Professional Documents

Culture Documents

1international Organizations Active in The Field of International Tax Law

1international Organizations Active in The Field of International Tax Law

Uploaded by

ساكاو /sakaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1international Organizations Active in The Field of International Tax Law

1international Organizations Active in The Field of International Tax Law

Uploaded by

ساكاو /sakaoCopyright:

Available Formats

-1International Organizations Active in the Field of International Tax Law

There are many international organizations active in the field of international tax law, the most

important of which are listed below:

Organization for Economic Cooperation and Development (OECD): The OECD is one of the most

important international organizations working in the field of international taxation; it issues

international standards on various aspects of taxation, such as combating tax evasion and exchanging

tax information.

International Monetary Fund (IMF): The IMF provides technical assistance to countries in the area of

taxation and publishes reports on the tax systems of its member countries.

World Bank: The World Bank provides loans to countries to finance tax reform projects and publishes

studies on tax systems in developing countries.

United Nations: The United Nations plays an important role in promoting international cooperation in

the field of taxation and issues international treaties on various aspects of taxation.

World Customs Organization (WCO): The WCO promotes international cooperation in the area of

customs anti-smuggling and issues international standards on customs procedures.

World Trade Organization (WTO): The WTO regulates international trade and issues international rules

on rules of origin and customs duties.

There are also a number of region al bodies active in the area of international tax law, the most

important of which are

European Union (EU): The EU issues tax laws that are binding on its member states and exchanges tax

information among them.

Organization of American States (OAS): The OAS promotes international cooperation in the field of

taxation among its member states and issues international standards on various aspects of taxation.

Organization of Islamic Cooperation (OIC): Promotes international cooperation in the field of taxation

among member countries and issues international standards on various aspects of taxation.

These organizations provide a number of services in the field of international tax law, the most

important of which are:

Issuing international standards on various aspects of taxation.

Technical assistance to countries in the field of taxation.

Publication of reports on the tax systems of member countries.

Strengthening international cooperation in the field of taxation.

Combating tax evasion and exchanging tax information.

-2Tools for the implementation of international tax law

There are several tools that are used to implement international tax law, the main ones are:

1. International treaties:

Double taxation agreements: these agreements are aimed at avoiding double taxation, determining the

rules for allocating the authority to impose taxation on income and profits between the contracting

states.

Agreements on the exchange of tax information: these agreements aim to strengthen international

cooperation in the field of combating tax evasion, and to define the rules for the exchange of tax

information between the contracting states.

Agreements on mutual administrative assistance in tax matters: these agreements are aimed at

strengthening international cooperation in the field of tax collection, defining the rules for providing

mutual administrative assistance between the contracting states.

2. National legislation:

Tax laws: tax laws establish the rules for taxation of various types of income and wealth.

Anti-tax evasion laws: anti-tax evasion laws establish penalties for people who evade paying taxes.

3. Administrative procedures:

Tax inspection: tax inspectors audit the books and accounts of companies and individuals to ensure the

correctness of their tax returns.

Tax collection: tax authorities collect taxes owed by people and companies.

4. International cooperation:

Exchange of tax information: countries exchange tax information with each other to combat tax

evasion.

Mutual Administrative Assistance in tax matters: countries provide mutual administrative assistance to

each other in the field of tax collection.

5. Technology:

Tax Information Systems: countries use tax information systems to improve tax administration.

Tax analysis: countries use tax analysis techniques to detect cases of tax evasion.

These tools are used to ensure the effective application of international tax law, promote justice and

equality in the field of taxation.

-3Difference between International Tax and International Taxation

International tax refers to the taxes levied by a country on the income or assets of individuals or

businesses that are not residents of that country. International tax can be complex, as it involves the

application of multiple tax laws and jurisdictions.

International taxation is the broader field of study that encompasses all aspects of taxation that involve

more than one country. This includes international tax, as well as other topics such as transfer pricing,

tax treaties, and international tax planning.

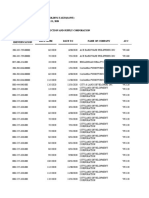

Here is a table summarizing the key differences between international tax and international taxation:

Characteristic International Tax International Taxation

Definition Taxes levied by a country on Broader field of study

non-residents encompassing all aspects of

taxation that involve more than

one country

Scope Focuses on the specific taxes Includes international tax, as

that apply to non-residents well as other topics such as

transfer pricing, tax treaties, and

international tax planning

Complexity Can be complex, as it involves Even more complex, as it

the application of multiple tax requires a deep understanding

laws and jurisdictions of multiple tax systems and

international agreements

Importance Increasingly important in Essential for businesses and

today's globalized economy individuals that operate in

multiple countries

Here are some examples of international tax:

A U.S. citizen who earns income from a job in Canada would be subject to Canadian international tax on

that income.

