Professional Documents

Culture Documents

Scan1 Compressed

Scan1 Compressed

Uploaded by

Mohammad ArsHad0 ratings0% found this document useful (0 votes)

9 views11 pagesddd

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentddd

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

9 views11 pagesScan1 Compressed

Scan1 Compressed

Uploaded by

Mohammad ArsHadddd

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 11

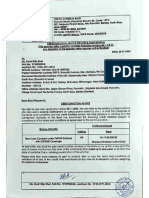

INDIAN OVERSEAS BANK

Socorro Serula (Porvorim) Branch (Br. Code: 1971)

481, Mopuca Panlim Road, Alto Porvorim, Bardez, North Goo,

efen ote Sie ose-baraone, 418061

ipeisn Oberobe: ae IF Code: 10BA0001971,

‘@-mall: lob1971@i0b,In, MICR Code: 403020015

‘Aadhoar No: 5192-3771-0918

UDYAM.Aadhaar : UDYAM- GA-01-0007542

Present Residential Address: BSF-3, Samarth Enclave, Ella, Old Goo, Pin Code 403402(Rented).

Peimanent Residential Address: H No §30, Dazarwada Near Vithoba Temple, Marcel, Margao

‘South Goa (Parental-in Laws)

Aadhaar Address: B15/2, B MC Colony, M.G road, Mithanagar, Near | Datta Mandir,

Mumbai - 400104,

Office Address: Reva Star, Upper Ground Floor, Porvorim, Opposite Goa Board. Porvorim,

‘Village Panchayat Penha De France, North Goa, Bardez (Rented).

Dear Sir(s)/Madamis),

(CREDIT SANCTION ADVICE

We refer to your loan application dated 30.11.2023. We also refer to the related correspondence

‘iid discussions seeking clarifications on various points raised by you / us and the consensus of

the terms and conditions ond the credit facilities arrived. We take pleasure in advising that the

‘Competent Authority of the Bank has sanctioned the following credit facilities subject to

‘compliance of the terms and conditions as appended to this communication.

Limits sanctioned

Nature of facility.

Exiting Frosh

Term Loan Covered under PMEGP Scheme | Nil s.19,00,000.00

men ceTe= Cover upees Nineteen Lakhs Oniy)

‘Asand when you avail the soid credit facilities, renewal of the limits at our option is due () at the

‘end of twelve months from the date of this communication (valid up to one year) or (I) from the

date of our letter, if any, advising revalidation of this sanction.

Please note that bank reserves its right to amend, alter or vary the terms and conditions or

‘withdraw all or any of the credit limits sanctioned at any time at its discretion without assigning

‘ony reasons whatsoever,

Please arrange to comply with the terms and conditions of the above sanction as detailed in the

‘Annexure |, Il & land execute the necessary securlty documents upon completion of which the

limits shall become operative,

This sanction advice It being delivered to you in duplicate along with the annexures. Kindly

retum the duplicate copy of this

duly signed on all pages by you as also by the token of your acceptance of Credit

‘We are thankful to the bank for providing clarifications sought by us regarding this sanction. We

‘are fully satisfied with and accept the terms and conditions of sanction of the credit facilities

stipulated above by the bank as the same were artived at by consensus after discussions and

receiving clatfications,

‘Signature of all the borrower ‘Signature of all Guarantors

with date With name and date.

Pa

pate: 25 Jor Ja

pee

Mis, Swali Dilip Bhat, PAN No: BYWPBS533L, Aadhaar No: 5192-3771-0918

ANNEXURE =

Nature of faci ‘Amount Security and secufty value

Hypothecation of REM and AUDIOMETER

‘COMBO, Make: Interaacoutic, Model:

Affinity with speaker and Vedio Otoscope to

be purchased from M/s, Medible

Technologies.

Hypothecation of Product: SERA with ABRIS

‘and screening OAE (both DP and TE) & Alo:

Access & Product: MT10 with Handheld

Term Loan Covered Rs.19,00,000.00 | screening impedance incl. Reflex

under PMEGP Scheme | @upees Nineteen | ™eesurements + PC inlgration Including

with CGIMSE Coverage | ““PSirsonyy "| Diagnostic Suite Sync + Thermal Printer fo be

purchased from M/s, Otlc Hearing Solutions

Puig.

