Professional Documents

Culture Documents

Comparative Statement Balance Sheet: Particulars

Comparative Statement Balance Sheet: Particulars

Uploaded by

Eshi0 ratings0% found this document useful (0 votes)

4 views4 pagesOriginal Title

Umm

Copyright

© © All Rights Reserved

Available Formats

ODT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

Download as odt, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views4 pagesComparative Statement Balance Sheet: Particulars

Comparative Statement Balance Sheet: Particulars

Uploaded by

EshiCopyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

Download as odt, pdf, or txt

You are on page 1of 4

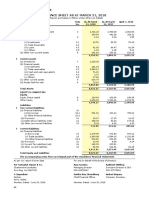

Comparative Statement Balance Sheet

Note Absolute Percentage

Particulars No. 2022 2023 change Change

1. Equity and Liabilities:

1. Shareholder's Funds:

a) Share Capital:

i) Equity Share capital 2103 2074 29 1.37

ii) Other Equity 67203 65671 -1532 -2.27

2. Non-Current Liabilities

a) Financial Liabilities 3904 4870 966 24.74

b) Deferred tax liabilities 841 866 25 2.97

c) Other non-current liabilities 360 414 54 15

3.Current liabilities

a) Lease liabilities 558 713 155 27.77

b) Trade Payables 2669 2426 -243 -9.1

c) Other Financial liabilities 11269 12697 1428 12.67

d) Other current liabilites 7381 7609 228 3.08

e) Provision 920 1163 243 26.41

f) Income tax Liabilities(net) 2179 2834 655 30.05

Total 99387 101337 1950 1.96

2. Assets:

1. Non-Current Assets:

a)Property,Plant and equipment 11384 11656 272 2.38

b)Right of use assets 3311 3561 250 7.55

c)Capital work in progress 411 275 136 33.09

d)Intangible Asset 211 211 0 0

e)Other intangible Asset 32 3 -29 -90.62

f)Financial Asset

i)Investment 22869 23686 817 3.57

ii)Loans 34 39 -5 -14.7

iii)Other Financial Assets 727 1341 614 84.45

g)Deferred tax Assets 970 779 -191 -19.69

h)Income tax assets 5585 5916 331 5.92

i)other non-current assets 1416 1788 372 26.27

2. Current Assets

a) Investments 5467 4476 -991 -18.12

b) Trade Receivables 18966 20773 1807 9.52

c) Cash and Cash Equivalents 12270 6534 -5736 -46.74

d) Loans 219 291 72 32.87

e) Other Financial Assets 6580 9088 2508 38.11

f) Other Current Assets 8935 10920 1985 22.21

Total 99387 101337 1950 1.96

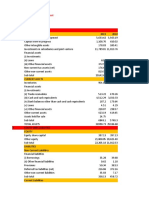

Common Size Balance Sheet

Note 2022 2023 % of 31 % of 31

Particulars No. march 2022 march 2023

1. Equity and Liabilities:

1. Shareholder's Funds:

a) Share Capital:

