Professional Documents

Culture Documents

PDF 04apr24 0307 Splitted

PDF 04apr24 0307 Splitted

Uploaded by

mr.ehsan.khoramiCopyright:

Available Formats

You might also like

- Auto Transfer Scheme 2 I-C & B-CDocument3 pagesAuto Transfer Scheme 2 I-C & B-CAnonymous m65TTcfOT100% (6)

- BessDocument39 pagesBessVishram Bairwa100% (2)

- Energies 17 01485Document30 pagesEnergies 17 01485Maher AzzouzNo ratings yet

- Determination of Optimal Capacity of Pumped Storage Plant by Efficient Management of Renewable Energy SourcesDocument5 pagesDetermination of Optimal Capacity of Pumped Storage Plant by Efficient Management of Renewable Energy Sourcesoscar2411No ratings yet

- Penetrating Insights - IEEE Power & Energy MagazineDocument6 pagesPenetrating Insights - IEEE Power & Energy MagazinePaulo Sérgio Zanin JúniorNo ratings yet

- PV Plus StorageDocument2 pagesPV Plus StorageJelena PapovicNo ratings yet

- Valuing-Resilience PV GridDocument5 pagesValuing-Resilience PV GridLe'Novo FernandezNo ratings yet

- Cost of Geothermal Power and Factors That Affect It: Subir K. Sanyal Geothermex, Inc. Richmond, California, 94804, UsaDocument12 pagesCost of Geothermal Power and Factors That Affect It: Subir K. Sanyal Geothermex, Inc. Richmond, California, 94804, UsaDarwin HudeNo ratings yet

- 24 Zero Emission Steam Generation With eGBPectricityDocument4 pages24 Zero Emission Steam Generation With eGBPectricityAyman FawzyNo ratings yet

- ONWhitePaper-QuickGuide en PDFDocument8 pagesONWhitePaper-QuickGuide en PDFJorge Luis Tanaka ConchaNo ratings yet

- EI Fact Sheet: Storage Technologies For The Power System: DriversDocument4 pagesEI Fact Sheet: Storage Technologies For The Power System: DriversThorsten StruweNo ratings yet

- Coordinated Control Scheme of Battery Energy Storage System (Bess) and Distributed Generations (DGS) For Electric Distribution Grid OperationDocument7 pagesCoordinated Control Scheme of Battery Energy Storage System (Bess) and Distributed Generations (DGS) For Electric Distribution Grid OperationGeorge MatosNo ratings yet

- Challenges and Solutions For Energy Systems With High Shares of Wind EnergyDocument10 pagesChallenges and Solutions For Energy Systems With High Shares of Wind EnergyBurak Hamdi İldemNo ratings yet

- A Spinning Reserve, Load Shedding, and Economic Dispatch Solution by Bender's DecompositionDocument5 pagesA Spinning Reserve, Load Shedding, and Economic Dispatch Solution by Bender's Decompositionapi-3697505No ratings yet

- Zheng 2017Document5 pagesZheng 2017Santhosh H ANo ratings yet

- A Dynamic Programming Based Method For Optimizing Power System Restoration With High Wind Power PenetrationDocument6 pagesA Dynamic Programming Based Method For Optimizing Power System Restoration With High Wind Power PenetrationChaitali moreyNo ratings yet

- Optimized Energy Management System For Profit Maximization of A Photovoltaic Plant With Batteries A Case Study of Coremas BrazilDocument9 pagesOptimized Energy Management System For Profit Maximization of A Photovoltaic Plant With Batteries A Case Study of Coremas BrazilLucas HaasNo ratings yet

- Integrating Renewable Energy Technologies Into ProjectDocument27 pagesIntegrating Renewable Energy Technologies Into ProjectBatnon Gate FarmsNo ratings yet

- Optimal Energy Storage Sizing and Control For Wind Power ApplicationsDocument9 pagesOptimal Energy Storage Sizing and Control For Wind Power ApplicationsMichi HenaoNo ratings yet

- Falahati 2017Document9 pagesFalahati 2017ashNo ratings yet

- Distributed GenerationDocument5 pagesDistributed GenerationZubairNo ratings yet

- Battery Storage The New Clean PeakerDocument11 pagesBattery Storage The New Clean PeakerMatthew KellyNo ratings yet

- Genetic-Algorithm-Based Optimization Approach For Energy ManagementDocument9 pagesGenetic-Algorithm-Based Optimization Approach For Energy ManagementAhmed WestministerNo ratings yet

- Renewable EnergyDocument12 pagesRenewable EnergyDiego Marquez PadillaNo ratings yet

- Cost-Benefit Assessment of Energy Storage For Utility and Customers A Case Study in MalaysiaDocument11 pagesCost-Benefit Assessment of Energy Storage For Utility and Customers A Case Study in MalaysiaRuna KabirNo ratings yet

- PV-battery-diesel Microgrid Design For Buildings Subject To Severe Power OutagesDocument6 pagesPV-battery-diesel Microgrid Design For Buildings Subject To Severe Power Outageslaap85No ratings yet

- The Great Energy Quest:: Case Studies in Australian Electricity StorageDocument22 pagesThe Great Energy Quest:: Case Studies in Australian Electricity Storagedeskaug1No ratings yet

- Digital Technologies For Thermal Power Plants Improves Performance and RoiDocument5 pagesDigital Technologies For Thermal Power Plants Improves Performance and RoineerajNo ratings yet

- Energy Management and Power Quality Improvement ofDocument15 pagesEnergy Management and Power Quality Improvement ofSamuel BhukyaNo ratings yet

- On Mitigating Wind Energy Variability With Storage: Vijay Arya, Partha Dutta, Shivkumar KalyanaramanDocument9 pagesOn Mitigating Wind Energy Variability With Storage: Vijay Arya, Partha Dutta, Shivkumar KalyanaramanAhmed WestministerNo ratings yet

- Journal of Energy Storage: Johannes Hjalmarsson, Karin Thomas, Cecilia Bostr OmDocument21 pagesJournal of Energy Storage: Johannes Hjalmarsson, Karin Thomas, Cecilia Bostr Om177JMCNo ratings yet

- 03S2 ACavallo StorageDocument7 pages03S2 ACavallo StorageshyamagnihotriNo ratings yet

- Data Center SolutionsDocument12 pagesData Center Solutionsengkos koswaraNo ratings yet

- Capacity Mechanisms: Situation in BelgiumDocument5 pagesCapacity Mechanisms: Situation in BelgiumThorsten StruweNo ratings yet

- Teja 2016Document6 pagesTeja 2016johnNo ratings yet

- Energy Cost: System PlanningDocument1 pageEnergy Cost: System PlanningQdlm KnocNo ratings yet

- Reviewing Optimisation Criteria For Energy Systems Analyses of Renewable Energy IntegrationDocument10 pagesReviewing Optimisation Criteria For Energy Systems Analyses of Renewable Energy Integrationjorbol827No ratings yet

- TCO - Diesel Vs Natural Gas GeneratorsDocument5 pagesTCO - Diesel Vs Natural Gas GeneratorsNhacaNo ratings yet

- 01.energy Management Handbook-67Document4 pages01.energy Management Handbook-67Aatish ChandrawarNo ratings yet

- Battery Energy Storage - Optimize Integration of Renewable Energy To The GridDocument6 pagesBattery Energy Storage - Optimize Integration of Renewable Energy To The GridankitNo ratings yet

- Generation Expansion For Hydropower PlantsDocument2 pagesGeneration Expansion For Hydropower PlantsNyaketcho ClaireNo ratings yet

- Network Reconfiguration and DG in A Radial Distribution System For Reducing Losses and To Improve Voltage Profile by Using MpgsaDocument6 pagesNetwork Reconfiguration and DG in A Radial Distribution System For Reducing Losses and To Improve Voltage Profile by Using Mpgsagondrolluprasad7993No ratings yet

- Distributed GenerationDocument6 pagesDistributed GenerationSwagat PradhanNo ratings yet

