Professional Documents

Culture Documents

Managerial Accounting Bonus Questions

Managerial Accounting Bonus Questions

Uploaded by

maha13aljasmiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Accounting Bonus Questions

Managerial Accounting Bonus Questions

Uploaded by

maha13aljasmiCopyright:

Available Formats

Managerial Accounting

Bonus Questions

Milar Corporation makes a product with the following standard costs:

Standard Quantity or

Hours Standard Price or Rate

Direct materials 7.7 pounds $ 4.00per pound

Direct labor 0.1 hours $ 20.00per hour

Variable overhead 0.1 hours $ 4.00per hour

In January the company produced 2,000 units using 16,060 pounds of the direct material and 210

direct labor-hours. During the month, the company purchased 16,900 pounds of the direct

material at a cost of $65,910. The actual direct labor cost was $4,473 and the actual variable

overhead cost was $756.

The company applies variable overhead on the basis of direct labor-hours. The direct materials

purchases variance is computed when the materials are purchased.

Calculate:

a. The materials quantity variance

b. The materials price variance

c. The labor efficiency variance

d. The labor rate variance

e. The variable overhead efficiency variance

f. The variable overhead rate variance

Here is how to calculate each variance:

a. Materials quantity variance = (actual quantity - standard quantity) x standard price

= (16,060 - (2,000 x 7.7)) x $4.00

= $2,508 unfavorable

b. Materials price variance = (actual price - standard price) x actual quantity

= ($65,910 / 16,900 - $4.00) x 16,900

= $1,990 unfavorable

c. Labor efficiency variance = (actual hours - standard hours) x standard rate

= (210 - (2,000 x 0.1)) x $20.00

= $177 unfavorable

d. Labor rate variance = (actual rate - standard rate) x actual hours

= ($4,473 / 210 - $20.00) x 210

= $27 unfavorable

e. Variable overhead efficiency variance = (actual hours - standard hours) x standard rate

= (210 - (2,000 x 0.1)) x $4.00

= $18 favorable

f. Variable overhead rate variance = (actual rate - standard rate) x actual hours

= ($756 / 210 - $4.00) x 210

= $4 unfavorable

a. The materials quantity variance for January is $2,508 unfavorable.

b. The materials price variance for January is $1,990 unfavorable.

c. The labor efficiency variance for January is $177 unfavorable.

d. The labor rate variance for January is $27 unfavorable.

e. The variable overhead efficiency variance for January is $18 favorable.

f. The variable overhead rate variance for January is $4 unfavorable.

You might also like

- Chapter 8: Standard Cost Accounting - Materials, Labor, and Factory OverheadDocument67 pagesChapter 8: Standard Cost Accounting - Materials, Labor, and Factory OverheadSaeym SegoviaNo ratings yet

- BUS 5110 - Written Assignment - Unit 5 - MADocument5 pagesBUS 5110 - Written Assignment - Unit 5 - MAAliyazahra Kamila100% (1)

- Variance Analysis WorksheetDocument8 pagesVariance Analysis WorksheetLeigh018No ratings yet

- Mas - 8Document2 pagesMas - 8Rosemarie CruzNo ratings yet

- Pre Assignment PracticeDocument7 pagesPre Assignment PracticeaeyNo ratings yet

- Questions - Chapter 9Document5 pagesQuestions - Chapter 9sajedulNo ratings yet

- MASQUIZDocument11 pagesMASQUIZGelyn CruzNo ratings yet

- D. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionDocument4 pagesD. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionGuinevereNo ratings yet

- Ankitastic Exams Solutions MCQ and Long AnswerDocument29 pagesAnkitastic Exams Solutions MCQ and Long AnswerAnkitastic tutoring ServicesNo ratings yet

- UAS-ACCT6130-cost Accounting-Latihan persiapan-PJJDocument4 pagesUAS-ACCT6130-cost Accounting-Latihan persiapan-PJJOlim BariziNo ratings yet

- M11 CHP 10 1 Standard Costs 2011 0524Document58 pagesM11 CHP 10 1 Standard Costs 2011 0524Rose Ann De Guzman67% (3)

- Ankitastic Exams SolutionsDocument30 pagesAnkitastic Exams SolutionsAnkitastic tutoring ServicesNo ratings yet

