Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsSMW2033 - Financial Accounting

SMW2033 - Financial Accounting

Uploaded by

Ridhwan AfiffCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Surat RasmiDocument1 pageSurat RasmiRidhwan AfiffNo ratings yet

- Transcript - 2024 03 26Document100 pagesTranscript - 2024 03 26Ridhwan AfiffNo ratings yet

- Tutorial 2Document2 pagesTutorial 2Ridhwan AfiffNo ratings yet

- Argument EssayDocument1 pageArgument EssayRidhwan AfiffNo ratings yet

- Tutorial 1Document3 pagesTutorial 1Ridhwan AfiffNo ratings yet

- Disagree PointDocument2 pagesDisagree PointRidhwan AfiffNo ratings yet

- Argumentative Essay - Sample 2 - Students Should Spend Less Time Listening To MusicDocument2 pagesArgumentative Essay - Sample 2 - Students Should Spend Less Time Listening To MusicRidhwan AfiffNo ratings yet

SMW2033 - Financial Accounting

SMW2033 - Financial Accounting

Uploaded by

Ridhwan Afiff0 ratings0% found this document useful (0 votes)

6 views8 pagesOriginal Title

SMW2033 - Financial Accounting (2)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

6 views8 pagesSMW2033 - Financial Accounting

SMW2033 - Financial Accounting

Uploaded by

Ridhwan AfiffCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 8

SULIT SMW2033/A181/A

USIM

FINAL EXAMINATION

SEMESTER I, ACADEMIC SESSION 2018/2019

DATE : JANUARY 2019 DURATION : 3 HOURS

SMW2033

FINANCIAL ACCOUNTING

(PERAKAUNAN KEWANGAN)

INSTRUCTIONS TO CANDIDATES:

1, Answer all questions in the answer booklet provided.

2, All answers must be written in English.

3. All answers must be clearly written and readable.

4. Candidates are not allowed to take the question papers out of the

‘examination hall.

5. Please complete your particulars in Borang H

DO NOT OPEN THIS QUESTION PAPER UNTIL YOU ARE INSTRUCTED TO DO SO

This question paper has seven (7) printed pages excluding this cover page ]

HAKCIPTA TERPELIHARA USIM

SULIT

‘SMW2033/A181/A

[100 MARKS]

ANSWER ALL QUESTIONS IN THE ANSWER BOOKLET PROVIDED

1. a)

Explain the following underlying assumptions for the preparation of

financial statements:

i. Monetary unit

(3 marks)

ji, Acorual

(4 marks)

iii, Separate entity

(3 marks)

Explain factors that cause the differences between the balance on the

cashbook and the balance on the bank statement.

(5 marks)

[Total: 15 marks]

At June 30, 2017, Cotton Trading reported the following information on its

statement of financial position.

Account Receivables RMg60,000

Less: Allowance for Doubtful Debts RM 76,800

During July 2017 to June 2018, the company had the following transactions

related to receivables:

Sales on account RM3,700,000

Sales return RM 50,000

Collection of account receivables RM2,810,000

Bad debts written off RM 90,000

HAKCIPTA TERPELIHARA USIM

1

SULIT ‘SMW2033/A181/A

The company maintains the allowance for doubtful debts at 8% of account

receivables,

You are required to

a) Show the journal entries as at 30 June 2018 to record all transactions,

(4 marks)

b) Prepare account receivables and allowance for doubtful debts accounts

for the year ended 30 June 2018.

(8 marks)

c) Show the extract of Statement of Comprehensive Income for the year

ended 30 June 2018,

(2 marks)

d) Show the extract of Statement of Financial Position as at 30 June 2018,

(2 marks)

[Total: 16 marks]

HAKCIPTA TERPELIHARA USIM

2

‘SULIT

a)

‘SMW2033/A181/A

By giving an example, analyse the impact of FOB (free on board)

shipping point term and FOB (free on board) destination term on

inventory amount if the goods are transit on the last day of accounting

year.

(8 marks)

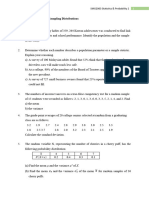

Jaya Mas Trading uses periodic inventory system. Its records show the

following for the month of September.

