Professional Documents

Culture Documents

Mar 2023

Mar 2023

Uploaded by

gaurav sharma0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

99018037_MAR_2023

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageMar 2023

Mar 2023

Uploaded by

gaurav sharmaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

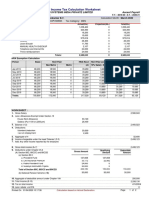

Canara HSBC LIfe Insurance Company Limited PAYSLIP FOR : MAR-2023

Employee Code 99018037 Employee Name GEETANJALI DWIVEDI

Gender Female Date of Joining 04 Mar 2022

Designation SENIOR RELATIONSHIP OFFICER Location DELHI

PAN ASZPD6508P Bank Name CANARA

Bank A/c No 110046448124 PF No. GNGGN00293350000027831

PF UAN 101803205211 Department SALES-RETAIL

Career Level 8 Cost Centre SALES-RETAIL (1601)

Worked Days 31 Standard Days 31

Earnings Standard Monthly Arrears Total Deductions Amount

BASIC 15,000.00 15,000.00 15,000.00 PROVIDENT FUND 1,800.00

HOUSE RENT ALLOWANCE 7,500.00 7,500.00 7,500.00 INCOME TAX 36,279.00

SUPPLEMENTARY

2,811.83 2,812.00 2,812.00

ALLOWANCE

STATUTORY BONUS 3,000.00 3,000.00 3,000.00

MOBILE ALLOWANCE 500.00 500.00 500.00

INCENTIVE 0.00 141,372.00 141,372.00

CONTEST 0.00 3,000.00 3,000.00

Gross Pay 173,184.00 173,184.00 Gross Deduction 38,079.00

Net Pay 135,105.00

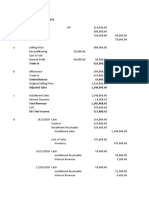

Income Tax Computation for the Financial Year 2022-2023

I Earnings A Section 80C

ANNUAL BASIC 1,80,000.00 PROVIDENT FUND 21,600.00

ANNUAL HRA 90,000.00 TOTAL INVESTMENTS 21,600.00

LESS : TOTAL DEDUCTION U/S

ANN SUPP ALLOWANCE 33,744.00 21,600.00

80C

B Other Deductions Under

MOBILE ALLOWANCE 6,000.00

Chapter VI A:

INCENTIVE 4,39,839.00 TOTAL TAXABLE INCOME 7,51,990.00

STAT BONUS 36,000.00 TAX 62,898.00

SALES CONTEST 38,000.00 TAX AFTER REBATE 62,898.00

GROSS INCOME 8,23,583.00 TAX AFTER SURCHARGE 62,898.00

II Less : Exempt US 10 CESS 2,516.00

Sec 10 Exemption TOTAL TAX 65,414.00

TOTAL EXEMPTIONS U/S 10 8,23,583.00 TAX DEDUCTED TILL DATE 29,135.00

III Less : Deductions US 16 TAX PAYABLE 36,279.00

STANDARD DEDUCTION 50,000.00 HRA Exemption

SALARY AFTER SEC16 7,73,583.00 Other Perquisites and Tax

IV Other Income Reported By

Employee

TAXABLE SALARY 7,73,583.00

** This is a computer generated payslip and does not require signature and stamp.

You might also like

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- The Vertical Dimension in Prosthesis and Orthognathodontics PDFDocument380 pagesThe Vertical Dimension in Prosthesis and Orthognathodontics PDFPatri Meisaros100% (1)

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Matdip301 Advanced Mathematics-IDocument2 pagesMatdip301 Advanced Mathematics-IHari PrasadNo ratings yet

- Apr 2023Document1 pageApr 2023gaurav sharmaNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- 251677202212salaryslip - PDF DecDocument2 pages251677202212salaryslip - PDF Decsaurabhm12343No ratings yet

- Laporan KeuanganDocument3 pagesLaporan KeuanganSiska AnggrainiNo ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- Statement-of-Receipts-and-Expenditures-FDPP-FORM-3Document5 pagesStatement-of-Receipts-and-Expenditures-FDPP-FORM-3Jesson EniegoNo ratings yet

- VRCM9179 Feb 2023Document1 pageVRCM9179 Feb 2023Alluzz AmiNo ratings yet

- Payslip May 2024Document1 pagePayslip May 2024ravi.ramana64No ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- Payslip SepDocument1 pagePayslip SepBrajesh PandeyNo ratings yet

- Payslip Mar 2024Document1 pagePayslip Mar 2024simplycreated931No ratings yet

- Greytip Software PVT LTD: Payslip For The Month of April - 2021Document1 pageGreytip Software PVT LTD: Payslip For The Month of April - 2021vigneshNo ratings yet

