Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 views2018-19 Statement of Profit and Loss

2018-19 Statement of Profit and Loss

Uploaded by

capraisyjanetteCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Document 28 PDFDocument3 pagesDocument 28 PDFamirNo ratings yet

- FNCE 6018 Group Project: Hedging at PorscheDocument2 pagesFNCE 6018 Group Project: Hedging at PorschejorealNo ratings yet

- NAACP Membership FormDocument1 pageNAACP Membership FormLenette HoldenNo ratings yet

- Applied Economics Week 3-4Document10 pagesApplied Economics Week 3-4MOST SUBSCRIBER WITHOUT A VIDEO100% (1)

- Statement of Profit and LossDocument1 pageStatement of Profit and LossrytryrtyrtNo ratings yet

- Statement Profit Loss StandaloneDocument1 pageStatement Profit Loss Standalonesubham not a nameNo ratings yet

- Statement Profit Loss ConsolidatedDocument1 pageStatement Profit Loss Consolidatedshubham kumarNo ratings yet

- Annual Report 2020 21 261 PDFDocument1 pageAnnual Report 2020 21 261 PDFAnand GovindanNo ratings yet

- Annual Report FY 2022 23Document4 pagesAnnual Report FY 2022 23Piyush PalawatNo ratings yet

- Integrated Report and Annual Accounts 2016-17-175 175Document1 pageIntegrated Report and Annual Accounts 2016-17-175 175Sanju VisuNo ratings yet

- Tata Motors Group Q4 Annual Financial Results FY19 20Document10 pagesTata Motors Group Q4 Annual Financial Results FY19 20Anil Kumar AkNo ratings yet

- Regd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001Document6 pagesRegd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001HolaNo ratings yet

- Financial Results Consolidated Q1fy23Document4 pagesFinancial Results Consolidated Q1fy23Raj veerNo ratings yet

- Apollo Tyres Ltd.Document3 pagesApollo Tyres Ltd.Nishant HardiyaNo ratings yet

- Financial Result Q4fy22 ConsolidatedDocument6 pagesFinancial Result Q4fy22 ConsolidatedTharunyaNo ratings yet

- TML Standalone Results Sept 2023 1Document5 pagesTML Standalone Results Sept 2023 1NagendranNo ratings yet

- TATA MOTORS Profit and Loss SheetDocument1 pageTATA MOTORS Profit and Loss SheetKaushal RautNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- (In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanDocument9 pages(In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanAnamika NandiNo ratings yet

- Quarter AnnualDocument8 pagesQuarter AnnualNeetu JainNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document2 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Yash ModiNo ratings yet

- Income: For The Year Ended March 31, 2020Document3 pagesIncome: For The Year Ended March 31, 2020Vaibhav BorateNo ratings yet

- Statemnt of Profit and LossDocument1 pageStatemnt of Profit and LossRutuja shindeNo ratings yet

- DPL Annual Report 2022 23 Pages 2Document1 pageDPL Annual Report 2022 23 Pages 2workf17hoursformeNo ratings yet

- 2016 Annual ReportDocument7 pages2016 Annual ReportHeadshot's GameNo ratings yet

- Specific Project 2 AccountancyDocument10 pagesSpecific Project 2 Accountancyshouryayadav872No ratings yet

- Eastern Coalfields LimitedDocument9 pagesEastern Coalfields LimitedSyed Shamiul HaqueNo ratings yet

- CMA FormatDocument7 pagesCMA FormatRamakrishnan NatarajanNo ratings yet

- Standalone Profit LossDocument1 pageStandalone Profit LossrahulNo ratings yet

- Q2FY19 Standalone ResultDocument4 pagesQ2FY19 Standalone ResultDivyansh SinghNo ratings yet

- Ilovepdf MergedDocument5 pagesIlovepdf MergedRaghav AgarwalNo ratings yet

- Directors' Report: 1. Company PerformanceDocument57 pagesDirectors' Report: 1. Company PerformanceMUHAMMEDNo ratings yet

