Professional Documents

Culture Documents

ZIMRA Strategy 2019-2023

ZIMRA Strategy 2019-2023

Uploaded by

Ospen Noah SitholeCopyright:

Available Formats

You might also like

- Leave FormDocument1 pageLeave FormOspen Noah Sithole100% (1)

- Zoology Project On Butterfly ?Document66 pagesZoology Project On Butterfly ?kanha creations With kanha100% (1)

- DuasDocument180 pagesDuasdn08smmcNo ratings yet

- CH371 Novel Separation ProcessDocument3 pagesCH371 Novel Separation ProcessIrfan K MoiduNo ratings yet

- Revised Business Plan JefamDocument65 pagesRevised Business Plan JefamISAAC TAGOE100% (3)

- Clean Room Requirements 20130927Document5 pagesClean Room Requirements 20130927HNmaichoi100% (1)

- Nra Strategic Plan 2018-2022Document56 pagesNra Strategic Plan 2018-2022Akm EngidaNo ratings yet

- Insurance Regulatory AuthorityDocument51 pagesInsurance Regulatory AuthorityĦøşęħ ÖżįlNo ratings yet

- Annual 2019Document40 pagesAnnual 2019imammujib32No ratings yet

- GRA Strategic Plan Vers 2.0 06.12.11 PDFDocument36 pagesGRA Strategic Plan Vers 2.0 06.12.11 PDFRichard Addo100% (3)

- Performance Audit Report of Jamaica Preparedness For Implementation of Sustainable Development GoalsDocument54 pagesPerformance Audit Report of Jamaica Preparedness For Implementation of Sustainable Development GoalsKayon WolfeNo ratings yet

- Gigaba FullMTBPSDocument86 pagesGigaba FullMTBPSjillianNo ratings yet

- 38.a Study of Best HR Practices With Reference To Reliance General InsuranceDocument32 pages38.a Study of Best HR Practices With Reference To Reliance General InsurancerajNo ratings yet

- National MSME Policy 2020-2024 New 1Document28 pagesNational MSME Policy 2020-2024 New 1BURUNDI1No ratings yet

- 00 IntroDocument254 pages00 IntroTatenda MadzingiraNo ratings yet

- Foundations of Management Assignment "A Strategic Review"Document29 pagesFoundations of Management Assignment "A Strategic Review"Anurag porteNo ratings yet

- Types of Situations Covered by This GuideDocument42 pagesTypes of Situations Covered by This GuideMohammedOumerNo ratings yet

- MoF Strategic Plan Revised On April 2021 - v2Document61 pagesMoF Strategic Plan Revised On April 2021 - v2BALI PETROLEUMNo ratings yet

- Csopf Final 2019Document580 pagesCsopf Final 2019DamasceneNo ratings yet

- Annual Report Tata Techno 2010 PDFDocument144 pagesAnnual Report Tata Techno 2010 PDFArchitNo ratings yet

- SME Strategy 2015 Draft 2 0 Edits DD SMEDDocument25 pagesSME Strategy 2015 Draft 2 0 Edits DD SMEDsayed mujeeb HashimiNo ratings yet

- 7.chap 3Document29 pages7.chap 3Manish KumarNo ratings yet

- Public-Private Partnership Policy Statement - Gom: Government of The Republic of MalawiDocument64 pagesPublic-Private Partnership Policy Statement - Gom: Government of The Republic of MalawiMwawiNo ratings yet

- Activity Report 2019Document32 pagesActivity Report 2019fabukaNo ratings yet

- Misr Insurance Co Annual Report 30 June 2010Document60 pagesMisr Insurance Co Annual Report 30 June 2010hadihadihaNo ratings yet

- BIMSTECPaper 2023 ZamanSharminDocument32 pagesBIMSTECPaper 2023 ZamanSharminShohan_1234No ratings yet

- ZDA Strategic Plan - Abridged VersionDocument24 pagesZDA Strategic Plan - Abridged VersionJoseph Saidi TemboNo ratings yet

- Tobu Japan - Profile - Ar2021Document24 pagesTobu Japan - Profile - Ar2021John SharonNo ratings yet

- Annual Report 2019 20Document100 pagesAnnual Report 2019 20Arun SasidharanNo ratings yet

- Highlights - Budget 2017Document10 pagesHighlights - Budget 2017Norfae'zah MohammadNo ratings yet

- National Financial Inclusion Strategy 2017 2022Document54 pagesNational Financial Inclusion Strategy 2017 2022MCTI-DOC KasamaNo ratings yet

- PPP PolicyDocument21 pagesPPP PolicyRhoda WinaniNo ratings yet

- Manna Business Plan - FinalDocument33 pagesManna Business Plan - FinalJoe WinstonNo ratings yet

- Cabo Oeste - Governance Framework - 2008 - Government Western CapeDocument90 pagesCabo Oeste - Governance Framework - 2008 - Government Western CapeAntônio Jones Bezerra de AlmeidaNo ratings yet

- Mfi Financing Strategy Guidelines and Template: Microreport #89Document64 pagesMfi Financing Strategy Guidelines and Template: Microreport #89aynalemNo ratings yet

- CGTMSE AnnualreportDocument44 pagesCGTMSE Annualreportdr NayanBharadwajNo ratings yet

- FIA Strategic Plan PDFDocument35 pagesFIA Strategic Plan PDFDaniel K chiwonaNo ratings yet

- Bpmn3023 Strategic Management FIRST SEMESTER SESSION 2019/2020 (A191) Group FDocument51 pagesBpmn3023 Strategic Management FIRST SEMESTER SESSION 2019/2020 (A191) Group FsallyNo ratings yet

- TMF Group Annual Report 2023 With Audit ReportDocument141 pagesTMF Group Annual Report 2023 With Audit ReportMilo MileNo ratings yet

- Namibia Industrial PolicyDocument24 pagesNamibia Industrial PolicyTHE DAILY PLUGNo ratings yet

- WB-P168115 q6o3OFUDocument79 pagesWB-P168115 q6o3OFUAamiin AbdirizakNo ratings yet

- Zim AssetDocument129 pagesZim AssetNyamutatanga Makombe100% (5)

- Senerath Gunawardena Marketing PlanDocument21 pagesSenerath Gunawardena Marketing Plantheatresonic0% (1)

- Strategic Plan 2016-2020Document56 pagesStrategic Plan 2016-2020brienahNo ratings yet

- Report of The Auditor General of The Republic of FijiDocument54 pagesReport of The Auditor General of The Republic of FijistiribuneNo ratings yet

- Public Finance ReportDocument59 pagesPublic Finance Reportshubhro dattaNo ratings yet

- Bida SRCP 20181217 FDocument61 pagesBida SRCP 20181217 FRidwan Haque DolonNo ratings yet

- GuidelinesonsciDocument25 pagesGuidelinesonscifert certNo ratings yet

- Full MTBPSDocument79 pagesFull MTBPSBusinessTech100% (1)

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- 2016 Budget Guidelines PDFDocument136 pages2016 Budget Guidelines PDFNYAMEKYE ADOMAKONo ratings yet

- National AML CFT CPF Strategy 2023 2027 1690886281Document30 pagesNational AML CFT CPF Strategy 2023 2027 1690886281Chidera Ajoke Austin-AwulonuNo ratings yet

- MSME Policy IP April 2010Document36 pagesMSME Policy IP April 2010Chuchure TekaNo ratings yet

- SDB Ir23 Website Interactive 16.11.2023-1Document429 pagesSDB Ir23 Website Interactive 16.11.2023-1Mohd Basir bin AhmadNo ratings yet

- Business Plan ExampleDocument18 pagesBusiness Plan ExampleMABUBUYE UBUNTU MA AFRICA AMAHLENo ratings yet

- Annual Report of Mudra 2017-18 PDFDocument108 pagesAnnual Report of Mudra 2017-18 PDFPappu ModiNo ratings yet

- Business StrategyDocument12 pagesBusiness StrategyBest Fun Compilation ClubNo ratings yet

- BCM Article UnivDocument8 pagesBCM Article UnivKhairul AdamsNo ratings yet

- CPCS FAQsDocument34 pagesCPCS FAQsArbi Dela CruzNo ratings yet

- Magma Annual Report Ar 10-11Document100 pagesMagma Annual Report Ar 10-11karn_dhandhaniaNo ratings yet

- Agreement Technic Electronic CorporationDocument9 pagesAgreement Technic Electronic CorporationRajiv SoneNo ratings yet

- Karnataka Industrial 2014-19 Policy Draft PDFDocument72 pagesKarnataka Industrial 2014-19 Policy Draft PDFsidrubNo ratings yet

- Launching A Digital Tax Administration Transformation: What You Need to KnowFrom EverandLaunching A Digital Tax Administration Transformation: What You Need to KnowNo ratings yet

- CAREC Integrated Trade Agenda 2030 and Rolling Strategic Action Plan 2018–2020From EverandCAREC Integrated Trade Agenda 2030 and Rolling Strategic Action Plan 2018–2020No ratings yet

- PE Comp BDocument8 pagesPE Comp BOspen Noah SitholeNo ratings yet

- Dissertation Presentation GuideDocument34 pagesDissertation Presentation GuideOspen Noah SitholeNo ratings yet

- Effects of Outsourcing The Performance of Mining Companies in Zambia. Dissertation-Brown KalelaDocument82 pagesEffects of Outsourcing The Performance of Mining Companies in Zambia. Dissertation-Brown KalelaOspen Noah SitholeNo ratings yet

