Professional Documents

Culture Documents

Final Test Fin533 January 2024

Final Test Fin533 January 2024

Uploaded by

2023607226Copyright:

Available Formats

You might also like

- Maf651 Seminar 2 ReportDocument13 pagesMaf651 Seminar 2 Report2022908185No ratings yet

- IKEA Case StudyDocument12 pagesIKEA Case StudyAmrit Prasad0% (1)

- Rich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o oDocument11 pagesRich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o odchandra15100% (2)

- Final Report of Sta116Document25 pagesFinal Report of Sta116Nurul Farah Syuhada Binti ZaidiNo ratings yet

- Examiners' Report 2014: LA3003 Land Law - Zone A Specific Comments On QuestionsDocument15 pagesExaminers' Report 2014: LA3003 Land Law - Zone A Specific Comments On QuestionsAnannya GhoshNo ratings yet

- Exercise 3 Character and Number FunctionDocument7 pagesExercise 3 Character and Number FunctionFaqihah SyazwaniNo ratings yet

- 7 Day Reboot CookbookDocument51 pages7 Day Reboot CookbookJesus Murguía100% (1)

- Configuration MOP Aircel ICRDocument7 pagesConfiguration MOP Aircel ICRKaran ParmarNo ratings yet

- Nur Ainina Najwa BT Zamzuri - Test 2Document12 pagesNur Ainina Najwa BT Zamzuri - Test 2harley quinnnNo ratings yet

- DQS259 - Assignment 1Document21 pagesDQS259 - Assignment 1Ahmad NaufalNo ratings yet

- Financial Management (FIN401) : Capital BudgetingDocument34 pagesFinancial Management (FIN401) : Capital BudgetingNavid GodilNo ratings yet

- 4A - GROUP 3 - KEDUA by Waks ShakeDocument38 pages4A - GROUP 3 - KEDUA by Waks ShakeWani che joNo ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- 3B Group2 Case StudyDocument8 pages3B Group2 Case Studynatasya hanimNo ratings yet

- Hours of Work - AnswerDocument5 pagesHours of Work - AnswerAida TuahNo ratings yet

- Cit452 Visual Analysis Nur Aliza Akasha 2022964141Document16 pagesCit452 Visual Analysis Nur Aliza Akasha 2022964141Arif FitriNo ratings yet

- Analysis of Hong Leong BankDocument9 pagesAnalysis of Hong Leong BankThai CelineNo ratings yet

- Practical Report C2 Adm665 - Athirah 2021120107Document11 pagesPractical Report C2 Adm665 - Athirah 2021120107Liyana AzizNo ratings yet

- CSC583 Artificial Intelligence Algorithms Group Assignment (30%)Document3 pagesCSC583 Artificial Intelligence Algorithms Group Assignment (30%)harith danishNo ratings yet

- MKT539 - Intan Khairunnisa - Individual AssignmentDocument17 pagesMKT539 - Intan Khairunnisa - Individual AssignmentIntan KhairunnisaNo ratings yet

- Part A: AIS615 Test 1Document6 pagesPart A: AIS615 Test 1fareen faridNo ratings yet

- ASM510 - Accss - Assignment 1 - TASNEEM MAISARA&NUR IZZATYDocument14 pagesASM510 - Accss - Assignment 1 - TASNEEM MAISARA&NUR IZZATYZaty RosmiNo ratings yet

- Field Report Pac671 - Nur AzreenDocument16 pagesField Report Pac671 - Nur Azreen2021117961No ratings yet

- Reflective Paper MGT430Document5 pagesReflective Paper MGT430AmmarNo ratings yet

- Lab Assignment 1 Ucs551Document23 pagesLab Assignment 1 Ucs551izwanNo ratings yet

- Lab Report Agr521 Group 4Document26 pagesLab Report Agr521 Group 4nt2hwj7tphNo ratings yet

- Watt Gearboxes-CatalogueDocument18 pagesWatt Gearboxes-CataloguecakhokheNo ratings yet

- ITT470 Project Report - Car Security & MonitoringDocument11 pagesITT470 Project Report - Car Security & Monitoring2022491196100% (1)

- BMS533 Practical Lab Report (Group 6)Document37 pagesBMS533 Practical Lab Report (Group 6)YUSNURDALILA DALINo ratings yet

- CSC577 (Test2) - 20222 20220620Document3 pagesCSC577 (Test2) - 20222 20220620yayanariff96No ratings yet

- Analisis Misi Pengurusan StrategikDocument4 pagesAnalisis Misi Pengurusan StrategikAienYien LengLeng YengYeng PinkyMeNo ratings yet

- Audit Risk NotesDocument14 pagesAudit Risk NotesRana NadeemNo ratings yet

- LAW309 Q5AM110A (Gloria Sylna Anak Sylvester 2019658372)Document10 pagesLAW309 Q5AM110A (Gloria Sylna Anak Sylvester 2019658372)LARRY JONNA LASSY THERENCENo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- Fin533 Group AssignmentDocument23 pagesFin533 Group AssignmentAzwin YusoffNo ratings yet

- (4.0) BSR552 - TIMBER FRAME SYSTEM (GP 4) - 4A FinalizedDocument61 pages(4.0) BSR552 - TIMBER FRAME SYSTEM (GP 4) - 4A FinalizedMuhammad RidzuanNo ratings yet

- Individual Assignment Ims506Document12 pagesIndividual Assignment Ims5062022861828No ratings yet

