Professional Documents

Culture Documents

Expansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West Bengal

Expansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West Bengal

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West Bengal

Expansion of Cashless Transaction in Daily Life: A Case Study in Birbhum District of West Bengal

Copyright:

Available Formats

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR1735

Expansion of Cashless Transaction in

Daily Life: A Case Study in Birbhum

District of West Bengal

Dr. Tirthankar Mandal **

Assistant Professor,

Department of Economics, Krishna Chandra College

Hetampur, Birbhum, WB – 731124, India

Abstract:- Cashless transactions refer to the exchange of government processes, expanding internet access, and

money through electronic means, rather than using promoting the use of technology for social and economic

physical currency or traditional paper-based methods. It development. It has also played a crucial role in advancing

has become increasingly popular due to technological India's position as a global IT and digital services hub.

advancements, convenience, and the widespread use of However, challenges such as digital literacy, cyber security,

the internet and mobile devices. Several forms of digital and infrastructure development in remote areas continue to be

transactions exist, such as online banking, mobile addressed as the program evolves.

banking, UPI, POS etc. The various types of activities

performed by common citizens through cashless The present work examines how far people become

transactions in daily life. In rural India, different kinds of habituated and experienced by digital transactions in day-to-

challenges exist to the adoption of digital transaction like day life. The various types of activities performed by

digital literacy, internet connectivity. With the help of a common citizens through cashless transactions in daily life

linear regression analysis, it has been observed that are mobile recharge, LPG booking, cable/DTH recharge,

demographic and technological factors play important electricity bill payment, education fees payment, restaurant

role in spreading cashless transaction in everyday life. bill payment, purchasing in local market, tour and travel

booking etc. The number of operative modes for digital

Keywords:- Cashless Transaction; Digital Knowledge; transaction like credit/debit card, internet banking facility,

Technological Information. UPI facility, mobile wallet etc. has a crucial role in

accelerating the performance of cashless transaction in daily

I. INTRODUCTION life also. This paper finds out the causes and indicators to

expand the growth of digital transactions at the grassroots

A cashless transaction implies a financial transaction in level which lead to an overall digitalized economy.

which physical currency, such as coins and banknotes, is not

exchanged. Instead, these transactions are conducted II. LITERATURE REVIEW

electronically, typically using various digital payment

methods and technologies. Cashless transactions have In a study, Joshi (2017) [4], found that people are

become increasingly popular due to their convenience, speed, proactively adopting new modes of digital payments and also

and security. Online banking platforms enable users to pay hoist the usage of new digital payment modes over old digital

bills, such as utility bills, loans, and credit card bills, directly payment modes. Demonetization also amplified in digital

from their bank accounts. This involves purchasing goods and payment transactions especially in newfangled modes of

services from e-commerce websites. Shoppers can browse digital payments like NACH, IMPS, AEPS, BBPS, UPI,

products, add them to a virtual cart, and complete the BHIM(UPI) and NETC. Singh (2017) [11] studied to find out

purchase online using various payment methods, including the customer perception and impact of demographic factors

credit/debit cards, digital wallets, and online banking. Online like gender, age, education, profession, income etc. on

and mobile banking apps allow users to transfer money from adoption of digital mode of payment. No significant

their bank accounts to another person or organization's difference has been observed between male and female, age,

account. Cashless transactions are quick and can be done profession and annual income. Education level plays an

anywhere with an internet connection. Many cashless important role in the digital payment mode. U. Shankar

payment methods employ encryption and authentication (2017) [10] tried to identify the prospects and challenges of

measures to protect sensitive information. Several apps and Digital Transaction System in India and to find out the steps

platforms, such as PhonePe, Google Pay, Amazon Pay, taken by the RBI and government to discourage the use of

Paytm, BHIM etc. facilitate peer-to-peer money transfers and cash. It has been observed that India is gradually transitioning

digital payments. To transform the country into a digitally from a cash-centric to digital economy and the whole country

empowered society and knowledge economy the Government is undergoing the process of modernization in money

of India initiated the "Digital India" programme. The Digital transactions, with e-payment services. A large number of

India initiative has made significant progress in digitizing businesses, even street vendors, are now accepting electronic

IJISRT24MAR1735 www.ijisrt.com 2103

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR1735

payments, prompting the people to learn to transact the digital The average number of online banking users of different apps

way. To examine that the importance of cashless policies in is also different. There is no significant effect of area on

the economy of a country and how it affects to their economic number of application type for online banking users. S.P.

growth Singhraul and Garwal (2018) [13] tried to find out Tomar et al. (2020) [15] studied for assessing the awareness

various challenges and opportunity associated with the of the digital transaction schemes and find out the sources in

implementation of the cashless policies in India in their implementation. They found that the overall awareness

comparison of other countries. Their observation was that the regarding digital transaction schemes and methods were