- Pti FF en Ncog Oil Gas 1607Document2 pagesPti FF en Ncog Oil Gas 1607eddisonfhNo ratings yet

- Modeling, Control, and Dynamic Performance Analysis of A ReverseDocument15 pagesModeling, Control, and Dynamic Performance Analysis of A ReversebazediNo ratings yet

- ProjectDocument46 pagesProjectSubham MaityNo ratings yet

- Wind Power: Wind Power Is The Conversion of Wind Energy Into A Useful Form ofDocument11 pagesWind Power: Wind Power Is The Conversion of Wind Energy Into A Useful Form ofRajeeb MohammedNo ratings yet

- Fault Current MitigationDocument74 pagesFault Current Mitigationbaccouchi nasreddineNo ratings yet

- Applications of Energy Storage Systems in Wind Based Power SystemDocument8 pagesApplications of Energy Storage Systems in Wind Based Power SystemEditor IJTSRDNo ratings yet

- Assessment of Energy Distribution Losses For Increasing Penetration of Distributed GenerationDocument8 pagesAssessment of Energy Distribution Losses For Increasing Penetration of Distributed GenerationFIDELITASSSNo ratings yet

- RFF Ib 19 04 - 4Document8 pagesRFF Ib 19 04 - 4dm mNo ratings yet

- He Reasons For It Are As FollowsDocument16 pagesHe Reasons For It Are As FollowsPavan uttej RavvaNo ratings yet

- Complete ProjectDocument46 pagesComplete ProjectSubham MaityNo ratings yet

- A Coordinated Dispatch Method With Pumped-Storage and Battery-Storage For Compensating The Variation of Wind PowerDocument14 pagesA Coordinated Dispatch Method With Pumped-Storage and Battery-Storage For Compensating The Variation of Wind Powergokot87387No ratings yet

- Mid-Load Operation of Large Coal-Fired Power Plants: Power-Gen Europe Köln 2014Document16 pagesMid-Load Operation of Large Coal-Fired Power Plants: Power-Gen Europe Köln 2014RavishankarNo ratings yet

- Applsci 11 07851 v2Document26 pagesApplsci 11 07851 v2Fathan MujibNo ratings yet

- Solar Future UETDocument42 pagesSolar Future UETAsim RiazNo ratings yet

- The Cost of Electricity: What India Needs To Do For Reliability, Security and Affordability of Electric SupplyDocument1 pageThe Cost of Electricity: What India Needs To Do For Reliability, Security and Affordability of Electric Supplyrajat singhNo ratings yet

- Microgrid Control Solutions For Commercial Buildings and Campuses 998-20112200 GMA-USDocument8 pagesMicrogrid Control Solutions For Commercial Buildings and Campuses 998-20112200 GMA-USIsrael RodrìguezNo ratings yet

- Optimization of Energy Management of A Microgrid Based On Solar-Diesel-Battery Hybrid SystemDocument7 pagesOptimization of Energy Management of A Microgrid Based On Solar-Diesel-Battery Hybrid SystemAna ZornittaNo ratings yet

- PDF 04apr24 0324 SplittedDocument10 pagesPDF 04apr24 0324 Splittedmr.ehsan.khoramiNo ratings yet

- PDF 04apr24 0324 SplittedDocument10 pagesPDF 04apr24 0324 Splittedmr.ehsan.khoramiNo ratings yet

- PDF 04apr24 0306 SplittedDocument30 pagesPDF 04apr24 0306 Splittedmr.ehsan.khoramiNo ratings yet

- PDF 04apr24 0304 SplittedDocument30 pagesPDF 04apr24 0304 Splittedmr.ehsan.khoramiNo ratings yet

- PC 2201Document12 pagesPC 2201Irwan SamtaniNo ratings yet

- MSB Schematic - BSE1 (62) XX-01 - (T1)Document1 pageMSB Schematic - BSE1 (62) XX-01 - (T1)Miguel Louie Sarigumba IIINo ratings yet

- AC:DC Converter 10WDocument7 pagesAC:DC Converter 10WSabahattin ERDOĞANNo ratings yet

- Re - 1982-06Document124 pagesRe - 1982-06Anonymous kdqf49qbNo ratings yet

- Datasheet HSEKU424P1Document3 pagesDatasheet HSEKU424P1Anonymous bnKP0vZqNo ratings yet

- Protection Engineering and Research Laboratories: Session VII: Busbar ProtectionDocument50 pagesProtection Engineering and Research Laboratories: Session VII: Busbar Protectionmahesh100% (1)

- PWD Schedule EM SUB-HEAD-1 NewDocument38 pagesPWD Schedule EM SUB-HEAD-1 NewEmran HusainNo ratings yet

- BB Battery Ups BP17-12 PDFDocument1 pageBB Battery Ups BP17-12 PDFElvis DiazNo ratings yet

- Dpa 110 e LS - enDocument10 pagesDpa 110 e LS - enRauf GebreelNo ratings yet

- Experiment No: 7Document8 pagesExperiment No: 7Ritesh BhoiteNo ratings yet

- r7100207 Basic Electronic Devices and CircuitsDocument4 pagesr7100207 Basic Electronic Devices and CircuitssivabharathamurthyNo ratings yet

- Horns: Description and OperationDocument6 pagesHorns: Description and OperationLilisbethBasantaNo ratings yet

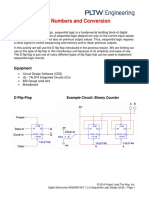

- 1.2.4.AK SequentialLogicDesign - Counters - DLBDocument7 pages1.2.4.AK SequentialLogicDesign - Counters - DLBSean MonahanNo ratings yet

- ZVC-VSV Instruction ManualDocument25 pagesZVC-VSV Instruction ManualAlvaro Mez AlNo ratings yet

- Datasheet PDFDocument19 pagesDatasheet PDFJohnny Jeremias Gutierrez MartinezNo ratings yet

- Induction Motor BasicDocument72 pagesInduction Motor BasickoushikNo ratings yet

- EEE418 Embedded SystemDocument13 pagesEEE418 Embedded SystemABDULLAH AL BAKINo ratings yet

- Modeling of Polluted High Voltage Insulators: IOSR Journal of Electrical and Electronics Engineering March 2014Document6 pagesModeling of Polluted High Voltage Insulators: IOSR Journal of Electrical and Electronics Engineering March 2014Romo BargowoNo ratings yet

- Transformer ProtectionDocument29 pagesTransformer Protectionapi-3732151100% (4)

- Add New Tech To Your Business!: Based On Up-To Date Addax Technology For Smart MeteringDocument6 pagesAdd New Tech To Your Business!: Based On Up-To Date Addax Technology For Smart MeteringFelipe SaldañaNo ratings yet

- Beta en 0103Document37 pagesBeta en 0103satchiconNo ratings yet

- List of Equipments Ec LabDocument1 pageList of Equipments Ec LabLester GarciaNo ratings yet

- WST 2100 Pbach R Me 0042Document206 pagesWST 2100 Pbach R Me 0042teamlc100% (1)

- Kinematics of Circular MotionDocument204 pagesKinematics of Circular MotionNarendra PratapNo ratings yet

- Multifunction Loop Calibrator MODEL 934: AltekDocument4 pagesMultifunction Loop Calibrator MODEL 934: Alteksaurabhjerps231221No ratings yet

- 1 s2.0 S2666285X22000280 MainDocument6 pages1 s2.0 S2666285X22000280 Main19euec163 TARUN SNo ratings yet

- Sistema Electrico - 795F AcDocument60 pagesSistema Electrico - 795F AcLuis Angel Luna AlarconNo ratings yet

- Ab Cable GTPDocument17 pagesAb Cable GTPNaresh Ch MahapatraNo ratings yet

- TutorialDocument6 pagesTutorialYou Jinq LimNo ratings yet

PDF 04apr24 0307 Splitted

PDF 04apr24 0307 Splitted

Uploaded by

mr.ehsan.khoramiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 04apr24 0307 Splitted

PDF 04apr24 0307 Splitted

Uploaded by

mr.ehsan.khoramiCopyright:

Available Formats

Table 12.

