Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsGQ 6.2 Sol

GQ 6.2 Sol

Uploaded by

nessamuchenaGraded question solution

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Sol. Man. - Chapter 9 Income TaxesDocument15 pagesSol. Man. - Chapter 9 Income TaxesMiguel Amihan100% (1)

- Acc 304 Module 1Document31 pagesAcc 304 Module 1vzu53350No ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Intacc2 Assignment 6.1 AnswersDocument6 pagesIntacc2 Assignment 6.1 AnswersMingNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Tax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDocument3 pagesTax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDevi PrasannaNo ratings yet

- Week 5 Portfolio (kèm ảnh)Document8 pagesWeek 5 Portfolio (kèm ảnh)qwqjkm9bfrNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- As 22Document1 pageAs 22Sajish RaiNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Taller FinalDocument13 pagesTaller FinalJennifer Ramos PerezNo ratings yet

- Ztaxsheet AdobeDocument2 pagesZtaxsheet AdobeGarima ChughNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- SK TempDocument2 pagesSK TempsanjchandanNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document11 pagesIncome Tax Calculator Fy 2020 21 v1nach.nachiketNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Financial Accounting 3A Assignment 2Document10 pagesFinancial Accounting 3A Assignment 2Mikaeel MohamedNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- Finalchapter-16 2Document22 pagesFinalchapter-16 2Jud Rossette ArcebesNo ratings yet

- 2019 IntAcc Vol 3 CH 4 AnswersDocument9 pages2019 IntAcc Vol 3 CH 4 AnswersRizalito SisonNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- TEST 3 SolutionDocument3 pagesTEST 3 SolutionlusandasithembeloNo ratings yet

- Practice Exam Chapters 16-18 Solutions: Problem IDocument4 pagesPractice Exam Chapters 16-18 Solutions: Problem IAtif RehmanNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- 2020 DT Notes RevisionDocument7 pages2020 DT Notes RevisionTsekeNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Recap I Tulati IDocument1 pageRecap I Tulati IPaul Gabriel BălteanuNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- GSTR9 33AAACA7962L1ZH 032022-FinalDocument8 pagesGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNo ratings yet

- Screenshot 2023-02-28 at 4.57.32 PMDocument2 pagesScreenshot 2023-02-28 at 4.57.32 PMTanushree MishraNo ratings yet

- CHAPTER6Document24 pagesCHAPTER6Lhica EsterasNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Income Taxes - Medix LTD MemoDocument3 pagesIncome Taxes - Medix LTD Memoandiswa zuluNo ratings yet

- Particulars of Tax CreditDocument2 pagesParticulars of Tax CreditMd Roni HasanNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- BÀI TẬP NHÓM-IAS12-P11.2-11.3Document5 pagesBÀI TẬP NHÓM-IAS12-P11.2-11.3Kiều OanhNo ratings yet

- Memorandum Question 12 Mandlacoal LTD 2021Document8 pagesMemorandum Question 12 Mandlacoal LTD 2021NOKUHLE ARTHELNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Flip Question (Substantive Test)Document2 pagesFlip Question (Substantive Test)nessamuchenaNo ratings yet

- RGKV RKV301 Assignment Question (Optimal Mix)Document1 pageRGKV RKV301 Assignment Question (Optimal Mix)nessamuchenaNo ratings yet

- Assignment Solutions (Auditing Key Financial Controls)Document7 pagesAssignment Solutions (Auditing Key Financial Controls)nessamuchenaNo ratings yet

- Final RGKV301 Test 2 S - 2023Document1 pageFinal RGKV301 Test 2 S - 2023nessamuchenaNo ratings yet

- RGKV301 Test 2 SolutionDocument1 pageRGKV301 Test 2 SolutionnessamuchenaNo ratings yet

- Final RGKV301 Test 2 Q - 2023Document7 pagesFinal RGKV301 Test 2 Q - 2023nessamuchenaNo ratings yet

- RGKV301 Test 2 Q - 2022Document7 pagesRGKV301 Test 2 Q - 2022nessamuchenaNo ratings yet

- GQ Solution 25.6Document2 pagesGQ Solution 25.6nessamuchenaNo ratings yet

- GQ Solution 25.3Document1 pageGQ Solution 25.3nessamuchenaNo ratings yet

GQ 6.2 Sol

GQ 6.2 Sol

Uploaded by

nessamuchena0 ratings0% found this document useful (0 votes)

14 views1 pageGraded question solution

Original Title

GQ 6.2 SOL

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGraded question solution

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views1 pageGQ 6.2 Sol

GQ 6.2 Sol

Uploaded by

nessamuchenaGraded question solution

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

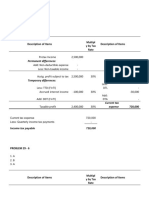

Solutions to GAAP : Graded Questions Taxation: Deferred taxation

Solution 6.2

a) Deferred tax computation

Carrying Tax Temporary Deferred

amount base difference tax (30%)

C C C C

Asset-cost 300 300 0 0

Accumulated depreciation / 6

Tax allowance 100 80 20

20

200 220 6 (A)