India in terms of using digital payment methods is still very maximum among age group 18-29 and a significant

poor in comparison to other developed countries in the world. association was found between the usage of mobile wallets

The reasons behind it are the unavailability of proper internet and the different age groups with the younger age groups

connectivity, lack of awareness and knowledge of financial having more knowledge than the older age group in this

transaction, charges on card payments and un operational regard. S. Mohd. & R. Pal (2020) [7] analysed the awareness

bank accounts etc. Roy & Das (2018) [9] examined the of household regarding cashless transactions in Kangra

awareness and adoption level of Digital Banking Services District. There is less awareness about latest modes of digital

(DBS) people at pre and post demonetization period. They payments like USSD, AEPS, UPI, Mobile wallets and

find that the rural and urban people have awareness about the internet banking and people have no adequate literacy and

demonetization process but the percentage of users for all acquaintance with information and technology to implement

categories of Digital Banking Services like card, internet and the cashless system.

mobile are very high for the urban sector than the rural sector.

The rural people are found to be more convenient to use card III. OBJECTIVE

banking than the other two categories of Digital Banking

Services, internet and mobile banking. Gender, education, The main objective of this study is to find out the role of

occupation, age, income creates an impact for availing DBS. different demographic and technological factors influencing

The adoption level of digital banking service is dependent on and improving the cashless transaction in daily life. These

demonetization knowledge, reliability, customer support, factors are gender, age, monthly income, technological and

service security, ease of use and performance. digital information the person acquire etc. Simultaneously it

has also been examined the number of operative modes of

Prakash S. et al. (2020) [8] found that the people use digital transaction available to the person how much

online banking before demonetization for money transfer and accelerates the cashless transaction. The study was conducted

feel secured about it. The male are more aware about plastic randomly in different parts of rural and urban area of Birbhum

money than female for transaction. The online banking users district, West Bengal.

and sex are independent in rural and urban area. There is no

significant effect of area on number of online banking users.

IV. METHODOLOGY

Let the Standard Form of k-Variable Regression Model is

Linear model: 𝑌𝑖 = 𝛼 + 𝛽1 𝑋1𝑖 + 𝛽2 𝑋2𝑖 + 𝛽3 𝑋3𝑖 + ⋯ … … . +𝛽𝑘 𝑋𝑘𝑖 + 𝑈𝑖 … … … … … … … … … … … … … … … … … … … . … … … … . (1)

And cov(ui, Xji) = 0

Exponential model: ln(𝑌𝑖 ) = 𝛼 + 𝛽1 𝑋𝑖 + 𝑈𝑖 … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … . (2)

Where,

In linear model the explanatory variables (Xi) are used to measure the rate of change of the dependent variable

gender, age, monthly income, average digital information and by the explanatory variable.

average technological information. The variables average

digital information and technological information are V. RESULT AND DISCUSSION

constructed by the average score of some qualitative as well

as quantitative parameters and thereafter the Cronbach's The regression model between number of purpose of

Alpha test for the reliability has been tested (0.720 & 0.714 digital transaction and all covariates is statistically significant

respectively) which become significant. A multicollinearity at 0.01 level of significance. From table 1 the estimated

test also applied to check the interdependence among the equation can be written as 𝑌 ̂𝑖 = −3.81 + 0.975𝑋1𝑖 +

explanatory variables. The exponential regression model is 1.27 𝑋2𝑖 − 1.07𝑋3𝑖 + 0.52 𝑋4𝑖 − 0.019 𝑋5𝑖 .

IJISRT24MAR1735 www.ijisrt.com 2104

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR1735

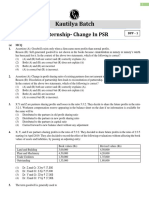

Table 1: Linear Regression Result

Number of obs = 94, F(5, 88) = 69.06, Prob > F = 0.0000, R-squared = 0.7969,

Adj R-squared = 0.7854, Root MSE = 1.467

ndtp Coef. Std. Err. t P>t [95% Conf. Interval]

avgtechinfo .9754097 .4138153 2.36 0.021 .1530388 1.797781

avgdtinfo 1.270968 .1715902 7.41 0.000 .9299689 1.611968

gender -1.072925 .3407897 -3.15 0.002 -1.750173 -.3956774

lminc .5279418 .1843239 2.86 0.005 .1616367 .8942469

age -.0193085 .0170987 -1.13 0.262 -.0532886 .0146716

_cons -3.810655 1.360034 -2.80 0.006 -6.513438 -1.107873

All the covariates are significant except age. The of number of purpose of cashless transaction. Figure 1 and 2

coefficient of average technological information and average shows the qfit plot of both the average technological and

digital information are 0.975 and 1.27 respectively and both digital information variables against the number of purposes

the coefficients are statistically significant. As the average of digital transaction. The curves are upward rising indicates

technological information increases the number of purpose of an increasing relationship. The coefficient of age is negative

digital transaction increases by 0.975 whereas the increase of which implies that aged people are less interested to cashless

average digital information leads to an increase of 1.27 times transaction than younger (figure 3).