- M/S Lucky Nursing Bureau: Balance Sheet As On 31/3/08 Liabilities Amount Amount Assets Amount AmountDocument3 pagesM/S Lucky Nursing Bureau: Balance Sheet As On 31/3/08 Liabilities Amount Amount Assets Amount Amountkumarjmt7427No ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- Web Payslip 266675 202305Document2 pagesWeb Payslip 266675 202305prabhat.finnproNo ratings yet

- Pay SlipsDocument6 pagesPay Slipsshubneet775No ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- Runi 1816Document1 pageRuni 1816Harsh JasaniNo ratings yet

- COMPDocument2 pagesCOMPSairishi GhoshNo ratings yet

- I Mumd44312Document1 pageI Mumd44312dbind1999No ratings yet

- File2707202312075557Document3 pagesFile2707202312075557Ankit ShuklaNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Mitali Garg E01392Document1 pageMitali Garg E01392Mitali GargNo ratings yet

- Bikash Kirtania 2023Document3 pagesBikash Kirtania 2023jaiswalv629057No ratings yet

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- Payslip Feb 2024Document2 pagesPayslip Feb 2024sweta.work24No ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Tradecoms ITR Balancesheet 20-21Document6 pagesTradecoms ITR Balancesheet 20-21Abhishek Kr SinghNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- Shesnath ChowdharyDocument8 pagesShesnath ChowdharyCA Saurabh SrivastavaNo ratings yet

- Payslip May 2024Document1 pagePayslip May 2024simplycreated931No ratings yet

- DownloadDocument1 pageDownloadAnimesh JenaNo ratings yet

- Malarmangai 2021-2022Document10 pagesMalarmangai 2021-2022Karthick KumarNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- Web Payslip 266675 202308Document2 pagesWeb Payslip 266675 202308prabhat.finnproNo ratings yet

- May - 2023 2024 4 PDFDocument1 pageMay - 2023 2024 4 PDFdrangulasaiNo ratings yet

- Kertas Kerja - UTSDocument10 pagesKertas Kerja - UTSAlviana RenoNo ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- Aug PDFDocument1 pageAug PDFRNo ratings yet

- Gane 1824Document1 pageGane 1824govindansanNo ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- 12 - January 2024 PayslipDocument1 page12 - January 2024 PayslipaigbevascoNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- Fiserv November SalaryDocument1 pageFiserv November SalarySiddharthNo ratings yet

- May - 2023 2024 3Document1 pageMay - 2023 2024 3drangulasaiNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- C Statment - Ivan Maleakhi - Aug 2020Document4 pagesC Statment - Ivan Maleakhi - Aug 2020Budi ArtantoNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- SalarySlip MarchDocument2 pagesSalarySlip Marchseenasrinivas113No ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Payslip For The Month of May 2020: Earnings DeductionsDocument1 pagePayslip For The Month of May 2020: Earnings DeductionsRNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sep2023 (1) - RemovedDocument4 pagesSep2023 (1) - Removedgaurav sharmaNo ratings yet

- TRFT000906 Jul 2023181022 B9Document1 pageTRFT000906 Jul 2023181022 B9gaurav sharmaNo ratings yet

- Jeyakumar PancardDocument1 pageJeyakumar Pancardgaurav sharmaNo ratings yet

- Lisia Maity Wealthaspire 45338 1707822642358Document9 pagesLisia Maity Wealthaspire 45338 1707822642358gaurav sharmaNo ratings yet

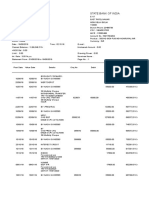

- Tax Certificate - 008857356 - 161253Document1 pageTax Certificate - 008857356 - 161253gaurav sharmaNo ratings yet

- Premium Due Certificate - 009403096 - 11150Document1 pagePremium Due Certificate - 009403096 - 11150gaurav sharmaNo ratings yet

- 5030XXXXDocument1 page5030XXXXgaurav sharmaNo ratings yet

- Education CertificateDocument2 pagesEducation Certificategaurav sharmaNo ratings yet

- Tele PerformanceDocument3 pagesTele Performancegaurav sharmaNo ratings yet

- Gip 202212021333106Document3 pagesGip 202212021333106gaurav sharmaNo ratings yet

- Call Ba0Document8 pagesCall Ba0gaurav sharmaNo ratings yet

- Gaurav SharmaDocument4 pagesGaurav Sharmagaurav sharmaNo ratings yet

- How To Read and Understand This Benefit Illustration?: Date: Proposal NoDocument2 pagesHow To Read and Understand This Benefit Illustration?: Date: Proposal Nogaurav sharmaNo ratings yet

- Statement of Account: State Bank of IndiaDocument2 pagesStatement of Account: State Bank of Indiagaurav sharmaNo ratings yet

