Professional Documents

Culture Documents

Preview

Preview

Uploaded by

johncerioniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preview

Preview

Uploaded by

johncerioniCopyright:

Available Formats

Page 1 of 3

Statement number 237

Issue date 28 March 2024

MR J A CERIONI Write to us at Box 3 BX1 1LT

HOLMHURST Call us on 0345 300 0000

92 GREENBANK ROAD Visit us online www.lloydsbank.com

STOKE-ON-TRENT

ST6 7HA

yTQTQTYxvPUxxyTYVPxwwRYV

japM8Q0UwWFcZIzTn0WVFAMK Your Branch HANLEY (775803)

oWawomdVRwhTnTNXlcGrk:5p

ST6 7HA uephkrXAQTvaktwJclVIYaGa

nyhof7;gWFnpyE6uCW78YwMp Sort Code 77-58-03

zzzzzzzzzzzzzzzzzzzzzzzz

Account Number 24386960

IBAN GB12 LOYD 7758 0324 3869 60

BIC LOYDGB21H74

CLASSIC 02 March 2024 to 28 March 2024

Your Account Arranged Overdraft limit £300

Date of previous statement 01 March 2024

Balance on 02 Mar 2024 £1,531.58

Money in £1,438.67

Money out £1,346.39

Balance on 28 Mar 2024 £1,623.86

Arranged overdraft interest £0.00

You should review your account regularly to check whether it

remains appropriate for your circumstances.

Your Interest Rates Fees Explained

Club Lloyds Account Holders – The Club Lloyds maintaining the

Amount of Arranged Overdraft Arranged Overdraft account fee will be shown in the transactions overleaf as ‘'Club

£0.00+ 0.092% per day (39.9% EAR* variable) Lloyds fee’. If you are eligible to have this Maintaining the

account fee waived, you will also see a transaction described as

We apply the daily interest rate shown above to your arranged overdraft balance at the end of the day ‘'Club Lloyds waived’. This does not apply to non-Club Lloyds

*EAR is the Equivalent Annual Rate. This is the annual interest rate of an overdraft. This means you are charged customers.

over the year based on how often and how much you are overdrawn by, and the effect of compounding it - Other services - There are fees for other services you have asked

charging interest on interest already charged. This interest rate does not include any other fees and charges. for. You can find more details in your account conditions or at

www.lloydsbank.com.

Turn over for more information on managing overdrafts '

Lloyds Bank plc, 25 Gresham Street, London, EC2V 7HN.

Things you need to know

Getting in touch

J Write to us: Lloyds Bank,

PO Box 1, BX1 1LT Q Visit us in branch K Go online:

lloydsbank.com/contactus f Call: 0345 300 0000

8am-8pm, 7 days a week

Ways to manage your account About the fees we charge if you use your card abroad

Keep track of what's going in and coming out of your account at any time using: Personal Debit and Cashpoint® Card Charges - If you use your card to withdraw

• Internet Banking – View and manage your accounts online - 24 hours a day, 7 cash or make a payment in a currency other than pounds, the amount is converted

days a week. Register at lloydsbank.com/internetbanking to pounds on the day it is processed by Visa using the Visa Payment Scheme

• Mobile Banking – Manage your account on the go with your mobile phone or exchange rate on the day. You can find the exchange rate by calling

tablet - 24 hours a day, 7 days a week. Download our app from Google Play or 0345 300 0000 (+44 1733 347 007 from overseas). If your account is held in the

the App Store. Channel Islands or Isle of Man, call 0345 744 9900 (+44 1539 736626 from

overseas). If you call before the transaction is processed the rate provided will be

• Telephone Banking – Our automated service is available 24/7, or you can talk

an indication only.

to us between 8am and 8pm, 7 days a week. Not all services are available 24

hours a day, 7 days a week. We will charge you a foreign currency transaction fee of 2.99% of the value of the

• Text Alerts – We can also send you mobile alerts. Alerts can help you manage transaction. This is a fee for the currency conversion. You can find more

your money and avoid charges. They remind you when you need to pay cleared information on our website about the exchange rates that apply to your

funds into your account. They can also help you avoid going into an transaction to help you compare them with other card issuers' rates.