- Vpa CalaDocument4 pagesVpa CalaOspen Noah SitholeNo ratings yet

- Zimbabwe Environment CC Policybrief 2016-04-13Document37 pagesZimbabwe Environment CC Policybrief 2016-04-13Ospen Noah SitholeNo ratings yet

- Entrepreneur InterviewDocument1 pageEntrepreneur InterviewOspen Noah SitholeNo ratings yet

- 7TH POST-CABINET BRIEFING March26 2024Document9 pages7TH POST-CABINET BRIEFING March26 2024Ospen Noah SitholeNo ratings yet

- Interview Guidelines - Clearing ControllerDocument1 pageInterview Guidelines - Clearing ControllerOspen Noah SitholeNo ratings yet

- Public Notice 23 On 1st QPD 2024 Pending Returns in TaRMS 25 03 2024Document1 pagePublic Notice 23 On 1st QPD 2024 Pending Returns in TaRMS 25 03 2024Ospen Noah SitholeNo ratings yet

- CALA F Waste MNGDocument7 pagesCALA F Waste MNGOspen Noah SitholeNo ratings yet

- Monetary Policy Statement 2024 - 240405 - 143514Document13 pagesMonetary Policy Statement 2024 - 240405 - 143514Ospen Noah SitholeNo ratings yet

- CALA G UniformsDocument6 pagesCALA G UniformsOspen Noah SitholeNo ratings yet

- SI 54 of 2024 Control of Goods (Import and Expor - 240329 - 080430Document1 pageSI 54 of 2024 Control of Goods (Import and Expor - 240329 - 080430Ospen Noah SitholeNo ratings yet

- How To Start An Online Auto Parts BusinessDocument20 pagesHow To Start An Online Auto Parts BusinessOspen Noah SitholeNo ratings yet

- TUTORIAL Questions ANSWERS PDFDocument27 pagesTUTORIAL Questions ANSWERS PDFOspen Noah SitholeNo ratings yet

- 2-Neha VashisthaDocument12 pages2-Neha VashisthaOspen Noah SitholeNo ratings yet

- Ent205 Nov 2017Document6 pagesEnt205 Nov 2017Ospen Noah SitholeNo ratings yet

- Step by Step: Installation of Piston RingsDocument1 pageStep by Step: Installation of Piston RingsOspen Noah SitholeNo ratings yet

- YALI Maximizing Your Digital Marketing TranscriptDocument3 pagesYALI Maximizing Your Digital Marketing TranscriptOspen Noah SitholeNo ratings yet

- Tutorial QuestionsDocument44 pagesTutorial QuestionsOspen Noah SitholeNo ratings yet

- PUBOCOCCYGEUS: The Muscle of Sexual FunctionDocument8 pagesPUBOCOCCYGEUS: The Muscle of Sexual FunctionOspen Noah Sithole100% (1)

- How To Create An Online Retail Store in India: NextwhatbusinessDocument4 pagesHow To Create An Online Retail Store in India: NextwhatbusinessOspen Noah SitholeNo ratings yet

- Poor Managers Force Good Employees To Leave: Author: Sifiso Dingani - February 2020Document3 pagesPoor Managers Force Good Employees To Leave: Author: Sifiso Dingani - February 2020Ospen Noah SitholeNo ratings yet

- Playing To Win: How Strategy Really Works: November 2018Document4 pagesPlaying To Win: How Strategy Really Works: November 2018Ospen Noah SitholeNo ratings yet

- Businesstech Co Za News Business 225631 8 South African FranDocument31 pagesBusinesstech Co Za News Business 225631 8 South African FranOspen Noah SitholeNo ratings yet

- Computational Analysis of Centrifugal Compressor Surge Control Using Air InjectionDocument24 pagesComputational Analysis of Centrifugal Compressor Surge Control Using Air InjectionrafieeNo ratings yet

- Datasheet Painel Solar 360W KuMax CS3U PDocument2 pagesDatasheet Painel Solar 360W KuMax CS3U PDenis SilvaNo ratings yet

- Horizontal Jaw RelationsDocument90 pagesHorizontal Jaw RelationsKeerthiga TamilarasanNo ratings yet

- Test-Retest Reliability of The Speech-Evoked Auditory Brainstem ResponseDocument10 pagesTest-Retest Reliability of The Speech-Evoked Auditory Brainstem ResponseCabinet VeterinarNo ratings yet

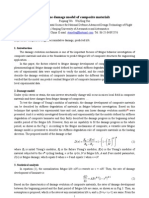

- A Fatigue Damage Model of Composite MaterialsDocument4 pagesA Fatigue Damage Model of Composite MaterialsPrathamesh BilgundeNo ratings yet

- GPX SBRO 004 E Rev.0.1Document4 pagesGPX SBRO 004 E Rev.0.1OperacionesNo ratings yet

- ASCO Dry Ice Machines OverviewDocument2 pagesASCO Dry Ice Machines OverviewLuis CarlosNo ratings yet

- Jobm 201800252Document14 pagesJobm 201800252leilany casillasNo ratings yet

- TF65-67 Thermal Overload Relay: Product-DetailsDocument5 pagesTF65-67 Thermal Overload Relay: Product-DetailsSergio PartidaNo ratings yet

- Cardomom in Guatemala June 11 2022Document9 pagesCardomom in Guatemala June 11 2022Luis MijaresNo ratings yet

- Report On Reuse of Abandoned Quarries and Mine Pits in KeralaDocument90 pagesReport On Reuse of Abandoned Quarries and Mine Pits in KeralaDrThrivikramji Kyth100% (10)

- SM DH Series ManualDocument154 pagesSM DH Series Manualkikyangello90No ratings yet

- CT-Demag Flyer InstrumentDocument2 pagesCT-Demag Flyer InstrumentKarthik SriramakavachamNo ratings yet

- System Studies For Oil and Gas Plants - SiemensPTIDocument29 pagesSystem Studies For Oil and Gas Plants - SiemensPTIkuchowNo ratings yet

- Dell Service ManualDocument220 pagesDell Service ManualYeik ThaNo ratings yet

- Sailor100gx TM 98 145912 B PDFDocument276 pagesSailor100gx TM 98 145912 B PDFCarlos CoelhoNo ratings yet

- Integrity Management of Safety Critical Equipment and SystemsDocument10 pagesIntegrity Management of Safety Critical Equipment and SystemsLi QiNo ratings yet

- Company Analysis Report On M/s Vimal Oil & Foods LTDDocument32 pagesCompany Analysis Report On M/s Vimal Oil & Foods LTDbalaji bysani100% (1)

- MC-WHY DO PEOPLE SNORE - PFC In-Class Language Practice MaterialDocument1 pageMC-WHY DO PEOPLE SNORE - PFC In-Class Language Practice MaterialKutay KılıçtekNo ratings yet

- Eqpt - No. 50CH0203LC10 Fly Ash Fly Ash Material 200 T Capacity 1 No QtyDocument62 pagesEqpt - No. 50CH0203LC10 Fly Ash Fly Ash Material 200 T Capacity 1 No Qtykumar gauravNo ratings yet

- 79-Article Text-140-3-10-20170810Document5 pages79-Article Text-140-3-10-20170810Raihanah Fadhillah YulianiNo ratings yet

- Cu ZN 10Document2 pagesCu ZN 10wjjt6chgtmNo ratings yet

- Slht-Tve 10 Q3 M2Document13 pagesSlht-Tve 10 Q3 M2Jecel Feb BiangosNo ratings yet

- Red Oxide Primer (ENG)Document3 pagesRed Oxide Primer (ENG)Evan BadakNo ratings yet

- SanDiegoZoo GuideMap 1.2016 REFERNCEDocument1 pageSanDiegoZoo GuideMap 1.2016 REFERNCETerry Tmac McElwainNo ratings yet

- (IADC) JRC Rig Move Warranty Survey Revision 2.0 16 October 2014 Aligned With ISO SNAMEDocument20 pages(IADC) JRC Rig Move Warranty Survey Revision 2.0 16 October 2014 Aligned With ISO SNAMEpaoloNo ratings yet

ZIMRA Strategy 2019-2023

ZIMRA Strategy 2019-2023

Uploaded by

Ospen Noah SitholeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ZIMRA Strategy 2019-2023

ZIMRA Strategy 2019-2023

Uploaded by

Ospen Noah SitholeCopyright:

Available Formats

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

ZIMBABWE REVENUE AUTHORITY

STRATEGIC PLAN

[2019 - 2023]

ZIMRA Strategic Plan (2019-2023) Page 1 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