Fig 1: Qfit Plot of Average Technological Information

8

6

4

ndtp

2

0

-2

0 1 2 3 4 5

avgdtinfo

Fig 2: Qfit Plot of Average Digital Information

IJISRT24MAR1735 www.ijisrt.com 2105

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR1735

Fig 3: Margin Plot (Age)

The coefficient of gender is negative and statistically effect and margin plot of male and female. Table 3 and figure

significant. The negative value of the coefficient (-1.07) 5 deal with an interaction between gender and age. The aged

indicates an interesting result that females are significantly people are comparatively less interested to perform cashless

higher contribution than male in cashless transaction transaction for both male and female.

performed daily. Table 2 and Figure 4 show the marginal

Table 2: Marginal Effect (Gender)

Predictive margins Model VCE : OLS

Linear prediction, predict() Number of obs = 94

Margin Delta-method Std. Err. t P>t [95% Conf. Interval]

gender

Female 4.819265 .2503087 19.25 0.000 4.321829 5.316701

male 3.74634 .2070901 18.09 0.000 3.334791 4.157888

Predictive Margins of gender with 95% CIs

5.5

5

4.5

4

3.5

0 1

gender

Fig 4: Margin Plot (Gender)

IJISRT24MAR1735 www.ijisrt.com 2106

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR1735

Table 3: Marginal Effect (Age)

Predictive margins Number of obs = 94

Linear prediction, predict() Model VCE : OLS

age_at Margin Delta-method Std. Err. t P>t [95% Conf. Interval]

20 4.567595 .3658205 12.49 0.000 3.840603 5.294586

30 4.374509 .2217268 19.73 0.000 3.933874 4.815145

40 4.181424 .1515725 27.59 0.000 3.880206 4.482643

50 3.988339 .2350722 16.97 0.000 3.521182 4.455496

60 3.795254 .3821216 9.93 0.000 3.035867 4.55464

Fig 5: Interactive Margin Plot (Age & Gender)

The coefficient of monthly income is positive (0.527) variable (figure 6). If the number of operative modes of

and statistically significant. In this regression the monthly cashless transaction like credit/debit/ATM card, UPI, internet

income variable has been considered in logarithmic term banking etc. increases the chance of accepting digital

which shows the relationship between dependent variable is transaction in any daily transaction increases.

positive but diminishing marginal return. Table 4 shows the

multi collinearity test value and the mean VIF is 2.29 which Table 4: Multicollinearity Test

indicates that there are no significant correlation among the Variable VIF 1/VIF

explanatory variables. avgtechinfo 3.51 0.284689

avgdtinfo 2.56 0.390213

Table 5 shows the exponential regression result between lminc 2.52 0.397585

number of purpose of digital transaction in logarithmic form age 1.60 0.623314

and number of available modes of cashless transaction. The gender 1.23 0.812067

coefficient of explanatory variable is 0.038 and it is Mean VIF 2.29

statistically significant. The result implies that explanatory

variable has an increasing marginal effect on dependent

Table 5: Exponential Regression Model

Number of obs = 94, F(5, 88) = 69.06, Prob > F = 0.0026, R-squared = 0.1295,

Adj R-squared = 0.1163, Root MSE = .50979

lndtp Coef. Std. Err. P>t [95% Conf. Interval]

ndtm .0384116 .0122609 3.13 0.003 .0139319 .0628912

_cons 1.159607 .1681061 6.90 0.000 .8239722 1.495242

IJISRT24MAR1735 www.ijisrt.com 2107

Volume 9, Issue 3, March – 2024 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165 https://doi.org/10.38124/ijisrt/IJISRT24MAR1735

2.2

2

ln(ndtp)

1.8

1.6

1.4

0 5 10 15 20

ndtm

Fig 6: Qfit Plot (Exponential)

VI. CONCLUSION [6]. Mandal, T. (2023). Adoption of UPI and

Implementation of UPI-ATM in India: A Logit

Digital transactions in India have been on the rise in Analysis, Indian Journal of Economic and Finance,

recent years, through the Digital India initiative. It increased 3(1), 52-59.

internet penetration, growth of digital payment infrastructure. https://doi.org/10.54105/ijef.E7990.03010523