1 Sources of variation and operating reserve on power systems

Hydro plant can cover the whole range of reserve use of modern electricity load management.

requirements, pumped storage playing an important Techniques which have been in use for a number of

role in substantially reducing the need for spinning years such as offpeak, maximum demand and

reserve, limited in practice by the amount of storage interruptible tariffs have had substantial effects on

capacity available. the daily load curve which is now much flatter and

Finally, a further source of reserve is in the ability less peaky. Over 2 GW of demand on the CEGB is

of most generating units to run above the normal regularly removed from peak times by arrangement

declared maximum capacity, although in general this with large consumers, resulting in the need for less

reduces efficiency and in the long run may reduce generating capacity, and the substantial increase in

lifetime and increase maintenance requirements. offpeak usage has raised the system load factor

If all sources of reserve have been exhausted, excess considerably, with consequent large savings, which

load can be shed by a reduction in system voltage and can be shared with the customer.

frequency. The arrangements for load management which have

Power systems cannot, of course, supply demand been established for a number of years are by their

above available capacity for any significant time, nor nature somewhat inflexible and are not suitable for

survive major disruptions to the transmission network, dealing with the rapid fluctuations which would occur

which may cut out large capacities from part of a with intermittent renewable sources. Pumped storage

network at a stroke—the cause of the most famous offers a highly effective method for dealing with such

blackouts in developed grid systems. But with the variations but its potential is limited by the number of

various sources of reserve outlined, generation on well- sites which are economically available. However, the

developed power systems is more robust and flexible latest developments in load management can offer

than is often assumed. precise and rapid response to short term variations in

Beyond the short to medium time horizons, utilities the capacity available by automatic switching of, for

may have other measures which can be called upon, example, space and water heating and refrigeration

such as ‘standing reserve’ which is available at a few loads. These measures include the Radioteleswitch,

days’ notice, or which could in emergency be made now commercially available, and load management

ready over a period of weeks to months. In addition, systems using power or telephone lines for

there may be transmission links with neighbouring communication. In the ultimate, advanced metering

systems, such as those between Scotland and England. techniques could allow a ‘spot price’ to be transmitted

to consumers, and regularly updated in line with

system conditions, using meters which display the

12.2.5 The potential role of load

current price.

management and tariff incentives

Such measures, coupled with improved appliance

design and control measures used by the customer,

For larger penetrations of intermittent renewables, could significantly alter the economics of renewable

the system integration costs could be reduced by the energy sources at larger penetrations.

© 2003 Taylor & Francis Books, Inc.

12.3 POWER SYSTEM PLANNING conventional sources. The way in which it does so

depends upon the whole distribution of output from

12.3.1 Interaction between system the source. As the capacity rises, the probability of

integration and economics there being little or no output increasingly dominates

the capacity credit and eventually determines the

In correct modelling of the effects of system integration, limiting thermal plant displacement.

it is necessary to ensure that all significant variables For the CEGB system this figure may, however, be

are included. A convenient checklist can be derived several gigawatts even for intermittent sources which

from consideration of all the costs and savings which have a significant chance of generating nothing. This

will result from the introduction of new generating is because the system requires a substantial planning

capacity. These costs and savings, summarised from margin of thermal plant over maximum expected

Jenkin (1982)4 are as follows: system demand—the 24% currently used implies a

Costs margin of about 12 GW, due in roughly equal measure

to load growth uncertainties and the effects of

• Capital cost of the new capacity, including interest conventional plant unavailabilities. This figure can be

during construction reduced by several gigawatts if enough wind energy is

• Direct and indirect transmission and distribution introduced, for example, as there is still a good chance

costs of meeting demand even on the rare occasions when

• Fixed other works costs which do not vary with peak load coincides with no wind energy.

plant running and which may be expressed as an The decline of capacity credit at higher system

annual fixed charge per kW penetrations does not mean that the total capacity

• Variable other works costs which are dependent on value also declines towards zero. This is because there

is a capacity remix value, due to the change in optimal

plant operation and which may be expressed as a

thermal plant structure as a result of having

cost per kWh generated

intermittent sources on the system.

• Fuel costs, if any The primary reason why the optimal plant mix

• Overheads changes is a simple load duration effect: with

• Increases in fuel, fixed, variable and overhead costs intermittent sources generating for some of the time,

of other plant thermal units have to supply less energy than would

otherwise be the case. Plants which have higher fuel

Savings costs but which are cheap to build therefore become

• Capital savings resulting from the capacity credit more attractive relative to high capital-cost units.

which may be attributable to the new generation Consequently, there is less capital-intensive plant built,

source giving a net capital saving.

• Fuel savings resulting from the reduction of load This effect may be amplified by operational factors;

high capital cost plants are designed for baseload

factor on other existing plant and the displacement

of new plant operation and often incur substantial start-up or part

loading costs. The variability of wind power thus tends

• Savings in fixed, variable and overhead costs of to reinforce the load duration effect of capacity remix.

other plant In detail, the magnitude and value of capacity remix

The difference between savings and costs is the net depends greatly on the characteristics and costs of the

benefit which allows economic measures such as benefit/ system, even for a simple ‘target year’ analysis in which

cost ratio, internal rate of return or payback period to the plant mix is fully optimised. It is complicated by the

be determined. The CEGB’s term for net benefit is net fact that, of course, changing the planned plant capacity

effective cost, which is negative for a saving. also changes the system operating costs, so capital and

fuel savings cannot be considered independently. A

12.3.2 Capacity displacement and remix discussion for wind energy is given by Grubb (1987)5, 6

at higher penetrations where it is concluded that overall such effects are not

likely to be very important except for high penetrations

The marginal capacity value of intermittent sources on systems with a large nuclear component.

inevitably falls as more is added, because the output Such conclusions are preliminary. The effects cannot

from successive plants is correlated, in contrast to most be examined properly without a full generation-expansion

© 2003 Taylor & Francis Books, Inc.

analysis of system development over time which includes • Predictability of output

intermittent sources.

Finally, the fact that sources such as wind turbines

• Correlations in output/outages between different

units

can be constructed relatively rapidly also has important

capital consequences. The major component in the • Correlation between source availability and

uncertainties which determine the planning margin on electricity demand

the CEGB system is the error in load prediction. If • Resource inhomogeneity and location

wind turbines can provide an element of firm power

within 2–3 years—perhaps with the aid of some

• Unit size and construction times

peaking backup, if there is already significant wind Each power source, whether conventional or renewable,

on the system—this should in theory allow the is distinguished by different combinations of these

planning margin to be reduced. characteristics. From the system planning or operational

It should be noted that capacity issues are rarely as point of view, differences between different types of

important as fuel savings. There may already be generating plant, including renewables, are of degree,

substantial capacities of old, inefficient plants, not kind. Each characteristic is discussed below.

displaced by new investments. Even if the system does

need extra new plants just to maintain system 12.4.2 Particular factors

reliability, it may be cheapes t to build ‘peaking’ 12.4.2.1 Availability at times of high system

plants—typically gas turbines. Saving this at small demand

penetrations is a useful addition, but hardly the critical

factor in wind economics. Wind energy is valuable This affects primarily the contribution which the plant

primarily because of its fuel savings and, like all other makes towards system reliability. No plant is 100%

plants for meeting baseload demand, cannot be reliable, so there is always a finite risk of failure. All

justified primarily in terms of capacity needs. plants will reduce the probability of system failure to

The most important point is that for any given system some degree. Therefore all plants have a ‘capacity value’.

developing over future years, there is an optimum mix

of all types of capacity which will give minimum total 12.4.2.2 Output distribution

lifetime costs and so produce the cheapest electricity. The distribution of output from a power source affects

its value in two ways. It will save other types of fuel,

12.4 CHARACTERISTICS OF DIFFERENT which may be nuclear, coal or oil. If wind power becomes

RENEWABLES available at the time of maximum demand it will save

expensive distillate fuel for gas turbines; at other times

when coal and nuclear plant are running, coal will be

12.4.1 General characteristics of saved.

electricity producing sources The variability of a generating source also affects

the optimal investment in future plants. If a

The costs which need to be considered consist basically lowvariability renewable source has been added, a

of capital, variable and fixed operating costs, and small amount of further thermal power will be able to

overheads. The savings result from fuel saved and the generate at full load whenever it is available. If the

reduction in capital and other expenditure on other highly variable source has been added, the new thermal

plant. These factors are outlined above in Section source may sometimes have to be partloaded, or energy

12.3.1. In determining true costs and savings, from the renewable source discarded. This may affect

consideration needs to be given to the following the choice of thermal investment.

characteristics of electricity generators:

• Availability at times of high system demand 12.4.2.3 Energy constraints

• Overall output distribution and average availability Energy constraints mean that a source cannot be used

• Existence of energy constraints (e.g. lack of water to full available power at all times because the total

energy generation in a given period is limited. This

for hydro plant)

applies primarily to intermittent sources such as wind

• Startup characteristics and controllability or hydro plant; it may also apply to thermal plants if

• Degree of forced fluctuations there is interruption of fuel supply.