i) Equity Share capital 2103 2074 2.12 2.05

ii) Other Equity 67203 65671 67.68 64.78

2. Non-Current Liabilities

a) Financial Liabilities 3904 4870 3.93 4.81

b) Deferred tax liabilities 841 866 0.85 0.85

c) Other non-current liabilities 360 414 0.36 0.41

3.Current liabilities

a) Lease liabilities 558 713 0.56 0.7

b) Trade Payables 2669 2426 2.69 2.39

c) Other Financial liabilities 11269 12697 11.33 12.54

d) Other current liabilites 7381 7609 7.43 7.51

e) Provision 920 1163 0.93 1.15

f) Income tax Liabilities(net) 2179 2834 2.13 2.8

Total 99387 101337 100.00% 100.00%

2. Assets:

1. Non-Current Assets:

a)Property,Plant and equipment 11384 11656 11.46 11.52

b)Right of use assets 3311 3561 3.33 3.51

c)Capital work in progress 411 275 0.41 0.28

d)Intangible Asset 211 211 0.21 0.21

e)Other intangible Asset 32 3 0.03 0.01

f)Financial Asset

i)Investment 22869 23686 23.01 23.39

ii)Loans 34 39 0.03 0.04

iii)Other Financial Assets 727 1341 0.79 1.32

g)Deferred tax Assets 970 779 0.98 0.77

h)Income tax assets 5585 5916 5.62 5.89

i)other non-current assets 1416 1788 1.42 1.77

2. Current Assets

a) Investments 5467 4476 5.5 4.42

b) Trade Receivables 18966 20773 19.1 20.5

c) Cash and Cash Equivalents 12270 6534 12.35 6.45

d) Loans 219 291 0.22 0.29

e) Other Financial Assets 6580 9088 6.62 8.96

f) Other Current Assets 8935 10920 8.99 10.77

Total 99387 101337 100.00% 100.00%

Comparative Statement Profit and Loss

Note 2022 2023 Absolute Percentage

Particulars no. Change Change

1. Revenue From Operation 103940 124014 20074 19.31

2. Other Income 3224 3859 635 19.7

3. Total Income (1+2) 107164 127873 20709 19.32

4. Expense:---

(a) Employee benefit expense 51664 62764 11100 21.48

(b) Cost of technical and sub contractor 16298 19096 2798 17.17

(c) Travel Expenses 731 1227 496 67.85

(d) Cost of software packages and others 2985 5214 229 74.67

(e) Communication Expenses 433 502 69 15.94

(f) Consultancy and professional charges 1511 1236 -275 18.2

(g) Depreciation and amortization charges 2429 2753 324 13.34

(h) Finance Cost 128 157 29 22.66

(i) Other Expese 2490 3281 791 31.77

Total Expeses 78669 96230 17561 22.32

5. Profit before tax (3-4) 28495 31643 3148 11.05

6. Less: Tax Expense

(a) Current Tax 8167 6960 -1207 14.78

(b) Deferred Tax 208 300 92 44.23

7. Profit after Tax (5-6) 23286 21235 -2051 8.81

Common Size Profit and Loss

Note 2022 2023 % of 31 % of 31

Particulars no. march 2022 march 2023

1. Revenue From Operation 103940 124014 100 100

2. Other Income 3224 3859 3.1 3.11

3. Total Income (1+2) 107164 127873 103.09 103

4. Expense:---

(a) Employee benefit expense 51664 62764 49.7 50.6

(b) Cost of technical and sub contractor 16298 19096 15.66 15.39

(c) Travel Expenses 731 1227 0.7 0.99

(d) Cost of software packages and others 2985 5214 2.87 4.2

(e) Communication Expenses 433 502 0.42 0.4

(f) Consultancy and professional charges 1511 1236 1.45 1

(g) Depreciation and amortization charges 2429 2753 2.34 2.22

(h) Finance Cost 128 157 0.12 0.13

(i) Other Expese 2490 3281 2.39 2.65

Total Expeses 78669 96230 75.64 77.6

5. Profit before tax (3-4) 28495 31643 27.41 25.52

6. Less: Tax Expense

(a) Current Tax 8167 6960 7.85 5.61

(b) Deferred Tax 208 300 0.2 0.24

7. Profit after Tax (5-6) 23286 21235 22.41 17.12

You might also like

- Chapter 13Document75 pagesChapter 13Anonymous rh4M7A100% (2)

- Consolidated Balance Sheet Particulars Note 31-Mar-21 PERCENTAGE 31-Mar-20Document4 pagesConsolidated Balance Sheet Particulars Note 31-Mar-21 PERCENTAGE 31-Mar-20akashNo ratings yet

- Hero Statement ConsolidatedDocument30 pagesHero Statement Consolidatednath.sandipNo ratings yet

- Gail Balance SheetDocument4 pagesGail Balance SheetAastha GargNo ratings yet

- ITC Balance SheetDocument1 pageITC Balance SheetDivitya ChaudharyNo ratings yet

- Statement of Assets and Liabilities 2018 19Document1 pageStatement of Assets and Liabilities 2018 19Ashis chhokerNo ratings yet

- Statement of Assets and Liabilities - H1 2018-19 8Document1 pageStatement of Assets and Liabilities - H1 2018-19 8saichakrapani3807No ratings yet

- Balance Sheet As at March 31, 2018: ANNUAL REPORT 2017-2018Document3 pagesBalance Sheet As at March 31, 2018: ANNUAL REPORT 2017-2018shreyansh naharNo ratings yet

- Standalone Financial StatementsDocument80 pagesStandalone Financial Statementssyed salahuddinNo ratings yet

- Annual Report FY 2022 23 292 300Document6 pagesAnnual Report FY 2022 23 292 300varshneyarchitaNo ratings yet

- 23MB0026 FAR AssignmentDocument14 pages23MB0026 FAR Assignmenthimanshu011623No ratings yet

- Annual Report - 2022 20283Document2 pagesAnnual Report - 2022 20283vishnu vinodNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFKeran VarmaNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFJayesh ChandNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFAneesh DugarNo ratings yet

- Fiona Czerniawska, Paul May, Management Consultan (Z-LiDocument62 pagesFiona Czerniawska, Paul May, Management Consultan (Z-LimuzigurlNo ratings yet

- Consolidated Balance Sheet: As at March 31, 2019Document2 pagesConsolidated Balance Sheet: As at March 31, 2019Tushar kumarNo ratings yet

