Professional Documents

Culture Documents

Cyrus Mistry Answer

Cyrus Mistry Answer

Uploaded by

iamask66Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cyrus Mistry Answer

Cyrus Mistry Answer

Uploaded by

iamask66Copyright:

Available Formats

1.

India's corporate governance scenario differs from that of developed countries in several ways, as exemplified by the

case of the Tata Group:

a. Shareholding Structure: Indian business groups, including Tata, often use interlocking shareholding to maintain

control over group firms. This contrasts with the dispersed ownership structure typical in developed countries, where

institutional investors hold significant sway.

b. Regulatory Framework: While India has regulatory bodies like SEBI mandating governance practices, enforcement

may be lax. In contrast, developed countries have stringent regulatory regimes and stronger enforcement

mechanisms.

c. Role of Promoters: Indian promoters, like Ratan Tata, often wield significant influence over group decisions,

sometimes at the expense of minority shareholders. In developed countries, there's usually a clearer separation

between ownership and management, with greater emphasis on shareholder rights.

d. Decision-Making Transparency: Indian corporate decision-making processes may lack transparency, with key

decisions sometimes made without full disclosure to shareholders. In developed countries, there's typically greater

transparency and accountability to shareholders.

Overall, while India has made strides in corporate governance, there remain significant differences compared to

developed countries, with implications for shareholder rights and transparency within companies like Tata.

Cyrus Mistry's performance as the chairman of Tata Sons can be evaluated through various lenses:

a. Strategic Direction: Mistry implemented initiatives to streamline operations and divested underperforming assets,

aiming to focus on profitable businesses. However, his decision-making regarding the sale of Tata Steel Europe and

other assets faced criticism for its long-term viability.

b. Financial Performance: Under Mistry's tenure, Tata Group's financial performance exhibited mixed results. While

some subsidiaries thrived, others faced challenges, with Tata Steel Europe incurring losses, impacting the overall

group performance negatively.

c. Corporate Governance: Mistry advocated for improved corporate governance within Tata Group, enhancing

transparency and accountability. However, conflicts with Tata Trusts and allegations of governance failures raised

concerns about his leadership style.

d. Stakeholder Relations: Mistry's tenure saw strained relations with Tata Trusts and Ratan Tata, leading to his removal.

Despite his efforts to steer the conglomerate, his leadership faced opposition from key stakeholders.

Overall, while Mistry implemented strategic changes, his tenure was marked by controversies and challenges, impacting

his performance rating as Tata Sons' chairman.

Tata Sons levied several charges against Cyrus Mistry:

a. Decreased Dividends: Tata Sons alleged that dividends from group companies declined under Mistry's leadership,

affecting shareholder returns. Validity: While dividend payouts are crucial, factors influencing them extend beyond

leadership, including business performance and market conditions.

b. Complaints about Legacy Issues: Mistry's constant grievances about past problems, despite his awareness, suggested

a failure to address them effectively. Validity: Mistry's focus on legacy issues could indicate a lack of proactive

solutions during his tenure, potentially hindering progress.

c. Misleading Plans: Tata Sons claimed that Mistry misled the selection committee in 2011 with ambitious plans for the

group but failed to execute them. Validity: If Mistry misrepresented plans without achieving intended outcomes, it

reflects poor leadership and strategic management.

d. Family Business Association: Allegations surfaced regarding Mistry's failure to distance himself from his family

business, potentially influencing decision-making. Validity: If Mistry's ties to his family business influenced Tata

Group's operations, it could compromise objectivity and raise conflicts of interest.

e. Concentration of Power: Tata Sons accused Mistry of consolidating power, deviating from the group's interest.

Validity: Concentrated authority may hinder collaborative decision-making and corporate governance, affecting long-

term sustainability.

The validity of these charges depends on evidence substantiating their impact on Tata Group's performance and

governance under Mistry's leadership.

Independent directors play a crucial role in balancing the power dynamics within companies owned largely by promoters.

Their primary responsibility is to represent the interests of minority shareholders and ensure that corporate decisions are

made in a fair, transparent, and ethical manner. This includes providing oversight on financial matters, evaluating strategic

initiatives, and scrutinizing the actions of the management and the board.

