Professional Documents

Culture Documents

Daily Updates - March 27

Daily Updates - March 27

Uploaded by

rksapsecgrc010Copyright:

Available Formats

You might also like

- Index Fund Investing 101Document100 pagesIndex Fund Investing 101newmexicoomfs100% (9)

- Fundamentals of Financial Management 14th Edition Brigham Test BankDocument15 pagesFundamentals of Financial Management 14th Edition Brigham Test BankGeraldTorresfdpam100% (14)

- Daily Updates - March 28Document2 pagesDaily Updates - March 28rksapsecgrc010No ratings yet

- Daily Updates - April 01Document2 pagesDaily Updates - April 01rksapsecgrc010No ratings yet

- Daily Updates - May 10Document2 pagesDaily Updates - May 10kmanikecNo ratings yet

- Daily Updates - May 23Document2 pagesDaily Updates - May 23Abbas IbrahimNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Daily Stock Market Briefing 07-06Document11 pagesDaily Stock Market Briefing 07-06Sanchit BagaiNo ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Investment Morning ReportDocument3 pagesInvestment Morning ReportABHIJIT PRAKASH JHANo ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Daily Stock Market Briefing 10-06-2024Document11 pagesDaily Stock Market Briefing 10-06-2024Sanchit BagaiNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Tue, 4 Jun 2024: Global IndicesDocument7 pagesTue, 4 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Daily Stock Market Briefing 19-03-2024Document10 pagesDaily Stock Market Briefing 19-03-2024Kamal MeenaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Quity Esearch AB Erivativ E Eport THDocument9 pagesQuity Esearch AB Erivativ E Eport THAru MehraNo ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- Apr 25 Morning NewsDocument2 pagesApr 25 Morning Newssk5794657No ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Post Market Briefing 20-03-2024Document9 pagesDaily Post Market Briefing 20-03-2024Kamal MeenaNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 29 June 2012Document10 pagesDaily Equty Report by Epic Research - 29 June 2012Arthur GentryNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 27 June 2012Document10 pagesDaily Equty Report by Epic Research - 27 June 2012Ryan WalterNo ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Capstocks (Daily Reports) 29 Feb 2024Document13 pagesCapstocks (Daily Reports) 29 Feb 2024LaxmiNarasimhaa KrishnapurAnanthNo ratings yet

- E R L D R 5: Quity Esearch AB Erivative Eport THDocument9 pagesE R L D R 5: Quity Esearch AB Erivative Eport THAru MehraNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- Daily Market Briefing 21-03-2024Document5 pagesDaily Market Briefing 21-03-2024Shaikh ParvezNo ratings yet

- T I M E S: Market Yearns For Fresh TriggersDocument22 pagesT I M E S: Market Yearns For Fresh TriggersDhawan SandeepNo ratings yet

- Market Outlook For 28 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 28 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- Capitalbuilderdaily PDFDocument5 pagesCapitalbuilderdaily PDFCapital Buildr Financial ServicesNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Erivati VE Eport RD ARDocument9 pagesErivati VE Eport RD ARAru MehraNo ratings yet

- Market Data.: By: Ameya, Kanchan, Meghna, Punit, RahulDocument15 pagesMarket Data.: By: Ameya, Kanchan, Meghna, Punit, Rahulams0828No ratings yet

- Markets For You - 25 February 2015Document2 pagesMarkets For You - 25 February 2015Rahul SaxenaNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlNo ratings yet

- East Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthFrom EverandEast Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthNo ratings yet

- OceanofPDF - Com Financial Times - The Financial Times LimitedDocument22 pagesOceanofPDF - Com Financial Times - The Financial Times LimitedMuhammad MustaphaNo ratings yet

- Innovation Loves CompanyDocument33 pagesInnovation Loves CompanycantuscantusNo ratings yet

- IGWT Report 23 - Nuggets 17 - The Synchronous Bull Market IndicatorDocument29 pagesIGWT Report 23 - Nuggets 17 - The Synchronous Bull Market IndicatorSerigne Modou NDIAYENo ratings yet

