Professional Documents

Culture Documents

Book 4 Apr 2024

Book 4 Apr 2024

Uploaded by

joshiabhinavaj247Copyright:

Available Formats

You might also like

- Unified Tenancy Contract 1.4Document2 pagesUnified Tenancy Contract 1.4Aftab AbbasiNo ratings yet

- Common Core Math 4 Today, Grade 3: Daily Skill PracticeFrom EverandCommon Core Math 4 Today, Grade 3: Daily Skill PracticeRating: 4 out of 5 stars4/5 (1)

- Osmania University LLB Question Papers Semester I PDFDocument54 pagesOsmania University LLB Question Papers Semester I PDFDrRavishankar SirikondaNo ratings yet

- Rent Rece: t.OOIIDocument1 pageRent Rece: t.OOIIjoshiabhinavaj247No ratings yet

- Ijlr - : Ale Assessee Taken L o R Recovery ofDocument1 pageIjlr - : Ale Assessee Taken L o R Recovery ofjoshiabhinavaj247No ratings yet

- Mock Paper 2Document9 pagesMock Paper 2md salmanNo ratings yet

- Practice Multiple Choice Test 5: I.J K IDocument8 pagesPractice Multiple Choice Test 5: I.J K Iapi-3834751No ratings yet

- Adobe Scan 10 Oct 2022Document1 pageAdobe Scan 10 Oct 2022Ttrex DNo ratings yet

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Document1 pageLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoNo ratings yet

- Aravali International SchoolDocument6 pagesAravali International SchoolArsh GuptaNo ratings yet

- Work Together 6-1 6-2 6-3Document1 pageWork Together 6-1 6-2 6-3James SargentNo ratings yet

- Practical AccountingDocument9 pagesPractical Accountingestela revillaNo ratings yet

- Amul Business ModelDocument8 pagesAmul Business ModelSʜʌʜwʌj HʋsʌɩŋNo ratings yet

- AP TA BU TIN Apprai A D: I L DGE G S L Metho SDocument11 pagesAP TA BU TIN Apprai A D: I L DGE G S L Metho SKanha SharmaNo ratings yet

- MTP Accountacy 12thDocument6 pagesMTP Accountacy 12tharsalan123ahmed.comNo ratings yet

- Finnncial AnalysisDocument8 pagesFinnncial Analysisharish chandraNo ratings yet

- FAR.2806-PPE Depn.Document4 pagesFAR.2806-PPE Depn.Kristian ArdoñaNo ratings yet

- !:R.Ir:, L:L :Li:.1F, 1: Trtrffi4$Ffis$$Document1 page!:R.Ir:, L:L :Li:.1F, 1: Trtrffi4$Ffis$$Tiganus ViorelNo ratings yet

- Word Income From House PropertyDocument19 pagesWord Income From House PropertyRathin Banerjee100% (1)

- !!! - A Answer The Round Lu Ignificant Figure .: Questions. 2Document9 pages!!! - A Answer The Round Lu Ignificant Figure .: Questions. 2Xie HangchenNo ratings yet

- Capital Gains WsDocument20 pagesCapital Gains WsDisha Commerce AcademyNo ratings yet

- Tax Planning PapersDocument14 pagesTax Planning PapersPrem ManiNo ratings yet

- ITL Paper Feb 2023Document2 pagesITL Paper Feb 2023Harnoor SinghNo ratings yet

- Corporate AccountsDocument8 pagesCorporate AccountsAmira JNo ratings yet

- L Agreement Document: The Procurement ofDocument65 pagesL Agreement Document: The Procurement ofBishnu Thapa MagarNo ratings yet

- Gaurav Solanki Section E 447 Assingment 3Document10 pagesGaurav Solanki Section E 447 Assingment 3Praveen Singh ChauhanNo ratings yet

- Certificate of Payment: tJ6/IlDocument6 pagesCertificate of Payment: tJ6/IlAjay MedikondaNo ratings yet

- Payback Period ProblemsDocument6 pagesPayback Period ProblemsMohan VeerabomalaNo ratings yet

- Unit 5: Income From House PropertyDocument11 pagesUnit 5: Income From House PropertySiddhant PowleNo ratings yet

- Sol Q6Document4 pagesSol Q6yen c aNo ratings yet

- Cap BudDocument4 pagesCap Budyashikasoni8722No ratings yet

- Fix or Evict? Loan Modifications Return More Value Than ForeclosuresDocument21 pagesFix or Evict? Loan Modifications Return More Value Than ForeclosuresForeclosure FraudNo ratings yet

