencesDocument46 pagesViews, Synonyms, and Sequencesprad15No ratings yet

- Good, Bad and Ugly Process Burner FlamesDocument3 pagesGood, Bad and Ugly Process Burner Flamesratninp9368No ratings yet

- Calcium HypochloriteDocument260 pagesCalcium HypochloriteWidya Pradipta100% (1)

- Advancement ProposalDocument2 pagesAdvancement ProposalJEFFERSON GOMEZNo ratings yet

- Lapczyk PDFDocument22 pagesLapczyk PDFFredy PicaulyNo ratings yet

- Brainy kl7 Unit Test 7 CDocument5 pagesBrainy kl7 Unit Test 7 CMateusz NochNo ratings yet

- JD - Part Time Online ESL Teacher - Daylight PDFDocument2 pagesJD - Part Time Online ESL Teacher - Daylight PDFCIO White PapersNo ratings yet

- Ibot vs. TaycoDocument2 pagesIbot vs. TaycoMishal Oisin100% (1)

- Bricked N910FDocument2 pagesBricked N910FPhan Mem Tien ÍchNo ratings yet

- Cincinnati Retirement System Update: March 28, 2022Document24 pagesCincinnati Retirement System Update: March 28, 2022WVXU NewsNo ratings yet

- Common Service Data Model (CSDM) 3.0 White PaperDocument31 pagesCommon Service Data Model (CSDM) 3.0 White PaperЕвгения МазинаNo ratings yet

- Jeffrey Epstein39s Little Black Book UnredactedDocument95 pagesJeffrey Epstein39s Little Black Book Unredactedrevor100% (3)

- 0RBIAR0B4E1ADocument321 pages0RBIAR0B4E1AAnkur VermaNo ratings yet

- Specification - MechanicalDocument5 pagesSpecification - MechanicalEDEN FALCONINo ratings yet