unarranged overdraft or having payments refused. Unless you’ve opted out, If you use your debit card or your Cashpoint® card to withdraw cash in a currency

you’ll automatically receive alerts provided we have an up to date mobile other than pounds (at a cash machine or over the counter) we will also charge a

number for you. Find out more at lloydsbank.com/mobilealerts foreign currency cash fee of £1.50. Where you elect to allow the cash machine

operator/financial service provider to make the conversion to pounds we will only

Overdrafts - choosing the right way to borrow charge a foreign cash fee of £1.50. The provider of the foreign currency may make

An arranged overdraft can help out when you need to borrow in the short term. For a separate charge for conversion. We won't charge a foreign currency cash fee or a

example to pay an unexpected bill. But if you use it often and don’t reduce your foreign cash fee if you withdraw euro within the EEA or UK.

balance, it can turn into an expensive way to borrow. Our cost calculator, which you

can find online at lloydsbank.com/overdrafts, tells you how much an arranged Where you use your debit card to make a purchase or other transaction (not cash

overdraft costs. You should consider if an arranged overdraft facility is the most withdrawal) in a currency other than pounds, whether in person, or by internet or

suitable option for you to borrow money. If you need to borrow money for a longer phone, we will also charge a £0.50 foreign currency purchase fee. The foreign

time, there may be other options better suited to your needs. For more information currency purchase fee does not apply to the Premier and Platinum debit cards; and

visit lloydsbank.com/borrow or call us to talk through your options. will not be charged if your payment is made in euro within the EEA or UK.

We will not make a charge for the withdrawal of cash in pounds within the UK,

Check if your account is still right for you however, the owner of a non-Lloyds Bank cash machine may. Other charges apply,

Your banking needs can change over time so it’s important to check your account is please see the banking charges guide for details.

still right for you by visiting lloydsbank.com/currentaccounts to see our latest

With Travel Smart you can use your debit card abroad as often as your like with no

current accounts.

debit card fees for £7 a week. Add it to your account before you travel and it’ll start

Our interest rates on the date you tell us.

If we pay interest on your balance, your current interest rate is shown on the front of Keeping your data safe

this statement. To find out what the interest rates are on our other accounts, visit

We promise to keep your personal information safe and only use in the way you’ve

lloydsbank.com/current-accounts/rates. Alternatively ask us in branch.

asked. See our privacy notice at lloydsbank.com/privacy or call us for a copy on

0345 602 1997.

JProtecting yourself from fraud We’re here for you if something isn’t right

• Check your statements regularly - If something doesn’t look right or you We want to make sure you’re happy with the products and service we offer. But if

spot a transaction on your statement you didn’t make, call us straight away something goes wrong, let us know and we’ll do everything we can to put things

on 0800 917 7017 or +44 207 4812614 if outside the UK. We may not be right. If you’re still not happy, you can ask the Financial Ombudsman Service to look

able to refund a payment on some types of account if you tell us more than at your concerns, for free.

13 months after the date it happened.

• Keep your statements in a safe place - If you want to throw them away, you The Financial Services Compensation Scheme (FSCS)

should do it in a secure way, like shredding them – please don’t just put them The deposits you hold with us are covered by the Financial

in the bin. Services Compensation Scheme (FSCS). Every year we’ll

send you an information sheet which tells you the types of

• Helping you stay protected - We’ll do all we can to help you avoid fraud. Visit

deposits covered and the protection offered by the FSCS.

lloydsbank.com/security for ways to protect yourself and information on

For more information visit FSCS.org.uk

the latest scams.

• If your card, cheque book or PIN is lost or stolen - Call us straight away on We send statements and other communications from time to time for legal

0800 096 9779 or +44 1702 278 270 if outside the UK – lines are open reasons or to let you know about changes to your accounts or services.

24/7. When you call us your call may be monitored or recorded in case we need to check

• The freeze card feature in our Mobile Banking app lets you quickly freeze and we have carried out your instructions correctly and to help improve our quality of

unfreeze different types of transaction on your cards whenever you need to. service.