- Q2FY11 ResultsDocument4 pagesQ2FY11 ResultsSaurabh ShivhareNo ratings yet

- Standalone Balance Sheet Standalone Statement of Profit and LossDocument3 pagesStandalone Balance Sheet Standalone Statement of Profit and LosssqxxsnnfdgNo ratings yet

- Statement of Profit and Loss Balance SheetDocument3 pagesStatement of Profit and Loss Balance SheetSanam TNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document10 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Sourya MitraNo ratings yet

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- Aurobindo Mar20Document10 pagesAurobindo Mar20free meNo ratings yet

- Consol Result Mar23Document16 pagesConsol Result Mar23Amit KumarNo ratings yet

- Financial Results Consolidated Q2 FY 2023 2024Document10 pagesFinancial Results Consolidated Q2 FY 2023 2024surendran naiduNo ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- TCL Consolidated Sebi Results 31 December 2022Document3 pagesTCL Consolidated Sebi Results 31 December 2022Ravi Kumar KodiyalaNo ratings yet

- Balance Sheet - FDocument1 pageBalance Sheet - FRohit SoniNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- Regulation 33 Unaudited Financial Results For The Half Year Ended On 30.09.2019Document5 pagesRegulation 33 Unaudited Financial Results For The Half Year Ended On 30.09.2019Neetu JainNo ratings yet

- Afm Report Group 1 (Tata Motors)Document40 pagesAfm Report Group 1 (Tata Motors)ASHIKA DUGARNo ratings yet

- ONGC Cash FlowDocument4 pagesONGC Cash FlowSreehari K.SNo ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- 17106A1013 - Ratio Analysis of Apollo TyresDocument14 pages17106A1013 - Ratio Analysis of Apollo TyresNitin PolNo ratings yet

- SGXNET FY2016 - 21feb17Document12 pagesSGXNET FY2016 - 21feb17phuawlNo ratings yet

- Profit&Loss 09 10Document1 pageProfit&Loss 09 10Rashmin TomarNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document8 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006pradeepNo ratings yet

- Padma TractorsDocument35 pagesPadma TractorsArun KumarNo ratings yet

- APOLLO TYRE - Financial-Results-June-30-2019 PDFDocument6 pagesAPOLLO TYRE - Financial-Results-June-30-2019 PDFvandana sahuNo ratings yet

- Elgi Gulf (Fze) Balance Sheet As at 31St March 2015Document7 pagesElgi Gulf (Fze) Balance Sheet As at 31St March 2015SnehaNo ratings yet

- June 2021Document3 pagesJune 2021akshay kausaleNo ratings yet

- Digitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Document5 pagesDigitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Mahesh hamneNo ratings yet

- Q4 Results of Bal 2022-23Document11 pagesQ4 Results of Bal 2022-23dewerNo ratings yet

- 3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFDocument64 pages3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFsamullemNo ratings yet

- Statement of Profit and Loss For The Year Ended 31St March 2017Document1 pageStatement of Profit and Loss For The Year Ended 31St March 2017Himanshu DuttaNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- Balance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMDocument1 pageBalance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMharshit abrolNo ratings yet

- Chapter 2Document7 pagesChapter 2IanNo ratings yet

- .TFFL:: Lls4Lxj - It:IisjfifDocument1 page.TFFL:: Lls4Lxj - It:IisjfifPANDILAKSHMINo ratings yet

- MTN Uganda Earnings AnalysisDocument7 pagesMTN Uganda Earnings AnalysisTimothy KawumaNo ratings yet

- Tension & Shear CapacityDocument5 pagesTension & Shear CapacityFaridUddinNo ratings yet

- Centrifugal Sprayed Concrete For Lining Horizontal Pipes Culverts and Vertical ShaftsDocument7 pagesCentrifugal Sprayed Concrete For Lining Horizontal Pipes Culverts and Vertical ShaftsFabiano MoraisNo ratings yet

