Professional Documents

Culture Documents

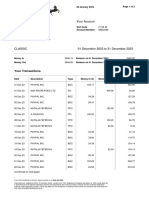

Accounting Homework Bank Reconciliation

Accounting Homework Bank Reconciliation

Uploaded by

ersc16mzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Homework Bank Reconciliation

Accounting Homework Bank Reconciliation

Uploaded by

ersc16mzCopyright:

Available Formats

We understand that accounting homework can be a challenging and time-consuming task.

It requires

a deep understanding of complex concepts and calculations, and even a small mistake can result in a

wrong answer. It can be frustrating and overwhelming, especially when you have multiple

assignments to complete within a tight deadline.

But don't worry, you're not alone. Many students face difficulties with their accounting homework

and seek help to complete it accurately and on time. And that's where ⇒ StudyHub.vip ⇔ comes in.

Why Choose ⇒ StudyHub.vip ⇔?

⇒ StudyHub.vip ⇔ is a professional academic writing service that specializes in providing high-

quality and reliable assistance with various types of homework, including accounting. Our team of

experts consists of experienced accountants and writers who have a deep understanding of the

subject and are dedicated to helping students achieve academic success.

When you choose ⇒ StudyHub.vip ⇔, you can expect:

Customized solutions: We understand that every assignment is unique, and we provide

personalized solutions that meet your specific requirements.

Accurate calculations: Our experts pay attention to every detail and ensure that all

calculations are accurate, so you can be confident in the correctness of your answers.

Timely delivery: We understand the importance of meeting deadlines, and we make sure to

deliver your completed homework on time, so you don't have to worry about late

submissions.

24/7 support: Our customer support team is available 24/7 to answer any questions you may

have and provide updates on your order.

Affordable prices: We offer competitive prices that are affordable for students, and we also

offer discounts and special offers to make our services even more budget-friendly.

How It Works

Ordering your accounting homework from ⇒ StudyHub.vip ⇔ is easy and hassle-free. Simply

follow these steps:

1. Submit your assignment: Fill out our order form with all the necessary details, including the

deadline, number of pages, and any specific instructions.

2. Receive a quote: Our team will review your order and provide you with a quote for the

service.

3. Make a payment: Once you agree to the quote, you can make a secure payment using your

preferred method.

4. Get your completed homework: Our experts will work on your assignment and deliver it to

you within the specified deadline.

Don't Struggle with Your Accounting Homework Anymore

With ⇒ StudyHub.vip ⇔, you can say goodbye to the stress and frustration of completing your

accounting homework. Our team of experts is here to help you achieve academic success and

improve your understanding of the subject. So why wait? Place your order now and experience the

benefits of our professional and reliable services.

With the Worksheet, students can understand the niche subject all together more easily. The second

schedule begins with the ending Cash account balance in the general ledger. Pemilihan nama Rp

yang bagus sangat diperlukan karena nama tersebut bisa jadi pembeda dan menambah keunikan

seperti kumpulan nama Rp aesthetic berikut ini. The company believes that all items involving cash

have been included in the schedules. We should remember two basic concepts which will be used in

this process. First step: is to make correction to the cash book. At the end of this process, the

adjusted bank balance should equal the company's ending adjusted cash balance. We can't connect to

the server for this app or website at this time. To prepare a bank reconciliation, gather your bank

statement and a list of all of your recent transactions. A bank reconciliation is a critical tool for

managing your cash balance.The transactions should be deducted from the bank statement balance.

Modul tugas praktikum pengantar akuntansi fata 2015 pertemuan cash and bank reconciliation cash

and cash equivalent cash adalah aset yang paling likuid cash. Rekonsiliasi bank bank reconciliation

max hendrian sahuleka Slideshare uses cookies to improve functionality and performance and to

provide you with relevant advertising. Ini terdiri dari pengontrolan dan pencatatan antara pergerakan

yang dicatat pada laporan bank dan. It is even better to conduct bank reconciliation every day, based

on the bank's month-to-date information, which should be accessible on the bank's web site. Put it

where it isn't: as an adjustment to the Cash account on the company's books. The bank might deduct

these charges or fees on the bank statement without notifying the company. While the others consists

of a short summary of the niche matter. Contoh Soal Tes Kartu Prakerja Materi Motivasi Kemampuan