TABLE OF CONTENTS

1 INTRODUCTION AND BACKGROUND…………………………………………………………………………………………………………… 5

2 NATIONAL VISION 2030 AND TRANSITIONAL STABILISATION PROGRAMME………………………………………………… 6

2.1 National Vision and Priorities…………………………………………………………………………………………………………………………… 6

2.2 Transitional Stabilisation Programme……………………………………………………………………………………………………………… 6

3 ZIMRA'S TERMS OF REFERENCE AND MANDATE…………………………………………………………………………………………… 7

3.1 Terms of Reference………………………………………………………………………………………………………………………………………… 7

3.2 ZIMRA's Overall Mandate………………………………………………………………………………………………………………………………… 7

4 EXTERNAL ENVIRONMENTAL ANALYSIS (PESTEL ANALYSIS)………………………………………………………………………… 8

5 INTERNAL STRATEGY ANALYSIS (SWOT)……………………………………………………………………………………………………… 11

6 ZIMRA'S VISION, MISSION AND VALUES……………………………………………………………………………………………………… 12

7 ZIMRA'S KEY RESULT AREAS, STRATEGIC GOALS AND PERFORMANCE MATRIX……………………………………………… 13

7.1 ZIMRA's Corporate Key Result Areas (KRAs)…………………………………………………………………………………………………… 13

7.2 ZIMRA's Strategic Goals (2019-2023)……………………………………………………………………………………………………………… 13

7.3 ZIMRA's Strategic Map……………………………………………………………………………………………………………………………………… 16

7.4 ZIMRA's Strategy Foundation (4Ps)………………………………………………………………………………………………………………… 17

7.5 ZIMRA's Strategy Performance Matrix……………………………………………………………………………………………………………… 20

8 ZIMRA'S STRATEGIC OUTCOMES………………………………………………………………………………………………………………… 27

9 KEY STRATEGIES / ACTION PLANS TO ACHIEVE OUTCOMES………………………………………………………………………… 28

9.1 Key Strategies / Action Plan to achieve Maximised Revenue Collection………………………………………………………… 29

9.2 Key Strategies / Action Plan to achieve Improved Voluntary Compliance……………………………………………………… 30

9.3 Key Strategies / Action Plan to achieve Enhanced Trade Faciliation and protection of civil society………………

31

9.4 Key Strategies / Action Plan to achieve Maximised Revenue Strengthened Institutional Image……………………

32

10 CONCLUSION……………………………………………………………………………………………………………………………………………… 33

10 ZIMRA's Strategic Projects (2019-2023)…………………………………………………………………………………………………………… 33

10 ZIMRA's Change Management Programme (2019-2023)………………………………………………………………………………… 34

10 Strategy Implementation and Monitoring………………………………………………………………………………………………………… 34

10 Performance Management and Strategy Evaluation……………………………………………………………………………………… 35

ZIMRA Strategic Plan (2019-2023) Page 2 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

(i) CHAIRMAN’S FOREWORD

harness our collective potential and

marshal that energy for our country.

This Strategic Plan explains how we will

achieve our four key results which are to:

Strengthen institutional image

Maximize revenue collection

Increase voluntary compliance and

Enhance trade facilitation and

protection of civil society

in order to meet our overarching mandate as

an agent of the State in terms of the

Revenue Authority Act.

Planning around risks sets out the context

Dr. Callisto Jokonya (ZIMRA Board Chairman) in which we operate and plays an important

role in influencing our priorities. We

Welcome to our Strategic Plan, an identify culture change and governance as

important document that explains how we critical among our priorities below:

will meet our operational objectives of Grow tax-base and enhance

revenue collection and enhancing trade integrated data management

development for the period 1 January 2019 Enhance service delivery and

to 31 December 2023. taxpayer education

Increase security and agility in the

The new board of directors and a new five- international flow of goods and

year strategy for Zimbabwe Revenue persons

Authority are a perfect opportunity for

bringing new thinking into this strategic We also remain alive to the risk and

institution in the economic development for potential rewards of technological

Zimbabwe. ZIMRA is arguably the largest innovation which seek to push up

revenue collection entity in Zimbabwe and the quality of service and allows us to take

should be driven by radical management a proactive approach to policy

attitudes that deliver outstanding success. A advice, supervision, enforcement and

positive mental attitude is the driving force revenue assurance which, combined, deter

needed to bring the projected results in this non-compliance behaviour.

strategic plan into reality.

I hope that both our Civil Society and the

The ground around us is constantly Business Partners will find this Strategic

shifting and change is inevitable. The Plan useful, and I look forward to our

future, for some, is a frightening place. I continued collaboration over the next five

disagree. I see and relish a future of years.

immense possibility. The time is now to

ZIMRA Strategic Plan (2019-2023) Page 3 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

(ii) COMMISSIONER GENERAL’S MESSAGE

realising our National Vision 2030.ZIMRA

Management will implement Strategies to

support Three Pillars of the Government`s

Transitional Stabilisation Programme,

namely:

1 : Ease of doing business

2 : Restoration of Fiscal

Balance

3 : Plugging of Revenue

Leakages

We seek to achieve our desired results

through various strategies anchored on a

strong foundation, the 4Ps namely:

People

Processes

Partnerships and

Projects

Ms. Faith Mazani (ZIMRA Commisioner General) Our innovation processes identified 12

priority projects that will help us achieve

I am humbled and greatly honoured to our Strategic Goals in order to fulfil our

present a strategy which endeavours to purpose. Due to the fiscal gap and the need

build and sustain linkages and to avail considerable resources over the

collaborations with all our stakeholders. next 5 years, we will require external

partnerships and assistance in funding these

Our Strategic Plan expresses the future projects. I am confident that this Strategic

aspirations of all the stakeholders as an Plan will guide our priorities and operations

Integrated Results Based Management as we embark on our journey together for

(IRBM) framework. This facilitates the next five years towards the development

efficient and sustainable utilisation of of our country.

resources, enhances synergies and exploits

our strengths and the available

opportunities to confront any threats to

ZIMRA Strategic Plan (2019-2023) Page 4 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

1. INTRODUCTION AND BACKGROUND

This document is the Strategic Plan for the anticipated results in terms of the

Zimbabwe Revenue Authority (ZIMRA) ZIMRA budgets, annual work and

for the period 2019-2023 developed in line performance monitoring plans and will be

with the Integrated Results Based the basis of performance contracts for the

Management System being implemented Board and Executive Management.

by the Government of Zimbabwe (GOZ).

The Government of Zimbabwe has put in

In drawing up this Strategic Plan, place the Transitional Stabilisation

consultations were done so as to pay due Programme (TSP) which is the national

regard to any representations and development plan that set the national

recommendations by the Minister of priorities for the new Vision: “Towards a

Finance and Economic Development Prosperous & Empowered Upper Middle

(MoFED) in compliance with the Public Income Society by 2030”.

Entities Corporate Governance ACT

[CHAPTER 10:31] This Integrated Results Based Strategic

Plan also seeks to define ZIMRA’s

This Strategic Plan seeks to establish a contribution to the attainment of the

Strategy Map of the strategic results, Ministry of Finance and Economic

processes, programmes, projects, activities Development (MoFED) Vision “Sustained

and direction that ZIMRA communicates to inclusive growth and macroeconomic

its stakeholders, clients, partners and stability for an upper middle-income

employees. It also establishes the ZIMRA economy by 2030.”

vision, mission, core values, key result

areas, goals, activities and strategies that This document analyses the internal and

ZIMRA will focus on in the short to external environment as well as the

medium term to achieve the desired Business Model as it aims to articulate

outputs, outcomes and impacts. The ZIMRA contribution to Vision 2030

initiatives from this strategic plan will be through its contribution to the MoFED

assessed on the achievement of the Strategy.

ZIMRA Strategic Plan (2019-2023) Page 5 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

2. NATIONAL VISION 2030 AND TRANSITION STABILISATION PROGRAMME

2.1 NATIONAL VISION AND PRIORITIES

Towards a prosperous and empowered upper middle-income society with job

opportunities and a high quality of life for its citizens by 2030

NATIONAL KEY RESULT AREAS

1. Sustainable Economic Growth

2. Good Governance

3. Infrastructure Development

4. Prevention and alleviation of HIV and AIDS

5. Aids and other serious diseases

6. Improved access to affordable and quality basic social services

7. Poverty reduction

8. Promotion of Gender and Employment of Women

9. Safe, secure and peaceful environment

10. Institutional capacity and human capital development

11. Employment creation

12. Environmental sustainability

NATIONAL PRIORITIES

1. Inclusive Economic Growth

2. Social Development

3. Governance

4. Cross-cutting Enablers

5. Macro-Economic Stability & Financial Re-engagement

2.2 Transitional Stabilisation Programme (TSP) 2019-2020

ZIMRA’s strategy (2019-2023) is guided by Zimbabwe’s National Vision 2030,

“Towards a Prosperous & Empowered Upper Middle Income Society by 2030” and the

Transitional Stabilisation Programme (TSP). The Strategy addresses the following pillars

in the TSP

Resource Mobilization

Ease of Doing Business Reforms

Plugging Revenue Leakages

ZIMRA Strategic Plan (2019-2023) Page 6 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

3. ZIMRA’S TERMS OF REFERENCE AND MANDATE

3.1 TERMS OF REFERENCE

ZIMRA derives its mandate mainly from the Revenue Authority Act (23:11), the Customs and

Excise Act (CAP 23:02), other subsidiary Statutory Legislation, Statutory Instruments,

Government Directives and other Acts shown below:

a. Revenue Authority Act Chapter 23:11

b. Finance Act [Chapter :04]

c. Customs and Excise [Chapter 23:02]

d. Income Tax Act [Chapter 23:06]

e. Value Added Tax Act [Chapter 23:12]

f. Capital Gains Tax Act [Chapter 23:01]

g. Exchange Control Act [Chapter 22:05] 5(1), 10,]

h. Tax Reserve Certificate Act [Chapter 23:10]

3.2 ZIMRA’s Overall Mandate

ZIMRA is mandated by law to:

Act as an agent of the State in assessing, collecting and enforcing the payment of all

revenues; and

Advise the Minister of Finance & Economic Development on matters relating to the

raising and collection of revenues; and

Act as an agent of the state to enforce the import and export controls; and

Perform any other function that may be conferred or imposed on the Authority in

terms of Revenue Authority Act, Government directive or any other enactment

ZIMRA Strategic Plan (2019-2023) Page 7 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

4. EXTENAL ENVIRONMENT ANALYSIS (PESTEL ANALYSIS)

Table 2: External environment analysis done in June 2018

POLITICAL ECONOMIC

Opportunities Opportunities

Cordial relations Attractive investor destination increasing hope that

National they will be a boost in foreign direct investment

There is emphasis or demonstration on flowing into the country. Boost

peace and unity from the highest Authority. International reengagement which has resulted in

Calm political environment currently business engagements, increased technical support as

obtaining leading up to the elections. well as conclusion of Mutual Administrative Assistants

Regional Agreements (MMAAs), Double Taxation agreements

Member of the following bodies: SADC, and Memorandum of understanding with other

COMESA, East and Southern Africa jurisdictions which will certainly have a positive

(ESA). economic impact.

