Professional Documents

Culture Documents

Features and Objectives of CG

Features and Objectives of CG

Uploaded by

19UBCA020 HARIHARAN K0 ratings0% found this document useful (0 votes)

7 views2 pagesOriginal Title

Features and Objectives of Cg

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesFeatures and Objectives of CG

Features and Objectives of CG

Uploaded by

19UBCA020 HARIHARAN KCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Corporale Governance 87

5. It is only a part of the larger econon)iccontext in which firms

operate. It depends upon legal, regulatory and institutional

environment.

4.7 EATURES OF CORPORATE GOVERNANCE

According to Bansal (2005), corporate governance has the following

features,

1. Constitution of committee: It covers constitution and functioningof

various committee such as audit committee, remuneration committee,

shareholdersgrievance committee, compliance committee.

2. Structuring of boards: It covers aspects relating to the compositionof

boards,representation of insiders and outsiders on the board, role of non-

executiveand independentdirectors.

3. Board systems and procedures: It covers aspects such as convening

of board meetings, frequency and attendance at board meetings, fulfilling

the information requirements of the board for decision making.

4. Shareholders' democracy: Shareholders/ participation in meetings,

fulfillingshareholders' rights and disclosure of information required by the

stakeholders.

5. Value orientation: Corporate governance encompasses ethics, values

and morals of a corporation and its directors.

6. Monitoring of strategic decisions: It involves monitoring and

overseeing strategic decisions in a socio-economic and cultural contexts.

4.8 C VES OF CORPORATE GOVERNANCE

Corporategovernance extends beyond corporate law. It is integral to the

very existenceof a company. The key objectivesof corporate governance

are listed below:

1. Strengthening investors 'confidence: It tries to inspire and strengthen

the investors' confidence by ensuring company's commitment to higher

profits.

2. Transparency: Its rudimentary objectiveis not mere fulfilmentof the

requirementsof legal provisions but to ensure commitment of the board in

managingthe companyin a transparentmanner so as to maximizethe

stakeholders' value.

3. Balanced board: To see that the board is balanced as regards

the representation of adequate number of non-executive director and

independentdirectors to take care of the interests of stakeholders.

Ethics and Social Responsibility

88 Corporate Governance,

board's policies and procedures: To review that

4. Review of and practices in the interestthe board

procedures

adopts transparent of both

company and stakeholders.

shareholders: To check that the board

5. Board's decision to

pertaining to the developments taking

provides

adequateinformation periodically.

place in the

companyto the shareholders

board: To ensure that the board leads

6, Long-term vision of the the

long-term value and shareholders,

to maximize

company forward so as

wealth.

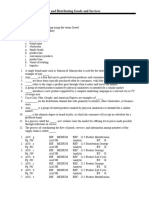

Need for Corporate Governance versus Corporate

Governance Needs

Needfor Corporate Governance Corporate Governace Needs

Impact of globalization. To prevent expropriation.

Economic changes. Improving the quality of inform-

ation provided.

Change in the structure of share- Enhancing minority shareholder's

holding. participation in decision making.

Financial reporting and trans- Making the board more effective

parency. and independent.

Shareholders/ stakeholders net Reducing the related party trans-

worth/wealth. action.

Failure of corporate directors in Enhanced responsibility on the role

carryingout their fiduciary duties. of internal auditors.

Threshold ownership: minimum

Concentrationof securities in fewer

hands brought about disastrous shareholdings for exercising the

results. rights.

Transparency in information is Disclosure of information of related

encouraged particularly in grey matters affecting the rights of

areas as secrecy of information minority shareholders and prevent

reduces the image and reputation of dominant shareholders from undue

the organizations. advantages.

Family directorships have not

yielded expected performance and Enhancing the effectiveness of the

Board.

outcome.

Enforceabilityof legal provisions is

very much lacking. Regulatory measures to build up the

imace.

The law breakers escape easily due

to various loopholes in law. Suggestingimposition of penalties

and fines for failure in the

performance.