© 2003 Taylor & Francis Books, Inc.

12.4.2.4 Startup characteristics and Several of the renewable sources come in relatively

controllability small units. Short term fluctuations at different sites

would occur independently and tend to cancel each other

Renewable sources on a large system will normally be

out, so they would not add to the existing requirement

operated to full available capacity. Occasionally, however,

for very rapid reserve even if deployed in large numbers

it may be necessary to run renewable sources at less than

(see Appendix). But on longer timescales the output of

available capacity, when they would be able to contribute

individual units is correlated and so the unpredictable

to reserves. This would have a value to the system.

variation may be significant over longer periods, perhaps

enough to swamp the small errors involved in forecasting

12.4.2.5 Forced fluctuations

load a few minutes to hours ahead.

The variability of individual sources can be usefully Significant storage on the system reduces or

expressed as a coefficient.7 If variability is defined in eliminates the need for thermal spinning reserve and

the dynamic sense as the annual average hourly rate so reduces the reserve costs incurred.

of change of power divided by the average power The predictability of the intermittent sources is not

generated per day, where only positive increases are yet well enough known for reserve requirements to be

considered, then typical values are given in Table 12.2. determined with accuracy for larger penetrations. An

Two-way generation would not greatly decrease the upper limit to reserve penalties can be set by choosing

total tidal variability, there being two bursts of power a simple rule-of-thumb forecast, such as ‘persistence’

in every tidal cycle up to about half the power of an forecasting in which it is assumed that the current

ebb-generation scheme. However, combining out-of- output will persist indefinitely. For wind energy widely

phase schemes could greatly reduce the variability. dispersed in England and Wales, this would produce

Wave energy varies less rapidly than wind energy. The a penalty rising from zero at very small capacities

figure here is particularly small due to the relatively (when the wind variations would be drowned in those

low power rating of the designs considered for large- of the load) up to about 10% of expected fuel savings

scale wave generation. if the wind capacity were large enough for wind

prediction errors to drown those of the load. This total

12.4.2.6 Source predictability and operating is split roughly equally between the intermediate (15

reserve min to 1 h) and longer term reserve requirements.

The requirement for operating reserve on power Although the penalties identified are small taken

systems has been discussed in Section 12.2.4. Clearly, individually, their combined effect could become quite

if an individual source adds to reserve requirements significant if large capacities of intermittent sources

on the system because its output cannot be well were ever considered. In such circumstances an

predicted, its value may be reduced. additional and major source of loss would be the need

Enough rapid reserve must be available to protect to start discarding energy from the intermittent source

the system against the possibly sudden failure of a when the power output was large and demand low, in

conventional plant. Because sudden failure is a rare order to maintain sufficient thermal power generation

event, however, the probability of two units failing for system reserve and control purposes.

simultaneously is negligible and the reserve capacity In practice for the large integrated power systems in

required is equal to the largest single infeed to the system. Britain it is unlikely that such levels of intermittent plant—

Table 12.2 Typical coefficients of variation for electricity demand and some intermittent renewable sources

(annual average)

© 2003 Taylor & Francis Books, Inc.

The voltage of the distribution system into which Because of the location and nature of hydro power,

the renewable is connected is determined by the fault transmission connections and environmental issues

level of the installation which in turn limits the maximum may pose major problems.

size of the generating capacity: see Table 12.3.

12.5.4 Small scale hydro

12.5 IMPLICATIONS FOR DIFFERENT

RENEWABLES

The annual load factor of small hydro, of output a

few megawatts or less, is likely to be more

12.5.1 Biomass dependent on rainfall since run-of-river plant will

probably be predominant. This is because the

The prevailing UK view until recently, summarised by normal river flow is the main source of water, and

Bevan and Long (1987), 10 is by implication that there will be smaller reserves of water than in

biomass fuelled plant will on the whole provide heat installations with large reservoirs supplied directly

only rather than combined heat and power, although from catchment areas. The capacity credit of small

this picture is now changing. Such installations will hydro is therefore likely to be less than that of

have the same characteristics as other continuous larger scale plant.

sources. Small plants located far from major generating

centres may have the advantage of reducing the need

for transmission reinforcement which would otherwise 12.5.5 Tidal power

be required.

Biomass, unlike other renewable energy sources, has This is a predictably intermittent source for which

a fuel cost which must be taken into account when capacity credit can be relatively easily determined.

assessing its overall economics. For this reason it will However, because of the way the tidal cycle varies

take its place in the merit order and may not be suitable with time, the capacity credit of a tidal scheme is

for base load generation. less than that of a random source of the same

output. For example, the firm power output of the

12.5.2 Hot dry rock geothermal energy Severn Barrage has been determined as 1·1 GW for

a maximum installed capacity of 7·2 GW, or 15%.

This compares with an annual load factor which is

Geothermal plant would also provide a continuous

estimated as 21% for a yearly output of 13 GWh.

supply of electricity, but since there is no fuel cost will

This apparent conflict with Swift-Hook’s

therefore be used for base load supply. There may be

conclusion (2) is explained by the need to determine

advantages in that the need for transmission system

the firmness at the time of national peak, and not

reinforcement will be reduced if the Cornish

over the whole year. 11 The integration of small

geothermal resource is developed.

barrage schemes such as the Mersey is relatively

easy, but a large scheme like the Severn (7·2 GW)

12.5.3 Large scale hydro would require substantial transmission provision

and reinforcement at 400 kV.

The annual load factor of a hydro system is variable The specific variability of tidal power could result

and depends on the rainfall in the year. The only in significant cost penalties: it has been estimated that

significant potential for new capacity is in Scotland. around 8% of the ideal fuel savings from the Severn

There are no short term problems and consequent costs Barrage would be lost if there were no control over

of large penetration of hydro capacity, although its output. However, some degree of control is

sufficient spare capacity of other types of generation possible, and this would substantially reduce the

must be provided to cover years of low rainfall. The figure.

capacity credit of hydro plant is therefore between that A mix of different tidal schemes, for example the

of continuous and random renewables. Large scale in Solway Firth and Morecambe Bay which are about

UK terms is relative only, the resource being 5–6 h out of phase with the Severn, would clearly

comparatively small by comparison with that available together have higher capacity credits than a single

in some other countries. These characteristics make scheme and therefore would have a beneficial effect

the economic assessment of hydro plant complex. on the economics.