- A Stock Is Not An Index - of Dollars and DataDocument9 pagesA Stock Is Not An Index - of Dollars and DataDragosnic100% (1)

- BlackRock US Equity Index Segregated FundDocument1 pageBlackRock US Equity Index Segregated Fundarrow1714445dongxinNo ratings yet

- Energy Services & Equipment Sector ReportDocument52 pagesEnergy Services & Equipment Sector ReportSaad AliNo ratings yet

- An Intraday Trading MethodologyDocument249 pagesAn Intraday Trading Methodologysuraj100% (1)

- 2023 December Nick Atkeson How To Make Money in A World Where Fin Analyst Are WrongDocument60 pages2023 December Nick Atkeson How To Make Money in A World Where Fin Analyst Are WrongBob ReeceNo ratings yet

- Dynamic Zones User GuideDocument40 pagesDynamic Zones User Guideemre kayaNo ratings yet

- The Little Black Book of Billionaire'S Secrets: Will MeadeDocument34 pagesThe Little Black Book of Billionaire'S Secrets: Will MeadeJane Berry100% (1)

- External Stakeholders - Apple Inc.Document3 pagesExternal Stakeholders - Apple Inc.Arcturus PolluxNo ratings yet

- Fs SP 500 GrowthDocument7 pagesFs SP 500 GrowthDynand PLNNo ratings yet

- Fs SP 500 Shariah IndexDocument8 pagesFs SP 500 Shariah IndexJimot DLangapaNo ratings yet

- Ijbfr V8N2 2014Document132 pagesIjbfr V8N2 2014Suriya SamNo ratings yet

- PGSFDocument1 pagePGSFEileen LauNo ratings yet

- Blackrock US Equity Index Segregated FundDocument1 pageBlackrock US Equity Index Segregated Fundarrow1714445dongxinNo ratings yet

- Asset Management's Guide To The MarketsDocument71 pagesAsset Management's Guide To The MarketsKhaled batticheNo ratings yet

- Test Bank For Fundamentals of Financial Management 14th EditionDocument15 pagesTest Bank For Fundamentals of Financial Management 14th EditionFred Thorton100% (39)

- 23.03.27 SW the-PutCall-ratio-As-A-contrarian-market-timing-Indicator (2022, Fabian Scheler, PCR As A Contrarian Indicator)Document4 pages23.03.27 SW the-PutCall-ratio-As-A-contrarian-market-timing-Indicator (2022, Fabian Scheler, PCR As A Contrarian Indicator)Rolf ScheiderNo ratings yet

- Uncertainty, Data & Judgement: Extra ExercisesDocument53 pagesUncertainty, Data & Judgement: Extra ExercisesSergio GoldinNo ratings yet

- Ishares Core S&P 500 Index Etf (Xus)Document4 pagesIshares Core S&P 500 Index Etf (Xus)Roi SoleilNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- A Beginners Guide To The Stock Market Everything You Need To Start Making Money Today by Kratter, Matthew R. (Kratter, Matthew R.)Document70 pagesA Beginners Guide To The Stock Market Everything You Need To Start Making Money Today by Kratter, Matthew R. (Kratter, Matthew R.)Simple ReaderNo ratings yet

- Aquamarine Fund - Manager Letter 2021Document21 pagesAquamarine Fund - Manager Letter 2021chalapathi kumar yarlagaddaNo ratings yet

- 07 Chapter 2Document30 pages07 Chapter 2anithaivaturi100% (1)

- Buybacks Set Pace For Record: For Personal, Non-Commercial Use OnlyDocument30 pagesBuybacks Set Pace For Record: For Personal, Non-Commercial Use OnlyRazvan Catalin CostinNo ratings yet

- Corporate Finance The Core 3rd Edition Berk Test BankDocument47 pagesCorporate Finance The Core 3rd Edition Berk Test Banklivelongoutfoot0uzwu100% (25)

- Hp12c Invest SecuritiesDocument164 pagesHp12c Invest SecuritiesHoward SunNo ratings yet

Daily Updates - March 27

Daily Updates - March 27

Uploaded by

rksapsecgrc010Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Updates - March 27

Daily Updates - March 27

Uploaded by

rksapsecgrc010Copyright:

Available Formats

DAILY MARKET UPDATE – (27/03/2024)

Indian Stock Market Outlook for March 27

➢ The Indian stock market benchmark indices, Sensex

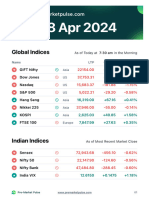

INDICES CLOSE CHANGE %

and Nifty 50 are likely to open lower on Wednesday

SENSEX 72,470.30 -0.50%

tracking mixed global market cues.