In the case of Nusli Wadia's role as an independent director at Tata Steel, his performance indicates a proactive approach

to governance. By voicing concerns over actions perceived to be against shareholder interests, such as the removal of

Cyrus Mistry, Wadia demonstrated a commitment to upholding independence and challenging decisions that could

potentially harm stakeholders. His willingness to stand firm against pressure from the promoter group underscores the

importance of independent directors in preserving corporate integrity and protecting shareholder rights, even in

challenging circumstances.

Shareholders of Tata Steel must conduct a thorough evaluation of the resolutions concerning Cyrus Mistry and Nusli

Wadia. In terms of Cyrus Mistry, they should delve into the specifics of Tata Sons' charges against him, analysing whether

there is substantial evidence to support these allegations. Additionally, shareholders should scrutinize Mistry's

performance during his tenure as chairman of Tata Sons, considering both his achievements and any shortcomings that

may have been detrimental to the company.

Similarly, regarding Nusli Wadia, shareholders must assess his effectiveness as an independent director, examining

whether he acted in the best interests of Tata Steel and its shareholders. They should evaluate Wadia's actions and

decisions within the boardroom, considering his role in promoting transparency, accountability, and good governance

practices.

Ultimately, shareholders should vote thoughtfully, prioritizing the long-term interests of Tata Steel and its stakeholders.

They should aim to make informed decisions based on a comprehensive understanding of the situation and its potential

implications for the company's governance and performance.

Cyrus Mistry resigned from the boards of various Tata Group companies in response to the escalating conflict with Tata

Sons, which sought his removal through extraordinary general meetings (EGMs). By preemptively stepping down, Mistry

aimed to mitigate potential shareholder confrontations and maintain some control over his exit strategy. Resignation

provided him with the opportunity to disengage from the contentious battle with Ratan Tata and Tata Sons, allowing him

to shift focus to defending his reputation and legacy outside the Tata Group.

Additionally, Mistry's resignation may have been a strategic decision to avoid further disruption within the companies he

chaired. Remaining in his position amidst mounting pressure from Tata Sons could have exacerbated internal tensions and

hindered the smooth functioning of the businesses under his leadership. By voluntarily resigning, Mistry aimed to

minimize disruptions and uphold the interests of the companies and their stakeholders to the best of his ability.

Furthermore, Mistry's departure from the boards of Tata Group companies could be interpreted as a form of protest

against what he perceived as unfair treatment and interference in his governance by Tata Sons. Resigning allowed him to

make a statement about his disagreement with Tata Sons' actions and assert his independence from the Tata Group's

influence.

Overall, Mistry's resignation from the boards of Tata Group companies was a strategic move to navigate a challenging

situation and assert some control over his departure amidst escalating tensions with Tata Sons. It provided him with the

opportunity to focus on defending his reputation and pursuing his interests outside the Tata Group's sphere of influence.

You might also like

- Case Study On TwitterDocument6 pagesCase Study On TwitterMd. Zahid HossainNo ratings yet

- Ratan Tata or Cyrus MistryDocument8 pagesRatan Tata or Cyrus Mistrybramha pratapNo ratings yet

- Tata GroupDocument12 pagesTata GroupDanny Paul100% (1)

- SamsungCase QuestionsDocument2 pagesSamsungCase QuestionsBas SchaikNo ratings yet

- Chapter 07 Futures and OptiDocument68 pagesChapter 07 Futures and OptiLia100% (1)

- Corporate Governance Case Study TataDocument5 pagesCorporate Governance Case Study TataShivam Jadhav100% (1)

- Certificate Course On Introduction To CoDocument4 pagesCertificate Course On Introduction To Codeepak singhalNo ratings yet

- Kanishka Agrawal FINALSUBMISSIONDocument13 pagesKanishka Agrawal FINALSUBMISSIONKanishka AgrawalNo ratings yet

- Archana Lenka - MBAHR - CorporateGov - Casestudy2Document6 pagesArchana Lenka - MBAHR - CorporateGov - Casestudy2Archana LenkaNo ratings yet