- Solid and Semi-Solid Media: Discussion: Transfer Culture InoculationDocument2 pagesSolid and Semi-Solid Media: Discussion: Transfer Culture InoculationLeena MuniandyNo ratings yet

- Mat530 - Mini Project - Group 2Document25 pagesMat530 - Mini Project - Group 2NUR DINI HUDANo ratings yet

- Jan22 QQ PDFDocument5 pagesJan22 QQ PDFSYAZWINA SUHAILINo ratings yet

- Jobsheet Unit 7Document8 pagesJobsheet Unit 7Na'im FauzanNo ratings yet

- Group Assign 1 - Draft Acc407Document4 pagesGroup Assign 1 - Draft Acc407Syed IbrahimNo ratings yet

- Management 111204015409 Phpapp01Document12 pagesManagement 111204015409 Phpapp01syidaluvanimeNo ratings yet

- Solution Aud589 Feb 2021Document7 pagesSolution Aud589 Feb 2021RABIATULNAZIHAH NAZRINo ratings yet

- MGT400 Test - July 2022 NATASHA NABILA M1 2020459196Document16 pagesMGT400 Test - July 2022 NATASHA NABILA M1 2020459196natashabasryNo ratings yet

- Lab 4 FST 202Document12 pagesLab 4 FST 202NURUL BALQIS DZULKIFLINo ratings yet

- Group Project Sta589Document16 pagesGroup Project Sta589Batrisyia NorahimNo ratings yet

- DQS 251 Assignment 2Document54 pagesDQS 251 Assignment 2izzatul haniNo ratings yet

- Sta104 Try 2 - 230615 - 235749Document5 pagesSta104 Try 2 - 230615 - 235749Siti Hajar KhalidahNo ratings yet

- Muhammad Khairul Akmal Bin Mazlan-Group Project Proposal CSC305Document3 pagesMuhammad Khairul Akmal Bin Mazlan-Group Project Proposal CSC305Muhammad Khairul Akmal Bin Mazlan100% (1)

- Jabatan Pendaftaran Negara & Ors v. A Child & Ors (Majlis Agama Islam Negeri Johor, Intervener) (2020) 2 MLJ 277 (Federal Court)Document5 pagesJabatan Pendaftaran Negara & Ors v. A Child & Ors (Majlis Agama Islam Negeri Johor, Intervener) (2020) 2 MLJ 277 (Federal Court)HAIFA ALISYA ROSMINNo ratings yet

- Group Project Far670 7e VS MynewsDocument33 pagesGroup Project Far670 7e VS MynewsNurul Nadia MuhamadNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Swot Analysis On The Current Scenarios of Malaysian Public ServiceDocument12 pagesSwot Analysis On The Current Scenarios of Malaysian Public ServicePreety Selvam100% (1)

- (6 July Updated) Project Proposal Ads 512 - Group 5 - Namaf8aDocument21 pages(6 July Updated) Project Proposal Ads 512 - Group 5 - Namaf8asyafiqahmikaNo ratings yet

- FIVERS (REPORT - Case 1 SuperMart)Document20 pagesFIVERS (REPORT - Case 1 SuperMart)Furqan Anwar0% (1)

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- HRM648 Case Study Group AssignmentDocument9 pagesHRM648 Case Study Group Assignment2022753001No ratings yet

- Individual Assignment: Visualization 1Document5 pagesIndividual Assignment: Visualization 1Muhd FakhrullahNo ratings yet

- Process StrategyDocument2 pagesProcess StrategyNUR AINAA BALQIS BINTI MOHMAD RUDUANNo ratings yet

- Laboratory3-ITT557-2020878252-SITI FARHANADocument16 pagesLaboratory3-ITT557-2020878252-SITI FARHANAAnna SasakiNo ratings yet

- Q1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsDocument17 pagesQ1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsCliNo ratings yet

- Experiment 6 Organic Chemistry ResultDocument4 pagesExperiment 6 Organic Chemistry ResultFariza ZaidanNo ratings yet

- Family's Financial PlanningDocument25 pagesFamily's Financial PlanningsyafiqahanidaNo ratings yet

- Chapter 9 - FormulaDocument2 pagesChapter 9 - Formula2023607226No ratings yet

- Nur Hanis Sofia Binti Jainal (Relective Essay)Document5 pagesNur Hanis Sofia Binti Jainal (Relective Essay)2023607226No ratings yet

- Fin420 AssignmentDocument2 pagesFin420 Assignment2023607226No ratings yet

- Trend Analysis BONIADocument4 pagesTrend Analysis BONIA2023607226No ratings yet

- AadhyaKaul RESUME GDocument1 pageAadhyaKaul RESUME GJalaj GuptaNo ratings yet

- BA 501-Text AnalyticsDocument2 pagesBA 501-Text AnalyticsTanisha AgarwalNo ratings yet

- School BusDocument156 pagesSchool Bussowmeya veeraraghavanNo ratings yet

- Maule M7 ChecklistDocument2 pagesMaule M7 ChecklistRameez33No ratings yet

- Taxpayers' Tax Compliance Behavior - Business Profit Taxpayers' of Addis Ababa City AdministrationDocument126 pagesTaxpayers' Tax Compliance Behavior - Business Profit Taxpayers' of Addis Ababa City AdministrationGELETAW TSEGAW80% (5)

- Mil STD 1587e PDFDocument43 pagesMil STD 1587e PDFRaj Rajesh100% (1)

- Gay-Lussac's Law Problems and SolutionsDocument1 pageGay-Lussac's Law Problems and SolutionsBasic PhysicsNo ratings yet

