Professional Documents

Culture Documents

Accounts and Records

Accounts and Records

Uploaded by

pujitha vegesnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts and Records

Accounts and Records

Uploaded by

pujitha vegesnaCopyright:

Available Formats

11.

ACCOUNTS AND RECORDS

1) What course of action can be adopted if there is any incorrect entry made in books of

accounts other than those of clerical nature?

a) It can be deleted directly

b) It must be deleted after obtaining approval from GST officer

c) It can be scored out under attestation

d) No entries can be corrected.

2) Principal place of business means the place of business _____.

a) as Informed to GST officer separately

b) As mentioned in Income tax records

c) As mentioned in the certificate of GST registration

d) As mentioned on sign board of the premises

3) Who is not required to maintain records relating to stock of goods and details of taxes in

terms of Rule 56 of CGST Rules, 2017?

a) Manufacturer

b) Service provider

c) Composition Supplier

d) Transporter

4) Where the _______ considers that any class of taxable persons is not in a position to keep

and maintain accounts in accordance with the provisions of this section, he may, for reasons

to be recorded in writing, permit such class of taxable persons to maintain accounts in such

manner as may be prescribed.

a) GST Council

b) Commissioner

c) Central Government

d) Proper officer

5) In which manner it is mandatory to maintain books of accounts?

a) Manual form

b) Electronic Form

c) Any form -manual or electronic

d) Both manual and electronic

6) How the electronic records be authenticated by a registered person?

a) physical signature

b) digital signature

c) scan copy of physical signature

d) affixing stamp

7) All the accounts and records are required to be retained until the expiry of____from the due

date of furnishing of annual return.

a) 60 months

b) 72 months

c) 84 months

d) 96 months

8) A registered person is required to maintain books of accounts relating to___________.

(i) Supply of goods or services

(ii) Receipt of goods or services

(iii) Stock of goods

(iv) input tax credit availed

a) (i) & (ii)

b) (i) & (iii)

c) (iii) & (iv)

d) (i),(ii),(iii) & (iv)

9) A registered person who is engaged in manufacturing of Plastic Bottles is required to

maintain books of accounts relating to _________.

(i) Raw material

(ii) Input services

(iii) Goods manufactured including waste & by products

(iv) waste and by products

a) (i) & (ii)

b) (i) & (iii)

c) (iii) & (iv)

d) (i),(ii),(iii) & (iv)

You might also like

- Bilans Uspeha - PROFIT AND LOSS ACCOUNTDocument2 pagesBilans Uspeha - PROFIT AND LOSS ACCOUNTLorimer010100% (8)

- Vikas Soni HealthDocument1 pageVikas Soni HealthVikas SoniNo ratings yet

- BIR Form No. 0605Document2 pagesBIR Form No. 0605Ronald varrie BautistaNo ratings yet

- This Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Document8 pagesThis Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Kin LeeNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Question Answer On Central Accounts Manual: April 1976Document4 pagesQuestion Answer On Central Accounts Manual: April 1976Souvik Datta100% (5)

- Partnership and CorporationDocument6 pagesPartnership and CorporationShaira Nicole Vasquez50% (2)

- Chapter 13Document5 pagesChapter 13Kirsten FernandoNo ratings yet

- CIR vs. AlgueDocument2 pagesCIR vs. AlgueJayson AbabaNo ratings yet

- Most Imp MCQ ExciseDocument247 pagesMost Imp MCQ ExciseVasuNo ratings yet

- 11th Accounts, Assign. 111th Accounts, Assign. 1Document8 pages11th Accounts, Assign. 111th Accounts, Assign. 1Prachiii SharmaNo ratings yet

- Indirect Tax-Sample QuestionDocument8 pagesIndirect Tax-Sample Questionantonyashin007No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument3 pages© The Institute of Chartered Accountants of IndiaDeepak KumarNo ratings yet

- GST MCQ 1Document7 pagesGST MCQ 1avinashNo ratings yet

- 3 - Place of Supply Long Answer Type QuestionsDocument7 pages3 - Place of Supply Long Answer Type QuestionsMighty SinghNo ratings yet

- Indirect TAX Objective 240328 150830Document13 pagesIndirect TAX Objective 240328 150830aditikotere92No ratings yet

- GST MCQS - 2 Without AnswerDocument9 pagesGST MCQS - 2 Without AnswerSpidy MacNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- Most Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1Document236 pagesMost Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1148salwa HussainNo ratings yet