- Demographic Effects On Labor Force Participation RateDocument7 pagesDemographic Effects On Labor Force Participation RatemichaelNo ratings yet

- SLT NotesDocument11 pagesSLT NotesTime-Lapse CamNo ratings yet

- 19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFDocument4 pages19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFYaswanth KumarNo ratings yet

- COVID-19: Outcomes For Global Supply Chains: Luis Miguel FONSECADocument15 pagesCOVID-19: Outcomes For Global Supply Chains: Luis Miguel FONSECALinh HoangNo ratings yet

- 13 Nilufer-CaliskanDocument7 pages13 Nilufer-Caliskanab theproNo ratings yet

- Komunikasi Krisis Perusahaan TelekomunikasiDocument8 pagesKomunikasi Krisis Perusahaan TelekomunikasiDelia NurusyifaNo ratings yet

- Shava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricaDocument13 pagesShava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricachazunguzaNo ratings yet

- Chapter 2 The Fundamental Economic Problem Scarcity and ChoiceDocument39 pagesChapter 2 The Fundamental Economic Problem Scarcity and ChoiceJoelyn RamosNo ratings yet

- 02 Wage RegisterDocument7 pages02 Wage RegisterShritej nirmalNo ratings yet

- AMP Investor PresentationDocument15 pagesAMP Investor PresentationMattNo ratings yet

- Financial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pDocument16 pagesFinancial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pdainesecowboyNo ratings yet

- Material Cost and Escalation Clauses in Indian ConsDocument14 pagesMaterial Cost and Escalation Clauses in Indian ConsgayaseshaNo ratings yet

- SS 1D Chapter 1Document5 pagesSS 1D Chapter 1samuel laxamanaNo ratings yet

- Project WorkDocument11 pagesProject WorkC.s TanyaNo ratings yet

- Low Carbon Content SteelsDocument1 pageLow Carbon Content SteelsAntonio ClimaNo ratings yet

- Business Level StrategyDocument34 pagesBusiness Level StrategyByl Dawn DeafNo ratings yet

- Acronyms and AbbreviationsDocument1 pageAcronyms and AbbreviationsSabrina CarriónNo ratings yet

- Summary Ifsb Puteri F1025Document5 pagesSummary Ifsb Puteri F1025Siti Nur QamarinaNo ratings yet

- A.Haque, B.Rahm - Traffic AnalysisDocument5 pagesA.Haque, B.Rahm - Traffic AnalysisDhaabar SalaaxNo ratings yet

- Transaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalanceDocument3 pagesTransaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalancejyothiNo ratings yet

- Critical Thinking On TD BankDocument5 pagesCritical Thinking On TD Bankabaya zebedeoNo ratings yet

2018-19 Statement of Profit and Loss

2018-19 Statement of Profit and Loss

Uploaded by

capraisyjanette0 ratings0% found this document useful (0 votes)

8 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views1 page2018-19 Statement of Profit and Loss

2018-19 Statement of Profit and Loss

Uploaded by

capraisyjanetteCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

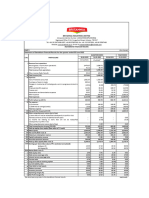

Consolidated Statement of Profit and Loss

INTEGRATED REPORT (01-77)

(` in crores)

Notes Year ended Year ended

March 31, 2019 March 31, 2018

I. Revenue from operations 32

(a) Revenue 299,190.59 289,386.25

(b) Other Operating Revenues 2,747.81 2,954.39

Total revenue from operations 301,938.40 292,340.64

II. Other income (includes Government grants) 33 2,965.31 3,957.59

III. Total Income (I+II) 304,903.71 296,298.23

IV. Expenses:

(a) Cost of materials consumed

(i) Cost of materials consumed 182,254.45 173,371.19

(ii) Basis adjustment on hedge accounted derivatives (1,245.37) (1,378.60)

(b) Purchase of products for sale 13,258.83 15,903.99

( c) Changes in inventories of finished goods, work-in-progress and products for sale 2,053.28 (2,046.58)