A U.S. company that has a branch in the United Kingdom would be subject to UK international tax on the

profits of that branch.

Here are some examples of international taxation:

Transfer pricing: the rules that govern how multinational companies price the goods and services they

transfer between their different subsidiaries.

Tax treaties: agreements between two or more countries that aim to avoid double taxation and

promote cross-border investment.

International tax planning: the strategies that businesses and individuals use to minimize their tax

liability in multiple countries.

International tax and international taxation are both important topics for businesses and individuals that

operate in multiple countries. By understanding the key differences between these two terms, you can

be better prepared to comply with the relevant tax laws and minimize your tax liability.

You might also like

- 7A SOP - Coal Samplin, Preparation & AnalysisDocument34 pages7A SOP - Coal Samplin, Preparation & AnalysisDebabrata Ghosh100% (2)

- AbstractDocument1 pageAbstractساكاو /sakaoNo ratings yet

- Lecture On International TaxationDocument20 pagesLecture On International TaxationAtia IbnatNo ratings yet

- Taxation Law Project - 200101139Document16 pagesTaxation Law Project - 200101139Siddhartha RaoNo ratings yet

- FO 1 Assignment Ankit Singh BBAP2Document12 pagesFO 1 Assignment Ankit Singh BBAP2Rahul SinghNo ratings yet

- Grupo - Tributación InternacionalDocument17 pagesGrupo - Tributación InternacionalJEAN PIERRE ALEXANDER PAICO GUEVARANo ratings yet

- Summary 1-Principles of Int'l TaxationDocument33 pagesSummary 1-Principles of Int'l Taxationkiana mitreNo ratings yet

- Study of International TaxationDocument21 pagesStudy of International TaxationPîyûsh KôltêNo ratings yet

- Unit - 5: 1 Define E-Way Bill ?Document21 pagesUnit - 5: 1 Define E-Way Bill ?Sara SowjanyaNo ratings yet

- International Affairs2Document61 pagesInternational Affairs2cristina.galluzzi1998No ratings yet

- Chapter 3 Introduction To International TaxationDocument19 pagesChapter 3 Introduction To International Taxationrogue.pve1No ratings yet

- Offshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaDocument6 pagesOffshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaSukantoTanotoNo ratings yet

- International Tax Law and Its Influence On National Tax SystemsDocument15 pagesInternational Tax Law and Its Influence On National Tax SystemsbirrarafNo ratings yet

- Taxation Under CommonwealthDocument1 pageTaxation Under CommonwealthJonathan Ludovice MirandaNo ratings yet

- Offshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaDocument6 pagesOffshore Tax Evasion and Tax Avoidance: A Business Perspective From IndonesiaSukantoTanoto100% (1)

- International TaxationDocument33 pagesInternational TaxationKaran VohraNo ratings yet

- International - Breaking The Double Tax Paradigm - IBFDDocument31 pagesInternational - Breaking The Double Tax Paradigm - IBFDCarlos CabreraNo ratings yet

- Tax Treaty AdvDocument2 pagesTax Treaty AdvLookyoNo ratings yet

- Term Paper: Dr. R.Anita RaoDocument26 pagesTerm Paper: Dr. R.Anita Raosuchanda87No ratings yet

- Taxation II Class NoticeDocument47 pagesTaxation II Class NoticeTimoth MbwiloNo ratings yet

- Tax Treaty: Department of Finance and Accounting G: 01Document5 pagesTax Treaty: Department of Finance and Accounting G: 01Ismail AbderrahimNo ratings yet

- TT Introduction EngDocument16 pagesTT Introduction EngMukul ChoudharyNo ratings yet

- International Tax TreatiesDocument6 pagesInternational Tax TreatiesNaila KhanNo ratings yet

- A Close Look Into Double Taxation Avoidance Agreements With India: Some Relevant Issues in International TaxationDocument19 pagesA Close Look Into Double Taxation Avoidance Agreements With India: Some Relevant Issues in International TaxationshubhangNo ratings yet

- 11 A Close Look Into Double Taxation Avo PDFDocument19 pages11 A Close Look Into Double Taxation Avo PDFA PLNo ratings yet

- Eurodad Tax Report 2014Document100 pagesEurodad Tax Report 2014Jeff PragerNo ratings yet

- Law On Income TaxDocument10 pagesLaw On Income TaxJuliever EncarnacionNo ratings yet