- How Do I Manually Boot HP-UX On Integrity (Itanium) Based SystemsDocument6 pagesHow Do I Manually Boot HP-UX On Integrity (Itanium) Based Systemsnilu772008No ratings yet

- PNS BAFS 184.2016. GAHP Chicken Broilers LayersDocument22 pagesPNS BAFS 184.2016. GAHP Chicken Broilers LayersFelix Albit Ogabang IiiNo ratings yet

- ApduDocument1 pageApduMilen MihailovNo ratings yet

- Threat Hunting Through Email Headers - SQRRLDocument16 pagesThreat Hunting Through Email Headers - SQRRLSyeda Ashifa Ashrafi PapiaNo ratings yet

- Especificaciones Técnicas Blower 2RB510 7av35z PDFDocument5 pagesEspecificaciones Técnicas Blower 2RB510 7av35z PDFSebas BuitragoNo ratings yet

- Applied Pharmacology For The Dental Hygienist 8th Edition Haveles Test BankDocument35 pagesApplied Pharmacology For The Dental Hygienist 8th Edition Haveles Test Bankatop.remiped25zad100% (29)

- Foleybelsaw Catalog Spring 2011Document64 pagesFoleybelsaw Catalog Spring 2011James GarrettNo ratings yet

- Pharmacy Informatics in Multihospital Health Systems: Opportunities and ChallengesDocument8 pagesPharmacy Informatics in Multihospital Health Systems: Opportunities and ChallengesPriscila Navarro MedinaNo ratings yet

- Bernoulli's Principle: Ron Niño Q. AbieraDocument14 pagesBernoulli's Principle: Ron Niño Q. AbieraMaria Chela Shophia Realo MandarioNo ratings yet

- Law On Sales Course OutlineDocument10 pagesLaw On Sales Course Outlinekikhay11No ratings yet

- Neurotrauma & Critical CareDocument10 pagesNeurotrauma & Critical CareyohanesNo ratings yet

- Cy17b PH Technical Trial System Protocols v5Document16 pagesCy17b PH Technical Trial System Protocols v5Glenn Cabance LelinaNo ratings yet

- Outline of ISF2024Document10 pagesOutline of ISF2024Matias JavierNo ratings yet

- Personal Development PlanDocument2 pagesPersonal Development PlanOliver ConnollyNo ratings yet

- Discovery JT FoxxDocument10 pagesDiscovery JT Foxxrifishman1No ratings yet

- Usando MessageBox C BuilderDocument3 pagesUsando MessageBox C BuilderFernando Luiz Do AmaralNo ratings yet

- Test 2Document2 pagesTest 2maingocttNo ratings yet

- Igcse: Definitions & Concepts of ElectricityDocument4 pagesIgcse: Definitions & Concepts of ElectricityMusdq ChowdhuryNo ratings yet

- Organisation Structure of Ulccs: Director in ChargeDocument1 pageOrganisation Structure of Ulccs: Director in ChargeMohamed RiyasNo ratings yet

Final Test Fin533 January 2024

Final Test Fin533 January 2024

Uploaded by

2023607226Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Test Fin533 January 2024

Final Test Fin533 January 2024

Uploaded by

2023607226Copyright:

Available Formats

CONFIDENTIAL 1 BA/JAN 2024/ FIN533

FACULTY OF BUSINESS AND MANAGEMENT

FINAL TEST

COURSE : PERSONAL FINANCIAL PLANNING

COURSE CODE : FIN533

FINAL TEST : JANUARY 2024

TIME : 2 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of five (5) questions. Answer ALL questions.

2. This question paper consists of an appendix on tax reliefs and tax schedule.

3. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This final test consists of 13 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 BA/JAN 2024/ FIN533

QUESTION 1

Mr. Ammar has worked in the oil and gas industry as a chemical engineer for almost twenty

years. He lives with his wife and three children in a bungalow that he bought for RM 600,000

ten years ago. It is worth RM 900,000 today. He took a mortgage from MBB bank for twenty-

five years to buy the house and pays RM 3,800 monthly. The outstanding balance of the

mortgage is RM 700,000. In January 2023, he bought a brand-new Tesla and paid a down

payment of twenty percent from his savings account and the balance is financed with a hire

purchase from Affin Bank. The monthly installments for the car are RM 1,500.

Mr. Ammar’s gross monthly salary is RM 20,000 with EPF deductions of 11% and the

employer’s contribution of 12%. His monthly tax deduction is RM 2,000.

Below is the financial information for Mr. Ammar for the year ending December 2023.

Savings account - RHB RM 10,000

Joint account with his wife - BIMB RM 8,000

ASB (Dec 2023) RM 200,000

ASB dividend RM 16,000

EPF balance (Dec 2023) RM 450,000

AIA whole life policy monthly premium RM 400

Tabung Haji dividend RM 2,000

AIA cash value RM 8,000

Prudential BSN Warisan (Hibah) monthly premium RM 350

Credit card installments monthly RM 1,000

Credit card balance RM 6,000

Groceries monthly RM 1,000

Yearly home and car maintenance RM 10,000

Miscellaneous expenses monthly RM 400

Travel and vacation yearly RM 10,000

Wife and children's allowances monthly RM 2,000

Parents allowances monthly RM 1,000

Part time maid monthly RM 500

Zakat monthly RM 1,000

Tabung Haji (Dec 2023) RM 50,000

Tesla current market value RM 180,000

Purchase iPhone 15 pro max in January RM 6,000

iPhone current value RM 5,000

Volkswagen Passat (fully paid) market value RM 40,000

Tag Hauer watch RM 6,000

Private Retirement Scheme RM 50,000

Public Mutual Unit Trust RM 100,000

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 BA/JAN 2024/ FIN533

Tesla loan balance RM 230,000

Atome (Buy now pay later) Due RM 4,000

a) Using the above information construct a statement of financial position as of 31st

December 2023 for Mr. Ammar.