(Deductible)

b) Deferred tax journal

Dr Deferred tax: income tax (A) 6

Cr Income tax expense (P/L) 6

c) Current tax computation

x 0.30

Profit before taxation 1 000

Permanent differences 0

1 000

Temporary differences -

+ Depreciation 100

- Tax allowance (80)

Taxable profit 1 020 306 Dr TE Cr CTP

d) Current tax journal

Dr Income tax expense (P/L) 306

Cr Current tax payable: income tax (L) 306

e) SOCI

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 20X4

C

Profit before taxation 1 000

Income tax expense (306 - 6) (300)

700

© Service & Kolitz, 2022 - 2023 Chapter 6: Page 3

You might also like

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- Sol. Man. - Chapter 9 Income TaxesDocument15 pagesSol. Man. - Chapter 9 Income TaxesMiguel Amihan100% (1)

- Acc 304 Module 1Document31 pagesAcc 304 Module 1vzu53350No ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Intacc2 Assignment 6.1 AnswersDocument6 pagesIntacc2 Assignment 6.1 AnswersMingNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Tax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDocument3 pagesTax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDevi PrasannaNo ratings yet

- Week 5 Portfolio (kèm ảnh)Document8 pagesWeek 5 Portfolio (kèm ảnh)qwqjkm9bfrNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- As 22Document1 pageAs 22Sajish RaiNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- Taller FinalDocument13 pagesTaller FinalJennifer Ramos PerezNo ratings yet

- Ztaxsheet AdobeDocument2 pagesZtaxsheet AdobeGarima ChughNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- SK TempDocument2 pagesSK TempsanjchandanNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document11 pagesIncome Tax Calculator Fy 2020 21 v1nach.nachiketNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Financial Accounting 3A Assignment 2Document10 pagesFinancial Accounting 3A Assignment 2Mikaeel MohamedNo ratings yet

- PRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionDocument7 pagesPRIA FAR - 014 Income Taxes (PAS 12) Notes and SolutionEnrique Hills RiveraNo ratings yet

- Finalchapter-16 2Document22 pagesFinalchapter-16 2Jud Rossette ArcebesNo ratings yet

- 2019 IntAcc Vol 3 CH 4 AnswersDocument9 pages2019 IntAcc Vol 3 CH 4 AnswersRizalito SisonNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- TEST 3 SolutionDocument3 pagesTEST 3 SolutionlusandasithembeloNo ratings yet

- Practice Exam Chapters 16-18 Solutions: Problem IDocument4 pagesPractice Exam Chapters 16-18 Solutions: Problem IAtif RehmanNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- 2020 DT Notes RevisionDocument7 pages2020 DT Notes RevisionTsekeNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Recap I Tulati IDocument1 pageRecap I Tulati IPaul Gabriel BălteanuNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- GSTR9 33AAACA7962L1ZH 032022-FinalDocument8 pagesGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNo ratings yet

- Screenshot 2023-02-28 at 4.57.32 PMDocument2 pagesScreenshot 2023-02-28 at 4.57.32 PMTanushree MishraNo ratings yet

- CHAPTER6Document24 pagesCHAPTER6Lhica EsterasNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Income Taxes - Medix LTD MemoDocument3 pagesIncome Taxes - Medix LTD Memoandiswa zuluNo ratings yet

- Particulars of Tax CreditDocument2 pagesParticulars of Tax CreditMd Roni HasanNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- BÀI TẬP NHÓM-IAS12-P11.2-11.3Document5 pagesBÀI TẬP NHÓM-IAS12-P11.2-11.3Kiều OanhNo ratings yet

- Memorandum Question 12 Mandlacoal LTD 2021Document8 pagesMemorandum Question 12 Mandlacoal LTD 2021NOKUHLE ARTHELNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Flip Question (Substantive Test)Document2 pagesFlip Question (Substantive Test)nessamuchenaNo ratings yet

- RGKV RKV301 Assignment Question (Optimal Mix)Document1 pageRGKV RKV301 Assignment Question (Optimal Mix)nessamuchenaNo ratings yet

- Assignment Solutions (Auditing Key Financial Controls)Document7 pagesAssignment Solutions (Auditing Key Financial Controls)nessamuchenaNo ratings yet

- Final RGKV301 Test 2 S - 2023Document1 pageFinal RGKV301 Test 2 S - 2023nessamuchenaNo ratings yet

- RGKV301 Test 2 SolutionDocument1 pageRGKV301 Test 2 SolutionnessamuchenaNo ratings yet

- Final RGKV301 Test 2 Q - 2023Document7 pagesFinal RGKV301 Test 2 Q - 2023nessamuchenaNo ratings yet

- RGKV301 Test 2 Q - 2022Document7 pagesRGKV301 Test 2 Q - 2022nessamuchenaNo ratings yet

- GQ Solution 25.6Document2 pagesGQ Solution 25.6nessamuchenaNo ratings yet

- GQ Solution 25.3Document1 pageGQ Solution 25.3nessamuchenaNo ratings yet