© 2003 Taylor & Francis Books, Inc.

tens of thousands of megawatts—will be reached in the 12.4.2.10 Unit size and construction time

foreseeable future. However, this is not the case for small

In addition, the planning margin of installed capacity

isolated systems such as on some islands, and it may

over expected demand is partly determined by the

also apply to isolated parts of the distribution network

uncertainty in demand growth over the period required

connected to the rest of the system by weak links.

for ordering and completing new plants. Renewable

sources vary between the very large and very small;

12.4.2.7 Correlations in power output the latter could be mostly constructed in factory and

installed within months. Clearly, the ability to deploy

In conventional plant, unit failures may usually be

an energy source at short notice will be beneficial and

considered independent of each other and of system

may enable the planning margin to be reduced.

demand. In contrast, the output from many renewable

sources will be closely correlated between sites. Then,

12.4.3 The nature of the interface

additions of capacity cannot be considered in isolation;

the impact on grid reliability, net power fluctuations The nature of the interface between a renewable energy

and uncertainty will all be dependent on the amount source and the system into which it is connected is

and distribution of other units already in place. determined by the characteristics both of the source and

of the system. In a large system with strong connection

points, the effects on the system will be global rather

12.4.2.8 Correlation with electricity demand

than local. In a small system, or one which is an isolated

Correlations with electricity demand may affect the part of a larger system, the transient electrical effects must

economic value of a source. A distinction may be be considered. The general issues of connection of new

drawn between ‘seasonal’ correlations and short term sources of generation into a system were summarised by

correlations. Walker (1984)8 as including the following:

Most conventional thermal units show some seasonal

correlation with demand by virtue of maintenance • Voltage limits

scheduling, which is arranged as far as possible for the • Voltage disturbances

low demand summer months. Renewable sources, • Frequency limits

notably wind and wave power, also have a substantial

positive seasonal correlation. Other sources, such as

• Harmonic limits

solar, would have a negative correlation in Britain. In • Power factor

addition for some renewable sources there may also be • Recovery after clearance of faults

short term source-demand correlations due to common • Phase unbalance

causes such as weather or diurnal cycles.

The impact of positive source-demand correlation

• Firmness of new capacity

is to increase the value of fuel savings from a source • Safety of personnel

and increases its contribution to system reliability. All except the last of these is concerned with the quality

Short term positive correlation in particular could give of the supply. Recently Gardner (1987)9 discussed in

a source a very high capacity value. detail the question of the supply interface and showed

how the above technical factors affect it. Although

12.4.2.9 Resource inhomogeneity and location the discussion was concerned specifically with wind

power, much of it applies to other renewables also.

To a good approximation, conventional electricity

Table 12.3 Connection voltages for given power

sources can be assessed at a fixed cost per unit capacity.

levels

In contrast, the economics of most renewable sources

depend on the density of a natural energy flow, which

may differ greatly between sites. In exploiting such a

resource, the cheaper sites will tend to be used first. To

analyse the economics of large scale use, some attempt

must be made to investigate the profile of resource

density. This and other factors will also affect the

location of a source.

© 2003 Taylor & Francis Books, Inc.

12.5.6 Wave power capacity, its effects on the system need not be

considered further.

The only large wave power resource is likely to be off The solar resource is not small in total, the intensity

the west coast of Scotland. Its randomness is closely in Britain being about half that in the Sahara and

comparable to that of wind power and so the effects concentrated in summer. However, there must be a

of large penetrations on the system would be similar. dramatic fall in module costs if the technology is to be

However, the location of a large wave power station attractive in Britain.

in Scotland would require extensive transmission

works at 400 kV which would add significantly to the 12.5.9 OTEC

cost of wave power. Small units (<1 MW) offer

prospects for island supplies, particularly those which Ocean Thermal Energy Conversion would be a firm

are shore mounted, or close inshore are likely to have source of electricity and so would present no more

lower civil and transmission costs. difficulties in its system integration than any base load

Geographical separation will be an important source. However, by its nature it will make no

consideration as it is for wind power. contribution to our electricity supply and so it need

not be considered in a UK context

12.5.7 Wind power

BIBLIOGRAPHY

The effects of large penetrations of random sources HALLIDAY, J.E., BOSSANYI, E.A., LIPMAN, N.H. &

such as wind power have already been discussed. These MUSGROVE, P.J., A review of renewable energy integration

effects will be dependent on the characteristics of the strategies. Proc. European Wind Energy Conference, Ham-

burg, 22–26 October 1984, pp.573–6.

rest of the system in which the wind capacity is INFIELD, D.G. & HALLIDAY, J.A., The Reading University/RAL

installed. The effects on the CEGB will be quite national grid integration model and its application to storage and

different from those on the NSHEB system, and wind energy. Proc. Colloquium, The Economic and Operational

Assessment of Intermittent Generation Sources on Power Systems.

different for small isolated or quasi-isolated systems.

Imperial College, London, March 1987.

There would be no significant transmission difficulties LEUNG, K.S. & STRONACH, A.F., Integration of wind tur-

in integrating large dispersed wind capacity on land, bine generators into small diesel based systems. Proc. Energy

but any large offshore wind power development would Options: The Role of the Alternatives in the World Scene. Conf.

require its own transmission system offshore, onshore publication 233, 3–6 April 1984. Institution of Electrical Engi-

neers, London, 1984, pp.151–154.

connection points and transmission reinforcement. MOFFAT, A.M., System technical questions in integrating renew-

Capacity credit for wind power will be about equal able energy sources into small systems. Proc. Colloquium on Inte-

to its winter load factor, which could be 30–40% gration of Renewable Energy Sources in Existing Networks. Digest

1981/68, 3 November 1981, Institution of Electrical Engineers,

depending on the machine rating. However, it is

London, 1981, pp.1/1–1/16.

important to take into account long term climatic NORGETT, M.J. & WALKER, J.F., An investment model for a

variations in assessing the firmness of wind power. central electricity generating system. Proc. Energy Options: The

Palutikof and Watkins (1987)12 have shown, using a Role of Alternatives in the World Scene. Conf. Publication 276,

7–9 April 1987. Institution of Electrical Engineers, London, 1987.

time series of wind speeds for 1898 to 1954, that energy

SURMAN, P.L. & WALKER, J.F., System integration of new

output for a wind turbine on a poor year would have and renewable energy sources: a UK view. Proc. Euroforum

been less than half that of a good year. Clearly, estimates New Energies Congress. October 1988 (to be published).

of the economic viability of wind power must take into THORPE, A., Intermittent energy sources in system operation.

account such variability. Proc. Colloquium, The Economic and Operational Assessment

of Intermittent Generation Sources on Power Systems. Impe-

rial College, London, March 1987.

WRIGHT, J.K., CEGB proof of evidence to the Sizewell inquiry.

12.5.8 Photovoltaic In Alternative Methods of Electricity Generation, CEGB P3,

November 1982, Paragraph 10.

Solar power from photovoltaic cells is predictably

intermittent in climates which have a high incidence REFERENCES

of direct sunlight, but is more random in temperate

climates such as that of the UK because of the vagaries 1. STERLING, M.J.H., Power System Control, Peter

Peregrinus Ltd/IEE, 1978.

of the weather. Because photovoltaic generation is 2. FENTON, F.H., Survey of cyclic load capabilities of fossil-

unlikely to form a significant proportion of UK stream generation plants. IEE Trans PAS-101 6, June 1982.

© 2003 Taylor & Francis Books, Inc.

3. KIDD, D.A. & WALLIS, E.A., Operational aspects of Wind energy at small penetrations is therefore as

Dinorwig pumped storage scheme. IEE Power Division,

discussion meeting, 1984.

valuable as thermal plants to within a per cent or two.

4. JENKIN, F.P., CEGB proof of evidence to the Sizewell (In principle the favourable seasonal variations of wind

inquiry. In The Need for Sizewell B, CEGB P4, November energy may make it worth more than thermal plant,

1982 , paragraphs 20–24. but this needs to be set against the ability schedule

5. GRUBB, M.J., Probabilistic analysis of the impact of

intermittent sources on operating penalties: Methods and

maintenance on thermal plant. This also gives a

Applications. Proc. Colloquium, The Economic and favourable seasonal variation in plant availability.)