- Financial ManagementDocument4 pagesFinancial Managementsipun acharyaNo ratings yet

- Adobe Scan 3 Mar 2023 PDFDocument1 pageAdobe Scan 3 Mar 2023 PDFshubham tarmaleNo ratings yet

- Chap 8. The Transportation and Assignment ProblemDocument76 pagesChap 8. The Transportation and Assignment ProblemBhupesh SharmaNo ratings yet

- Csec Poa Paper2 Jan2015Document21 pagesCsec Poa Paper2 Jan2015Rochelle Spaulding100% (1)

- Adobe Scan 09 Mar 2023Document20 pagesAdobe Scan 09 Mar 2023Kanishka DixitNo ratings yet

- Perturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoDocument93 pagesPerturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoJovannyNo ratings yet

- Perturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoDocument69 pagesPerturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoJovannyNo ratings yet

- 2013FinancialAccountingMarch2023RepeatersCBCS202021onwardsDocument8 pages2013FinancialAccountingMarch2023RepeatersCBCS202021onwardstejurathodnaikNo ratings yet

- Cost Management Accounting II-P - VIII - A-32-G - N - 1396Document12 pagesCost Management Accounting II-P - VIII - A-32-G - N - 1396Ashenafi ZelekeNo ratings yet

- Solving Trigonometric EquationsDocument6 pagesSolving Trigonometric EquationsJerry FoliasNo ratings yet

- Project Management NotesDocument3 pagesProject Management NotesAtiqullah sherzadNo ratings yet

- Management Accounting764 eVyE8h3I7eDocument3 pagesManagement Accounting764 eVyE8h3I7eABHINAV AGRAWALNo ratings yet

- Assignment-2: Submitted By: Name: Vipul Kumar Singh Roll No: 133118 Submitted To: Prof. Kuldeep BaishyaDocument4 pagesAssignment-2: Submitted By: Name: Vipul Kumar Singh Roll No: 133118 Submitted To: Prof. Kuldeep BaishyaVipul SinghNo ratings yet

- Ch-3, Setting New Business (Tax Planning)Document67 pagesCh-3, Setting New Business (Tax Planning)poonammadan0001No ratings yet

- Income Tax Previous Year Question PaperDocument3 pagesIncome Tax Previous Year Question PaperPULKITNo ratings yet

- Statement. Mention The Tools of Decision Making. 7 8Document4 pagesStatement. Mention The Tools of Decision Making. 7 8TCB Bhaban Corp. Br.No ratings yet

- Unsloved TVMDocument6 pagesUnsloved TVMMuditNo ratings yet

- Lecture 11 - Determination of Annual Value PDF-converted NewDocument38 pagesLecture 11 - Determination of Annual Value PDF-converted NewK.NALININo ratings yet

- Application of Percentages (1)Document15 pagesApplication of Percentages (1)Vinay KumarNo ratings yet

- Project Management 3Document14 pagesProject Management 3Shraddha BorkarNo ratings yet

- Unit 5: Income From House PropertyDocument11 pagesUnit 5: Income From House PropertySeshanki ChaudhariNo ratings yet

- Bank Recon AssignmentDocument4 pagesBank Recon AssignmentAndrea BreisNo ratings yet

- Applications For Pima County District 3 Supervisor SeatDocument198 pagesApplications For Pima County District 3 Supervisor SeatTucsonSentinelNo ratings yet

- Ilovepdf MergedDocument2 pagesIlovepdf MergedSuman AgarwalNo ratings yet

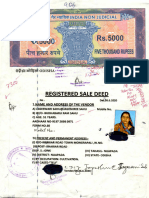

- Registered Sale Deed: N N JudicialDocument33 pagesRegistered Sale Deed: N N JudicialShoaib KhanNo ratings yet

- Departmental PEQDocument38 pagesDepartmental PEQRishikaNo ratings yet

- 41 Corporate Accounting May 2022Document7 pages41 Corporate Accounting May 2022Divyasree DsNo ratings yet

- Let's Practise: Maths Workbook Coursebook 8From EverandLet's Practise: Maths Workbook Coursebook 8No ratings yet

- Rent Rece: t.OOIIDocument1 pageRent Rece: t.OOIIjoshiabhinavaj247No ratings yet