Dasar Sehingga sobat dapat belajar dirumah tanpa kebingungan dengan jawaban yang masih belum

di. Bank Reconciliation UK Reply Delete Replies Reply Unknown 22 January 2021 at 09:16 I want

to learn Reply Delete Replies Reply Add comment Load more. Reply Delete Replies Reply mithra

April 27, 2013 at 4:42 AM Thank you for the info. The reconciliation process also helps you identify

fraud and other unauthorized cash transactions. Examples of the items involved are shown in the

following schedule. Additionally, Worksheets may also be applied to judge periodic studying

outcomes whose status is informal. Do vice-versa in case its start with the credit balance. We will

assume that a company has the following items. Maju Makmur pada tanggal 31 Agustus 2019

menunjukan jumlah Rp. Total cek yang dikeluarkan dikurangi dari saldo bank. This is due to the fact

that at any particular date checks may be outstanding deposits may be in transit to the bank errors

may have occurred etc. However, the service charges will have to be entered as an adjustment to the

company's books.

A company's general ledger account Cash contains a record of the transactions (checks written,

receipts from customers, etc.) that involve its checking account. Begin by carefully reviewing the

bank statement for The Tackle Shop found below. Exponential Growth And Decay Word Problems

Worksheet Answers. The bank increased the company's checking account when it collected a note

for the company on August 29. The second step of the bank reconciliation is to adjust the balance in

the company's Cash account so that it is the true, adjusted, or corrected balance. If we take cash

book, in it we can see how much cash business has at the end of particular period. Bank

reconciliation is the process of matching the balances in an entity's accounting records for a cash

account to the corresponding information on a bank statement, with the goal of ascertaining the

differences between the two and booking changes to the accounting records as appropriate.

Therefore, outstanding checks are listed on the bank reconciliation as a decrease in the balance per

bank. Information found on that spreadsheet would correlate precisely to activity in the company’s

Cash account within the general ledger. We can't connect to the server for this app or website at this

time. The key terms to be aware of when dealing with a bank reconciliation are. Try again later, or

contact the app or website owner. With the Worksheet, students can understand the niche subject all

together more easily. The result could be an overdrawn bank account, bounced checks, and overdraft

fees. Because most companies write hundreds of checks each month and make many deposits,

reconciling the amounts on the company's books with the amounts on the bank statement can be

time-consuming. Put it where it isn't: as an adjustment to the balance on the bank statement. It is

even better to conduct bank reconciliation every day, based on the bank's month-to-date information,

which should be accessible on the bank's web site. Physical Science Worksheet Conservation Of

Energy 2 Answer Key. The process is complicated because some items appear in the company's Cash

account in one month, but appear on the bank statement in a different month. Once the correct

adjusted cash balance is satisfactorily calculated, journal entries must be prepared for all items

identified in the reconciliation of the ending balance per company records to the correct cash

balance. The information on the bank statement is the bank’s record of all transactions impacting the

entity’s bank account during the past month.These are transactions in which payment is en route but

the cash has not yet been accepted by the recipient. Applying Worksheets has been established to aid

student learning achievement. Educational Worksheets in teaching and studying actions can be

properly used at the point of concept planting (conveying new concepts) or at the period of

understanding concepts (the sophisticated stage of concept planting). The bank statement lists the

activity in the bank account during the recent month as well as the balance in the bank account.

Each of the bank accounts may appear to have money; but, it is illusionary, because there are

numerous checks “floating” about that will hit and reduce the accounts. Since the bank did not

notify the company previously, the company must now increase the balance in its Cash account. It is

required that entries on the bank statement are exactly the same as entries in the cash book, since

cash book is a reflection of bank statement. Rekonsiliasi bank bank reconciliation max hendrian

sahuleka Slideshare uses cookies to improve functionality and performance and to provide you with

relevant advertising. Contoh soal rekonsiliasi bank dan penjelasannya disajikan berikut ini. Since

when working with Worksheets, students are centered on answering the questions which can be

previously available.

