Professional Documents

Culture Documents

October 2022 Statement

October 2022 Statement

Uploaded by

shopwellrsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

October 2022 Statement

October 2022 Statement

Uploaded by

shopwellrsCopyright:

Available Formats

Regions Bank

Port Charlotte Office

2100 Forrest Nelson Blvd

Port Charlotte, FL 33952

RAFAEL MARTINEZ

636 EDGEMERE ST NW

PORT CHARLOTTE FL 33948-6318 2

ACCOUNT # 0293783221

092

Cycle 07

Enclosures 0

Page 1 of 3

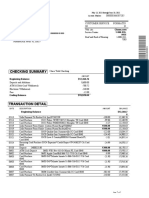

LIFEGREEN CHECKING

September 16, 2022 through October 14, 2022

SUMMARY

Beginning Balance $17.80 Minimum Balance $58 -

Deposits & Credits $1,131.46 + Average Balance $37

Withdrawals $1,104.41 -

Fees $39.00 -

Automatic Transfers $0.00 +

Checks $0.00 -

Ending Balance $5.85

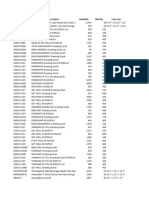

DEPOSITS & CREDITS

09/19 EB From Checking # 0272036664 Ref# 000000 0000057 315.00

09/26 EB From Checking # 0272036664 Ref# 000000 0000058 100.00

10/11 Bank Credit Fee Refund Rafael Martine 3.00

10/11 Bank Credit Fee Refund Rafael Martine 36.00

10/11 Reg E Claim Correction 592.46

10/14 EB From Checking # 0272036664 Ref# 000000 0000059 85.00

Total Deposits & Credits $1,131.46

WITHDRAWALS

09/19 Discover E-Payment Martinez Rafae 3624 250.00

09/19 EB to Checking # 0325515071 Ref# 000000 0000045 50.00

09/20 Card Purchase McDonald S F235 5814 Aurora CO 80011 7352 10.41

09/23 Synchrony Bank Payment Martinez,Rafae 650172511382908 42.00

09/27 EB to Checking # 0325515071 Ref# 000000 0000046 10.00

10/11 Home Depot Payment Martinez Jr,Ra 090876547727161 50.00

10/12 EB to Checking # 0272036664 Ref# 000000 0000047 597.00

10/14 EB to Checking # 0325515071 Ref# 000000 0000048 45.00

For all your banking needs, please call 1-800-REGIONS (734-4667)

or visit us on the Internet at www.regions.com. (TTY/TDD 1-800-374-5791)

For new purchase or refinance mortgage information, contact your

Mortgage Loan Originator, Kenneth Dolan, NMLS 609866, at (757)477-0292

or online at www.regionsmortgage.com/kendolan.

For payment and other information about your existing mortgage loan, contact Mortgage

Servicing at 1-800-986-2462 and for Home Equity loans call 1- 800-231-7493.

Thank You For Banking With Regions!

2022 Regions Bank Member FDIC. All loans subject to credit approval.

Regions Bank

Port Charlotte Office

2100 Forrest Nelson Blvd

Port Charlotte, FL 33952

2

RAFAEL MARTINEZ

636 EDGEMERE ST NW

PORT CHARLOTTE FL 33948-6318

ACCOUNT # 0293783221

092

Cycle 07

Enclosures 0

Page 2 of 3

WITHDRAWALS (CONTINUED)

10/14 EB to Vc 0798 Ref# 000000 0000049 50.00

Total Withdrawals $1,104.41

FEES

09/20 Other Bank ATM Withdrawal Fee 3.00

09/23 Paid Overdraft Item Fee 36.00

Total Fees $39.00

Total For This Total Calendar

Statement Period Year-to-Date

Total Overdraft Fees (may include waived fees) 36.00 180.00

Total Returned Item Fees (may include waived fees) 0.00 72.00

DAILY BALANCE SUMMARY

Date Balance Date Balance Date Balance

09/19 32.80 09/26 41.39 10/12 15.85

09/20 19.39 09/27 31.39 10/14 5.85

09/23 58.61 - 10/11 612.85

You may request account disclosures containing

terms, fees, and rate information (if applicable)

for your account by contacting any Regions office.