- Billl DhijDocument1 pageBilll Dhijgaurav sharmaNo ratings yet

- Suzhou Singapore International School: Area of Interaction: Product / Outcome: SpecificationsDocument36 pagesSuzhou Singapore International School: Area of Interaction: Product / Outcome: SpecificationsMatt RobergeNo ratings yet

- Family Biz BibleDocument26 pagesFamily Biz BibleFrank ParrNo ratings yet

- Laura Su ResumeDocument1 pageLaura Su Resumeapi-280311314No ratings yet

- Impact of Artificial Intellgence in Education SectorDocument9 pagesImpact of Artificial Intellgence in Education Sectorsravi271No ratings yet

- DLL Quarter 3 Week 10 SCIENCE 3Document3 pagesDLL Quarter 3 Week 10 SCIENCE 3Cherry ursuaNo ratings yet

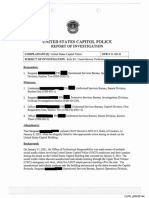

- Capd 000000144Document83 pagesCapd 000000144Capitol Breach DiscoveryNo ratings yet

- Biology, Ecology, and Management of The Pea Weevil, Bruchus Pisorum (Coleoptera: Chrysomelidae)Document12 pagesBiology, Ecology, and Management of The Pea Weevil, Bruchus Pisorum (Coleoptera: Chrysomelidae)Alexandra-Ana-Maria VulpeNo ratings yet

- Coldharbour/Wrotham Road GravesendDocument28 pagesColdharbour/Wrotham Road GravesendWessex ArchaeologyNo ratings yet

- Manual Serviço - Aiwa NSX-D77, NSX-T76, NSX-T77Document48 pagesManual Serviço - Aiwa NSX-D77, NSX-T76, NSX-T77fabioferraoNo ratings yet

- Module 1: Authentic Assessment in The ClassroomDocument10 pagesModule 1: Authentic Assessment in The ClassroomSir Log100% (1)

- Coordinated Tuning of Synchronous Generator Controllers For Power Oscillation DampingDocument6 pagesCoordinated Tuning of Synchronous Generator Controllers For Power Oscillation DampingMohammed SellamiNo ratings yet

- CIV2037F Additional QuestionsDocument3 pagesCIV2037F Additional QuestionsquikgoldNo ratings yet

- Love Marriage Vs Arranged Marriage EssayDocument8 pagesLove Marriage Vs Arranged Marriage Essayezmt6r5c100% (1)

- 510 - Sps Vega vs. SSS, 20 Sept 2010Document2 pages510 - Sps Vega vs. SSS, 20 Sept 2010anaNo ratings yet

- March/April 2016 Cadillac Area Business MagazineDocument16 pagesMarch/April 2016 Cadillac Area Business MagazineCadillac Area Chamber of CommerceNo ratings yet

- Entrepreneurship Summative Test Q1Document3 pagesEntrepreneurship Summative Test Q1urhenNo ratings yet

- Cinnamon Contact StomatitisDocument2 pagesCinnamon Contact StomatitisDwiNo ratings yet

- EXPERIMENTAL - PDF (Journal Article)Document10 pagesEXPERIMENTAL - PDF (Journal Article)Jeric C. ManaliliNo ratings yet

- NDT Basics GuideDocument29 pagesNDT Basics Guideravindra_jivaniNo ratings yet

- Guía Express TOEFL iBTDocument21 pagesGuía Express TOEFL iBTJordan Raji JrLcNo ratings yet

- The Mavericks MNIT 1st Year 2022-23Document3 pagesThe Mavericks MNIT 1st Year 2022-23Shantul KhandelwalNo ratings yet

- AVCN1 Full BDocument395 pagesAVCN1 Full BPhương TrungNo ratings yet

- Jurnal - Asmawati - E321192152 .Document11 pagesJurnal - Asmawati - E321192152 .Nurul fuadiNo ratings yet

- Ce - HydrologyDocument9 pagesCe - HydrologyMadelyn MorilloNo ratings yet

- Chapter 3 - Entity Relationship ModellingDocument34 pagesChapter 3 - Entity Relationship ModellingShrawan Trivedi100% (1)

- Lecture3-Inode Table Content and InodeConversionDocument33 pagesLecture3-Inode Table Content and InodeConversionYaminiNo ratings yet

- Idose4 - Whitepaper - Technical - Low Res - PDF Nodeid 8432599&vernum - 2 PDFDocument40 pagesIdose4 - Whitepaper - Technical - Low Res - PDF Nodeid 8432599&vernum - 2 PDFOmarah AbdalqaderNo ratings yet

- Hotel Revenue Projection Template V 1.1Document3 pagesHotel Revenue Projection Template V 1.1Viaggi Nel MondoNo ratings yet