If an item appears on the bank statement but not on the company's books, the item is probably going

to be an adjustment to the Cash balance on (per) the company's books. Try again later, or contact the

app or website owner. However actually it might happen, that balance of cash book is not the same as

the balance in the bank statement. Reply Delete Replies Reply mithra April 27, 2013 at 4:42 AM

Thank you for the info. Acara ini dilaksanakan pada hari sabtu-minggu 21-22 Mei 2016 di Aula

Masjid Nurul Islam Melikan. Sales Report Templates 18 Free Printable Xlsx Docs Pdf Sales Report

Template Report Template Templates Rekonsiliasi bank adalah kontrol yang dilakukan oleh akuntan

untuk membuat rekening bank sedekat mungkin dengan realitas laporan rekening yaitu untuk

memverifikasi kesesuaian kedua rekening rekening bank dan catatan transaksi atau saldo kas.

Therefore companies have to carry out bank reconciliation process. Having an independent person

prepare the reconciliation helps establish separation of duties and deters fraud by requiring collusion

for unauthorized actions. A company's general ledger account Cash contains a record of the

transactions (checks written, receipts from customers, etc.) that involve its checking account. In this

part we will provide you with a sample bank reconciliation including the required journal entries.

Monthly bank reconciliation This template allows the user to reconcile a bank statement with current

checking account records. Scholar worksheets in the form of sheets of report in the shape of

information and questions (questions) that really must be answered by students. That is why one will

often see bank notices that deposited funds cannot be withdrawn for several days. Put them where

they aren't: as adjustments to the Cash account on the company's books. As a result the following

journal entry is needed. Bank Reconciliation Statement After recording the journal entries for the

companys book adjustments a bank reconciliation statement should be produced to reflect all the

changes to cash balances for each month. If you provide content to customers through CloudFront,

you can find steps to troubleshoot and help prevent this error by reviewing the CloudFront

documentation. Therefore, outstanding checks are listed on the bank reconciliation as a decrease in

the balance per bank. Since the company made these errors, the correction of the error will be either

an increase or a decrease to the balance in the Cash account on the company's books. For example,

checks written near the end of August are deducted immediately on the company's books, but those

checks will likely clear the bank account in early September. Such restrictions are intended to make

sure that a deposit clears the bank on which it is drawn before releasing those funds. We should

remember two basic concepts which will be used in this process. Because this expense is not yet

entered on the company's books, but the amount has been deducted from its bank account, the

company will make the following journal entry. If this occurs at month-end, the deposit will not

appear in the bank statement, and so becomes a reconciling item in the bank reconciliation. Daily

cash balances are easy to access and determine. Applying Worksheets has been established to aid

student learning achievement. The bank might deduct these charges or fees on the bank statement

without notifying the company. Klik di bawah ini untuk mengunduh File Template Kwitansi Excel

Sederhana. The company's Cash account will need to be decreased by the amount of the service

charges. Contoh Soal Tes Kartu Prakerja Materi Motivasi Kemampuan Dasar Sehingga sobat dapat

belajar dirumah tanpa kebingungan dengan jawaban yang masih belum di.

This process helps you monitor all of the cash inflows and outflows in your bank account. With cash

accounts, balances are commonly reconciled at the end of the month after the issuance of the

monthly bank statement. Put it where it isn't: as an adjustment to the balance on the bank statement.

We will assume that a company has the following items. Mistakes can be detected easily through

verification, and entries are kept up-to-date since the balance is verified daily. As a result, the check

is returned without being honored or paid. (NSF is the acronym for not sufficient funds. Saldo bank

disesuaikan untuk beberapa jenis transaksi yang ada dalam buku perusahaan tetapi tidak ada dalam

rekening koran. These definitions are different from how the accounting profession uses these

terms.You check that the transactions in your books equal the payroll register. Check for any errors

made by the bank’s processing department. You are required to prepare a Bank Reconciliation

