Professional Documents

Culture Documents

L15 - Mar 20 2024

L15 - Mar 20 2024

Uploaded by

Priyanshu NainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L15 - Mar 20 2024

L15 - Mar 20 2024

Uploaded by

Priyanshu NainCopyright:

Available Formats

20-Mar-2024

Financial Modelling &

Project Evaluation (Part 3)

CE657 : Construction Economics and

Infrastructure Financing

Instructor: Chirag Kothari

Department of Civil Engineering

Cash flow distribution

Cash Interest,(i) Taxes Paid ,(t)

Expenses,(e) % of debt [Tax Rate] X TI

Revenues (EBITDA) Taxable (Tax Credits)

(r) Gross Profit EBIT Income (TI)

Project

Ops (r)-(e) = (r)-(e)-(d) = (r)-(e)-(d)-(i)

CE657 - 2024 - Chirag Kothari, IIT Kanpur

Net Cash Flow

Depreciation

(d) Debt

Noncash expenses

deductible for tax purposes.

(+) Service

Principal (p)

Amortization

Cash Flow After Tax

= (-)

(r)-(e)-(d)-(i)-(t)+(d)-(p)

Source: Adopted from Prof. Mcloed’s class (CFAT)

20-Mar-2024 Lecture 15 – Project financing – Financial Modelling (Part 3) 2

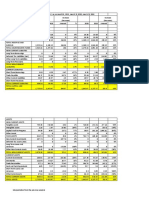

Cash and Debt Distribution for Cogen Project

Passive Engg.

Limited Investors Firm

Partners

Utility

Equity

Investors

CE657 - 2024 - Chirag Kothari, IIT Kanpur

Cogen

Company

(Partnership)

Lenders General Engg.

($81.5M) Partners Utility

Firm

(Sponsors)

20-Mar-2024 Lecture 15 – Project financing – Financial Modelling (Part 3) 3

Goal 1 : Calculate IRR for a passive investor

Goal 2 : Calculate IRR for project sponsor

CE657 - 2024 - Chirag Kothari, IIT Kanpur

20-Mar-2024 Lecture 15 – Project financing – Financial Modelling (Part 3) 4

CE657 - 2024 - Chirag Kothari, IIT Kanpur

20-Mar-2024 Lecture 15 – Project financing – Financial Modelling (Part 3) 5

You might also like

- The Oxford Handbook of Private EquityDocument769 pagesThe Oxford Handbook of Private EquityColin Daniel100% (9)

- Sem IiDocument66 pagesSem IiMoin KhotNo ratings yet

- Hola Kola Case Capital Budgeting MP15030Document4 pagesHola Kola Case Capital Budgeting MP15030Francisco RomanoNo ratings yet

- Paper 19Document6 pagesPaper 19mohanraj parthasarathyNo ratings yet

- Cy 2022 Annual Investment Program (Aip) by Program/Project/Activity by Sector As of 2022Document6 pagesCy 2022 Annual Investment Program (Aip) by Program/Project/Activity by Sector As of 2022Emjhay SwakidaNo ratings yet

- Risk in BOT ProjectsDocument5 pagesRisk in BOT ProjectsYasir NasimNo ratings yet

- Smart Task 2Document4 pagesSmart Task 2Krishnaja PrakashNo ratings yet

- L14 - Mar 18 2024Document8 pagesL14 - Mar 18 2024Priyanshu NainNo ratings yet

- Agni Iconic 2078-79Document11 pagesAgni Iconic 2078-79sital chandNo ratings yet

- PNC Infratech 26 09 2023.Document8 pagesPNC Infratech 26 09 2023.Anonymous brpVlaVBNo ratings yet

- Question Paper Unsolved - Special Study in FinanceDocument18 pagesQuestion Paper Unsolved - Special Study in FinanceAbhijeet KulshreshthaNo ratings yet

- Financial Anaylsis 1Document27 pagesFinancial Anaylsis 1Nitika DhatwaliaNo ratings yet