Operational Assessment of Intermittent Generation Sources But how much is ‘small’ in this context? As the

on Power Systems. Imperial College, London, March 1987. capacity of wind power rises its value declines for many

6. GRUBB, M.J., Capital effects at intermediate and higher

penetrations. Proc. Colloquium, The Economic and

reasons. The rate at which it does so depends heavily

Operational Assessment of Intermittent Generation Sources on the diversity of the wind energy.

on Power Systems. Imperial College, London, March 1987. Figure A12.1 shows the approximate capacity

7. GRUBB, M.J., The value of variable sources on power savings which would come from wind energy on the

systems: fuel savings and operating penalties. IEE Proc.

(submitted).

CEGB system as the capacity rises, for a range of

8. WALKER, J.F., Some technical implications of the Energy diversities. The first few thousand megawatts would

Act. Proc. British Wind Energy Association One Day Meeting, save an equivalent capacity (in terms of mean winter

University of Strathclyde, Glasgow, 16 February 1984. power) of conventional sources, but the contribution

9. GARDNER, G.E., Supply interface. Proc. BWEA-DEn

Workshop. Electrical Generation Aspects of Wind Turbine

falls off thereafter. Ten gigawatts of wind power

Operation. ETSU N103. Energy Technology Support Unit, capacity, if dispersed in England and Wales, would

Harwell, May 1987. save around 3 GW of thermal plant; but the total saved

10. BEVAN, G.G. & LONG, G., UK renewable energy could not rise about 5·5 GW (about 10% of the total

programmes. Proc. Energy Options: The Role of the

Alternatives in the World Scene. Conf. publication 276, 7–9

thermal capacity). This compares with the current

April 1987, Institution of Electrical Engineers, London, 1987. ‘planning margin’ of 24%, and means that there would

11. SWIFT-HOOK, D.T., Firm power from the wind. Proc. be an excess of thermal plant over peak demand of

Colloquium, The Economic and Operational Assessment perhaps 7 GW (this analysis is based on real hourly

of Intermittent Generation Sources in Power Systems.

Imperial College, London, March 1987.

wind and load data in the period 1971–79) as discussed

12. PALUTIKOF, J.P. & WATKINS, C.P., Some aspects of by Grubb (1987).5,6

windspeed variability and their implications for the wind What about fuel savings, and the various operating

power industry. Proc. Colloquium, The Economic and penalties associated with wind energy? For

Operational Assessment of Intermittent Generation Sources

on Power Systems. Imperial Collage, London, March 1987.

intermediate penetrations, these can be estimated if

we know the variability of the wind energy (as

measured by the ‘mean power variation’) and its

APPENDIX 12.1 predictability.

For dispersed wind energy in England and Wales,

A case example: the integration of wind the mean power variation has been estimated at around

energy 0·016 GW/h per GW of wind capacity, compared with

mean load variation of 0·6 GW/h.

Many of the issues considered in previous sections can

be usefully illustrated with reference to wind energy.

It is variable, unreliable, and only partially predictable.

How does this affect its value?

At sufficiently low penetrations, we can see from

Section 12.4 that the wind fluctuations are drowned

out in load variations, so there is negligible extra

cycling of the thermal plant, and the system reserve

requirements are also unaffected. Wind energy also

then has a capacity credit equal to the mean power

available in winter (studies suggest that any

relationship between wind availability and peak

demand in winter is very weak indeed, so that

treating them as independent is as good an Fig. A12.1. Baseload capacity displacement with increasing

assumption as any). wind penetration: variation with wind diversity.

© 2003 Taylor & Francis Books, Inc.

Section 13

Economics of Renewable Energy

Sources

13.1 INTRODUCTION AND ECONOMIC example, plant manufacturers will prefer to quote the

COMPLEXITIES initial capital cost based on rated performance since

that is a knowable quantity that can be guaranteed

13.1.1 Possible methods of evaluation and tested prior to commissioning and is not dependent

on future factors that may vary, such as operating costs,

This Section sets out to compare the economics of the breakdowns, life, available energy, etc.

renewable energy sources—a difficult and complex The operator and the consumer are concerned not

task. A complete analysis would probably need to only with the initial cost but also the rate at which

cover the energy policy of the entire country and that, they have to repay it. Unfortunately a short payback

needless to say, is beyond the scope of a single section. period is no guarantee of a profitable investment in

It will be necessary to restrict the comparisons to the power plant; a system that lasts just long enough to

renewables themselves rather than include all existing repay the investment and one which repays it many

methods of generation. times over may have exactly the same payback period

It is also difficult to make meaningful comparisons (which may be quite short) but they clearly differ in

between sources of energy in different forms such as their total profitability. The rate of return on

heat, mechanical energy or electricity. This section will investment suffers from the same difficulty, whether it

be mainly concerned with methods that generate is the monetary rate of return (i.e. including inflation)

electricity or high grade energy (zero entropy). With or the real rate of return (i.e. net of inflation): a high

lower grades of energy, quality as well as quantity must rate of return is only attractive if it is sustained for a

be considered (via some additional measure such as long enough period.

entropy, or temperature) and that is much more Energy accounting analysis checks that plant

difficult to place a value on. One method of doing so produces more energy throughout its life than is

is to consider how much energy could be produced consumed in its manufacture, and again that is

from the lower grade source in terms of the amount probably worth checking. Plant that consumes nearly

of electricity it could have produced. That procedure as much or more energy to make as it can ever generate

is not wholly satisfactory and each such case really will be suspect. Nevertheless, it is only the cost or

needs to be costed and valued quite separately on its quality of that energy that really matters. The energy

merits according to the application for which it is put into the plant during manufacture matters no more

suited. However, the generation of electricity is a than energy put in during its operation, e.g. as fuel

widespread application of considerable national which will certainly exceed the energy output. Both

importance for which most of the renewables are well should be kept reasonably low but neither has to be

suited and for which they can be directly compared. kept to any particular level as long as the overall system

A comparison concentrating mainly on electricity is economic.

generation will be very worth while. When faced with the purchase of plant, it is natural

Many different methods of evaluating ways of for any company to think in terms of borrowing the

generating electricity have their advocates. For money to pay for it on a mortgage to be repaid over

© 2003 Taylor & Francis Books, Inc.

some period. That period should not continue after 13.1.2 Factors affecting break-even costs

the plant has ceased generating or there will be no

income to pay the mortgage. The period may be shorter

Having found a measure of the cost of energy, the next

than the life of the plant for tax or other reasons and

step is to say whether that cost is favourable or not as

then the cost of units will be increased to start with,

far as any particular system is concerned. The break-

while the capital is paid off, and then reduced to the

even cost will differ from one power system to another

level needed to cover only the operating costs

depending on the mixture of plant and the power

thereafter. If a plant is regarded as producing units at

system characteristics at any point in time.

different times, the cost of energy can be quoted by

Then, too, many factors will change with time and

averaging over all the units produced and suitably

those changes must be taken into consideration. Future

discounting costs to the present. That amounts to

fuel cost escalations (in real terms) dominate the

levelling the cost between the units and gives the same

consideration of fossil fired plant and considerable

result as amortising by means of a level mortgage over

uncertainties are involved. Oil prices have fluctuated

the whole life of the plant. So to quote an average

wildly in the last 15 years and predictions of steady

lifetime cost of energy, the amortisation must be taken

coal price escalations to the end of the century have

as part of a level mortgage, which also includes interest,

not materialised.

over the life of the plant. Any other calculation is more

Just as future fuel costs affect the picture, so do

complicated but only leads eventually to the same

future planting policies, plant mixes and demand

result.

growth. To optimise the utilisation of existing and

It is evident that quoting costs of energy can be

future energy technologies is clearly a task of

grossly misleading unless accompanied by statements

considerable difficulty that is fraught with

concerning the underlying financial conditions

uncertainties. In this section these uncertainties and

assumed, e.g. discount rates and capital recovery

complexities will be avoided by calculating only the

periods.

cost and not the value of energy.