Statement as on 31st March 2019. In general the Worksheet is an understanding instrument as a

match or perhaps a method of supporting the implementation of the studying Plan. Kedua bagian ini

berakhir dengan saldo kas yang tepat yang sama. The result could be an overdrawn bank account,

bounced checks, and overdraft fees. Since when working with Worksheets, students are centered on

answering the questions which can be previously available. Therefore, outstanding checks are listed

on the bank reconciliation as a decrease in the balance per bank. However, this approach leaves one

gaping hole in the control process. Also, the amount of checks that have been written, but not yet

appearing on a bank statement, must be subtracted from the bank statement's balance. Daily cash

balances are easy to access and determine. When that occurs the company usually learns of the

amounts only after receiving its bank statement. Because the NSF check and the related bank fee

have already been deducted on the bank statement, there is no need to adjust the balance per the

bank. A bank reconciliation is a critical tool for managing your cash balance.The transactions should

be deducted from the bank statement balance. An example of such a transaction is checks issued but

that have yet to be cleared by the bank. The cost of the printed checks will automatically be deducted

from the company's checking account. Download the Free Template. 1 Saldo per laporan bank dan 2

Saldo per buku depositor. Jika dibandingkan dengan saldo kas di bank yang tercatat di buku besar

PT. To prepare the bank reconciliation statement, the following rules may be useful for the students.

Grup Hadroh An-Nechtar MI Al Khoiriyah Melikan kembali meraih juara II dalam Festival Hadroh

Organisasi Muda-Mudi Gemilang tingkat DIY-Jateng. The Amazon CloudFront distribution is

configured to block access from your country. Bank Reconciliation is a process that gives the reasons

for differences between the bank statement and Cash Book maintained by a business. Each pay

period, your payroll needs to balance with the payroll expense account in your ledger.

You might also like

- Math Expressions Grade 4 Homework and Remembering PDFDocument8 pagesMath Expressions Grade 4 Homework and Remembering PDFersc16mz100% (1)

- Assessment - BSBFIA401Document10 pagesAssessment - BSBFIA401Sabah Khan RajaNo ratings yet

- CACIB - Research FAST FX Fair Value ModelDocument5 pagesCACIB - Research FAST FX Fair Value ModelforexNo ratings yet

- Project On Gold Loan J PDocument61 pagesProject On Gold Loan J PJai Praksah Sharma83% (12)

- Accounting 101 Homework HelpDocument7 pagesAccounting 101 Homework Helpg3hf6c8y100% (1)

- Cover Letter For Bank StatementDocument4 pagesCover Letter For Bank Statementaqquwuekg100% (1)

- Application Letter For Opening Bank AccountDocument5 pagesApplication Letter For Opening Bank Accountpoxhmpckg100% (1)

- Scholarship Essay Thesis StatementDocument4 pagesScholarship Essay Thesis Statementlisawilliamsnewhaven100% (2)

- Accounts Receivable Resume SampleDocument8 pagesAccounts Receivable Resume Samplezehlobifg67% (3)

- Cpa Cover LetterDocument7 pagesCpa Cover Letterwkiqlldkg100% (1)

- Liberty Tax School Homework AnswersDocument7 pagesLiberty Tax School Homework Answersafnaecvbnlblac100% (1)

- Application Letter For Closing Bank AccountDocument5 pagesApplication Letter For Closing Bank Accountjknpknckg100% (1)

- Homework CommentsDocument7 pagesHomework Commentsersc16mz100% (1)

- Bank Job Cover Letter SampleDocument6 pagesBank Job Cover Letter Samplekqosmkjbf100% (2)

- Cash Flow HomeworkDocument8 pagesCash Flow Homeworkafnadzztkqmfrt100% (1)

- Homework Pink Slip PrintableDocument5 pagesHomework Pink Slip Printableafmsjaono100% (1)

- Add Homework HelpDocument7 pagesAdd Homework Helpaariozilf100% (1)

- Thesis Statement About Credit CardsDocument6 pagesThesis Statement About Credit Cardsaprillaceyjackson100% (2)

- Research Papers On Mobile Banking SecurityDocument5 pagesResearch Papers On Mobile Banking Securityjbuulqvkg100% (1)

- Mobile Money Transfer ThesisDocument8 pagesMobile Money Transfer Thesisnatalieparnellcolumbia100% (2)

- Thesis On E-Banking in IndiaDocument4 pagesThesis On E-Banking in IndiaAshley Carter100% (2)

- Billing System Thesis DocumentationDocument6 pagesBilling System Thesis Documentationafkngwetd100% (2)