- Case Study On Tata Sons and Cyrus MistryDocument6 pagesCase Study On Tata Sons and Cyrus MistryNandini ChandraNo ratings yet

- Appeal From Tata GroupDocument4 pagesAppeal From Tata Groupkritin j PaulrajNo ratings yet

- Group 4 - SuccessionPlanning - TMCFDocument16 pagesGroup 4 - SuccessionPlanning - TMCFRITWIJ CHOUDHARYNo ratings yet

- Becg Case Study 2Document4 pagesBecg Case Study 2nidhibhopalNo ratings yet

- Promoters Influence On Corporate Governance: A Case Study of Tata GroupDocument9 pagesPromoters Influence On Corporate Governance: A Case Study of Tata GroupAaronNo ratings yet

- The Tata Corporate Governance Episode: The India-Specific' Issues and ConcernsDocument5 pagesThe Tata Corporate Governance Episode: The India-Specific' Issues and ConcernsPGDM IMSNo ratings yet

- Corporate Governance and Leadership-A Case of Infosys and TATADocument6 pagesCorporate Governance and Leadership-A Case of Infosys and TATASaketNo ratings yet

- Tata Agency ProblemDocument2 pagesTata Agency ProblemShreya Karn 2027446100% (1)

- Tata Group Is A WellDocument4 pagesTata Group Is A WellVIDIT GUPTANo ratings yet

- TatasonsDocument15 pagesTatasonsShromona ChakrabortyNo ratings yet

- Tata Case SolutionDocument10 pagesTata Case Solutionshantanu_malviya_1100% (1)

- Law CIA-3Document14 pagesLaw CIA-3YESHASVINI Y 2328959No ratings yet

- Shakeup at Tata Group May Leave Tata Stocks Volatile: The After EffectDocument5 pagesShakeup at Tata Group May Leave Tata Stocks Volatile: The After EffectDynamic LevelsNo ratings yet

- Tata Sons Press ReleaseDocument3 pagesTata Sons Press ReleaseFirstpostNo ratings yet

- Group Dynamics W.R.T. Ratan Tata and Cyrus MistryDocument11 pagesGroup Dynamics W.R.T. Ratan Tata and Cyrus MistryAnand AroraNo ratings yet

- A Recurrent Quest For Corporate Governance in India Revisiting The Imbalanced Scales of Shareholders' Protection in Tata Mistry CaseDocument17 pagesA Recurrent Quest For Corporate Governance in India Revisiting The Imbalanced Scales of Shareholders' Protection in Tata Mistry CaseSupriya RaniNo ratings yet

- Tata Sons Hits Back, Mistry's Mail Leak UnpardonableDocument3 pagesTata Sons Hits Back, Mistry's Mail Leak UnpardonableDynamic LevelsNo ratings yet

- Tata GroupDocument8 pagesTata GroupBHAVIK DOSHINo ratings yet

- The Tata-Mistry SagaDocument7 pagesThe Tata-Mistry SagaAravind ShankarNo ratings yet

- Report On Tata GroupDocument7 pagesReport On Tata GroupjamesNo ratings yet

- Changes in Culture and Management Style Were Seen To Erode Values' - Times of IndiaDocument4 pagesChanges in Culture and Management Style Were Seen To Erode Values' - Times of IndiaRaam KrishnaNo ratings yet

- Analysis of Tata Group As A Family Business: By-Rithika Ravichandran and Dhairya ChhabraDocument41 pagesAnalysis of Tata Group As A Family Business: By-Rithika Ravichandran and Dhairya Chhabradhairya.eng501No ratings yet

- Corporate Governance at Tata Sons Did They Walk The Talk CaseDocument12 pagesCorporate Governance at Tata Sons Did They Walk The Talk CaseAyush KapoorNo ratings yet

- Individual Cases and Article Critiques 2Document14 pagesIndividual Cases and Article Critiques 2Allen NiNo ratings yet