You might also like

- Individual Assignment Case Chapter 5 - Aisyah Nuralam 29123362Document4 pagesIndividual Assignment Case Chapter 5 - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Nikhil Bhutada - Manyavar SIP Report - 2nd DraftDocument120 pagesNikhil Bhutada - Manyavar SIP Report - 2nd DraftKrishna kishor tiwariNo ratings yet

- CH 04Document111 pagesCH 04arif nugrahaNo ratings yet

- Corporate Governance in India: Concept, Course of Action and ComplianceDocument11 pagesCorporate Governance in India: Concept, Course of Action and Complianceisisrhode75% (8)

- Corporate GovernanceDocument21 pagesCorporate GovernancesanupsimonNo ratings yet

- Chapter 9 Service Home WorkDocument6 pagesChapter 9 Service Home WorkAbdallah HamouryNo ratings yet

- Corporate Governance 2021Document21 pagesCorporate Governance 2021Kelebogile MoesiNo ratings yet

- EthicsDocument156 pagesEthicsMotivational 12No ratings yet

- CorporateGovernance IntroductionDocument10 pagesCorporateGovernance IntroductionSatbeer SinghNo ratings yet

- Corporate GovernanceDocument40 pagesCorporate GovernanceAnutosh GuptaNo ratings yet

- Corporate Governance Enhancing The Valuation of Stock HoldersDocument16 pagesCorporate Governance Enhancing The Valuation of Stock Holders123helperNo ratings yet

- Corporate GovernanceDocument33 pagesCorporate GovernanceAmol Shelar50% (2)

- Code of Corporate GovernanceDocument12 pagesCode of Corporate GovernanceZsamyla Nikka A. AbrasaldoNo ratings yet

- Chapter 3 Governance - BalladaDocument53 pagesChapter 3 Governance - BalladaUnnamed homosapienNo ratings yet

- Pradeep Kumar Gupta22020091612606Document12 pagesPradeep Kumar Gupta22020091612606Madhav ZoadNo ratings yet

- Business Ethics and Corporate GovernanceDocument55 pagesBusiness Ethics and Corporate GovernanceVaidehi ShuklaNo ratings yet

- Cae01 Chapter 1 ModuleDocument8 pagesCae01 Chapter 1 Modulerefuerzorizzamae149No ratings yet

- Corporate Governance Is The System of Rules, Practices and Processes by Which A Company Is Directed and ControlledDocument8 pagesCorporate Governance Is The System of Rules, Practices and Processes by Which A Company Is Directed and ControlledNicefebe Love SampanNo ratings yet

- Pradeep Kumar Gupta22020091612606Document12 pagesPradeep Kumar Gupta22020091612606log10No ratings yet

- Aca 312B NotebookDocument13 pagesAca 312B NotebookErika Joy Casimero ColasteNo ratings yet

- 1.corporate GovernanceDocument20 pages1.corporate Governanceveenars84No ratings yet

- Module 3Document6 pagesModule 3Marjalino Laicell CrisoloNo ratings yet

- Corporate Governance: Improvisation in IndiaDocument15 pagesCorporate Governance: Improvisation in IndiaKRNo ratings yet

- Five Steps To Effective Corporate GovernanceDocument7 pagesFive Steps To Effective Corporate Governanceneamma0% (1)

- SESI 4 Ch13Document29 pagesSESI 4 Ch13kimkimberlyNo ratings yet

- CG & AccountabilityDocument60 pagesCG & AccountabilitysushilkhannaNo ratings yet

- How Companies Are Directed, Ruled and Controlled: Corporate Governance Is AboutDocument50 pagesHow Companies Are Directed, Ruled and Controlled: Corporate Governance Is AboutnkNo ratings yet

- Grup B - P12 - SPM Class FDocument14 pagesGrup B - P12 - SPM Class FFrischa Putri SusantoNo ratings yet

- Unit 1 Corporate GovernanceDocument27 pagesUnit 1 Corporate GovernanceLORD GAMINGNo ratings yet

- Corporate GovernanceDocument23 pagesCorporate Governancejoshant012No ratings yet

- Corporate GovernanceDocument7 pagesCorporate Governancemehakrotra256No ratings yet

- Reviewer in MGT3Document5 pagesReviewer in MGT3Dave ManaloNo ratings yet

- Bus 2101Document33 pagesBus 2101Mary Kathleen GolinganNo ratings yet

- Corporate Governance: Constitution of CommitteeDocument26 pagesCorporate Governance: Constitution of CommitteeRajeev KambleNo ratings yet