(10 marks)

b) Using the information provided, construct a cash flow statement for the financial year

ending 31st. December 2023 for Mr. Ammar.

(10 marks)

c) Calculate and comment on the following ratios for Mr. Ammar:

i) Current ratio

ii) Liquid asset to take home pay

iii) Debt ratio

iv) Debt service coverage ratio

(10 marks)

d) Analyze the financial situation for Mr. Ammar in 2023:

i) Calculate and comment on Mr. Ammar savings rate in 2023.

ii) Comments on Mr. Ammar’s net worth and his cash flow situation.

iii) List four actions that can be taken by Mr. Ammar to improve his financial well-

being.

(10 marks)

QUESTION 2

Mr. Agustine is a senior engineer at Sime Darby Corporation. He earns RM22,750 per month.

Mr. Agustine owns 2 houses for rental purposes, one in Machang and the other one in

Ampang. Rental income per month is RM2,000 for each house. The rental expenses are

RM1,350 per annum for both houses.

Her wife, Puan Wahida is an accountant in Citibank Berhad. Her gross income is RM8,500

per month. Puan Wahida has been requested by her manager to work part-time every

weekend and she will be paid RM4,000 per month. Puan Wahida agreed to start in April 2022.

Both pay 11% of their salary to EPF. The monthly tax deductions for Puan Wahida and Mr.

Agustine are RM550 and RM1,500 respectively.

Their first child, Ali is currently studying Pharmacy in England while their second child, Aminah

who has married last year to Abdullah is pursuing study in Degree of Law at Universiti Islam

Antarabangsa Malaysia (UIAM) Gombak. Their third child, Arisa is also handicapped and

studying Degree in Accounting at Universiti of Malaya (UM). Their youngest, Yusuf, 3 years

old is in pre-school “Tadika Pasti” with monthly fees of RM350.

In June 2022, the couple visited Japan and stayed 3 nights at the Shibuya Hotel, Tokyo at a

cost of RM340 per night. In addition, Mr. Agustine has treated his family to a night stay for 2

rooms at Grand Hyatt Kuala Lumpur at a cost of RM1,200 per room for a KLCC view to

celebrate his promotion to senior engineer effective August 2022.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 BA/JAN 2024/ FIN533

Below are additional details of the couple.

Items Mr. Agustine Pn. Wahida

(RM) (RM)

Dividends from Tabung Haji 20,000 10,800

Parent medical expenses 4,700 6,200

Electric wheelchair for Aminah 4,200 -

Electric wheelchair for Arisa 4,200 -

Electric wheelchair for sister 3,600 -

Takaful health insurance premium per month 800 500

Prudential life insurance per month 400 250

Interest on fixed deposit that pays 1.5% per month 1,230 780

Accounting Journals - 1,200

Annually e-magazine subscriptions

- Auto Car 150 -

- Her World - 180

- Simply Her - 300

- Luxurious Magazine - 450

Education fees for sister 1,200 600

Vaccination for Yusuf - 800

Complete medical examination for family 3,000 -

Purchased Covid-19 detection kits thru Shopee - 240

UNIFI internet subscriptions for parents per annum 1,800 1,800

Annual contribution to Private Retirement Scheme 10,000 3,200

DIGI subscriptions (self) 2,400 2,400

Purchased laptop for Ali 5,000 -

Purchased I-pad for Yusuf - 2,200

Purchased golf set 3,500 2,000

Purchased breastfeeding equipment for Yusuf - 1,200

Donation to MAKNA 5,000 1,350

Donation to Tai Kiong (unauthorized organization) 250 100

Zakat on salary per year 16,500 3,600

Zakat Fitrah 176 -

SSPN deposit per year 7,500 5,200

SSPN withdrawal per year 500 500

Entrance fee to Aquaria KLCC - 200

Entrance fee to Zoo Negara 150

Entrance fee to Zoo Melaka 180

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 BA/JAN 2024/ FIN533

a) Puan Wahida did not elect for joint assessment, and she wishes to claim child relief for

their last child. As a financial planner, you are required to calculate the tax payable by

Mr. Agustine only for the year assessment 2022.

(15 marks)

b) Explain any two (2) strategies that can be employed by Mr. Agustine to minimize his

tax payable to the government while ensuring compliance with tax regulations.

(5 marks)

QUESTION 3

a) Early September 2023, Mr. Aydan celebrated his 42-year birthday and realized that his

EPF savings balances were RM560,780 (Account 1) and RM305,660 (Account 2). He

plans to utilize his EPF accounts for both investments and withdrawals. His plans

included:

▪ To invest in AM Islamic Balanced Fund a sum of RM65,000 in September 2023

and in PMB Dana Bestari a sum of RM55,000 in January 2024 (His basic

savings requirement is RM101,000).

▪ To withdraw a sum of RM45,000 to finance his son's tuition fees in October

2023, who is pursuing his Degree in Accounting at Taylor’s University.

▪ Mr. Aydan is planning to pay for his father’s kidney surgery which is scheduled

in November 2023. The surgery will cost RM18,000.

▪ Mr. Aydan is also planning to perform his Umrah in Mecca in December 2023

and anticipated that the total cost of the Umrah package will be around

RM10,000.