= Hypothecation of Interior Designing Product

tobe purchased from Aryana Design Studio

Hypothecation of Entire stocks of RM / WIP /

FG and Book Debts of the firm in present and

future.

) Collateral: NIL as covered under CGTMSE - CREDIT GUARANTEE SCHEME

c) Guarantees: Nil as covered under CGTMSE - CREDIT GUARANTEE SCHEME

Details of Corporate Guarantee, if any: Not applicable

@ Coverage in ECIB (ECGC) / CGTMSE: Not applicable

B. MARGIN: (for each type of facility)

Term Loan Covered under PMEGP Scheme with | 5% As per PMEGP Scheme with 35%

CGIMSE Coverage Margin Subsidy provided by the Central

Govt Portal.

b) Cash Credit / Packing Credit:

Particulars ‘As per Existing sanction AS per Proposed sanction

Not applicable

Receivables NA NA

MCC / CC-ETF

Particulars | As per Existing sanction — [is erigeredsato

==

©) Bits:

Particulars | As per

@) Non Fund Based limits:

Particulars ‘As per Existing sanction ‘As per Proposed sanction

Letter of Credit ‘Not applicable

Letter of Guarantee ‘Not applicable

Others ‘Not applicable

. RATE OF INTEREST: Gor each type of fociity

Typecolfactty_| Aspe tnsing snetion Ai pei Hopored sanction

Sonat 7] RUN LOTIOR 6 1798 T0.11.1oKpO

Ame Score "A

“

_ PRCSTMSE -

Packing Credit

‘Bins Not applicable

© The concession In Interest rale / charges allowed, if any, shail be available only fil the

‘validity of the current extemal rating and in case of revalidation, itis subject to same/better

rating ls obtoined and at the discretion of the bank.

+ Interest rate Is subject to revision/Increase and the periodical change in the benchmark

‘ate will be displayed in the Bank's website trom time fo time.

D. OTHER CHARGES:, é 2 ‘

t . t “ be

oy Pabe toesd RRT ees face Soe onalahet Tefunded even if you do not

toke up {he limits, revalidate the fonction or foteciose the loan / fociliies. Details Of these

‘os unde

‘of Procatsng GI

Ly (a ‘As tpblicable,

|__Gomse schefte__

b) Applicable Documentation chafges fo be paid.

©) Applicable consumer and commercial CisIL chdtges to be tecovered.

@) Exchange and cothmission as per the Bank's guidelines as detailed hereunder shall be

recovered,

Nature of Scheme a Saiset

4 Sane Beret Not

Blls=Foreign _. _...._ | Not plicable. Ee 4

Letter of Credit = inland

Not appicable|

Letter of Credit = Forelan Not applicable

Letter of Guarantee: Not applicable

©) Commitment charges of 0.50% will be charged on unutilzed portion of working capital facility

subject to tolerance level of +/-20% for each limit.

{). REPAYMENT SCHEDULE: (for each type of facility)

‘Nature of Facility | Repayment Terms

Term Loan Covered | The Term Loan will be paid in S1EMI of Rs.33,436.00 with 3 Months

under PMEGP Holiday Period with Interest Serving.

‘Scheme with

CGTMSE

G. INSURANCE:

‘Al the secutities both prime and collateral shall be comprehensively insured against fe, strikes.

fiots and ciMi commotion, malicious damage, burglary and other risks as may be deemed

necessary by the Bank, Insurance cover to be preferably obtained from Universal Sompo

General Insurance Co. Ltd., If the rates ore competitive.

H. INSPECTION:

‘Ms. Swail Dilip Bhat, PAN No: BYWPBS5331, Aadhaar No: §192-3771-0918

Ronat Cl Secures shal be Inspected monttYy by the Crectt Officer and quortery

recente. Inspection charges a1 per extant guidelines ofthe Bark shell be recovers

Borower id enaure/tacitate tree access to the Uril/ documents/fies for hagection bw tre

»

2

»

»

5)

PRE-RELEASE CONDITIONS;

Ai procedural formatter relating fo lending to irvted Companies should be corres with,

The levis 7 toon wit be released after execution of telated documents ond) crecten of

BPEC and ensure clear and marketable title of the property.