- Representation - Mr. Cyrus P. Mistry - 5 December 2016Document15 pagesRepresentation - Mr. Cyrus P. Mistry - 5 December 2016Moneylife FoundationNo ratings yet

- JPSP - 2022 - 201Document10 pagesJPSP - 2022 - 201Axit ThakkarNo ratings yet

- The Illusory Promise of Stakeholder GovernanceDocument29 pagesThe Illusory Promise of Stakeholder GovernanceDaniel CruzNo ratings yet

- Current Affairs Capsule - 01Document9 pagesCurrent Affairs Capsule - 01darbha91No ratings yet

- Marketing ManagementDocument31 pagesMarketing ManagementKASHISH AGARWALNo ratings yet

- TATA Case StudyDocument7 pagesTATA Case StudyRoshNo ratings yet

- Advance Corporate StrategyDocument5 pagesAdvance Corporate StrategyPassionate_to_LearnNo ratings yet

- Why The Satyam Fiasco Is Good For India: Images Get QuoteDocument13 pagesWhy The Satyam Fiasco Is Good For India: Images Get QuoteprashanttripathiNo ratings yet

- Ratan Tata Vs Cyrus Mistry Case PDFDocument11 pagesRatan Tata Vs Cyrus Mistry Case PDFbanerjeechiranjib637No ratings yet

- Tata's Ethical and Legal Issues of CommunicationDocument16 pagesTata's Ethical and Legal Issues of CommunicationsaamarthNo ratings yet

- Case Solution - 5 - 6 - 920200904120000Document4 pagesCase Solution - 5 - 6 - 920200904120000Abhishek VermaNo ratings yet

- Introduction To Tata Sons Vs Cyrus MistryDocument5 pagesIntroduction To Tata Sons Vs Cyrus MistryPriyanshuNo ratings yet

- Financial Management Assignment About Agency Problem CIA-3A: Prof. Rajani RamdasDocument4 pagesFinancial Management Assignment About Agency Problem CIA-3A: Prof. Rajani RamdasAbin Som 2028121No ratings yet

- NCRD'S Sterling Institute of Management Studies: Subject Assignment Submitted To Submitted ByDocument4 pagesNCRD'S Sterling Institute of Management Studies: Subject Assignment Submitted To Submitted ByNishita ShivkarNo ratings yet

- Case Study: Board Architecture at Arcelor MittalDocument12 pagesCase Study: Board Architecture at Arcelor MittalbbbbruceNo ratings yet

- B.E May 2010Document2 pagesB.E May 2010ashisingh89No ratings yet

- Mba Summer 2022Document3 pagesMba Summer 2022vtejas842No ratings yet

- OB ProjectDocument5 pagesOB Projectkkachouh2No ratings yet

- Budget 2017-18 Priorities: MR Modi's Big GambleDocument1 pageBudget 2017-18 Priorities: MR Modi's Big Gamblemayank3478No ratings yet

- Weakness of Corporate GovernanceDocument4 pagesWeakness of Corporate GovernanceGabriely MligulaNo ratings yet

- Corporate Governance in SatyamDocument6 pagesCorporate Governance in Satyamnishan_patel_3No ratings yet

- Group 7B Satyam MandelaDocument17 pagesGroup 7B Satyam MandelaPrateek TaoriNo ratings yet

- Corp SynopsisDocument4 pagesCorp SynopsisNavneet BhatiaNo ratings yet

- Corporate Governance Failure at SatyamDocument4 pagesCorporate Governance Failure at SatyamPoojaa ShirsatNo ratings yet

- Strategic MGMT Sess 6 DoneDocument20 pagesStrategic MGMT Sess 6 DoneShwetaNo ratings yet

- TATA Group FinalDocument2 pagesTATA Group FinalShorya PariharNo ratings yet

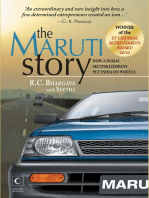

- The Maruti Story: How A Public Sector Company Put India On WheelsFrom EverandThe Maruti Story: How A Public Sector Company Put India On WheelsRating: 3 out of 5 stars3/5 (1)