NIFTY 50 22,004.74 -0.42%

➢ The Gift Nifty was trading around 22,050 level, a

discount of nearly 40 points from the Nifty futures’ BANKNIFTY 46,600.20 -0.56%

previous close. S&P 500 5,203.58 -0.28%

➢ The Sensex declined 361.64 points to close at NASDAQ 16,315.70 -0.42%

72,470.30, while the Nifty 50 settled 92.05 points, or NIKKEI 225 40,781.46 +0.95%

0.42%, lower at 22,004.70.

HANG SENG 16,597.17 -0.13%

Key Market Developments Overnight

➢ US Stock Market: US stock market indices ended lower on Tuesday, with the Dow and S&P 500

falling for the third straight session.

➢ Asian Markets: On Wednesday, most Asian markets experienced upward movement. The Nikkei 225

in Japan increased by 0.24%, and the Topix saw a gain of 0.4%. Meanwhile, South Korea's Kospi

slightly declined by 0.1%, and the Kosdaq remained unchanged. Futures for Hong Kong's Hang Seng

index suggested a weaker start to trading.

➢ Indian Stock Market: On Tuesday, the benchmark indices of the Indian stock market concluded with

a half-percent decrease, marking the end of their three-day winning streak, influenced by subdued

global signals..

➢ Gift Nifty: Gift Nifty was trading around the 22,050 level, a discount of nearly 40 points from the Nifty

futures’ previous close, indicating a weak start for the Indian stock market indices.

➢ Oil Prices: Crude oil continued its downward trend following data indicating a significant increase in

US inventories. Brent crude dropped by 0.58% to $85.75 per barrel following a 0.6% decline on

Tuesday, while West Texas Intermediate fell by 0.50% to $81.21.

Stocks to Watch: March 27

➢ Wipro: Peter J. Arduini, President and CEO of GE HealthCare, announced that the company's India

unit will bolster its position in the global supply chain with an investment of ₹8,000 crore over the next

five years, starting from the upcoming financial year. Operating a joint venture with Wipro Ltd known

as Wipro GE Healthcare, where it holds a 51% stake, GE HealthCare sees India as a key player in its

supply chain, currently ranking among the top four countries. Arduini expressed confidence in India's

potential to climb even higher in importance in the future.

➢ Cipla: Sanofi India and Sanofi Healthcare India have formed an exclusive partnership with Cipla for

distributing and promoting six central nervous system (CNS) products in India, including the popular

anti-epileptic medication Frisium. Additionally, Cipla has received approval from the US regulatory

authority to merge Cipla Technologies LLC into Cipla USA Inc, effective March 31, 2024. Both entities

are fully owned indirect subsidiaries of Cipla in the USA.

➢ Titan Company: The company has completed the liquidation of its subsidiary TCL Watches

Switzerland AG (earlier known as Favre Leuba AG, (FLAG). With this, TCL Watches Switzerland AG

ceasedto be a wholly-owned subsidiary of the company with effect from March 21, 2024.

➢ Indian Hotels Company: The company has infused $6.5 million in its wholly owned subsidiary

IHOCO BV in Netherlands. The subsidiary will use for repaying debt and other operational purposes

of its subsidiary United Overseas Holding Inc in USA.

➢ Hinduja Group: The Hinduja Group has started the process of rebranding Reliance Capital (RCap)

and its operating companies, following the successful bid of the debt-laden firm, as it awaits final

regulatory approvals.