International Bilateral and multilateral agreements on trade and

Open for business agenda. administrative assistants.

Re-engagements with the international The Special Economic Zones which will play a major

community. role in boasting economic activity. This is expected to

Transparency in the election process go a long way in increasing industry performance in

through invitation of international election general.

observers The improved performance in industry sectors like

Energy, Mining, Agriculture and Tourism has created

Political Stability renewed hope for the economy

High investor confidence. The creation of the Zimbabwe Investment

Re-engagement of international Development Authority (ZIDA) will result in easy of

community. doing business and accounting for all investments in

The above encourages foreign direct the country.

investment and local economic activity which

translates to economic growth hence increased Threats

revenue base which will lead to increased Foreign exchange remains a major challenge coupled

collections by ZIMRA. with liquidity challenges and cash shortages.

Creation of a multi-pricing system in the economy,

POLITICAL THREATS which has eroded purchasing power and consumer

Political interference with ZIMRA spending patterns.

operations

SGCIAL TECHNOLOGICAL

Opportunities Opportunities

Diverse culture in Zimbabwe - Diverse National ICT policy developed to embrace ICT

ideas(innovation) innovation: ZIMRA has opportunity to align its ICT

Availability of skilled and educated policy with national policy.

manpower Technological improvements on scanners can be used

Growing informal sector to deal with congestion at border posts.

ZIMRA Strategic Plan (2019-2023) Page 8 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

Queue management technologies to deal with

congestion at border posts and offices.

Threats Use of SMS and e-mails to communicate with clients

Diverse culture - Inheritance of bad including sending confirmations for transactions.

practices/culture e.g. non-compliance Business intelligence & artificial intelligence (allows

Highly educated people - Increase in analysis), big data (used to support social networks)

sophisticated white collar crimes e.g. cyber- Improvements in storage technologies which allows all

crimes information to be stored and to be readily available:

Brain drain - Loss of skilled and educated Will facilitate data warehousing initiatives in ZIMRA.

manpower Access to global resources – cloud computing and

Non-communicable, epidemic and endemic support for new technologies. Can be supported even

diseases such as HIV/AIDS, Cancer, without physical presence.

malaria -Increased public expenditure, Improved communication capacity due to new

Extinction of active labour force. technologies and declining communication costs.

High levels of unemployment - Erodes tax

base, Increase in social ills, Security threat. Threats

High levels of social ills – corruption, Fraud, hacking, spam, cybercrime & ransomware –

fraud, smuggling, non-compliance, related to security of data/systems.

prostitution, money-laundering, substance Data security and confidentiality threats.

abuse; Rapid technological changes: Obsolescence - inability

Erodes tax base to keep pace with changes.

Threat to productivity Failure to keep pace with technologies – need to keep

Lose of manpower pace with upgrades etc.

High country risk Technology failure and resultant downtime and

disruptions.

Use of new, complicated and unregulated new

technologies such as cryptocurrencies that affect

Authority’s capacity to account for tax. Includes

difficult to tax e-commerce transactions (online

transactions)

Virtual companies.

LEGAL ENVIRONMENTAL

Threats Opportunities

Retrospective laws resulting in refunds or

creation of debt Good weather for growth tourism and agriculture

Lack of transitional periods for new laws in thereby increasing the revenue base. E.g. maize,

some case. e.g. business could have ordered tobacco, livestock

goods in advance or goods on high seas. Abundance of renewable energy sources that can

Disconnect between pronouncement and be exploited commercially e.g. solar ,wind ,biogas,

gazetting/promulgation .e.g. tax amnesty hydro

Non-aligned laws e.g. HS tariff issues Conservation of waterbodies for tourism and

Archaic laws e.g. Income Tax, postal farming opportunities

notification

Trade barrier laws e.g.SI 64 Threats

Policy inconsistencies(promise and failure Climate Changes causing prolonged uncertainty to

to follow up with legislation) farming sector.

Delays in the promulgation of laws

ZIMRA Strategic Plan (2019-2023) Page 9 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

Lack of consultation e.g. wheat ,tobacco Drought affecting farming, veld fires affecting animal

Delays in the judicial processes farming.

Too many controls Deforestation resulting in desertification,

Opportunities destabilization of the ecosystem leading to low

Review of the indigenisation law – more productivity.

FDI Increasing housing projects in wetlands affecting

rainfall patterns and productivity.

ZIMRA Strategic Plan (2019-2023) Page 10 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

5. INTERNAL STRATEGIC ANALYSIS (SWOT ANALYSIS)

Table 3; Internal SWOT analysis

STRENGTHS WEAKNESSES

Good corporate governance Inadequate resources – human, financial, equipment,

Empowerment through legislation infrastructure, aged and impaired assets

Skilled and experienced staff (appropriate Internal corruption –corrupt staff members

development programmes in place and a Failure to retain skills

strong learning culture) Poor internal communication

Clear Vision Systems challenges – lack of integration, poor

Effective planning process connectivity, systems uptime, inadequate functionality

Young workforce coming up Labour issues – litigious workforce, unsatisfactory

Progressive CG (supportive leadership) handling of labour issues

Countrywide presence Manual processes

Poor policy and poor policy implementation – Transfer

Policy, Uniform Policy, Motor Vehicle Policy, Asset

Disposal Policy, ICT Security Policy, Advancement

Policy

Poor disaster recovery preparedness

OPPORTUNITIES THREATS

Increased international trade through Inadequate national consultation on fiscal policies

Trade Agreements resulting in implementation challenges and erosion of

Growing tax base from the untapped tax base

informal sector Failure to implement taxation laws due to political

Availability of educated and skilled interference resulting in erosion of the tax base

manpower in the country Creation of laws with retrospective effect

Abundance of technological innovations Revenue leakages due to cyber threats, e-commerce, e-

to improve efficiency currencies, corruption, tax evasion, smuggling, fraud

Increased foreign direct investment to and informal sector

widen the tax base Insufficient recurrent and capital expenditure funding

Additional revenue opportunities from for strategic plan implementation

improved performance in Agriculture, Poor economic performance resulting in high

Mining, Energy and Tourism sectors unemployment, low industrial capacity utilization that

Technical and financial support from erodes the tax base

international community Inadequate infrastructure that impedes business growth

and trade facilitation

Slow justice delivery system resulting in delayed

finalization of revenue disputes

ZIMRA Strategic Plan (2019-2023) Page 11 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

6. ZIMRA’S VISION, MISSION AND VALUES

Our Vision

To become a beacon of

excellence in the provision

of fiscal services and

facilitation of trade and

travel.

Our Mission Our Values

To mobilise revenue Integrity

and facilitate

sustainable compliance Transparency

with fiscal and customs Fairness

laws for the economic Commitment

development of

Zimbabwe. Innovativeness

ZIMRA Strategic Plan (2019-2023) Page 12 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

7. ZIMRA’S KEY RESULT AREAS (KRA) , STRATEGIC GOALS AND

PERFORMANCE MATRIX (2019-2023)

7.1 ZIMRA’S BROAD CORPORATE KEY RESULT AREAS (2019-2023)

All ZIMRA’s strategic initiatives (2019-2023) will be guided and focused on the Corporate

Key Result Areas (KRA’s) summarized below i.e. ZIMRA Strategic efforts will be towards:

Mobilising Maximum Revenue (KRA1 : Revenue Collection),

Facilitation of smooth trade (KRA 2: Trade Facilitation) and

Improvement of Institutional Image (KRA3 : Institutional Image)

Table 11: ZIMRA’s Corporate Key Result Areas (KRA)

No. Key Result Weightage Responsible Ministry Linkages to Macro SDG

Area Department/s KRA Priorities (Reference Reference

Reference and Description)

KRA1 Revenue 60% Domestic KRA1 1. Inclusive SDG 8

Collection Taxes, economic growth

Revenue

Assurance and

Special

Projects,

Customs and

Excise

KRA2 Trade 20% Customs and KRA1 5. Macro-economic SDG 9

Facilitation Excise, ECTS, stability and

financial re-

engagement

KRA3 Institutional 20% All KRA5 3. Governance SDG 17

Image

These above broad Corporate Key Result Areas are further split into the following ZIMRA

Strategic Goals (2019-2023)

7.2 ZIMRA STRATEGIC GOALS (2019-2023)

ZIMRA’s Strategic Goals (2019-2023) as depicted in ZIMRA’s Strategic Map are classified

into the following three Strategic Perspectives

Results Perspective

Internal Processes and Systems Perspective

People and Resources Perspective

ZIMRA Strategic Plan (2019-2023) Page 13 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

Results Perspective / Outcomes

The Results Perspective has four Strategic Goals that reflect ZIMRA’s desired results during

the next 5 years (2019-2023). The table below summarises the Strategic Goals and their

descriptions:

Table 10: ZIMRA Strategic Goals under Results / Outcomes Perspective

Results / Outcomes Perspective

SG Ref Strategic Goal Description

SG1 Maximize Revenue Mobilising and collecting sustainable revenues, in

collection order to adequately fund Government operations.