Few challenges such as limited digital literacy and [7]. Mohd, S. & Pal, R. (2020). Moving from Cash to

connectivity issues, and some demographic factors make Cashless: A Study of Consumer Perception towards

obstacle to the adoption of online transactions in rural areas Digital Transactions. PRAGATI : Journal of Indian

(Mandal, 2023[6]). Many rural residents are neither familiar Economy, 7, 1-13.

with digital technology nor have proper internet access. Poor https://doi.org/10.17492/pragati.v7i1.195425

internet connectivity in remote rural areas can hinder the [8]. Prakash, S. C., Kurane, T. S., Salunkhe, S. T., &

adoption of online transactions. Safety and security in digital Pawar, P. A. (2020). A Study of Impact of Cashless

financial services and ensuring the riskless online Transaction on Society Using Statistical Methods.

transactions remain important concerns. While the challenges International Journal of Innovative Science and

endure, the adoption of online transactions in rural India is Research Technology, 5, 300-305.

increasing and contributing to financial inclusion and expand https://doi.org/10.38124/IJISRT20JUL233

the access to essential services for rural communities. The [9]. Roy Dutta, M. & Das, A. (2018). Impact of

efforts to overcome these challenges and spread out digital demonetization on adoption of digital banking

infrastructure will further constain the growth of digital services in India: a case study in the rural and suburban

transactions in India. area of West Bengal. Indian Journal of Economics and

Development, 6(1).

REFERENCES [10]. Shankar, U. (2017). Digital Economy in India:

Challenges and Prospects. International Journal of

[1]. Aggarwal, K., Malik, S., Mishra, D.K., & Paul, D. Research in Management Studies, 2(11).

(2021). Moving from Cash to Cashless Economy: https://doi.org/10.35338/EJESSR.2021.3519

Toward Digital India. Journal of Asian Finance, [11]. Singh, S. & Rana, R. (2017). Study Of Consumer

Economics and Business, 8, 43-54. Perception Of Digital Payment Mode. Journal of

https://doi.org/10.13106/JAFEB.2021.VOL8.NO4.00 Internet Banking and Commerce, 22(3).

43 [12]. Singhal, R. & Gupta, A. (2021). Impact Of Covid-19

[2]. Behera, S. & Balaji, P. (2019). Cashless Economy: On Digital Payment Services At Towns And Villages.

The Dream Of Digital India. International Journal of International Journal of Creative Research Thoughts,

Management, Technology And Engineering, 9(4), 9(5), 585-594.

5629-5636. [13]. Singhraul, B.P. (2018). Cashless Economy –

[3]. Hasan, A., Aman, M. A., & Ali, M. A. (2020). Challenges and Opportunities in India. Pacific

Cashless Economy in India: Challenges Ahead. Business Review International, 10(9).

Shanlax International Journal of Commerce, 8(1), 21– [14]. Tiwari, T., Srivastava, A., & Kumar, S. (2019).

30. https://doi.org/10.34293/commerce.v8i1.839 Adopting of Digital Payment Methods in India.

[4]. Joshi, Mrunal. (2017). Digital Payment System: A International Journal of Electronic Finance , 9 (3),

Feat Forward of India. Research Dimensions. Digital 217-229. https://doi.org/10.1504/IJEF.2019.099058

Payment System and Rural India. 1. [15]. Tomar, S. P., Dangwal, N., & Kasar, P. K. (2020).

[5]. Kafley G. S. & Chandrasekaran, M. (2019). E- Awareness and sources of the digital transactions

Payment System In Rural India: Issues And schemes: a cross sectional study in a rural block of

Challenges. SELP Journal of Social Science, 10(40). Jabalpur, Madhya Pradesh, India. International

@ www.iaraindia.com Journal of Research in Medical Sciences, 8(2), 730–

733. https://doi.org/10.18203/2320-

6012.ijrms20200265

IJISRT24MAR1735 www.ijisrt.com 2108

You might also like

- ALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument17 pagesALiterature Study of Consumer Perception Towards Digital Payment Mode in IndiaManipal SinghNo ratings yet

- A Study On Digital Payment Awareness Among Small Scale VendorsDocument4 pagesA Study On Digital Payment Awareness Among Small Scale VendorsEditor IJTSRDNo ratings yet

- A Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaDocument16 pagesA Literature Study of Consumer Perception Towards Digital Payment Mode in IndiaSimon ShresthaNo ratings yet

- Ijmra 15218Document12 pagesIjmra 15218Mradul KatiyarNo ratings yet

- 455pm - 5.EPRA JOURNALS 12530Document4 pages455pm - 5.EPRA JOURNALS 12530tirthankarNo ratings yet

