Professional Documents

Culture Documents

Aviva New Group Term Life - R - Taikisha Engineering

Aviva New Group Term Life - R - Taikisha Engineering

Uploaded by

ARKAJIT DEY-DMOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva New Group Term Life - R - Taikisha Engineering

Aviva New Group Term Life - R - Taikisha Engineering

Uploaded by

ARKAJIT DEY-DMCopyright:

Available Formats

Aviva Life Insurance Company India Limited

401-A, 4th Floor, Block A, DLF Cyber Park

Sector -20, Gurgaon - 122016, Haryana

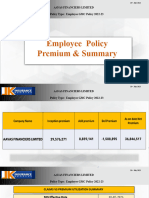

Premium Quotation

Proposed Plan Name: Aviva New Group Term Life (122N141V01) Quotation Date: 1-Feb-23

Client Name (Master Policy Holder): Taikisha Engineering India Private Limited Quote Valid Up To: 1-Mar-23

Plan Option OYRGTA : Option A Participation Mode: Compulsory

Nature of Business: Engineering Participation Rate NA

No. of Eligible Lives 555 Type of Group: Employer Employee Scheme

Weigthed Age of the Group: 41.33 Years Quotation for: (NB/RB) New Business

Commission As per IRDA Regulations Quotation Number: NB_AGTL003696_1

Benefit Summary

Total Premium Amount

Insurance Benefits Name Benefit Structure Total Sum Assured (Rs.) Unit Rate per 1000 Sum Assured

(Rs.)

Basic Life Insurance Cover (BLC) 5 times of annual CTC upto 1.5cr 1,830,531,960 2,604,847 1.423

**Total Premium Excluding Goods and Services Tax 2,604,847

Age limitations for this group Minimum Age allowed 22 last birthday Maximum Age allowed 58 last birthday

Free Cover Limit

Number of members whose sum assured

*Free Cover Limit

is exceeding FCL

Basic Life Insurance Cover (BLC) 15,000,000 0

* Free Cover Limit (FCL) is applicable only till age of 65 years last birthday and beyond this age complete underwriting will be applicable as per standard rules.

* Covid-19 related T&C's needs to be followed for all members.

* For all the members with sum assured more than FCL, complete individual underwriting will be applicable as per standard rules.

* Medical cost ( If any ) will be borne by the Master policy Holder.

* SA for members above age 75 last birthday will be limited to 5 lakhs only.

General Terms and Condition

1 ** Taxes including but not limited to Goods and Services Tax,Cess as applicable shall also be levied as notified by the goverment from time to time. Tax laws are subject to change.

2 These premium rates are based on the year wise death claim experience shared with Aviva.

3 The premium amount calculated above is for annual mode, for other than annual frequency, installment premium shall be calculated as given below:

Half yearly premium Annual premium * 0.5108

Quarterly Premium Annual premium * 0.2591

Monthly Premium Annual premium * 0.0871

4 The Mater Policy Holder/Member will not be able to change plan option once the policy get booked.

5 The sum assured should not exceed 10 times annual CTC of the employee.

6 Commission/Remuneration (if any) shall be payable as prescribed under approved File & Use of the plan.

7 The quote is valid for only full time employees of the company.

8 All the Employees should be on payroll of Indian organization irrespective of the currency of remuneration paid to them.

9 Currency of amount payable and receivable should be in Indian rupees and Master policyholder should be an Indian entity.

In case the group, consists of employees with foreign nationality, following shall be the eligibility criteria for such members:

(i) Employees should be on the roll of Master Policyholder.

10 (ii) Coverage shall be decided depending on the location (can be India, Home Country or Some other Country) at which the employee is posted.

(iii) In case the Employee is working outside India, Group Overseas Residency Underwriting Guidelines will be applicable for such member basis which the employee can be either covered at

standard rate or rate up or may be declined for coverage.

Employee(s) based or expected to be based at an overseas location for a period more than 182 days in a policy year (total stay in a year- includes travelling for office purpose/holidays) will be granted coverage on

11 the basis of Group Overseas Residency Underwriting Guidelines. The employee can either be covered at standard rate or rate up or may be declined. Master Policyholder will have to inform Aviva about such

employees from time to time. In addition to this, the Master policy holder will also have to inform Aviva about any Expats members if any in the policy from time to time.

12 Under this policy member are covered for any kind of death: either Natural, Accidental or due to illness.

The quote is based on the member data including the claims details & relevant risk factors i.e. salary, age, industry, occupation, geographic location etc, provided by the proposer/master policyholder. The quote

13

is valid only if the information provided by the proposer/master policyholder is “complete and correct”.

14 The premium rates mentioned above may vary if there is change in any material information provided to us.

15 The quote is valid for only those members who satisfy the "Active At Work" Clause.

All members shall be allowed to opt for coverage within 30 days of joining MPH / becoming eligible for this group term insurance scheme. No member shall be allowed coverage at a later date during the policy

16 year.