- Financial ModellingDocument19 pagesFinancial ModellingJuzer JiruNo ratings yet

- CIPLADocument20 pagesCIPLAPrashant YadavNo ratings yet

- Fermenta Biotech Limited Standalone Financials FY 2017-18Document50 pagesFermenta Biotech Limited Standalone Financials FY 2017-18niragNo ratings yet

- Consolidated Balance Sheet of Dmart and SpencersDocument4 pagesConsolidated Balance Sheet of Dmart and SpencersRuchika AgarwalNo ratings yet

- 4 Financial-InformationDocument154 pages4 Financial-InformationDIVEY KocharNo ratings yet

- MSKA & Associates (Formerly Known As MZSK & Associates)Document35 pagesMSKA & Associates (Formerly Known As MZSK & Associates)Mudit KediaNo ratings yet

- ITC Balance SheetDocument1 pageITC Balance SheetParas JatanaNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFAINDRILA BERA100% (1)

- 2017 Fai NanceDocument11 pages2017 Fai NanceDeekshith NNo ratings yet

- Data 14.3.24Document4 pagesData 14.3.24Mani kandan.GNo ratings yet

- ITC Report and Accounts 2023 184Document1 pageITC Report and Accounts 2023 184Nishith RanjanNo ratings yet

- 4 Financial Statements 2020-21Document154 pages4 Financial Statements 2020-21HetalNo ratings yet

- ITC Standalone Financial StatementsDocument80 pagesITC Standalone Financial Statementsninenova99No ratings yet

- Standalone Financial Statements (1) Pages 1Document2 pagesStandalone Financial Statements (1) Pages 1sqxxsnnfdgNo ratings yet

- Annual ReportsDocument41 pagesAnnual ReportsCharvirNo ratings yet

- 2020-21 BP2Document2 pages2020-21 BP2Akash GuptaNo ratings yet

- Bibliography: Pratheepkanth (2011)Document7 pagesBibliography: Pratheepkanth (2011)Aditya KothariNo ratings yet

- Standalone Balance Sheet: As at 31st March, 2018Document62 pagesStandalone Balance Sheet: As at 31st March, 2018Dipanwita KunduNo ratings yet

- Standalone Balance Sheet: Financial Statements Dabur India LimitedDocument1 pageStandalone Balance Sheet: Financial Statements Dabur India LimitedYagika JagnaniNo ratings yet

- Ambuja Cement Ratio AnalysisDocument8 pagesAmbuja Cement Ratio AnalysisvikassinghnirwanNo ratings yet

- Name: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CDocument5 pagesName: Mamta Madan Jaya Topic: Management Accounting (Comparative Balance Sheet) ROLL NO: 5296 Class: Sybms Marketing Div: CKirti RawatNo ratings yet

- Acc 205 Ca2Document11 pagesAcc 205 Ca2Nidhi SharmaNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetkrishnasinghal866No ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedRaghav AgarwalNo ratings yet

- 21 22 PDFDocument2 pages21 22 PDFfat teenNo ratings yet

- Balance-Sheet-Consolidated 20 19Document2 pagesBalance-Sheet-Consolidated 20 19Anand GovindanNo ratings yet

- Chapter 5Document12 pagesChapter 5Arjun Singh ANo ratings yet

- Standalone-Financial-Statements ItcDocument79 pagesStandalone-Financial-Statements Itcpriyanka valechha100% (1)

- Solution of End Term ExamDocument11 pagesSolution of End Term ExamADAMYA VARSHNEYNo ratings yet

- ONGC Standalone Balance SheetDocument6 pagesONGC Standalone Balance SheetSHUBHI MAKHIJANINo ratings yet

- Tata Balance SheetDocument16 pagesTata Balance SheetAnkit ChodharyNo ratings yet

- BS Excel AiDocument4 pagesBS Excel AiMani kandan.GNo ratings yet

- 17106A1013 - Ratio Analysis of Apollo TyresDocument14 pages17106A1013 - Ratio Analysis of Apollo TyresNitin PolNo ratings yet

- Ola Electric Mobility Limited Financials June-23Document61 pagesOla Electric Mobility Limited Financials June-23Abhijeet KumawatNo ratings yet

- Financial Analysis - SampleDocument1 pageFinancial Analysis - SampledhruvilNo ratings yet

- Ma 120Document39 pagesMa 120jayNo ratings yet

- Fam Ciaiii - Niyati Shukla - 2227741Document17 pagesFam Ciaiii - Niyati Shukla - 2227741Mayank KumarNo ratings yet

- GSL Consolidate Fiscals Fy 2021-22Document56 pagesGSL Consolidate Fiscals Fy 2021-22Kirti MeenaNo ratings yet

- Essar Bulk Terminal Paradip LimitedDocument33 pagesEssar Bulk Terminal Paradip LimitedMudit KediaNo ratings yet

- MRF Balance Sheet AnalysisDocument3 pagesMRF Balance Sheet AnalysisKUNAL GUPTANo ratings yet