- ms1 q3Document5 pagesms1 q3KrisshiaLynnSanchezNo ratings yet

- Practice Sheet STD CostingDocument3 pagesPractice Sheet STD CostingPrerna AroraNo ratings yet

- Practice - Chapter 7 - ACCT - 401Document8 pagesPractice - Chapter 7 - ACCT - 401mohammed azizNo ratings yet

- ACC108 Assignment No. 1 (Standard Costing)Document5 pagesACC108 Assignment No. 1 (Standard Costing)John Andrei ValenzuelaNo ratings yet

- Chapter 10 5eDocument4 pagesChapter 10 5eym5c2324No ratings yet

- MAS Problem VarianceDocument19 pagesMAS Problem VarianceMaria ZarinaNo ratings yet

- Cima Standard Costing and Variance Analysis Session 1 QuestionsDocument13 pagesCima Standard Costing and Variance Analysis Session 1 QuestionsKiri chrisNo ratings yet

- Acc 0Document21 pagesAcc 0Ashish BhallaNo ratings yet

- Acctg 10A Assignment - Standard CostingDocument2 pagesAcctg 10A Assignment - Standard CostingClaire diane Crave0% (1)

- Cima Standard Costing Seesion 2 QuestionsDocument16 pagesCima Standard Costing Seesion 2 QuestionsKiri chrisNo ratings yet

- Standard Quantity of Kilograms Allowed $21,000.00: Direct Materials VariancesDocument12 pagesStandard Quantity of Kilograms Allowed $21,000.00: Direct Materials VariancesMannix Richard DelRosarioNo ratings yet

- Tut 4 AnsDocument8 pagesTut 4 AnsPuffleNo ratings yet

- 314 Chap 8Document5 pages314 Chap 8Jonah Marie TaghoyNo ratings yet

- Variance Assignment With SolutionDocument2 pagesVariance Assignment With SolutionFatma AbdelnaemNo ratings yet

- CMA II - Chapter 3, Flexible Budgets & StandardsDocument77 pagesCMA II - Chapter 3, Flexible Budgets & StandardsLakachew Getasew0% (1)

- Week 5 Variance AnalysisDocument43 pagesWeek 5 Variance AnalysisMichel BanvoNo ratings yet

- 314 Chap 7&8Document9 pages314 Chap 7&8Jonah Marie TaghoyNo ratings yet

- Chapter 7 The Master Budget and Flexible BudgetingDocument14 pagesChapter 7 The Master Budget and Flexible BudgetingJuana LyricsNo ratings yet

- Practice Questions On Direct and Indirect Cost VariancesDocument8 pagesPractice Questions On Direct and Indirect Cost VariancesAishwarya RaoNo ratings yet

- Tutorial 2Document7 pagesTutorial 2jasonneo999No ratings yet

- Latihan Soal Standar CostingDocument2 pagesLatihan Soal Standar Costing31 Sri RizkillahNo ratings yet

- Standard Costing Practise QuestionsDocument6 pagesStandard Costing Practise QuestionsGHULAM NABI0% (1)

- UntitledDocument17 pagesUntitledPiands FernandsNo ratings yet

- Exercise Topic 3Document8 pagesExercise Topic 3TEIK LOONG KHORNo ratings yet

- Assignment Standard Costing SolutionsDocument13 pagesAssignment Standard Costing SolutionsMartha MasalangkayNo ratings yet

- Standard Costing & Variance Analysis - Sample Problems With SolutionsDocument8 pagesStandard Costing & Variance Analysis - Sample Problems With SolutionsMarjorie NepomucenoNo ratings yet

- Budgets For Control, Part 2Document29 pagesBudgets For Control, Part 2vukicevic.ivan5No ratings yet

- Cost+Management - MCQDocument3 pagesCost+Management - MCQBina Tassadaq HussainNo ratings yet

- FAS1 - STD CostDocument9 pagesFAS1 - STD CostMica Moreen GuillermoNo ratings yet

- Lesson 9 - Variance Analysis-250809 - 013136Document34 pagesLesson 9 - Variance Analysis-250809 - 013136rinie85No ratings yet

- Budgeting QuizDocument3 pagesBudgeting QuizMay Grethel Joy PeranteNo ratings yet

