Professional Documents

Culture Documents

Principles of Financial Management Practice Qs

Principles of Financial Management Practice Qs

Uploaded by

22UG1-0372 WICKRAMAARACHCHI W.A.S.M.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Principles of Financial Management Practice Qs

Principles of Financial Management Practice Qs

Uploaded by

22UG1-0372 WICKRAMAARACHCHI W.A.S.M.Copyright:

Available Formats

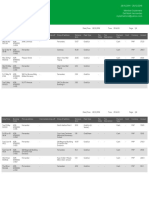

Practice Questions

1. If you invest Rs.30,000/= in a bank account which gives you 10% simple annual interest,

determine the value of your investment after 6 years.

2. If you invest Rs.30,000/= in a bank account which gives you 12% annual compounding

interest, determine the value of your investment after 6 years.

3. If you deposit Rs.500,000/= in an account earning 5% per annum compounded annually,

how much would you have in the account after 3 years?

4. If you receive Rs.500,000/=, 2 years from now, what is the PV of that Rs.250,000/=, if

your interest rate is 5% per annum compounded annually?

5. Amali deposits Rs.100,000/= in an account earning 8% per annum compounded annually.

What is the future value of her deposit after 3 years?

6. Senuri needs Rs.100,000/= in 3 years. The interest rate is 8% per annum compounded

annually. How much should she deposit today to obtain Rs.300,000 in 3 years?

7. Find the future value at the end of one year if the present value is Rs.500,000/= and the

interest rate is 8% per annum. Use the following compounding frequencies:

I. Annual Compounding

II. Semiannual Compounding

III. Quarterly Compounding

IV. Monthly Compounding

8. Calculate the effective annual rates of the following nominal annual rates.

I. 25% annual interest rate compounding semi annually

II. 25% annual interest rate compounding quarterly

III. 25% annual interest rate compounding monthly

9. You are going to make the below-mentioned deposits in a bank account that pays 10%

per annum. How much will you have at the end of year 5?

Year Amount (Rs.)

1 10,000

2 50,000

3 30,000

4 10,000

5 10,000

10. You are going to make the below-mentioned deposits in a bank account that pays 10%

per annum. What is the present value of your deposit?

Year Amount

(Rs.)

0 -

1 10,000

2 35,000

3 10,000

4 20,000

5 20,000

11. Mr. Kieth predicted annual cash profits from his business for immediate future as

follows:

Year Cash profit

(Rs.mn)

1 05

3 10

5 10

9 20

If the market interest rate for the next 9 years is stable at 10%, calculate the PV of these future

earnings.

12. Assume you deposit Rs.25,000 each at the end of every year for ten years in a savings

account that pays 8% per annum. How much will you have at the end of 20 years?

13. Assume you deposit Rs. 30,000 each at the end of every year for 10 years in a savings

account that pays 10% per annum. What is the present value of the deposits you are going

to make?

14. You purchased Prime PLC shares when stood at Rs.160/= per share 1 year ago. The stock

is currently trading at Rs. 100/= per share. Assume you have just received a Rs. 40/=

dividend.

i. What was the return earned over the past year?

ii. What is the rate of return of the investment?

15. Determine the risk of the below security using variance and standard deviation.

State of Economy Probability of Rate of return if

state of economy state occurs

1 0.2 10%

2 0.4 12%

3 0.4 15%

16. You have the opportunity to choose between the investment X and Y.

Condition Probability Forecasted return on asset (%)

Asset X Asset Y

1 0.2 5 25

2 0.2 10 20

3 0.2 15 15

4 0.2 20 10

5 0.2 25 5

i. Based on the expected returns what is the best investment?

ii. What is the variance and standard deviation of the two companies?

iii. What is the coefficient of variance of the two companies?

iv. If you are a rational investor, determine the investment you would choose.

17. An investor wishes to invest in a security – “K”, which has a beta of 1.4. Currently a risk-

free security would yield a return of 10%. If the expected market return is assessed at

12% what would be the return required by the investor for security K.

18. Calculate the payback period of each of the following projects.

Project 1 (Rs.) Project 2 (Rs.)

Project 3 (Rs.)

Investment 2,000,000 1,500,000 1,000,000

Year 1 500,000 100,000 100,000

Year 2 400,000 300,000 150,000

Year 3 200,000 500,000 200,000

Year 4 150,000 700,000 250,000

Year 5 100,000 800,000 350,000

19. ABC Company wants to invest 1,500,000 in an investment plan. They have got two

alternative investment plans and the net cashflows of those investment plans are as

follows:

Year Plan 1 (Rs.) Plan 2 (Rs.)