- Digital Payment Dynamics Unveiling The Impacts On Sustainable Development, Environmental Protection, and Social InclusionDocument7 pagesDigital Payment Dynamics Unveiling The Impacts On Sustainable Development, Environmental Protection, and Social InclusionEditor IJTSRDNo ratings yet

- Digital Payments and Demonetisation: Received Dec. 08, 2017 Accepted Jan. 12, 2018Document5 pagesDigital Payments and Demonetisation: Received Dec. 08, 2017 Accepted Jan. 12, 2018Prajwal KottawarNo ratings yet

- Digital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesDocument9 pagesDigital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesIJRASETPublicationsNo ratings yet

- A Study On Consumer Perception Towards Digital Payment: Prakash MDocument12 pagesA Study On Consumer Perception Towards Digital Payment: Prakash MZEDXNo ratings yet

- A Study of Perception Towards Digital Payment Adoption in Sagar City of Madhya PradeshDocument8 pagesA Study of Perception Towards Digital Payment Adoption in Sagar City of Madhya Pradeshpankaj_jhariyaNo ratings yet

- 1.1. Objective of The StudyDocument26 pages1.1. Objective of The StudyKruttika MohapatraNo ratings yet

- A Study On Customer Perception Towards Upi and Its Growing Influence in The Realm of Digital Payments: An Empirical Study"Document7 pagesA Study On Customer Perception Towards Upi and Its Growing Influence in The Realm of Digital Payments: An Empirical Study"Nitin ChourasiaNo ratings yet

- IJCRT21X0137Document61 pagesIJCRT21X0137Jay HadavaniNo ratings yet

- Students Perception Towards Digital Payment System-A Study With A Special Reference To Mangalore UniversityDocument20 pagesStudents Perception Towards Digital Payment System-A Study With A Special Reference To Mangalore UniversityKrestyl Ann GabaldaNo ratings yet

- REVIEW LITERATURE Digital PaymentsDocument7 pagesREVIEW LITERATURE Digital PaymentsMahimalluru Charan KumarNo ratings yet

- Mid Term - A Study of Consumer Perception Towards Mobile Wallet in Delhi NCRDocument35 pagesMid Term - A Study of Consumer Perception Towards Mobile Wallet in Delhi NCRamanNo ratings yet

- General Management - DIGITAL PAYMENT REVOLUTION PDFDocument40 pagesGeneral Management - DIGITAL PAYMENT REVOLUTION PDFasitbhatiaNo ratings yet

- (IJCST-V7I1P3) : Joshua Gisemba OkemwaDocument7 pages(IJCST-V7I1P3) : Joshua Gisemba OkemwaEighthSenseGroup100% (1)

- Perception On Usage of Digital Payments (With Special Reference To Coimbatore City)Document5 pagesPerception On Usage of Digital Payments (With Special Reference To Coimbatore City)Myilswamy KNo ratings yet

- JURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175Document21 pagesJURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175hahaha123No ratings yet

- Impact of Digital Wallets On Consumer Behavior in IndiaDocument17 pagesImpact of Digital Wallets On Consumer Behavior in IndiaIJAR JOURNALNo ratings yet

- Digital Payment by S.SDocument10 pagesDigital Payment by S.SMr David SarkarNo ratings yet

- 10405-Article Text-20446-1-10-20211112Document8 pages10405-Article Text-20446-1-10-20211112Tyrone LaputNo ratings yet

- Digital Payment System 2018Document12 pagesDigital Payment System 2018wong wai hongNo ratings yet

- Article 7Document6 pagesArticle 7Karthik RamanujamNo ratings yet

- Role Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentDocument11 pagesRole Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentIAEME PublicationNo ratings yet

- Impact and Importance of Digital Payment in IndiaDocument3 pagesImpact and Importance of Digital Payment in IndiaPrajwal KottawarNo ratings yet

- A Study On Changing Scenerio of Cashless Economy-1Document14 pagesA Study On Changing Scenerio of Cashless Economy-1Vainika Prasad V SNo ratings yet

- A Study On Consumer Perception of Digital Payment Methods in Times of Covid PandemicDocument13 pagesA Study On Consumer Perception of Digital Payment Methods in Times of Covid PandemicMuthuNo ratings yet

- Vol2I1 Paper15Document15 pagesVol2I1 Paper15Piyush BhoyarNo ratings yet

- Study On Impact of Covid - 19 On Acceptance of Digital PaymentsDocument18 pagesStudy On Impact of Covid - 19 On Acceptance of Digital PaymentsPankaj GuravNo ratings yet

- Digital Financial Services in India: An Analysis of Trends in Digital PaymentDocument17 pagesDigital Financial Services in India: An Analysis of Trends in Digital PaymentRajesh KumarNo ratings yet