You might also like

- Insurance ProjectDocument99 pagesInsurance Projectjitendra jaushik83% (95)

- A Study of The Risk and Return of Alternative Investment Opportunities Available To High Net Worth Individuals in IndiaDocument56 pagesA Study of The Risk and Return of Alternative Investment Opportunities Available To High Net Worth Individuals in Indiasohailsam100% (1)

- 2 5l:10pay (Differemnt)Document3 pages2 5l:10pay (Differemnt)sun16darNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001420020721Document6 pagesE SymbiosysFiles Generated OutputSIPDF 10200001420020721Sankalp SrivastavaNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- BIPDF243912133949Document6 pagesBIPDF243912133949Mcnet WideNo ratings yet

- Illustration (13)Document2 pagesIllustration (13)gdrivelink07No ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- Illustration Qc0n0t6y4j58fDocument3 pagesIllustration Qc0n0t6y4j58fNavneet PandeyNo ratings yet

- 2 5l:7pay (Deferment)Document3 pages2 5l:7pay (Deferment)sun16darNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument7 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsMcnet WideNo ratings yet

- Illustration (17) - 2023-12-16T143445.154Document2 pagesIllustration (17) - 2023-12-16T143445.154shailendra.goswamiNo ratings yet

- IllustrationDocument2 pagesIllustrationapallover72No ratings yet

- IllustrationDocument2 pagesIllustrationdeepakzynNo ratings yet

- Illustration - 2024-01-04T213945.722Document2 pagesIllustration - 2024-01-04T213945.722Rishavdar ClassNo ratings yet

- Illustration - 2023-11-04T171018.610Document2 pagesIllustration - 2023-11-04T171018.610bakavoNo ratings yet

- Illustration 5Document2 pagesIllustration 5Phanindra GaddeNo ratings yet

- Exide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022Document3 pagesExide Life Assured Gain Plus-Wed Jun 29 10 - 00 - 09 IST 2022lakshmee262No ratings yet

- IllustrationDocument4 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- Illustration - 2022-08-26T182737.117Document2 pagesIllustration - 2022-08-26T182737.117Soumen BeraNo ratings yet

- Illustration Qc5w6uxpu25w3Document2 pagesIllustration Qc5w6uxpu25w3Sakshi RaghuvanshiNo ratings yet

- HDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Document3 pagesHDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Teja Reddy Telugu YuvathaNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- 7 Month Waiver of PremiumDocument4 pages7 Month Waiver of PremiumnikhilraoNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlusVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- IllustrationDocument2 pagesIllustrationdeepakzynNo ratings yet

- Illustration Qbsb7jcemgoauDocument2 pagesIllustration Qbsb7jcemgoauSharma RaviNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Vinoth - HDFC ParDocument3 pagesVinoth - HDFC ParVinodh VijayakumarNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- Benefit Illustration For HDFC Life Super Income PlanDocument2 pagesBenefit Illustration For HDFC Life Super Income PlanVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- BenefitIllustrations 1Document2 pagesBenefitIllustrations 1vonamal985No ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument7 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsaman khatriNo ratings yet

- Dearabc, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by ChoosingDocument5 pagesDearabc, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by Choosingjbbheda789No ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakNo ratings yet

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsDocument7 pagesProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsaman khatriNo ratings yet

- IllustrationDocument2 pagesIllustrationVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationNeerja M GuhathakurtaNo ratings yet

- Sanchay Par Advantage - Deferred IncomeDocument3 pagesSanchay Par Advantage - Deferred Incomesushant KumarNo ratings yet

- 50k - Sanchay Par AdvantageDocument3 pages50k - Sanchay Par Advantagevamsi krishna bayyarapuNo ratings yet

- GTL Product PPT FY25Document30 pagesGTL Product PPT FY25ranayati21No ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- Illustration - 2023-07-12T192907.748Document2 pagesIllustration - 2023-07-12T192907.748abinashsekharmishra1No ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- HDFC PolicyDocument2 pagesHDFC Policyestrade1112No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Bajaj - Group Hospital Cash PolicyDocument16 pagesBajaj - Group Hospital Cash PolicySWETUNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- JK Ins BrokersDocument25 pagesJK Ins BrokersARKAJIT DEY-DMNo ratings yet

- JK Insurance BrokerDocument23 pagesJK Insurance BrokerARKAJIT DEY-DMNo ratings yet

- Policy Analysis & Value AddsDocument16 pagesPolicy Analysis & Value AddsARKAJIT DEY-DMNo ratings yet

- Slic UlipDocument12 pagesSlic UlipARKAJIT DEY-DMNo ratings yet

- 1581507360officer Mediclaim 2020 - Approved Tender DocumentDocument5 pages1581507360officer Mediclaim 2020 - Approved Tender DocumentARKAJIT DEY-DMNo ratings yet

- JK Insurance Broker - Copy-CompressedDocument21 pagesJK Insurance Broker - Copy-CompressedARKAJIT DEY-DMNo ratings yet