Page 3 of 3

Easy Steps to Balance Your Account 4a List any checks, payments, transfers or other

withdrawals from your account that are not on

Checking this statement.

Account

Check

1. Write here the amount shown on $ No. Amount

statement for ENDING BALANCE

$

$

2. Enter any deposits which have not been $

credited on this statement. + $

$

3. Total lines 1 & 2 $ $

= $

$

4. Enter total from 4a $ $

(column on right side of page) - $

$

5. Subtract line 4 from line 3. $ $

This should be your checkbook balance. =

$

$

$

Total Enter in

Line 4 at Left

The law requires you to use "reasonable care and promptness" in examining your bank statement and any checks sent with it and to report to the Bank an

unauthorized signature (i.e., a forgery), any alteration of a check, or any unauthorized endorsement. You must report any forged signatures, alterations or forged

endorsements to the Bank within the time periods specified under the Deposit Agreement. If you do not do this, the Bank will not be liable to you for the losses or

claims arising from the forged signatures, forged endorsements or alterations. Please see the Deposit Agreement for further explanation of your responsibilities

with regard to your statement and checks. A copy of our current Deposit Agreement may be requested at any of our branch locations.

Summary of Our Error Resolution Procedures

In Case of Errors or Questions About Your Electronic Transfers

Telephone us toll-free at 1-800-734-4667

or write us at

Regions Electronic Funds Transfer Services

Post Office Box 413

Birmingham, Alabama 35201

Please contact Regions as soon as you can, if you think your statement is wrong or if you need more information about a transfer listed on your statement. We

must hear from you no later than sixty (60) days after we sent the FIRST statement on which the problem or error appeared.

(1) Tell us your name and account number.

(2) Describe the error or the transfer you are unsure about and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

If you tell us verbally, we may require that you send us your complaint or question in writing within ten (10) business days.

We will determine whether an error occurred within ten (10) business days after we hear from you and will correct any error promptly. If we need more time,

however, we may take up to forty-five (45) days to investigate your complaint or question (ninety (90) days for POS transactions or for transfers initiated outside of

the United States). If we decide to do this, we will credit your account within ten (10) business days for the amount you think is in error. If, after the investigation,

we determine that no bank error occurred, we will debit your account to the extent previously credited. If we ask you to put your complaint in writing and we do not

receive it within ten (10) business days, we may not credit your account.

New Accounts- If an alleged error occurred within thirty (30) days after your first deposit to your account was made, we may have up to ninety (90) days to

investigate your complaint, provided we credit your account within twenty (20) business days for the amount you think is in error.

If we decide there was no error, we will send you a written explanation within three (3) business days after we finish our investigation. You may ask for copies of

the documents that we used in our investigation.

FOR QUESTIONS CONCERNING THIS STATEMENT OR FOR VERIFICATION OF A PREAUTHORIZED DEPOSIT, PLEASE CALL 1-800-REGIONS

(734-4667) OR VISIT YOUR NEAREST REGIONS LOCATION.

ADJ - Adjustment RI - Return Item CR - Credit SC - Service Charge OD - Overdrawn

EB - Electronic Banking NSF - Nonsufficient Funds APY - Annual Percentage Yield FWT - Federal Withholding Tax *Break in Number Sequence

You can make a deposit at the branch during business hours or at a Regions Deposit-Smart ATM, and you can also make a transfer or deposit through Regions

Online Banking or Mobile Banking. To make a deposit to an overdrawn account 24 hours a day, please visit https://selfservice.regions.com.

