Professional Documents

Culture Documents

Ty Sorn-T: (Time:Z%) Iours)

Ty Sorn-T: (Time:Z%) Iours)

Uploaded by

shahisonal02Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ty Sorn-T: (Time:Z%) Iours)

Ty Sorn-T: (Time:Z%) Iours)

Uploaded by

shahisonal02Copyright:

Available Formats

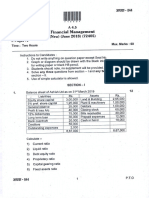

Paper / Subject Code: 44303 / Financial Reporting & Analysis

Ty B BT I sorn-T /*"i I ir-r- r1

[Time:Z%}Iours] [Marks:,75]

N.B. l.Q. 1 is compulsory.

2.Q2 to Q.5 are compulsory with internal choice.

3. Figures to the right indicate full marks.

4. Workings should form a part of your answer.

5. Use of simple calculator is allowed.

.l) A) Match the followine. (Any 8

Column A Co-lumnB.

I Balance sheet of banking companies a. In caie ofheayylrjsk

2 Demand deposits b. Creditedlo profrt.and loss

J Fire insurance o. Repayable on demand

4 Reinsurance d- IsSued:by RBI

5 Profit on Sale of Investment e. Disc{osed in the :S.chetlule of Sharecabital

6 Bonus shares issued f. ,Financing activily

1 License for banking o

b. General'insulance-

8 Issue ofdebentures h. Form A

9 Payment of Wages Investing Activrtv

10 Purchase of Fixed Assets OperatinE Aitivit\.

Q.l) B) State whether the following statements are TRUE or FALSE (Any 7) (7)

l. Rebate on bills discounted is unearned discount.

2. Standard assets are tlrose assets vrhich lrave the least risk.

3. IFRS - I deals with First time adoptiou of lnternational Financial Reporting Standards

4. When a company gets reinsurance business, it has to pay commission.

5. Fixed Assets are always shown at ltet oIdepreciatiorr basis

6. It is the duty of directors and rnanagement to ensure proper Code of Ethics are implemented.

7. Company Final Accounts lorrnats are prescribed as per laws.

8. Reserve for Unexpired risk is 100% in case of marine business

9. AS-3 requires Cash flow statement to be prepared as per 'Inclirect Method'

i 0. Revenue Account should be prepared separately for fire, marine & miscellaneous businesses.

Q.2) Following are the balanoes providsd for Pushti Bank Ltd. as on 3l-3-2018 [1s]

P-afiioulars Rs, Particulars Rs.

Interest on loan 2,59,000 Profit on sale of Assets 2,000

Interesl on fixed.deposits 2;75;A:fr0 Profit on exchange transaction 10.000

Rebate on tsills,diS0ounted 49;000 Interest on RBI borrowings 12.000

Commission 8,200 Interest on borrowings from other banks 10,000

Establishment 54,000 Ernployee salaries 20,000

Discount of Bills discounted (net) 1,95,000 Interest on savings Bank deposits 68,000

Inte,rest oii cash credits 2.23,000 Postage & telegrams 1,400

Renfl&'Taxes 18.000 Printing & Stationery 2,900

Iriter.e$ on- overdiaft s 1,54,000 Sundry charses (Cr) 1,740

Director,s fees 3.000 Interest on current account 42.000

Auditois fees 1,200 Interest on balance with RBI 50,000

Bad debts to ,be written off amounted to Rs. 40,000. Provision for taxation may be maae-@

35%. Transfer 25le% to statutory reserves and 5o/o to revenue r6serves.

56720 Page 1 of4

5 6 AB7 F 2253 lF97 1 8065 6750C68 7E620B

Paper / Subject Code: 44303 / Financial Reporting & Analysis

OR

Q2) A) From tlie following information find out the amount of provisions to be shown in the profit

and loss account of Dhairyalaxmi

axm Commercial Bank. (8)

Assets Rs (in lakhs)

Standard 16,000

Sub Standard 8,000

Doubtful upto one year 3,600

Doubtful upto three years 1.600

Doubtful upto more than three years r.z\a

Loss assets 1,200

Q2) B) From the Followirrg data calculate rebate on Bilts Discount as ou 3 I .3.20 t 8 [7]