(d) Excise duty - 790.16

(e) Employee benefits expense 34 33,243.87 30,300.09

(f) Finance costs 35 5,758.60 4,681.79

STATUTORY REPORTS (78-195)

(g) Foreign exchange (gain)/loss (net) 905.91 (1,185.28)

(h) Depreciation and amortisation expense 23,590.63 21,553.59

(i) Product development/Engineering expenses 4,224.57 3,531.87

(j) Other expenses 36 62,238.12 60,184.21

(k) Amount transferred to capital and other account (19,659.59) (18,588.09)

Total Expenses (IV) 306,623.30 287,118.34

V. Profit before exceptional items and tax (III-IV) (1,719.59) 9,179.89

VI. Exceptional Items:

(a) Defined benefit pension plan amendment past service cost/(credit) 46 (d) 147.93 (3,609.01)

(b) Employee separation cost 46 (f) 1,371.45 3.68

( c) Provision for / impairment of capital work-in-progress and intangibles under development (net) 46 ( c) 180.97 1,641.38

(d) Provision for costs of closure of operation of a subsidiary company 46 (e) 381.01 -

(e) Provision for impairment in Jaguar Land Rover 7 27,837.91 -

(f) Profit on sale of investment in a subsidiary company 46 (g) (376.98) -

(g) Others 46 (i) 109.27 (11.19)

VII. Profit/(Loss) before tax (V-VI) (31,371.15) 11,155.03

VIII. Tax expense/(credit) (net): 21

(a) Current tax (including Minimum Alternate Tax) 2,225.23 3,303.46

(b) Deferred tax (4,662.68) 1,038.47

Total tax expense/(credit) (2,437.45) 4,341.93

IX. Profit/(loss) for the year from continuing operations (VII-VIII) (28,933.70) 6,813.10

FINANCIAL STATEMENTS (196-395)

X. Share of profit of joint ventures and associates (net) 8 209.50 2,278.26

XI. Profit/(loss) for the year (IX+X) (28,724.20) 9,091.36

Attributable to:

(a) Shareholders of the Company (28,826.23) 8,988.91

(b) Non-controlling interests 102.03 102.45

XII. Other comprehensive income/(loss):

(A) (i) Items that will not be reclassified to profit or loss:

(a) Remeasurement gains and (losses) on defined benefit obligations (net) (2,561.26) 4,676.51

(b) Equity instruments at fair value through other comprehensive income (net) 35.60 42.86

( c) Share of other comprehensive income in equity accounted investees (net) 11.15 (7.16)

(d) Gains and (losses) in cash flow hedges of forecast inventory purchases (1,746.24) 1,227.74

(ii) Income tax (expense)/credit relating to items that will not be reclassified to profit or loss 697.41 (991.02)

(B) (i) Items that will be reclassified to profit or loss:

(a) Exchange differences in translating the financial statements of foreign operations (2,010.22) 9,518.15

(b) Gains and (losses) in cash flow hedges 52.82 18,069.71

( c) Share of other comprehensive income in equity accounted investees (net) (58.61) 429.41

(ii) Income tax (expense)/credit relating to items that will be reclassified to profit or loss 3.58 (3,403.69)

Total other comprehensive income/(loss) for the period (net of tax) (5,575.77) 29,562.51

Attributable to:

(a) Shareholders of the Company (5,575.50) 29,535.61

(b) Non-controlling interests (0.27) 26.90

XIII. Total comprehensive income/(loss) for the period (net of tax) (XI+XII) (34,299.97) 38,653.87

Attributable to:

(a) Shareholders of the Company (34,401.73) 38,524.52

(b) Non-controlling interests 101.76 129.35

XIV. Earnings per equity share (EPS) 44

(a) Ordinary shares (face value of ₹2 each):

(i) Basic EPS ` (84.89) 26.46

(ii) Diluted EPS ` (84.89) 26.45

(b) ‘A’ Ordinary shares (face value of ₹2 each):