You might also like

- Chase Sep V 2.9Document11 pagesChase Sep V 2.9faxev8373350% (4)

- Your Business Banking: Account SummaryDocument5 pagesYour Business Banking: Account SummaryJasmine Lewis92% (12)

- July 23, 2009 Through August 24, 2009 JPMorgan Chase BankDocument4 pagesJuly 23, 2009 Through August 24, 2009 JPMorgan Chase BankMaria Blackburn33% (3)

- Chase Sep V 2.9Document11 pagesChase Sep V 2.9faxev8373350% (2)

- Usaa Receipt ShareDocument10 pagesUsaa Receipt ShareRohan DuncanNo ratings yet

- ListDocument4 pagesListVinicio RojasNo ratings yet

- JPMCStatementDocument4 pagesJPMCStatementJoe Whitelaw50% (2)

- Basic Banking Account As of Feburary 14, 2020: Checking Opening Balance Closing BalanceDocument2 pagesBasic Banking Account As of Feburary 14, 2020: Checking Opening Balance Closing BalanceKellogg Delia100% (1)

- Chase Bank FebruaryDocument4 pagesChase Bank FebruaryAvya Brutus100% (1)

- CHASEBANKDocument2 pagesCHASEBANKyomex0% (1)

- Bank Statement: If You Have Questions About Your Statement, Please Call Us at 800-453-BANKDocument5 pagesBank Statement: If You Have Questions About Your Statement, Please Call Us at 800-453-BANKswift workNo ratings yet

- Ejk2 Colorado Inc 7705 Wadsworth BLVD Ste M ARVADA CO 80003Document10 pagesEjk2 Colorado Inc 7705 Wadsworth BLVD Ste M ARVADA CO 80003Юлия ПNo ratings yet

- Bank Statement Template 27Document2 pagesBank Statement Template 27mohamed elmakhzni100% (1)

- October 2021Document6 pagesOctober 2021Adriana JohnsonNo ratings yet

- Swarm WhitepaperDocument46 pagesSwarm WhitepaperJoel Dietz100% (1)

- Gross National Income Per Capita 2019, Atlas Method and PPPDocument4 pagesGross National Income Per Capita 2019, Atlas Method and PPPElisha WankogereNo ratings yet

- ListDocument4 pagesListHeriberto ManzoNo ratings yet

- 2953 Regions Bank October 2023 StatementDocument4 pages2953 Regions Bank October 2023 Statementjennymark8866No ratings yet

- Checkingstatement - 02 10 2023Document4 pagesCheckingstatement - 02 10 2023Super broly Jiren x gogetaNo ratings yet

- Diego 6 1Document2 pagesDiego 6 1Fabian Roca0% (1)

- Account # 0306977871: Lifegreen CheckingDocument4 pagesAccount # 0306977871: Lifegreen CheckingAmanda Conry0% (3)

- Scott Luman 5929 FM 711 CENTER, TX 75935-000Document6 pagesScott Luman 5929 FM 711 CENTER, TX 75935-000dolapo BalogunNo ratings yet

- Checking Summary: You Now Have More Time To Let Us Know About Certain Check Errors On Your AccountDocument6 pagesChecking Summary: You Now Have More Time To Let Us Know About Certain Check Errors On Your Accountbbizzle121927No ratings yet

- April 2024 StatementDocument4 pagesApril 2024 Statementdurzua4416No ratings yet

- Statements 6792Document4 pagesStatements 6792muchas guataNo ratings yet

- UnlockedDocument4 pagesUnlockedNestor MartinezNo ratings yet

- October 2023 StatementDocument4 pagesOctober 2023 Statementjennymark8866No ratings yet

- Recent Statment 2024 1Document7 pagesRecent Statment 2024 1amatobertrumNo ratings yet

- List UnlockedDocument4 pagesList UnlockedElieve GraphicsNo ratings yet

- Regions Bank StatementDocument2 pagesRegions Bank StatementGalarraga H AbrahamNo ratings yet

- Recent Statment 2024Document5 pagesRecent Statment 2024amatobertrumNo ratings yet

- StatementDocument4 pagesStatementkdontobexNo ratings yet

- 2021 (2) January Amanda2Document6 pages2021 (2) January Amanda2Amanda ConryNo ratings yet