{in gocordance with the Extant Guidelines issued by Credit Support Services Department

CO. os in force complete vetting of documents to be done before release of funds under

Letter of undertaking to be obtained ftom the subjects to bring adequate own funds by

‘way of additional capital / unsecured loans so as to maintain the TOL/TNW and current ratio

‘ot the rates prescribed by the Bank.

Letter of undertaking to be obtained from the company to utilize the credit facilities for the

Purpose for which it is sanctioned and not to indulge in Copital Market and other

‘speculative activities.

Letter of undertaking to be obtoined from the subjects authoring the bank to cancel the

entire sanctioned limit / unavalled portion of the sanctioned limit without assigning any

reasons therefore.

Company to bring in fresh funds into the system towards margin (Upfront). Term loan will be

disbursed to the suppliers directly along with promoter's margin.

OND!

All the formalities for mortgage/creation of charge on securities to be completed including

fegistered memorandum and obtention of upto date Broken Period Encumbrance:

Certificate and latest tax paid receipt.

The sanctioned credit facilities - fresh/enhancement shall be released only upon receipt of

Permission from the competent authority os per the extant intemal guidelines on pre-

felease clearance including vetting of documents.

Mortgage to be registered with CERSA! within the stipulated time.

Our Charge on the secutiies of the Company has to be fled with ROC within the

Prescribed period and search certificate would be obtained for vatification at the cost of

the borrower.

Valuation reports from 2 approved Valuers to be obtained prior to release of limits, in case,

the variation between the two Is more than 10%, 3 valuation report from another Valuer

from the panel to be obtained.

Ms, Swatt Dilip Bhat, PAN No: BYWPBSS33L, Aadhaar No: 6192-3771-0918

6) Stipulation on capital infusion or conversion of unsecured debt fo equity or withdrawal of

unsecured debt out of the business (wherever applicable).

7) Other significant terms, if any (as stipulated by the sanctioning authority)

8) In accordance with RBI Guidelines, all credit exposures of Rs.6 ctore and above to periodic

legal audit and re-verification of tie deeds with relevant authorities as part of regular audit

‘exercise til the loan stands fully repaid. Accordingly In applicable cases, Legal Audit will be

Conducted at borower's cost:

9 Branch shall implement such of those latest Instructions as approved by the Board/MCB

‘and duy circulated by the Central Office and the new guidelines introduced with respect

toloan documentation, between the date of sanction and the date of availment,

10) Notwithstanding anything contained in the Sanction TERMS, THE Bank at any point of time

reserves the absolute right to cancel the limits (either fully or partially) unconditionally

without prior notice (a) In case of borrower's credit worthiness and/or (b) in case of non-

‘compliance of terms and conditions of the Sanction and/or (c) in case of the limits/ part of

+ the limits are not utilized by you.

oor

OTHER TERMS AND CONDITIONS OF SANCTION LETTER DATED 25.01.2024

1. Right of Recall:

‘@)ihe credit facility should be utlized for the specific purpose for which the same has been

sanctioned and if the bank has reason fo believe that the borrower has violated, or

‘apprehends that the borrower s about to violate the said conditions the Bank shall have

the option to exercise its right to recall the entire loan or any part thereof at once, in

‘addition to its right to withdraw the undrawn limits, notwithstanding anything contrary

contained in this Sanction Advice,

byt is affirmed that this ight Is without prejudice to the Bank's right to demand the Loan

‘amount for violation of other terms and conditions of the sanction and/or the terms

reflected in the loan/ security documents to be executed by the borrower.