1 200,000 500,000

2 300,000 500,000

3 500,000 400,000

4 500,000 300,000

5 500,000 200,000

Total 2,000,000 1,900,000

Calculate the NPV of each plan if the cost of capital is 10%.

20. Piyal Company wants to get the contract of Rs. 2,500,000.00 in a government project.

But government has given two project details and the forecasted net cash flows of the

projects are as follows:

Year Project 1 (Rs.) Project 2 (Rs.)

1 800,000 (100,000)

2 700,000 500,000

3 600,000 700,000

4 500,000 1,000,000

5 400,000 1,100,000

Total 3,000,000 3,200,000

i. Compute the Pay Back Period of each plan

ii. Advice the company on investment decision based on NPV Approach (Cost of

capital is 12%)

iii. Calculate IRR (Take r2 as 20%)

iv. Advice the company

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- PWC Payments Handbook 2023Document34 pagesPWC Payments Handbook 2023Koshur KottNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Comparison of Basel 1 2 3Document6 pagesComparison of Basel 1 2 3anastasyadustiraniNo ratings yet

- 8.deposits LD MMDocument39 pages8.deposits LD MMAnonymous cs4BLczE100% (4)

- JLGDocument6 pagesJLGomprakashrnr100% (1)

- Book - Unveiling The Retirement MythDocument525 pagesBook - Unveiling The Retirement MythsmbbamaNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- FM Questions MSDocument7 pagesFM Questions MSUdayan KarnatakNo ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- Module I: Introduction To Financial ManagementDocument10 pagesModule I: Introduction To Financial ManagementPruthvi BalekundriNo ratings yet

- Practice SheetDocument2 pagesPractice Sheetishapnil 63No ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- Investment Appraisal: Mas Educational CentreDocument7 pagesInvestment Appraisal: Mas Educational CentreSaad Khan YTNo ratings yet

- Assignment 1 CF Section BDocument2 pagesAssignment 1 CF Section BPoornima SharmaNo ratings yet

- Corporate Valuation NumericalsDocument47 pagesCorporate Valuation Numericalspasler9929No ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- FM Assignment - 01Document3 pagesFM Assignment - 01usafreefire078No ratings yet

- TVMDocument3 pagesTVMswapnil6121986No ratings yet

- Homework4 With Ans JDocument18 pagesHomework4 With Ans JBarakaNo ratings yet

- ) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%Document4 pages) of The Two Projects and Suggest Which of The Two Projects Should Be Accepted Assuming A Discount Rate of 10%kfbhgikNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Practice Questions May 2018Document11 pagesPractice Questions May 2018Minnie.NNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- International Financial Management V1Document13 pagesInternational Financial Management V1solvedcareNo ratings yet

- Financial Management Assignment (2009)Document5 pagesFinancial Management Assignment (2009)sleshiNo ratings yet

- Financial Management 532635578Document30 pagesFinancial Management 532635578viaan1990No ratings yet

- Assignment Bba 4th SemDocument3 pagesAssignment Bba 4th SemShadaab MalikNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- FM Practical QuestionsDocument6 pagesFM Practical QuestionsLakshayNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Financial Management Model Paper-1Document6 pagesFinancial Management Model Paper-1rutujajambotkarNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- AL Financial Management Nov Dec 2016Document4 pagesAL Financial Management Nov Dec 2016hyp siinNo ratings yet

- Exercises Chap3Document3 pagesExercises Chap3Nguyễn Phương Nhi 12C2No ratings yet

- MBA 2nd-4th Sem Internal TestDocument3 pagesMBA 2nd-4th Sem Internal TestNritya khoundNo ratings yet

- ACF 103 Exam Revision Qns 20151Document5 pagesACF 103 Exam Revision Qns 20151Riri FahraniNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Subject: Financial Management: Faculty: Dr. Sitangshu KhatuaDocument4 pagesSubject: Financial Management: Faculty: Dr. Sitangshu KhatuaMittal Kirti MukeshNo ratings yet

- Business Finance 2011Document2 pagesBusiness Finance 2011Sita ChapaiNo ratings yet

- Investment PapersDocument6 pagesInvestment PapersAbhishek JainNo ratings yet

- FFTFMDocument5 pagesFFTFMKaran NewatiaNo ratings yet

- Tutorial Set 1Document8 pagesTutorial Set 1Jephthah BansahNo ratings yet

- Case Study On Equity ValuationDocument3 pagesCase Study On Equity ValuationUbaid DarNo ratings yet