- Statement Ending 10/08/2022: Summary of AccountsDocument2 pagesStatement Ending 10/08/2022: Summary of Accountsmohamed elmakhzniNo ratings yet

- ListDocument4 pagesListTheyadore KyrahNo ratings yet

- Sarah Stump GreenState CU E-StatementDocument4 pagesSarah Stump GreenState CU E-Statementjennymark8866No ratings yet

- June 2023 Financial StatementDocument14 pagesJune 2023 Financial StatementRohan DuncanNo ratings yet

- Statement Ending 10/08/2022: Summary of AccountsDocument2 pagesStatement Ending 10/08/2022: Summary of Accountsmohamed elmakhzniNo ratings yet

- JULY 31 BofA 07 20 Statement PDFDocument4 pagesJULY 31 BofA 07 20 Statement PDFhomanNo ratings yet

- Estado Bancario ChaseDocument2 pagesEstado Bancario ChasePedro Ant. Núñez Ulloa100% (1)

- Debit Account Transactions Date Description Type Amount Available Norman Carl Richard JRDocument3 pagesDebit Account Transactions Date Description Type Amount Available Norman Carl Richard JRfreeman p. donNo ratings yet

- Statements 9272Document2 pagesStatements 9272ngochungth6391No ratings yet

- Proof - of - Address 20230731 Statements 9272Document2 pagesProof - of - Address 20230731 Statements 9272ngochungth6391No ratings yet

- Braydn Ross JohnsonDocument4 pagesBraydn Ross JohnsonSteven LeeNo ratings yet

- Statement Ending 19/08/2022: Summary of AccountsDocument2 pagesStatement Ending 19/08/2022: Summary of Accountsmohamed elmakhzniNo ratings yet

- Your Statement: Everyday OffsetDocument5 pagesYour Statement: Everyday OffsetdaryllemillerNo ratings yet

- Account # 0304459148: Lifegreen CheckingDocument4 pagesAccount # 0304459148: Lifegreen CheckingViktoria DenisenkoNo ratings yet

- Bank StatementsDocument4 pagesBank Statementslekanlekan411No ratings yet

- Shuzette Chase StatementtDocument2 pagesShuzette Chase Statementtdesigns.vicartNo ratings yet

- Regions BankDocument4 pagesRegions BankYoel CabreraNo ratings yet

- TINA Bank StatementDocument2 pagesTINA Bank Statementmohamed elmakhzniNo ratings yet

- ListDocument4 pagesListNestor MartinezNo ratings yet

- Helen Feb Bank Statement 2020Document4 pagesHelen Feb Bank Statement 2020scottwesley887No ratings yet

- Bank Checking Statement 9073Document2 pagesBank Checking Statement 9073Aleesha Aleesha0% (1)

- Estatement Chase JuneDocument6 pagesEstatement Chase JuneAtta ur RehmanNo ratings yet

- Region Bank StatementDocument4 pagesRegion Bank Statementpolaoapp3044No ratings yet

- ListDocument2 pagesListAn Šp0% (1)

- Your Adv Plus Banking: Account SummaryDocument8 pagesYour Adv Plus Banking: Account SummaryLORENZO HERNANDEZNo ratings yet

- Wells Fargo StatementDocument4 pagesWells Fargo Statementandy0% (1)

- January 2022 StatementDocument4 pagesJanuary 2022 StatementgatsbythackerNo ratings yet

- Canada RBCDocument1 pageCanada RBCcaezoniadesynzNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chifoklass, Bioré Daily Blue Agave + Baking Soda Face Wash, Balancing Pore Facial CleanserDocument1 pageChifoklass, Bioré Daily Blue Agave + Baking Soda Face Wash, Balancing Pore Facial CleansershopwellrsNo ratings yet

- Boxer Gifts Usa 2023 CatalogDocument68 pagesBoxer Gifts Usa 2023 CatalogshopwellrsNo ratings yet

- Aa1009230099468 RC15092023Document3 pagesAa1009230099468 RC15092023shopwellrsNo ratings yet

