Professional Documents

Culture Documents

Law of Property

Law of Property

Uploaded by

raju2007kcea0 ratings0% found this document useful (0 votes)

6 views6 pagesOriginal Title

Law of property

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views6 pagesLaw of Property

Law of Property

Uploaded by

raju2007kceaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

The term “Lease” is widely used in various economic transactions related to

the transfer of property. It is a contractual agreement made for transfer of

an asset from one person to another. It is used for the transfer of the asset

in both commercial and non-commercial or personal fields. Lease under

Indian Laws is defined under Section 105 of the Transfer of Property Act,

1882. A person can enjoy another person’s property for a specific period of

time as per the contractual agreement made by them.

What is Lease?

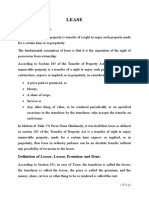

Section 105 of the Transfer of Property Act– defined Lease as —

“A lease of immovable property is a transfer of a right to enjoy such

property, made for a certain time, express or implied, or in perpetuity, in

consideration of a price paid or promised, or of money, a share of crops,

service or any other thing of value, to be rendered periodically or on

specified occasions to the transferor by the transferee, who accepts the

transfer on such terms.

Lessor, lessee, premium, and rent defined as—

The transferor is called the lessor, the transferee is called the lessee, the

price is called the premium, and the money, share, service or other thing to

be so rendered is called the rent.

According to the definition mentioned above, a Lease is a contractual

agreement made for the transfer of the right of immovable property from

one person to another for a specified duration of time in exchange for

money, share of crops or any other services. The rights transferred in the

form of a lease can be expressly or impliedly given to the other person who

seeks those rights. A person can get a lease by paying the total sum of

money as a premium or in installments as rent for the immovable property.

Lessor and Lessee

In the contract of Lease, the person who is the transferor of the property is

called the Lessor and the person who is the transferee is called the Lessee.

Both Lessor and Lessee can come into the contract of lease for the transfer

of right of the immovable property. The person acquiring the property in the

form of the lease can work on the property and share the profit gained by it

to the true owner of the property.

Lease is a contractual relationship between the Lessor and the Lessee

therefore, the essential elements of a valid contract are necessary to be

fulfilled and the parties should be competent to the contract according to the

Indian Contract Act, 1872.

Rights and liabilities of lessor and lessee are given in Chapter 5 Transfer of

Property Act, 1882.

Duration of lease

Lease being a contractual agreement specifies the date and time of the

contract and the duration in which the contract is valid. But there are certain

circumstances that do not describe the duration of the lease and are neither

mentioned in any of the local customs and usages. In such circumstances

Section 106 of the Transfer of Property Act, 1882 is applicable which

explains certain situations and prescribes the duration of the lease.

Section 106 describes the duration of lease of two conditions including

Agriculture or Manufacturing purpose or other purposes.

Agriculture Or Manufacturing purpose

According to Section 106, if a lease agreement is made for agriculture and

manufacturing purposes without specifying the duration of the contract then

it is prescribed to be for a year and notice for termination of the lease is

given in 6 months. The notice made should be written and sent by post or

personally delivered to another party and duly signed by them. The notice

made should be affixed without hiding it from the other party.

Other Purpose

If the lease agreement is made for any other transactions then the time

duration of the lease is specified to be 1 month and renewed every month if

it is not mentioned in the contract. The notice for such a lease can be given

within 15 days of the lease contract and delivered to the other party in the

same way mentioned for the agriculture or manufacturing lease purpose.

Essential features of a valid lease

There are various essential elements of a contract of lease mentioned under

the Transfer of Property Act, 1882.

1. Immovable Property – A contract of Lease can be made only for

immovable property or assets. It cannot be done for a moveable property.

The lease made will be for the working and use of the immovable property

and the Lessor and Lessee exchange the rights of the property through the

contract of lease.

2. Parties – For a Lease agreement, the existence of two or more parties is

necessary for the proper transfer of rights of the immovable property. It is a

bi-partied system and it cannot be complete in the absence of the parties,

therefore, making the contract of lease void.