(i) Basic EPS ` (84.89) 26.56

(ii) Diluted EPS ` (84.89) 26.55

See accompanying notes to consolidated financial statements

In terms of our report attached For and on behalf of the Board

For B S R & Co. LLP N CHANDRASEKARAN [DIN: 00121863] N MUNJEE [DIN:00010180] GUENTER BUTSCHEK [DIN: 07427375]

Chartered Accountants Chairman CEO and Managing Director

Firm’s Registration No: 101248W/W-100022 F S NAYAR [DIN:00003633]

S B BORWANKAR [DIN: 01793948]

V K JAIRATH [DIN:00391684] ED and Chief Operating Officer

YEZDI NAGPOREWALLA

Partner O P BHATT [DIN:00548091] P B BALAJI

Membership No. 049265 Group Chief Financial Officer

R SPETH [DIN:03318908]

H K SETHNA [FCS: 3507]

Directors Company Secretary

Mumbai, May 20, 2019 Mumbai, May 20, 2019

289

08_Consolidated Financial__28-06-2019.indd 289 7/5/2019 6:37:22 PM

You might also like

- Document 28 PDFDocument3 pagesDocument 28 PDFamirNo ratings yet

- FNCE 6018 Group Project: Hedging at PorscheDocument2 pagesFNCE 6018 Group Project: Hedging at PorschejorealNo ratings yet

- NAACP Membership FormDocument1 pageNAACP Membership FormLenette HoldenNo ratings yet

- Applied Economics Week 3-4Document10 pagesApplied Economics Week 3-4MOST SUBSCRIBER WITHOUT A VIDEO100% (1)

- Statement of Profit and LossDocument1 pageStatement of Profit and LossrytryrtyrtNo ratings yet

- Statement Profit Loss StandaloneDocument1 pageStatement Profit Loss Standalonesubham not a nameNo ratings yet

- Statement Profit Loss ConsolidatedDocument1 pageStatement Profit Loss Consolidatedshubham kumarNo ratings yet

- Annual Report 2020 21 261 PDFDocument1 pageAnnual Report 2020 21 261 PDFAnand GovindanNo ratings yet

- Annual Report FY 2022 23Document4 pagesAnnual Report FY 2022 23Piyush PalawatNo ratings yet

- Integrated Report and Annual Accounts 2016-17-175 175Document1 pageIntegrated Report and Annual Accounts 2016-17-175 175Sanju VisuNo ratings yet

- Tata Motors Group Q4 Annual Financial Results FY19 20Document10 pagesTata Motors Group Q4 Annual Financial Results FY19 20Anil Kumar AkNo ratings yet

- Regd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001Document6 pagesRegd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001HolaNo ratings yet

- Financial Results Consolidated Q1fy23Document4 pagesFinancial Results Consolidated Q1fy23Raj veerNo ratings yet

- Apollo Tyres Ltd.Document3 pagesApollo Tyres Ltd.Nishant HardiyaNo ratings yet

- Financial Result Q4fy22 ConsolidatedDocument6 pagesFinancial Result Q4fy22 ConsolidatedTharunyaNo ratings yet

- TML Standalone Results Sept 2023 1Document5 pagesTML Standalone Results Sept 2023 1NagendranNo ratings yet

- TATA MOTORS Profit and Loss SheetDocument1 pageTATA MOTORS Profit and Loss SheetKaushal RautNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- (In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanDocument9 pages(In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanAnamika NandiNo ratings yet

- Quarter AnnualDocument8 pagesQuarter AnnualNeetu JainNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document2 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Yash ModiNo ratings yet

- Income: For The Year Ended March 31, 2020Document3 pagesIncome: For The Year Ended March 31, 2020Vaibhav BorateNo ratings yet

- Statemnt of Profit and LossDocument1 pageStatemnt of Profit and LossRutuja shindeNo ratings yet