2. The referred credit facilty is extended solely at the Bank's discretion. In addition to what is

stated in point 1, the Bank reserves the right to withdraw partially/wholly or regulate such

credit faciity on the occurrence of any one of the following events of the Borrower:

1. Non-compliance with terms and conditions of sanction

|, Induiging in drawings beyond the sanctioned limits

I, Issuing cheques for purposes other than specifically agreed

IV. indulging in large cash withdrawals not commensurate with the requirements

‘estimated,

ANINEXURE ~ I

V. _Indulging in activities, which ore detrimental fo the image/ interest of the Bank viz.

cts that are unlawful, malofide etc.

VI. Deterioration in the conduct of accounts/faclties In any manner whatsoever.

3. Deterrents for defoutt:

{)In terms of directives in force now or as may be modified from time to time, default in

repayment of instalments and/or servicing of interest for a notified period automatically

results In categorization of all borowal accounts as Non-Performing Asset (NPA), Such

categorization renders the borrower ineligible from seeking (1) Additional/Ad-hoc credit

Cy

Ms. Swaii Dilip Bhat, PAN No: BYWPB5S331, Aadhaar No: 5192-3771-0918

foclities (Fund Based and/or Non-fund based), (i) Waiver of overdue interest and Gi)

Soft recovery measures.

4. Bank is under no obligation to consider the request of the borrower, if any, for adcitional

Credit facilty(es) without a comprehensive review of the existing credit mits, operations in

the accounts and past performance in meeting commitments such as servicing of interest

charged to the Loan accounts), repayment of Loan instalments, prompt subrrission of

stocksstatements, upkeep of records and books of accounts, upkeep of machinery

financed, honouring commitments under LC/LG promptly etc., a8 applicable to the purpose

tor which credit facilty has been extended.

&. In the event of the borowal account being overdiawn without prior agreement or

‘exceeding the agreed borrowing limit of in the event of delay / non-subrrission of stock

statement, the bank shall charge overdue interest at the rates specified from time to time,

6. If cudited financials and certified stock statement as on 31st March of every year are not

submitted before 31st October, o penalty of additional interest of 1% shall be levied from Ist

November til the date of submission.

7. In case devolvement of LCs has taken piace consecutively for 2 times, all concessions

cllowed shall be withdrawn and applicable charges as per the rating and circulars in force:

‘shall be charged for the LC limit.

& Revision in RLIR Rate and charging of interest:

{In case of borowal accounts where Interest rate Is linked to RLLR (Repo Rate based

Lending Rate) or where fixed interest rate is specified by the Bank, changes if any, in

the Bank's RLLR and/or fixed rate specified by the Bank, shall be conveyed through

Press Report or Publicity through media or a suitable ‘Notice’ placed in the banking hat

‘of the branch and such mode of communication shall be construed as sufficient

‘Notice" to the borrower about the revisions effected in the interest rates.

'b) The applicable interest rate/s will be charged with monthly, or such other rests as may

be notified by the Bank from time to time.

©) The interest will be calculated and charged as per the daily balances, to the borrowal

‘account/s until the same is fully liquidated and the interest so charged will be paid by

the borrower as per the terms agreed or as and when demanded by the Bank.

9. Prepayment of facilities: Prepayment of your borrowal accounts will be subject to the

Tecovery of charges at the discretion of the Bank.

10. Copies of loan documents to be executed by the borrower for the credit facility (jes)

referred herein, will be provided at his/her/their cost, on receipt of a specific request to the

undersigned in writing.

11. End use of funds: Upon availment of credit facility on terms agreed, the borrower has to

produce necessary documentary evidence for end-use and facilitate verification by the

Bonk. As and when called for, a certificate from their Auditor regarding end-use of the loan

availed should be produced to the Bank.

2. Disclosure clause: All the borrowal accounts with our Branch/ Bank will be subjected to the

‘application of disclosure- norms prescribed by RBI.

13. A. CIC Clause: The information / data pertaining to all the borrowal accounts shall be

fumished to Credit Inforrnation Companies such as Credit Information Bureau of India

Limited (CIBIL) and other Agencies / Authorities, from time to time in terms of mandatory

provisions in force.