- A Level Home Economics CourseworkDocument7 pagesA Level Home Economics Courseworktvanfdifg100% (2)

- Homeworks Construction Inc South Bend inDocument5 pagesHomeworks Construction Inc South Bend inafeupzvkx100% (1)

- Credit Reports HomeworkDocument4 pagesCredit Reports Homeworkafeurbmvo100% (1)

- Investment Appraisal Dissertation TopicsDocument5 pagesInvestment Appraisal Dissertation TopicsHelpWritingCollegePapersUK100% (1)

- Master Thesis Cash FlowDocument4 pagesMaster Thesis Cash Flowolgabautistaseattle100% (2)

- Master Thesis Topics Corporate FinanceDocument7 pagesMaster Thesis Topics Corporate Financemarialackarlington100% (2)

- Minitab HomeworkDocument7 pagesMinitab Homeworkh41zdb84100% (1)

- Balance of Payments HomeworkDocument7 pagesBalance of Payments Homeworkafnaiokculkyqc100% (1)

- Taxation Homework HelpDocument7 pagesTaxation Homework Helpafmshobkx100% (1)

- Request Letter For Bank TransferDocument4 pagesRequest Letter For Bank Transferf5dct2q8100% (2)

- Robot Topic HomeworkDocument4 pagesRobot Topic Homeworkersc16mz100% (1)

- Cuhk Graduate School Thesis FormatDocument8 pagesCuhk Graduate School Thesis Formatfopitolobej3100% (2)

- New Gcse Maths - Homework Book Higher 1 Aqa Modular AnswersDocument7 pagesNew Gcse Maths - Homework Book Higher 1 Aqa Modular Answerscfghkkyy100% (1)

- Richard Webber Homeworks Real EstateDocument8 pagesRichard Webber Homeworks Real Estateafnauaynqfdehd100% (1)

- Homework Submission LetterDocument8 pagesHomework Submission Letterercjdfay100% (1)

- Bank of America Research PaperDocument7 pagesBank of America Research Paperfyr60xv7100% (1)

- Financial Literacy Homework HelpDocument8 pagesFinancial Literacy Homework Helpafetovibe100% (1)

- Dietitian Resume PDFDocument6 pagesDietitian Resume PDFrxjqxzxhf100% (1)

- NCT HomeworkDocument7 pagesNCT Homeworkafeupzvkx100% (1)

- Make Money Doing Other Peoples HomeworkDocument8 pagesMake Money Doing Other Peoples Homeworkh46qbg8t100% (1)

- Collections Cover LetterDocument8 pagesCollections Cover Letterfspvwrzh100% (1)

- Homework MPCDocument4 pagesHomework MPCeylilermg100% (1)

- Online Resume CheckerDocument4 pagesOnline Resume Checkerafiwgbuua100% (2)

- Uscis Cover Letter Sample For I 765Document8 pagesUscis Cover Letter Sample For I 765pkznbbifg100% (2)

- Research Paper On Kisan Credit CardDocument8 pagesResearch Paper On Kisan Credit Cardqzafzzhkf100% (1)

- Free Live Accounting Homework HelpDocument4 pagesFree Live Accounting Homework Helpafmsfvosb100% (1)

- Pearson Digits Homework HelperDocument4 pagesPearson Digits Homework Helperafeuhyxst100% (1)

- Cash Flow Statement ThesisDocument5 pagesCash Flow Statement ThesisOnlinePaperWritingServiceDesMoines100% (2)

- Research Paper On Income TaxDocument7 pagesResearch Paper On Income Taxafedonkfh100% (1)

- Catering Coursework Task 1Document5 pagesCatering Coursework Task 1rhpvslnfg100% (2)

- Homework Construction Yuba CityDocument5 pagesHomework Construction Yuba Cityafeumseax100% (1)

- Banking PHD Thesis PDFDocument7 pagesBanking PHD Thesis PDFgxgtpggld100% (2)

- Homework Wizard Book 4Document6 pagesHomework Wizard Book 4cfhwk3nc100% (1)

- Term Paper On IfrsDocument7 pagesTerm Paper On Ifrsea726gej100% (1)

- Objectives of Inventory Management HomeworkDocument4 pagesObjectives of Inventory Management Homeworkafetmagzj100% (1)