- Bfa 322 - Taxation A Cross Border ActivitiesDocument11 pagesBfa 322 - Taxation A Cross Border Activitiesjoannemutheu8No ratings yet

- Abuse in International TaxationDocument4 pagesAbuse in International TaxationAmarendraKumarNo ratings yet

- Lecture10 Chapter15 JHDocument25 pagesLecture10 Chapter15 JHJerónimo BedoyaNo ratings yet

- Business Taxation Case StudyDocument5 pagesBusiness Taxation Case StudyVedant NairNo ratings yet

- Lecture 11 - INTERNATIONAL TAXATIONDocument34 pagesLecture 11 - INTERNATIONAL TAXATIONStephen ArkohNo ratings yet

- Ch6 - Hiep Dinh ThueDocument80 pagesCh6 - Hiep Dinh ThueQUỲNH HUỲNH TRẦN TRÚCNo ratings yet

- Qtaxation Mba 4th SemesterDocument9 pagesQtaxation Mba 4th SemesterMurshid Ali OfficialNo ratings yet

- Introduction To Principles and Application KEVIN HOLMES 2Document116 pagesIntroduction To Principles and Application KEVIN HOLMES 2DogeNo ratings yet

- Taxation and Fiscal Policy: First Semester 2020/2021Document33 pagesTaxation and Fiscal Policy: First Semester 2020/2021emeraldNo ratings yet

- ICTD International Tax Literature Review - V2Document54 pagesICTD International Tax Literature Review - V2Chiara WhiteNo ratings yet

- 2023 CTA Exam - Paper 3 Syllabus - Mar23Document5 pages2023 CTA Exam - Paper 3 Syllabus - Mar23FuchingAuntieNo ratings yet

- Introduction To International TaxationDocument30 pagesIntroduction To International TaxationJessnah GraceNo ratings yet

- Austry CahierDocument22 pagesAustry Cahiermacc84No ratings yet

- Millennian S. Tax AssignmentDocument9 pagesMillennian S. Tax AssignmentMillennian SNo ratings yet

- General Report - Oecd-Un PistoneDocument23 pagesGeneral Report - Oecd-Un PistoneGauravGoyalNo ratings yet

- Cases On Transfer Pricing NMDDocument29 pagesCases On Transfer Pricing NMDSwati CharbheNo ratings yet

- ICRICT Alternatives Eng Sept 2017Document30 pagesICRICT Alternatives Eng Sept 2017Fritz BruggerNo ratings yet

- The Mutual Agreement Procedure and Arbitration of Double Taxation DisputesDocument23 pagesThe Mutual Agreement Procedure and Arbitration of Double Taxation DisputesSushmaHariniAmasaNo ratings yet

- Double Taxation Avoidance AgreementDocument8 pagesDouble Taxation Avoidance AgreementSanaur RahmanNo ratings yet

- Tax Havens and Money Laundering in IndiaDocument12 pagesTax Havens and Money Laundering in IndiaVaishali RathiNo ratings yet

- Double Taxation Avoidance TreatyDocument10 pagesDouble Taxation Avoidance TreatyPriya RaneNo ratings yet

- Mock Exams Dec 2017 Marking SchemeDocument12 pagesMock Exams Dec 2017 Marking SchemeTimore FrancisNo ratings yet

- Tema 6-BEPS Project-ENGDocument15 pagesTema 6-BEPS Project-ENGkiana mitreNo ratings yet

- ADIT Paper I - Candidate Script 2010Document6 pagesADIT Paper I - Candidate Script 2010Constantinos_m0% (1)

- TAD CH.2 PritDocument76 pagesTAD CH.2 PritYitera SisayNo ratings yet

- International Taxation: Author: Pandey Komalvimal KumarDocument9 pagesInternational Taxation: Author: Pandey Komalvimal Kumarkomal komalNo ratings yet

- MNC WordDocument4 pagesMNC WordChristianMarkSebastianNo ratings yet

- 15 010 International Tax Policy and Double Tax Treaties Final Web PDFDocument36 pages15 010 International Tax Policy and Double Tax Treaties Final Web PDFHanif ajalaahNo ratings yet

- DoubleDocument9 pagesDoubleEmmanuel Amarfio MensahNo ratings yet

- Eurodad - Hidden Profits The EU's Role in Supporting An Unjust Global Tax System PDFDocument112 pagesEurodad - Hidden Profits The EU's Role in Supporting An Unjust Global Tax System PDFDan Israel - MediapartNo ratings yet