- A Study On Digital Payments in India With Perspective of Consumer S AdoptionDocument10 pagesA Study On Digital Payments in India With Perspective of Consumer S AdoptionIron ManNo ratings yet

- 546 PDFDocument10 pages546 PDFIron ManNo ratings yet

- Leng 12Document3 pagesLeng 12Kceey CruzNo ratings yet

- ICT India Working Paper 1Document16 pagesICT India Working Paper 1Mohan SinghNo ratings yet

- Consumer's Perception Towards Online Banking ServicesDocument7 pagesConsumer's Perception Towards Online Banking ServicesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Analysis of How COVID-19 Revolutionized India's Payment InfrastructureDocument11 pagesAn Analysis of How COVID-19 Revolutionized India's Payment InfrastructureIJRASETPublicationsNo ratings yet

- Activity-2 - 1CD20CS126 - RAHUL TIWARI - CompressedDocument17 pagesActivity-2 - 1CD20CS126 - RAHUL TIWARI - CompressedRahul TiwariNo ratings yet

- Digital Payments IndiaDocument23 pagesDigital Payments IndiaLakshay SolankiNo ratings yet

- Article 2Document19 pagesArticle 2sunilrs1980No ratings yet

- Leng 10Document5 pagesLeng 10Kceey CruzNo ratings yet

- Iegs Cashless India Research PaperDocument12 pagesIegs Cashless India Research PaperKanikaNo ratings yet

- Adoption of Digital Payment System by Consumer: A Review of LiteratureDocument8 pagesAdoption of Digital Payment System by Consumer: A Review of LiteratureRavi VermaNo ratings yet

- DBK Publi Chapter 9 2022 89 109Document21 pagesDBK Publi Chapter 9 2022 89 109Balakrishna DammatiNo ratings yet

- Jet Irt 006018Document9 pagesJet Irt 006018Mradul KatiyarNo ratings yet

- A Study On Adoption of Digital Payment Through Mobile Payment Application With Reference To Gujarat StateDocument6 pagesA Study On Adoption of Digital Payment Through Mobile Payment Application With Reference To Gujarat StateEditor IJTSRDNo ratings yet

- An Overview On Digital Payments 4Document12 pagesAn Overview On Digital Payments 4shivamNo ratings yet

- Cashless India - A Digital RevolutionDocument15 pagesCashless India - A Digital RevolutionHrishikesh PuranikNo ratings yet

- A Comparative Study of Marketing Strategies of PAYTM and GOOGLE PAYDocument6 pagesA Comparative Study of Marketing Strategies of PAYTM and GOOGLE PAYHarsh PatelNo ratings yet

- An Overview On Digital Payments 4Document12 pagesAn Overview On Digital Payments 4DS DebasisNo ratings yet

- C S: D A C N: Ashless Ociety Rive'S ND Hallenges IN IgeriaDocument11 pagesC S: D A C N: Ashless Ociety Rive'S ND Hallenges IN IgeriaMandy DiazNo ratings yet

- Effect of Cashless Payment Methods A Case Study Perspective AnalysisDocument4 pagesEffect of Cashless Payment Methods A Case Study Perspective AnalysisAaryan Singh100% (1)

- Factors Influencing Customers Acceptance of Using The QR Code Feature in Offline Merchants For Generation Z in Bandung (Extended UTAUT2)Document28 pagesFactors Influencing Customers Acceptance of Using The QR Code Feature in Offline Merchants For Generation Z in Bandung (Extended UTAUT2)Nguyên ThảoNo ratings yet

- Consumer Perception Towards Digital Payment ModeDocument8 pagesConsumer Perception Towards Digital Payment ModeSibiCk100% (1)

- Sustainability 14 07150 v2Document19 pagesSustainability 14 07150 v2realynNo ratings yet

- PSG 48 65Document19 pagesPSG 48 65ElsaNo ratings yet

- Scope of Digital Payment SystemDocument7 pagesScope of Digital Payment Systemsameer shaikhNo ratings yet