SG2 Enhance trade facilitation This entails expediting the movement, enforcement of

and protection of society regulatory controls, clearance and release of goods

including goods in transit in compliance with

international standards, treaties, protocols and

conventions in which the country is a signatory.

SG3 Increase voluntary Develop and implement strategies that facilitate

compliance complete, accurate and timeous declarations, filing and

payment of taxes due. This includes facilitative

compliance initiatives such as cooperative compliance

SG4 Strengthen institutional Increase confidence by clients and stakeholders for a

image better perception of the organisation

Strategic Goals under the Internal Processes and Systems Perspective

The Internal Processes and Systems Perspective has eight Strategic Goals which reflect what

ZIMRA will do under Internal Processes and systems. The table below summarises the

Strategic Goals (SG) under the internal Processes and Systems Perspective and their

descriptions:

Table 9: ZIMRA Strategic Goals under Internal Processes and Systems Perspective

Internal Processes and Systems Perspective

SG Ref Strategic Goal Description

SG5 Increase security and agility To ensure ZIMRA is well-positioned to secure the

in the international flow of global supply chain in conformance with international

goods and persons standards and best practices on supply chain safety.

SG6 Grow tax base and enhance Bringing all potential and eligible taxpayers into the

integrated data management ZIMRA database through proposal of fiscal reforms,

other expansion initiatives and development and

ZIMRA Strategic Plan (2019-2023) Page 14 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

utilising of integrated ICT systems with both internal

and key external stakeholders.

SG7 Enhance service delivery This entails delivery of service in accordance with

and taxpayer education ZIMRA client charter and good international practise

by ensuring timeous information dissemination and

awareness to the society on taxation through various

channels.

SG8 Increase risk based tax and Develop and implement target oriented core tax

customs compliance audits/investigations from a centralised data

warehouse.

SG9 Implement Results Oriented This involves adopting strategic management

Strategic Management processes that focus on delivering desired outcomes.

SG10 Simplify processes and Identifying, simplifying, re-engineering and

procedures automating all business processes to improve

effectiveness and efficiency to meet stakeholder

expectations

SG11 Strengthen ethics, integrity This entails upholding ZIMRA’s core values and

and Enterprise risk ethics. It also involves designing a plan-based strategy

management that identifies potential events that may affect the

attainment of the Authority’s objectives, managing

them and giving assurance that the risks remain within

acceptable levels

SG12 Improve Communication Leveraging external support to learn best practices

and Partnerships and manage internal communication

Strategic Goals under the People and Resources Perspective

The People and Resources perspective has four Strategic Goals which reflect objectives

centred on ZIMRA Staff Members and the required resources in order to achieve the desired

strategic resources. The table below summarises the Strategic Goals under the People and

Resources Perspective and their description:

Table 8: ZIMRA Strategic Goals under People and Resources Perspective

People and Resources Perspective

SG Ref Strategic Goal Description

SG13 Ensure Timely and Adequate This entails the availing of sufficient resources as and

Funding when required to support the organisational projects,

business operations and strategy.

ZIMRA Strategic Plan (2019-2023) Page 15 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

SG14 Enhance staff capacity and This entails timeously attracting, developing and

retention retaining talent that is dedicated and motivated to

support the attainment of the Authority’s mandate.

SG15 Modernise Infrastructure Provision of adequate offices, staff accommodation

(including ICT) and ICT and facilities to improve operational efficiency and

Systems also updating ICT systems, data centres and

interfacing to external systems in order to achieve

mutual synergies, which in turn will maximise revenue

collection and operational efficiencies.

SG16 Strengthen performance This involves improvement of staff performance and

driven culture behaviours to meet organisational standards

7.3 ZIMRA’s Strategic MAP (2019-2023)

The Strategic Map shown on the next page is a summary of the Strategic Goals under the

different perspectives and how they feed into ZIMRA’s Vision and Mission. ZIMRA’s

strategic initiatives will mainly support the following Transitional Stabilisation Programme

(TSP) National Strategic Pillars:

Ease of doing business

Restoration of Fiscal Balance

Plugging of Revenue Leakage

The Strategic Objectives (SG) depicted in ZIMRA’s Strategic Map are all cascaded down to

relevant Divisions / Departmental Strategies with detailed strategic initiatives for each

strategic goal.

ZIMRA Strategic Plan (2019-2023) Page 16 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

7.4 ZIMRA’s four Ps – foundation of the ZIMRA’s strategy

ZIMRA’s strategy is anchored on the following 4Ps:

People

Having the right people (staff

members) with the right skills

and right attitude to execute the

strategy. This entails right

recruitment, appropriate human

capital development and staff

motivation.

Processes

Development and

implementation of effective,

efficient and simplified

processes that enable the

organisation to meet its service

targets within budget (cost –

effective). ZIMRA will carry

out a Business Re-engineering

Project in to increase

operational efficiency.

ZIMRA Strategic Plan (2019-2023) Page 17 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

Partnerships

Building win-win strategic

partnerships with Taxpayers in

order to promote voluntary

compliance and effective

partnerships with other

stakeholders to support the delivery

of value to customers.

Projects

Adoption and application of

international best practice Project

Management to ensure that

ZIMRA’s Projects are delivered in

time and within cost budget.

Below is ZIMRA’s Strategic Map

which summarises ZIMRA’s

Strategic Goals (2019-2023)

ZIMRA Strategic Plan (2019-2023) Page 18 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

STRATEGIC MAP – ZIMRA 2019-2023

ZIMBABWE 2030

ZIMBABWE VISION 2030: TOWARDS A PROSPEROUS & EMPOWERED UPPER MIDDLE INCOME SOCIETY

EASE OF DOING BUSINESS RESTORATION OF FISCAL BALANCE PLUGGING REVENUE LEAKAGES

MISSION: To mobilise revenue and facilitate sustainable compliance

ZIMRA 2023

with fiscal and customs laws for the economic development of VISION: To be a leader in innovative fiscal services for a competitive

Zimbabwe. business environment.

VALUE PROPOSITION: Integrity I Transparency I Fairness I Commitment I Innovativness

RESULTS

Strengthen Institutional Maximize Revenue Increase voluntary Enhance trade facilitation

Image collection compliance and protection of society

Increase security and

INTERNAL PROCESSES &

Increase Risk-based tax Grow taxbase and Enhance service delivery agility in the

and customs compliance enhance integrated data and taxpayer education international flow of

system management

SYSTEMS

goods and persons

Implement results Strengthen ethics, Improve

Simplify processes and oriented strategic intergrity and communication and

procedures management enterprise risk partnerships

management

PEOPLE & RECOURSES

Enhance staff capacity Strengthen Modernize Ensure timely and

and retention performance driven infrastructure and adequate funding

culture integrate ICT systems

OUR 4 P S: PEOPLE I PROCESSES I PARTNERSHIPS I PROJECT MANAGENMENT

ZIMRA Strategic Plan (2019-2023) Page 19 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

7.5 ZIMRA’S Strategy Performance Matrix

The Strategy Performance Matrix below shows the Key Performance Indicators (KPI) for each Strategic Goal and how they will be measured

(metrics / calculation). The Matrix also shows previous performance trends on the KPIs (baseline) and annual targets for 2019-2023. This

forms the basis for ZIMRA’s strategy evaluation.