- Hero DetailsDocument11 pagesHero DetailsLaksh SinghalNo ratings yet

- Standalone Balance Sheet: As at 31 March, 2021 (All Amounts in Crores, Unless Otherwise Stated)Document4 pagesStandalone Balance Sheet: As at 31 March, 2021 (All Amounts in Crores, Unless Otherwise Stated)gitanjali srivastavNo ratings yet

- Economics 5 1Document44 pagesEconomics 5 1EshiNo ratings yet

- ECO Test-3 MacroDocument4 pagesECO Test-3 MacroEshiNo ratings yet

- TicketDocument2 pagesTicketEshiNo ratings yet

- AsdaDocument15 pagesAsdaEshiNo ratings yet

- Presentation For Investors (Company Update)Document17 pagesPresentation For Investors (Company Update)Shyam SunderNo ratings yet

- Pre-3 Mari HandoutsDocument10 pagesPre-3 Mari HandoutsEmerlyn Charlotte FonteNo ratings yet

- Gmernacej W5C5 AssigmentOLDDocument6 pagesGmernacej W5C5 AssigmentOLDalmaNo ratings yet

- Financial Analyst P8nov09exampaperDocument20 pagesFinancial Analyst P8nov09exampaperNhlanhla2011No ratings yet

- SMMT - Fs Consolidated q2 2022Document67 pagesSMMT - Fs Consolidated q2 2022Merlyn SariNo ratings yet

- DepedDocument25 pagesDepedCharles Allen TanglaoNo ratings yet

- Accrual vs. Cash BasisDocument7 pagesAccrual vs. Cash BasisFantayNo ratings yet

- 15 Opinion LiquidationDocument16 pages15 Opinion LiquidationKRIS ANNE SAMUDIONo ratings yet

- LEAP - Business Finance - Q3 W3 W4Document9 pagesLEAP - Business Finance - Q3 W3 W4Jade MonteverosNo ratings yet

- Financial Ratios For Chico ElectronicsDocument8 pagesFinancial Ratios For Chico ElectronicsThiago Dias DefendiNo ratings yet

- Business Plan Karimi-Lake ToursDocument25 pagesBusiness Plan Karimi-Lake ToursJoseph IbukahNo ratings yet

- Access UBS Accounting Sample ReportDocument35 pagesAccess UBS Accounting Sample ReportGohNo ratings yet

- Advanced Accounting: Corporate Liquidations and ReorganizationsDocument43 pagesAdvanced Accounting: Corporate Liquidations and ReorganizationsitaNo ratings yet

- Capii Audit June13Document10 pagesCapii Audit June13casarokarNo ratings yet

- A) B) C) D)Document15 pagesA) B) C) D)Atteique AnwarNo ratings yet

- STD 12 Accountancy1Document264 pagesSTD 12 Accountancy1Chetan KhonaNo ratings yet

- TUE-THURS MMD 2020 Adjusting Entries and Financial StatementsDocument45 pagesTUE-THURS MMD 2020 Adjusting Entries and Financial StatementsArmin NoblesNo ratings yet

- BSBFIM601 - Part B - Budget - NovoDocument18 pagesBSBFIM601 - Part B - Budget - NovoGabi Assis0% (2)

- Problem 14-1: Bonds As Trading 2005Document18 pagesProblem 14-1: Bonds As Trading 2005Yen YenNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8Th Edition Wahlen Solutions Manual Full Chapter PDFDocument53 pagesFinancial Reporting Financial Statement Analysis and Valuation 8Th Edition Wahlen Solutions Manual Full Chapter PDFanthelioncingulumgvxq100% (13)

- SS 09 - AnswersDocument27 pagesSS 09 - AnswersVan Le Ha0% (1)

- The Objectives of Accounts Receivable ManagementDocument14 pagesThe Objectives of Accounts Receivable ManagementAjay Kumar TakiarNo ratings yet

- Ias38 Q8Document2 pagesIas38 Q8Abdul jumaNo ratings yet

- Income Statement and Balance Sheet (LV & Parda)Document30 pagesIncome Statement and Balance Sheet (LV & Parda)Pallavi KalraNo ratings yet

- Presentation, Results and Discussion: Facing Legal Consequences in Performing Money Lending BusinessDocument13 pagesPresentation, Results and Discussion: Facing Legal Consequences in Performing Money Lending BusinessDiana Faye CaduadaNo ratings yet

- Ind As 111 Joint ArrangementDocument12 pagesInd As 111 Joint ArrangementAlok ThakurNo ratings yet

- Asiana Airlines ReportDocument16 pagesAsiana Airlines ReportShiamak FrancoNo ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- Ratios Report Ambuja CementDocument11 pagesRatios Report Ambuja CementSajal GoyalNo ratings yet