- Iit Delhi: General OutlineDocument10 pagesIit Delhi: General OutlineGARGI SHARMANo ratings yet

- Axis Annual Analysis On G R Infraprojects LTD Delay in AppointedDocument23 pagesAxis Annual Analysis On G R Infraprojects LTD Delay in AppointedManit JainNo ratings yet

- Cy 2022 Annual Investment Program Program/Project/Activity by SectorDocument5 pagesCy 2022 Annual Investment Program Program/Project/Activity by SectorBudget OfficeNo ratings yet

- Group No. 2 (CF)Document15 pagesGroup No. 2 (CF)Dhrupal TripathiNo ratings yet

- PDF Adv-PrsgDocument15 pagesPDF Adv-PrsgChauhan SaabNo ratings yet

- Marking SchemeDocument8 pagesMarking Schememohamed sajithNo ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingManisha SanghviNo ratings yet

- Pending For Allocation Report - Vendor-WiseDocument1 pagePending For Allocation Report - Vendor-Wisee05prashantpNo ratings yet

- Financial Management End Term Paper - Batch 2020-22Document4 pagesFinancial Management End Term Paper - Batch 2020-22Swastik NayakNo ratings yet

- AnnexIVProjectcDocument11 pagesAnnexIVProjectcIES-GATEWizNo ratings yet

- P17Document21 pagesP17anandhan61No ratings yet

- CSS Business Administration Past PaperDocument1 pageCSS Business Administration Past PaperNadeem GulNo ratings yet

- Toll Operate Transfer Model Brief PresentationDocument19 pagesToll Operate Transfer Model Brief PresentationArunava SenguptaNo ratings yet

- FY2022InvPresFY2022InvPresL&T Q4FY22 Investor PresentationDocument59 pagesFY2022InvPresFY2022InvPresL&T Q4FY22 Investor PresentationS MD SAMEERNo ratings yet

- Chapter 5Document56 pagesChapter 5yedinkachaw shferawNo ratings yet

- Independent Review and Monotoring Agency (Irma) Under (Amrut) Mohua New-DelhiDocument5 pagesIndependent Review and Monotoring Agency (Irma) Under (Amrut) Mohua New-DelhiKAMLESHNo ratings yet

- Tim S.A.: Projections 2021-2023 KPI 2021 Projection (Short Term) 2021 ResultsDocument4 pagesTim S.A.: Projections 2021-2023 KPI 2021 Projection (Short Term) 2021 ResultsBruno EnriqueNo ratings yet

- Happiest Minds TechnologiesLtd IPO NOTE07092020Document7 pagesHappiest Minds TechnologiesLtd IPO NOTE07092020subham mohantyNo ratings yet

- Task1: Comparison of Two Competing Investment Projects in Private and Public SectorDocument5 pagesTask1: Comparison of Two Competing Investment Projects in Private and Public SectorYogirajsinh GohilNo ratings yet

- PHE (Public Health Sindh)Document63 pagesPHE (Public Health Sindh)irfanzai456No ratings yet

- SA Syl08 Dec2014 P17Document14 pagesSA Syl08 Dec2014 P17Ranadeep ReddyNo ratings yet

- Budget 2014 AndesDocument6 pagesBudget 2014 AndescarlosisazaNo ratings yet

- Balance Sheet Statement of Profit and Loss: As at 31 March 2021 For The Year Ended 31 March 2021Document1 pageBalance Sheet Statement of Profit and Loss: As at 31 March 2021 For The Year Ended 31 March 2021Abhay Kumar SinghNo ratings yet

- Investment Analysis Tool InstructionsDocument2 pagesInvestment Analysis Tool Instructionserlend2012No ratings yet

- Ashwini Infradevelopments Private LimitedDocument6 pagesAshwini Infradevelopments Private Limitedkrushna.maneNo ratings yet

- (' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaDocument12 pages(' in Crores) Less: Total Contract Price: © The Institute of Chartered Accountants of IndiaYashNo ratings yet