- Monetary and Non-Monetary Rewards for Employees Motivation in Tanzania Public Sector: The Management PerspectivesDocument8 pagesMonetary and Non-Monetary Rewards for Employees Motivation in Tanzania Public Sector: The Management PerspectivesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Integrating Multimodal Deep Learning for Enhanced News Sentiment Analysis and Market Movement ForecastingDocument8 pagesIntegrating Multimodal Deep Learning for Enhanced News Sentiment Analysis and Market Movement ForecastingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Gender-Based Violence: Engaging Children in the SolutionDocument10 pagesGender-Based Violence: Engaging Children in the SolutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Underwater Image Enhancement using GANDocument9 pagesUnderwater Image Enhancement using GANInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Development of ‘Creative Thinking: Case Study of Basic Design StudioDocument9 pagesDevelopment of ‘Creative Thinking: Case Study of Basic Design StudioInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Knowledge about Halitosis and Dental and Oral Hygiene in Patients with Fixed Orthodontics at the HK Medical Center MakassarDocument4 pagesThe Relationship between Knowledge about Halitosis and Dental and Oral Hygiene in Patients with Fixed Orthodontics at the HK Medical Center MakassarInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Comparative Analysis of Pineapples (Ananas Comosus) from Different Bioethanol Sources Available in the PhilippinesDocument39 pagesA Comparative Analysis of Pineapples (Ananas Comosus) from Different Bioethanol Sources Available in the PhilippinesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Investigation Model to Combat Computer Gaming Delinquency in South Africa, Server-Based Gaming, and Illegal Online GamingDocument15 pagesAn Investigation Model to Combat Computer Gaming Delinquency in South Africa, Server-Based Gaming, and Illegal Online GamingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Evaluation of Causes of Visual Impairment Among Bespectacled Between the Age 18-23: A Study from Tamil Nadu, IndiaDocument3 pagesEvaluation of Causes of Visual Impairment Among Bespectacled Between the Age 18-23: A Study from Tamil Nadu, IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Peter's Trypanophobia and HemophobiaDocument9 pagesPeter's Trypanophobia and HemophobiaInternational Journal of Innovative Science and Research Technology100% (1)

- Synergizing for Students Success: A Collaborative Engagement of Parent-Teacher in Grade FourDocument13 pagesSynergizing for Students Success: A Collaborative Engagement of Parent-Teacher in Grade FourInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Awareness Study on Cardiac Injury during Fitness Exercises: A Study from Tamil Nadu, IndiaDocument4 pagesAn Awareness Study on Cardiac Injury during Fitness Exercises: A Study from Tamil Nadu, IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Personality Factors as Predictors of the Level of Personality Functioning in Adolescence: Examining the Influence of Birth Order, Financial Status, and SexDocument10 pagesPersonality Factors as Predictors of the Level of Personality Functioning in Adolescence: Examining the Influence of Birth Order, Financial Status, and SexInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Modified Hourgand Graph Metric DimensionsDocument7 pagesModified Hourgand Graph Metric DimensionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Unveiling Victor Hugo through Critical Race Theory Feminist Lens: A Social Constructivist ApproachDocument7 pagesUnveiling Victor Hugo through Critical Race Theory Feminist Lens: A Social Constructivist ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Encouraging Leadership as Mediator on Supportive Work Atmosphere and Instructional Inventiveness of TeachersDocument11 pagesEncouraging Leadership as Mediator on Supportive Work Atmosphere and Instructional Inventiveness of TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Unraveling the Nuanced Nature of Secrets: Psychological Implications of Concealment and DisclosureDocument6 pagesUnraveling the Nuanced Nature of Secrets: Psychological Implications of Concealment and DisclosureInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Outdoor Learning and Attitude towards Sustainability of Grade 3 TeachersDocument10 pagesOutdoor Learning and Attitude towards Sustainability of Grade 3 TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Water Heritage DocumentationDocument45 pagesWater Heritage DocumentationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Prevalence of Metabolic Syndrome in IndiaDocument11 pagesPrevalence of Metabolic Syndrome in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Bullying and Grades: Insights from Junior High Students in a Catholic InstitutionDocument12 pagesBullying and Grades: Insights from Junior High Students in a Catholic InstitutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- .Sense of Self-Worth as Predictor of Learning Attitude of Senior High School Students in New Corella District, Davao Del NorteDocument12 pages.Sense of Self-Worth as Predictor of Learning Attitude of Senior High School Students in New Corella District, Davao Del NorteInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Supportive Learning Environment and Assertive Classroom Management Strategies as a Contributing Factor of the Academic Resiliency of T.L.E. StudentsDocument10 pagesSupportive Learning Environment and Assertive Classroom Management Strategies as a Contributing Factor of the Academic Resiliency of T.L.E. StudentsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Automatic Essay Scoring with Context-based Analysis with Cohesion and CoherenceDocument8 pagesAutomatic Essay Scoring with Context-based Analysis with Cohesion and CoherenceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Appendicitis Hidden under the Facade of Addison’s Crisis: A Case ReportDocument2 pagesAppendicitis Hidden under the Facade of Addison’s Crisis: A Case ReportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Liver Abscess Caused by Foreign BodyDocument5 pagesLiver Abscess Caused by Foreign BodyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design Information Security in Electronic-Based Government Systems Using NIST CSF 2.0, ISO/IEC 27001: 2022 and CIS ControlDocument8 pagesDesign Information Security in Electronic-Based Government Systems Using NIST CSF 2.0, ISO/IEC 27001: 2022 and CIS ControlInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Proposed Model for Fainting People Detection Using Media Pipe TechnologyDocument4 pagesA Proposed Model for Fainting People Detection Using Media Pipe TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring Well-being in College Students: The Influence of Resilience and Social SupportDocument11 pagesExploring Well-being in College Students: The Influence of Resilience and Social SupportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Evaluating the Performance of Vapor Compression Cycle by Adding NanoparticleDocument12 pagesEvaluating the Performance of Vapor Compression Cycle by Adding NanoparticleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mankiw Chapter 12 Mundell Fleming Model Is LM and ErDocument40 pagesMankiw Chapter 12 Mundell Fleming Model Is LM and Erbasirunjie86No ratings yet