Units Unit Cost

September 1 Inventory 140 RM65.00

8 Purchase 100 RM70.00

12 Purchase 80 RM72.50

18 Sales 125 RM90.00

22 Sales 50 RM92.00

Calculate cost of goods sold and ending inventory using

(FIFO) method and Weighted Average method.

n, first-out

(13 marks)

[Total: 21 marks]

HAKCIPTA TERPELIHARA USIM

3

SULIT

‘SMW2033/A181/A

4. The following trial balance has been extracted from the ledger of Restu Bonda

Sdn. Bhd. on 30 September 2018,

RESTU BONDA SDN.BHD

Trial Balance as at 30 September 2018

‘Account Name Debit (RM) | Credit (RM)

Cash 20,700 |

‘Account Receivable 30,700

| Office Suppies 44,700

Equipment ~ 133,000

Accumulated Depreciation- Equipment | 47,800

Van 120,000

‘Accumulated Depreciation- Van 24,000

Notes Payable 60,000

‘Account payable 48,500

Capital 720,000

Drawings 12,000

Sales 763,400

[Purchase 456,000

| Retum inwards 8800

Retum Outwards 4,700

[Inventory on 1 October 2017 —~—~—=~S~SCS*«S 2,000

Maintenance and Repair Expense 12,100

Utilities Expense 74,000

Salaries and Wages Expense 140,000 |

Advertising Expense 24,400

Additional information as at 30 September 2018:

* Stock on 30 September 2018 was valued at RM57,300.

* Interest of RM3,800 is accrued on notes payable.

HAKCIPTA TERPELIHARA USIM

4

SULIT

b)

SMW2033/A181/A

+ Unused Office Supplies at the end of 30 September 2018 is RM

2,600.

* —_RM1,200 of utilities charges have not been paid and not yet

recorded for the current year.

* Equipment was depreciated at 20% reducing balance while van

was depreciated at 20% of the cost each year.

Prepare the necessary adjusting entries in the general journal

(8 marks)

Prepare the statement of comprehensive income for Restu Bonda for the

year ended 30 September 2018.

(13 marks)

Prepare the statement of financial position for Restu Bonda as at 30

September 2018.

(13 marks)

[Total: 34 marks]

HAKCIPTA TERPELIHARA USIM

5

SULIT

‘SMW2033/A181/A

Juara Cookies Enterprise is a manufacturing firm producing cookies owned by

En, Bakar. It produces cookies in a small factory build next to En. Bakar house,

which is also doubled as its administrative office, The followings are the costs

and expenses that it incurred in June 2018 to produce 180,000 packs of

cookies,

RM

Factory utilities 650

Depreciation on factory machines 100

Depreciation on delivery trucks 832

Factory supervisor's salary 2,500

‘Administrative manager's salary 4,000

Indirect materials used 5,000

Direct materials used 38,600 |

Factory manager's salary 4,000 |

Direct labours’ wages 75,000

Selling and marketing expenses 7500 |

Repairs to office equipment 360

Repairs to factory machines ee 750]

Advertising 7,200

Office supplies used 12

Office phone bills 344

From the above information, calculate for Juara Cookies Enterprise the

following costs for June 2018:

i conversion costs

i, prime costs

iii period costs

iv. products costs

v. total manufacturing costs

vi. total non-manutacturing costs

HAKCIPTA TERPELIHARA USIM

6

(12 marks)

SULIT ‘SMW2033/A181/A

b) How much does it cost Juara Cookies Enterprise to produce one pack of

cookies?

(2 marks)

[Total: 14 marks]

END OF QUESTIONS

Dicetak oleh

Unit Peperksaan dan Pengiiazehan

Bahagian Pengurusan Akadernik

Universiti Sains Islam Malaysia,

HAKCIPTA TERPELIHARA USIM

7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Surat RasmiDocument1 pageSurat RasmiRidhwan AfiffNo ratings yet

- Transcript - 2024 03 26Document100 pagesTranscript - 2024 03 26Ridhwan AfiffNo ratings yet

- Tutorial 2Document2 pagesTutorial 2Ridhwan AfiffNo ratings yet

- Argument EssayDocument1 pageArgument EssayRidhwan AfiffNo ratings yet

- Tutorial 1Document3 pagesTutorial 1Ridhwan AfiffNo ratings yet

- Disagree PointDocument2 pagesDisagree PointRidhwan AfiffNo ratings yet

- Argumentative Essay - Sample 2 - Students Should Spend Less Time Listening To MusicDocument2 pagesArgumentative Essay - Sample 2 - Students Should Spend Less Time Listening To MusicRidhwan AfiffNo ratings yet