- Ijlr - : Ale Assessee Taken L o R Recovery ofDocument1 pageIjlr - : Ale Assessee Taken L o R Recovery ofjoshiabhinavaj247No ratings yet

- Oross: (11, Aoo:, ::or (B)Document1 pageOross: (11, Aoo:, ::or (B)joshiabhinavaj247No ratings yet

- Assessee: Cent o RentDocument1 pageAssessee: Cent o Rentjoshiabhinavaj247No ratings yet

- Abhinav JoshiDocument8 pagesAbhinav Joshijoshiabhinavaj247No ratings yet

- AbhinavDocument8 pagesAbhinavjoshiabhinavaj247No ratings yet

- Adobe Scan 9 Mar 2024Document7 pagesAdobe Scan 9 Mar 2024joshiabhinavaj247No ratings yet

- Adobe Scan 18 Feb 2024Document10 pagesAdobe Scan 18 Feb 2024joshiabhinavaj247No ratings yet

- Attar Singh Gurmukh Singh. Vs ITO (SC)Document3 pagesAttar Singh Gurmukh Singh. Vs ITO (SC)pcbhandariNo ratings yet

- Payroll Summary For The Month of AugustDocument46 pagesPayroll Summary For The Month of AugustAida MohammedNo ratings yet

- Commerical License 2022-2023Document2 pagesCommerical License 2022-2023Majdi HalikNo ratings yet

- LLQP Quick FormulasDocument2 pagesLLQP Quick FormulasRenato PuentesNo ratings yet

- MCQ On GSTDocument21 pagesMCQ On GSTSanket MhetreNo ratings yet

- I 8233Document5 pagesI 8233How To PsyNo ratings yet

- 124.J & P Services Pty Limited ABNDocument2 pages124.J & P Services Pty Limited ABNFlinders TrusteesNo ratings yet

- Special JournalsDocument2 pagesSpecial JournalsabsidycoNo ratings yet

- Other Percentage Taxes: Title V of The Tax Code, Sections 117 To 127Document17 pagesOther Percentage Taxes: Title V of The Tax Code, Sections 117 To 127zelNo ratings yet

- Boat Rockerz 235V2 With Asap Charging Version 5.0 Bluetooth HeadsetDocument1 pageBoat Rockerz 235V2 With Asap Charging Version 5.0 Bluetooth HeadsetJayNo ratings yet

- Trust Treated As Private Foundation - Open SocietyDocument200 pagesTrust Treated As Private Foundation - Open SocietyMatias SmithNo ratings yet

- CIR v. Team Sual CorporationDocument21 pagesCIR v. Team Sual CorporationAronJamesNo ratings yet

- Account Statement As of 21-03-2020 11:43:46 GMT +0530Document2 pagesAccount Statement As of 21-03-2020 11:43:46 GMT +0530Sourabh MeenaNo ratings yet

- Bos 58983Document20 pagesBos 58983NitzNo ratings yet

- Taxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxDocument10 pagesTaxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxShasharu Fei-fei LimNo ratings yet

- 103 400mDocument2 pages103 400mismail saltanNo ratings yet

- Schedule of Charges 01 12 2020Document24 pagesSchedule of Charges 01 12 2020Marlboro RedNo ratings yet

- PDF Ambit Bill CompressDocument3 pagesPDF Ambit Bill CompressJim ShortNo ratings yet

- Pearson VUE Voucher Sales Order: Bill ToDocument1 pagePearson VUE Voucher Sales Order: Bill ToHendra SoenderskovNo ratings yet

- Outline of Topics Taxation Law Review IvDocument6 pagesOutline of Topics Taxation Law Review IvervingabralagbonNo ratings yet

- FederalFormsResource 2020Document6 pagesFederalFormsResource 2020Soriano GabbyNo ratings yet

- CIR v. Seagate Technology Philippines G.R. No. 153866 February 11, 2005Document3 pagesCIR v. Seagate Technology Philippines G.R. No. 153866 February 11, 2005Marife MinorNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDPrakhar BhargavaNo ratings yet

- State Bank of India - VaibhavDocument1 pageState Bank of India - VaibhavVaibhav GuptaNo ratings yet

- Upselling PolicyDocument2 pagesUpselling PolicyylouihiNo ratings yet

- Rashmi Metaliks Limited: Pay Slip of Employee For December 2020Document1 pageRashmi Metaliks Limited: Pay Slip of Employee For December 2020Uma KoduriNo ratings yet