3. Subject matter of lease – The subject matter or the purpose of the

lease agreement is compulsory and necessary to be mentioned in the

contract. The purpose of transfer of the right of the immovable property, the

services and profit decided, the details of the immovable property, and other

important data is required to be written in the contract of lease.

4. Duration – The duration of a lease agreement is an essential element

which specifies the commencement of the contract and how long the

services and rights will be transferred through a valid legal contract. Section

106 of the Transfer of Property Act, 1882 is referred if it is not mentioned in

the contract of lease.

5. Consideration – Lawful consideration is necessary for the fulfillment of a

contract of lease. The transfer of the rights of the immovable property is

made by giving consideration in the form of money as premium or rent,

shared profit or as share of crops and services.

6. Competency – The parties entering into a contract of lease should be

competent according to the Indian Contract Act, 1872. Both the Lessor and

the Lessee must be of sound mind, of majority age, and not subject to any

law which restricts them to be a part of a valid contract. If the transfer of

the right of property is done to a minor, then a legal guardian is necessary

to work on behalf of the minor till he or she attains a majority age.

7. Valid contract essentials – Lease is a contractual agreement made

between two parties and therefore, it must follow the essential elements of a

valid contract given under Indian Contract Act, 1872. Essential elements like

Offer, Acceptance, Consideration, Lawful Object, Intention of the Parties,

Competency, Capacity to Contract, Subject Matter, Writing and Registration

etc, are important to be followed in the Contract of Lease.

8. Express and implied transfer – The transfer of right of the immovable

property between the Lessor and the Lessee should be made expressly or

impliedly, in a written contract. And the notice of the termination of the

lease should be given according to the clause mentioned in the contract of

lease and should be duly signed and delivered among the parties.

9. Possession of Property – In the contractual agreement of lease,

transfer of the right of property is made and the parties exchange the right

of possession of the property for a certain period of time and do not

exchange the ownership of the immovable property.

Types of lease

There are different types of lease agreement for the transfer of the right of

the immovable property, these are:

1. Financial lease

This type of lease is permanent and irrevocable. The Lessor transfers the

rights of the immovable property for a long period of time and works on the

property. The Lessee takes charge of all the burdens and liabilities of the

property.

For instance, if a person assigned another person to look after his

agricultural land and grow crops and maintain it without specifying the

termination of the lease, then it is said to be a financial lease.

2. Operating lease

In this type of lease, the Lessee does not hold the burden of the property

and the lessor takes care of the property. This type of lease is for a short

period of time.

For instance, if a person transfers the property rights to another person in

the form of a lease to provide services on the immovable property for a

short period of time then it is considered an operating lease.

3. Sale and lease back leasing

In this type of lease, the lessee sells the asset to the lessor with an advance

agreement between the two of leasing the asset back to the lessee for a

fixed lease rental period. Such a lease is also known as Bipartite lease.

4. Direct lease

This is a tri-partied lease which includes :

equipment supplier,

lessor,

lessee.

5. Single investor lease

In this type of lease, the lessor has to arrange for money in order to finance

his asset by way of debt or equity. The lender cannot recover anything from

the lessee, in case the lessor defaults in payment.

6. Leveraged lease

There are three parties in this type of lease :

the lessor,

the lessee and

the financier/lender.

The lessor arranges for the equity and the financier has the responsibility to

finance the debt.

7. Domestic lease

When the lease contract is made within the country it is known as domestic

lease.

8. International lease

There are two types of International lease. :

Cross border lease

Import lease

An import lease occurs when the lessor and the lessee reside in the same

country and the equipment supplier resides in a different country. On the

contrary, when the lessor and the lessee reside in two separate countries ‘X’

and ‘Y’ then the lease is known as a Cross border lease. It doesn’t matter

where the equipment supplier resides.