BillNo. Amount Rs Due Date Rate of Discount

A456 2.737.500 05.06.2018 2%

B875 7,500,000 12.06.2018 2%

c578 4.230.000 25.06.2018 4%

D235 6,090,00-0 06,0?.201.9 6%

Q.3) From the following figures relating to Ayush lnsurance Compauy, Prepare Revenue

Account for Fire Depafiment, for the year ended 3l't March, 2018. (15)

Direct Business Re insurance

Particulars

Rs Rs

Premium:

Rece ved 300000 45000

Rece vable - 01.04.2017 1 5000 2625

Receivable - 3 1.03.201 8 22500 3s00

Paid '

30000

Payable - 01.04.2017 2s00

payable - 31.03.2018 5250

Clairns :

Paid 206250 15625

Payable - 01.04.2017 11875 162s

payable - 3 1.03.2018 21875 2750

ReCeived 12500

Receivable - 01.04.201 l tl25

Rece vable'. 31,032018 1 500

Commission.:

On Insurance accepted 1 8750 137 5

On Re - iu*suranie ceded 1 750

OR

.,'',: 56720 Page 2 of 4

56 AB7 F2253 I F97 r 80656750C687E620B

..

"t,

Paper / Subject Code: 44303 / Financial Reporting & Analysis

Bima Insurance Ltd Fire Insurance division ides the infbnn_ation

Particulars Rs. Partic u lars

Reserve for Unexpired risk as

on31-3-2017 600,000 Premium received

Outstanding Claims - 0l-4-2017 200,000 Commission . .Direcf busi:iress 30,000

Outstanding Claims - 31-3-2018 150,000 Commission - Reinsuranii iedei +0;000

Claims Paid 800,000 Comm iss-ion - Re insurance icc.pptpd 5,000

Reinsurance Premium Paid 50,000

,, '600;0Q0,

Reinsurance Premium

Recovered 30,000

LEgd:exirensbs-,(relati{rg to etaims) 30,000

Prepare Revenue A/c for the year effi 'risk

.4 A) Jeeva Ltd des the below inf,ormation related to fixed asseis ofas on.3 -03-201

i 8 (8)

Particulars :Debit Rs Credit Rs,

I!e!t & Machinery 2000,000 500j000,

Goodwill 1 500,000

Land 300.0.000

Furniture 80.0;000' 75,000

The Company purch furniture of Rs. 25,000 on

l-1-2018' The compaqv d'epreeiates 10-7o on straight line method p."pu;;d;a ar*o s.r,edule.

.4) B) Following is the extractof trail balance of RamkrishnaLtd

on 3l-03_201g.

Particular

Share Capital

300,000

General Reserves

544,000

Profit & Loss Account

I50,000

Strare, aapfal, eqnsists: ofA

500, 8% cumulative Redeemable preference Shares of Rs. 100 each

80.000 Equity Shares of Rs. l0 each

250, 8yo cumulative Redeernable preference Shares of Rs. 1 00 each

27,500 Equity Shares of Rs. l0 each

2,000 Equify shares were issued for consideration other than cash

Additional Infonnation - Directors issued bonus shares to equity shareholders by capitalizing

General Reserve in the ratior :r for which uo adjustmerts we.e macle in books

Prepare a Schedule of Share Capital and Reserves and Surplus.

OR

56720 Page 3 of 4

56A87F2253 I F97 I 80656750C687E6208

\ \

Paper / Subject Code: 44303 / Financial Reporting & Analysis

a 4) Following are tht Balance sheet of Swami Ltd.as on 31't Mar,201l & 31't Mar,2AI (1s)

Liabilities 2017 2018 Assets 2011 201 8

Rs. Rs Rs. Rs.

Share capital 270,000 270.000 Goodwill 27.9A.0 9,900

Land &

Reserve 81,000 108,000 54;800 90,000

Buildine

Loans 90,000 54,000 Plant 226.800 1 70,1 00

Fixed Deposits 13s.900 t24.020 Furniture ,81;0-00

Sundry Creditors 143,290 87,840 Investments 81"000 99,000

Prov. for Dividend 27.000 32,400 Debtors 189.000 228;i.240

Prov. for Tax 2t.600 2s.200 Bank t79.280 23,220

Total 768,780 701,460 Total 768.780 701.46i,0

Additional Information :

l) Income tax provision for the year was Rs. 26,000

2) Depreciation on Furniture is 10% and on Land & Building Rs. 10.000

3) Investrnent costing Rs. 16,000 sold for Rs. 20,000 during the year

You are required to prepare Cash Flow Statement for 3 1-3-201 B.