- IRCTC Bus - Online Bus Ticket Booking - Bus ReservationDocument1 pageIRCTC Bus - Online Bus Ticket Booking - Bus Reservationchaitanya bobbyNo ratings yet

- Account Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanthoshkalpavally cooldudeNo ratings yet

- On October 1 2008 Kristy Gomez Established An Interior DecoratDocument2 pagesOn October 1 2008 Kristy Gomez Established An Interior DecoratAmit PandeyNo ratings yet

Book 4 Apr 2024

Book 4 Apr 2024

Uploaded by

joshiabhinavaj247Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book 4 Apr 2024

Book 4 Apr 2024

Uploaded by

joshiabhinavaj247Copyright:

Available Formats

.

, ncome

such tax are caijed m~nicipal tax Or house' fax ()~

shall be allowed for the tax so paid from GAV but if tax q:

-

If tax has been paid by the tenant,._ in that case tax shall not

Exampk . --:--- __ -_~~_.._w

Duri~g the previous year 2023-24 municipality has levied tdea··,20·()6

In this case, amount allowed to be deducted is , 15,000. In the nQt ...&

t45,000 but the asses~ee has paid t 55,000 which includes ,s,ooo for the

y•·A,f'•

i.if

subsequent year. In this case, amount allowed be deducted in previous yeir

-. . . . ..

J, •

I

I I ' • •

Question 3: Write a note on computation of income of house lying vacant

Answer: House lying vacant for some period Section 23(1)(c)

lOlft for

· ·: :- .• • •. :.• ·~ ·, •.

If the house is partly let out and partly vacant, in such. cases expected rent shall be computed

but while computing rent received /receivable, rent for the period for which the

excluded and fGAV shall be higher of expected rent and rent •received/receiva e

received/receivable 1~ l~an the expected rent owing to vacancy, in that case

shall be gross annual value. e.g. lf expected rent is t20,000 p.m. and rent received/receivable u.~otN

p.m. and there is vacancy for 5 months, in this case GAV shall be the expected rent because even

was no vacancy, still rent received/receivable was less than expected rent. · · - • -• '.

If in this case rent received/receivable is ?25,000 p.m. and it is vacant for 5 months, gross annual value.

be the rent received/receivable because if there was no vac~cy, rent R/R would have been higher

expected rent accordingly in the given case, R/R is lower than expected rent owing to vac3:11cy.

_

l •

. • t I (

' <

' f ,. •

. '' . ,t

,.

•

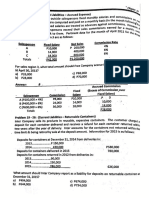

Illustration 4: Com oss annual value in the followin cases for the assessment ear 2024-25:

•Particulars Situation 1 Situation 2 Situation 3 Situation 4

Fair Rent .m. 9,000 13,000 16,000 12,000

Munici al Valuation .m. 10,000 9000 18,000 9,000

Standard Rent .m. 12,000 11,000 16,000 • • 7,000

Rent received/ receivable 7,000 11,500 16,000 ·,' 20,000 I

.m. . ..

Vacanc I month I month 2 months 2 month

Solution:

Situation 1

Computation of Gross Annual Value

(a) Fair Rent _•

(9,000 X 12) '.

, I

(b) Municipal Valuation

(10,000 X 12) ' ,

(c) Higher of (a) or (b)

(d) Standard Rent

(12,000 X 12)

(e) Expected Rent {Lower of (c) or (d)}

(f) Rent Received/Receivable , .-

(7,000 X 11) _ . .-' .. :

If there was no vacancy, in that case rent received/receivable would have been ~7000 x 12 = ~84,000 •:

and it is still less than expected rent, therefore GAV shall be expected rent.

Gross Annual Value

. Situatjon 2

1

Computation of Gross Annual Value

(a) Fair Rent

(13,000 X 12)

(b) Municipal Valuation .' .

1,08 _

(9,000 X 12)

. . ;

.