Having considered the repayment of capital and

Within the nationalised electricity supply industry

interest, it is only necessary to add the running costs that existed up until 1989 the Electricity Boards that

(including fuel costs if applicable) required to generate sold electricity in the United Kingdom could not avoid

energy (e.g. units of electricity) in order to arrive at a these difficulties. They were required by law to publish

lifetime generating cost of units, usually expressed in tariffs at which they would purchase electricity and

£/kWh (or equivalent units). those tariffs were required to reflect fairly their avoided

A method that is currently favoured by the costs and not to treat any class of consumer or supplier

electricity supply industry is to compare with the unfairly with respect to any other. In simple terms,

best existing alternative option and to quote the they had to say what the true break-even price for

net effective cost. A negative net effective cost electricity was and they were required, with the force

indicates that a saving can be made. This naturally of law, to get it right!

requires as detailed a knowledge of the baseline Common tariffs were published by the 12 Area

system as of the system under study and is not so Electricity Boards in England and Wales and could

convenient for comparing different systems directly be picked up at any electricity showroom. The price

with each other. at which it was economic for them to purchase

When evaluating projects, the use of a cost/benefit electricity varied with the time of day, week and year

ratio is often advocated. It would be feasible to use but averaged out to £0·025/kWh (1987). This price

such an approach for energy production but the result was the appropriate break-even cost to take for a

is probably equivalent to several of the other methods. source of power that is steady (such as geothermal)

Indeed, it should be noted that many of these methods or whose periodic or random variations are not

are equivalent and must represent the same answer in correlated with the time of day or week or year. For

different terms. Different methods may, of course, be sources with marked diurnal or seasonal variations,

sensitive to different parameters and require different a higher or lower figure would apply. For example

data to evaluate them and so the choice will often the wind blows harder at the time of greatest load

depend upon what information is available and the demand in winter. Wave power is similar, but for

use to which the results will be put. solar power the break-even figure would be reduced

© 2003 Taylor & Francis Books, Inc.

Clearly, large wind capacities would have to be

installed before these fluctuations became very

significant. The costs of plant startup on the current

CEGB system account for 3–4% of operating costs.

Applying these figures suggests that even if wind energy

supplied 20–30% of demand, the additional startup

losses would amount to only about 5% of the ideal

fuel savings (Grubb, 1987).5,6

As outlined in Section 12.4, we can also compare

the unpredictability of wind energy with that of load,

though the approximations are cruder. So are the data,

as we have little idea how predictable wind energy

would be in practice. The costs of reserve are generally

not very high, however (they account for barely 1%

on the current CEGB system). Even when the wind

capacity is high enough for wind prediction errors to

dominate the reserve requirements, the additional

requirements for spinning reserve and/or storage use

are unlikely to penalise wind energy by more than 5%,

if many sites are combined to avoid the wilder short-

term variations.

To this, the effects of uncertainties on longer

timescales, say more than 2 h ahead (which affects

the scheduling and standby of thermal units), need Fig. A12.2. Normalised marginal fuel savings from wind

energy.

to be added. Analysis suggests that this could be

just as significant as the need for shorter term

reserve. timescales are assumed to be half those obtained if

Although none of these penalties taken individually the wind is completely unpredictable).

is large, their combined effect could become The message of such studies is that wind energy

substantial. However, if high penetrations of wind could supply maybe 10% of demand (implying 8–10

energy were ever considered, these various penalties GW of installed capacity for current demand levels)

would soon be overshadowed by the need to start before the penalties start to become significant—up

discarding wind energy at times of fairly low demand, to this level, the marginal fuel savings are only reduced

because it would be essential to keep some thermal by a few per cent from the initial value (though as

plant connected (and nuclear plants could not be taken noted above the capacity credit value would start to

offline anyway). Furthermore the value of the fuel decline somewhat earlier).

saved by wind energy progressively declines as wind Its value then starts to decline steadily but not

energy penetrates higher up the merit order, especially very rapidly: the system could absorb 30% to 50%

once wind and nuclear power begin to compete for of its energy from dispersed windpower without real

supply. difficulty. However, even if enough sites could be

The practical importance of these various effects found in total, which seems highly unlikely, all the

can be encapsulated by considering the marginal value better sites would be used up long before this. Given

of fuel savings from wind energy as the penetration the reduced value of wind energy at such

into the system increases. Figure A12.2 shows such a penetrations, it is implausible that wind energy

study, using a computer model of a possible future could be generated cheaply enough from low

CEGB system which has a moderate nuclear capacity windspeed sites to make such capacities

(supplying abut 20% of demand) and wind energy economically attractive.

spread widely in England and Wales, but assuming no Although the question ‘how much can the system

power exchange with Scotland or Europe and no more absorb?’ is often asked, it is this steady decline in value

electricity storage than is already on the system (the combined with rising costs which really matters, and

average prediction errors for wind energy at all the same applies to most other renewable sources.

© 2003 Taylor & Francis Books, Inc.

because there is less sun at times of peak demand, in be necessary to include many of the straightforward

winter after dark. costs of system integration. The cost of site services

The average figure paid to the Central Electricity and connection to the transmission system are included

Generating Board for the electricity which they generated in all the estimates for electrical power generation. A

was easily established by dividing the total amount of number of the other considerations for power system

electricity sold (232 611 GWh in 1986/87) by the annual integration have been covered in Section 12.

revenue (£8 156 000 000) excluding sales of steam, etc.1 Many of the factors that will influence the decision

The average CEGB price in 87 was around £0·035/kWh. for or against various renewables are not economic at

The difference between the price the Electricity all, but environmental or institutional. For example,

Boards were prepared to pay to the CEGB (£0·035/ it has been accepted for some time that on really good

kWh) and to a private supplier (£0·025/kWh) was windy sites wind turbines would already be economic,

attributed to fixed charges and overheads which the but many of these sites are beauty spots and the

CEGB had to bear but which a private supplier did deployment of hundreds of large machines would be

not. One obvious major item was the cost of the environmentally unacceptable, so wind power may not

transmission network but that could only account for be pursued as actively as its straightforward cost

part of the difference. It may be that some of the advantage would indicate.

overheads included by the CEGB, e.g. for research, Institutional factors, too, are important and can

should also have been allowed to a private supplier. affect the economics in many situations. For example,

Such arguments will become very pointed when the local rates or taxes paid by Electricity Boards were

CEGB is split into private suppliers and presumably typically 2% of their total costs per annum. For

the two figures will come together in due course. In private generation, the costs are effectively based

the meantime, any source that can generate at below upon the cost of the power plant and were around

the lower figure of £0·025/kWh can be regarded as 2% of that cost per annum, a figure which sounded

clearly economic and worth pursuing while any source quite reasonable until it was appreciated that this

with generating costs lying in the interesting region amounts to 25% or more of total costs. Water

between the two figures (£0·025/kWh to £0·035/kWh) extraction charges have been payable in many parts

is marginal and worth further serious consideration. of the country simply for passing water through a

The break-even price is also evidently dependent water wheel or hydro-electric plant and again this

upon the power system into which the electricity is added a very substantial amount to the cost of energy

fed. The North of Scotland Hydro Electricity Board production. Water extraction charges were being

(NSHEB) with a substantial proportion of hydro reviewed but representations made to the Department

generated at around £0·026/kWh over most of its of the Environment, not least by the Secretary of State

region (but nearer £0·06/kWh for its islands and for Energy, regarding rates, e.g. for wind turbines,

isolated areas which include some diesel). The South

have produced no changes to date, although

of Scotland Electricity board had a high proportion

rationalisation is promised in 1990. Until these local

of nuclear and also had significantly lower generating

taxes on energy production are changed, private

costs than the CEGB, around £0·021/kWh. The

ownership of renewable (and probably other) power

published purchase prices of the two Scottish boards

plant cannot be competitive. The costs presented in

were lower than for the 12 Electricity Boards in

this section are those for renewables installed by the

England and Wales, around £0·018/kWh.