- DPL Annual Report 2022 23 Pages 2Document1 pageDPL Annual Report 2022 23 Pages 2workf17hoursformeNo ratings yet

- 2016 Annual ReportDocument7 pages2016 Annual ReportHeadshot's GameNo ratings yet

- Specific Project 2 AccountancyDocument10 pagesSpecific Project 2 Accountancyshouryayadav872No ratings yet

- Eastern Coalfields LimitedDocument9 pagesEastern Coalfields LimitedSyed Shamiul HaqueNo ratings yet

- CMA FormatDocument7 pagesCMA FormatRamakrishnan NatarajanNo ratings yet

- Standalone Profit LossDocument1 pageStandalone Profit LossrahulNo ratings yet

- Q2FY19 Standalone ResultDocument4 pagesQ2FY19 Standalone ResultDivyansh SinghNo ratings yet

- Ilovepdf MergedDocument5 pagesIlovepdf MergedRaghav AgarwalNo ratings yet

- Directors' Report: 1. Company PerformanceDocument57 pagesDirectors' Report: 1. Company PerformanceMUHAMMEDNo ratings yet

- Q2FY11 ResultsDocument4 pagesQ2FY11 ResultsSaurabh ShivhareNo ratings yet

- Standalone Balance Sheet Standalone Statement of Profit and LossDocument3 pagesStandalone Balance Sheet Standalone Statement of Profit and LosssqxxsnnfdgNo ratings yet

- Statement of Profit and Loss Balance SheetDocument3 pagesStatement of Profit and Loss Balance SheetSanam TNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document10 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Sourya MitraNo ratings yet

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- Aurobindo Mar20Document10 pagesAurobindo Mar20free meNo ratings yet

- Consol Result Mar23Document16 pagesConsol Result Mar23Amit KumarNo ratings yet

- Financial Results Consolidated Q2 FY 2023 2024Document10 pagesFinancial Results Consolidated Q2 FY 2023 2024surendran naiduNo ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- TCL Consolidated Sebi Results 31 December 2022Document3 pagesTCL Consolidated Sebi Results 31 December 2022Ravi Kumar KodiyalaNo ratings yet

- Balance Sheet - FDocument1 pageBalance Sheet - FRohit SoniNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- Regulation 33 Unaudited Financial Results For The Half Year Ended On 30.09.2019Document5 pagesRegulation 33 Unaudited Financial Results For The Half Year Ended On 30.09.2019Neetu JainNo ratings yet

- Afm Report Group 1 (Tata Motors)Document40 pagesAfm Report Group 1 (Tata Motors)ASHIKA DUGARNo ratings yet

- ONGC Cash FlowDocument4 pagesONGC Cash FlowSreehari K.SNo ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- 17106A1013 - Ratio Analysis of Apollo TyresDocument14 pages17106A1013 - Ratio Analysis of Apollo TyresNitin PolNo ratings yet

- SGXNET FY2016 - 21feb17Document12 pagesSGXNET FY2016 - 21feb17phuawlNo ratings yet

- Profit&Loss 09 10Document1 pageProfit&Loss 09 10Rashmin TomarNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document8 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006pradeepNo ratings yet

- Padma TractorsDocument35 pagesPadma TractorsArun KumarNo ratings yet

- APOLLO TYRE - Financial-Results-June-30-2019 PDFDocument6 pagesAPOLLO TYRE - Financial-Results-June-30-2019 PDFvandana sahuNo ratings yet

- Elgi Gulf (Fze) Balance Sheet As at 31St March 2015Document7 pagesElgi Gulf (Fze) Balance Sheet As at 31St March 2015SnehaNo ratings yet

- June 2021Document3 pagesJune 2021akshay kausaleNo ratings yet

- Digitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Document5 pagesDigitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Mahesh hamneNo ratings yet

- Q4 Results of Bal 2022-23Document11 pagesQ4 Results of Bal 2022-23dewerNo ratings yet

- 3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFDocument64 pages3.4 - Comptes Consolidés 31 Décembre 2020 - (VA) - VDEFsamullemNo ratings yet