You might also like

- Unified Tenancy Contract 1.4Document2 pagesUnified Tenancy Contract 1.4Aftab AbbasiNo ratings yet

- Common Core Math 4 Today, Grade 3: Daily Skill PracticeFrom EverandCommon Core Math 4 Today, Grade 3: Daily Skill PracticeRating: 4 out of 5 stars4/5 (1)

- Osmania University LLB Question Papers Semester I PDFDocument54 pagesOsmania University LLB Question Papers Semester I PDFDrRavishankar SirikondaNo ratings yet

- Rent Rece: t.OOIIDocument1 pageRent Rece: t.OOIIjoshiabhinavaj247No ratings yet

- Ijlr - : Ale Assessee Taken L o R Recovery ofDocument1 pageIjlr - : Ale Assessee Taken L o R Recovery ofjoshiabhinavaj247No ratings yet

- Mock Paper 2Document9 pagesMock Paper 2md salmanNo ratings yet

- Practice Multiple Choice Test 5: I.J K IDocument8 pagesPractice Multiple Choice Test 5: I.J K Iapi-3834751No ratings yet

- Adobe Scan 10 Oct 2022Document1 pageAdobe Scan 10 Oct 2022Ttrex DNo ratings yet

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Document1 pageLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoNo ratings yet

- Aravali International SchoolDocument6 pagesAravali International SchoolArsh GuptaNo ratings yet

- Work Together 6-1 6-2 6-3Document1 pageWork Together 6-1 6-2 6-3James SargentNo ratings yet

- Practical AccountingDocument9 pagesPractical Accountingestela revillaNo ratings yet

- Amul Business ModelDocument8 pagesAmul Business ModelSʜʌʜwʌj HʋsʌɩŋNo ratings yet

- AP TA BU TIN Apprai A D: I L DGE G S L Metho SDocument11 pagesAP TA BU TIN Apprai A D: I L DGE G S L Metho SKanha SharmaNo ratings yet

- MTP Accountacy 12thDocument6 pagesMTP Accountacy 12tharsalan123ahmed.comNo ratings yet

- Finnncial AnalysisDocument8 pagesFinnncial Analysisharish chandraNo ratings yet

- FAR.2806-PPE Depn.Document4 pagesFAR.2806-PPE Depn.Kristian ArdoñaNo ratings yet

- !:R.Ir:, L:L :Li:.1F, 1: Trtrffi4$Ffis$$Document1 page!:R.Ir:, L:L :Li:.1F, 1: Trtrffi4$Ffis$$Tiganus ViorelNo ratings yet

- Word Income From House PropertyDocument19 pagesWord Income From House PropertyRathin Banerjee100% (1)

- !!! - A Answer The Round Lu Ignificant Figure .: Questions. 2Document9 pages!!! - A Answer The Round Lu Ignificant Figure .: Questions. 2Xie HangchenNo ratings yet

- Capital Gains WsDocument20 pagesCapital Gains WsDisha Commerce AcademyNo ratings yet

- Tax Planning PapersDocument14 pagesTax Planning PapersPrem ManiNo ratings yet

- ITL Paper Feb 2023Document2 pagesITL Paper Feb 2023Harnoor SinghNo ratings yet

- Corporate AccountsDocument8 pagesCorporate AccountsAmira JNo ratings yet

- L Agreement Document: The Procurement ofDocument65 pagesL Agreement Document: The Procurement ofBishnu Thapa MagarNo ratings yet

- Gaurav Solanki Section E 447 Assingment 3Document10 pagesGaurav Solanki Section E 447 Assingment 3Praveen Singh ChauhanNo ratings yet

- Certificate of Payment: tJ6/IlDocument6 pagesCertificate of Payment: tJ6/IlAjay MedikondaNo ratings yet

- Payback Period ProblemsDocument6 pagesPayback Period ProblemsMohan VeerabomalaNo ratings yet

- Unit 5: Income From House PropertyDocument11 pagesUnit 5: Income From House PropertySiddhant PowleNo ratings yet

- Sol Q6Document4 pagesSol Q6yen c aNo ratings yet

- Cap BudDocument4 pagesCap Budyashikasoni8722No ratings yet

- Fix or Evict? Loan Modifications Return More Value Than ForeclosuresDocument21 pagesFix or Evict? Loan Modifications Return More Value Than ForeclosuresForeclosure FraudNo ratings yet

- Financial ManagementDocument4 pagesFinancial Managementsipun acharyaNo ratings yet

- Adobe Scan 3 Mar 2023 PDFDocument1 pageAdobe Scan 3 Mar 2023 PDFshubham tarmaleNo ratings yet

- Chap 8. The Transportation and Assignment ProblemDocument76 pagesChap 8. The Transportation and Assignment ProblemBhupesh SharmaNo ratings yet