Conclusion

The term lease is widely used in our day to day life for the matters relating

to transfer of immovable property. It is defined under Section 106 to Section

117, Chapter V of the Transfer of Property Act, 1888. The Lease agreement

is made similar to a valid contract mentioned under the Indian Contract Act,

1872. It is a bi-partied agreement where the parties transfer the property

rights for certain share of profit or service made on the immovable property.

It has various types and essentials mentioned under the Act.

You might also like

- Extra Space Storage Lease NJ Eff. 11-1-21Document5 pagesExtra Space Storage Lease NJ Eff. 11-1-21hutz5000100% (1)

- Classification of ObligationsDocument16 pagesClassification of ObligationsArah Jean Barba Daffon100% (2)

- Leases (TOPA)Document14 pagesLeases (TOPA)KarthikNo ratings yet

- The Transfer of Property Act 1882Document7 pagesThe Transfer of Property Act 1882harshad nickNo ratings yet

- Topa Law AssignmentDocument15 pagesTopa Law AssignmentbboydextorNo ratings yet

- 762154Document9 pages762154shreyesh sachanNo ratings yet

- LeaseDocument10 pagesLeaseHarshvardhan MelantaNo ratings yet

- Tpa ProjectDocument15 pagesTpa Projectcrcr3316No ratings yet

- TPA Assignment.. Shashwat Srivastava.. 1020171828 PDFDocument22 pagesTPA Assignment.. Shashwat Srivastava.. 1020171828 PDFKushagra SrivastavaNo ratings yet

- All Q - A Property Law LASTDocument2 pagesAll Q - A Property Law LASTsawan hastaNo ratings yet

- Property FDDocument15 pagesProperty FD20047 BHAVANDEEP SINGHNo ratings yet

- TOPA NotesDocument47 pagesTOPA NotesnkNo ratings yet

- Lease: Section 105Document14 pagesLease: Section 105Deepak PanwarNo ratings yet

- LeaseDocument7 pagesLeaseSeenu SeenuNo ratings yet

- LeaseDocument16 pagesLeaseAbir Al Mahmud KhanNo ratings yet

- Shivi, Lease Deed in India: Meaning, Contents and Registration, Legistify, (8th March, 12:01 PM)Document5 pagesShivi, Lease Deed in India: Meaning, Contents and Registration, Legistify, (8th March, 12:01 PM)Ribhav AgrawalNo ratings yet

- TPA Assignment.. Shashwat Srivastava.. 1020171828Document20 pagesTPA Assignment.. Shashwat Srivastava.. 1020171828Rahul manglaNo ratings yet

- Lease Rights of Lessee - Law NotesDocument7 pagesLease Rights of Lessee - Law NotesAbhishek tiwariNo ratings yet

- Lease of Immovable PropertyDocument5 pagesLease of Immovable PropertyCharran saNo ratings yet

- What Is A Lease DeedDocument3 pagesWhat Is A Lease DeedAdan HoodaNo ratings yet

- LeaseDocument6 pagesLeaseKhan farazNo ratings yet

- Property Law Project Avinash TiwariDocument31 pagesProperty Law Project Avinash TiwariAvinash TiwariNo ratings yet

- Lease TpaDocument5 pagesLease TpaReeya PrakashNo ratings yet

- LeaseDocument7 pagesLeasetriptisahu1196No ratings yet

- Lease - Scope Meaning Creation Rights and Liablities Determination and Holding OverDocument8 pagesLease - Scope Meaning Creation Rights and Liablities Determination and Holding OverAaayushi jainNo ratings yet

- Case Note by Ishvender SinghDocument8 pagesCase Note by Ishvender SinghvikasNo ratings yet

- What Is Lease and What Are Its Elements and Termination?: Prepared by Bindranjan Durvijay Singh, SyllbDocument11 pagesWhat Is Lease and What Are Its Elements and Termination?: Prepared by Bindranjan Durvijay Singh, SyllbRanjanSinghNo ratings yet