- UPD Inventory All 2-6-2023Document245 pagesUPD Inventory All 2-6-2023shopwellrsNo ratings yet

- Funko Instock.02Document12 pagesFunko Instock.02shopwellrsNo ratings yet

- 588esp1220 Spec SheetDocument1 page588esp1220 Spec SheetshopwellrsNo ratings yet

- Dinner PlateDocument29 pagesDinner PlateSABA ALINo ratings yet

- A Reviewofinnovationsindisbondingtechniquesforrepair 2014Document9 pagesA Reviewofinnovationsindisbondingtechniquesforrepair 2014Cristian GarciaNo ratings yet

- Performance Comparison of Aeronautical Telemetry in S-Band and C-BandDocument11 pagesPerformance Comparison of Aeronautical Telemetry in S-Band and C-BandfakeNo ratings yet

- Labrel Midterms and FinalsDocument186 pagesLabrel Midterms and Finalsjanine nenariaNo ratings yet

- Using MySQL With LabVIEWDocument49 pagesUsing MySQL With LabVIEWsion2010363650% (2)

- Perea RecommendationDocument1 pagePerea Recommendationapi-550296747No ratings yet

- Government of Madhya Pradesh Public Health Engineering DepartmentDocument63 pagesGovernment of Madhya Pradesh Public Health Engineering DepartmentShreyansh SharmaNo ratings yet

- In Design: Iman BokhariDocument12 pagesIn Design: Iman Bokharimena_sky11No ratings yet

- Niranjan A Murthy 2018Document15 pagesNiranjan A Murthy 2018Tim KNo ratings yet

- Accounting Question BankDocument217 pagesAccounting Question BankFaiza TahreemNo ratings yet

- Pmnetwork20210102 DLDocument76 pagesPmnetwork20210102 DLruhul01No ratings yet

- Food Handlers Risk AssessmentDocument1 pageFood Handlers Risk AssessmentNidheesh K KNo ratings yet

- Solve Splits Feedback ToolDocument6 pagesSolve Splits Feedback ToolkabyaNo ratings yet

- I LuxDocument24 pagesI LuxNirav M. BhavsarNo ratings yet

- Monty 1510: Spare Parts List Tire ChangerDocument24 pagesMonty 1510: Spare Parts List Tire ChangerJonathan FullumNo ratings yet

- Linear Programming NotesDocument92 pagesLinear Programming Notesmiss_bnm0% (1)

- EIC5000 Electronic Indicator Control Installation and Operation InstructionsDocument8 pagesEIC5000 Electronic Indicator Control Installation and Operation InstructionsАртемNo ratings yet

- Isihskipper January 2010Document25 pagesIsihskipper January 2010enelcharcoNo ratings yet

- User Exit in Batch ManagementDocument5 pagesUser Exit in Batch ManagementSameer BagalkotNo ratings yet

- Quantitative and Qualitative Research in FinanceDocument18 pagesQuantitative and Qualitative Research in FinanceZeeshan Hyder BhattiNo ratings yet

- Adams, Clark - 2009 - Landfill Bio DegradationDocument17 pagesAdams, Clark - 2009 - Landfill Bio Degradationfguasta100% (1)

- Ra 10639Document6 pagesRa 10639Rea Rosario MaliteNo ratings yet

- Pre TrialDocument6 pagesPre Trialerickson romeroNo ratings yet

- MBA ABM SyllabusDocument33 pagesMBA ABM Syllabuszinga007No ratings yet

- Level-3 Answer Keys PDFDocument42 pagesLevel-3 Answer Keys PDFSukhbir GrakNo ratings yet

- ACLU Letter On Riverside County RedistrictingDocument2 pagesACLU Letter On Riverside County RedistrictingThe Press-Enterprise / pressenterprise.comNo ratings yet

- FOURNIER RF-5B - Sperber Flight Manual (English)Document29 pagesFOURNIER RF-5B - Sperber Flight Manual (English)Rene QueirozNo ratings yet

- Indian Ports Community SystemDocument6 pagesIndian Ports Community Systempatil sNo ratings yet