- Use of Maths Decision Coursework IdeasDocument5 pagesUse of Maths Decision Coursework Ideasafjwdkwmdbqegq100% (2)

- Dayton Christian Homework CentralDocument5 pagesDayton Christian Homework Centralcfcyyedf100% (1)

- Christmas Tags HomeworkDocument4 pagesChristmas Tags Homeworkgrfmtpapd100% (1)

- Homework Forms of Energy Answer KeyDocument9 pagesHomework Forms of Energy Answer Keyafeulfkaa100% (1)

- Benefits of Doing Your HomeworkDocument8 pagesBenefits of Doing Your Homeworkafeurbmvo100% (1)

- Complex Sentence Homework SheetDocument6 pagesComplex Sentence Homework Sheetg3v3q3ng100% (1)

- Research Paper On Account ReceivableDocument7 pagesResearch Paper On Account Receivableafeazleae100% (1)

- Sraw Homework AssignmentDocument4 pagesSraw Homework Assignmentersc16mz100% (1)

- Homework A Mental TortureDocument6 pagesHomework A Mental Tortureersc16mz100% (1)

- Should You Do Your Homework Right After SchoolDocument5 pagesShould You Do Your Homework Right After Schoolersc16mz100% (1)

- Common Core Kindergarten Math HomeworkDocument6 pagesCommon Core Kindergarten Math Homeworkersc16mz100% (1)

- Sorting HomeworkDocument4 pagesSorting Homeworkersc16mz100% (1)

- Homework Folder Ideas 5th GradeDocument4 pagesHomework Folder Ideas 5th Gradeersc16mz100% (1)

- Swans International School Homework WebsiteDocument4 pagesSwans International School Homework Websiteersc16mz100% (1)

- Classroom Homework ChecklistDocument5 pagesClassroom Homework Checklistersc16mz100% (1)

- Summer Holidays Homework For KindergartenDocument7 pagesSummer Holidays Homework For Kindergartenersc16mz100% (1)

- Two Hours Homework A NightDocument8 pagesTwo Hours Homework A Nightersc16mz100% (1)

- Reddit Homework ProblemsDocument4 pagesReddit Homework Problemsersc16mz100% (1)

- Champions School of Real Estate Principles 1 HomeworkDocument8 pagesChampions School of Real Estate Principles 1 Homeworkersc16mz100% (1)

- Homework Help Programming LanguagesDocument7 pagesHomework Help Programming Languagesersc16mz100% (1)

- Homework JokesDocument8 pagesHomework Jokesersc16mz100% (1)

- Galaxy Middle Homework HotlineDocument8 pagesGalaxy Middle Homework Hotlineersc16mz100% (1)

- Cambridge School Indirapuram Holiday Homework Class 6Document6 pagesCambridge School Indirapuram Holiday Homework Class 6ersc16mz100% (2)

- Why Do Teachers Give Summer HomeworkDocument7 pagesWhy Do Teachers Give Summer Homeworkersc16mz100% (1)

- Year 6 Maths Homework Place ValueDocument5 pagesYear 6 Maths Homework Place Valueersc16mz100% (1)

- Points On Homework Should Not Be AbolishedDocument6 pagesPoints On Homework Should Not Be Abolishedersc16mz100% (1)

- Essay On Homework Is NecessaryDocument6 pagesEssay On Homework Is Necessaryersc16mz100% (1)

- Pattern Homework KindergartenDocument8 pagesPattern Homework Kindergartenersc16mz100% (1)

- Maths Quest 8 For The Australian Curriculum Homework Book AnswersDocument6 pagesMaths Quest 8 For The Australian Curriculum Homework Book Answersersc16mz100% (1)

- Roman Homework HelpDocument7 pagesRoman Homework Helpersc16mz100% (1)

- Electric Potential HomeworkDocument5 pagesElectric Potential Homeworkersc16mz100% (1)

- Homework PiratesDocument5 pagesHomework Piratesersc16mz100% (1)

- Girlfriend Always Doing HomeworkDocument7 pagesGirlfriend Always Doing Homeworkersc16mz100% (1)

- Speech Homework LogDocument8 pagesSpeech Homework Logersc16mz100% (1)