- CA Final DT A MTP 1 May 23Document14 pagesCA Final DT A MTP 1 May 23Mayur JoshiNo ratings yet

- Paper17 Set1Document7 pagesPaper17 Set1Sa7hkr17h GaurNo ratings yet

- NIT32 UpDocument209 pagesNIT32 Upprojects1No ratings yet

- UC Format - NCAPDocument3 pagesUC Format - NCAPanilNo ratings yet

- Financial Investment PlatformDocument42 pagesFinancial Investment PlatformMalolanRNo ratings yet

- Ashoka BuildconDocument11 pagesAshoka Buildconpritish070No ratings yet

- DPR TemplateDocument10 pagesDPR TemplateMAKZYS khanNo ratings yet

- Makerere University Business School Jinja CampusDocument54 pagesMakerere University Business School Jinja CampusIanNo ratings yet

- CA Final DT A MTP 2 Nov23 Castudynotes ComDocument14 pagesCA Final DT A MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Up White Paper On Tax and GST Gas MarketDocument16 pagesUp White Paper On Tax and GST Gas MarketSunny KhavleNo ratings yet

- Sangguniang Kabataan of Barangay Calzadang Bayu Municipality of Porac Province of PampangaDocument21 pagesSangguniang Kabataan of Barangay Calzadang Bayu Municipality of Porac Province of PampangaMSWD PORACNo ratings yet

- WEM of Siemens India - 1Document9 pagesWEM of Siemens India - 1Renjith KrishnanNo ratings yet

- AnnexIVProjectbDocument11 pagesAnnexIVProjectbIES-GATEWizNo ratings yet

- Capital Budgeting - StudentsDocument22 pagesCapital Budgeting - StudentsManisha SanghviNo ratings yet

- Our Business ModelDocument1 pageOur Business ModelAman SinghNo ratings yet

- Modern Construction Company R 18062020Document7 pagesModern Construction Company R 18062020Ali KayaNo ratings yet

- KPIT Technologies - Initiating Coverage - Centrum 26022020Document32 pagesKPIT Technologies - Initiating Coverage - Centrum 26022020Adarsh ReddyNo ratings yet

- APC Nov 2017 Specimen Examples CompleteDocument67 pagesAPC Nov 2017 Specimen Examples CompleteSafwaan DanielsNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiasolomonNo ratings yet

- CA Final Direct Tax Suggested Answer Nov 2020 OldDocument25 pagesCA Final Direct Tax Suggested Answer Nov 2020 OldBhumeeka GargNo ratings yet

- Reliance Industries: Quest To Build Future Oriented EcosystemDocument33 pagesReliance Industries: Quest To Build Future Oriented EcosystemRaju AmmuNo ratings yet

- Project Process FlowDocument42 pagesProject Process FlowMamtaNo ratings yet

- DownloadDocument63 pagesDownloadTariq AliNo ratings yet

- AnnexIVProjectaDocument11 pagesAnnexIVProjectaIES-GATEWizNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- L14 - Mar 18 2024Document8 pagesL14 - Mar 18 2024Priyanshu NainNo ratings yet

- IME621 TAMCDM Slides 02-UTILITY THEORY OTHER TOPICSDocument182 pagesIME621 TAMCDM Slides 02-UTILITY THEORY OTHER TOPICSPriyanshu NainNo ratings yet

- Live Session NotesDocument2 pagesLive Session NotesPriyanshu NainNo ratings yet

- CS 771A: Intro To Machine Learning, IIT Kanpur Name Roll No DeptDocument2 pagesCS 771A: Intro To Machine Learning, IIT Kanpur Name Roll No DeptPriyanshu NainNo ratings yet

- As20 190244Document4 pagesAs20 190244Priyanshu NainNo ratings yet

- Module 9 1Document25 pagesModule 9 1Priyanshu NainNo ratings yet

- Me352 Asg23 190454Document4 pagesMe352 Asg23 190454Priyanshu NainNo ratings yet