- Tax Homework Set 3Document4 pagesTax Homework Set 3afnoewgmfstnwl100% (1)

- Final ProjectDocument55 pagesFinal ProjectYash MaheshwariNo ratings yet

- Invoice LP2212100071 - PT Universal Farm - Batal Muat Export PDFDocument1 pageInvoice LP2212100071 - PT Universal Farm - Batal Muat Export PDFbudi irawanNo ratings yet

- Santa Barbara Budget Book 10-11 CompleteDocument716 pagesSanta Barbara Budget Book 10-11 CompleteGlenn HendrixNo ratings yet

- Amcham Economic Summit Program - WebDocument4 pagesAmcham Economic Summit Program - WebSyntax ConsultingNo ratings yet

- Case Study SDLC Dan SCM Szyliowicz, J S, & Goetz, A R 1995 Getting PDFDocument21 pagesCase Study SDLC Dan SCM Szyliowicz, J S, & Goetz, A R 1995 Getting PDFLorensius GintingNo ratings yet

- Ba5101 IqDocument15 pagesBa5101 IqNISHANT SAHANo ratings yet

- HP MouseDocument1 pageHP MousevishwanathNo ratings yet

- Olson DL Wu D Enterprise Risk Management in FinanceDocument277 pagesOlson DL Wu D Enterprise Risk Management in FinanceAnna ZubovaNo ratings yet

- Explaining The Price Anomaly of KRX Preferred StocksDocument11 pagesExplaining The Price Anomaly of KRX Preferred Stockstjl84No ratings yet

- Transfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Document71 pagesTransfer Pricing: CA Final: Paper 5: Advanced Management Accounting: Chapter 7Abid Siddiq Murtazai100% (1)

- Chapter 10b - Long Term Finance - EquitiesDocument5 pagesChapter 10b - Long Term Finance - EquitiesTAN YUN YUNNo ratings yet

- Cleaning Correlation MatricesDocument6 pagesCleaning Correlation Matricesdoc_oz3298No ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- Role of Chief Risk Officer (KPMG)Document10 pagesRole of Chief Risk Officer (KPMG)laddudilNo ratings yet

- Market Analysis / TrendsDocument9 pagesMarket Analysis / TrendsrehmanNo ratings yet

- Ajay Britannia BsDocument5 pagesAjay Britannia BsKhushali PoddarNo ratings yet

- Purchase-To-Payment Process Assessment - Sample 2Document36 pagesPurchase-To-Payment Process Assessment - Sample 2viswaja100% (1)

- The Customer Behaviour & Custmer Satisfaction at AvivaDocument85 pagesThe Customer Behaviour & Custmer Satisfaction at Avivashashank100% (1)

- TIN Application - Statement of Estimate (Entity)Document5 pagesTIN Application - Statement of Estimate (Entity)Christian Nicolaus MbiseNo ratings yet

- Change in PSR 1 PDFDocument6 pagesChange in PSR 1 PDFNavya jainNo ratings yet

- AUD Notes Chapter 1Document14 pagesAUD Notes Chapter 1janell184100% (1)

- Ch13 Wiley Plus Wk3Document58 pagesCh13 Wiley Plus Wk3Prakash VaidhyanathanNo ratings yet

- 2021 Proportunity - Investment AnnouncementDocument3 pages2021 Proportunity - Investment Announcementclaus_44No ratings yet

- Hanjin LocalchagreDocument5 pagesHanjin LocalchagreTrần Minh CườngNo ratings yet

- Bulk Sales LawDocument4 pagesBulk Sales LawKatrina Quinto Petil100% (1)

- Ccris BNM BookletDocument11 pagesCcris BNM BookletMuhamad AzmirNo ratings yet

- JIMS Inter-College Techno-Management-Cultural Fest Verve-2K12 BrochureDocument10 pagesJIMS Inter-College Techno-Management-Cultural Fest Verve-2K12 BrochureJagan Institute of Management StudiesNo ratings yet

- BennerDocument17 pagesBennertom.nazarian2010No ratings yet