- Corp Notes 1Document23 pagesCorp Notes 1ishutiwari56789No ratings yet

- Corporate GovernanceDocument50 pagesCorporate GovernanceMooniAwanNo ratings yet

- Bachelor of Science in Accountancy: Corporate Governance, Business Ethics, Risk Management, and Internal ControlDocument2 pagesBachelor of Science in Accountancy: Corporate Governance, Business Ethics, Risk Management, and Internal ControlJherryMigLazaroSevillaNo ratings yet

- CORPORATE GOV - PERFORMANCE MANAGEMENT - General PrinciplesDocument23 pagesCORPORATE GOV - PERFORMANCE MANAGEMENT - General PrinciplesGeoid AnalyticsNo ratings yet

- Corporate Governance (CG)Document24 pagesCorporate Governance (CG)Nyaba NaimNo ratings yet

- Soc. Sci 1 Chapter 3Document78 pagesSoc. Sci 1 Chapter 3Lailanie FortuNo ratings yet

- Corporate Governance ReportDocument23 pagesCorporate Governance ReportDiksha RangaNo ratings yet

- CL Unit 2Document10 pagesCL Unit 2Jasjeet SinghNo ratings yet

- Governing OrganizationgDocument13 pagesGoverning OrganizationgNINIO B. MANIALAGNo ratings yet

- MCS CH 13 PPT FixDocument27 pagesMCS CH 13 PPT FixArtikaIndahsariNo ratings yet

- Becg m-5Document16 pagesBecg m-5CH ANIL VARMANo ratings yet

- Good GovernanceDocument11 pagesGood GovernanceDizon Ropalito P.No ratings yet

- Corporate Governance: By: Ms. Shweta GoelDocument35 pagesCorporate Governance: By: Ms. Shweta GoelShweta GoelNo ratings yet

- Corporate GovernanceDocument5 pagesCorporate GovernanceMj PacunayenNo ratings yet

- Topic 3 - GovernanceDocument27 pagesTopic 3 - GovernanceFarissa Elya100% (1)

- Borrowing Powers of Directors of Public Limited CompaniesDocument14 pagesBorrowing Powers of Directors of Public Limited CompaniesMuhammad Saeed BabarNo ratings yet

- Corporate Governance Outline 2Document36 pagesCorporate Governance Outline 2emman neriNo ratings yet

- Ch10 Monitoring and ControlDocument7 pagesCh10 Monitoring and ControlchristineNo ratings yet

- Corporate Governance - Overview, Principles, ImportanceDocument5 pagesCorporate Governance - Overview, Principles, ImportancesninaricaNo ratings yet

- BECG PowerPointDocument92 pagesBECG PowerPointHussain NazNo ratings yet

- Unit - 1 - Conceptual Framework of Corporate GovernanceDocument15 pagesUnit - 1 - Conceptual Framework of Corporate GovernanceRajendra SomvanshiNo ratings yet

- Benefits of Good Corporate GovernanceDocument4 pagesBenefits of Good Corporate Governancekemalatha88No ratings yet

- Question Answered From Corporate Governance - A Book by Christine A. MallinDocument7 pagesQuestion Answered From Corporate Governance - A Book by Christine A. MallinUzzal Sarker - উজ্জ্বল সরকার100% (5)

- Investor Protection Under Corporate GovernanceDocument31 pagesInvestor Protection Under Corporate GovernanceSoumitra Chawathe100% (3)

- Ba22 ReviewerDocument9 pagesBa22 Reviewerbisana.alangeloNo ratings yet

- Module - Corporate Governance - Chapter 2Document7 pagesModule - Corporate Governance - Chapter 2Aimae Inot Malinao100% (1)

- Chapter 1Document26 pagesChapter 1Baby KhorNo ratings yet

- Good Gov ReviewerrrDocument12 pagesGood Gov ReviewerrrAlyssa GalivoNo ratings yet

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- "Reigning the Boardroom: A Trailblazing Guide to Corporate Governance Success": GoodMan, #1From Everand"Reigning the Boardroom: A Trailblazing Guide to Corporate Governance Success": GoodMan, #1No ratings yet