Table 3: Strategy Performance Matrix (2019-2023)

SG STRATEGIC GOAL KEY METRICS/CALCULATION BASELINE TARGETS

REF PERFORMANCE

INDICATOR

SG1 Maximize Revenue Revenue collected to Gross collections less 2015- 93.04% 2019 –100% of

collection Ministry of Finance Refunds and Non-revenue 2016-91.05% target

and Economic collections/ 2017- 108% 2020 – 100% of

Development Target Ministry of Finance and 2018-119% target

Economic target 2021 – 100% of

target

2022 – 100% of

target

2023 – 100% of

target

SG2 Enhance trade Time taken for ZIMRA average processing 2015-3 Hours 2019 – 2.5 hrs

facilitation and import clearances time for imports 2016-3 hours 2020 – 2 hrs

protection of society 2017-3 hours 2021 – 1.5 hrs

2018-3 hours 2022 - 1.4 hrs

2023 – 1 hr

Time taken for ZIMRA average processing 2015-3 Hours 2019 – 2.5 hrs

export clearance time for exports 2016-3 hours 2020 – 2 hrs

2017-3 hours 2021 – 1.5 hrs

2018-3 hours 2022 - 1.4 hrs

ZIMRA Strategic Plan (2019-2023) Page 20 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

2023 – 1 hr

SG3 Increase voluntary % On-time Total number of remittances Not tracked in TADAT 2019 – 50%

compliance remittances of core on time / format 2020 – 55%

taxes Total number of expected 2018 Q3 – 34% 2021 - 70%

remittances due per Core taxes. 2022 – 80%

2023 – 90%

% On-time filling of Total number of returns filled Not tracked in TADAT 2019 – 50%

returns by the due date / format 2020 – 55%

Number of expected returns 2018 Q3 – 30.21% 2021 - 70%

2022 – 80%

2023 – 90%

SG4 Strengthen Number of Number of communication 2016 – 8 2019 – 12

institutional image communication channels used vs available 2017 – 9 2020 – 15

channels used 2018 – 10 2021 – 17

2022 – 19

2023 – 20

Positive coverage Positive coverage vs total 2018 – 64.7% 2019 – 65%

coverage 2020 – 68%

2021 – 70%

2022 – 71%

2023 – 72%

SG5 Increase security and High risk cargo hit At least 20% hits versus 2015- 3071 2019 – 8%

agility in the rate selected high risk cargo 2016- 2795 2020 – 11%

international flow of 2017- 2917 (4.9%) 2021 – 14%

goods and persons 2022 - 17%

2023 – 20%

ZIMRA Strategic Plan (2019-2023) Page 21 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

SG6 Grow tax base and Number of new Newly registered taxpayers/ 2015=10.90% 2019 – 50 000

enhance integrated taxpayers registered Opening number of taxpayers (16,316/15,012) 2020 – 55 000

data management on the Tax base 2016=10.40% 2021 – 60 000

(16,294/15,615) 2022 – 65 000

2017=15.80% 2023 – 70 000

(26,104/16,510)

2018= 4.64%(8777/18900 )

%age amount Amount collected from new 2018 – 0.84% 2019 - 2%

collected from new taxpayers divided by the total 2020 – 2%

taxpayers /total revenue collected 2021 – 2%

revenue collected 2022 -2%

2023 -2%

SG7 Enhance service Client satisfaction Satisfaction index 2015=62.5% 2019 –67%

delivery and index 2016=63.4% 2020 – 68%

taxpayer education 2017=63.95% 2021 – 70%

2018 – 65% 2022 – 71%

2023 – 72%

SG8 Increase risk based Revenue collected Revenue collected from 2015-5% 2019-4%

tax and customs from audits/investigations as a 2016-3% 2020-5%

compliance audits/investigations %age of ZIMRA target 2017-3% 2021-5%

2018-5.72% 2022-6%

2023-7%

Actual Actual audit/investigations 2015-10289 2019-2960

audit/investigations cases finalized 2016-7580 2020-2985

cases finalized 2017-6561 2021-3010

versus target 2018- 3753 2022-3035

2023-3060

Value of additional Value of additional 2015-4.25% 2019-11%

assessments assessments (excluding penalty 2016-4.5% 2020-12%

ZIMRA Strategic Plan (2019-2023) Page 22 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

(excluding penalty and interest) issued from 2017-4.75% 2021-13%

and interest) issued audits/investigations as a %age 2018-7.12% 2022-14%

from of ZIMRA target 2023-15%

audits/investigations

SG9 Implement Results %Set strategic Number of strategic GOALs 2015-64.7% 2019-100%

Oriented Strategic targets met and targets met/ Total number 2016-30.0% 2020-100%

Management of strategic GOALs 2017-31.6% 2021-100%

2018 – not available 2022-100%

2023-100%

%Projects Number of projects completed Nil 2019-100%

milestones within set timelines and costs/ 2020-100%

completed within set Total number of prioritized 2021-100%

timelines and cost projects 2022-100%

2023-100%

SG10 Simplify processes % of automated No of automated process X 2019-100%

and procedures processes vs 100 Nil 2020-100%

planned 2021-100%

total no processes planned for 2022-100%

automation 2023-100%

SG11 Strengthen ethics, Actual corruption Number of Corruption Related 2015-NA 2019-0

integrity and index (ZIMRA to DGC Group C and D Cases X 2016-1.66% 2020-0

Enterprise risk work on a project to 100 2017-0.33% 2021-0

management change the Total number of Staff 2018 – 0.81% 2022-0

Corruption Index 2023-0

ZIMRA Strategic Plan (2019-2023) Page 23 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

measurement

method in 2019)

% adherence to Number of positive responses 2015- 2019-100%

corporate X 100 2016-96% 2020-100%

governance Total questions 2017-86% 2021-100%

requirements 2018-85% 2022-100%

2023-100%

Risk index on a scale Risk impact X likelihood of 2015-3.7 2019-3.2

of 1-9 occurrence 2016-4.53 2020-3.13

2017-3.29 2021-3.1

2018-3.27 2022-3.1

2023-3.1

SG12 Improve Amount of donor Amount of donor funds raised NA 2019 - $3mil

Communication and funds raised vs target 2020 - $3mil

Partnerships 2021 - $4mil

2022 - $4mil

2023 - $5mil

Employee Internal Client Satisfaction 2018 – 64% 2019 – 65%

Perception Survey Survey 2020 – 68%

2021 – 70%

2022 – 71%

2023 – 72%

SG13 Ensure Timely and Trade payables (Trade Payables/ Average 2015 – NR days 2019-75days

Adequate Funding turnover ratio Accounts Payable)x30 2016 – NR days 2020 -60days

(foreign payments) 2017 – 122.56 days 2021 -50days

2022 – 40days

2025 – 30 days

ZIMRA Strategic Plan (2019-2023) Page 24 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

Trade payables Trade creditors divided by two 2015 – 24.83 days 2019-18days

turnover ratio Cost of sales multiplied by 365 2016 – 17.63 days 2020 -20days

days 2017 – 15.83 days 2021 -22days

2022 – 24days

2025 – 25 days

Budget variance Total proposed budget divided 2015 – 54.87% 2019 -90%

ratio total allocated budget multiply 2016 – 58.67% 2020- 92%

by 100 2017 – 75.55% 2021 –93%

2018-110% 2022 –94%

2023 –95%

SG14 Enhance staff % Vacancy rate Total number of staff in post at 2015 – 5.1% 2019 – 7%

capacity and the beginning of the quarter 2016 – 5.6% 2020 – 6%

retention add staff recruited less staff 2017 – 4.9% 2021 – 4%

terminations divided by the 2018-8.3% 2022 – 3%

staff establishment at the end 2023 – 2%

of the quarter.

Average number of 2015 – 2.4 hrs 2019 – 8 hrs

training hours per 2016 – 2.5 hrs 2020 – 16 hrs

employee 2017 – 2.8 hrs 2021 – 24 hrs

2022 – 32 hrs

2023 – 40 hrs

Staff turnover rate Total number of staff 2015 – 0.74% 2019 – 1.05%

terminations divided by the 2016 – 0.85% 2020 – 1.05%

average number of employees 2017 – 1.07% 2021 – 1.05%

for the year. 2022 – 1.05%

2023 – 1.0%

ZIMRA Strategic Plan (2019-2023) Page 25 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

SG15 Modernise Units Count of units modernised. 2015-0 2019-40

Infrastructure and Modernised/year 2016-0 2020-20

ICT Systems 2017-0 2021-17

2022- 7

2023- 2

Availability (Network+ Systems+ HVAC+ 2015- 2019-97.5%

Power)/4 2016-95.75% 2020-98.5%

2017-96.65% 2021-99.671%

2022-99.749%

2023-99.982%

% external sources (integrated 2015-0% 2019-30%

integrated for data stakeholders/planned 2016-30% 2020-50%

exchange vs stakeholder integrations)*100 2017-20% 2021-70%

identified over the 5 2022-85%

year period 2023-100%

SG16 Strengthen %Staff members Number of staff meeting nil 2019-90%

performance driven meeting set targets target/ number of staff in post 2020-92%

culture 2021-94%

2022-96%

2023-98%

ZIMRA Strategic Plan (2019-2023) Page 26 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

8 ZIMRA’S STRATEGIC OUTCOMES

ZIMRA’s focus on the three Corporate Key Result Areas (KRA’s) reflected in Section 12 will result in the following STRATEGIC

OUTCOMES for ZIMRA and the Taxpayers:

Table 12: ZIMRA Key Result Areas and their corresponding Key Outcomes

Key Result Area (KRA) KRA KRA Corresponding Strategic Outcome(s) Outcome Ref Outcome Weight

Ref Weight

Revenue Collection 1 60% Maximised Revenue Collection Outcome 1 40%

Improved Voluntary Compliance Outcome 2 20%

Trade Facilitation 2 20% Enhanced Trade Facilitation and Outcome 3 20%

Protection of Civil Society

Institutional Image 3 20% Strengthened Institutional Image Outcome 4 20%

ZIMRA Strategic Plan (2019-2023) Page 27 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

9 KEY STRATEGIES /ACTION PLANS TO ACHIEVE ZIMRA’S STRATEGIC OUTCOMES

ZIMRA Strategic Plan (2019-2023) Page 28 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

9.1 ZIMRA KEY STRATEGIES /ACTION PLAN TO ACHIEVE OUTCOME 1 – MAXIMISED REVENUE COLLECTION

Strategies / Action Plan to Maximise Revenue Collection Lead

Divisions

2019 Carry out comprehensive Tax Gap Analysis to identify compliance gaps in Domestic Taxes and Customs using the Customs,

framework shown in section below. Domestic

Register new taxpayers using third party database sources and data matching techniques e.g. Registrar of Taxes

Companies, Licensing Authorities, Registrar General, Deeds Office, NSSA, ZIMSTAT,

Carry out Business Re-engineering Project to simply processes and procedures in order to facilitate increased

revenue

Automate and mordenise systems and processes to facilitate increased revenue collection

Commence the process of acquisition of a new Domestic Taxes Revenue Management (TRM) system

Implement Debt Management Project with emphasis in recovery of legacy debt

Plug revenue leakages by implementing SI246 of 2018, an ‘Unexplained Wealth Order’

Intensify Authorised Economic Operator Programme (Analyse imports and identify Clearing Agents with huge

volumes in order to capacitate and empower them by giving them AEO status).