- Transfer Pricing' - An International Taxation Issue Concerning The Balance of Interest Between The Tax Payer and Tax AdministratorDocument8 pagesTransfer Pricing' - An International Taxation Issue Concerning The Balance of Interest Between The Tax Payer and Tax AdministratorchristianNo ratings yet

- Economic Analysis of India's Double Tax Avoidance AgreementsDocument33 pagesEconomic Analysis of India's Double Tax Avoidance AgreementsSukhdeep RandhawaNo ratings yet

- Business: Loans, Debt, Trusts, Grants, Investing, Scholarships, Mortgages, Dividends, Tax Avoidance, and MoreFrom EverandBusiness: Loans, Debt, Trusts, Grants, Investing, Scholarships, Mortgages, Dividends, Tax Avoidance, and MoreNo ratings yet

- Soal 1: 1. Computed Equivalent Unit For Production CostDocument10 pagesSoal 1: 1. Computed Equivalent Unit For Production CostRaihan Rohadatul 'AisyNo ratings yet

- CCT Unit 3 Elasticity of Demand Butwl: P P Q P P Q Q e ElasticityDocument29 pagesCCT Unit 3 Elasticity of Demand Butwl: P P Q P P Q Q e ElasticityAyesha jamesNo ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - NoMohan PvdvrNo ratings yet

- Gujarat 04092012Document80 pagesGujarat 04092012Dhruvil MehtaNo ratings yet

- Gratuity Report IND As 19Document25 pagesGratuity Report IND As 19Prashant GaurNo ratings yet

- 01-Egypt Mep Supplier - Rev02Document17 pages01-Egypt Mep Supplier - Rev02Mohammed AtefNo ratings yet

- The Iron AgeDocument17 pagesThe Iron AgeArk YogaNo ratings yet

- Final Exam Econ 2Document8 pagesFinal Exam Econ 2Ysabel Grace BelenNo ratings yet

- Profile On The Production of Tomato Sauce & KetchupDocument29 pagesProfile On The Production of Tomato Sauce & Ketchupnidhi100% (1)

- Predator: High Efficiency V-Cell FilterDocument4 pagesPredator: High Efficiency V-Cell Filterjulian reyNo ratings yet

- Methodology Well Foundation at Yamuna RiverDocument18 pagesMethodology Well Foundation at Yamuna RiverSambit NayakNo ratings yet

- Financial Times Europe - 18.10.22Document20 pagesFinancial Times Europe - 18.10.22Cesar Acosta CashuNo ratings yet

- Beat TYBCOM-SAMPLE-MCQS-SEM-VI LDocument14 pagesBeat TYBCOM-SAMPLE-MCQS-SEM-VI LRajkumar MootaNo ratings yet

- The Impact of The First World War and Its Implications For Europe TodayDocument9 pagesThe Impact of The First World War and Its Implications For Europe TodayNanee DNo ratings yet

- Annexure V Bid MatrixDocument17 pagesAnnexure V Bid Matrixraj1508No ratings yet

- Excore Diamond ToolsDocument24 pagesExcore Diamond ToolsDexterNo ratings yet

- Ch02 Evolution of Intl BusinessDocument17 pagesCh02 Evolution of Intl BusinessNurse NotesNo ratings yet

- Angle Weight ChartDocument7 pagesAngle Weight ChartAbhinav KumarNo ratings yet

- Porter's Five ForcesDocument6 pagesPorter's Five ForcesHumberto SusunagaNo ratings yet

- 2020 2307Document15 pages2020 2307Pajarillo Kathy AnnNo ratings yet

- En - MB1136 DEFAULT C05 - SchematicDocument5 pagesEn - MB1136 DEFAULT C05 - SchematicAlejandro PazNo ratings yet

- 9 Financial AnalysisDocument79 pages9 Financial AnalysisAngel CastilloNo ratings yet

- FRM - Syllabus PDFDocument64 pagesFRM - Syllabus PDFAnonymous x5odvnNVNo ratings yet

- Proofofcashbylailanepptxpdf PDF FreeDocument19 pagesProofofcashbylailanepptxpdf PDF Freedanica gomezNo ratings yet

- Chap 01 - 8e - FrankDocument68 pagesChap 01 - 8e - FrankThieu Ngoc MaiNo ratings yet

- Chapter 3-Lease ContractDocument5 pagesChapter 3-Lease ContractmarsupilamiNo ratings yet

- Information Sheet: Link Your Account With CDPDocument3 pagesInformation Sheet: Link Your Account With CDPJewyang HuangNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- FM112 Students Chapter IIDocument12 pagesFM112 Students Chapter IIThricia Mae IgnacioNo ratings yet