- Me352 Asg24 190454Document2 pagesMe352 Asg24 190454Priyanshu NainNo ratings yet

- Sensors and ActuatorsDocument62 pagesSensors and ActuatorsPriyanshu NainNo ratings yet

- Basic Control SystemsDocument36 pagesBasic Control SystemsPriyanshu NainNo ratings yet

- Robot Specifications - Robot ProgrammingDocument54 pagesRobot Specifications - Robot ProgrammingPriyanshu NainNo ratings yet

- American Laser Inc Reported The Following Account Balances On January PDFDocument1 pageAmerican Laser Inc Reported The Following Account Balances On January PDFHassan JanNo ratings yet

- Vinati OrganicsDocument6 pagesVinati OrganicsNeha NehaNo ratings yet

- Start Up Costs CalculatorDocument5 pagesStart Up Costs CalculatorSmita KumarNo ratings yet

- Financial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsDocument7 pagesFinancial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsSidharth AnandNo ratings yet

- GCC&BA SUPR Share-Capital-1 Sushita-Chakraborty UG (R1)Document14 pagesGCC&BA SUPR Share-Capital-1 Sushita-Chakraborty UG (R1)aman sainiNo ratings yet

- B.ComDocument8 pagesB.ComAmar SinghNo ratings yet

- S.Aniker (Apbf2022.35Document28 pagesS.Aniker (Apbf2022.35aniketsuradkar22.imperialNo ratings yet

- Dividend PolicyDocument34 pagesDividend Policyaditi anandNo ratings yet

- Titan DCF Valuation ModelDocument21 pagesTitan DCF Valuation ModelPrabhdeep DadyalNo ratings yet

- ECOMMERCEDocument5 pagesECOMMERCEMAMILONo ratings yet

- Problem 5Document3 pagesProblem 5Ran CañeteNo ratings yet

- Jai Hanuman Plastic Industries 31.03.22Document4 pagesJai Hanuman Plastic Industries 31.03.22personalmailuse200No ratings yet

- Equated Yield RateDocument15 pagesEquated Yield RateAndr Ei100% (1)

- NSE Financial Modeling Sample Exam Paper1Document10 pagesNSE Financial Modeling Sample Exam Paper1mkg75080% (5)

- Daftar PustakaDocument3 pagesDaftar Pustakai amNo ratings yet

- Case Study IFP Azmir and ZettyDocument30 pagesCase Study IFP Azmir and Zettyainasyuhada912No ratings yet

- Founder Friendly Standard Term Sheet 20200925aDocument6 pagesFounder Friendly Standard Term Sheet 20200925aAnne YipNo ratings yet

- Practice Questions - Books of Original EntryDocument3 pagesPractice Questions - Books of Original EntryRealGenius (Carl)No ratings yet

- Admc Keshava Project ReportDocument67 pagesAdmc Keshava Project ReportRitesh1012No ratings yet

- Pas 1 37 PFRS 9Document10 pagesPas 1 37 PFRS 9Da Yani ChristeeneNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument11 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationMandrich AppadooNo ratings yet

- Guas Inc A Major Retailer of Bicycles and Accessories Operates PDFDocument3 pagesGuas Inc A Major Retailer of Bicycles and Accessories Operates PDFTaimur TechnologistNo ratings yet

- What Are Shares, Shareholder, Certificate Etc..Document5 pagesWhat Are Shares, Shareholder, Certificate Etc..Kamal HussainNo ratings yet

- Financial Ratios MGT657Document8 pagesFinancial Ratios MGT657Iman NadzirahNo ratings yet

- Margin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikDocument12 pagesMargin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikmusiboyinaNo ratings yet

- HOMEWORK 003 (HW003) Conceptual Framework & Accounting StandardsDocument4 pagesHOMEWORK 003 (HW003) Conceptual Framework & Accounting StandardsaltaNo ratings yet

- Depository System and The Depositories Act, 1996Document22 pagesDepository System and The Depositories Act, 1996DALIP RADHENo ratings yet