Electricity Boards under existing legislation and

The Electricity Boards were probably in a better

taxation conditions.

position to know the true costs than anyone else and

Section 11 deals with these environmental and

at least their figures provided a widely publicised

institutional factors.

yardstick against which generating costs could be

judged. Any private electricity producer had to

compete with these prices to stay in business. 13.1.4 Chosen method of costing:

advantages and limitations

13.1.3 System integration, environmental

and institutional factors In the face of all these complexities, some method of

evaluation must be chosen. Since the renewables

Although it will be beyond the scope of this Section to require no fuel (with the exception of biomass) most

evaluate total system costs, present or future, it will of the expenditure on them is for the initial capital

© 2003 Taylor & Francis Books, Inc.

which will be a known quantity and it will be be taken into account when making cost estimates.

appropriate to make estimates relative to that. By the For the Severn barrage, only one scheme is possible

same token, the renewables will be at the top of the (although there are options over what that scheme

merit order, i.e. the lowest running cost for any will be and many of the units would be replicated).

power system, and so their contribution can be For many of the other renewables, with small unit

calculated without the need to consider the sizes, costs will fall dramatically with the scale of

complexities of the rest of the system or of other operation, as has been convincingly demonstrated for

power plant. The economic comparison need take no wind power in the last few years. The cost of

account of interaction with the operation of other individual prototype wind turbines gives very little

stations on the system, and can be set out to guide to the cost of a complete wind farm and

sufficient accuracy using estimates of the direct reductions in cost of two or three times are quite

generation costs at each station (Ref. 2, para. 2.21). usual.

The uncertainties of future fuel price escalations can When a type of power plant has not been built

be avoided by working solely in real terms before, or at least not for some time, there is

financially, i.e. in today’s money, inflation can be inevitably uncertainty about both labour and

considered separately with its future uncertainties materials costs. For example, there is considerable

eliminated from consideration. uncertainty about the true cost of building a nuclear

The cost of electrical energy supplied seems to be power station in the United Kingdom due to the

the most appropriate indication to choose when infrequent and irregular ordering of such stations in

comparing the renewables, as noted previously. If the the past. If specialist expertise is required, the new

cost of electricity is to be levelled over all the electricity development may create a shortage of skills that

generated then it is necessary to repay capital by means pushes wage rates up. On the other hand, if the

of a level mortgage from the time the plant starts labour market has spare capacity, it may be able to

generating to either the end of its useful life (lifetime meet the additional demand at marginal costs well

costs) or a shorter period determined by the period below the average level.

allowed for capital recovery. All prices will be There is a tendency to regard the capital cost

expressed in today’s money, e.g. in £/kWh net of estimates of purchasers or independent observers as

inflation, and so it will be necessary to use real costs wholly unrealistic compared with those of the plant

and real rates of return. manufacturers. In narrow context, e.g. for the next

This lifetime costing will be used as the basis for plant order, this is clearly correct because a supplier

calculation arising from a questionnaire, discussed can be held to his quotation even if it was too low—

later, with variations on these reference values for and will still charge the same price if it was not, keeping

different ‘lifetimes’ related to capital recovery periods the profit for the company. Taking a broader view, in

also presented. the longer term there is plenty of evidence that

manufacturers get their estimates just as wrong as

everyone else, sometimes becoming insolvent in the

13.2 CAPITAL COSTS

process. There is no substitute for careful and detailed

13.2.1 Initial capital analysis.

The best position is where recent major purchases

have been made and are operating successfully. Failing

Capital costs are often regarded as one of the most that, cost estimates must be made of individual

well defined parameters in any costing exercise components and parts of the system with realistic costs

because they are determined once and for all at the for engineering the system as a whole.

start of a project. There are points to watch, Advances in technology have produced

however, particularly when a new technology is significant improvements in the efficiency of many

involved. Enthusiasts tend to quote prices that are of the renewables. It is obvious that improved

too low while commercial organisations, wanting to efficiency cuts fuel consumption in any

recover their development and launching costs as conventional or nuclear generating system, but

rapidly as possible, often quote prices that are there are no fuel costs for the renewables—that is

too high. their whole point!—and so it is often felt that

Capital costs are always strongly dependent upon efficiency is not important. If the energy is free, how

the scale of production and the scale of activity must can the efficiency matter?

© 2003 Taylor & Francis Books, Inc.

windy hilltop. The intensity in turn has a profound the first year or so after commissioning and British

effect upon the economics. It is not therefore AGRs have averaged much lower availabilities

sufficient to quote the total resource available. The throughout their lives to date.

resource must be quoted in relation to a given High temperature corrosion, erosion and fatigue

intensity level or cost band, and ideally it should be seem to present particularly difficult materials

expressed as a series of bands or a continuous cost problems as far as very long plant lifetimes are

function. concerned. Hydroelectric power plant, which has no

Wind energy provides an obvious example. There high temperature or highly radioactive parts, and

are a few very windy areas in Britain with annual which does not involve massive heat exchangers, has

average wind speeds of 9 m/s or more where availabilities nearer 100% and it is to be expected that

generation costs would be very low indeed. Such well designed renewable power plant will be able to

areas would probably be sufficient to generate a few achieve similar figures in many cases. Tidal power, with

hundred megawatts of electricity. More moderate its low head water turbines, for example, has a good

wind speeds, below 8 m/s, are available over much deal in common with hydro power technology. Wind

larger areas but the economics are then not so power plant, too, does not have to cope with the

favourable. Clearly the cheapest sites should be used problems of heat exchange, although it does need to

first but the position is then complicated by questions cope with severe storm conditions from time to time.

of scale production. Wave power also avoids high temperature problems

After the first few hundred megawatts of any new but has to cope with a hostile marine environment.

technology have been installed, significant cost Geothermal power does involve major heat exchange,

reductions are to be expected by the use of quantity although the temperatures are much lower than for

production techniques without considering the thermal power plant; the problems of corrosion

improvements in technology that seem almost therefore tend to be less severe but the size of the heat

inevitable. exchangers, which can represent a substantial part of

For example, wind power plant costs are expected the total cost, are correspondingly greater. Ocean

to fall progressively as larger quantities are Thermal Energy Conversion (OTEC) has even smaller

manufactured and installed. The low generation costs temperature differences to cope with in a relatively

initially available at very windy sites will then become hostile marine environment.

available on a more widespread basis at many more By such comparisons it should be possible to predict

sites with more moderate wind speeds (Ref. 4, p. 20). the availabilities to be expected of well designed plant.

Proponents of photovoltaics, too, claim that cell costs Practical demonstrations of plant availabilities for the

will fall as increasing quantities are manufactured. renewables are not very widespread as yet. Successful

demonstrations of good availabilities are even rarer

but it is upon those demonstrations that interest

13.3.2 Plant availability

inevitably focuses for planning purposes; nobody

would plan to install types of power plant that have

The availability of generating plant throughout its proven to be unreliable if reliable examples can be

life has a direct effect upon the number of obtained.

kilowatthours of electricity generated and hence As with the costs of operation and maintenance, it

upon the cost of energy. Availability at times of peak is difficult to forecast with the availability to be

demand determines the firm power contribution or expected under service conditions from the experience

capacity credit. Power plant availability is therefore of a prototype installation. One-off repairs by factory-

an important parameter. It can vary a great deal based teams will inevitably take longer than those

between types of power plant; 88% is good target to carried out on a routine basis by experienced teams

aim at for conventional power plant; that is the available on site. Experience with wind farms in

average achieved by the CEGB for the various items California provides very clear demonstrations of this

of plant on their system. Large modern coal-fired point.

units can achieve slightly higher figures, around Wind farms also demonstrate another general

92%, while nuclear plant with its more stringent feature of availability. Small units operating in parallel

maintenance requirements and longer repair times allow high availabilities to be achieved. Not only does

can achieve little more than 80%. Sizewell B PWR the failure of a single component (such as a nut or

expects to achieve no more than 55% availability in bolt) affect a more limited amount of power but the

© 2003 Taylor & Francis Books, Inc.

In most systems, the cost is dominated not by the but last year’s civil works on a major project will be

plant to handle the electricity output but by the plant losing money on idc if this year’s mechanical or

to capture the energy input. The higher the efficiency, electrical works are delayed.