➢ Piramal Enterprises: Piramal Enterprisesinvested Rs 2,000 crore in Piramal Capital & Housing

Finance (PCHFL), a wholly-owned subsidiary of the company by way of subscription to a rights issue.

********************************

You might also like

- Index Fund Investing 101Document100 pagesIndex Fund Investing 101newmexicoomfs100% (9)

- Fundamentals of Financial Management 14th Edition Brigham Test BankDocument15 pagesFundamentals of Financial Management 14th Edition Brigham Test BankGeraldTorresfdpam100% (14)

- Daily Updates - March 28Document2 pagesDaily Updates - March 28rksapsecgrc010No ratings yet

- Daily Updates - April 01Document2 pagesDaily Updates - April 01rksapsecgrc010No ratings yet

- Daily Updates - May 10Document2 pagesDaily Updates - May 10kmanikecNo ratings yet

- Daily Updates - May 23Document2 pagesDaily Updates - May 23Abbas IbrahimNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulseytmandar29No ratings yet

- Pre-Market Report 07-05Document7 pagesPre-Market Report 07-05biplabmajumderNo ratings yet

- Pre-Market PulseDocument9 pagesPre-Market PulserohitcmauryaNo ratings yet

- Pre - Market Report 11-06Document7 pagesPre - Market Report 11-06Movies Dfdtqtt1tNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- Pre-Market Report 15-04Document7 pagesPre-Market Report 15-04atharv302005No ratings yet

- Daily Stock Market Briefing 07-06Document11 pagesDaily Stock Market Briefing 07-06Sanchit BagaiNo ratings yet

- Pre-Market Pulse 19th DecemberDocument8 pagesPre-Market Pulse 19th Decembersumit_mukundNo ratings yet

- Pre Market PulseDocument9 pagesPre Market Pulsenoobmasterpro007No ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulsedeondalmeida17No ratings yet

- Pre-Market Report 05-04-2Document7 pagesPre-Market Report 05-04-2Avi BansalNo ratings yet

- Investment Morning ReportDocument3 pagesInvestment Morning ReportABHIJIT PRAKASH JHANo ratings yet

- Pre-Market Pulse 20 DecemberDocument8 pagesPre-Market Pulse 20 Decembersumit_mukundNo ratings yet

- Pre-Market Report 06-05Document7 pagesPre-Market Report 06-05biplabmajumderNo ratings yet

- MOSt Market Outlook 13 TH May 2024Document10 pagesMOSt Market Outlook 13 TH May 2024sandeepfafsNo ratings yet

- Pre Market PulseDocument8 pagesPre Market Pulsejoew71437No ratings yet

- Daily Stock Market Briefing 10-06-2024Document11 pagesDaily Stock Market Briefing 10-06-2024Sanchit BagaiNo ratings yet

- MOSt Market Outlook 27 TH March 2024Document10 pagesMOSt Market Outlook 27 TH March 2024Sandeep JaiswalNo ratings yet

- Tue, 4 Jun 2024: Global IndicesDocument7 pagesTue, 4 Jun 2024: Global IndicesKetan ShahNo ratings yet

- Daily Stock Market Briefing 19-03-2024Document10 pagesDaily Stock Market Briefing 19-03-2024Kamal MeenaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Pre-Market Pulse 18th DecemberDocument8 pagesPre-Market Pulse 18th Decembersumit_mukundNo ratings yet

- Daily Equty Report by Epic Research - 28 June 2012Document10 pagesDaily Equty Report by Epic Research - 28 June 2012Pamela McknightNo ratings yet

- MOSt Market Outlook 26 TH March 2024Document10 pagesMOSt Market Outlook 26 TH March 2024Sandeep JaiswalNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Quity Esearch AB Erivativ E Eport THDocument9 pagesQuity Esearch AB Erivativ E Eport THAru MehraNo ratings yet

- Wed, 5 Jun 2024: Global IndicesDocument7 pagesWed, 5 Jun 2024: Global IndicesKetan ShahNo ratings yet

- MOSt Market Outlook 4 TH April 2024Document10 pagesMOSt Market Outlook 4 TH April 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 26 June 2012Document9 pagesDaily Equty Report by Epic Research - 26 June 2012Drew PetersonNo ratings yet