- LeasingDocument52 pagesLeasingShishir N VNo ratings yet

- LeaseDocument6 pagesLeases2110917107No ratings yet

- Property 6th SemDocument12 pagesProperty 6th Sem1994sameerNo ratings yet

- Formation and Termination of LeaseDocument16 pagesFormation and Termination of LeaseTabeer Yaseen70No ratings yet

- Lease and LicenseDocument9 pagesLease and Licenseejbeth01No ratings yet

- F.services Notes-3Document1 pageF.services Notes-3ravindranathNo ratings yet

- Anuj Patel, 183, LeaseDocument23 pagesAnuj Patel, 183, LeaseAnuj PatelNo ratings yet

- ASSIGNMENT 19 OvesDocument9 pagesASSIGNMENT 19 OvesfaarehaNo ratings yet

- Lease Unit 4Document1 pageLease Unit 4Shahvez RafiNo ratings yet

- Group 1the Law of LeaseDocument16 pagesGroup 1the Law of LeaseROMEO CHIJENANo ratings yet

- Financial Services: Topic:-LeasingDocument11 pagesFinancial Services: Topic:-LeasingUtkarsh RajputNo ratings yet

- Tpa 2 MSJDocument17 pagesTpa 2 MSJfdgfhNo ratings yet

- Property Law PDFDocument12 pagesProperty Law PDFAmartya Vikram SinghNo ratings yet

- LEASE AND GIFT Under TOPADocument27 pagesLEASE AND GIFT Under TOPAchickenshavedNo ratings yet

- Section 105 of The Transfer of Property ActDocument4 pagesSection 105 of The Transfer of Property ActaggarwalbhaveshNo ratings yet

- LPL4801-sg 1Document34 pagesLPL4801-sg 1Rubert ReynekeNo ratings yet

- What Is An Agreement To SellDocument3 pagesWhat Is An Agreement To SellAdan HoodaNo ratings yet

- Law of PropertyDocument10 pagesLaw of Propertyshubhankar negiNo ratings yet

- Lease (Sections 105 To 117)Document17 pagesLease (Sections 105 To 117)Nitin GoyalNo ratings yet

- Property Law Profect PrintDocument24 pagesProperty Law Profect Printsumitkumar_suman100% (1)

- LEASE (Intro To Law)Document11 pagesLEASE (Intro To Law)moonriverNo ratings yet

- LeaseDocument5 pagesLeaseselvaa kumarNo ratings yet

- TPA PointersDocument2 pagesTPA PointersfatemaNo ratings yet

- Lease: Premium, and The Money, Share, Service or Other Thing To Be So Rendered Is Called The RentDocument6 pagesLease: Premium, and The Money, Share, Service or Other Thing To Be So Rendered Is Called The RentABHIJEETNo ratings yet

- The Law of LeasesDocument17 pagesThe Law of LeasesRANDAN SADIQNo ratings yet

- Essential Elements: The Essential Elements of A Lease Are As FollowsDocument8 pagesEssential Elements: The Essential Elements of A Lease Are As FollowssssNo ratings yet

- Property Law 2 ProjectDocument16 pagesProperty Law 2 ProjectSandeep Choudhary100% (1)

- Document TitleDocument6 pagesDocument TitlefaarehaNo ratings yet

- Land LawsDocument8 pagesLand Lawsaujlaparam10No ratings yet

- Module 4 LeaseDocument34 pagesModule 4 LeaseJuhi JethaniNo ratings yet

- Definition of LeaseDocument6 pagesDefinition of LeaseMuhammad ShehzadNo ratings yet

- LeasingDocument13 pagesLeasingKrunal PrajapatiNo ratings yet

- Module 7Document5 pagesModule 7siddhant.balpande120No ratings yet

- Lease of Immovable Property: Rights and Liabilities of The LessorDocument5 pagesLease of Immovable Property: Rights and Liabilities of The LessorArunaMLNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Leave and License Agreement 10Document6 pagesLeave and License Agreement 10Prateek KumarNo ratings yet

- 6) Dona Adela V Tidcorp, G.R. No. 201931 PDFDocument22 pages6) Dona Adela V Tidcorp, G.R. No. 201931 PDFJosemariaNo ratings yet