Find out more at

lloydsbank.com/help-guidance/customer-support/lost-or-stolen-cards

If your vision is impaired – please contact us for an alternative

format such as large print, Braille or audio CD.

You can call us using Relay UK if you have a hearing or speech impairment. There's more information on the Relay UK help pages

www.relayuk.bt.com. If you need support due to a disability please get in touch. SignVideo services are also available if you're Deaf and use British

Sign Language at lloydsbank.com/signvideo

Lloyds Bank plc. Registered Office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no. 2065 Lloyds Bank plc is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278.

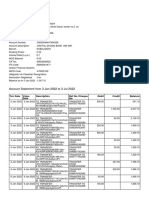

Statement No. 237 Sort Code 77-58-03

28 March 2024 Account Number 24386960

Page 3 of 3

CLASSIC

Your Transactions

Date Pmnt Details Money Out (£) Money In (£) Balance (£)

Type

01 Mar 24 STATEMENT OPENING BALANCE 1,531.58

04 Mar 24 FPO LLOYDS BANK CASHBA 5187914001763321 917.80 613.78

03MAR24 14:28

11 Mar 24 TFR J CERIONI 09MAR24 775803 35434068 300.00 313.78

26 Mar 24 BGC AVIVAC0768770CG 01 58.91 372.69

27 Mar 24 DEB BARCLAYCARD CD 0343 128.59 244.10

28 Mar 24 BGC YX934976A DWP SP 879.76 1,123.86

28 Mar 24 TFR J CERIONI 775803 35434068 500.00 1,623.86

28 Mar 24 STATEMENT CLOSING BALANCE 1,346.39 1,438.67 1,623.86

Payment types:

FPO - Faster Payment TFR - Transfer BGC - Bank Giro Credit DEB - Debit Card

Transaction Details

The "Details" column in your statement shows the date that a Debit Card payment has come into or out of your account only if that

happened on a weekend or a Bank Holiday.

Lloyds Bank plc, 25 Gresham Street, London, EC2V 7HN.

You might also like

- Lloyds Bank StatementDocument4 pagesLloyds Bank StatementEve PawleyNo ratings yet

- Cash AccountDocument4 pagesCash AccountDotopuberNo ratings yet

- Lioyds Bank Statment 3Document4 pagesLioyds Bank Statment 3zainabNo ratings yet

- Wells Fargo Wire Transfer FormDocument2 pagesWells Fargo Wire Transfer FormProsper HarryNo ratings yet

- Classic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Document4 pagesClassic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Deva LinaNo ratings yet

- 3months Bank Statement RgvrdyDocument6 pages3months Bank Statement RgvrdyNikhilreddy SingireddyNo ratings yet

- PreviewDocument5 pagesPreviewRialdu DuarteNo ratings yet

- Classic 11 March 2023 To 12 April 2023: Your AccountDocument6 pagesClassic 11 March 2023 To 12 April 2023: Your Accountrig ers100% (1)

- Easter ChickDocument3 pagesEaster Chickmarythorne17No ratings yet

- PreviewDocument4 pagesPreviewluulfarah99No ratings yet

- PreviewDocument5 pagesPreviewolamide.odukunleNo ratings yet

- Lloyds Bank StatementDocument4 pagesLloyds Bank Statementky139396No ratings yet

- Screenshot 2024-03-14 at 15.54.00Document4 pagesScreenshot 2024-03-14 at 15.54.00luulfarah99No ratings yet

- PreviewDocument5 pagesPreviewHarry TiwanaNo ratings yet

- PreviewDocument5 pagesPreviewEze AnayoNo ratings yet

- PreviewDocument5 pagesPreviewFaz AliNo ratings yet

- Preview 2Document3 pagesPreview 2Harry TiwanaNo ratings yet

- Preview 2Document3 pagesPreview 2jasimchy1975No ratings yet

- Preview 11Document3 pagesPreview 11Harry TiwanaNo ratings yet

- Classic 01 August 2019 To 08 August 2019: Your AccountDocument5 pagesClassic 01 August 2019 To 08 August 2019: Your AccountHuszár PicsaNo ratings yet