- Apr 25 Morning NewsDocument2 pagesApr 25 Morning Newssk5794657No ratings yet

- MOSt Market Outlook 20 TH March 2024Document10 pagesMOSt Market Outlook 20 TH March 2024Sandeep JaiswalNo ratings yet

- Daily Post Market Briefing 20-03-2024Document9 pagesDaily Post Market Briefing 20-03-2024Kamal MeenaNo ratings yet

- MOSt Market Outlook 13 TH February 2024Document10 pagesMOSt Market Outlook 13 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 12 TH February 2024Document10 pagesMOSt Market Outlook 12 TH February 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 20 TH February 2024Document10 pagesMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 29 June 2012Document10 pagesDaily Equty Report by Epic Research - 29 June 2012Arthur GentryNo ratings yet

- MOSt Market Outlook 16 TH February 2024Document10 pagesMOSt Market Outlook 16 TH February 2024Sandeep JaiswalNo ratings yet

- Daily Equty Report by Epic Research - 27 June 2012Document10 pagesDaily Equty Report by Epic Research - 27 June 2012Ryan WalterNo ratings yet

- MOSt Market Outlook 28 TH March 2024Document10 pagesMOSt Market Outlook 28 TH March 2024Sandeep JaiswalNo ratings yet

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Capstocks (Daily Reports) 29 Feb 2024Document13 pagesCapstocks (Daily Reports) 29 Feb 2024LaxmiNarasimhaa KrishnapurAnanthNo ratings yet

- E R L D R 5: Quity Esearch AB Erivative Eport THDocument9 pagesE R L D R 5: Quity Esearch AB Erivative Eport THAru MehraNo ratings yet

- MOSt Market Outlook 1 ST April 2024Document10 pagesMOSt Market Outlook 1 ST April 2024Sandeep JaiswalNo ratings yet

- Daily Market Briefing 21-03-2024Document5 pagesDaily Market Briefing 21-03-2024Shaikh ParvezNo ratings yet

- T I M E S: Market Yearns For Fresh TriggersDocument22 pagesT I M E S: Market Yearns For Fresh TriggersDhawan SandeepNo ratings yet

- Market Outlook For 28 Dec - Cautiously OptimisticDocument5 pagesMarket Outlook For 28 Dec - Cautiously OptimisticMansukh Investment & Trading SolutionsNo ratings yet

- Capitalbuilderdaily PDFDocument5 pagesCapitalbuilderdaily PDFCapital Buildr Financial ServicesNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Erivati VE Eport RD ARDocument9 pagesErivati VE Eport RD ARAru MehraNo ratings yet

- Market Data.: By: Ameya, Kanchan, Meghna, Punit, RahulDocument15 pagesMarket Data.: By: Ameya, Kanchan, Meghna, Punit, Rahulams0828No ratings yet

- Markets For You - 25 February 2015Document2 pagesMarkets For You - 25 February 2015Rahul SaxenaNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- MOSt Market Outlook 19 TH March 2024Document10 pagesMOSt Market Outlook 19 TH March 2024Sandeep JaiswalNo ratings yet

- MOSt Market Outlook 2 ND April 2024Document10 pagesMOSt Market Outlook 2 ND April 2024Sandeep JaiswalNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlNo ratings yet

- East Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthFrom EverandEast Asia and Pacific Economic Update April 2014: Preserving Stability and Promoting GrowthNo ratings yet

- OceanofPDF - Com Financial Times - The Financial Times LimitedDocument22 pagesOceanofPDF - Com Financial Times - The Financial Times LimitedMuhammad MustaphaNo ratings yet

- Innovation Loves CompanyDocument33 pagesInnovation Loves CompanycantuscantusNo ratings yet

- IGWT Report 23 - Nuggets 17 - The Synchronous Bull Market IndicatorDocument29 pagesIGWT Report 23 - Nuggets 17 - The Synchronous Bull Market IndicatorSerigne Modou NDIAYENo ratings yet