Improve data interchange between Revenue Authorities by integrating systems

Research, develop and recommend a simple tax for SMES (Turnover Tax, PPP for SME Infrastructure

Development)

2020-2023 Develop ZIMRA Mobile Applications that integrate Taxpayers, Banks, other Stakeholders to the ZIMRA Self- Customs,

assessment and payment systems Domestic

Integrate Third Party databases sources to ZIMRA systems, i.e. automate and link ZIMRA systems to external Taxes

databases e.g. Deed Offices, Registrar of Companies, SME Registration,

Implement new Tax Revenue Management System and make it operational by 31 December 2020

Research on Digital Tax Accounts in order to increase revenue collection

Develop VAT fiscalisation in order to increase revenue collections

Implement modern audit and transfer pricings techniques (Use of Computer Assisted Auditing Techniques –

CAATS and IDEA)

Develop and implement automated risk assessment system

Review penalty loading model in 2020

ZIMRA Strategic Plan (2019-2023) Page 29 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

9.2 ZIMRA KEY STRATEGIES /ACTION PLAN TO ACHIEVE OUTCOME 2 – IMPROVED VOLUNTARY COMPLIANCE

Strategies / Action Plan to Improve Voluntary Compliance Lead Divisions

2019 Carry a Voluntary Compliance Campaign Project using Print Media, Online, Television and Social Media Customs, RASP,

Create a Tax Education online portal Domestic Taxes,

Review and simply processes and procedures in order to encourage voluntary compliance Loss Control,

To develop and implement a Customer Relationship Management (CRM) systems to foster strong Legal, Corporate

partnerships with Taxpayers Communications

Prosecute Tax defaulters

Introduce new Taxpayer Education and Awareness programmes

Implement Compliance best practices e.g. Data Matching, Data Warehousing, World Customs

Organisation and World Trade Organisation Conventions

Integrate payment platforms with ZIMRA E-services to increase taxpayer transaction convenience

Establish Surveillance and Monitoring Centre in order to deter illicit dealings and promote compliance

Improve imports declaration compliance by enforcing mandatory pre-clearance facility SI9 of 2018

Research and recommend legislative changes in order to improve voluntary compliance

Carry out collaborative engagements with key industry stakeholders in order to promote voluntary

Implement Annual Voluntary Compliance Awards in order to encourage compliance

2020-2023 Develop and implement an online self-service / tax assistance interactive solution Customs, RASP,

Integrate ZIMRA databases to external stakeholder databases in order to improve compliance Domestic Taxes,

Research on Voluntary Compliance incentives for recommendation to the Ministry Loss Control,

Lobby government to introduce tax- education in schools curriculum Legal, Corporate

Communications

ZIMRA Strategic Plan (2019-2023) Page 30 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

9.3 ZIMRA KEY STRATEGIES /ACTION PLAN TO ACHIEVE OUTCOME 3 – ENHANCED TRADE FACILITATION AND

PROTECTION OF CIVIL SOCIETY

Strategies / Action Plan to Enhance Trade Facilitation and Protection of Civil Society Lead

Divisions

2019 Upgrade ASCUDA World System – automate advance cargo/passer manifest, interface ASCUDA with Customs, IT

Transporter Specifications and introduce new risk profiling parameters

Procure and install Non-Intrusive Inspection (NIIT) technologies (NIIT Controls Systems Equipment)

Extend Cooperative Compliance Programmes (enhance Approved Economic Operators – AEO

Programmes)

Introduce border surveillance drones

Commence the Beitbridge Redevelopment Project

Commence Border Systems integration Project (Systems to link with other Regional Revenue Authorities)

Review internal processes, procedures and systems in order to reduce imports/exports clearance time from 3

hours to 2.5 hours

Enhance the Import / Export Risk Management System by improving the risk profiling parameters in order

to improve detection of harmful, dangerous and prohibited goods

Implement and enforce corruption whistleblowing by both the clients and ZIMRA employees (incentivize

ZIMRA Staff members foil and report corruption/bribery attempts)

Implement Change Management Project in order to enhance staff service culture at the borders

2020-2023 Implement Single Window at selected borders Customs, IT

Implement One-Stop Border Post (Victoria Falls and Kazungula)

Finalise the Beitbridge Redevelopment Project

Commence the Forbes Redevelopment Project

Complete the full integration of systems

ZIMRA Strategic Plan (2019-2023) Page 31 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

9.4 ZIMRA KEY STRATEGIES /ACTION PLAN TO ACHIEVE OUTCOME 4 – STRENGHTHENED INSTITUTIONAL IMAGE

Strategies / Action Plan to Strengthen ZIMRA’s Institutional Image Lead

Divisions

2019 Carry out Business Re-engineering Project (Identify, simplify, automate and modernize systems and processes) in ALL

order to improve operational efficiency and service quality

Review the ZIMRA Client Charter – automate client/employee satisfaction survey, implement online customer

feedback platform

Resolve client / staff surveys issued raised

Modernise infrastructure

Operationalise the new ZIMRA 24 –hour Contact Centre to offer high quality customer service

Implement Change Management Project in order to improve staff commitment, staff motivation and client service

culture

Align organizational structure to strategy in order to improve operational efficiency

Establish structured internal and external communication channels

Develop and implement ZIMRA Brand Promotion (use of Print, Online, Social Media in order to promote the ZIMRA

Brand)

Carry out a well-structured Anti-Corruption Campaign using media

Implement Surveillance and Monitoring Command Centre in order to deter corruption

Implement ‘Mystery Shopping’ in order to flush corruption culprits within ZIMRA

Strengthen ethics, integrity and enterprise risk management

Commence the Implementation of new Tax Revenue Management System for improved operational efficiency service

quality

2020-2023 Introduce Mobile-device enabled client interface platforms ALL

Negotiate MOUs/Service Level Agreements with key strategic partners in the service chain

Continue with processes automation to improve interactive client self-service

Commence the Implementation of new Tax Revenue Management System for improved operational efficiency service

quality

Register ZIMRA as a Tax Profession Regulator in order to improve ethical and service quality standards offered by Tax

Practitioners

ZIMRA Strategic Plan (2019-2023) Page 32 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

10 CONCLUSION

10.1 ZIMRA’s Strategic Projects (2019 -2023)

ZIMRA has adopted PRINCE2 (Projects In a Controlled Environment) Project Management

Methodology in project implementation. The Authority will implement several projects

during the strategic planning period 2019-2023. However, the following key projects have

been picked out as Strategic Projects that will be monitored at Executive Management Level:

No. Strategic Project Brief Description

1 Data Cleansing Project to clean Domestic Taxes Database to eliminate

inaccuracies, update the database ahead of a new Tax

Revenue Management System

2 Tax Revenue Acquisition, installation and configuration of a new Tax

Management System Revenue Management System for Domestic Taxes

3 ASCUDA Systems Upgrade of Customs system, ASCUDA World with particular

Upgrade emphasis on automation of advance cargo/passer manifest,

interfacing of ASCUDA with Transporter Specifications and

introduce new risk profiling parameters

4 Staff and Office Construction of Staff Accommodation at the border and office

Accommodation accommodation including construction of ZIMRA Head

Office in Harare

5 Data Centre Acquisition of state of the art modern servers and setting up of

a centralized Data Centre with capacity to handle and store

big data

6 Automation Review of processes and automation of identified processes

7 Systems Integration Integration of different systems within ZIMRA and

integration of ZIMRA systems to selected external systems

8 Surveillance and Development and equipment of a centralized Surveillance and

Monitoring Centre Monitoring Centre in Harare

9 Contact Centre Development and setting up of a central Customer Services

Contact Centre in Harare

10 Data Warehouse and Development, equipment and setting up of a central Data

Risk Management Warehouse to store taxpayer’s static and transactional

information.

11 Debt Management Project to reduce the outstanding legacy debt which stood at

$5 billion as at 31 December 2018.

12 Change Management Project to realign processes, systems, structures and people to

new strategy

ZIMRA Strategic Plan (2019-2023) Page 33 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

10.2 ZIMRA’s Change Management Program (2019 – 2023)

Change management is a structured approach of transforming the organisation, it’s people

and processes from the current state to a desired state. The Authority will implement a

Change Management Program whose main objectives is:

To align staff culture (actions and behaviours) to the new strategy

To align internal processes, systems and procedures to the new Strategy

To improve ZIMRA’s brand image – strengthen institutional image

To eliminate corruption

To eliminate fear and create an innovation culture

To embed new ZIMRA Values into staff members and make them a way of working

10.2 Strategy Implementation, Monitoring and Evaluation

ZIMRA involved all staff members in the strategic planning process. Similarly, ZIMRA will

involve all staff members in strategy implementation. The following Strategic

Implementation structure will be utilised:

ZIMRA’S STRATEGY IMPLEMENTATION STRUCTURE

EXCO

SIMMCO

OPSCOs (in Regions)

Change Agents

Staff Members

Change Management Program Committee made up of selected members

Change Program Board (EXCO), Change Project Owner (CG)

ZIMRA Strategic Plan (2019-2023) Page 34 of 35

Zimbabwe Revenue Authority (ZIMRA) Strategic Plan 2019-2023

EXCO – Executive Committee is in charge of strategic planning, implementation

monitoring and evaluation oversight and will be accountable to ZIMRA’s strategic

and divisional targets.