- Negotiable Instrument Law ReviewerDocument8 pagesNegotiable Instrument Law ReviewerJerwel De PerioNo ratings yet

- Chattel MortgageDocument2 pagesChattel MortgageNowhere ManNo ratings yet

- Bba-I Business Law (unit-II) Sale of Goods Act 1930 Condition & WarrantyDocument18 pagesBba-I Business Law (unit-II) Sale of Goods Act 1930 Condition & WarrantyYash SharmaNo ratings yet

- 2011 - Klockner V AdvanceDocument16 pages2011 - Klockner V AdvanceAnnadeJesusNo ratings yet

- A. Express TermsDocument27 pagesA. Express TermscwangheichanNo ratings yet

- Contrcts IIDocument290 pagesContrcts IIShekhar Panse100% (1)

- Memorandum of Agreement Ajj TradingDocument6 pagesMemorandum of Agreement Ajj TradingHoward Untalan100% (1)

- Partnership Under The Civil Code of The Philippines Codal ProvisionsDocument17 pagesPartnership Under The Civil Code of The Philippines Codal ProvisionsKeerstine BatucanNo ratings yet

- Cristobal Vs GomezDocument3 pagesCristobal Vs GomezianmichaelvillanuevaNo ratings yet

- Insurance Syllabus With Laws RA 10607Document7 pagesInsurance Syllabus With Laws RA 10607Pring SumNo ratings yet

- Electrical Installation Contract ModelDocument2 pagesElectrical Installation Contract ModelScribdTranslationsNo ratings yet

- Agency Digest FullDocument7 pagesAgency Digest FullRein GallardoNo ratings yet

- Arbitration and ConciliationDocument3 pagesArbitration and ConciliationPuralika MohantyNo ratings yet

- Negotiable Instruments, Torts and Damages Case Digest: BPI V. CA, China Banking Corp and Phil. Clearing Housee Corp. (1992) Our BookshelfDocument1 pageNegotiable Instruments, Torts and Damages Case Digest: BPI V. CA, China Banking Corp and Phil. Clearing Housee Corp. (1992) Our BookshelfVernis VentilacionNo ratings yet

- Law On Obligations AnswerDocument10 pagesLaw On Obligations AnswerMadduma, Jeromie G.No ratings yet

- Gsis V CA DigestDocument1 pageGsis V CA DigestAbraham GuiyabNo ratings yet

- Legal Review VICARIOUS LIABILITY AN EMPLOYERS BURDEN PDFDocument3 pagesLegal Review VICARIOUS LIABILITY AN EMPLOYERS BURDEN PDFshaniahNo ratings yet

- Torres Madrid Brokerage Vs FEB Mitsui MarineInsuranceDocument2 pagesTorres Madrid Brokerage Vs FEB Mitsui MarineInsuranceTAU MU OFFICIAL100% (1)

- Components of DeedsDocument23 pagesComponents of Deedsvaraxiy659No ratings yet

- Victory Liner Vs GammadDocument3 pagesVictory Liner Vs GammadMarrielDeTorresNo ratings yet

- Company Law Study Material FinalDocument183 pagesCompany Law Study Material Finalshivam_2607No ratings yet

- Contractual, Is Premised Upon The Negligence in The Performance of ADocument2 pagesContractual, Is Premised Upon The Negligence in The Performance of AAnsai Claudine CaluganNo ratings yet

- PIL HANDOUT in TextDocument173 pagesPIL HANDOUT in Textbhargavi mishraNo ratings yet

- Parents Consent For Band CompetitionDocument1 pageParents Consent For Band CompetitionGlydel Mae Villamora - SaragenaNo ratings yet

- 07 Formation of A CompanyDocument19 pages07 Formation of A CompanySmart Farai ManangaziraNo ratings yet

- Rumah Lelong Seri AustinDocument0 pagesRumah Lelong Seri AustinAsyrudin SyahNo ratings yet