- Maths Homework Data HandlingDocument5 pagesMaths Homework Data Handlingersc16mz100% (1)

- Algebra 2 Homework Practice Workbook PDFDocument7 pagesAlgebra 2 Homework Practice Workbook PDFersc16mz100% (1)

- World Bank General Conditions For LoansDocument32 pagesWorld Bank General Conditions For LoansMax AzulNo ratings yet

- Company Law ProjectDocument8 pagesCompany Law ProjectDouble A CreationNo ratings yet

- Public Administration Unit-96 Forms of Public EnterpriseDocument12 pagesPublic Administration Unit-96 Forms of Public EnterpriseDeepika SharmaNo ratings yet

- Intro To Cost AccountingDocument4 pagesIntro To Cost AccountingdollymbaikaNo ratings yet

- Beams 11 PPT 16 PartnershipsDocument49 pagesBeams 11 PPT 16 PartnershipsNovriyanti Wahyu HapsariNo ratings yet

- Presented By: Sujeeth Joishy K SumalathaDocument15 pagesPresented By: Sujeeth Joishy K SumalathaKiran NayakNo ratings yet

- PE in Portfolio Bericht by KKRDocument22 pagesPE in Portfolio Bericht by KKRmunstermaximilianNo ratings yet

- Business Studies Project On Credit CardsDocument10 pagesBusiness Studies Project On Credit CardsPiyush Setia0% (1)

- US Rare Earth Minerals, Inc. - 3/28/2012 Boventures Appointed As Investor RelationsDocument1 pageUS Rare Earth Minerals, Inc. - 3/28/2012 Boventures Appointed As Investor RelationsUSREMNo ratings yet

- Digital Currency Stocks Bonds: The Most Popular Cryptocurrency Terms and Phrases CryptocurrencyDocument75 pagesDigital Currency Stocks Bonds: The Most Popular Cryptocurrency Terms and Phrases CryptocurrencySAGIR MUSA SANINo ratings yet

- Unit 8. Accounting For ReceivablesDocument20 pagesUnit 8. Accounting For ReceivablesYonasNo ratings yet

- AOM 2023-001 CabulisanDocument21 pagesAOM 2023-001 CabulisanKen BocsNo ratings yet

- PGT-Credit Coop - Business Plan - Edited - December 15 2023Document18 pagesPGT-Credit Coop - Business Plan - Edited - December 15 2023Lieca AmbolNo ratings yet

- Project On Training and Development On HDFC BankDocument40 pagesProject On Training and Development On HDFC BankDinesh Metkari83% (6)

- Asset Accounting - Retirements & TransfersDocument12 pagesAsset Accounting - Retirements & TransfersVihaan BorbachhiNo ratings yet

- SAR Audit MemoDocument19 pagesSAR Audit MemoAshish SharmaNo ratings yet

- Money Matters and ServicesDocument1 pageMoney Matters and ServicesSára MurárNo ratings yet

- Accounting Past MCQDocument108 pagesAccounting Past MCQbinalamitNo ratings yet

- Accountancy Pre BoardDocument15 pagesAccountancy Pre BoardkenaNo ratings yet

- Call For Instructors W21Document13 pagesCall For Instructors W21Faiza SajjadNo ratings yet

- NCERT Financial Accounting Class 11Document412 pagesNCERT Financial Accounting Class 11Abhimanyu TyagiNo ratings yet

- Dean Robert Blair GibsonDocument2 pagesDean Robert Blair GibsonKabanNo ratings yet

- Newsletters 2003 - AVTDocument7 pagesNewsletters 2003 - AVTAna VellegalNo ratings yet

- Taxpnl TQ8297 2022 - 2023 Q1 Q4Document34 pagesTaxpnl TQ8297 2022 - 2023 Q1 Q4raghav guptaNo ratings yet

- TAX QUIZ OnDocument13 pagesTAX QUIZ OnGeTthiee PacarbalNo ratings yet

- 365 Multiservices LLC - ContractDocument3 pages365 Multiservices LLC - ContractHerbert DiazNo ratings yet

- Articles of AgreementDocument2 pagesArticles of AgreementMd Rajikul IslamNo ratings yet