- Preview 10Document3 pagesPreview 10Harry TiwanaNo ratings yet

- Preview 3Document9 pagesPreview 3Harry TiwanaNo ratings yet

- Classic 07 June 2023 To 06 July 2023: Your AccountDocument5 pagesClassic 07 June 2023 To 06 July 2023: Your AccountAlexandru BuscaNo ratings yet

- Bank StatementDocument3 pagesBank Statementrk7vzkvh9jNo ratings yet

- Current Account Statement - 23022024Document5 pagesCurrent Account Statement - 23022024aliqadri4556No ratings yet

- PreviewDocument6 pagesPreviewiebikereNo ratings yet

- Current Account Statement - 23022024Document6 pagesCurrent Account Statement - 23022024aliqadri4556No ratings yet

- Preview 12Document3 pagesPreview 12Harry TiwanaNo ratings yet

- Preview 4Document4 pagesPreview 4Harry TiwanaNo ratings yet

- PreviewDocument3 pagesPreviewAdetunji Babatunde TaiwoNo ratings yet

- Preview 7Document3 pagesPreview 7Harry TiwanaNo ratings yet

- Annual CIS Statement Tax Year 2020-2021 2Document4 pagesAnnual CIS Statement Tax Year 2020-2021 2Harry TiwanaNo ratings yet

- PreviewDocument4 pagesPreviewsania.begum2006No ratings yet

- PreviewDocument5 pagesPreviewIon MoldovanuNo ratings yet

- Preview 9Document3 pagesPreview 9Harry TiwanaNo ratings yet

- Preview 5Document4 pagesPreview 5Harry TiwanaNo ratings yet

- Halifax StatementDocument4 pagesHalifax Statementgreatfelix09No ratings yet

- Alqab StatDocument5 pagesAlqab Stataliqadri4556No ratings yet

- PreviewDocument6 pagesPreviewregineloning83No ratings yet

- Lioyds Abnk Statement 2Document11 pagesLioyds Abnk Statement 2zainabNo ratings yet

- Digital Inbox4373516690433518971 240325 223423Document6 pagesDigital Inbox4373516690433518971 240325 223423maxstefan290No ratings yet

- PreviewDocument9 pagesPreviewjames.gardner1310No ratings yet

- PDF Document 444D 82E5 B0 0Document6 pagesPDF Document 444D 82E5 B0 0Ionutpopescu1997No ratings yet

- PreviewDocument4 pagesPreviewandrealhepburnNo ratings yet

- Current Account 16 August 2022 To 15 September 2022: Your Account Arranged Overdraft Limit 150Document4 pagesCurrent Account 16 August 2022 To 15 September 2022: Your Account Arranged Overdraft Limit 150Neelam MirNo ratings yet

- Lloyds Bank StatementDocument6 pagesLloyds Bank StatementamatobertrumNo ratings yet

- Preview PDFDocument5 pagesPreview PDFUbong UmorenNo ratings yet

- PreviewDocument11 pagesPreviewvickythom10No ratings yet

- PreviewDocument4 pagesPreviewJoshua PerumalaNo ratings yet

- NEW Higginbotham-Jonespreview +++ - HALIFAXDocument4 pagesNEW Higginbotham-Jonespreview +++ - HALIFAX13KARATNo ratings yet

- Classic 20 April 2021 To 19 May 2021: Your AccountDocument3 pagesClassic 20 April 2021 To 19 May 2021: Your AccountAlvina SaragovNo ratings yet

- Liderança Com PropósitosDocument6 pagesLiderança Com PropósitosAmandaNo ratings yet

- Spend & Save Account: Your Account Arranged Overdraft Limit (500.00Document6 pagesSpend & Save Account: Your Account Arranged Overdraft Limit (500.00joeNo ratings yet

- PreviewDocument7 pagesPreviewMartyn James PrattNo ratings yet

- Statement 601533 74663593 08 Mar 2024-DesbloqueadoDocument2 pagesStatement 601533 74663593 08 Mar 2024-Desbloqueado8zpsyy86trNo ratings yet