SIMMCO – Strategy Implementation and Monitoring Committee (SIMMCO) is

made up of selected Senior Managers from each ZIMRA Division (2 per each

Division). This Committee is in charge of facilitation of ZIMRA’s strategic planning,

implementation, monitoring and evaluation.

OPSCOs – Operational Committees (OPSCOs) are made up of middle level

managers / supervisors whose responsibility is to give technical and tactical input to

strategy. Each Region will have one Operational Committee.

Change Champions – these are influential change agents selected across staff

members. Change Champions will be capacitated to drive and influence the desired

change amongst staff members.

Change Management Project Board – ZIMRA’s Executive Management

Committee (EXCO) shall automatically be the Change Management Project Board.

Change Management Project Owner – change management should be driven from

the top in order for it to be successful. ZIMRA’s Change Management Program will

be led by the Commissioner General as the Project Owner.

10.3 Performance Management and Strategy Evaluation

The Authority had adopted the Integrated Results Based Management (IRBM) as a strategy

implementation, monitoring and evaluation tool. ZIMRA’s 5-year strategy is IRBM

compliant, an Agency Integrated Performance Agreement (AIPA) and Divisional Integrated

Performance Agreements (DIPAs) have been developed and approved by the ZIMRA Board.

The Authority is committed and confident of achieving the set strategic targets which will

contribute positively to Zimbabwe’s socio-economic development.

_____________________________________________

Ms. Faith Mazani

ZIMRA -Commissioner General

______________________________________________

Dr. Callisto Jokonya

ZIMRA Board Chairman

ZIMRA Strategic Plan (2019-2023) Page 35 of 35

You might also like

- Leave FormDocument1 pageLeave FormOspen Noah Sithole100% (1)

- Zoology Project On Butterfly ?Document66 pagesZoology Project On Butterfly ?kanha creations With kanha100% (1)

- DuasDocument180 pagesDuasdn08smmcNo ratings yet

- CH371 Novel Separation ProcessDocument3 pagesCH371 Novel Separation ProcessIrfan K MoiduNo ratings yet

- Revised Business Plan JefamDocument65 pagesRevised Business Plan JefamISAAC TAGOE100% (3)

- Clean Room Requirements 20130927Document5 pagesClean Room Requirements 20130927HNmaichoi100% (1)

- Nra Strategic Plan 2018-2022Document56 pagesNra Strategic Plan 2018-2022Akm EngidaNo ratings yet

- Insurance Regulatory AuthorityDocument51 pagesInsurance Regulatory AuthorityĦøşęħ ÖżįlNo ratings yet

- Annual 2019Document40 pagesAnnual 2019imammujib32No ratings yet

- GRA Strategic Plan Vers 2.0 06.12.11 PDFDocument36 pagesGRA Strategic Plan Vers 2.0 06.12.11 PDFRichard Addo100% (3)

- Performance Audit Report of Jamaica Preparedness For Implementation of Sustainable Development GoalsDocument54 pagesPerformance Audit Report of Jamaica Preparedness For Implementation of Sustainable Development GoalsKayon WolfeNo ratings yet

- Gigaba FullMTBPSDocument86 pagesGigaba FullMTBPSjillianNo ratings yet

- 38.a Study of Best HR Practices With Reference To Reliance General InsuranceDocument32 pages38.a Study of Best HR Practices With Reference To Reliance General InsurancerajNo ratings yet

- National MSME Policy 2020-2024 New 1Document28 pagesNational MSME Policy 2020-2024 New 1BURUNDI1No ratings yet

- 00 IntroDocument254 pages00 IntroTatenda MadzingiraNo ratings yet

- Foundations of Management Assignment "A Strategic Review"Document29 pagesFoundations of Management Assignment "A Strategic Review"Anurag porteNo ratings yet

- Types of Situations Covered by This GuideDocument42 pagesTypes of Situations Covered by This GuideMohammedOumerNo ratings yet

- MoF Strategic Plan Revised On April 2021 - v2Document61 pagesMoF Strategic Plan Revised On April 2021 - v2BALI PETROLEUMNo ratings yet

- Csopf Final 2019Document580 pagesCsopf Final 2019DamasceneNo ratings yet

- Annual Report Tata Techno 2010 PDFDocument144 pagesAnnual Report Tata Techno 2010 PDFArchitNo ratings yet

- SME Strategy 2015 Draft 2 0 Edits DD SMEDDocument25 pagesSME Strategy 2015 Draft 2 0 Edits DD SMEDsayed mujeeb HashimiNo ratings yet

- 7.chap 3Document29 pages7.chap 3Manish KumarNo ratings yet

- Public-Private Partnership Policy Statement - Gom: Government of The Republic of MalawiDocument64 pagesPublic-Private Partnership Policy Statement - Gom: Government of The Republic of MalawiMwawiNo ratings yet

- Activity Report 2019Document32 pagesActivity Report 2019fabukaNo ratings yet

- Misr Insurance Co Annual Report 30 June 2010Document60 pagesMisr Insurance Co Annual Report 30 June 2010hadihadihaNo ratings yet

- BIMSTECPaper 2023 ZamanSharminDocument32 pagesBIMSTECPaper 2023 ZamanSharminShohan_1234No ratings yet

- ZDA Strategic Plan - Abridged VersionDocument24 pagesZDA Strategic Plan - Abridged VersionJoseph Saidi TemboNo ratings yet

- Tobu Japan - Profile - Ar2021Document24 pagesTobu Japan - Profile - Ar2021John SharonNo ratings yet

- Annual Report 2019 20Document100 pagesAnnual Report 2019 20Arun SasidharanNo ratings yet

- Highlights - Budget 2017Document10 pagesHighlights - Budget 2017Norfae'zah MohammadNo ratings yet

- National Financial Inclusion Strategy 2017 2022Document54 pagesNational Financial Inclusion Strategy 2017 2022MCTI-DOC KasamaNo ratings yet

- PPP PolicyDocument21 pagesPPP PolicyRhoda WinaniNo ratings yet

- Manna Business Plan - FinalDocument33 pagesManna Business Plan - FinalJoe WinstonNo ratings yet

- Cabo Oeste - Governance Framework - 2008 - Government Western CapeDocument90 pagesCabo Oeste - Governance Framework - 2008 - Government Western CapeAntônio Jones Bezerra de AlmeidaNo ratings yet

- Mfi Financing Strategy Guidelines and Template: Microreport #89Document64 pagesMfi Financing Strategy Guidelines and Template: Microreport #89aynalemNo ratings yet

- CGTMSE AnnualreportDocument44 pagesCGTMSE Annualreportdr NayanBharadwajNo ratings yet

- FIA Strategic Plan PDFDocument35 pagesFIA Strategic Plan PDFDaniel K chiwonaNo ratings yet

- Bpmn3023 Strategic Management FIRST SEMESTER SESSION 2019/2020 (A191) Group FDocument51 pagesBpmn3023 Strategic Management FIRST SEMESTER SESSION 2019/2020 (A191) Group FsallyNo ratings yet

- TMF Group Annual Report 2023 With Audit ReportDocument141 pagesTMF Group Annual Report 2023 With Audit ReportMilo MileNo ratings yet

- Namibia Industrial PolicyDocument24 pagesNamibia Industrial PolicyTHE DAILY PLUGNo ratings yet

- WB-P168115 q6o3OFUDocument79 pagesWB-P168115 q6o3OFUAamiin AbdirizakNo ratings yet

- Zim AssetDocument129 pagesZim AssetNyamutatanga Makombe100% (5)

- Senerath Gunawardena Marketing PlanDocument21 pagesSenerath Gunawardena Marketing Plantheatresonic0% (1)

- Strategic Plan 2016-2020Document56 pagesStrategic Plan 2016-2020brienahNo ratings yet

- Report of The Auditor General of The Republic of FijiDocument54 pagesReport of The Auditor General of The Republic of FijistiribuneNo ratings yet

- Public Finance ReportDocument59 pagesPublic Finance Reportshubhro dattaNo ratings yet

- Bida SRCP 20181217 FDocument61 pagesBida SRCP 20181217 FRidwan Haque DolonNo ratings yet

- GuidelinesonsciDocument25 pagesGuidelinesonscifert certNo ratings yet

- Full MTBPSDocument79 pagesFull MTBPSBusinessTech100% (1)

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- 2016 Budget Guidelines PDFDocument136 pages2016 Budget Guidelines PDFNYAMEKYE ADOMAKONo ratings yet

- National AML CFT CPF Strategy 2023 2027 1690886281Document30 pagesNational AML CFT CPF Strategy 2023 2027 1690886281Chidera Ajoke Austin-AwulonuNo ratings yet

- MSME Policy IP April 2010Document36 pagesMSME Policy IP April 2010Chuchure TekaNo ratings yet