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaNo ratings yet

- STD Costing Tough QuestionsDocument1 pageSTD Costing Tough QuestionsMedhaNo ratings yet

- Flexible Budgets and Computation of Labour and Material VariancesDocument4 pagesFlexible Budgets and Computation of Labour and Material VariancesBisag AsaNo ratings yet

- General Model For Variable Manufacturing Costs Variance AnalysisDocument2 pagesGeneral Model For Variable Manufacturing Costs Variance AnalysisEyuel SintayehuNo ratings yet

- Item To Classify Standard Actual Type of VarianceDocument7 pagesItem To Classify Standard Actual Type of Variancedavid johnsonNo ratings yet

- Job Costing CADocument13 pagesJob Costing CAmiranti dNo ratings yet

- Kelompok 4-SOAL STANDAR COSTINGDocument3 pagesKelompok 4-SOAL STANDAR COSTINGAndriana Butera0% (1)

- Standarvd Cost & VarianceDocument3 pagesStandarvd Cost & Variancemohammad bilalNo ratings yet

- CostDocument2 pagesCostMarielle CuriosoNo ratings yet

- Standard Costing: Cost AccountingDocument15 pagesStandard Costing: Cost Accountingwilson pribadiNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingCarl AngeloNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Energy Efficient Homes - How To Save Money By Increasing Energy Efficiency At HomeFrom EverandEnergy Efficient Homes - How To Save Money By Increasing Energy Efficiency At HomeNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Case Study No 1Document1 pageCase Study No 1maha13aljasmiNo ratings yet

- PrinEconArabWorld 4e Ch04 PowerPointDocument43 pagesPrinEconArabWorld 4e Ch04 PowerPointmaha13aljasmiNo ratings yet

- Online Session #10 Stated and Implied Main Idea PracticeDocument40 pagesOnline Session #10 Stated and Implied Main Idea Practicemaha13aljasmiNo ratings yet

- 14 Energy UseDocument13 pages14 Energy Usemaha13aljasmiNo ratings yet

- Quiz 2 Managerial AccountingDocument24 pagesQuiz 2 Managerial Accountingmaha13aljasmiNo ratings yet

- Final Exam Practice #2Document10 pagesFinal Exam Practice #2maha13aljasmiNo ratings yet

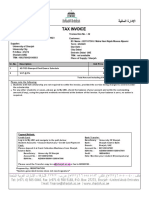

- Invoice 20230403235745Document1 pageInvoice 20230403235745maha13aljasmiNo ratings yet

- Principle of Marketing - Assignment 1 Guidlines - Individual AssignmentDocument4 pagesPrinciple of Marketing - Assignment 1 Guidlines - Individual Assignmentmaha13aljasmiNo ratings yet

- Reserach About Cyber SecurityDocument2 pagesReserach About Cyber Securitymaha13aljasmiNo ratings yet

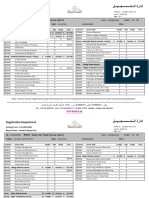

- Screenshot 2023-11-24 at 6.26.50 PMDocument8 pagesScreenshot 2023-11-24 at 6.26.50 PMmaha13aljasmiNo ratings yet

- Midterm Managerial AccountingDocument9 pagesMidterm Managerial Accountingmaha13aljasmiNo ratings yet

- Story 1Document1 pageStory 1maha13aljasmiNo ratings yet

- Story 2Document1 pageStory 2maha13aljasmiNo ratings yet

- StudyDocument2 pagesStudymaha13aljasmiNo ratings yet

- Final Exam Practice 3 Answer KeyDocument7 pagesFinal Exam Practice 3 Answer Keymaha13aljasmiNo ratings yet

- PrinEconArabWorld 4e Ch02 PowerPointDocument20 pagesPrinEconArabWorld 4e Ch02 PowerPointmaha13aljasmiNo ratings yet

- TR EVisa 101434495599Document1 pageTR EVisa 101434495599maha13aljasmiNo ratings yet

- Legal Environment of Business Spring 2024Document25 pagesLegal Environment of Business Spring 2024maha13aljasmiNo ratings yet

- Massoma CVDocument1 pageMassoma CVmaha13aljasmiNo ratings yet