- Csec Poa Paper2 Jan2015Document21 pagesCsec Poa Paper2 Jan2015Rochelle Spaulding100% (1)

- Adobe Scan 09 Mar 2023Document20 pagesAdobe Scan 09 Mar 2023Kanishka DixitNo ratings yet

- Perturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoDocument93 pagesPerturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoJovannyNo ratings yet

- Perturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoDocument69 pagesPerturbation and Projection Methods For Solving DSGE Models: Lawrence J. ChristianoJovannyNo ratings yet

- 2013FinancialAccountingMarch2023RepeatersCBCS202021onwardsDocument8 pages2013FinancialAccountingMarch2023RepeatersCBCS202021onwardstejurathodnaikNo ratings yet

- Cost Management Accounting II-P - VIII - A-32-G - N - 1396Document12 pagesCost Management Accounting II-P - VIII - A-32-G - N - 1396Ashenafi ZelekeNo ratings yet

- Solving Trigonometric EquationsDocument6 pagesSolving Trigonometric EquationsJerry FoliasNo ratings yet

- Project Management NotesDocument3 pagesProject Management NotesAtiqullah sherzadNo ratings yet

- Management Accounting764 eVyE8h3I7eDocument3 pagesManagement Accounting764 eVyE8h3I7eABHINAV AGRAWALNo ratings yet

- Assignment-2: Submitted By: Name: Vipul Kumar Singh Roll No: 133118 Submitted To: Prof. Kuldeep BaishyaDocument4 pagesAssignment-2: Submitted By: Name: Vipul Kumar Singh Roll No: 133118 Submitted To: Prof. Kuldeep BaishyaVipul SinghNo ratings yet

- Ch-3, Setting New Business (Tax Planning)Document67 pagesCh-3, Setting New Business (Tax Planning)poonammadan0001No ratings yet

- Income Tax Previous Year Question PaperDocument3 pagesIncome Tax Previous Year Question PaperPULKITNo ratings yet

- Statement. Mention The Tools of Decision Making. 7 8Document4 pagesStatement. Mention The Tools of Decision Making. 7 8TCB Bhaban Corp. Br.No ratings yet

- Unsloved TVMDocument6 pagesUnsloved TVMMuditNo ratings yet

- Lecture 11 - Determination of Annual Value PDF-converted NewDocument38 pagesLecture 11 - Determination of Annual Value PDF-converted NewK.NALININo ratings yet

- Application of Percentages (1)Document15 pagesApplication of Percentages (1)Vinay KumarNo ratings yet

- Project Management 3Document14 pagesProject Management 3Shraddha BorkarNo ratings yet

- Unit 5: Income From House PropertyDocument11 pagesUnit 5: Income From House PropertySeshanki ChaudhariNo ratings yet

- Bank Recon AssignmentDocument4 pagesBank Recon AssignmentAndrea BreisNo ratings yet

- Applications For Pima County District 3 Supervisor SeatDocument198 pagesApplications For Pima County District 3 Supervisor SeatTucsonSentinelNo ratings yet

- Ilovepdf MergedDocument2 pagesIlovepdf MergedSuman AgarwalNo ratings yet

- Registered Sale Deed: N N JudicialDocument33 pagesRegistered Sale Deed: N N JudicialShoaib KhanNo ratings yet

- Departmental PEQDocument38 pagesDepartmental PEQRishikaNo ratings yet

- 41 Corporate Accounting May 2022Document7 pages41 Corporate Accounting May 2022Divyasree DsNo ratings yet

- Let's Practise: Maths Workbook Coursebook 8From EverandLet's Practise: Maths Workbook Coursebook 8No ratings yet

- Rent Rece: t.OOIIDocument1 pageRent Rece: t.OOIIjoshiabhinavaj247No ratings yet

- Ijlr - : Ale Assessee Taken L o R Recovery ofDocument1 pageIjlr - : Ale Assessee Taken L o R Recovery ofjoshiabhinavaj247No ratings yet

- Oross: (11, Aoo:, ::or (B)Document1 pageOross: (11, Aoo:, ::or (B)joshiabhinavaj247No ratings yet

- Assessee: Cent o RentDocument1 pageAssessee: Cent o Rentjoshiabhinavaj247No ratings yet

- Abhinav JoshiDocument8 pagesAbhinav Joshijoshiabhinavaj247No ratings yet

- AbhinavDocument8 pagesAbhinavjoshiabhinavaj247No ratings yet

- Adobe Scan 9 Mar 2024Document7 pagesAdobe Scan 9 Mar 2024joshiabhinavaj247No ratings yet