- Puma Ar 2022 Annual ReportDocument375 pagesPuma Ar 2022 Annual Reportramannamj4No ratings yet

- Contact Details of Mega Food Park Projects As On 01.01.2020 PDFDocument10 pagesContact Details of Mega Food Park Projects As On 01.01.2020 PDFsanjay sharmaNo ratings yet

- Syllabus Strategy Hybrid 2022-2023 (19) - 2Document7 pagesSyllabus Strategy Hybrid 2022-2023 (19) - 2sauvageNo ratings yet

- 01 Task Performance 1 - SBADocument6 pages01 Task Performance 1 - SBAPrincess AletreNo ratings yet

- For More Notes, Presentations, Project Reports VisitDocument71 pagesFor More Notes, Presentations, Project Reports VisitkamdicaNo ratings yet

- Module 2 - Introduction To Assurance PrinciplesDocument21 pagesModule 2 - Introduction To Assurance Principlesflorabel paranaNo ratings yet

- Comfort DelGro Annual Report 2010Document164 pagesComfort DelGro Annual Report 2010dr_twiggyNo ratings yet

- 2021 Leadway Annual ReportDocument201 pages2021 Leadway Annual Reportallder allderNo ratings yet

- Thesis For Financial Management StudentsDocument8 pagesThesis For Financial Management Studentsamberwheelerdesmoines100% (2)

- CG and CSR at GodrejDocument34 pagesCG and CSR at GodrejsamikshanNo ratings yet

- Kalbers 2009Document25 pagesKalbers 2009Bona SamosirNo ratings yet

- AnnualReport2021 AVIA Att1Document268 pagesAnnualReport2021 AVIA Att1Kusuma AntaraNo ratings yet

- Annual Report 2018-19Document284 pagesAnnual Report 2018-19Tejas KarwaNo ratings yet

- M K Land - CG Report - 2021Document56 pagesM K Land - CG Report - 2021Adam Bin Abu BakarNo ratings yet

- Daimler Ir Annual Report 2017Document345 pagesDaimler Ir Annual Report 2017Manish Kumar ChaudharyNo ratings yet

- Stakeholder Governance: How Stakeholders Influence Corporate Decision MakingDocument14 pagesStakeholder Governance: How Stakeholders Influence Corporate Decision MakingSampath Yadav100% (1)

- Consultancy Project - Team 5 - Corporate Governance - BoeingDocument27 pagesConsultancy Project - Team 5 - Corporate Governance - BoeingGH NgNo ratings yet

- Solution Manual For Applying International Financial Reporting Standards Picker Leo Loftus Wise Clark Alfredson 3rd EditionDocument6 pagesSolution Manual For Applying International Financial Reporting Standards Picker Leo Loftus Wise Clark Alfredson 3rd Editionbrillspillowedfv6nvm100% (32)

- Prelim Fm1Document5 pagesPrelim Fm1SERNADA, SHENA M.No ratings yet

- Case Studies of Good Corporate GovernanceDocument288 pagesCase Studies of Good Corporate GovernanceIFC Sustainability75% (12)

- Sticky CostDocument14 pagesSticky CostAkuntansi 2018No ratings yet

- Law Notes, Past Questions and Answers At: ND STDocument56 pagesLaw Notes, Past Questions and Answers At: ND STVite Researchers33% (3)

- Philippine Financial Reporting Standards 9 Financial InstrumentsDocument15 pagesPhilippine Financial Reporting Standards 9 Financial InstrumentsGilbertGalopeNo ratings yet

- SWOT - Company SecretaryDocument8 pagesSWOT - Company Secretaryshubham831968No ratings yet

- Seminar 11-04-13 Mitul Shah Deloitte UKDocument39 pagesSeminar 11-04-13 Mitul Shah Deloitte UKpsmysticNo ratings yet

- 310 Corporate GovernanceDocument24 pages310 Corporate GovernanceManojNo ratings yet

- Ifrs Annual Report 2021Document65 pagesIfrs Annual Report 2021Xiyang WUNo ratings yet

- Regulation TDocument13 pagesRegulation TAbhi RajendraprasadNo ratings yet