- PreviewDocument3 pagesPreviewsameerahme03No ratings yet

- BookDocument6 pagesBookusmanabid2009No ratings yet

- Preview HALIFAXDocument4 pagesPreview HALIFAX13KARATNo ratings yet

- Current-Account-Statement 01032024 BRETTDocument3 pagesCurrent-Account-Statement 01032024 BRETTjohnsonwto15No ratings yet

- Statement DecemberDocument4 pagesStatement DecemberNNo ratings yet

- PreviewDocument3 pagesPreviewvi6205552No ratings yet

- FEE WAIVER Tc16feb23Document1 pageFEE WAIVER Tc16feb23Sharif MdNo ratings yet

- E RupeeDocument3 pagesE RupeeHritam BoseNo ratings yet

- UnlockedDocument27 pagesUnlockedSameer DeshmukhNo ratings yet

- Application and Receipt For International Wire TransferDocument1 pageApplication and Receipt For International Wire TransferFerdee FerdNo ratings yet

- Kweek Coin - Technology and DevelopmentDocument8 pagesKweek Coin - Technology and DevelopmentPatrick Anderson ReisNo ratings yet

- Delivered GoodsDocument2 pagesDelivered Goodsorestispahiu1No ratings yet

- Wa0000.Document22 pagesWa0000.dwivediavinash482No ratings yet

- BNI Mobile Banking: Histori TransaksiDocument7 pagesBNI Mobile Banking: Histori TransaksiErwin NasrullahNo ratings yet

- Statement DEC2023 763439582Document28 pagesStatement DEC2023 763439582dubey.princesriNo ratings yet

- Pricing-Birla Navya AnaikaDocument7 pagesPricing-Birla Navya AnaikaResale/Renting Settlers IndiaNo ratings yet

- RDInstallment Report 01!06!2023Document1 pageRDInstallment Report 01!06!2023PRADEEP KUMARNo ratings yet

- InstructionsDocument2 pagesInstructionsCristinaNo ratings yet

- Cash Flow TempletDocument8 pagesCash Flow TempletMudassir AbbassNo ratings yet

- Account StatementDocument12 pagesAccount StatementManick SantraNo ratings yet

- PB Enterprise - Main Page Sewa Bulan 2Document2 pagesPB Enterprise - Main Page Sewa Bulan 2Salvador VamNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument16 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancevedhasai198No ratings yet

- Monzo - Bank - Statement - 2024 02 14 2024 03 22 - 9451Document7 pagesMonzo - Bank - Statement - 2024 02 14 2024 03 22 - 9451tyagi.rushil17No ratings yet

- Account Statement From 3 Jan 2022 To 3 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument14 pagesAccount Statement From 3 Jan 2022 To 3 Jul 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesatyam goyalNo ratings yet

- CubDocument6 pagesCubsunil1237No ratings yet

- Cellular Mobile Operators in PakistanDocument3 pagesCellular Mobile Operators in Pakistanabdulmateen01No ratings yet

- Bacs Standard 18 MigDocument17 pagesBacs Standard 18 MigRameez RajaNo ratings yet

- Nov Bill 2Document5 pagesNov Bill 2Jaiprakash RaoNo ratings yet

- Customer AttendanceDocument3 pagesCustomer Attendancejsl2001No ratings yet

- 2023 05 18 17 29 17feb 23 - 144009Document7 pages2023 05 18 17 29 17feb 23 - 144009Kapish BhallaNo ratings yet

- 03 - 23 - 2024 - STATEMENT - Sat Mar 23 19 - 30 - 56 GMT+03 - 00 2024Document6 pages03 - 23 - 2024 - STATEMENT - Sat Mar 23 19 - 30 - 56 GMT+03 - 00 2024minamouries155No ratings yet

- Procura Judiciara Divort Dna StanDocument8 pagesProcura Judiciara Divort Dna StanLoredana MarcelNo ratings yet

- City BankDocument4 pagesCity BankBD MahamudNo ratings yet

- Account Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Mar 2023 To 4 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesameer bawejaNo ratings yet