- Financial Accounting - MCQ'S For PracticeDocument8 pagesFinancial Accounting - MCQ'S For Practiceprathampawar5912No ratings yet

- Chapter 2Document2 pagesChapter 2Jao FloresNo ratings yet

- RegistrationDocument6 pagesRegistrationpujitha vegesnaNo ratings yet

- Tax MCQ 5Document17 pagesTax MCQ 5siddhant.gupta.delhiNo ratings yet

- Mock Full Book 02 BookDocument3 pagesMock Full Book 02 Bookgoharmahmood203No ratings yet

- Sample IDTDocument34 pagesSample IDTsaraNo ratings yet

- MCQ All 25 Accounts XiDocument36 pagesMCQ All 25 Accounts XiSuraj GuptaNo ratings yet

- Payment of Tax @icmaifamilyDocument9 pagesPayment of Tax @icmaifamilypriyababu4701No ratings yet

- GST - IMP D.Tax (AKD) - 2Document15 pagesGST - IMP D.Tax (AKD) - 2algoscale techNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- Amardeep XI First TermDocument8 pagesAmardeep XI First TermAnahita GuptaNo ratings yet

- GST - MCQ by VGDocument18 pagesGST - MCQ by VGIS WING APNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)Document12 pagesIntermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)AnjaliNo ratings yet

- Basic Accounting MCQs With AnswersDocument7 pagesBasic Accounting MCQs With AnswersShahid NaikNo ratings yet

- 5 - Principles of Taxation07092021Document10 pages5 - Principles of Taxation07092021Jahirul IslamNo ratings yet

- CBSE Grade 11 Accounts Practice Paper 234521Document8 pagesCBSE Grade 11 Accounts Practice Paper 234521The DealerNo ratings yet

- Intro To FA QP May 2018Document10 pagesIntro To FA QP May 2018Munodawafa ChimhamhiwaNo ratings yet

- MCQ OF CHAPTER 14 To CHAPTER 17Document8 pagesMCQ OF CHAPTER 14 To CHAPTER 17Aman AgarwalNo ratings yet

- MCQs On Chap 10 ADocument11 pagesMCQs On Chap 10 AAman AgarwalNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument3 pages© The Institute of Chartered Accountants of IndiaLalitha NagarajanNo ratings yet

- Multiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaDocument7 pagesMultiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaVIHARI DNo ratings yet

- MCQs Financial AccountingDocument30 pagesMCQs Financial AccountingMehboob Ul-haq100% (1)

- Namma Kalvi 11th Accountancy MCQ Test Question Paper EM 221528Document18 pagesNamma Kalvi 11th Accountancy MCQ Test Question Paper EM 221528Kanishka S IX-ENo ratings yet

- ACCA FA1 Practice Question 2Document10 pagesACCA FA1 Practice Question 2arslan.ahmed8179No ratings yet

- 11th-Accountancy-Book-Back-One-Mark-Study-Materials-English-Medium - 2 PDFDocument6 pages11th-Accountancy-Book-Back-One-Mark-Study-Materials-English-Medium - 2 PDFSuresh GNo ratings yet

- MCQ OF CHAPTER 12 A & B - Payment of TaxDocument11 pagesMCQ OF CHAPTER 12 A & B - Payment of TaxAman AgarwalNo ratings yet

- Input Tax Credit of CGST Can Be Utilised For The FollowingDocument10 pagesInput Tax Credit of CGST Can Be Utilised For The FollowingD Y Patil Institute of MCA and MBANo ratings yet

- Testbank Basic Accounting MCQ PDF - CompressDocument7 pagesTestbank Basic Accounting MCQ PDF - CompressKathlene JaoNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument20 pagesIntermediate Examination: Suggested Answers To QuestionsVVR &CoNo ratings yet

- Indirect Tax GST Tybcom 1Document13 pagesIndirect Tax GST Tybcom 1Vikas YadavNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- GST MCQDocument22 pagesGST MCQG Prasana KumarNo ratings yet

- Xii Acc 1 To 3 Ques CreativeDocument25 pagesXii Acc 1 To 3 Ques CreativeMukesh kannan MahiNo ratings yet