- Problems of Capital BudgetingDocument4 pagesProblems of Capital Budgetingm agarwalNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- Financial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Document3 pagesFinancial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Suraj GuptaNo ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- Time Value ExercisesDocument2 pagesTime Value ExercisesJamesTho0% (3)

- FM Question BankDocument17 pagesFM Question Bankrising dragonNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Spring2022 (July) Exam-Fin Part1Document8 pagesSpring2022 (July) Exam-Fin Part1Ahmed TharwatNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- FM I AssignmentDocument3 pagesFM I AssignmentApeksha S KanthNo ratings yet

- Ii Semester Endterm Examination March 2016Document2 pagesIi Semester Endterm Examination March 2016Nithyananda PatelNo ratings yet

- Mam2eDocument6 pagesMam2epriyanehasahaNo ratings yet

- TVM IiiDocument14 pagesTVM Iii22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- Investment AppraisalDocument9 pagesInvestment Appraisal22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- Lesson - 06.11.2023Document9 pagesLesson - 06.11.202322UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- Investment AppraisalDocument1 pageInvestment Appraisal22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- ICM 1301 - End Semester Paper (July 2023)Document7 pagesICM 1301 - End Semester Paper (July 2023)22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- Final Examination Academic Year: 2021-2022: SVKM'S NmimsDocument3 pagesFinal Examination Academic Year: 2021-2022: SVKM'S NmimsSanjam SinghNo ratings yet

- Problem 4: Multiple Choice - ComputationalDocument5 pagesProblem 4: Multiple Choice - ComputationalKATHRYN CLAUDETTE RESENTENo ratings yet

- Capital GainDocument41 pagesCapital GainKrrish KelwaniNo ratings yet

- Mid Term Mgt411 Vu NewDocument30 pagesMid Term Mgt411 Vu Newhk dhamanNo ratings yet

- MBA-2 Sem-III: Management of Financial ServicesDocument17 pagesMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNo ratings yet

- ch21 ReclassificationDocument6 pagesch21 Reclassificationmercyvienho100% (1)

- 062852Document2 pages062852Jiten KarmakarNo ratings yet

- Fia Fa1 Authorizing and Making PaymentsDocument29 pagesFia Fa1 Authorizing and Making PaymentsKj Nayee100% (1)

- Dena Bank Working Capital and Ratio Analysis VinayDocument106 pagesDena Bank Working Capital and Ratio Analysis Vinayविनय गुप्ता75% (4)

- DALDA AR QuestionaireDocument8 pagesDALDA AR QuestionaireAnum ImranNo ratings yet

- Final Project Kyc FinalDocument70 pagesFinal Project Kyc FinalAnonymous HackerNo ratings yet

- MTB Bank Iinternship ReportDocument52 pagesMTB Bank Iinternship ReportUmma HabibaNo ratings yet

- Mytaxi PH, Inc (008-479-980) 2/F, Rear Tower, Wilcon It Hub, Chino Roces Cor, Edsa, Bangkal Makati City, 1233 Manila, PhilippinesDocument4 pagesMytaxi PH, Inc (008-479-980) 2/F, Rear Tower, Wilcon It Hub, Chino Roces Cor, Edsa, Bangkal Makati City, 1233 Manila, PhilippinesDM HernandezNo ratings yet

- Economic Value AddedDocument4 pagesEconomic Value AddedsinghdamanNo ratings yet

- SavingsAccount History 13092023113303Document3 pagesSavingsAccount History 13092023113303Nadiah IsmaNo ratings yet

- ShumeiDocument12 pagesShumeichozhaganNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Saurabh YadavNo ratings yet

- Consumer Price IndexDocument3 pagesConsumer Price IndexRabeya KhanamNo ratings yet

- Day To Day BankingDocument3 pagesDay To Day Bankingbalrajsingh715751No ratings yet

- 1089 V K Textiles IndustriesDocument1 page1089 V K Textiles IndustriesEglNo ratings yet

- Finance Analyst - Finance All in One BundleDocument16 pagesFinance Analyst - Finance All in One Bundleyogesh patilNo ratings yet

- LIC Housing Finance LTD FDDocument6 pagesLIC Housing Finance LTD FDDwiref VoraNo ratings yet

- Modigliani & Miller + WACCDocument39 pagesModigliani & Miller + WACCNaoman ChNo ratings yet

- Basic Fundamental AnalysisDocument5 pagesBasic Fundamental AnalysisDeepal DhamejaNo ratings yet

- Quiz 1 - FT - PrintDocument1 pageQuiz 1 - FT - Printnicolearetano417No ratings yet