▪ To make a withdrawal from his Account 2 to reduce his housing loan balance.

Mr. Aydan has approached you for advice on the following:

i. The maximum amount that Mr. Aydan can invest for both his investments.

ii. Compute the balance amount that Mr. Aydan has in his EPF account after the

intended investments.

iii. Determine the amount Mr. Aydan can withdraw from his EPF account to reduce

his housing loan balance. The housing withdrawal is his last priority.

(10 marks)

b) According to Belanjawanku by EPF, a senior couple needs RM3,090 per month for a

reasonable standard of living. Briefly discuss the importance of retirement planning.

(5 marks)

QUESTION 4

a) Briefly discuss the rationality for writing a will.

(5 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 BA/JAN 2024/ FIN533

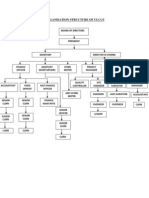

The following figure is for questions 4b and 4c

Figure 1

b) Mrs. Julia’s husband had died, leaving the deceased's inheritance worth RM4,000,000.

Besides, he had outstanding debt amounting to RM1,000,000. He left behind both his

parents, wife, and three (3) sons and two (2) daughters. Calculate the portion for each

of the beneficiaries in Ringgit Malaysia (to the nearest RM).

(6 marks)

c) Puan Normala passed away, leaving behind her mother, husband, one (1) daughter,

two (2) sons, and three (3) siblings’ sisters. Her estate inheritance such as unit trust

RM500,000, properties RM2,000,000 and EPF Savings amounted to RM500,000.

Determine the distribution amount for each beneficiary in Ringgit Malaysia (rounded to

the nearest RM).

(4 marks)

QUESTION 5

a) Discuss any two (2) strategies on how fintech can effectively help individuals manage

their personal finances effectively and efficiently.

(5 marks)

(6

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 BA/JAN 2024/ FIN533

b) Explain how open banking differs from cryptocurrency in terms of its fundamental

purposes.

(5 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 BA/JAN 2024/ FIN533

APPENDIX

Year of Assessment 2022

No Individual Relief Types Amount (RM)

1 Individual and dependent relatives 9,000

Medical treatment, special needs and carer expenses for 8,000

2

parents (Medical condition certified by medical practitioner) (Restricted)

Purchase of basic supporting equipment for disabled self, 6,000

3

spouse, child or parent (Restricted)

4 Disabled individual 6,000

Education fees (Self):

i. Other than a degree at masters or doctorate level – Course of

study in law, accounting, islamic financing, technical,

7,000

5 vocational, industrial, scientific or technology

(Restricted)

ii. Degree at masters or doctorate level – Any course of study

iii. Course of study undertaken for the purpose of upskilling or

self-enhancement (Restricted to RM2,000)

Medical expenses on:

i. Serious diseases for self, spouse or child

6 ii. Fertility treatment for self or spouse

iii. Vaccination for self, spouse and child (Restricted to RM8,000

RM1,000)

(Restricted)

7 Expenses (Restricted to RM1,000) on:

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 9 BA/JAN 2024/ FIN533

i. Complete medical examination for self, spouse or child

ii. COVID-19 detection test including purchase of self-detection

test kit for self, spouse or child

iii. Mental health examination or consultation for self, spouse or

child

Lifestyle – Expenses for the use / benefit of self, spouse or child

in respect of:

i. Purchase or subscription of books / journals / magazines /

newspapers / other similar publications (Not banned reading

materials)

ii. Purchase of personal computer, smartphone or tablet (Not for 2,500

8

business use) (Restricted)

iii. Purchase of sports equipment for sports activity defined

under the Sports Development Act 1997 and payment of gym

membership

iv. Payment of monthly bill for internet subscription (Under own

name)

Lifestyle – Additional relief for the use / benefit of self, spouse

or child in respect of:

i. Purchase of sports equipment for any sports activity as

defined under the Sports Development Act 1997 500

9a

ii. Payment of rental or entrance fee to any sports facility (Restricted)

iii. Payment of registration fee for any sports competition where

the organizer is approved and licensed by the Commissioner of

Sports under the Sports Development Act 1997

Lifestyle – Purchase of personal computer, smartphone or 2,500

9b tablet for own use / benefit or for spouse or child and not for

business use (Restricted)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 10 BA/JAN 2024/ FIN533

Purchase of breastfeeding equipment for own use for a child 1,000

10 aged 2 years and below (Deduction allowed once in every

TWO (2) years of assessment) (Restricted)

Child care fees to a registered child care center / kindergarten 3,000

11

for a child aged 6 years and below (Restricted)

Net deposit in Skim Simpanan Pendidikan Nasional (Net 8,000

12 deposit is the total deposit in 2022 MINUS total withdrawal in

2022) (Restricted)

4,000

13 Husband / wife / payment of alimony to former wife

(Restricted)

14 Disabled husband / wife 5,000

15a Each unmarried child and under the age of 18 years old 2,000

Each unmarried child of 18 years and above who is receiving

15b full-time education ("A-Level", certificate, matriculation or 2,000

preparatory courses).