B. Information Utility Clause: Financial information pertaining to all the borrowal accounts

shall be submitted to Information Utility (jes) in terms of the Insolvency and Bankruptcy

Code, 2016, insolvency and Bankruptcy Board of India. (Information Utilities) Regulations,

2017 and under the terms ahd conditions and applicable Bye-Laws of the Information Utility

of the choice of indian Overseas Bank. Such Information submitted by indian Overseas

Bank from time to time shall be verified and authenticated from time to time by the

‘borrower(s)/ guarantor(s) in the mode and within the time prescribed by the Information

A

Ms. Swall Dilip Bhat, PAN No; BYWPBS5331, Aadhoar No: 192-3771-0918

utilty. Applicable charges shal be bome by the borrower falling which the same is

recoverable ftom the guaran

‘) This credit sanction is valld for an avaliment period of sx months from the date of this

‘communication. Unless availed within six months, this sanction requires revalidation by

the Sanctioning Authority.

'b)When the necessity for revalidation arises, the borrower has to submit a written request-

Jetter to the branch furnishing the key financial parameters and the reasons for non-

‘volment of credit facies even after lapse of six months from the date of this

communication, Such request for revalidation will be evaluated by the Sanctioning

‘Authority ond the validation of availment - period of sanction or otherwise wil be

‘communicated to the borrower. It isto be noted that request for revalidation of sanction

willbe entertained only once.

Porticulars Vaiicity

‘Any Fresh / Enhanced Term | For avalment: 6 months

Loan / Working Capital ond

+ | !Non Fund Based faciities

‘Al facilities Including existing |To be renewed/reviewed once in 12 months. The

‘ond now sanctioned | borrower fo submit necessary papers / documents /

focilties financial statements, etc. at the end of 10" month

from the date of this sanction for ensuring timely

renewal. Any delay wil attract penal interest

15. KYC

)In terms of directives of RBI currently in force, KYC (Know Your Customer) guidelines are

‘applicable and the requifed personal information / data as and when sought by the

Bank should be furnished. ?

'b)In case the borrower is a Company falling under the purview of the Companies Act, the

release of Credit Facilities will be subject to the Company holding valid Corporate

Identity Number (CIN) and all Directors of the Company holding “Director's

Identification Number OIN).

116. Major changes in the constitution of the borrower: Change if any, in the constitution of

borrower, viz Reconstitution of Partnership Fim or conversion of Private Limited Company

into Public Limited Company or changes in Constitution/ Directors, proposals for merger /

tokeover etc, should be advised Immediately to the Bank in writing. The bank has the sole

discretion to accept or reject such reconstitution / conversion / changes and until such

time, the same will have the right to suspend the operation of the limits and in the event, the

Bank does not accept / recognize such reconstitution / conversion / changes, the Bank will

have the right to withdraw the undrawn limits.

¥7. Valuation of stock: The borrower should maintain suitable records to evidence the basis of

quantification /valuation of raw materials, components, workin process and finished goods

charged to the Bank, The bosis of valuation shall be os follows:

@) Raw Materia (RM): at cost or market value whichever is lower

'b) Work-in-Process: at RM value plus approximate direct expenses

) Finished Goods: at cost of production or market value, whichever is lower

18, Valuation report: Valuation report on the properties/machineries charged to the Bank will

be obtained aftesh every 3 years or eartiar of as and when deemed necessary by the Bank

from the Panel Valuers of the Bank at the cost of the borrower.

19. Stock Audit/Credit Audit: In addition to the regular stock inspection

Stock audit and/or Credit Audit will be con. if Guidelines of the Bank

20. Securttisation of Assets charged: The Bank shall have the right to secutitize the secured

Assets and In the event of such secuttsation the Bank Is not bound to send an individual

intimation as to the said securitisation to the borrower and/or guarantor(s).

21. Adverse effects in the conduct of business: The borrower shall keep the Bank Informed of the

happening of any event likely to have substantial effect on thelr profit or business; if, for

instance, monthly production or sales are substantially less than what had been indicated to

the Bank. the borrower will Inform the Bank accordingly, with explanations and the rernedi!

steps proposed to be token.