- ClaimSummary SampleDocument2 pagesClaimSummary SampleARKAJIT DEY-DMNo ratings yet

- New Ggs Policy Bond - 103011257 - ENVIRODocument10 pagesNew Ggs Policy Bond - 103011257 - ENVIROARKAJIT DEY-DMNo ratings yet

- Impact of Revised Wage Code On Gratuity LiabilitiesDocument3 pagesImpact of Revised Wage Code On Gratuity LiabilitiesARKAJIT DEY-DMNo ratings yet

- Group Life Tender Document 2018 PDFDocument44 pagesGroup Life Tender Document 2018 PDFARKAJIT DEY-DMNo ratings yet

- MusiCares: An Industry Imperative by Michael GreeneDocument3 pagesMusiCares: An Industry Imperative by Michael GreeneMichael GreeneNo ratings yet

- Plan ComparisonDocument2 pagesPlan ComparisonSahil JindalNo ratings yet

- Active Health Enhnace LeaflateDocument2 pagesActive Health Enhnace LeaflateViral Tube IndiaNo ratings yet

- A Comparative Study: Lic and Icici PrudentialDocument56 pagesA Comparative Study: Lic and Icici PrudentialKristoff FinchNo ratings yet

- Submission Guide and Technical Requirements 09122020Document7 pagesSubmission Guide and Technical Requirements 09122020David WangNo ratings yet

- Insurance Case StudyDocument2 pagesInsurance Case Studyharshnika100% (1)

- AYYUB KHAN VisionEndPlus 17.09.2019 17.30.29 PDFDocument5 pagesAYYUB KHAN VisionEndPlus 17.09.2019 17.30.29 PDFgoluNo ratings yet

- Software Criteria ChecklistDocument123 pagesSoftware Criteria ChecklistBruno BossoNo ratings yet

- 48th GST Council Meeting RecommendationsDocument17 pages48th GST Council Meeting RecommendationsRaviteja SirivelaNo ratings yet

- Presentation On LIC of India: By:-Naveen AhlawatDocument19 pagesPresentation On LIC of India: By:-Naveen AhlawatAnkur RaoNo ratings yet

- JLK 1975Document8 pagesJLK 1975fdila_5No ratings yet

- ACME Shoe Rubber & Plastic Corp v. CADocument1 pageACME Shoe Rubber & Plastic Corp v. CAMan2x SalomonNo ratings yet

- Aflac Insurcance Comapny's Marketing DescionsDocument2 pagesAflac Insurcance Comapny's Marketing DescionsIrfee0% (1)

- IIFL Padmavathi Final Project VenkateshDocument75 pagesIIFL Padmavathi Final Project VenkateshMatam Matam ChandraNo ratings yet

- Ent 121 - 97-102Document6 pagesEnt 121 - 97-102Joseph OndariNo ratings yet

- Road Vehicle Modification HandbookDocument23 pagesRoad Vehicle Modification Handbookmagicmuffins.69erNo ratings yet

- Contract TerminologyDocument20 pagesContract TerminologyMital DamaniNo ratings yet

- Silvio Di Prampero, Trading As Keystone Auto Company v. Fidelity & Casualty Company of New York, 286 F.2d 367, 3rd Cir. (1961)Document5 pagesSilvio Di Prampero, Trading As Keystone Auto Company v. Fidelity & Casualty Company of New York, 286 F.2d 367, 3rd Cir. (1961)Scribd Government DocsNo ratings yet

- The Economics of Medical MalpracticeDocument305 pagesThe Economics of Medical MalpracticeJimena DelgadoNo ratings yet

- Chapter Three-Rule vs. Counter-RuleDocument11 pagesChapter Three-Rule vs. Counter-RuleAsad KaramallyNo ratings yet

- How To Calculate Warehouse Storage CostsDocument2 pagesHow To Calculate Warehouse Storage CostsRIC NOYANo ratings yet

- Introduction To Ingen: The StructureDocument4 pagesIntroduction To Ingen: The StructureMergus MerganserNo ratings yet

- Bancassurance Model and Its Impact On Financial Inclusion 26Document1 pageBancassurance Model and Its Impact On Financial Inclusion 26Preetam ParabNo ratings yet

- 3 Phil-Nippon Kyoei Corp. vs. GudelosaoDocument8 pages3 Phil-Nippon Kyoei Corp. vs. GudelosaoKris OrenseNo ratings yet

- Arguement EssayDocument4 pagesArguement Essayapi-575360305No ratings yet

- TOR Custom Clearance in Ethiopia SCIDocument12 pagesTOR Custom Clearance in Ethiopia SCIDaniel GemechuNo ratings yet

- Authentic and ORIGINAL Documents of 1987 RESTORED ON DECEMBER 15, 2016Document646 pagesAuthentic and ORIGINAL Documents of 1987 RESTORED ON DECEMBER 15, 2016Stan J. CaterboneNo ratings yet

- HBFR Ara 2018 enDocument277 pagesHBFR Ara 2018 enFerdee FerdNo ratings yet