Each unmarried child of 18 years and above that:

i. receiving further education in Malaysia in respect of an award

of diploma or higher (excluding matriculation/ preparatory

courses).

ii. receiving further education outside Malaysia in respect of an

15b 8,000

award of degree or its equivalent (including Master or

Doctorate).

iii. the instruction and educational establishment shall be

approved by the relevant government authority.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 11 BA/JAN 2024/ FIN533

Disabled child 6,000

15c Additional exemption of RM8,000 disable child age 18 years old

and above, not married and pursuing diplomas or above

qualification in Malaysia @ bachelor degree or above outside 8,000

Malaysia in program and in Higher Education Institute that is

accredited by related Government authorities

Life insurance and EPF

i. Pensionable public servant category who do not contribute to

EPF or any approved scheme

● Life insurance premium

7,000

16 OR

(Restricted)

ii. OTHER than 16(i) category

● Life insurance premium (Restricted to

RM3,000)

● Contribution to EPF / approved scheme

(Restricted to RM4,000)

3,000

17 Deferred Annuity and Private Retirement Scheme (PRS)

(Restricted)

3,000

18 Education and medical insurance

(Restricted)

350

19 Contribution to the Social Security Organization (SOCSO)

(Restricted)

1,000

20 Domestic tourism expenses on:

(Restricted)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 12 BA/JAN 2024/ FIN533

i. Payment of accommodation at the premises registered (Click

here) with the Commissioner of Tourism under the Tourism

Industry Act 1992

ii. Payment of entrance fee to a tourist attraction

iii. Purchase of domestic tour package through a licensed travel

agent registered with the Commissioner of Tourism under the

Tourism

iv. Industry Act 1992

Expenses on charging facilities for Electric Vehicle (Not for 2,500

21

business use) (Restricted)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 13 BA/JAN 2024/ FIN533

Assessment Year 2022

Category Chargeable Income Calculations (RM) Rate Tax(RM)

%

A 0 - 5,000 On the First 5,000 0 0

B 5,001 - 20,000 On the First 5,000 1 0

Next 15,000 150

C 20,001 - 35,000 On the First 20,000 3 150

Next 15,000 450

D 35,001 - 50,000 On the First 35,000 8 600

Next 15,000 1,200

E 50,001 - 70,000 On the First 50,000 13 1,800

Next 20,000 2,600

F 70,001 - 100,000 On the First 70,000 21 4,400

Next 30,000 6,300

G 100,001 - 250,000 On the First 100,000 24 10,700

Next 150,000 36,000

H 250,001 - 400,000 On the First 250,000 24.5 46,700

Next 150,000 36,750

I 400,001 - 600,000 On the First 400,000 25 83,450

Next 200,000 50,000

J 600,001 - 1,000,000 On the First 600,000 26 133,450

Next 400,000 104,000

K 1,000,001 - 2,000,000 On the First 1,000,000 28 237,450

Next 1,000,000 280,000

L Exceeding 2,000,000 On the First 2,000,000 30 517,450

Next ringgit ………

END OF APPENDIX

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Maf651 Seminar 2 ReportDocument13 pagesMaf651 Seminar 2 Report2022908185No ratings yet

- IKEA Case StudyDocument12 pagesIKEA Case StudyAmrit Prasad0% (1)

- Rich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o oDocument11 pagesRich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o odchandra15100% (2)

- Final Report of Sta116Document25 pagesFinal Report of Sta116Nurul Farah Syuhada Binti ZaidiNo ratings yet

- Examiners' Report 2014: LA3003 Land Law - Zone A Specific Comments On QuestionsDocument15 pagesExaminers' Report 2014: LA3003 Land Law - Zone A Specific Comments On QuestionsAnannya GhoshNo ratings yet

- Exercise 3 Character and Number FunctionDocument7 pagesExercise 3 Character and Number FunctionFaqihah SyazwaniNo ratings yet

- 7 Day Reboot CookbookDocument51 pages7 Day Reboot CookbookJesus Murguía100% (1)

- Configuration MOP Aircel ICRDocument7 pagesConfiguration MOP Aircel ICRKaran ParmarNo ratings yet

- Nur Ainina Najwa BT Zamzuri - Test 2Document12 pagesNur Ainina Najwa BT Zamzuri - Test 2harley quinnnNo ratings yet

- DQS259 - Assignment 1Document21 pagesDQS259 - Assignment 1Ahmad NaufalNo ratings yet

- Financial Management (FIN401) : Capital BudgetingDocument34 pagesFinancial Management (FIN401) : Capital BudgetingNavid GodilNo ratings yet

- 4A - GROUP 3 - KEDUA by Waks ShakeDocument38 pages4A - GROUP 3 - KEDUA by Waks ShakeWani che joNo ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- 3B Group2 Case StudyDocument8 pages3B Group2 Case Studynatasya hanimNo ratings yet

- Hours of Work - AnswerDocument5 pagesHours of Work - AnswerAida TuahNo ratings yet

- Cit452 Visual Analysis Nur Aliza Akasha 2022964141Document16 pagesCit452 Visual Analysis Nur Aliza Akasha 2022964141Arif FitriNo ratings yet

- Analysis of Hong Leong BankDocument9 pagesAnalysis of Hong Leong BankThai CelineNo ratings yet

- Practical Report C2 Adm665 - Athirah 2021120107Document11 pagesPractical Report C2 Adm665 - Athirah 2021120107Liyana AzizNo ratings yet

- CSC583 Artificial Intelligence Algorithms Group Assignment (30%)Document3 pagesCSC583 Artificial Intelligence Algorithms Group Assignment (30%)harith danishNo ratings yet

- MKT539 - Intan Khairunnisa - Individual AssignmentDocument17 pagesMKT539 - Intan Khairunnisa - Individual AssignmentIntan KhairunnisaNo ratings yet