- Ex - 5Document7 pagesEx - 519UBCA020 HARIHARAN KNo ratings yet

- TaxInvoice 10412726Document2 pagesTaxInvoice 1041272619UBCA020 HARIHARAN KNo ratings yet

- DocScanner 16 Jun 2023 11 30 AmDocument8 pagesDocScanner 16 Jun 2023 11 30 Am19UBCA020 HARIHARAN KNo ratings yet

- HR Ex 2Document9 pagesHR Ex 219UBCA020 HARIHARAN KNo ratings yet

- SkillForge - Inside Sales JD is+PPODocument2 pagesSkillForge - Inside Sales JD is+PPO19UBCA020 HARIHARAN KNo ratings yet

- SMART HR Job DescriptionDocument1 pageSMART HR Job Description19UBCA020 HARIHARAN KNo ratings yet

- Janet+Egans ResumeDocument1 pageJanet+Egans Resume19UBCA020 HARIHARAN KNo ratings yet

- Time JDDocument1 pageTime JD19UBCA020 HARIHARAN KNo ratings yet

- Demand and Supply: by Jean Lee C. Patindol, 2011-12Document18 pagesDemand and Supply: by Jean Lee C. Patindol, 2011-12Biyaya San PedroNo ratings yet

- Assignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMDocument5 pagesAssignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMMarinella LosaNo ratings yet

- Chapter 4 and 5: Responsibility CentersDocument30 pagesChapter 4 and 5: Responsibility CentersRajat SharmaNo ratings yet

- Anthony Brain Bumiller: UltravisiónDocument2 pagesAnthony Brain Bumiller: UltravisiónMaria Fernanda Camacho TorresNo ratings yet

- 2024 Business BenchmarksDocument16 pages2024 Business BenchmarksinforumdocsNo ratings yet

- Chapter 2 Company and Marketing StrategyDocument42 pagesChapter 2 Company and Marketing StrategyGenoso OtakuNo ratings yet

- Marketing Multiple Choice Questions and AnswersDocument9 pagesMarketing Multiple Choice Questions and AnswersNicola DudanuNo ratings yet

- CH 12Document27 pagesCH 12alslmaniabdoNo ratings yet

- Project Report On Mutual FundDocument60 pagesProject Report On Mutual FundBaldeep KaurNo ratings yet

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDocument11 pagesACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainNo ratings yet

- Project Marketing PlanDocument15 pagesProject Marketing PlanMohitNo ratings yet

- Healthcare ValuationDocument14 pagesHealthcare ValuationdeepumanNo ratings yet

- Titan vs. TimexDocument50 pagesTitan vs. Timexparulkansotia100% (1)

- BUS 1105 Written Assignment Unit 5Document7 pagesBUS 1105 Written Assignment Unit 5Cherry HtunNo ratings yet

- UflexDocument32 pagesUflexChef Sachin rajNo ratings yet

- Ethiopias New Commercial CodeDocument6 pagesEthiopias New Commercial CodeFoad MohammedNo ratings yet

- Basic Features of BondsDocument1 pageBasic Features of Bondspmaina100% (1)

- Exam OC MAC Period 1 OC104E72.1 October 2012Document5 pagesExam OC MAC Period 1 OC104E72.1 October 2012Azaan KaulNo ratings yet

- Comparative Study Report Between Adidas and NikeDocument60 pagesComparative Study Report Between Adidas and Nikeshivamgoyal390No ratings yet

- Class XiithDocument11 pagesClass XiithSantvana ChaturvediNo ratings yet

- A Look Into de Beers' Strategies: Presented by Srikanth Kumar. T Sonu. T. SekharanDocument14 pagesA Look Into de Beers' Strategies: Presented by Srikanth Kumar. T Sonu. T. Sekharansrikanth23090% (1)

- Test Accounts 1Document8 pagesTest Accounts 1Sharmila PalNo ratings yet

- AP-300 (Audit of Liabilities)Document10 pagesAP-300 (Audit of Liabilities)Pearl Mae De VeasNo ratings yet

- Financial Modelling - 1Document20 pagesFinancial Modelling - 1Manisha0% (1)

- ADV I Chapter 3 2009Document17 pagesADV I Chapter 3 2009temedebere100% (1)

- Action Plan For ReedDocument5 pagesAction Plan For ReedNitin Shukla0% (1)