22, ability of Guarantors: Guorantor/s is/are advised to take notice that the bonk shall have

‘the right to exercise discretion with regard to allowing the loanee to withdraw amount from

‘the loan account over and above the limit sanctioned and the guarantee to be extended

shall cover such an eventuality oso,

1. The Limit s covered under CGTMSE, hence firm has to pay annual guarantee fee without fail

{for continuation of the CGTMSE guarantee.

2. The firm has to submit a undertaking letter that they have obtained all the required prior

‘permission / approvals from government / local governments / other statutory authorities for

tunning his business activity (wherever required) for which loan Is sought and that the

isbursements of the credit facies should be made only after the borrower has obtained

Tequisite clearances from all govemment authorities / agencies / local bodies and the

branch manager is fuly satisfied on the same,

3. The subject has fo submit monthiy stock statement and Receivables (book debts) statement

In the prescribed format on or before the 7th of succeeding month under report:

2) DP should not allow on absolute/ stagnant! rejected stocks.

b) Sales & purchases figures for the month are to be reported.

©) Drawings in the cash credit limit shall be allowed with a margin of 25% on fully paid up

stocks

@) Unpaid stocks & obsolete stock should be excluded while arriving DP for the limits.

8) Drawing Power shall be calculated strictly in accorciance with the guidelines in force

from time to time.

) Drawing of working capital limit shall be subject to availabilty of adequate drawing

‘power in the form of chargeable current ossets,

+) Penal interest @ 2% p.a. over and above normal interest rate will be charged for

delayed submission/non-submission of stock/Book debt statement besides return of

‘cheque, in sole discretion of Bank, due to non-availability of Drawing Power in the

‘account,

4. The fim hos to submit GST retums/ statutory tax retums copies on quarterly basis to review

the tumover / receipts to keep track of end use of fund and also to ensure that the firm files

its statutory retums i.e. GST etc in ime.

5. The firm shall keep the Bank informed of happening of any event likely to have a substantial

effect on thelr profits or business. If, for instance, the monthly collections are substantially less

‘thon what had been indicated fo the bank the company should inform the bank

‘accordingly with the reasons thereof and the remedial steps taken.

-

Ms. Swati Dilip Bhat, PAN No: BYWPB5S33I, Aadhaar No: 5192-3771-0916

6. Periodical inspection of all godown /shops /prime / collateral to be conducted as per the

bank guidelines. Inspection reports to be held on record. Inspection charges for periodical

Verification of machinery/ securities should be bomne by the company,

7. Our hypothecation charges has to be registered with CERSA) and charges for the same wil

be bome by the fim.

8. Our bank's name board indicating out finance to the company and hypothecation of

stocks / plont and machinery should be prominently displayed In the place of business

Mactory/ godown of the fim where the goods are stored.

9. The Bank will have the right to examine at any time the fim’s stocks, books of account ond

to Inspect the fim from time to time by officer/s of the Bank and/or qualified Auditors and/or

technical experts and / ot management consultants at the Bank's choice, Costs of such

Inspection wil be bome by the fim in addition to traveling expenses and out of pocket

expenses.

10. The borrower shall fumish to the bank with the position vis-a-vis the outstanding statutory

‘obligations such as Income tax, payment of PF, Gratuly, Electricity dues, any other statutory

dues etc., as and when demanded by the bank with reasons, if any, for increase frorn the

earlier month and the proposed plan of payments thereof,

1]. The assets charged to the Working Capital should not be charged to any other new lender

vwithout the prior approval of our bank.

12. The advance shall be governed by terms and conditions os stipulated by our bank/RBl from

time to time and the company has to abide by the same,

13. Debit Confimation of Balances should be submitted by the borrower and guarantors on haif

yearly basis or as and when called by the bank.