- Part A: AIS615 Test 1Document6 pagesPart A: AIS615 Test 1fareen faridNo ratings yet

- ASM510 - Accss - Assignment 1 - TASNEEM MAISARA&NUR IZZATYDocument14 pagesASM510 - Accss - Assignment 1 - TASNEEM MAISARA&NUR IZZATYZaty RosmiNo ratings yet

- Field Report Pac671 - Nur AzreenDocument16 pagesField Report Pac671 - Nur Azreen2021117961No ratings yet

- Reflective Paper MGT430Document5 pagesReflective Paper MGT430AmmarNo ratings yet

- Lab Assignment 1 Ucs551Document23 pagesLab Assignment 1 Ucs551izwanNo ratings yet

- Lab Report Agr521 Group 4Document26 pagesLab Report Agr521 Group 4nt2hwj7tphNo ratings yet

- Watt Gearboxes-CatalogueDocument18 pagesWatt Gearboxes-CataloguecakhokheNo ratings yet

- ITT470 Project Report - Car Security & MonitoringDocument11 pagesITT470 Project Report - Car Security & Monitoring2022491196100% (1)

- BMS533 Practical Lab Report (Group 6)Document37 pagesBMS533 Practical Lab Report (Group 6)YUSNURDALILA DALINo ratings yet

- CSC577 (Test2) - 20222 20220620Document3 pagesCSC577 (Test2) - 20222 20220620yayanariff96No ratings yet

- Analisis Misi Pengurusan StrategikDocument4 pagesAnalisis Misi Pengurusan StrategikAienYien LengLeng YengYeng PinkyMeNo ratings yet

- Audit Risk NotesDocument14 pagesAudit Risk NotesRana NadeemNo ratings yet

- LAW309 Q5AM110A (Gloria Sylna Anak Sylvester 2019658372)Document10 pagesLAW309 Q5AM110A (Gloria Sylna Anak Sylvester 2019658372)LARRY JONNA LASSY THERENCENo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- Fin533 Group AssignmentDocument23 pagesFin533 Group AssignmentAzwin YusoffNo ratings yet

- (4.0) BSR552 - TIMBER FRAME SYSTEM (GP 4) - 4A FinalizedDocument61 pages(4.0) BSR552 - TIMBER FRAME SYSTEM (GP 4) - 4A FinalizedMuhammad RidzuanNo ratings yet

- Individual Assignment Ims506Document12 pagesIndividual Assignment Ims5062022861828No ratings yet

- Solid and Semi-Solid Media: Discussion: Transfer Culture InoculationDocument2 pagesSolid and Semi-Solid Media: Discussion: Transfer Culture InoculationLeena MuniandyNo ratings yet

- Mat530 - Mini Project - Group 2Document25 pagesMat530 - Mini Project - Group 2NUR DINI HUDANo ratings yet

- Jan22 QQ PDFDocument5 pagesJan22 QQ PDFSYAZWINA SUHAILINo ratings yet

- Jobsheet Unit 7Document8 pagesJobsheet Unit 7Na'im FauzanNo ratings yet

- Group Assign 1 - Draft Acc407Document4 pagesGroup Assign 1 - Draft Acc407Syed IbrahimNo ratings yet

- Management 111204015409 Phpapp01Document12 pagesManagement 111204015409 Phpapp01syidaluvanimeNo ratings yet

- Solution Aud589 Feb 2021Document7 pagesSolution Aud589 Feb 2021RABIATULNAZIHAH NAZRINo ratings yet

- MGT400 Test - July 2022 NATASHA NABILA M1 2020459196Document16 pagesMGT400 Test - July 2022 NATASHA NABILA M1 2020459196natashabasryNo ratings yet

- Lab 4 FST 202Document12 pagesLab 4 FST 202NURUL BALQIS DZULKIFLINo ratings yet

- Group Project Sta589Document16 pagesGroup Project Sta589Batrisyia NorahimNo ratings yet

- DQS 251 Assignment 2Document54 pagesDQS 251 Assignment 2izzatul haniNo ratings yet

- Sta104 Try 2 - 230615 - 235749Document5 pagesSta104 Try 2 - 230615 - 235749Siti Hajar KhalidahNo ratings yet

- Muhammad Khairul Akmal Bin Mazlan-Group Project Proposal CSC305Document3 pagesMuhammad Khairul Akmal Bin Mazlan-Group Project Proposal CSC305Muhammad Khairul Akmal Bin Mazlan100% (1)

- Jabatan Pendaftaran Negara & Ors v. A Child & Ors (Majlis Agama Islam Negeri Johor, Intervener) (2020) 2 MLJ 277 (Federal Court)Document5 pagesJabatan Pendaftaran Negara & Ors v. A Child & Ors (Majlis Agama Islam Negeri Johor, Intervener) (2020) 2 MLJ 277 (Federal Court)HAIFA ALISYA ROSMINNo ratings yet

- Group Project Far670 7e VS MynewsDocument33 pagesGroup Project Far670 7e VS MynewsNurul Nadia MuhamadNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Swot Analysis On The Current Scenarios of Malaysian Public ServiceDocument12 pagesSwot Analysis On The Current Scenarios of Malaysian Public ServicePreety Selvam100% (1)

- (6 July Updated) Project Proposal Ads 512 - Group 5 - Namaf8aDocument21 pages(6 July Updated) Project Proposal Ads 512 - Group 5 - Namaf8asyafiqahmikaNo ratings yet

- FIVERS (REPORT - Case 1 SuperMart)Document20 pagesFIVERS (REPORT - Case 1 SuperMart)Furqan Anwar0% (1)