Q.5) a) State the benefits of IFRS to all stakeholclers. (8.)

b) "Ethics is of paramount irnportance irr Accounting Professiou" - Discuss. (7 I

OR

Q.5) Write short notes on: (Any 3) (15)

l. Provision lor Doubtful Debts

2. Rebate on Bills Discourrted

3. Contingent Liability

4. Contents of Directors Report

5. Re ins ura nce

56720 Page 4 of 4

5 6 AB7 F2253 r F97 r 80656750C687E6208

You might also like

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Business Plan For Cleaning ServiceDocument38 pagesBusiness Plan For Cleaning Servicebhakthas100% (7)

- Exam Formula SheetDocument2 pagesExam Formula SheetYeji KimNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Config - Rationale FSCM IHCDocument202 pagesConfig - Rationale FSCM IHCsapfico2k883% (6)

- Assignment Hyzer Disc Golf CourseDocument9 pagesAssignment Hyzer Disc Golf CourseTegar Babarunggul100% (1)

- 2BBL311 SEE IR Financial Accounting Dec 2017Document3 pages2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaNo ratings yet

- 943 Question PaperDocument3 pages943 Question PaperPacific TigerNo ratings yet

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T)Document5 pages4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- (CBCS) (Repeaters) Commerce Paper - 3.5: Accounting For Specialised InstitutionsDocument4 pages(CBCS) (Repeaters) Commerce Paper - 3.5: Accounting For Specialised InstitutionsSanaullah M SultanpurNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Calculation of Rebate: Particular Dr. CRDocument12 pagesCalculation of Rebate: Particular Dr. CRDennis BijuNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- CA Bcom PH 3rd Sem 2016Document7 pagesCA Bcom PH 3rd Sem 2016Gursirat KaurNo ratings yet

- Sem I Acc - NEP-UGCF 2022Document8 pagesSem I Acc - NEP-UGCF 2022Raj AbhishekNo ratings yet

- Answer On AccountingDocument6 pagesAnswer On AccountingShahid MahmudNo ratings yet

- Management Programme: Assignment First Semester 2009Document4 pagesManagement Programme: Assignment First Semester 2009gkmishra2001 at gmail.com100% (2)

- Advanced AccountsDocument3 pagesAdvanced AccountsArun SankarNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- B.B.A., Sem.-IV CC-213: Corporate Financial StatementsDocument4 pagesB.B.A., Sem.-IV CC-213: Corporate Financial StatementsJJ NayakNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Ca-Ii May 2022Document6 pagesCa-Ii May 2022Gayathri V GNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- RTP June 2018 AnsDocument29 pagesRTP June 2018 AnsbinuNo ratings yet

- Answer All Questions. Each Question Carries 2 MarksDocument3 pagesAnswer All Questions. Each Question Carries 2 MarksAthul RNo ratings yet

- Class 12 AMU Model PapersDocument77 pagesClass 12 AMU Model PapersMohammad FarazNo ratings yet

- Board Paper 2018Document14 pagesBoard Paper 2018zaraniyaz14No ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Banking QaDocument10 pagesBanking QaBijay AgrawalNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- Partnership QsDocument3 pagesPartnership QsJAYARAJALAKSHMI IlangoNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- MemorandumDocument6 pagesMemorandumntebohengmargretNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- 73601bos59426 Inter p5qDocument7 pages73601bos59426 Inter p5qKali KhannaNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- FinancialManagement October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 386E9789Document3 pagesFinancialManagement October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 386E9789Mubin Shaikh NooruNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Document15 pages13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNo ratings yet

- r7 Mba Financial Accounting and Analysis Set1Document3 pagesr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- Management Programme: MS-04: Accounting and Finance For ManagersDocument5 pagesManagement Programme: MS-04: Accounting and Finance For Managersanon_323108No ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- AccountingDocument8 pagesAccountingktong0121No ratings yet