14. Latest Assets and Liabilities statement of the partners and guarantors along with latest

Income tax retun to be submitted fo Bank as and when called for,

15. tfany change in the constitution of the company is contemplated, the prior approval of the

bank in wring should be obtained. if not the bank shall have the right to suspend

‘operations in the account or take any action as deemed fit, consequent upon such

reconstitution / change,

16. in cose the firm commits default in repayment of loan/advances or in the repayment of

interest thereon or any of the agreed installments of the loan on due dates, the bank and/or

Reserve Bank of India will have an unqualified right to disclose or publish its name or the

name of its directors as defauiters in such manner and through such medium as the bank or

RBI in their absolute discretion may think fit

17. All money advanced or to be advanced by the Bank will be utllzed exclusively for the

Purpose set forth in application / project report submitted fo the Bank. In case the advance

is utlized or attempted to be utized for any other purpose or if the Bank apprehends or has

reasons to believe that the said loan is being utilzed for any other purpose, the Bank shall

+ have the right to recall the entire or any part of the loan / advance forthwith without

‘assigning any reason thereof.

18. in terms of directives in force now or as may be modified from time to time, default in

repayment of installments and/or servicing of interest for a notified period automatically

tesutts in categorization of all borowal accounts as Non-Performing Asset (NPA). Such

‘categorization renders the borrower ineligible trom seeking () Adaifional/Ad-hoc credit

facilities Fund Based and/or Non-fund based), (i) Walver of overdue interest and (i) Soft

recovery measures,

19. Bonk is under no obligation to consider the request of the borrower, if any, for additional

Credit facility (les) without a comprehensive review of the existing credit limits, operations in

the accounts and past performance in meeting commitments such as servicing of interest

‘charged to the Loon accounts), repayment of Loan instalments, prompt submission of

stockstatements, upkeep of records and books of accounts, upkeep of machinery

financed, honouring commitments under LC/LG promptly etc as applicable to the purpose

{for which credit facility has been extended.

20. The bank will always be at liberty to stop making further advances or cancel the limits or

Such portion of the limits as bank deems fit at any time under intimation to the firm, without

‘assigning any reason even though the said limits have not been fully availed and banks right

to cancel unconditionally full or part of the limits which were fuly utlized ecxller and now

remains unutiized / partially utlized.

21. This limit is valid for one year which can be renewed further subject fo submission of financial

papers as required by the bank. Complete comprehensive renewal proposal in ail respect

should be submitted latest by end of 10-11 months from the date of sanction.

22. The borowal account of the party Is subject to the appiicabity of KYC (Know Your

Customer) Guidelines in terms of directives from RBI currently In force. Accordingly, subjects

to furnish the required personal information / data under KYC requirement as and when the

same ls sought by the bank. KYC data has to be updated by the branch at specific me

intervals, as appicable for the Risk Perception assigned to the firm and its proprietor.

‘* Manager I! Line

F568

Cs

‘Ms. Swail Dilip Bhat, PAN No: BYWPBSS33L, Aadhaar No: 5192-3771-0918

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2024 03 4 09 30 23 Passbookstmt - 1712116822949Document6 pages2024 03 4 09 30 23 Passbookstmt - 1712116822949Mohammad ArsHadNo ratings yet

- 2024 03 4 09 29 48 Passbookstmt - 1712116788763Document6 pages2024 03 4 09 29 48 Passbookstmt - 1712116788763Mohammad ArsHadNo ratings yet

- Scan1 CompressedDocument11 pagesScan1 CompressedMohammad ArsHadNo ratings yet

- Scan1-Compressed (1) (1) (1) - CompressedDocument11 pagesScan1-Compressed (1) (1) (1) - CompressedMohammad ArsHadNo ratings yet

- 19AG63R04Document2 pages19AG63R04Mohammad ArsHadNo ratings yet

- Anand Kumar Saiyam: Skill HighlightsDocument1 pageAnand Kumar Saiyam: Skill HighlightsMohammad ArsHadNo ratings yet

- Current Affairs (Eng) SSC GD 2022 - RBEDocument8 pagesCurrent Affairs (Eng) SSC GD 2022 - RBEMohammad ArsHadNo ratings yet

- Machinery Details NewDocument13 pagesMachinery Details NewMohammad ArsHadNo ratings yet

- Ashish Ranjan: Indian Institute of Technology KharagpurDocument2 pagesAshish Ranjan: Indian Institute of Technology KharagpurMohammad ArsHadNo ratings yet