- A Stock Is Not An Index - of Dollars and DataDocument9 pagesA Stock Is Not An Index - of Dollars and DataDragosnic100% (1)

- BlackRock US Equity Index Segregated FundDocument1 pageBlackRock US Equity Index Segregated Fundarrow1714445dongxinNo ratings yet

- Energy Services & Equipment Sector ReportDocument52 pagesEnergy Services & Equipment Sector ReportSaad AliNo ratings yet

- An Intraday Trading MethodologyDocument249 pagesAn Intraday Trading Methodologysuraj100% (1)

- 2023 December Nick Atkeson How To Make Money in A World Where Fin Analyst Are WrongDocument60 pages2023 December Nick Atkeson How To Make Money in A World Where Fin Analyst Are WrongBob ReeceNo ratings yet

- Dynamic Zones User GuideDocument40 pagesDynamic Zones User Guideemre kayaNo ratings yet

- The Little Black Book of Billionaire'S Secrets: Will MeadeDocument34 pagesThe Little Black Book of Billionaire'S Secrets: Will MeadeJane Berry100% (1)

- External Stakeholders - Apple Inc.Document3 pagesExternal Stakeholders - Apple Inc.Arcturus PolluxNo ratings yet

- Fs SP 500 GrowthDocument7 pagesFs SP 500 GrowthDynand PLNNo ratings yet

- Fs SP 500 Shariah IndexDocument8 pagesFs SP 500 Shariah IndexJimot DLangapaNo ratings yet

- Ijbfr V8N2 2014Document132 pagesIjbfr V8N2 2014Suriya SamNo ratings yet

- PGSFDocument1 pagePGSFEileen LauNo ratings yet

- Blackrock US Equity Index Segregated FundDocument1 pageBlackrock US Equity Index Segregated Fundarrow1714445dongxinNo ratings yet

- Asset Management's Guide To The MarketsDocument71 pagesAsset Management's Guide To The MarketsKhaled batticheNo ratings yet

- Test Bank For Fundamentals of Financial Management 14th EditionDocument15 pagesTest Bank For Fundamentals of Financial Management 14th EditionFred Thorton100% (39)

- 23.03.27 SW the-PutCall-ratio-As-A-contrarian-market-timing-Indicator (2022, Fabian Scheler, PCR As A Contrarian Indicator)Document4 pages23.03.27 SW the-PutCall-ratio-As-A-contrarian-market-timing-Indicator (2022, Fabian Scheler, PCR As A Contrarian Indicator)Rolf ScheiderNo ratings yet

- Uncertainty, Data & Judgement: Extra ExercisesDocument53 pagesUncertainty, Data & Judgement: Extra ExercisesSergio GoldinNo ratings yet

- Ishares Core S&P 500 Index Etf (Xus)Document4 pagesIshares Core S&P 500 Index Etf (Xus)Roi SoleilNo ratings yet

- Pre-Market PulseDocument8 pagesPre-Market Pulseayush7376307320No ratings yet

- A Beginners Guide To The Stock Market Everything You Need To Start Making Money Today by Kratter, Matthew R. (Kratter, Matthew R.)Document70 pagesA Beginners Guide To The Stock Market Everything You Need To Start Making Money Today by Kratter, Matthew R. (Kratter, Matthew R.)Simple ReaderNo ratings yet

- Aquamarine Fund - Manager Letter 2021Document21 pagesAquamarine Fund - Manager Letter 2021chalapathi kumar yarlagaddaNo ratings yet

- 07 Chapter 2Document30 pages07 Chapter 2anithaivaturi100% (1)

- Buybacks Set Pace For Record: For Personal, Non-Commercial Use OnlyDocument30 pagesBuybacks Set Pace For Record: For Personal, Non-Commercial Use OnlyRazvan Catalin CostinNo ratings yet

- Corporate Finance The Core 3rd Edition Berk Test BankDocument47 pagesCorporate Finance The Core 3rd Edition Berk Test Banklivelongoutfoot0uzwu100% (25)

- Hp12c Invest SecuritiesDocument164 pagesHp12c Invest SecuritiesHoward SunNo ratings yet