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- HRM648 Case Study Group AssignmentDocument9 pagesHRM648 Case Study Group Assignment2022753001No ratings yet

- Individual Assignment: Visualization 1Document5 pagesIndividual Assignment: Visualization 1Muhd FakhrullahNo ratings yet

- Process StrategyDocument2 pagesProcess StrategyNUR AINAA BALQIS BINTI MOHMAD RUDUANNo ratings yet

- Laboratory3-ITT557-2020878252-SITI FARHANADocument16 pagesLaboratory3-ITT557-2020878252-SITI FARHANAAnna SasakiNo ratings yet

- Q1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsDocument17 pagesQ1: Jan 2018: Deferred Tax Liabilities Deferred Tax AssetsCliNo ratings yet

- Experiment 6 Organic Chemistry ResultDocument4 pagesExperiment 6 Organic Chemistry ResultFariza ZaidanNo ratings yet

- Family's Financial PlanningDocument25 pagesFamily's Financial PlanningsyafiqahanidaNo ratings yet

- Chapter 9 - FormulaDocument2 pagesChapter 9 - Formula2023607226No ratings yet

- Nur Hanis Sofia Binti Jainal (Relective Essay)Document5 pagesNur Hanis Sofia Binti Jainal (Relective Essay)2023607226No ratings yet

- Fin420 AssignmentDocument2 pagesFin420 Assignment2023607226No ratings yet

- Trend Analysis BONIADocument4 pagesTrend Analysis BONIA2023607226No ratings yet

- AadhyaKaul RESUME GDocument1 pageAadhyaKaul RESUME GJalaj GuptaNo ratings yet

- BA 501-Text AnalyticsDocument2 pagesBA 501-Text AnalyticsTanisha AgarwalNo ratings yet

- School BusDocument156 pagesSchool Bussowmeya veeraraghavanNo ratings yet

- Maule M7 ChecklistDocument2 pagesMaule M7 ChecklistRameez33No ratings yet

- Taxpayers' Tax Compliance Behavior - Business Profit Taxpayers' of Addis Ababa City AdministrationDocument126 pagesTaxpayers' Tax Compliance Behavior - Business Profit Taxpayers' of Addis Ababa City AdministrationGELETAW TSEGAW80% (5)

- Mil STD 1587e PDFDocument43 pagesMil STD 1587e PDFRaj Rajesh100% (1)

- Gay-Lussac's Law Problems and SolutionsDocument1 pageGay-Lussac's Law Problems and SolutionsBasic PhysicsNo ratings yet

- How Do I Manually Boot HP-UX On Integrity (Itanium) Based SystemsDocument6 pagesHow Do I Manually Boot HP-UX On Integrity (Itanium) Based Systemsnilu772008No ratings yet

- PNS BAFS 184.2016. GAHP Chicken Broilers LayersDocument22 pagesPNS BAFS 184.2016. GAHP Chicken Broilers LayersFelix Albit Ogabang IiiNo ratings yet

- ApduDocument1 pageApduMilen MihailovNo ratings yet

- Threat Hunting Through Email Headers - SQRRLDocument16 pagesThreat Hunting Through Email Headers - SQRRLSyeda Ashifa Ashrafi PapiaNo ratings yet

- Especificaciones Técnicas Blower 2RB510 7av35z PDFDocument5 pagesEspecificaciones Técnicas Blower 2RB510 7av35z PDFSebas BuitragoNo ratings yet

- Applied Pharmacology For The Dental Hygienist 8th Edition Haveles Test BankDocument35 pagesApplied Pharmacology For The Dental Hygienist 8th Edition Haveles Test Bankatop.remiped25zad100% (29)

- Foleybelsaw Catalog Spring 2011Document64 pagesFoleybelsaw Catalog Spring 2011James GarrettNo ratings yet

- Pharmacy Informatics in Multihospital Health Systems: Opportunities and ChallengesDocument8 pagesPharmacy Informatics in Multihospital Health Systems: Opportunities and ChallengesPriscila Navarro MedinaNo ratings yet

- Bernoulli's Principle: Ron Niño Q. AbieraDocument14 pagesBernoulli's Principle: Ron Niño Q. AbieraMaria Chela Shophia Realo MandarioNo ratings yet

- Law On Sales Course OutlineDocument10 pagesLaw On Sales Course Outlinekikhay11No ratings yet

- Neurotrauma & Critical CareDocument10 pagesNeurotrauma & Critical CareyohanesNo ratings yet

- Cy17b PH Technical Trial System Protocols v5Document16 pagesCy17b PH Technical Trial System Protocols v5Glenn Cabance LelinaNo ratings yet

- Outline of ISF2024Document10 pagesOutline of ISF2024Matias JavierNo ratings yet

- Personal Development PlanDocument2 pagesPersonal Development PlanOliver ConnollyNo ratings yet

- Discovery JT FoxxDocument10 pagesDiscovery JT Foxxrifishman1No ratings yet

- Usando MessageBox C BuilderDocument3 pagesUsando MessageBox C BuilderFernando Luiz Do AmaralNo ratings yet

- Test 2Document2 pagesTest 2maingocttNo ratings yet

- Igcse: Definitions & Concepts of ElectricityDocument4 pagesIgcse: Definitions & Concepts of ElectricityMusdq ChowdhuryNo ratings yet

- Organisation Structure of Ulccs: Director in ChargeDocument1 pageOrganisation Structure of Ulccs: Director in ChargeMohamed RiyasNo ratings yet