- Adobe Scan 18 Feb 2024Document10 pagesAdobe Scan 18 Feb 2024joshiabhinavaj247No ratings yet

- Attar Singh Gurmukh Singh. Vs ITO (SC)Document3 pagesAttar Singh Gurmukh Singh. Vs ITO (SC)pcbhandariNo ratings yet

- Payroll Summary For The Month of AugustDocument46 pagesPayroll Summary For The Month of AugustAida MohammedNo ratings yet

- Commerical License 2022-2023Document2 pagesCommerical License 2022-2023Majdi HalikNo ratings yet

- LLQP Quick FormulasDocument2 pagesLLQP Quick FormulasRenato PuentesNo ratings yet

- MCQ On GSTDocument21 pagesMCQ On GSTSanket MhetreNo ratings yet

- I 8233Document5 pagesI 8233How To PsyNo ratings yet

- 124.J & P Services Pty Limited ABNDocument2 pages124.J & P Services Pty Limited ABNFlinders TrusteesNo ratings yet

- Special JournalsDocument2 pagesSpecial JournalsabsidycoNo ratings yet

- Other Percentage Taxes: Title V of The Tax Code, Sections 117 To 127Document17 pagesOther Percentage Taxes: Title V of The Tax Code, Sections 117 To 127zelNo ratings yet

- Boat Rockerz 235V2 With Asap Charging Version 5.0 Bluetooth HeadsetDocument1 pageBoat Rockerz 235V2 With Asap Charging Version 5.0 Bluetooth HeadsetJayNo ratings yet

- Trust Treated As Private Foundation - Open SocietyDocument200 pagesTrust Treated As Private Foundation - Open SocietyMatias SmithNo ratings yet

- CIR v. Team Sual CorporationDocument21 pagesCIR v. Team Sual CorporationAronJamesNo ratings yet

- Account Statement As of 21-03-2020 11:43:46 GMT +0530Document2 pagesAccount Statement As of 21-03-2020 11:43:46 GMT +0530Sourabh MeenaNo ratings yet

- Bos 58983Document20 pagesBos 58983NitzNo ratings yet

- Taxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxDocument10 pagesTaxable Income Citizenship & Residency Inside RP Outside RP Tax Rate On Certain Passive Income On Citizen and Resident Alien Final TaxShasharu Fei-fei LimNo ratings yet

- 103 400mDocument2 pages103 400mismail saltanNo ratings yet

- Schedule of Charges 01 12 2020Document24 pagesSchedule of Charges 01 12 2020Marlboro RedNo ratings yet

- PDF Ambit Bill CompressDocument3 pagesPDF Ambit Bill CompressJim ShortNo ratings yet

- Pearson VUE Voucher Sales Order: Bill ToDocument1 pagePearson VUE Voucher Sales Order: Bill ToHendra SoenderskovNo ratings yet

- Outline of Topics Taxation Law Review IvDocument6 pagesOutline of Topics Taxation Law Review IvervingabralagbonNo ratings yet

- FederalFormsResource 2020Document6 pagesFederalFormsResource 2020Soriano GabbyNo ratings yet

- CIR v. Seagate Technology Philippines G.R. No. 153866 February 11, 2005Document3 pagesCIR v. Seagate Technology Philippines G.R. No. 153866 February 11, 2005Marife MinorNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDPrakhar BhargavaNo ratings yet

- State Bank of India - VaibhavDocument1 pageState Bank of India - VaibhavVaibhav GuptaNo ratings yet

- Upselling PolicyDocument2 pagesUpselling PolicyylouihiNo ratings yet

- Rashmi Metaliks Limited: Pay Slip of Employee For December 2020Document1 pageRashmi Metaliks Limited: Pay Slip of Employee For December 2020Uma KoduriNo ratings yet

- IRCTC Bus - Online Bus Ticket Booking - Bus ReservationDocument1 pageIRCTC Bus - Online Bus Ticket Booking - Bus Reservationchaitanya bobbyNo ratings yet

- Account Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 3 Aug 2019 To 3 Feb 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanthoshkalpavally cooldudeNo ratings yet

- On October 1 2008 Kristy Gomez Established An Interior DecoratDocument2 pagesOn October 1 2008 Kristy Gomez Established An Interior DecoratAmit PandeyNo ratings yet