- Auditing Principles and Practice 17UCO514 K1-Level Questions Unit - IDocument18 pagesAuditing Principles and Practice 17UCO514 K1-Level Questions Unit - Iabebetgst teka1234No ratings yet

- Accounting 2Document35 pagesAccounting 2Yousaf JamalNo ratings yet

- Indirect Tax WordDocument30 pagesIndirect Tax WordSanket MhetreNo ratings yet

- Model Exam Question Paper StatutoryDocument7 pagesModel Exam Question Paper Statutoryshibin cpNo ratings yet

- CS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFDocument5 pagesCS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFRadhika ChopraNo ratings yet

- Final Set A, 2022Document6 pagesFinal Set A, 2022Vishavpreet SinghNo ratings yet

- ACC111 Final ExamDocument10 pagesACC111 Final ExamGayle Montecillo Pantonial OndoyNo ratings yet

- Paper 7Document23 pagesPaper 7Nipun AroraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- Auditing MCQ Unit 1 To Unit 4Document6 pagesAuditing MCQ Unit 1 To Unit 4amitNo ratings yet

- NSDL DP ModuleDocument30 pagesNSDL DP ModulePrateek Jhalani100% (1)

- 2ndyr - 1stF - Intermediate Accounting 1 - 2223Document33 pages2ndyr - 1stF - Intermediate Accounting 1 - 2223hsdownshsalaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Jindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Document1 pageJindal Steel & Power Limited: Plot No.-751, Similipada ANGUL, ODISHA, PIN-759122Tatwa Nanda0% (1)

- Donations and Gifts: T1-2019 Schedule 9Document2 pagesDonations and Gifts: T1-2019 Schedule 9hypnotix-2000No ratings yet

- Final Paper Task 2 (Girdhari)Document8 pagesFinal Paper Task 2 (Girdhari)Gîř Dh AřîNo ratings yet

- Tax BillDocument1 pageTax BillBrenda SorensonNo ratings yet

- 2y2s Syllabus CompilationDocument99 pages2y2s Syllabus CompilationChaNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013Eliza BethNo ratings yet

- Assumptions For Financial ModelingDocument3 pagesAssumptions For Financial Modelingken dexter m. barreraNo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- KAIA PresentationDocument7 pagesKAIA PresentationGanapathi BhatNo ratings yet

- Quiz On Chapter 13B&CDocument23 pagesQuiz On Chapter 13B&Cdianne caballeroNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tomukti nath guptaNo ratings yet

- TVC ElectronicsDocument3 pagesTVC ElectronicsBala_9990No ratings yet

- Taxation Law Internal Assignment Utkarsh DixitDocument5 pagesTaxation Law Internal Assignment Utkarsh DixitAshish RajNo ratings yet

- G.R. No. 151857 - Calamba Steel Center Inc. v. Commissioner of Internal RevenueDocument10 pagesG.R. No. 151857 - Calamba Steel Center Inc. v. Commissioner of Internal RevenueLolersNo ratings yet

- Tax Revenue Regulation Illustrative Problems Compilation iCPA NotesDocument13 pagesTax Revenue Regulation Illustrative Problems Compilation iCPA Notesmendoza.adrianeNo ratings yet

- Chapter One Introduction To Taxation and Tax AccountingDocument69 pagesChapter One Introduction To Taxation and Tax AccountingMelat Gebretsion100% (2)

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- ITR Slip 20-21Document1 pageITR Slip 20-21Mukesh Kumar GuptaNo ratings yet

- Vestey V IRCDocument5 pagesVestey V IRCShivanjani KumarNo ratings yet

- On July 1 2017 The Beginning of Its Fiscal YearDocument1 pageOn July 1 2017 The Beginning of Its Fiscal YearMuhammad ShahidNo ratings yet

- Real Work Sheet Assigment 3Document2 pagesReal Work Sheet Assigment 3Emmclan LauNo ratings yet

- Income Tax Ordinance ConceptDocument6 pagesIncome Tax Ordinance ConceptYour AdvocateNo ratings yet

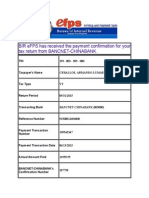

- BIR eFPS Has Received The Payment Confirmation For Your Tax Return From BANCNET-CHINABANKDocument2 pagesBIR eFPS Has Received The Payment Confirmation For Your Tax Return From BANCNET-CHINABANKJoseph PamaongNo ratings yet