- SEM III - Advanced Accounting (EM)Document4 pagesSEM III - Advanced Accounting (EM)Abdul MalikNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Form6 S13188O6N2401241200167 PDFDocument2 pagesForm6 S13188O6N2401241200167 PDFshahisonal02No ratings yet

- WhatsApp Image 2023-11-20 at 14.06.02Document5 pagesWhatsApp Image 2023-11-20 at 14.06.02shahisonal02No ratings yet

- Student JourneyDocument6 pagesStudent Journeyshahisonal02No ratings yet

- Atharva Bharati Blackbook Project Rollno.6-Edited FinalDocument68 pagesAtharva Bharati Blackbook Project Rollno.6-Edited Finalshahisonal02No ratings yet

- Fmproject 151014112459 Lva1 App6891Document44 pagesFmproject 151014112459 Lva1 App6891shahisonal02No ratings yet

- ACC 543 WK 4 - Apply Signature Assignment Flexible BudgetDocument17 pagesACC 543 WK 4 - Apply Signature Assignment Flexible BudgetDonny JobNo ratings yet

- Accounting For The Service Business Part 2Document37 pagesAccounting For The Service Business Part 2Jessa Mae AlgarmeNo ratings yet

- FA - 6th Mock TestDocument13 pagesFA - 6th Mock TestChaiz MineNo ratings yet

- Introduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsDocument23 pagesIntroduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsUmer Ali SangiNo ratings yet

- IT Services CompanyDocument22 pagesIT Services CompanyNauman QureshiNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- College of Business & Accountancy Manila City 1 Sem SY 2021-22Document2 pagesCollege of Business & Accountancy Manila City 1 Sem SY 2021-22Shiela Mae Pon AnNo ratings yet

- Financial Statements and Ratio Analysis NEWDocument108 pagesFinancial Statements and Ratio Analysis NEWDina Adel DawoodNo ratings yet

- Bsa 1201-Financial Accounting and Reporting Preliminary Departmental Exam Reviewer Topic CoverageDocument15 pagesBsa 1201-Financial Accounting and Reporting Preliminary Departmental Exam Reviewer Topic CoverageChjxksjsgskNo ratings yet

- 3) 9. Raising CapitalDocument29 pages3) 9. Raising CapitalJhon Ace DuricoNo ratings yet

- Financial Accounting 9th Edition Weygandt Solutions Manual 1Document107 pagesFinancial Accounting 9th Edition Weygandt Solutions Manual 1rachel100% (45)

- MAT112 (Assignment) Business Mathematics September 2019 - January 2019Document2 pagesMAT112 (Assignment) Business Mathematics September 2019 - January 2019syafiqahNo ratings yet

- Sinking Fund MethodDocument3 pagesSinking Fund MethodJoanna DuqueNo ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- A Consolidated Full Tutorial Booklet 2018Document32 pagesA Consolidated Full Tutorial Booklet 2018Sufina SallehNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsPrekshitha NNo ratings yet

- Ch14 Long Term LiabilitiesDocument39 pagesCh14 Long Term LiabilitiesBabi Dimaano Navarez67% (3)

- Financial Analysis - Two Harbors Investment Corporation Is A Real Estate Investment Trust (REIT) .Document8 pagesFinancial Analysis - Two Harbors Investment Corporation Is A Real Estate Investment Trust (REIT) .Q.M.S Advisors LLCNo ratings yet

- Questions Baesd On WaccDocument1 pageQuestions Baesd On WaccRohit ShrivastavNo ratings yet

- BLT - PSAK FS Bilingual - 31dec2013 PDFDocument202 pagesBLT - PSAK FS Bilingual - 31dec2013 PDFArdianSyah PtrNo ratings yet

- Exercice Chap 1 - Acc Equation - STDocument19 pagesExercice Chap 1 - Acc Equation - STNguyen Thi Ngoc Diep (FUG CT)No ratings yet

- Mary Nice P. MicutuanDocument5 pagesMary Nice P. MicutuanNice MicutuanNo ratings yet

- Perpetual Journal EntriesDocument31 pagesPerpetual Journal EntriesbaldeNo ratings yet

- Financial Statement ExampleDocument21 pagesFinancial Statement ExampleLucky MehNo ratings yet

- Physical FitnessDocument26 pagesPhysical Fitnessmuluken walelgnNo ratings yet