- Statement of Profit and Loss For The Year Ended 31St March 2017Document1 pageStatement of Profit and Loss For The Year Ended 31St March 2017Himanshu DuttaNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- Balance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMDocument1 pageBalance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMharshit abrolNo ratings yet

- Chapter 2Document7 pagesChapter 2IanNo ratings yet

- .TFFL:: Lls4Lxj - It:IisjfifDocument1 page.TFFL:: Lls4Lxj - It:IisjfifPANDILAKSHMINo ratings yet

- MTN Uganda Earnings AnalysisDocument7 pagesMTN Uganda Earnings AnalysisTimothy KawumaNo ratings yet

- Tension & Shear CapacityDocument5 pagesTension & Shear CapacityFaridUddinNo ratings yet

- Centrifugal Sprayed Concrete For Lining Horizontal Pipes Culverts and Vertical ShaftsDocument7 pagesCentrifugal Sprayed Concrete For Lining Horizontal Pipes Culverts and Vertical ShaftsFabiano MoraisNo ratings yet

- Demographic Effects On Labor Force Participation RateDocument7 pagesDemographic Effects On Labor Force Participation RatemichaelNo ratings yet

- SLT NotesDocument11 pagesSLT NotesTime-Lapse CamNo ratings yet

- 19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFDocument4 pages19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFYaswanth KumarNo ratings yet

- COVID-19: Outcomes For Global Supply Chains: Luis Miguel FONSECADocument15 pagesCOVID-19: Outcomes For Global Supply Chains: Luis Miguel FONSECALinh HoangNo ratings yet

- 13 Nilufer-CaliskanDocument7 pages13 Nilufer-Caliskanab theproNo ratings yet

- Komunikasi Krisis Perusahaan TelekomunikasiDocument8 pagesKomunikasi Krisis Perusahaan TelekomunikasiDelia NurusyifaNo ratings yet

- Shava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricaDocument13 pagesShava & Masuku - Living Currency - The Multiple Roles of Livestock in Livelihood Sustenance and Exchange in The Context of Rural Indigenous Communities in Southern AfricachazunguzaNo ratings yet

- Chapter 2 The Fundamental Economic Problem Scarcity and ChoiceDocument39 pagesChapter 2 The Fundamental Economic Problem Scarcity and ChoiceJoelyn RamosNo ratings yet

- 02 Wage RegisterDocument7 pages02 Wage RegisterShritej nirmalNo ratings yet

- AMP Investor PresentationDocument15 pagesAMP Investor PresentationMattNo ratings yet

- Financial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pDocument16 pagesFinancial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pdainesecowboyNo ratings yet

- Material Cost and Escalation Clauses in Indian ConsDocument14 pagesMaterial Cost and Escalation Clauses in Indian ConsgayaseshaNo ratings yet

- SS 1D Chapter 1Document5 pagesSS 1D Chapter 1samuel laxamanaNo ratings yet

- Project WorkDocument11 pagesProject WorkC.s TanyaNo ratings yet

- Low Carbon Content SteelsDocument1 pageLow Carbon Content SteelsAntonio ClimaNo ratings yet

- Business Level StrategyDocument34 pagesBusiness Level StrategyByl Dawn DeafNo ratings yet

- Acronyms and AbbreviationsDocument1 pageAcronyms and AbbreviationsSabrina CarriónNo ratings yet

- Summary Ifsb Puteri F1025Document5 pagesSummary Ifsb Puteri F1025Siti Nur QamarinaNo ratings yet

- A.Haque, B.Rahm - Traffic AnalysisDocument5 pagesA.Haque, B.Rahm - Traffic AnalysisDhaabar SalaaxNo ratings yet

- Transaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalanceDocument3 pagesTransaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalancejyothiNo ratings yet

- Critical Thinking On TD BankDocument5 pagesCritical Thinking On TD Bankabaya zebedeoNo ratings yet